Mercado de espesantes de alimentos de América del Norte, por tipo (proteína, almidón, hidrocoloides, pectina y otros), forma (gel, polvo, gránulos y otros), naturaleza (OGM y no OGM), fuente (planta, animal, marina y microbiana), aplicación (alimentos y bebidas) Tendencias de la industria y pronóstico hasta 2029

Análisis y perspectivas del mercado

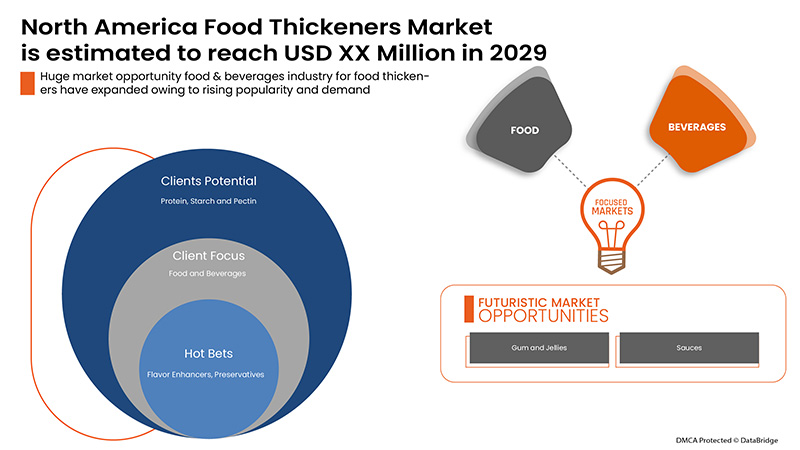

El aumento de los cambios en el estilo de vida de los consumidores, que se traduce en un mayor enfoque en su dieta, es un factor vital que acelera el crecimiento del mercado. Además, el aumento de la innovación en nuevos productos y de las actividades de investigación y desarrollo en el mercado creará nuevas oportunidades para el mercado de espesantes alimentarios de América del Norte. Sin embargo, el aumento de la investigación y los costes asociados al desarrollo y la fabricación de espesantes alimentarios y las fluctuaciones continuas en los precios de las materias primas de los hidrocoloides son los principales factores, entre otros, que se espera que limiten y sigan desafiando al mercado de espesantes alimentarios de América del Norte en el período de previsión.

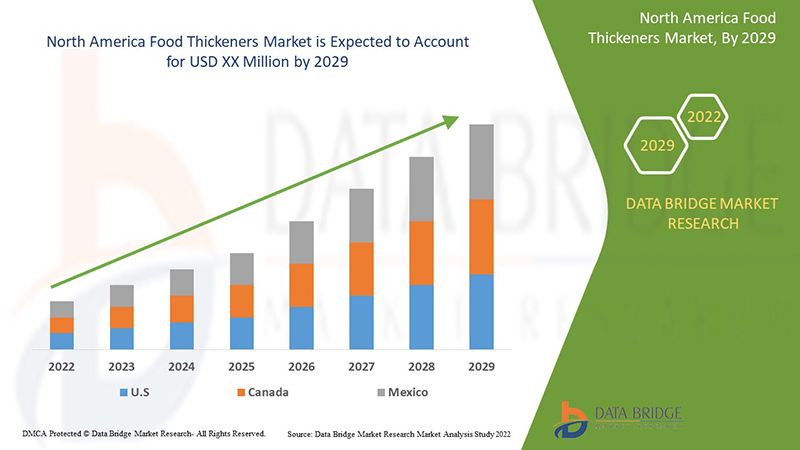

Data Bridge Market Research analiza que se espera que el mercado de espesantes de alimentos de América del Norte crezca con una CAGR del 5,6% en el período de pronóstico de 2022 a 2029.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Año histórico |

2020 (personalizable para 2019-2015) |

|

Unidades cuantitativas |

Ingresos en millones de USD |

|

Segmentos cubiertos |

Por tipo (proteína, almidón, hidrocoloides, pectina y otros), forma (gel, polvo, gránulos y otros), naturaleza (OGM y no OGM), fuente (vegetal, animal, marina y microbiana), aplicación (alimentos y bebidas) |

|

Países cubiertos |

Estados Unidos, Canadá, México |

|

Actores del mercado cubiertos |

Ingredion Incorporated, Cargill Incorporated, CP Kelco US, Inc., Tate & Lyle, DuPont Nutrition Bioscience ApS, Ashland, DSM, ADM, Jungbunzlauer Suisse AG, Deosen Biochemical (Ordos) Ltd., Solvay, Emsland Group, Guar Resources, LLC., Medline Industries, LP., GELITA AG, HL Agro Products Pvt. Ltd., Kent Precision Foods Group, Inc., VIKAS WSP LTD., entre otros. |

Definición de mercado

Los espesantes alimentarios se definen como los agentes modificadores de alimentos que se utilizan para modificar la textura y la estructura de los alimentos y las bebidas. Se utilizan para aumentar el espesor de los alimentos y las bebidas, ayudando a absorber el contenido de agua en los comestibles una vez que se integran en los productos. Estos productos se utilizan principalmente para modificar su viscosidad, dándoles una estructura general consistente. Los espesantes alimentarios más utilizados en el mercado son los almidones, seguidos de los hidrocoloides y las proteínas. Los espesantes alimentarios se utilizan en aplicaciones alimentarias como panadería, confitería, salsas , aderezos, adobos, jugos, bebidas, lácteos, postres helados, alimentos preparados, alimentos procesados, etc.

Dinámica del mercado de espesantes alimentarios en América del Norte

Conductores

- Aumento de la demanda de bebidas no alcohólicas, incluidos zumos de frutas y bebidas energéticas.

Los espesantes alimentarios se añaden a los zumos de frutas para añadir viscosidad al producto. El zumo de frutas es una bebida no fermentada que se obtiene exprimiendo o macerando mecánicamente las frutas. Los zumos de frutas como el de naranja, manzana, mango, frutas mixtas y otros están en auge debido a su amplia gama de beneficios para la salud. Los distintos tipos de zumo de frutas ofrecen diversos beneficios para la salud.

Por ejemplo,

El jugo de aguacate aumenta la energía natural del cuerpo. El jugo de sandía mantiene el cuerpo hidratado y mejora el metabolismo. El jugo de papaya favorece una digestión saludable. El jugo de limón combate las infecciones virales. El jugo de piña reduce los niveles de colesterol. El jugo de naranja reduce los signos del envejecimiento.

Los cambios en los estilos de vida y los cambios en los patrones de alimentación de los consumidores han dado como resultado un aumento en el consumo de fuentes de nutrición asequibles, saludables y de rápida preparación, como los jugos de frutas envasados. Además, los fabricantes están introduciendo una amplia gama de sabores y produciendo jugos de frutas sin conservantes ni azúcar para ampliar la base de consumidores, lo que impulsa la demanda general de jugos de frutas en todo el mundo.

Además, durante la actual pandemia de COVID-19, el consumo de jugos de frutas y verduras ha aumentado a nivel mundial debido a sus beneficios para la salud. Diversos actores de los mercados regionales e internacionales han lanzado productos con vitaminas y minerales fortificados para reforzar la inmunidad de las personas.

- Ventajas y diversas funciones asociadas al uso de espesantes de alimentos

Los espesantes alimentarios se utilizan principalmente para aumentar la viscosidad del líquido sin cambiar sus propiedades. Los espesantes alimentarios se utilizan como aditivo alimentario que aumentará la suspensión y la emulsión del producto para estabilizarlo. Los espesantes alimentarios se utilizan predominantemente en la fabricación de alimentos y bebidas como pudines, salsas, sopas, etc.

Los alimentos completamente sólidos también pueden provocar asfixia al tragarlos. Sin embargo, el líquido espesado pasa sin esfuerzo y los nutrientes no se pueden extraer del organismo. Por ello, se utiliza un espesante para mantener el equilibrio. Esta es la razón principal por la que los espesantes de alimentos actúan como una bendición para los pacientes con cáncer, traumatismos y trastornos neurológicos que no pueden tragar alimentos.

Además, los espesantes de alimentos son muy útiles para los adultos mayores que sufren problemas de deglución. El problema de deglución es frecuente en las poblaciones geriátricas y es difícil de prevenir. Este problema puede ser causado por varios factores, como razones de salud, enfermedades neurológicas, accidentes cerebrovasculares y cánceres. Otra preocupación para los adultos con problemas de deglución es la pérdida de dientes. Sin embargo, existe evidencia de que los espesantes de alimentos reducen el problema de aspiración en las personas mayores. Los logopedas han evaluado el impacto de los espesantes de alimentos. Esto les ha ayudado a aportar nuevas estrategias para ampliar el alcance del uso de espesantes de alimentos para contrarrestar el problema de deglución. Se espera que estas ventajas mencionadas anteriormente sean un factor impulsor del mercado de espesantes de alimentos de América del Norte.

Oportunidad

-

Decisiones estratégicas de los actores clave

Los principales actores del mercado han lanzado nuevos productos que presentan capacidades mejoradas. Los fabricantes han tomado las medidas necesarias para mejorar la precisión de los nuevos productos y la funcionalidad general.

Por ejemplo,

- En enero de 2021, Tate & Lyle amplió su línea de almidones a base de tapioca. La expansión incluye el lanzamiento de los nuevos almidones espesantes REZISTA MAX y los almidones gelificantes BRIOGEL. Esto ha ayudado a la empresa a ampliar su cartera de productos.

Por lo tanto, es probable que la creciente innovación significativa y el lanzamiento de nuevos productos ofrezcan una oportunidad para el mercado de espesantes de alimentos de América del Norte.

Restricciones/Desafíos

- Posibles problemas de salud relacionados con la goma xantana y la carragenina

Se ha demostrado que la goma xantana tiene efectos secundarios en la salud humana. Las personas expuestas al polvo de goma xantana pueden experimentar síntomas similares a los de la gripe, irritación de la nariz y la garganta, gases intestinales (flatulencia), hinchazón y problemas pulmonares.

Muchos médicos han recomendado no tomar goma xantana durante el embarazo y la lactancia. Hasta el momento, no se dispone de suficiente información sobre el uso de goma xantana durante el embarazo y la lactancia. Sin embargo, para mayor seguridad, los médicos recomiendan evitar el uso de cantidades mayores de goma xantana que las que se encuentran normalmente en los alimentos. Además, la goma xantana no se prescribe a quienes tienen náuseas, vómitos, apendicitis, heces duras que son difíciles de expulsar (impactación fecal), estrechamiento o bloqueo del intestino o dolor de estómago no diagnosticado, ya que es un laxante formador de masa que podría ser perjudicial en estas situaciones.

Además, la goma xantana puede reducir los niveles de azúcar en sangre durante una cirugía. Existe la preocupación de que pueda interferir con el control del azúcar en sangre durante y después de la cirugía. Por lo tanto, se recomienda dejar de usar goma xantana al menos dos semanas antes de una cirugía programada. Además, el azúcar en sangre puede disminuir debido a la menor absorción de azúcares de los alimentos por parte de la goma xantana. Es perjudicial para los pacientes con diabetes, ya que los medicamentos para la diabetes también se utilizan para reducir el azúcar en sangre.

Impacto posterior a la COVID-19 en el mercado de espesantes de alimentos de América del Norte

Los principales fabricantes del mercado están adoptando diversas estrategias de marketing, como la innovación de productos, la expansión regional y el desarrollo de nuevos productos, para mantener el mercado competitivo y satisfacer las tendencias cambiantes de los consumidores. La adopción de estas políticas de marketing estratégicas por parte de diversos competidores les ayudará a ganar cuota de mercado competitiva en la era posterior a la COVID-19.

Desarrollo reciente

- En febrero de 2021, Ingredion Incorporated firmó un acuerdo para crear una empresa conjunta con Grupo Arcor para producir ingredientes de valor agregado, como jarabes de glucosa, maltosa, fructosa y almidón. Esto ha ayudado a la empresa en la expansión regional.

Alcance del mercado de espesantes de alimentos en América del Norte

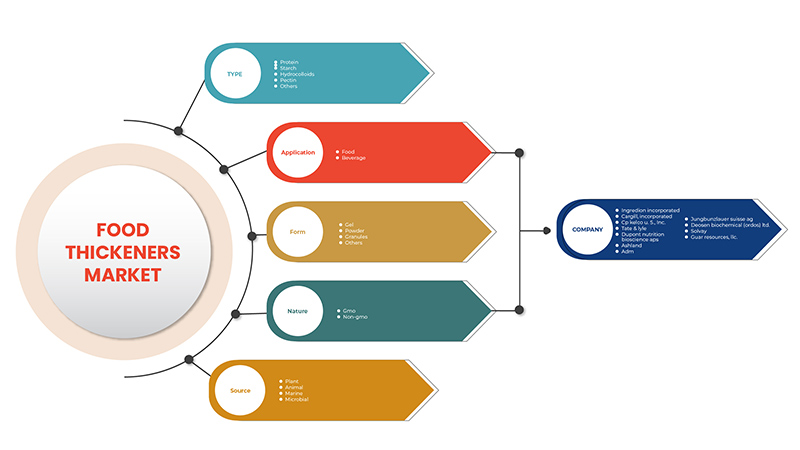

El mercado de espesantes de alimentos de América del Norte está segmentado en cinco segmentos notables según el tipo, la forma, la naturaleza, la fuente y la aplicación. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Proteína

- Almidón

- Hidrocoloides

- Pectina

- Otros

Según el tipo, el mercado de espesantes de alimentos de América del Norte está segmentado en proteínas, almidón, hidrocoloides, pectina y otros.

Forma

- Gel

- Polvo

- Granulados

- Otros

Sobre la base de la forma, el mercado de espesantes de alimentos de América del Norte está segmentado en gel, polvo, gránulos y otros.

Naturaleza

- OGM

- Sin OGM

Sobre la base de la naturaleza, el mercado de espesantes de alimentos de América del Norte está segmentado en OGM y no OGM.

Fuente

- Planta

- Animal

- Marina

- Microbiano

Según la fuente, el mercado de espesantes de alimentos de América del Norte está segmentado en vegetal, animal, marino y microbiano.

Solicitud

- Alimento

- Bebidas

Sobre la base de la aplicación, el mercado de espesantes de alimentos de América del Norte está segmentado en alimentos y bebidas.

Análisis y perspectivas regionales de los mercados de espesantes de alimentos de América del Norte

Se analiza el mercado de espesantes de alimentos de América del Norte y se proporcionan información y tendencias sobre el tamaño del mercado según el país, el tipo, la forma, la naturaleza, la fuente y la aplicación, como se menciona anteriormente.

Los países cubiertos en el informe del mercado de espesantes de alimentos de América del Norte son EE. UU., Canadá y México.

Se espera que Estados Unidos domine el mercado de espesantes de alimentos en América del Norte debido a la creciente industria de alimentos y bebidas. Se prevé que Canadá domine la región debido a las alianzas estratégicas entre los principales fabricantes, mientras que México podría dominar la región debido a la alta producción de espesantes de alimentos.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en las regulaciones del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos, como las ventas nuevas y de reemplazo, la demografía del país, la epidemiología de las enfermedades y los aranceles de importación y exportación, son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas norteamericanas, sus desafíos enfrentados debido a la alta competencia de las marcas locales y nacionales y el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de espesantes de alimentos en América del Norte

El competitivo mercado de espesantes de alimentos de América del Norte detalla a los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores solo se relacionan con el enfoque de las empresas en el mercado de espesantes de alimentos de América del Norte.

Algunos de los principales actores que operan en el mercado de espesantes de alimentos de América del Norte son Ingredion Incorporated, Cargill, Incorporated, CP Kelco US, Inc., Tate & Lyle, DuPont Nutrition Bioscience ApS, Ashland, DSM, ADM, Jungbunzlauer Suisse AG, Deosen Biochemical (Ordos) Ltd., Solvay, Emsland Group, Guar Resources, LLC., Medline Industries, LP., GELITA AG, HL Agro Products Pvt. Ltd., Kent Precision Foods Group, Inc., VIKAS WSP LTD., entre otros.

Metodología de la investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con tamaños de muestra grandes. Los datos del mercado se analizan y estiman utilizando modelos estadísticos y coherentes del mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Aparte de esto, los modelos de datos incluyen cuadrículas de posicionamiento de proveedores, análisis de la línea de tiempo del mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de la participación de mercado de la empresa, estándares de medición, América del Norte frente a la región y análisis de la participación de los proveedores. Solicite una llamada de un analista en caso de tener más consultas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA FOOD THICKENERS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIENTS CUSTOMIZATION:

4.1.1 WHAT IS THE MAJOR FOOD THICKENER, AND WHAT IS EACH FOOD THICKENER'S ISSUE (OR REQUIREMENT) TO SOLVE?

4.1.2 STARCH

4.1.3 HYDROCOLLOIDS

4.1.4 PECTIN

4.1.5 PROTEIN:

4.2 ANALYSIS OF MAJOR FOOD THICKENERS:

4.3 PRICING ANALYSIS OF FOOD THICKENERS

4.4 NORTH AMERICA FOOD THICKENERS MARKET: NEW PRODUCT LAUNCH STRATEGIES

4.4.1 GROWING DEMAND FOR PLANT-BASED SOURCED FOOD THICKENERS

4.4.2 LAUNCHING ORGANIC, CLEAN, AND SUSTAINABLE FOOD THICKENERS

4.4.3 PROMOTING BY HIGHLIGHTING GLUTEN-FREE THICKENERS

4.4.4 LAUNCHES-

4.5 FACTORS INFLUENCING PURCHASING DECISION OF END USERS

4.5.1 VARIETY OF APPLICATIONS CATERED BY FOOD THICKENERS PRODUCTS:

4.5.2 AVAILABILITY OF A VARIETY OF PRODUCT TYPES:

4.5.3 QUALITY OF THE PRODUCTS:

4.6 NORTH AMERICA FOOD THICKENERS MARKET: REGULATORY FRAMEWORK

4.7 SUPPLY CHAIN ANALYSIS

4.8 VALUE CHAIN ANALYSIS OF NORTH AMERICA FOOD THICKENERS MARKET

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR FRUIT JUICES

5.1.2 RISING DISPOSABLE INCOME COUPLED WITH CHANGING LIFESTYLES DUE TO RAPID URBANIZATION

5.1.3 ADVANTAGES AND SEVERAL FUNCTIONS ASSOCIATED WITH THE USE OF FOOD THICKENERS

5.1.4 RISING DEMAND FOR THICKENING AGENTS IN BAKERY AND CONFECTIONERY PRODUCTS

5.2 RESTRAINTS

5.2.1 POSSIBLE HEALTH CONCERNS REGARDING XANTHAN GUM AND CARRAGEENAN

5.2.2 HIGH R&D COSTS ASSOCIATED WITH THE DEVELOPMENT AND MANUFACTURING OF FOOD THICKENERS

5.2.3 FLUCTUATIONS IN RAW MATERIAL PRICES OF HYDROCOLLOIDS

5.3 OPPORTUNITIES

5.3.1 STRATEGIC DECISIONS BY KEY PLAYERS

5.3.2 ADVANCEMENTS IN THE EXTRACTION AND PROCESSING OF FOOD THICKENERS

5.4 CHALLENGES

5.4.1 STRINGENT GOVERNMENT REGULATIONS

5.4.2 DISTURBANCE IN SUPPLY CHAIN DUE TO COVID-19 PANDEMIC

6 COVID-19 IMPACT ON THE NORTH AMERICA FOOD THICKENERS MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE NORTH AMERICA FOOD THICKENERS MARKET

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON PRICE

6.4 IMPACT ON DEMAND

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 NORTH AMERICA FOOD THICKENERS MARKET, BY TYPE

7.1 OVERVIEW

7.2 HYDROCOLLOIDS

7.2.1 HYDROCOLLOIDS, BY TYPE

7.2.1.1 XANTHAN GUM

7.2.1.2 SODIUM ALGINATE

7.2.1.3 LOCUST BEAN GUM

7.2.1.4 GUM ARABIC

7.2.1.5 GAUR GUM

7.2.1.6 GUM KARAYA

7.2.1.7 GUM TRAGACANTH

7.2.1.8 OTHERS

7.2.2 HYDROCOLLOIDS, BY FORM

7.2.2.1 POWDER

7.2.2.2 GRANULES

7.2.2.3 GEL

7.2.2.4 OTHERS

7.3 PROTEIN

7.3.1 PROTEIN, BY TYPE

7.3.1.1 GELATIN

7.3.1.2 COLLAGEN

7.3.1.3 EGG PROTEIN

7.3.2 PROTEIN, BY FORM

7.3.2.1 POWDER

7.3.2.2 GRANULES

7.3.2.3 GEL

7.3.2.4 OTHERS

7.4 STARCH

7.4.1 STARCH, BY TYPE

7.4.1.1 CORN STARCH

7.4.1.2 WHEAT STARCH

7.4.1.3 ARROWROOT STARCH

7.4.1.4 POTATO STARCH

7.4.1.5 RICE STARCH

7.4.1.6 PEA STARCH

7.4.1.7 OTHERS

7.4.2 STARCH, BY FORM

7.4.2.1 POWDER

7.4.2.2 GRANULES

7.4.2.3 GEL

7.4.2.4 OTHERS

7.5 PECTIN

7.5.1 PECTIN, BY FORM

7.5.1.1 POWDER

7.5.1.2 GRANULES

7.5.1.3 GEL

7.5.1.4 OTHERS

7.6 OTHERS

8 NORTH AMERICA FOOD THICKENERS MARKET, BY FORM

8.1 OVERVIEW

8.2 POWDER

8.3 GRANULES

8.4 GEL

8.5 OTHERS

9 NORTH AMERICA FOOD THICKENERS MARKET, BY NATURE

9.1 OVERVIEW

9.2 NON-GMO

9.3 GMO

10 NORTH AMERICA FOOD THICKENERS MARKET, BY SOURCE

10.1 OVERVIEW

10.2 PLANT

10.3 ANIMAL

10.4 MARINE

10.5 MICROBIAL

10.5.1 BACTERIA

10.5.2 YEAST

10.5.3 FUNGI

11 NORTH AMERICA FOOD THICKENERS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 FOOD

11.2.1 FROZEN DESSERTS

11.2.2 DAIRY PRODUCTS

11.2.3 FRUIT PREPARATIONS

11.2.4 BAKERY

11.2.5 CONFECTIONERY

11.2.6 MEAT PRODUCTS

11.2.7 CONVENIENCE FOOD

11.2.8 PROCESSED FOOD

11.2.9 DAIRY ALTERNATIVE PRODUCTS

11.2.10 FUNCTIONAL FOOD

11.2.11 SEAFOOD PRODUCTS

11.2.12 SPORTS NUTRITION

11.2.13 MEAT ALTERNATIVE PRODUCTS

11.3 BEVERAGES

11.3.1 JUICES

11.3.2 DAIRY BASED DRINKS

11.3.3 CARBONATED SOFT DRINKS

11.3.4 SMOOTHIES

11.3.5 RTD TEA & COFFEE

11.3.6 SPORTS DRINKS

11.3.7 ENERGY DRINKS

11.3.8 OTHERS

12 NORTH AMERICA FOOD THICKENERS MARKET, BY REGION

12.1 OVERVIEW

12.2 NORTH AMERICA

12.2.1 U.S.

12.2.2 CANADA

12.2.3 MEXICO

13 NORTH AMERICA FOOD THICKENERS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 INGREDION INCORPORATED

15.1.1 COMPANY SNAPSHOT

15.1.2 COMPANY SHARE ANALYSIS

15.1.3 REVENUE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 CARGILL, INCORPORATED

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 TATE & LYLE

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 ADM

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 ASHLAND

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 CP KELCO

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 DSM

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 SOLVAY

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 DUPONT NUTRITION BIOSCIENCE APS

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 MEDLINE INDUSTRIES, LP.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 DEOSEN BIOCHEMICAL (ORDOS) LTD.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 EMSLAND GROUP

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 GELITA AG

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 GUAR RESOURCES, LLC.

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 HL AGRO PRODUCTS PVT. LTD.

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 JUNGBUNZLAUER SUISSE AG

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 KENT PRECISION FOODS GROUP, INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 VIKAS WSP LTD.

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 REGULATIONS BY HEALTH CANADA-

TABLE 2 HEALTH CANADA REGULATIONS-

TABLE 3 NORTH AMERICA FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 5 NORTH AMERICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 7 NORTH AMERICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 9 NORTH AMERICA PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 11 NORTH AMERICA PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 13 NORTH AMERICA STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 15 NORTH AMERICA STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 17 NORTH AMERICA PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 19 NORTH AMERICA FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA FOOD THICKENERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA MICROBIAL IN FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA FOOD IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA BEVERAGES IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA FOOD THICKENERS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA FOOD THICKENERS MARKET, BY COUNTRY, 2020-2029 (THOUSAND TONS)

TABLE 28 NORTH AMERICA FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 30 NORTH AMERICA STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 32 NORTH AMERICA STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 34 NORTH AMERICA PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 36 NORTH AMERICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 38 NORTH AMERICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 40 NORTH AMERICA PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 42 NORTH AMERICA PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 44 NORTH AMERICA FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA FOOD THICKENERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA MICROBIAL IN FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA FOOD IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA BEVERAGES IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 U.S. FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 U.S. FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 53 U.S. STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 U.S. STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 55 U.S. STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 56 U.S. STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 57 U.S. PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 58 U.S. PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 59 U.S. HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.S. HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 61 U.S. HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 62 U.S. HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 63 U.S. PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 U.S. PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 65 U.S. PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 66 U.S. PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 67 U.S. FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 68 U.S. FOOD THICKENERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 69 U.S. FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 70 U.S. MICROBIAL IN FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 71 U.S. FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 72 U.S. FOOD IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 U.S. BEVERAGES IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 CANADA FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 CANADA FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 76 CANADA STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 CANADA STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 78 CANADA STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 79 CANADA STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 80 CANADA PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 81 CANADA PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 82 CANADA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 CANADA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 84 CANADA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 85 CANADA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 86 CANADA PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 CANADA PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 88 CANADA PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 89 CANADA PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 90 CANADA FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 91 CANADA FOOD THICKENERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 92 CANADA FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 93 CANADA MICROBIAL IN FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 94 CANADA FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 CANADA FOOD IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 CANADA BEVERAGES IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 MEXICO FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 MEXICO FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 99 MEXICO STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 MEXICO STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 101 MEXICO STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 102 MEXICO STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 103 MEXICO PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 104 MEXICO PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 105 MEXICO HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 MEXICO HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 107 MEXICO HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 108 MEXICO HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 109 MEXICO PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 MEXICO PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 111 MEXICO PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 112 MEXICO PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 113 MEXICO FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 114 MEXICO FOOD THICKENERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 115 MEXICO FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 116 MEXICO MICROBIAL IN FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 117 MEXICO FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 118 MEXICO FOOD IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 119 MEXICO BEVERAGES IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA FOOD THICKENERS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FOOD THICKENERS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FOOD THICKENERS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FOOD THICKENERS MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA FOOD THICKENERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FOOD THICKENERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA FOOD THICKENERS MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA FOOD THICKENERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA FOOD THICKENERS MARKET: SEGMENTATION

FIGURE 10 RISING CONSUMPTION OF PROCESSED FOOD AMONG PEOPLE IS THE KEY DRIVER FOR GLOBAL FOOD THICKENERS MARKET

FIGURE 11 PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FOOD THICKENERS MARKET IN 2022 & 2029

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA FOOD THICKENERS MARKET

FIGURE 13 NORTH AMERICA FOOD THICKENERS MARKET: BY TYPE, 2021

FIGURE 14 NORTH AMERICA FOOD THICKENERS MARKET: BY FORM, 2021

FIGURE 15 NORTH AMERICA FOOD THICKENERS MARKET: BY NATURE, 2021

FIGURE 16 NORTH AMERICA FOOD THICKENERS MARKET, BY SOURCE, 2021

FIGURE 17 NORTH AMERICA FAT REPLACERS MARKET: BY APPLICATION, 2021

FIGURE 18 NORTH AMERICA FOOD THICKENERS MARKET: SNAPSHOT (2021)

FIGURE 19 NORTH AMERICA FOOD THICKENERS MARKET: BY COUNTRY (2021)

FIGURE 20 NORTH AMERICA FOOD THICKENERS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 21 NORTH AMERICA FOOD THICKENERS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 22 NORTH AMERICA FOOD THICKENERS MARKET: BY TYPE (2022 & 2029)

FIGURE 23 NORTH AMERICA FOOD THICKENERS MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.