North America Food Certification Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

2.62 Billion

USD

4.75 Billion

2025

2033

USD

2.62 Billion

USD

4.75 Billion

2025

2033

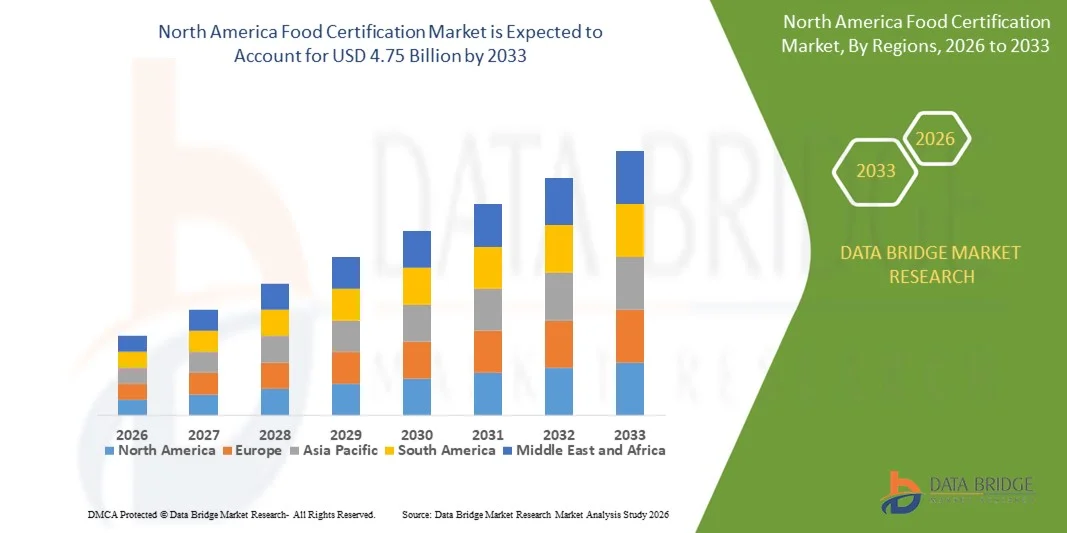

| 2026 –2033 | |

| USD 2.62 Billion | |

| USD 4.75 Billion | |

|

|

|

|

Segmentación del mercado de certificación de alimentos en Norteamérica por riesgo (alimentos de alto y bajo riesgo), tipo (ISO 22000, BRC, SQF, IFS, HALAL, KOSHER, certificaciones Free-From, HACCP, vegano y otros), aplicación (productos de panadería, confitería, alimentos para bebés, carnes y aves de corral, comida preparada, frutos secos y frutas deshidratadas, leche y productos lácteos, tabaco, miel, té y café, cereales, granos y legumbres, hierbas y especias, entre otros), categoría (certificación de alimentos orgánicos y certificación de alimentos sostenibles), usuario final (productores, fabricantes, minoristas, organizaciones de servicios de alimentación, entre otros): tendencias del sector y pronóstico hasta 2033.

Tamaño del mercado de certificación de alimentos en América del Norte

- El tamaño del mercado de certificación de alimentos de América del Norte se valoró en USD 2.62 mil millones en 2025 y se espera que alcance los USD 4.75 mil millones para 2033 , con una CAGR del 7,70% durante el período de pronóstico.

- El crecimiento del mercado se debe en gran medida a la creciente conciencia de los consumidores sobre la seguridad alimentaria, la calidad y la trazabilidad en las cadenas de suministro globales.

- Además, el aumento de los estándares regulatorios, la adopción de prácticas sostenibles y la creciente demanda de productos orgánicos certificados, sin OGM y libres de alérgenos están apoyando la expansión del mercado.

Análisis del mercado de certificación de alimentos en América del Norte

- El creciente énfasis en la seguridad alimentaria, la garantía de calidad y el cumplimiento de las regulaciones internacionales está configurando el mercado.

- La creciente adopción de estándares globales de certificación de alimentos por parte de fabricantes, minoristas y proveedores de servicios de alimentos está mejorando la transparencia de la cadena de suministro y reforzando la confianza del consumidor.

- Estados Unidos dominó el mercado de certificación de alimentos de América del Norte en 2025, respaldado por un marco regulatorio sólido, una alta conciencia de los consumidores y una demanda de productos certificados como orgánicos, sin OGM y libres de alérgenos.

- Se espera que Canadá sea testigo de la mayor tasa de crecimiento anual compuesta (CAGR) en el mercado de certificación de alimentos de América del Norte debido a la creciente conciencia de la seguridad alimentaria, la creciente demanda de productos orgánicos y sostenibles y las políticas gubernamentales de apoyo que incentivan las iniciativas de certificación de alimentos.

- El segmento de alimentos de alto riesgo registró la mayor participación en los ingresos del mercado en 2025, impulsado por la creciente necesidad de estrictas medidas de seguridad y cumplimiento normativo en productos alimenticios perecederos y procesados. Las certificaciones para alimentos de alto riesgo ayudan a garantizar la higiene, la trazabilidad y la seguridad del consumidor en todas las cadenas de suministro.

Alcance del informe y segmentación del mercado de certificación de alimentos en América del Norte

|

Atributos |

Perspectivas clave del mercado de certificación de alimentos en América del Norte |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de certificación de alimentos en América del Norte

Creciente demanda de seguridad, calidad y trazabilidad alimentaria

- El creciente enfoque en la seguridad y la calidad alimentaria está configurando significativamente el mercado de la certificación alimentaria, ya que los consumidores y las empresas prefieren cada vez más productos que cumplen con criterios estandarizados de seguridad, calidad y sostenibilidad. La certificación alimentaria está cobrando impulso gracias a su capacidad para garantizar el cumplimiento de los requisitos regulatorios y aumentar la confianza del consumidor sin afectar la disponibilidad ni el costo del producto. Esta tendencia fortalece su adopción en los sectores de procesamiento de alimentos, comercio minorista y catering, lo que anima a los organismos certificadores y fabricantes a innovar con programas de certificación sólidos.

- La creciente concienciación sobre la salud, la higiene y el abastecimiento sostenible ha acelerado la demanda de productos alimenticios certificados, incluyendo productos orgánicos, sin OMG, sin alérgenos y con etiqueta ecológica. Los minoristas y operadores de servicios de alimentación buscan activamente proveedores certificados para garantizar el cumplimiento normativo y la garantía de calidad, lo que impulsa la colaboración entre agencias de certificación y fabricantes de alimentos para mejorar la credibilidad y la trazabilidad.

- Las tendencias en certificación y sostenibilidad influyen en las decisiones de compra y adquisición, y las empresas priorizan el cumplimiento normativo, la transparencia y las prácticas ecológicas. Estos factores ayudan a las empresas a diferenciar sus productos en un mercado competitivo, fortalecer la reputación de la marca y generar confianza en los consumidores, a la vez que impulsan la adopción de programas de certificación internacionales y de terceros.

- Por ejemplo, en 2024, los principales fabricantes de alimentos ampliaron sus carteras de productos certificados, incorporando certificaciones ISO, HACCP y orgánicas para satisfacer la creciente demanda de calidad y seguridad verificadas. Estas certificaciones se introdujeron en respuesta a la preferencia de los consumidores por productos alimenticios confiables y seguros, y se implementaron en las operaciones de procesamiento, envasado y cadena de suministro.

- Si bien la demanda de certificación alimentaria está en aumento, la expansión sostenida del mercado depende de la mejora continua de los procesos, la realización de auditorías rentables y el mantenimiento de rigurosos estándares de cumplimiento. Las agencias de certificación también se centran en la escalabilidad, la verificación digital y el desarrollo de programas innovadores para equilibrar la eficiencia operativa, la credibilidad y la accesibilidad al mercado.

Dinámica del mercado de certificación de alimentos en América del Norte

Conductor

Énfasis creciente en la seguridad alimentaria, la calidad y la sostenibilidad

- La creciente demanda de alimentos seguros, de alta calidad y de origen sostenible por parte de los consumidores es un factor clave para el mercado de la certificación alimentaria. Las empresas buscan cada vez más certificaciones para validar el cumplimiento normativo, mejorar el atractivo de sus productos y cumplir con los estándares regulatorios y del sector.

- La expansión de las aplicaciones en alimentos envasados, bebidas, productos procesados y servicios de catering está impulsando el crecimiento del mercado. Las certificaciones alimentarias contribuyen a mejorar la trazabilidad, la higiene y el control de calidad, permitiendo a los fabricantes satisfacer las expectativas de los consumidores de productos seguros y fiables.

- Los organismos de certificación y las organizaciones del sector promueven activamente programas de seguridad y calidad alimentaria mediante auditorías, capacitación y verificación del cumplimiento. Estos esfuerzos se ven respaldados por el creciente enfoque en la sostenibilidad, la reducción del impacto ambiental y el fortalecimiento de la confianza del consumidor.

- Por ejemplo, en 2023, las principales marcas mundiales de alimentos informaron una mayor adopción de las certificaciones ISO 22000, HACCP y orgánicas en diversas líneas de productos. Esta expansión se produjo tras una mayor demanda del mercado de seguridad verificada, trazabilidad y abastecimiento sostenible, lo que impulsó la fidelización de clientes y la diferenciación competitiva.

- Si bien la creciente concienciación sobre la seguridad alimentaria y la sostenibilidad impulsa el crecimiento, una adopción más amplia depende de la optimización de costos, la accesibilidad de los programas de certificación y la escalabilidad de los procesos de auditoría. La inversión en verificación digital, capacitación y marcos estandarizados será crucial para satisfacer la demanda global y mantener la credibilidad del mercado.

Restricción/Desafío

Procesos de certificación complejos y de alto costo

- El costo relativamente más alto de obtener certificaciones alimentarias en comparación con las prácticas operativas estándar sigue siendo un desafío clave, lo que limita su adopción entre las pequeñas y medianas empresas. Los honorarios por auditoría, documentación y verificación del cumplimiento contribuyen a un aumento de los gastos.

- El conocimiento de los consumidores y fabricantes sobre las normas de certificación sigue siendo desigual en ciertos mercados. La comprensión limitada de los beneficios de las certificaciones limita su adopción en algunas categorías de alimentos y mercados emergentes.

- Las complejidades administrativas y de la cadena de suministro también impactan el crecimiento del mercado, ya que los productos certificados requieren el cumplimiento de estándares estrictos, documentación adecuada y auditorías periódicas. Los desafíos operativos, como la capacitación del personal y la estandarización de procesos, aumentan los requisitos de tiempo y recursos.

- Por ejemplo, en 2024, los pequeños procesadores y proveedores de alimentos informaron una adopción más lenta de las certificaciones ISO, HACCP y orgánicas debido a las limitaciones de costos y la complejidad de los procedimientos. El acceso limitado a organismos de certificación acreditados y sistemas de verificación digital ralentizó aún más la adopción.

- Superar estos desafíos requerirá procesos de certificación rentables, plataformas de auditoría digital y programas de concientización para fabricantes y consumidores. La colaboración con agencias reguladoras, minoristas y organizaciones del sector puede ayudar a impulsar el potencial de crecimiento a largo plazo del mercado global de certificación alimentaria. Además, el desarrollo de marcos de certificación simplificados y escalables será esencial para una adopción más amplia.

Alcance del mercado de certificación de alimentos en América del Norte

El mercado de certificación de alimentos de América del Norte está segmentado en función del riesgo, el tipo, la aplicación, la categoría y el usuario final.

- Por riesgo

En función del riesgo, el mercado norteamericano de certificación de alimentos se segmenta en alimentos de alto y bajo riesgo. El segmento de alimentos de alto riesgo registró la mayor participación en los ingresos del mercado en 2025, impulsado por la creciente necesidad de estrictas medidas de seguridad y cumplimiento normativo en productos alimenticios perecederos y procesados. Las certificaciones para alimentos de alto riesgo ayudan a garantizar la higiene, la trazabilidad y la seguridad del consumidor en todas las cadenas de suministro.

Se prevé que el segmento de alimentos de bajo riesgo experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente concienciación de los consumidores y la demanda de calidad verificada en productos alimenticios envasados y de larga duración. Las certificaciones de alimentos de bajo riesgo están ganando popularidad entre los fabricantes que buscan generar confianza y cumplir con los estándares de sostenibilidad y etiquetado limpio.

- Por tipo

Según el tipo, el mercado norteamericano de certificación de alimentos se segmenta en ISO 22000, BRC, SQF, IFS, HALAL, KOSHER, certificaciones Free-From, HACCP, vegano, entre otras. El segmento ISO 22000 mantuvo la mayor cuota de mercado en 2025 gracias a su reconocimiento global, su marco integral de gestión de la seguridad alimentaria y su aplicabilidad en múltiples categorías de alimentos.

Se prevé que el segmento HALAL experimente su mayor crecimiento entre 2026 y 2033, impulsado por la creciente demanda de productos que cumplan con las normas dietéticas y estén libres de alérgenos en la región. El crecimiento de la población musulmana en la región, sumado a la creciente concienciación sobre los estándares alimentarios certificados, anima a fabricantes y minoristas a ampliar su oferta de productos con certificación HALAL. Además, las plataformas de comercio electrónico y las cadenas minoristas modernas facilitan el acceso a productos certificados, impulsando aún más su adopción en el mercado.

- Por aplicación

Según la aplicación, el mercado de certificación de alimentos de Norteamérica se segmenta en productos de panadería, confitería, alimentos infantiles, productos cárnicos y avícolas, alimentos precocinados, frutos secos y frutas deshidratadas, leche y productos lácteos, tabaco, miel, té y café, cereales, granos y legumbres, hierbas y especias, entre otros. Los segmentos de panadería y lácteos obtuvieron la mayor participación en los ingresos en 2025 debido al alto consumo y al enfoque regulatorio en la seguridad y la calidad.

Se prevé que el segmento de alimentos para bebés experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente concienciación de los padres, la urbanización y la demanda de productos nutricionales certificados y de alta calidad. El aumento de la renta disponible, los hogares con doble ingreso y la prioridad en la salud y la seguridad infantil impulsan a los fabricantes a priorizar los alimentos para bebés certificados, trazables y fortificados.

- Por categoría

Según la categoría, el mercado de certificación de alimentos de Norteamérica se segmenta en certificación de alimentos orgánicos y certificación de alimentos sostenibles. El segmento de certificación de alimentos orgánicos tuvo la mayor participación en 2025, impulsado por la creciente demanda de productos sin OGM, sin pesticidas y ecológicos.

Se espera que el segmento de certificación de alimentos sostenibles registre el mayor crecimiento durante el período de pronóstico, impulsado por iniciativas centradas en la reducción del impacto ambiental, el abastecimiento responsable y un comportamiento de consumo responsable con el medio ambiente. La creciente concienciación de los consumidores sobre el cambio climático, el abastecimiento ético y las prácticas agrícolas sostenibles está animando a los fabricantes a obtener certificaciones de sostenibilidad.

- Por el usuario final

En función del usuario final, el mercado de certificación de alimentos de Norteamérica se segmenta en productores, fabricantes, minoristas, organizaciones de servicios de alimentación y otros. El segmento de fabricantes obtuvo la mayor participación en los ingresos del mercado en 2025 debido a la necesidad de cumplimiento en las etapas de producción, procesamiento y envasado.

Se prevé que el segmento minorista experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente adopción de productos certificados para garantizar la confianza del consumidor y cumplir con los estándares cambiantes de seguridad alimentaria y sostenibilidad. Las cadenas minoristas están ampliando sus carteras de productos certificados para diferenciar sus ofertas, mejorar la credibilidad de la marca y atraer a consumidores conscientes.

Análisis regional del mercado de certificación de alimentos de América del Norte

- Estados Unidos dominó el mercado de certificación de alimentos de América del Norte en 2025, respaldado por un marco regulatorio sólido, una alta conciencia de los consumidores y una demanda de productos certificados como orgánicos, sin OGM y libres de alérgenos.

- Los procesadores y minoristas de alimentos en EE. UU. confían en las certificaciones para garantizar el cumplimiento, mejorar la calidad del producto y generar confianza en el consumidor.

- La fuerte adopción se ve respaldada además por la integración tecnológica, la trazabilidad digital y las redes minoristas modernas, lo que convierte a las certificaciones en un factor clave en el crecimiento del mercado.

Perspectiva del mercado de certificación alimentaria de Canadá

Se prevé que el mercado canadiense de certificación de alimentos experimente su mayor crecimiento entre 2026 y 2033, impulsado por la creciente demanda de productos orgánicos, sostenibles y libres de alérgenos. Fabricantes y minoristas están adoptando certificaciones internacionales para cumplir con los requisitos regulatorios y atender a los consumidores preocupados por su salud. Además, la creciente concienciación sobre prácticas de abastecimiento ecológicas y éticas está impulsando la adopción de productos alimenticios certificados en todo el país.

Cuota de mercado de certificación de alimentos en América del Norte

La industria de certificación de alimentos de América del Norte está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

• Instituto Nacional de Normas Estadounidenses (EE. UU.)

• Agencia Canadiense de Inspección de Alimentos (Canadá)

• Consejo de Normas de Canadá (Canadá)

• Departamento de Agricultura de EE. UU. (EE. UU.)

• Administración de Alimentos y Medicamentos de EE. UU. (EE. UU.)

• Fundación Nacional de Saneamiento (EE. UU.)

• Servicios de la Red de Seguridad Alimentaria (EE. UU.)

• Underwriters Laboratories (EE. UU.)

• Agencia Canadiense de Inspección de Alimentos (Canadá)

• Instituto Nacional de Normas y Tecnología (EE. UU.)

• Asociación Estadounidense para la Acreditación de Laboratorios (EE. UU.)

• Consejo de Inocuidad Alimentaria de México (México)

• Entidad Mexicana de Acreditación (México)

• Junta Canadiense de Normas Generales (Canadá)

• Servicio de Salud Pública de EE. UU. (EE. UU.)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.