Mercado de pruebas de intolerancia y alérgenos alimentarios de América del Norte, por tipo de prueba ( prueba de alérgenos , prueba de intolerancia), método (in vitro, in vivo), usuario final (usuario final de pruebas de alérgenos, usuario final de pruebas de intolerancia): tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado

La seguridad y la calidad de los alimentos son preocupaciones importantes para la industria alimentaria y la venta minorista y la hostelería, y tienen un impacto en la productividad. Las alergias alimentarias están aumentando a nivel mundial, incluida la cantidad de alérgenos, la tasa de sensibilización y la tasa de prevalencia. Para proteger a las personas alérgicas a los alimentos en la comunidad, las alergias alimentarias deben gestionarse adecuadamente, analizarse en los alimentos procesados y etiquetarse correctamente en ellos. La presencia de pruebas de alérgenos ha aumentado recientemente y los laboratorios de pruebas pueden ayudar a detectar estos alérgenos. La función más importante de los laboratorios de alérgenos alimentarios es analizar los alimentos para detectar la presencia de alérgenos como la soja, los productos lácteos, el cacahuete y los frutos secos, entre otros.

La demanda de análisis de alimentos está aumentando, por lo que los fabricantes se involucran en los lanzamientos de nuevos productos, promociones, premios, certificaciones y participación en eventos del mercado. Estas decisiones, en última instancia, mejoran el crecimiento del mercado.

El informe de mercado de pruebas de intolerancia y alérgenos alimentarios proporciona detalles de la participación de mercado, los nuevos desarrollos y el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un informe de analista; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado. Las iniciativas estratégicas como la colaboración, el acuerdo y la firma de acuerdos de venta para inventar e innovar tratamientos farmacológicos son los principales impulsores que impulsaron la demanda del mercado en el período de pronóstico.

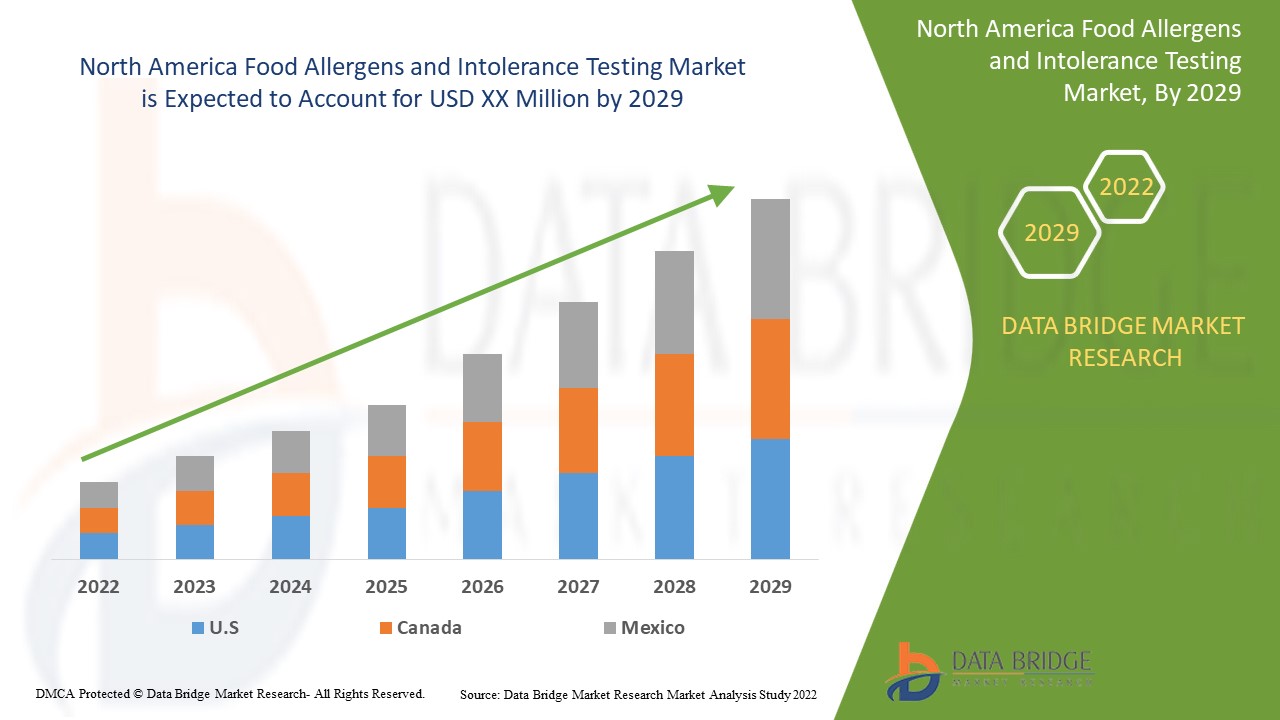

El mercado de pruebas de intolerancia y alérgenos alimentarios es favorable y tiene como objetivo reducir la progresión de la enfermedad. Data Bridge Market Research analiza que el mercado de pruebas de intolerancia y alérgenos alimentarios crecerá a una tasa compuesta anual del 7,9 % durante el período de pronóstico de 2022 a 2029.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Por tipo de prueba (prueba de alérgenos, prueba de intolerancia), método (in vitro, in vivo), usuario final (usuario final de prueba de alérgenos, usuario final de prueba de intolerancia) |

|

Países cubiertos |

Estados Unidos, Canadá, México |

|

Actores del mercado cubiertos |

Español: SGS SA, Agilent Technologies, Inc., NEOGEN Corporation, ALS Limited, Mérieux NutriSciences, Eurofins Scientific, Intertek Group plc, TÜV SÜD, Bureau Veritas, Symbio Laboratories, RJ Hill Laboratories Limited, NSF International, Healthy Stuff Online Limited, QIMA, IFP INSTITUT FÜR PRODUKTQUALITÄT GMBH, ADPEN LABORATORIES, INC., AsureQuality, Microbac Laboratories, Inc, Romer Labs Division Holding GmbH, FOOD SAFETY NET SERVICES, PCAS Labs, Element Materials Technology, OMIC USA Inc., entre otros. |

Definición de mercado

La alergia alimentaria es una reacción del sistema inmunitario que se produce poco después de ingerir un determinado alimento. Incluso una pequeña cantidad del alimento que provoca la alergia puede provocar signos y síntomas como problemas digestivos, urticaria o inflamación de las vías respiratorias. En algunas personas, una alergia alimentaria puede provocar síntomas graves o incluso una reacción potencialmente mortal conocida como anafilaxia. Por otro lado, una intolerancia alimentaria se produce cuando una persona tiene dificultad para digerir un alimento en particular. Esto puede provocar síntomas como gases intestinales, dolor abdominal o diarrea. Las pruebas de intolerancia y alérgenos alimentarios son el análisis científico de los alimentos y su contenido para la detección de alérgenos. Se realizan para proporcionar información sobre los diversos componentes alergénicos de los alimentos, incluida la estructura, la composición y las propiedades fisicoquímicas del alimento. Las pruebas de productos alimenticios se pueden realizar utilizando varios métodos muy avanzados para proporcionar información precisa sobre el valor nutricional y la seguridad del alimento.

Las pruebas y análisis de alimentos son esenciales para garantizar la inocuidad de los alimentos y garantizar que sean seguros para el consumo. Esto incluye fortalecer la red de laboratorios de análisis de alimentos, garantizar la calidad de los análisis, invertir en recursos humanos y llevar a cabo actividades de vigilancia, y educar a los consumidores.

Dinámica del mercado de pruebas de intolerancia y alérgenos alimentarios

Conductores

- Aumento de la prevalencia de alergias e intolerancias alimentarias

Según la Organización Mundial de la Salud, las alergias afectan hasta al 40 por ciento de la población mundial, y la proporción de personas que las padecen en las grandes ciudades y los países industrializados está aumentando. Pueden causar enfermedades crónicas y, en el caso de algunas alergias alimentarias, pueden ser mortales. La alergia alimentaria se ha convertido en un grave problema de salud pública. Se estima que la prevalencia de las alergias alimentarias es de alrededor del 2-4% en adultos y del 6-8% en niños. En los países occidentales, se ha informado de que la alergia alimentaria diagnosticada mediante provocación alcanza el 10%, y la mayor prevalencia se observa entre los niños más pequeños. También hay cada vez más pruebas de un aumento de la prevalencia en los países en desarrollo, con tasas de alergia alimentaria diagnosticada mediante provocación en China y África similares a las de los países occidentales. Una observación interesante es que los niños de ascendencia asiática oriental o africana nacidos en un entorno occidental tienen un mayor riesgo de alergia alimentaria en comparación con los niños caucásicos; este intrigante hallazgo enfatiza la importancia de las interacciones entre el genoma y el entorno y pronostica futuros aumentos de la alergia alimentaria en Asia y África a medida que continúa el crecimiento económico en estas regiones. Aunque la alergia a la leche de vaca y al huevo son dos de las alergias alimentarias más comunes en la mayoría de los países, se pueden observar diversos patrones de alergia alimentaria en regiones geográficas individuales determinadas por los patrones de alimentación de cada país. Además, con las reacciones adversas no tóxicas (hipersensibilidad), la tasa de prevalencia de las alergias alimentarias está aumentando exponencialmente. El creciente número de casos de alergia alimentaria ha llevado a las autoridades de salud pública de todo el mundo a tomar medidas significativas para frenar las reacciones alérgicas y sus consecuencias.

- Una variedad de alimentos susceptibles a los alérgenos crea la necesidad de realizar pruebas.

Desde los alimentos para bebés hasta los productos de panadería y confitería, pasando por los productos lácteos, las bebidas, los productos de conveniencia y los productos cárnicos, todos son susceptibles de provocar alergias, lo que está creando un gran mercado de pruebas de alérgenos alimentarios. Además, debido a la mala calidad de los alimentos para animales, siempre existe la posibilidad de que la carne provoque alergias en los seres humanos. Aunque la industria de alimentos y bebidas está observando un aumento en la demanda de aditivos para alimentos para animales que sean capaces de mejorar la calidad de los alimentos, el mercado de pruebas de intolerancia alimentaria todavía tiene importancia para mejorar las alergias causadas por la carne.

Aunque se han identificado más de 170 alimentos que causan alergias alimentarias en consumidores sensibles, el USDA y la FDA han identificado ocho alimentos alergénicos principales, según la FALCPA de 2004 (Ley de Etiquetado de Alérgenos Alimentarios y Protección del Consumidor).

Oportunidad

- Pruebas de alérgenos alimentarios en mercados emergentes

Según la Organización Mundial de Alergias (WAO), la cantidad de casos de anafilaxia en las salas de urgencias oscilaba entre 222, 300-350 y 3000 al año en Hungría, Japón y China, respectivamente. Además, la organización estima que la tasa de prevalencia de la anafilaxia es del 2%, 0,1% y 0,6-1% de la población en los EE. UU., Corea y Australia. La Administración de Alimentos y Medicamentos (FDA) ha hecho de la seguridad alimentaria un aspecto imperativo de la industria alimentaria, lo que actúa como un factor impulsor del mercado. Además, ha habido un aumento perceptible en el número de personas que padecen alergias alimentarias desde la década de 1990, lo que está convirtiendo aún más el mercado de pruebas de alérgenos alimentarios en un segmento importante en países como Europa, los EE. UU. y otros.

Restricciones/Desafíos

Existen muchos obstáculos que dificultan el diagnóstico adecuado de las alergias alimentarias en el mundo en desarrollo, ya que existe evidencia de que el conocimiento sobre alergias alimentarias por parte de los padres y los trabajadores de la salud es insuficiente y las pruebas de diagnóstico in vitro no son de fácil acceso. El diagnóstico temprano de la alergia alimentaria es importante para el pronóstico y el manejo nutricional adecuado. Sin embargo, incluso en los países desarrollados, se reporta un retraso de diagnóstico de 4 meses, especialmente en bebés con manifestaciones menos graves de alergia a la leche no mediada por IgE. Esta situación es probablemente peor en los países en desarrollo; Aguilar-Jasso et al. encontraron un retraso de 38 meses en el diagnóstico de la alergia alimentaria en el noroeste de México.

Se espera que la falta de infraestructura y recursos para el control de los alimentos en los países en desarrollo y las dificultades técnicas durante el muestreo, las pruebas y la identificación de proteínas obstaculicen el crecimiento del mercado. Los países de Oriente Medio y África y otros países de bajos ingresos siguen teniendo restricciones debido a la escasa concienciación sobre los alérgenos alimentarios y las pruebas de intolerancia. La falta de iniciativa gubernamental, la mala economía y, sobre todo, la falta de concienciación entre las personas sobre las alergias relacionadas con los alimentos van a obstaculizar el mercado.

Sin embargo, cada país está limitado por las directrices reguladas por diferentes autoridades, que se espera que actúen como un desafío para el crecimiento del mercado de pruebas de intolerancias y alérgenos alimentarios.

Acontecimientos recientes

- En diciembre de 2020, Eurofins Scientific lanzó la gama de productos SENSI Strip Allergen para detectar alérgenos alimentarios en productos alimenticios envasados. Este nuevo lanzamiento de producto ayudó a la empresa a mejorar su cartera de productos.

- En octubre de 2020, NEOGEN Corporation lanzó un nuevo método de extracción de alimentos para ampliar las capacidades de las pruebas de alérgenos alimentarios Reveal 3-D para la prueba directa de productos alimenticios. El nuevo producto Reveal 3-D permite la detección rápida de muestras de alimentos e ingredientes. El tampón está disponible para pruebas de huevo, coco, avellana, soja, maní y almendra. Este nuevo lanzamiento de producto ayudó a la empresa a ampliar su cartera de productos de seguridad alimentaria.

División del mercado de pruebas de intolerancia y alérgenos alimentarios

El mercado de pruebas de intolerancias y alérgenos alimentarios se clasifica en tres segmentos notables que se basan en el tipo de prueba, el método y el usuario final. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

Tipo de alérgeno

- Prueba de alérgenos

- Prueba de intolerancia

Sobre la base del tipo de prueba, el mercado de pruebas de alérgenos e intolerancias alimentarias se segmenta en pruebas de alérgenos y pruebas de intolerancia.

Método

- In vitro

- In vivo

Sobre la base del método, el mercado de pruebas de intolerancias y alérgenos alimentarios se segmenta en in vitro e in vivo.

Usuario final

- Prueba de alérgenos para el usuario final

- Prueba de intolerancia para el usuario final

Sobre la base del usuario final, el mercado de pruebas de intolerancias y alérgenos alimentarios se segmenta en usuario final de pruebas de alérgenos y usuario final de pruebas de intolerancia.

Análisis y perspectivas regionales del mercado de pruebas de intolerancia y alérgenos alimentarios

Se analiza el mercado de pruebas de intolerancias y alérgenos alimentarios y se proporcionan información y tendencias del tamaño del mercado por tipo de prueba, método y usuario final como se menciona anteriormente.

Las regiones cubiertas en el informe del mercado de pruebas de intolerancias y alérgenos alimentarios son EE. UU., Canadá y México.

Se espera que Estados Unidos domine el mercado norteamericano debido al gran número de actores principales del mercado.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de las pruebas de intolerancia y alérgenos alimentarios

El panorama competitivo del mercado de pruebas de intolerancia y alérgenos alimentarios proporciona detalles de los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos y el dominio de la aplicación. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en el mercado de pruebas de intolerancia y alérgenos alimentarios.

Algunos de los principales actores que operan en el mercado de pruebas de intolerancias y alérgenos alimentarios son SGS SA, Agilent Technologies, Inc., NEOGEN Corporation, ALS Limited, Mérieux NutriSciences, Eurofins Scientific, Intertek Group plc, TÜV SÜD, Bureau Veritas, Symbio Laboratories, RJ Hill Laboratories Limited, NSF International, Healthy Stuff Online Limited, QIMA, IFP INSTITUT FÜR PRODUKTQUALITÄT GMBH, ADPEN LABORATORIES, INC., AsureQuality, Microbac Laboratories, Inc, Romer Labs Division Holding GmbH, FOOD SAFETY NET SERVICES, PCAS Labs, Element Materials Technology, OMIC USA Inc., entre otros.

Metodología de la investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con tamaños de muestra grandes. Los datos del mercado se analizan y estiman utilizando modelos estadísticos y coherentes del mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Aparte de esto, los modelos de datos incluyen la cuadrícula de posicionamiento de proveedores, el análisis de la línea de tiempo del mercado, la descripción general y la guía del mercado, la cuadrícula de posicionamiento de la empresa, el análisis de la participación de mercado de la empresa, los estándares de medición, América del Norte frente a la región y el análisis de la participación de los proveedores. Solicite una llamada de un analista en caso de tener más consultas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TESTING TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES ANALYSIS-

4.1.1 BARGAINING POWER OF CUSTOMERS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 THE THREAT OF NEW ENTRANTS

4.1.4 THREAT OF SUBSTITUTES

4.1.5 RIVALRY AMONG EXISTING COMPETITORS

4.2 VALUE CHAIN ANALYSIS

4.3 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.4 TECHNOLOGY INNOVATIONS

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.6 FACTOR INFLUENCING PURCHASING DECISION OF END-USERS

4.6.1 QUALITY OF THE PRODUCTS:

4.6.2 AVAILABILITY OF A VARIETY OF TESTING TYPES:

4.6.3 WIDE USE IN VARIOUS INDUSTRIES:

4.7 UPCOMING TESTING TECHNOLOGIES

5 REGULATORY FRAMEWORK

5.1 NORTH AMERICA FOOD SAFETY INITIATIVE

5.2 INTERNATIONAL BODY FOR FOOD SAFETY STANDARDS AND REGULATIONS

5.3 FEDERAL LEGISLATION

5.3.1 EUROPEAN UNION

5.3.2 THE U.S.

5.3.3 CANADA

5.3.4 AUSTRALIA

5.4 FDA FOOD SAFETY MODERNIZATION ACT

5.5 FOOD SAFETY ON TRACEABILITY SYSTEMS AND FOOD DIAGNOSTICS

5.6 THE TOXIC SUBSTANCES CONTROL ACT OF 1976

5.7 REGULATORY IMPOSITIONS ON GM LABELING

5.8 RAPID ALERT SYSTEM FOR FOOD AND FEED (RASFF) TO REPORT FOOD SAFETY ISSUES

5.9 OTHERS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING PREVALENCE OF FOOD ALLERGIES AND INTOLERANCE

6.1.2 INCREASED HEALTH CARE EXPENDITURE WORLDWIDE

6.1.3 A VARIETY OF FOODS SUSCEPTIBLE TO ALLERGENS CREATES A NEED FOR TESTING

6.1.4 GROWING AWARENESS OF FOOD ALLERGENS

6.1.5 LABELING COMPLIANCE IN SEVERAL FOOD INDUSTRIES

6.2 RESTRAINTS

6.2.1 UNAVAILABILITY OF FOOD CONTROL INFRASTRUCTURE & RESOURCES

6.2.2 LACK OF AWARENESS ABOUT LABELLING REGULATION

6.2.3 HIGH COST OF TREATMENT

6.3 OPPORTUNITIES

6.3.1 FOOD ALLERGEN TESTING IN EMERGING MARKETS

6.3.2 USE OF HEALTH IN ALLERGY DIAGNOSIS

6.4 CHALLENGES

6.4.1 DIAGNOSTIC CHALLENGES IN DEVELOPING WORLD

6.4.2 LACK OF STANDARDIZATION IN ALLERGEN TESTING PRACTICES

7 POST COVID-19 IMPACT ON FOOD ALLERGENS AND INTOLERANCE TESTING MARKET

8 NORTH AMERICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET, BY TESTING TYPE

8.1 OVERVIEW

8.2 ALLERGEN TESTING

8.3 INTOLERANCE TESTING

9 NORTH AMERICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET, BY METHOD

9.1 OVERVIEW

9.2 IN-VITRO

9.3 IN-VIVO

10 NORTH AMERICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET, BY END USER

10.1 OVERVIEW

10.2 ALLERGEN TESTING END USER

10.3 INTOLERANCE TESTING END USER

11 NORTH AMERICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT

14 COMPANY PROFILE

14.1 EUROFINS SCIENTIFIC

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 SERVICE PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.1.5.1 ACQUISITION

14.1.5.2 LAUNCH

14.2 SGS SA

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 SERVICES PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.2.5.1 BUISNESS EXPANSION

14.2.5.2 ACQUISITION

14.3 BUREAU VERITAS

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 SERVICE PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.3.5.1 AGREEMENTS

14.3.5.2 AWARD

14.4 TÜV SÜD

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 SERVICE PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.4.4.1 EVENT

14.4.4.2 PATNERSHIP

14.5 ALS LIMITED

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 SERVICE PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.5.5.1 ACQUISITION

14.5.5.2 AWARDS

14.6 NEOGEN CORPORATION

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 SERVICE PORTFOLIO

14.6.4 RECENT DEVELOPMENS

14.6.4.1 PRODUCT DEVELOPMENTS

14.6.4.2 AGREEMENT

14.7 INTERTEK GROUP PLC

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 SERVICE PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.7.4.1 AWARD

14.7.5 ACQUISITION

14.8 ROMER LABS DIVISION HOLDING GMBH

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 QIMA

14.9.1 COMPANY SNAPSHOT

14.9.2 SERVICES PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 MÉRIEUX NUTRISCIENCES

14.10.1 COMPANY SNAPSHOT

14.10.2 SERVICES PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 MICROBAC LABORATORIES, INC.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 FOOD SAFETY NET SERVICES

14.12.1 COMPANY SNAPSHOT

14.12.2 SERVICES PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 ADPEN LABORATORIES, INC.

14.13.1 COMPANY SNAPSHOT

14.13.2 SERVICES PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 ASUREQUALITY

14.14.1 COMPANY SNAPSHOT

14.14.2 SERVICES PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 ELEMENT MATERIALS TECHNOLOGY

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 HEALTHY STUFF ONLINE LIMITED

14.16.1 COMPANY SNAPSHOT

14.16.2 SERVICE PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 IFP INSTITUT FÜR PRODUKTQUALITÄT GMBH

14.17.1 COMPANY SNAPSHOT

14.17.2 SERVICES PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 NSF INTERNATIONAL

14.18.1 COMPANY SNAPSHOT

14.18.2 SERVICE PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.18.3.1 RELOCATION

14.19 OMIC USA INC.

14.19.1 COMPANY SNAPSHOT

14.19.2 SERVICE PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 PCAS LABS

14.20.1 COMPANY SNAPSHOT

14.20.2 SERVICES PORTFOLIO

14.20.3 RECENT DEVELOPMENT

14.21 R J HILL LABORATORIES LIMITED

14.21.1 COMPANY SNAPSHOT

14.21.2 SERVICE PORTFOLIO

14.21.3 RECENT DEVELOPMENTS

14.21.3.1 LAUNCH

14.22 SYMBIO LABORATORIES

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT DEVELOPMENTS

14.22.3.1 EXPANSION

14.22.3.2 ACQUISITION

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de figuras

FIGURE 1 NORTH AMERICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: SEGMENTATION

FIGURE 11 EUROPE IS EXPECTED TO DOMINATE THE NORTH AMERICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET AND IS GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 12 INCREASING CASES OF FOOD ALLERGIES ARE EXPECTED TO DRIVE THE NORTH AMERICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET IN THE FORECAST PERIOD

FIGURE 13 ALLERGEN TESTING IN TESTING TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET IN 2022 & 2029

FIGURE 14 VALUE CHAIN OF NORTH AMERICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET

FIGURE 16 SELF-REPORTED PREVALENCE OF FOOD ALLERGY IN THE UNITED STATES

FIGURE 17 NORTH AMERICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY TESTING TYPE, 2021

FIGURE 18 NORTH AMERICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY TESTING TYPE, 2022-2029 (USD MILLION)

FIGURE 19 NORTH AMERICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY TESTING TYPE, CAGR (2022-2029)

FIGURE 20 NORTH AMERICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY TESTING TYPE, LIFELINE CURVE

FIGURE 21 NORTH AMERICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY METHOD, 2021

FIGURE 22 NORTH AMERICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY METHOD, 2022-2029 (USD MILLION)

FIGURE 23 NORTH AMERICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY METHOD, CAGR (2022-2029)

FIGURE 24 NORTH AMERICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY METHOD, LIFELINE CURVE

FIGURE 25 NORTH AMERICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY END USER, 2021

FIGURE 26 NORTH AMERICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 27 NORTH AMERICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY END USER, CAGR (2022-2029)

FIGURE 28 NORTH AMERICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY END USER, LIFELINE CURVE

FIGURE 29 NORTH AMERICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: SNAPSHOT (2021)

FIGURE 30 NORTH AMERICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY COUNTRY (2021)

FIGURE 31 NORTH AMERICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 32 NORTH AMERICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 33 NORTH AMERICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY TESTING TYPE (2022-2029)

FIGURE 34 NORTH AMERICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.