Mercado de adhesivos para pisos de América del Norte, por tipo de resina (adhesivo de poliuretano, adhesivo acrílico , adhesivo de vinilo, epoxi y otros), tecnología (adhesivo a base de agua, adhesivo a base de solvente y adhesivo termofusible), aplicación (resiliente, laminado, baldosas y piedra, alfombra, madera y otros), usuario final (adhesivo para pisos residenciales, adhesivo para pisos comerciales y adhesivo para pisos industriales): tendencias de la industria y pronóstico hasta 2030.

Análisis y tamaño del mercado de adhesivos para pisos de América del Norte

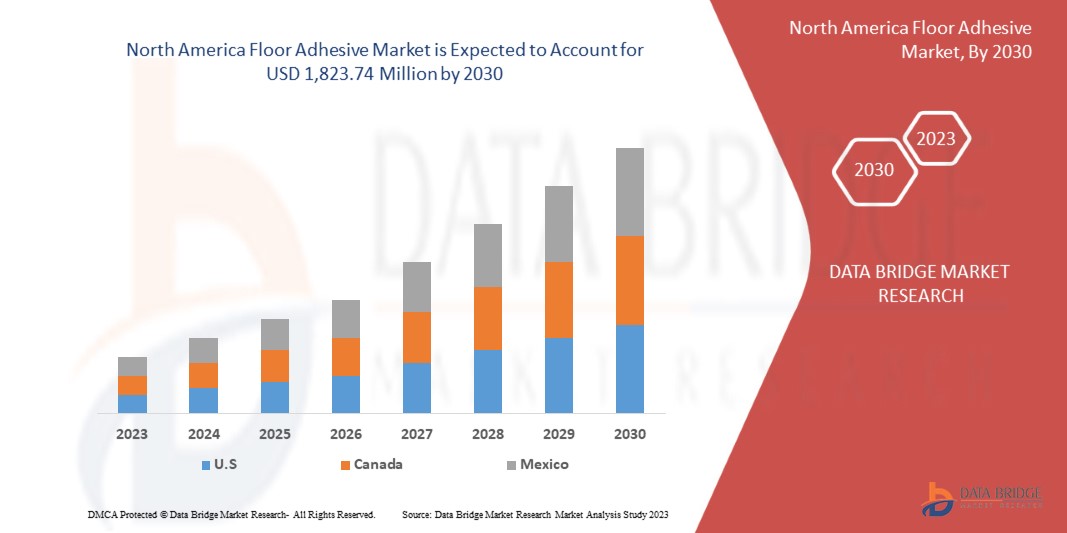

Se espera que el mercado de adhesivos para pisos de América del Norte crezca significativamente en el período de pronóstico de 2023 a 2030. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 4,8% en el período de pronóstico de 2023 a 2030 y se espera que alcance los USD 1.823,74 millones para 2030. El principal factor que impulsa el crecimiento del mercado de adhesivos para pisos es la creciente popularidad y la creciente conciencia sobre las propiedades de los productos adhesivos para pisos.

Cualquier tipo de pegamento potente y duradero que se utilice para fijar firmemente los componentes del piso a un contrapiso o una base se denomina adhesivo para pisos. Si bien algunos adhesivos multiusos se pueden utilizar con éxito con una variedad de materiales, se recomiendan diferentes adhesivos para varios tipos de pisos.

El informe del mercado de adhesivos para pisos de América del Norte proporciona detalles sobre la participación de mercado, los nuevos desarrollos y el impacto de los actores del mercado local y nacional, analiza las oportunidades en términos de segmentos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un informe de analista. Nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2020 - 2015) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en unidades y precios en USD |

|

Segmentos cubiertos |

Por tipo de resina (adhesivo de poliuretano, adhesivo acrílico, adhesivo de vinilo , epoxi y otros), tecnología ( adhesivo a base de agua , adhesivo a base de solvente y adhesivo termofusible), aplicación (resistente, laminado, baldosas y piedra, alfombra, madera y otros), usuario final ( adhesivo para pisos residenciales , adhesivo para pisos comerciales y adhesivo para pisos industriales) |

|

Países cubiertos |

Estados Unidos, Canadá y México |

|

Actores del mercado cubiertos |

HENRY, DOW, Arkema, HB Fuller Company, 3M, Wacker Chemie AG, LATICRETE INTERNATIONAL, INC, QEP Co., Inc., Mapei Corporation, Sika AG, HENKEL AG & CO. KGAA y BASF SE, entre otros. |

Definición de mercado

Un adhesivo para pisos es un pegamento fuerte y permanente para adherir materiales para pisos a un contrapiso o una base. Puede estar compuesto de muchos componentes, como polímeros, oligómeros, rellenos y aditivos de fuentes naturales o sintéticas. Se recomiendan diferentes tipos de adhesivos para pisos para los diferentes tipos de pisos, aunque pocas soluciones multipropósito se pueden usar de manera eficiente con varios materiales, que incluyen pisos residenciales, pisos deportivos y pisos no residenciales.

Dinámica del mercado de adhesivos para pisos en América del Norte

Esta sección trata sobre la comprensión de los factores impulsores, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- Aumento de la construcción y el desarrollo de infraestructura

Los sectores de la construcción y el desarrollo de infraestructuras se han expandido significativamente en los últimos años en América del Norte. El aumento se debe principalmente a varias causas, entre ellas el crecimiento de la población, la urbanización, la estabilidad económica y los esfuerzos gubernamentales. Como resultado, la demanda de adhesivos para pisos, que desempeñan un papel importante en la fijación e instalación de materiales para pisos, ha aumentado significativamente. La población de América del Norte sigue aumentando de manera constante, lo que da como resultado una creciente urbanización. La necesidad de espacio residencial y comercial aumenta a medida que más personas se mudan a las ciudades.

Por lo tanto, la industria de la construcción espera un aumento en los proyectos de construcción como complejos residenciales, edificios de oficinas, centros comerciales e instituciones educativas. El uso de adhesivos para pisos es necesario para la instalación de materiales para pisos en estas construcciones, lo que impulsa la demanda de adhesivos para pisos en la región.

- Avances crecientes en tecnologías de suelos

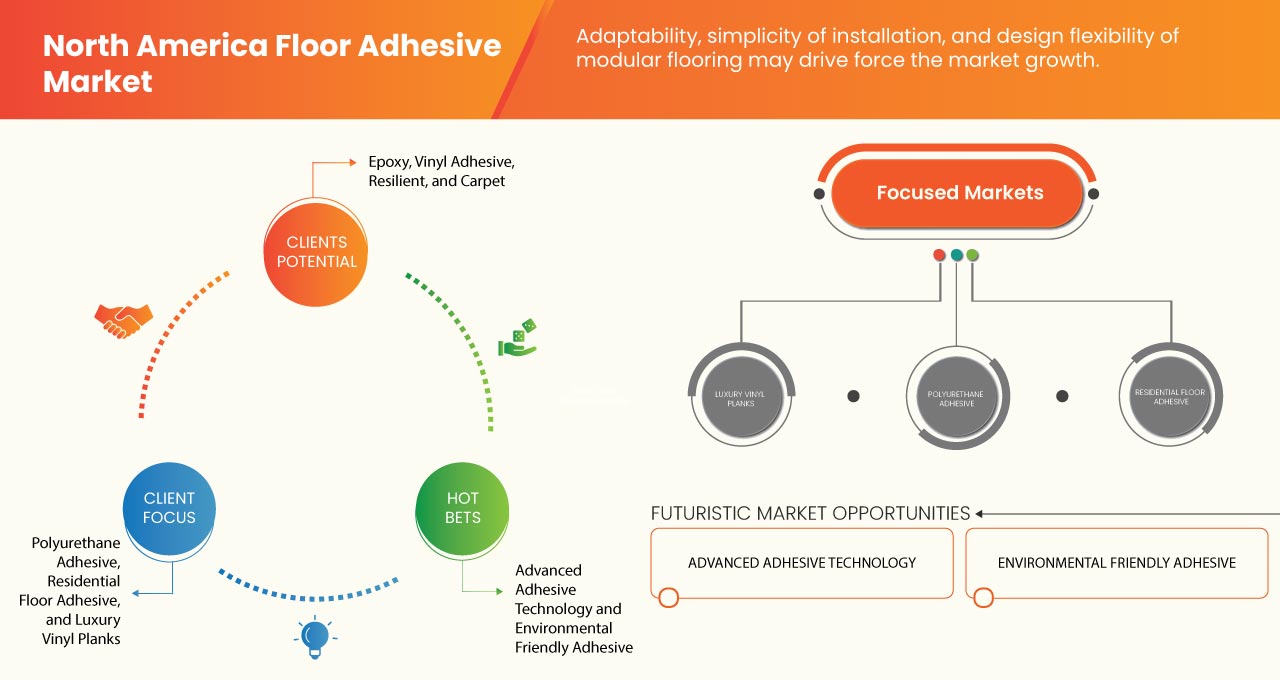

Los avances en el campo de los pisos han transformado los sectores de la construcción y el diseño de interiores, brindando soluciones innovadoras que mejoran la estética, la durabilidad, la eficiencia de instalación y la sustentabilidad. Estas innovaciones han tenido un impacto considerable en el mercado de adhesivos para pisos en América del Norte. Las soluciones de pisos modulares han ganado popularidad debido a su adaptabilidad, simplicidad de instalación y flexibilidad de diseño. Las baldosas o tablones individuales se entrelazan o se cementan para formar una superficie de piso coherente con estos métodos.

La creciente popularidad de los sistemas de pisos modulares ha aumentado la demanda de adhesivos para pisos especializados que brinden una fuerte adhesión y compatibilidad con diversos materiales modulares, como baldosas de vinilo de lujo (LVT), baldosas de alfombra y tablones de madera de ingeniería. Además, los pisos de madera dura, laminados y de madera de ingeniería prefabricados han ganado popularidad debido a su durabilidad y facilidad de mantenimiento. La instalación de pisos prefabricados a menudo requiere adhesivos diseñados específicamente para unir los materiales del piso al contrapiso, lo que impulsa la demanda de adhesivos para pisos.

Oportunidades

- Cambio hacia adhesivos ecológicos y sostenibles

Las crecientes preocupaciones ambientales y la adopción de prácticas de construcción ecológicas están impulsando un cambio drástico en la industria de adhesivos para pisos de América del Norte hacia materiales ecológicos y sostenibles. Los adhesivos para pisos tradicionales con frecuencia incluyen compuestos orgánicos volátiles (VOC) y otras sustancias potencialmente peligrosas que ponen en peligro la salud humana y el medio ambiente.

Por ello, los fabricantes y los clientes buscan cada vez más opciones respetuosas con el medio ambiente y aumentan las soluciones creativas y sostenibles de adhesivos para suelos. A medida que las empresas intentan innovar y ofrecer productos ecológicamente responsables, este cambio ha ofrecido enormes perspectivas en el mercado norteamericano de adhesivos para suelos.

- Fabricantes lanzan productos adhesivos nuevos e innovadores

Los fabricantes del mercado de adhesivos para pisos de América del Norte buscan constantemente desarrollar productos nuevos y creativos para satisfacer las crecientes necesidades de los clientes y las demandas de la industria. La introducción de soluciones de adhesivos para pisos no solo ha creado nuevas oportunidades para los fabricantes, sino que también ha contribuido al crecimiento y desarrollo general del mercado. Los rápidos avances en la tecnología de adhesivos han permitido a los productores crear productos con características de rendimiento mejoradas, como mayor fuerza de unión, períodos de curado más rápidos y mayor resistencia a las variables ambientales.

Los fabricantes están desarrollando adhesivos a base de agua como una alternativa más ecológica a los adhesivos a base de disolventes. Estos adhesivos son cada vez más populares en el mercado debido a sus menores emisiones de COV, la mejora de la calidad del aire interior y la facilidad de limpieza. Además, debido a su facilidad de uso, capacidad de reposicionamiento y compatibilidad con diversos materiales para suelos, la demanda de adhesivos sensibles a la presión (PSA) está aumentando.

Restricciones/Desafíos

- Fluctuación de los precios de las materias primas

La repentina fluctuación de los precios de las materias primas hizo que las empresas manufactureras se sumieran en una profunda crisis, especialmente en la situación de COVID-19, las recientes crisis económicas y las recesiones. Las materias primas, como polímeros, resinas, disolventes y aditivos, desempeñan un papel crucial en la formulación de adhesivos para suelos. Las fluctuaciones en los precios de estas materias primas pueden afectar significativamente los costes de fabricación y la rentabilidad de los productores de adhesivos. Con la volatilidad de los precios de las materias primas, la producción de adhesivos también sufre. La fluctuación de los precios de las materias primas puede dar lugar a un crecimiento inestable y restringido del mercado.

- Disponibilidad de opciones de pisos alternativos

Los adhesivos tradicionales para pisos se enfrentan a la competencia de alternativas como pisos flotantes, baldosas entrelazadas y materiales autoadhesivos, ya que los consumidores buscan soluciones para pisos diversificadas, ecológicas y rentables. Los pisos flotantes, como los laminados, los tablones de vinilo y la madera industrializada, han crecido en los últimos años.

Estas soluciones de suelos permiten una instalación rápida y sencilla sin necesidad de adhesivos. Los sistemas de suelos flotantes utilizan mecanismos de enclavamiento o cintas adhesivas para eliminar la necesidad de utilizar adhesivos estándar para suelos. La creciente popularidad de los suelos flotantes ha reducido la necesidad de soluciones de suelos a base de adhesivos.

- Intensa competencia debido al gran número de actores del mercado

El mercado de adhesivos para suelos de América del Norte es muy competitivo, principalmente debido a la presencia de un gran número de actores del mercado. Esta intensa competencia plantea desafíos para el crecimiento del mercado, ya que los fabricantes se esfuerzan por diferenciar sus productos y ampliar su cuota de mercado para satisfacer las cambiantes demandas de los clientes. El mercado de adhesivos para suelos de América del Norte está muy saturado, con numerosos fabricantes que ofrecen una amplia gama de productos adhesivos.

Además, los avances tecnológicos en las formulaciones de adhesivos y los procesos de fabricación han reducido las barreras de entrada, lo que ha permitido que nuevos actores ingresen al mercado. Esto ha aumentado aún más la competencia, ya que los fabricantes innovan para mantenerse a la vanguardia y mantener su ventaja competitiva.

Desarrollo reciente

- En marzo de 2023, DOW anunció el lanzamiento de una nueva plataforma de formulación de pintura digital. DOW Paint Vision ofrece capacidades basadas en datos para simplificar la formulación y acelerar la innovación en el sector de pinturas y recubrimientos. La plataforma combina décadas de conocimiento en investigación y desarrollo con miles de puntos de datos recopilados en los laboratorios de Dow y las tendencias más recientes en materia de sostenibilidad y necesidades de los usuarios finales. El lanzamiento ampliará las capacidades de investigación de la empresa, lo que, en última instancia, generará mayores ingresos.

Alcance del mercado de adhesivos para pisos en América del Norte

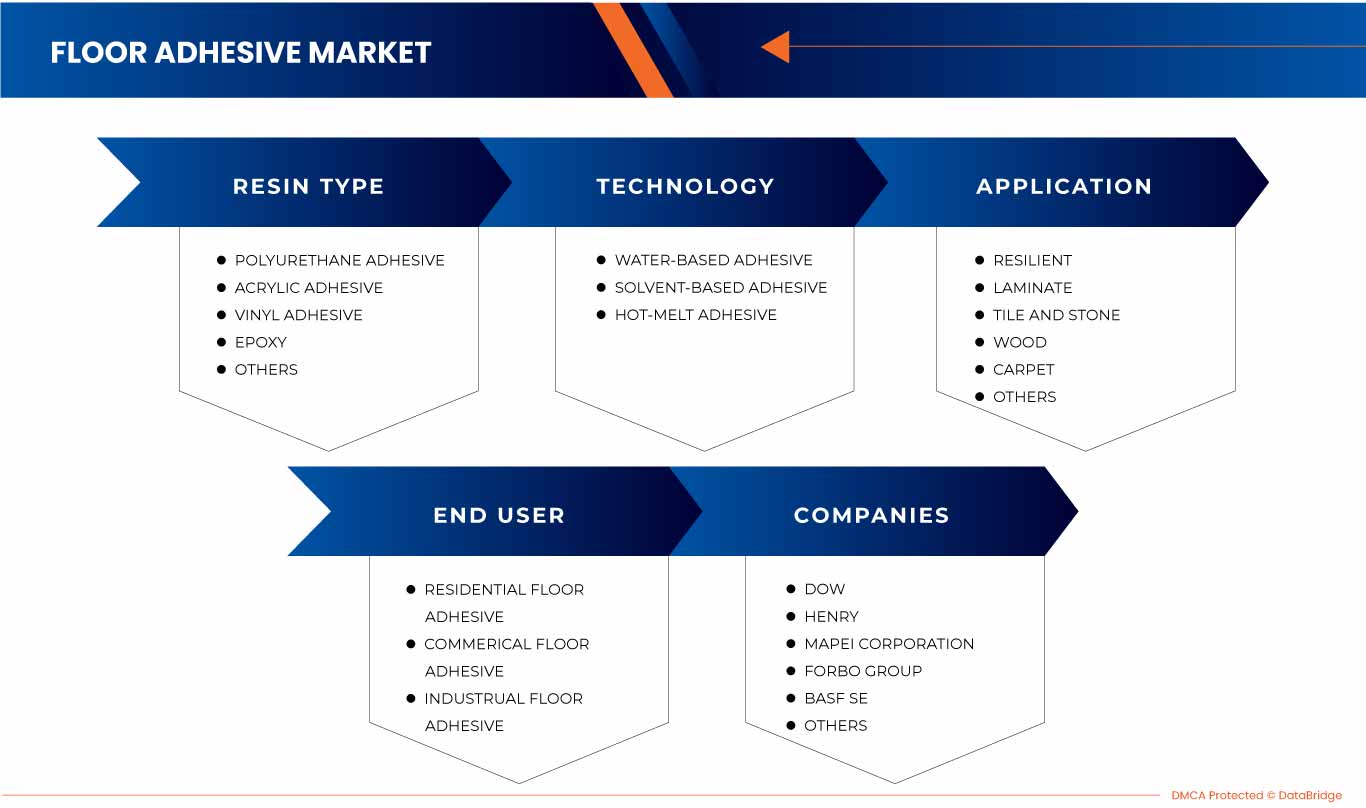

El mercado de adhesivos para pisos de América del Norte está segmentado en función del tipo de resina, la tecnología, la aplicación y el usuario final. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de resina

- Adhesivo de poliuretano

- Adhesivo acrílico

- Adhesivo de vinilo

- Epoxy

- Otros

Según el tipo de resina, el mercado está segmentado en adhesivo de poliuretano, adhesivo acrílico, adhesivo de vinilo, epoxi y otros.

Tecnología

- Adhesivo a base de agua

- Adhesivo a base de disolvente

- Adhesivo termofusible

Sobre la base de la tecnología, el mercado está segmentado en adhesivo a base de agua, adhesivo a base de solvente y adhesivo termofusible.

Solicitud

- Resiliente

- Laminado

- Azulejo y piedra

- Alfombra

- Madera

- Otros

Sobre la base de la aplicación, el mercado está segmentado en resistente, laminado, baldosas y piedra, alfombras, madera y otros.

Usuario final

- Adhesivo para pisos residenciales

- Adhesivo para suelos comerciales

- Adhesivo para suelos industriales

Sobre la base del usuario final, el mercado está segmentado en adhesivo para pisos residenciales, adhesivo para pisos comerciales y adhesivo para pisos industriales.

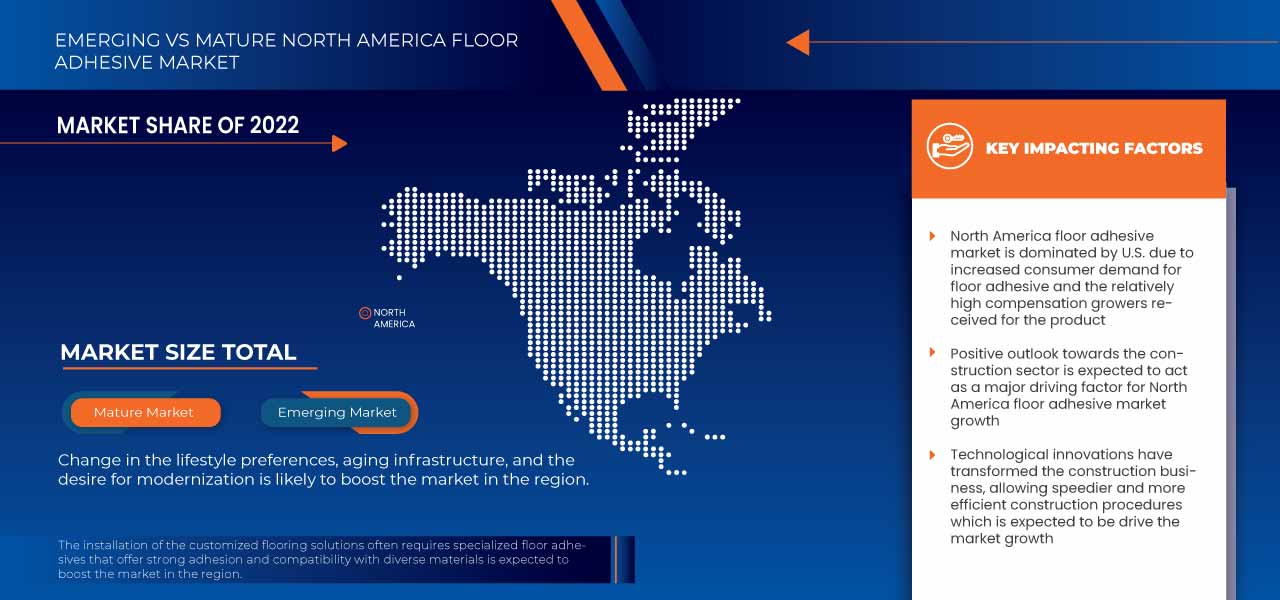

Análisis y perspectivas del mercado de adhesivos para pisos de América del Norte

El mercado de adhesivos para pisos de América del Norte está segmentado según el tipo de resina, la tecnología, la aplicación y el usuario final.

Los países del mercado de adhesivos para pisos de América del Norte son EE. UU., Canadá y México.

Se espera que Estados Unidos domine el mercado de adhesivos para pisos de América del Norte debido a la creciente conciencia sobre las propiedades de los productos adhesivos para pisos en el país.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. El análisis de los puntos de datos de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas regionales y sus desafíos afrontados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de adhesivos para suelos en América del Norte

El panorama competitivo del mercado de adhesivos para pisos de América del Norte proporciona detalles de los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de supervivencia de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado.

Algunos de los principales actores del mercado que operan en el mercado de adhesivos para pisos de América del Norte son HENRY, DOW, Arkema, HB Fuller Company, 3M, Wacker Chemie AG, Forbo, LATICRETE INTERNATIONAL, INC, QEP Co., Inc., Mapei Corporation, Sika AG, HENKEL AG & CO. KGAA y BASF SE, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 RESIN TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE ANALYSIS

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT’S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 SUPPLY CHAIN ANALYSIS

4.4.1 RAW MATERIAL PROCUREMENT & MANUFACTURING

4.4.2 DISTRIBUTION

4.4.3 END USERS

4.5 VENDOR SELECTION CRITERIA

4.6 RAW MATERIAL COVERAGE

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING CONSTRUCTION AND INFRASTRUCTURE DEVELOPMENT

6.1.2 INCREASING ADVANCEMENTS IN FLOORING TECHNOLOGIES

6.1.3 RISING TREND OF REMODELING AND RENOVATION ACTIVITIES

6.2 RESTRAINTS

6.2.1 FLUCTUATION IN THE PRICES OF RAW MATERIALS

6.2.2 AVAILABILITY OF ALTERNATE FLOORING OPTIONS

6.3 OPPORTUNITIES

6.3.1 SHIFT TOWARDS ECO-FRIENDLY AND SUSTAINABLE ADHESIVES

6.3.2 MANUFACTURERS LAUNCHING NEW AND INNOVATIVE ADHESIVE PRODUCTS

6.4 CHALLENGES

6.4.1 INTENSE COMPETITION DUE TO THE LARGE NUMBER OF MARKET PLAYERS

6.4.2 SHORTAGE OF SKILLED LABOUR IN THE CONSTRUCTION INDUSTRY

7 NORTH AMERICA FLOOR ADHESIVE MARKET BY REGION

7.1 NORTH AMERICA

8 COMPANY LANDSCAPE

8.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

9 COMPANY PROFILES

9.1 DOW

9.1.1 COMPANY SNAPSHOT

9.1.2 PRODUCT PORTFOLIO

9.1.3 REVENUE ANALYSIS

9.1.4 SWOT

9.1.5 RECENT DEVELOPMENTS

9.2 HENRY

9.2.1 COMPANY SNAPSHOT

9.2.2 PRODUCT PORTFOLIO

9.2.3 SWOT

9.2.4 RECENT DEVELOPMENT

9.3 MAPEI CORPORATION

9.3.1 COMPANY SNAPSHOT

9.3.2 SWOT

9.3.3 PRODUCT PORTFOLIO

9.3.4 RECENT DEVELOPMENTS

9.4 FORBO GROUP

9.4.1 COMPANY SNAPSHOT

9.4.2 REVENUE ANALYSIS

9.4.3 PRODUCT PORTFOLIO

9.4.4 SWOT

9.4.5 RECENT DEVELOPMENT

9.5 BASF SE

9.5.1 COMPANY SNAPSHOT

9.5.2 REVENUE ANALYSIS

9.5.3 PRODUCT PORTFOLIO

9.5.4 SWOT

9.5.5 RECENT DEVELOPMENT

9.6 3M

9.6.1 COMPANY SNAPSHOT

9.6.2 REVENUE ANALYSIS

9.6.3 PRODUCT PORTFOLIO

9.6.4 SWOT

9.6.5 RECENT DEVELOPMENTS

9.7 ARKEMA

9.7.1 COMPANY SNAPSHOT

9.7.2 PRODUCT PORTFOLIO

9.7.3 REVENUE ANALYSIS

9.7.4 SWOT

9.7.5 RECENT DEVELOPMENTS

9.8 H.B. FULLER COMPANY

9.8.1 COMPANY SNAPSHOT

9.8.2 REVENUE ANALYSIS

9.8.3 PRODUCT PORTFOLIO

9.8.4 SWOT

9.8.5 RECENT DEVELOPMENTS

9.9 HENKEL AG & CO. KGAA

9.9.1 COMPANY SNAPSHOT

9.9.2 REVENUE ANALYSIS

9.9.3 PRODUCT PORTFOLIO

9.9.4 SWOT

9.9.5 RECENT DEVELOPMENTS

9.1 LATICRETE INTERNATIONAL, INC.

9.10.1 COMPANY SNAPSHOT

9.10.2 SWOT.

9.10.3 PRODUCT PORTFOLIO

9.10.4 RECENT DEVELOPMENT

9.11 Q.E.P. CO., INC.

9.11.1 COMPANY SNAPSHOT

9.11.2 REVENUE ANALYSIS

9.11.3 PRODUCT PORTFOLIO

9.11.4 SWOT

9.11.5 RECENT DEVELOPMENT

9.12 SIKA AG

9.12.1 COMPANY SNAPSHOT

9.12.2 REVENUE ANALYSIS

9.12.3 PRODUCT PORTFOLIO

9.12.4 SWOT

9.12.5 RECENT DEVELOPMENT

9.13 WACKER CHEMIE AG

9.13.1 COMPANY SNAPSHOT

9.13.2 REVENUE ANALYSIS

9.13.3 PRODUCT PORTFOLIO

9.13.4 SWOT

9.13.5 RECENT DEVELOPMENTS

10 QUESTIONNAIRE

11 RELATED REPORTS

Lista de figuras

FIGURE 1 NORTH AMERICA FLOOR ADHESIVE MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FLOOR ADHESIVE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FLOOR ADHESIVE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FLOOR ADHESIVE MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FLOOR ADHESIVE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FLOOR ADHESIVE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA FLOOR ADHESIVE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA FLOOR ADHESIVE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA FLOOR ADHESIVE MARKET: SEGMENTATION

FIGURE 10 INCREASING ADVANCEMENT IN FLOORING TECHNOLOGIES IS EXPECTED TO DRIVE THE NORTH AMERICA FLOOR ADHESIVE MARKET IN THE FORECAST PERIOD FROM 2023 TO 2030

FIGURE 11 EPOXY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FLOOR ADHESIVE MARKET IN 2023 AND 2030

FIGURE 12 SUPPLY CHAIN OF NORTH AMERICA FLOOR ADHESIVE MARKET

FIGURE 13 VENDOR SELECTION CRITERIA

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA FLOOR ADHESIVE MARKET

FIGURE 15 NORTH AMERICA FLOOR ADHESIVE MARKET: SNAPSHOT (2022)

FIGURE 16 NORTH AMERICA FLOOR ADHESIVE MARKET: BY COUNTRY (2022)

FIGURE 17 NORTH AMERICA FLOOR ADHESIVE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 18 NORTH AMERICA FLOOR ADHESIVE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 19 NORTH AMERICA FLOOR ADHESIVE MARKET: BY TYPE (2023-2030)

FIGURE 20 NORTH AMERICA FLOOR ADHESIVE MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.