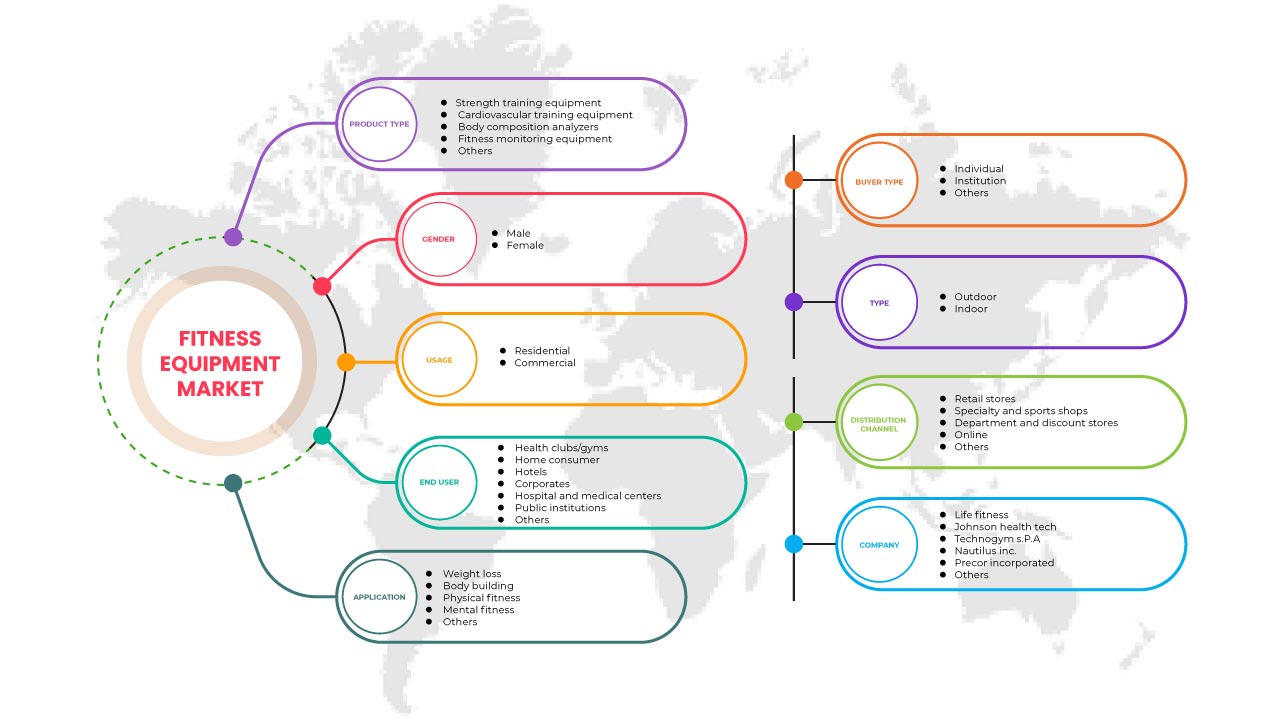

Mercado de equipos de fitness de América del Norte, por tipo de producto (equipo de entrenamiento de fuerza, equipo de entrenamiento cardiovascular, analizadores de composición corporal , equipo de monitoreo de fitness y otros), aplicación (pérdida de peso, culturismo, fitness físico, fitness mental y otros), género (masculino y femenino), tipo de comprador (individual, institucional y otros), uso (residencial y comercial), tipo (exterior e interior), usuario final (clubes de salud/gimnasios, consumidor doméstico, hoteles, empresas, hospitales y centros médicos, instituciones públicas y otros), canal de distribución (tiendas minoristas, tiendas especializadas y deportivas, tiendas departamentales y de descuento, en línea y otros) - Tendencias de la industria y pronóstico hasta 2030.

Análisis y perspectivas del mercado de equipos de fitness de América del Norte

El creciente deseo de estar saludable y en forma impulsa ahora la industria de los equipos de ejercicio. El crecimiento del mercado de equipos de ejercicio está impulsado por factores clave como la creciente urbanización, la prevalencia de la obesidad y las enfermedades crónicas debido a estilos de vida poco saludables y el aumento de los programas de bienestar corporativo y la demanda de diversas industrias. Además, la creciente conciencia sobre las consecuencias del aumento de la obesidad, el aumento de la población geriátrica y la creciente demanda de cirugías mínimamente invasivas y no invasivas impulsan el crecimiento general del mercado. Por otro lado, se estima que los altos costos de instalación o configuración de equipos o dispositivos y la creciente demanda de reventa de equipos de ejercicio que ahorran costos restringirán el crecimiento del mercado durante el período de pronóstico.

Sin embargo, la introducción de otros sistemas de entrenamiento y los cambios en las preferencias de los clientes están frenando el crecimiento del mercado de equipos de fitness.

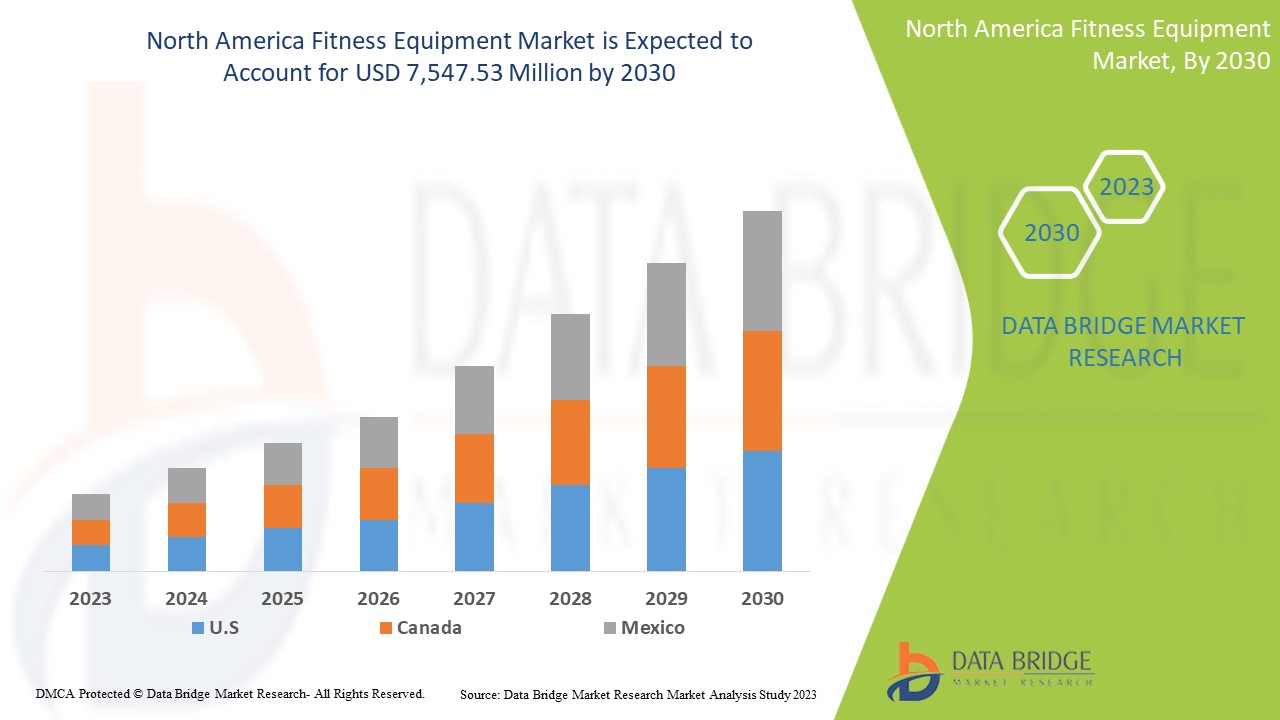

Data Bridge Market Research analiza que se espera que el mercado de equipos de fitness de América del Norte alcance un valor de USD 7.547,53 millones para 2030, con una CAGR del 7,3 % durante el período de pronóstico. Este informe de mercado también cubre en profundidad el análisis de precios, el análisis de patentes y los avances tecnológicos.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2020-2015) |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Por tipo de producto (equipo de entrenamiento de fuerza, equipo de entrenamiento cardiovascular, analizadores de composición corporal, equipo de monitoreo de actividad física y otros), aplicación (pérdida de peso, culturismo, aptitud física, aptitud mental y otros), género (masculino y femenino), tipo de comprador (individual, institucional y otros), uso (residencial y comercial), tipo (exterior e interior), usuario final (clubes de salud/gimnasios, consumidor doméstico, hoteles, empresas, hospitales y centros médicos, instituciones públicas y otros), canal de distribución (tiendas minoristas, tiendas especializadas y deportivas, tiendas departamentales y de descuento, en línea y otros) |

|

Países cubiertos |

Estados Unidos, Canadá y México |

|

Actores del mercado cubiertos |

Español: Nautilus, Inc., Life Fitness, Johnson Health Tech, TECHNOGYM SpA, TRUE, Impulse (QingDao) Health Tech CO., LTD, iFIT, Torque Fitness., Body-Solid Inc., Core Health & Fitness, LLC., Precor Incorporated, Afton, Fitness World, Shanghai Define Health Tech CO. LTD, REALLEADER FITNESS CO., LTD, Shandong Aoxinde Fitness Equipment Co., Ltd., BFT Fitness, Yanre Fitness, FITKING FITNESS y Fitline India. |

Definición del mercado de equipos de fitness de América del Norte

El equipo de fitness se refiere básicamente al equipo que se utiliza generalmente durante cualquier actividad física o relacionada con el fitness. Ayudan a mejorar la fuerza o la aptitud física. Por lo general, el equipo de fitness incluye varios equipos como pesas libres, máquinas de remo, cintas de correr, máquinas de pesas, bicicletas estáticas, elípticas y escaladoras, entre otros. El equipo de ejercicio es una máquina que resiste a una persona mientras realiza ejercicios físicos para aumentar la fuerza y la resistencia, controlar el peso y mejorar la flexibilidad. Ayuda a mejorar la personalidad y la apariencia. Hay cintas de correr, máquinas elípticas, máquinas de pesas, pesas libres y otros equipos de ejercicio disponibles. Estos dispositivos han sido utilizados por centros de fitness, gimnasios, usuarios domésticos y oficinas corporativas. Según (VA.gov), el equipo cardiovascular con programas preestablecidos se considera comercial. Utilice programas para personas con una amplia gama de capacidades aeróbicas.

Dinámica del mercado de equipos de fitness en América del Norte

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- Cada vez más personas participan en competiciones de actividades físicas

La actividad física tiene importantes beneficios para la salud del corazón, el cuerpo y la mente, y el ejercicio ayuda a prevenir y controlar enfermedades no transmisibles como las enfermedades cardiovasculares, el cáncer y la diabetes. Hoy en día, las personas de todo el mundo pueden llevar los resultados de su duro entrenamiento físico a torneos competitivos y poner a prueba sus habilidades en diversos eventos de fitness funcional. Existen muchas competiciones de actividades de fitness, como levantamiento de pesas, culturismo, carreras de larga distancia, carreras populares y competiciones de cross-fit. Muchas empresas y organizaciones de fitness han tomado la iniciativa y han organizado diversas competiciones de fitness y actividades al aire libre. La tasa de participación de los hombres fue mayor (20,7 por ciento) que la de las mujeres (18 por ciento). Esto incluyó deportes, ejercicio y otras actividades de ocio activas.

Por lo tanto, un número cada vez mayor de personas que realizan actividades físicas impulsa el crecimiento del mercado.

- La pandemia de Covid-19 provocó una creciente demanda de equipos de fitness para el hogar

La pandemia de COVID-19 ha tenido un impacto positivo sustancial en el sector de los equipos de fitness. La pandemia ha impuesto nuevas normas y regulaciones, como el distanciamiento social y los confinamientos, para evitar la propagación del virus. Como resultado, las personas de todo el mundo se vieron obligadas a quedarse en casa, lo que dio lugar a nuevas tendencias, como el trabajo desde casa. La creciente popularidad de los entrenamientos en casa ha aumentado la demanda de equipos de ejercicio durante la pandemia. El mayor enfoque en el autocuidado, el ejercicio y la salud ha ayudado a que las aplicaciones y plataformas de fitness ganen una tracción significativa a raíz de la pandemia. Además, la pandemia también ha impulsado a los entusiastas no relacionados con el fitness a dar más importancia a mantener su salud y su estado físico, lo que ayuda a generar tracción.

Además, la pandemia de COVID-19 también ha aumentado tanto la demanda de equipos de fitness para el hogar y aplicaciones de fitness que el número de equipos de fitness agotados en línea y las descargas de aplicaciones de fitness aumentaron casi un 30% en 2020.

Restricción

- Altos costos asociados con los equipos de fitness

Algunos equipos de fitness disponibles a precios muy altos, especialmente para los ingresos medios y bajos en los países en desarrollo y subdesarrollados, actúan como un factor limitante para el crecimiento. Con el avance tecnológico, el aumento de precios es evidente en el caso de los equipos de fitness de alta tecnología y los dispositivos portátiles de fitness. La incorporación de múltiples características como pantalla de alta calidad, mayor eficiencia energética, seguimiento de signos vitales adicionales, conectividad inalámbrica y software actualizado, entre otras, aumenta directamente el costo inicial del equipo de fitness y el dispositivo de fitness. El uso de dispositivos portátiles por parte de varios consumidores está aumentando su gasto en atención médica relacionada con el fitness. Un aumento en la cobertura de aplicaciones de los dispositivos portátiles aumenta su demanda, lo que ayuda directamente a su alto costo.

Por lo tanto, el alto costo asociado con los equipos de fitness está obstaculizando el crecimiento del mercado.

Oportunidad

- Creciente penetración de las plataformas de comercio electrónico, Internet y los teléfonos inteligentes

En el mundo actual, las personas necesitan un teléfono inteligente para comunicarse, comprar alimentos, acudir a consultas médicas, para estar al tanto de su estado físico. Muchas personas no pueden imaginar su vida sin teléfonos inteligentes. La gente quiere ponerse en forma con una metodología basada en la comodidad del hogar en lugar de seguir en gimnasios y clubes de fitness. Por lo tanto, la aplicación de fitness actúa como un puente entre las personas que reciben un programa de ejercicios, un plan de dieta y ejercicios, entre otros, simplemente usando su aplicación de fitness. Con el avance y el desarrollo tecnológico en los países, cada vez más personas utilizan teléfonos inteligentes en su vida diaria.

Desafío

- Cambio de preferencias de los clientes

El fitness digital se ha convertido rápidamente en un salvavidas de la industria a medida que más y más personas se acostumbran a él. Siendo realistas, el auge actual del fitness digital morirá a medida que se alivien las restricciones del confinamiento. Durante el confinamiento, el entrenamiento en línea proporcionó a las personas estructura, aptitud física, un sentido de comunidad y comunicación. Mantuvieron a la gente sana. El entrenamiento en línea llegó para quedarse, ya que los consumidores esperan ofertas híbridas en el futuro. Si bien muchos eventualmente regresan a sus rutinas de estudio habituales, un gimnasio que ofrece entrenamiento en línea es más accesible para los miembros. Los miembros del gimnasio se están volviendo más conscientes de los precios con las muchas opciones de fitness disponibles en línea hoy en día y sus precios competitivos. Y a medida que los gimnasios y estudios se preparan para diversificarse en línea y estudios en el futuro, la competencia es feroz. Después de la compra inicial, las personas están dispuestas a pagar más por un servicio que satisfaga sus necesidades y brinde valor agregado. No buscan necesariamente la opción más barata o de mayor calidad; buscan valor.

Impacto posterior a la COVID-19 en el mercado de equipos de fitness de América del Norte

La pandemia de COVID-19 ha tenido un impacto algo positivo en el mercado de equipos de fitness. La pandemia ha impuesto nuevas normas y regulaciones, como el distanciamiento social y los confinamientos, para evitar la propagación del virus. Como resultado, las personas de todo el mundo se vieron obligadas a quedarse en casa, lo que dio lugar a nuevas tendencias como el trabajo desde casa. La creciente popularidad de los entrenamientos en casa ha aumentado la demanda de equipos de ejercicio durante la pandemia. El mayor enfoque en el cuidado personal, el ejercicio y la salud ha ayudado a que las aplicaciones y plataformas de fitness ganen una tracción significativa a raíz de la pandemia.

Los fabricantes están tomando diversas decisiones estratégicas para recuperarse tras la COVID-19. Los actores están llevando a cabo múltiples actividades de I+D y lanzamiento de productos y asociaciones estratégicas para mejorar la tecnología y los resultados de las pruebas involucradas en el mercado.

Acontecimientos recientes

- En septiembre de 2022, Nautilus, Inc., líder en innovación en fitness en el hogar, anunció el lanzamiento de la cinta de correr Bowflex BXT8J compatible con la aplicación de fitness adaptativo JRNY en socios minoristas seleccionados en línea y en tiendas, lo que ofrece a los clientes una solución de fitness completa a un precio asequible. La cinta de correr Bowflex BXT8J ofrece cardio de alto rendimiento y la capacidad de vincular el dispositivo del usuario a la aplicación de fitness adaptativo JRNY. Esto ha ayudado a la empresa a ampliar su cartera de productos.

- En junio de 2022, Johnson Health Tech anunció la adquisición de la división de fitness de Cravatex Brands Limited, un distribuidor anterior de Johnson Health Tech, y se convirtió en la primera empresa de equipos de fitness en tener una subsidiaria de propiedad absoluta en India. Con su inversión continua en el desarrollo de productos y la experiencia en fabricación, Johnson Health Tech mejoró la industria del fitness. Esto ha ayudado a la empresa a expandir su negocio.

Alcance del mercado de equipos de fitness en América del Norte

El mercado de equipos de fitness de América del Norte está segmentado por tipo de producto, aplicación, género, tipo de comprador, uso, tipo, usuario final y canal de distribución. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

MERCADO DE EQUIPOS DE FITNESS EN AMÉRICA DEL NORTE, POR TIPO DE PRODUCTO

- Equipos de entrenamiento de fuerza

- Equipos de entrenamiento cardiovascular

- Analizadores de composición corporal

- Equipo de control de actividad física

- Otros

Según el tipo de producto, el mercado de equipos de fitness de América del Norte está segmentado en equipos de entrenamiento de fuerza, equipos de entrenamiento cardiovascular, analizadores de composición corporal, equipos de monitoreo de fitness y otros.

MERCADO DE EQUIPOS DE FITNESS EN AMÉRICA DEL NORTE, POR APLICACIÓN

- Pérdida de peso

- Culturismo

- Aptitud física

- Aptitud mental

- Otros

Sobre la base de la aplicación, el mercado de equipos de fitness de América del Norte está segmentado en pérdida de peso, culturismo, fitness físico, fitness mental y otros.

MERCADO DE EQUIPOS DE FITNESS EN AMÉRICA DEL NORTE, POR GÉNERO

- Masculino

- Femenino

En función del género, el mercado de equipos de fitness de América del Norte está segmentado en masculino y femenino.

MERCADO DE EQUIPOS DE FITNESS EN AMÉRICA DEL NORTE, POR TIPO DE COMPRADOR

- Individual

- Institución

- Otros

Según el tipo de comprador, el mercado de equipos de fitness de América del Norte se segmenta en individual, institucional y otros.

MERCADO DE EQUIPOS DE FITNESS EN AMÉRICA DEL NORTE, POR USO

- Residencial

- Comercial

En función del uso, el mercado de equipos de fitness de América del Norte está segmentado en residencial y comercial.

MERCADO DE EQUIPOS DE FITNESS EN AMÉRICA DEL NORTE, POR TIPO

- Exterior

- Interior

Según el tipo, el mercado de equipos de fitness de América del Norte está segmentado en interiores y exteriores.

MERCADO DE EQUIPOS DE FITNESS EN AMÉRICA DEL NORTE, POR USUARIO FINAL

- Clubes de salud/gimnasios

- Consumidores domésticos

- Hoteles

- Corporaciones

- Hospitales y centros médicos

- Instituciones públicas

- Otros

Sobre la base del usuario final, el mercado de equipos de fitness de América del Norte está segmentado en clubes de salud/gimnasios, consumidores domésticos, hoteles, empresas, hospitales y centros médicos, instituciones públicas y otros.

MERCADO DE EQUIPOS DE FITNESS EN AMÉRICA DEL NORTE, POR CANAL DE DISTRIBUCIÓN

- Tiendas minoristas

- Tiendas especializadas y de deportes

- Grandes almacenes y tiendas de descuento

- En línea

- Otros

Sobre la base del canal de distribución, el mercado de equipos de fitness de América del Norte está segmentado en tiendas minoristas, tiendas especializadas y deportivas, tiendas departamentales y de descuento, en línea y otras.

Análisis y perspectivas regionales del mercado de equipos de fitness de América del Norte

Se analiza el mercado de equipos de fitness de América del Norte y se proporciona información sobre el tamaño del mercado según el país, el tipo de producto, la aplicación, el género, el tipo de comprador, el uso, el tipo, el usuario final y el canal de distribución.

El mercado de equipos de fitness de América del Norte comprende los países de Estados Unidos, Canadá y México. Se espera que Estados Unidos crezca debido al aumento de la inversión en I+D y a su última tecnología avanzada e invenciones en equipos de fitness.

La sección de países del informe también proporciona factores de impacto individuales en el mercado y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se consideran la presencia y disponibilidad de marcas de América del Norte y los desafíos que enfrentan debido a la competencia grande o escasa de las marcas locales y nacionales, y el impacto de los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de equipos de fitness en América del Norte

El panorama competitivo del mercado de equipos de fitness de América del Norte proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en I+D, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y amplitud de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa en el mercado de equipos de fitness de América del Norte.

Algunos de los principales actores que operan en el mercado de equipos de fitness de América del Norte son Nautilus, Inc., Life Fitness, Johnson Health Tech, TECHNOGYM SpA, TRUE, Impulse (QingDao) Health Tech CO., LTD, iFIT, Torque Fitness., Body-Solid Inc., Core Health & Fitness, LLC., Precor Incorporated, Afton, Fitness World, Shanghai Define Health Tech CO LTD, REALLEADER FITNESS CO., LTD, Shandong Aoxinde Fitness Equipment Co., Ltd., BFT Fitness, Yanre Fitness, FITKING FITNESS y Fitline India, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA FITNESS EQUIPMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTE’S FIVE FORCES

4.2 PESTEL ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING NUMBER OF PEOPLE INVOLVED IN PHYSICAL ACTIVITIES COMPETITIONS

5.1.2 COVID-19 PANDEMIC RESULTED IN A RISING DEMAND FOR HOME FITNESS EQUIPMENT

5.1.3 INCREASING POPULARITY OF FITNESS GEAR AROUND THE GLOBE

5.1.4 INCREASED TECHNOLOGICAL ADVANCEMENT IN THE FITNESS SECTOR

5.2 RESTRAINTS

5.2.1 HIGH COST ASSOCIATED WITH FITNESS EQUIPMENT

5.2.2 LACK OF SKILLED FITNESS PROFESSIONALS

5.3 OPPORTUNITIES

5.3.1 GROWING PENETRATION OF E-COMMERCE PLATFORMS, THE INTERNET, AND SMARTPHONES

5.3.2 MULTIPLE APPLICATION COVERAGE

5.3.3 INCREASING NUMBER OF GYMS & FITNESS CLUBS

5.4 CHALLENGES

5.4.1 PATIENT INFORMATION PRIVACY POLICIES

5.4.2 SHIFTING OF CUSTOMER PREFERENCES

6 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 STRENGTH TRAINING EQUIPMENTS

6.2.1 DUMBBELLS

6.2.1.1 FIXED

6.2.1.2 ADJUSTABLE

6.2.2 BARBELLS

6.2.2.1 STRAIGHT BARBELLS

6.2.2.2 SAFETY SQUAT BARS

6.2.2.3 EZ CURL BARS

6.2.2.4 TRICEPS BARS

6.2.2.5 TRAP BARS

6.2.2.6 AXEL BARS

6.2.2.7 SWISS BARS

6.2.2.8 FARMERS WALK HANDLES

6.2.2.9 THICK GRIP BARS

6.2.2.10 OTHERS

6.2.3 BACHES AND RACKS

6.2.4 FREE WEIGHTS

6.2.5 PLATE LOADED

6.2.6 CABLE MACHINES

6.2.7 MULTISTATIONS

6.2.8 SINGLE STATIONS

6.2.9 RESISTANCE BANDS

6.2.9.1 POWER RESISTANCE BANDS

6.2.9.2 TUBE RESISTANCE BANDS WITH HANDLES

6.2.9.3 MINI-BANDS

6.2.9.4 LIGHT THERAPY RESISTANCE BANDS

6.2.9.5 BANDS

6.2.9.6 OTHERS

6.2.10 TRX SUSPENSION TRAINER

6.2.11 KETTLEBELLS

6.2.12 ACCESSORIES

6.2.13 OTHERS

6.3 CARDIOVASCULAR TRAINING EQUIPMENTS

6.3.1 TREADMILLS

6.3.2 ELLIPTICAL CROSS TRAINER

6.3.3 STATIONARY BIKES

6.3.4 ROWING MACHINES

6.3.5 STAIR STEPPER

6.3.6 OTHERS

6.4 FITNESS MONITORING EQUIPMENTS

6.4.1 SMART WATCH

6.4.2 FITNESS BANDS

6.4.3 PATCHES

6.4.4 OTHERS

6.5 BODY COMPOSITION ANALYZERS

6.5.1 BIO-IMPEDANCE ANALYSERS

6.5.2 DUAL ENERGY X-RAY ABSORPTIOMETRY EQUIPMENT

6.5.3 SKINFOLD CALLIPERS

6.5.4 AIR DISPLACEMENT PLETHYSMOGRAPHY EQUIPMENT

6.5.5 HYDROSTATIC WEIGHING EQUIPMENT

6.5.6 OTHERS

6.6 OTHERS

7 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 BODY BUILDING

7.3 WEIGHT LOSS

7.4 PHYSICAL FITNESS

7.5 MENTAL FITNESS

7.6 OTHERS

8 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY GENDER

8.1 OVERVIEW

8.2 MALE

8.3 FEMALE

9 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY BUYER TYPE

9.1 OVERVIEW

9.2 INDIVIDUALS

9.3 INSTITUTION

9.4 OTHERS

10 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY USAGE

10.1 OVERVIEW

10.2 COMMERCIAL

10.3 RESIDENTIAL

11 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY TYPE

11.1 OVERVIEW

11.2 OUTDOOR

11.3 INDOOR

12 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY END USER

12.1 OVERVIEW

12.2 HEALTH CLUBS/GYMS

12.3 PUBLIC INSTITUTIONS

12.4 HOTELS

12.5 HOME CONSUMERS

12.6 CORPORATES

12.7 HOSPITAL & MEDICAL CENTERS

12.8 OTHERS

13 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 RETAIL STORES

13.3 ONLINE

13.4 SPECIALTY & SPORTS SHOPS

13.5 DEPARTMENTAL & DISCOUNT STORES

13.6 OTHERS

14 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA FITNESS EQUIPMENT MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 LIFE FITNESS

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 IFIT

17.2.1 COMPANY SNAPSHOT

17.2.2 COMPANY SHARE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENTS

17.3 JOHNSON HEALTH TECH

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 TECHNOGYM S.P.A

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 NAUTILUS, INC.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 AFTON

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 BFT FITNESS

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 BODY-SOLID INC.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 CORE HEALTH & FITNESS, LLC.

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 FITKING FITNESS

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 FITLINE INDIA

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 FITNESS WORLD

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 IMPULSE (QINGDAO) HEALTH TECH CO., LTD

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 PRECOR INCORPORATED.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 REALLEADER FITNESS CO., LTD

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 SHANDONG AOXINDE FITNESS EQUIPMENT CO., LTD.

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 SHANDONG LIZHIXING FITNESS TECHNOLOGY CO., LTD.

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 SHANGHAI DEFINE HEALTH TECH CO LTD,

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 TORQUE FITNESS.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 True

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

17.21 YANRE FITNESS

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA STRENGTH TRAINING EQUIPMENT IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA STRENGTH TRAINING EQUIPMENT IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA DUMBBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA BARBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA RESISTANCE BANDS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA CARDIOVASCULAR TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA CARDIOVASCULAR TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA FITNESS MONITORING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA FITNESS MONITORING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA BODY COMPOSITION ANALYZER IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA BODY COMPOSITION ANALYZER IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA OTHERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA BODY BUILDING IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA WEIGHT LOSS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA PHYSICAL FITNESS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA MENTAL FITNESS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA OTHERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA MALE IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA FEMALE IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY BUYER TYPE, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA INDIVIDUALS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA INSTITUTION IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA OTHERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY USAGE, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA COMMERCIAL IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA RESIDENTIAL IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA OUTDOOR IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA INDOOR IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA HEALTH CLUBS/GYMS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA PUBLIC INSTITUTION IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA HOTELS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA HOME CONSUMERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA CORPORATES IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA HOSPITAL AND MEDICAL CENTERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA OTHERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA RETAIL STORES IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA ONLINE IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA SPECIALTY AND SPORTS SHOP IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA DEPARTMENTAL & DISCOUNT STORES IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA OTHERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA STRENGTH TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA DUMBBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA BARBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA RESISTANCE BANDS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 53 NORTH AMERICA CARDIOVASCULAR TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA FITNESS MONITORING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA BODY COMPOSITION ANALYSERS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY BUYER TYPE, 2021-2030 (USD MILLION)

TABLE 59 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY USAGE, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 62 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 63 U.S. FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 64 U.S. STRENGTH TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 65 U.S. DUMBBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 66 U.S. BARBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 67 U.S. RESISTANCE BANDS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 68 U.S. CARDIOVASCULAR TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 69 U.S. FITNESS MONITORING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 70 U.S. BODY COMPOSITION ANALYSERS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 71 U.S. FITNESS EQUIPMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 72 U.S. FITNESS EQUIPMENT MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 73 U.S. FITNESS EQUIPMENT MARKET, BY BUYER TYPE, 2021-2030 (USD MILLION)

TABLE 74 U.S. FITNESS EQUIPMENT MARKET, BY USAGE, 2021-2030 (USD MILLION)

TABLE 75 U.S. FITNESS EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 76 U.S. FITNESS EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 77 U.S. FITNESS EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 78 CANADA FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 79 CANADA STRENGTH TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 80 CANADA DUMBBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 81 CANADA BARBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 82 CANADA RESISTANCE BANDS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 83 CANADA CARDIOVASCULAR TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 84 CANADA FITNESS MONITORING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 85 CANADA BODY COMPOSITION ANALYSERS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 86 CANADA FITNESS EQUIPMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 87 CANADA FITNESS EQUIPMENT MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 88 CANADA FITNESS EQUIPMENT MARKET, BY BUYER TYPE, 2021-2030 (USD MILLION)

TABLE 89 CANADA FITNESS EQUIPMENT MARKET, BY USAGE, 2021-2030 (USD MILLION)

TABLE 90 CANADA FITNESS EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 91 CANADA FITNESS EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 92 CANADA FITNESS EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 93 MEXICO FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 94 MEXICO STRENGTH TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 95 MEXICO DUMBBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 96 MEXICO BARBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 97 MEXICO RESISTANCE BANDS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 98 MEXICO CARDIOVASCULAR TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 99 MEXICO FITNESS MONITORING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 100 MEXICO BODY COMPOSITION ANALYSERS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 101 MEXICO FITNESS EQUIPMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 102 MEXICO FITNESS EQUIPMENT MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 103 MEXICO FITNESS EQUIPMENT MARKET, BY BUYER TYPE, 2021-2030 (USD MILLION)

TABLE 104 MEXICO FITNESS EQUIPMENT MARKET, BY USAGE, 2021-2030 (USD MILLION)

TABLE 105 MEXICO FITNESS EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 106 MEXICO FITNESS EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 107 MEXICO FITNESS EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA FITNESS EQUIPMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FITNESS EQUIPMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FITNESS EQUIPMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FITNESS EQUIPMENT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FITNESS EQUIPMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FITNESS EQUIPMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA FITNESS EQUIPMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA FITNESS EQUIPMENT MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA FITNESS EQUIPMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA FITNESS EQUIPMENT MARKET: SEGMENTATION

FIGURE 11 THE GROWING PRVALENCE OF CARDIOVASCULAR DISEASES AND RISING DEMAND FOR FITNESS EQUIPMENT IN VARIOUS INDUSTRIES ARE EXPECTED TO DRIVE THE NORTH AMERICA FITNESS EQUIPMENT MARKET FROM 2023 TO 2030

FIGURE 12 STRENGTH TRAINING EQUIPMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FITNESS EQUIPMENT MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA FITNESS EQUIPMENT MARKET

FIGURE 14 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY PRODUCT TYPE, 2022

FIGURE 15 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 16 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 17 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY APPLICATION, 2022

FIGURE 19 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 20 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY APPLICATION, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY APPLICATION, LIFELINE CURVE

FIGURE 22 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY GENDER, 2022

FIGURE 23 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY GENDER, 2023-2030 (USD MILLION)

FIGURE 24 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY GENDER, CAGR (2023-2030)

FIGURE 25 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY GENDER, LIFELINE CURVE

FIGURE 26 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY BUYER TYPE, 2022

FIGURE 27 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY BUYER TYPE, 2023-2030 (USD MILLION)

FIGURE 28 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY BUYER TYPE, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY BUYER TYPE, LIFELINE CURVE

FIGURE 30 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY USAGE, 2022

FIGURE 31 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY USAGE, 2023-2030 (USD MILLION)

FIGURE 32 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY USAGE, CAGR (2023-2030)

FIGURE 33 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY USAGE, LIFELINE CURVE

FIGURE 34 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY TYPE, 2022

FIGURE 35 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY TYPE, 2023-2030 (USD MILLION)

FIGURE 36 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY TYPE, CAGR (2023-2030)

FIGURE 37 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY TYPE, LIFELINE CURVE

FIGURE 38 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY END USER, 2022

FIGURE 39 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY END USER, 2023-2030 (USD MILLION)

FIGURE 40 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY END USER, CAGR (2023-2030)

FIGURE 41 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY END USER, LIFELINE CURVE

FIGURE 42 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY DISTRIBUTION CHANNEL, 2022

FIGURE 43 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 44 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 45 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 46 NORTH AMERICA FITNESS EQUIPMENT MARKET: SNAPSHOT (2022)

FIGURE 47 NORTH AMERICA FITNESS EQUIPMENT MARKET: BY COUNTRY (2022)

FIGURE 48 NORTH AMERICA FITNESS EQUIPMENT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 49 NORTH AMERICA FITNESS EQUIPMENT MARKET: BY COUNTRY (2022 & 2030)

FIGURE 50 NORTH AMERICA FITNESS EQUIPMENT MARKET: BY PRODUCT TYPE (2023-2030)

FIGURE 51 NORTH AMERICA FITNESS EQUIPMENT MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.