North America Explosion Proof Equipment Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

3.01 Billion

USD

4.24 Billion

2024

2032

USD

3.01 Billion

USD

4.24 Billion

2024

2032

| 2025 –2032 | |

| USD 3.01 Billion | |

| USD 4.24 Billion | |

|

|

|

|

Segmentación del mercado de equipos a prueba de explosiones en Norteamérica, por oferta (hardware, software y servicios), clase de temperatura (T1 ( 450 °C), T2 ( 300 °C a 200 °C a 135 °C a 100 °C a 85 °C a

Tamaño del mercado de equipos a prueba de explosiones en América del Norte

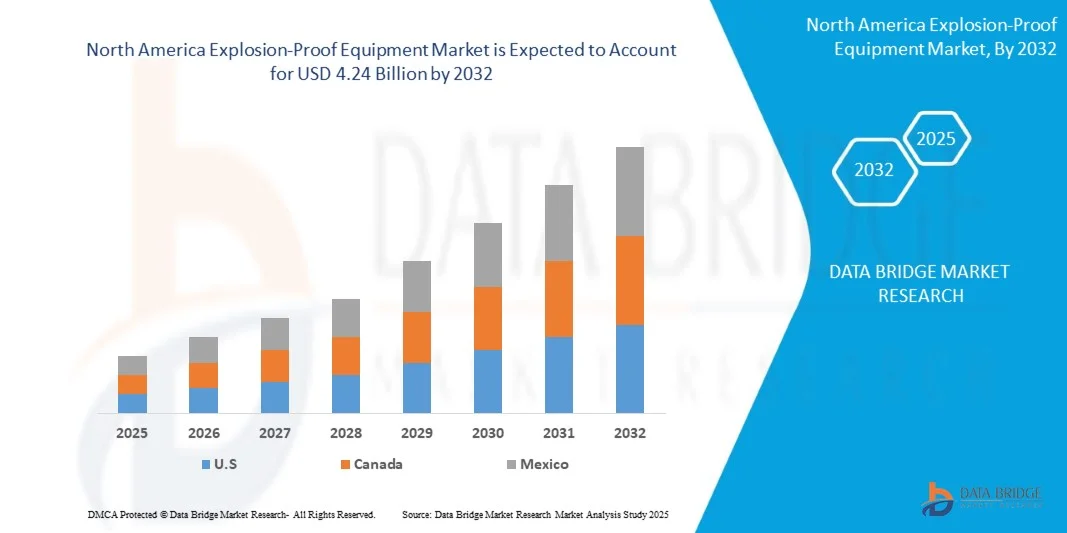

- El tamaño del mercado de equipos a prueba de explosiones de América del Norte se valoró en USD 3.01 mil millones en 2024 y se espera que alcance los USD 4.24 mil millones para 2032 , con una CAGR del 6,8% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente demanda de soluciones de seguridad en entornos industriales peligrosos, como el petróleo y el gas, la minería y el procesamiento químico.

- Las crecientes regulaciones gubernamentales centradas en la seguridad de los trabajadores y la prevención de explosiones industriales están acelerando aún más la adopción de equipos a prueba de explosiones en toda la región.

Análisis del mercado de equipos a prueba de explosiones en América del Norte

- La creciente demanda de soluciones de protección avanzadas en industrias como el petróleo y el gas, los productos químicos, los productos farmacéuticos y la fabricación está impulsando la expansión del mercado.

- Además, las continuas innovaciones tecnológicas en iluminación a prueba de explosiones, paneles de control y sistemas de comunicación están mejorando la seguridad operativa y la eficiencia en entornos de trabajo peligrosos.

- El mercado estadounidense de equipos a prueba de explosiones capturó la mayor participación en los ingresos de América del Norte en 2024, impulsado por la creciente implementación de protocolos de seguridad industrial y la presencia de numerosas instalaciones de petróleo y gas, químicas y de fabricación.

- Se espera que Canadá sea testigo de la mayor tasa de crecimiento anual compuesta (CAGR) en el mercado de equipos a prueba de explosiones de América del Norte debido al aumento de las inversiones en los sectores de minería, procesamiento químico y energía, junto con una mayor conciencia de la seguridad industrial y la adopción de soluciones inteligentes a prueba de explosiones habilitadas para IoT.

- El segmento de hardware registró la mayor cuota de mercado en 2024, impulsado por la implementación generalizada de carcasas, sensores y paneles de control certificados en instalaciones industriales. Las soluciones de hardware constituyen la columna vertebral de los sistemas de seguridad industrial y son fundamentales para la prevención de accidentes en entornos peligrosos.

Alcance del informe y segmentación del mercado de equipos a prueba de explosiones en América del Norte

|

Atributos |

Perspectivas clave del mercado de equipos a prueba de explosiones en América del Norte |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, producción y capacidad por empresa representadas geográficamente, diseños de red de distribuidores y socios, análisis detallado y actualizado de tendencias de precios y análisis deficitario de la cadena de suministro y la demanda. |

Tendencias del mercado de equipos a prueba de explosiones en América del Norte

El auge de las soluciones inteligentes a prueba de explosiones en la seguridad industrial

- La creciente adopción de equipos inteligentes a prueba de explosiones está transformando la seguridad industrial al permitir la monitorización en tiempo real y el mantenimiento predictivo. Estos sistemas permiten la detección temprana de condiciones peligrosas, minimizando el tiempo de inactividad y previniendo accidentes. Las empresas integran cada vez más análisis basados en IA para predecir posibles fallos, mientras que las plataformas en la nube ayudan a centralizar los datos de seguridad de múltiples instalaciones.

- La demanda de dispositivos a prueba de explosiones automatizados e integrados con IoT está aumentando en sectores como el petróleo y el gas, la química y la minería, lo que contribuye a una mayor seguridad operativa y a la eficiencia operativa. Estos dispositivos ayudan a reducir los errores humanos, garantizan una respuesta más rápida ante eventos peligrosos y mejoran el cumplimiento de las normas de seguridad en plantas industriales complejas.

- El desarrollo de soluciones de equipos modulares y escalables facilita la instalación y el mantenimiento, reduce los costos operativos y mejora la seguridad en el trabajo. Estas soluciones permiten una fácil modernización de los sistemas existentes, ofrecen flexibilidad para la expansión y reducen el tiempo de inactividad durante las actualizaciones de equipos.

- Por ejemplo, en 2024, varias plantas petroquímicas de EE. UU. implementaron sensores a prueba de explosiones basados en IoT en sus unidades de procesamiento, lo que permitió la detección temprana de fugas de gas y la reducción de incidentes de seguridad. La implementación también facilitó la monitorización continua, las alertas predictivas y la mejora de los informes a las autoridades reguladoras.

- Si bien las soluciones inteligentes a prueba de explosiones están mejorando la prevención de riesgos y la fiabilidad operativa, su eficacia depende de la innovación tecnológica continua, la capacitación adecuada de los empleados y el cumplimiento de las normas regulatorias. Las empresas también deben centrarse en la seguridad de los datos y la integración de sistemas para maximizar los beneficios de las soluciones de seguridad inteligentes.

Dinámica del mercado de equipos a prueba de explosiones en América del Norte

Conductor

“Aumento de la normativa de seguridad industrial y enfoque en la protección de los trabajadores”

- Las estrictas normas de seguridad de autoridades como OSHA y NEC impulsan la adopción de equipos a prueba de explosiones para prevenir accidentes laborales y garantizar el cumplimiento normativo. Las organizaciones están implementando auditorías de seguridad más rigurosas, modernizando equipos antiguos e invirtiendo en sistemas de seguridad certificados para cumplir con los requisitos regulatorios.

- Los operadores industriales priorizan la seguridad de los trabajadores y la mitigación de riesgos, lo que genera una mayor demanda de iluminación, paneles de control y sistemas de monitoreo certificados a prueba de explosiones. Este cambio también se ve influenciado por los requisitos de seguros, las expectativas de las partes interesadas y el aumento del costo de los accidentes y las bajas laborales.

- Además, los avances en tecnología de sensores, monitoreo en tiempo real y automatización incentivan a las empresas a invertir en soluciones confiables a prueba de explosiones que reducen los riesgos operativos. El mantenimiento predictivo, el monitoreo remoto y las alertas automatizadas impulsan aún más la adopción de equipos y la eficiencia operativa.

- Por ejemplo, en 2023, varias plantas de fabricación en Norteamérica modernizaron sus salas de control y zonas peligrosas con cabinas ignífugas y sistemas de monitorización inteligente, lo que mejoró el cumplimiento de las normas de seguridad. Estas mejoras también optimizaron la recopilación de datos para el mantenimiento preventivo y redujeron los tiempos de respuesta ante emergencias.

- Si bien el apoyo regulatorio y el progreso tecnológico son factores clave, la inversión continua en innovación y capacitación de los empleados es esencial para maximizar los beneficios de seguridad. Las empresas se asocian cada vez más con proveedores de tecnología para desarrollar soluciones personalizadas para entornos industriales complejos.

Restricción/Desafío

“Altos requerimientos de inversión de capital y mantenimiento”

- El elevado coste inicial de los equipos avanzados a prueba de explosiones limita su adopción entre las pequeñas y medianas empresas industriales, lo que dificulta su implementación a gran escala. El gasto incluye la compra, instalación, certificación e integración de los equipos en los sistemas de seguridad existentes, lo que puede resultar prohibitivo para las pequeñas empresas.

- Además, la instalación especializada y el mantenimiento continuo requieren personal capacitado, lo que incrementa los gastos operativos y limita la accesibilidad en instalaciones más pequeñas. La monitorización continua, las pruebas periódicas y las auditorías de cumplimiento incrementan aún más la complejidad operativa y el coste para mantener altos estándares de seguridad.

- Los desafíos logísticos y de la cadena de suministro para equipos, componentes y repuestos en plantas industriales remotas pueden retrasar la implementación y los cronogramas de mantenimiento. La dependencia de proveedores especializados, los plazos de entrega más largos y los problemas de disponibilidad regional pueden interrumpir los plazos del proyecto y aumentar los costos totales.

- Por ejemplo, en 2023, varias plantas de procesamiento químico reportaron retrasos en la instalación de equipos debido a la disponibilidad limitada de componentes certificados a prueba de explosiones y proveedores de servicios capacitados. Estos retrasos afectaron los cronogramas de los proyectos, incrementaron los costos de mano de obra y expusieron temporalmente las instalaciones a mayores riesgos de seguridad.

- Si bien la confiabilidad y el rendimiento de los equipos siguen mejorando, abordar los desafíos de costos y mantenimiento es crucial para una mayor penetración en el mercado y un crecimiento sostenido. Las empresas están explorando modelos de arrendamiento, soluciones modulares y alianzas de servicio local para que los equipos de seguridad de alta calidad sean más accesibles a una mayor variedad de operadores.

Alcance del mercado de equipos a prueba de explosiones en América del Norte

El mercado está segmentado en función de la oferta, clase de temperatura, zona y servicio de conectividad.

• Ofreciendo

En función de la oferta, el mercado de equipos a prueba de explosiones se segmenta en hardware, software y servicios. El segmento de hardware registró la mayor cuota de mercado en 2024, impulsado por la amplia implementación de carcasas, sensores y paneles de control certificados en instalaciones industriales. Las soluciones de hardware constituyen la base de los sistemas de seguridad industrial y son fundamentales para la prevención de accidentes en entornos peligrosos.

Se prevé que el segmento de software experimente el mayor crecimiento entre 2025 y 2032, impulsado por la creciente adopción de plataformas de monitorización basadas en IoT, herramientas de mantenimiento predictivo y análisis en la nube. Las soluciones de software mejoran la eficiencia de los sistemas a prueba de explosiones al proporcionar alertas en tiempo real, control centralizado e información basada en datos para la gestión proactiva de riesgos.

• Por clase de temperatura

Según la clase de temperatura, el mercado se segmenta en T1 a T6. El segmento T4 tuvo una participación significativa en 2024, gracias a su idoneidad para una amplia gama de aplicaciones industriales con límites moderados de temperatura superficial. Los dispositivos con clasificación T4 se utilizan comúnmente en los sectores químico, de petróleo y gas, y manufacturero debido a su fiabilidad y cumplimiento de las normas de seguridad.

Se prevé un sólido crecimiento del segmento T6 entre 2025 y 2032, impulsado por la demanda de equipos capaces de operar en zonas altamente sensibles con temperaturas superficiales máximas muy bajas. Los dispositivos a prueba de explosiones con clasificación T6 son los preferidos en aplicaciones que requieren los más altos estándares de seguridad, especialmente en entornos de minería y procesamiento químico peligroso.

• Por Zona

Según la zona, el mercado se segmenta de la Zona 0 a la Zona 22. El segmento de la Zona 1 representó la mayor participación en 2024, debido a su uso en áreas donde es probable que se produzcan atmósferas de gas explosivas durante las operaciones normales. Estas zonas abarcan la mayoría de las plantas e instalaciones industriales con gases o vapores inflamables.

Se espera que el segmento de Zona 0 experimente el mayor crecimiento durante el período de pronóstico, impulsado por la creciente necesidad de soluciones de seguridad en entornos altamente peligrosos con presencia continua de atmósferas explosivas. Los equipos con clasificación de Zona 0 garantizan la máxima protección y el cumplimiento de las estrictas normas de seguridad industrial.

• Por Servicio de Conectividad

En función del servicio de conectividad, el mercado se segmenta en cableado e inalámbrico. El segmento cableado tuvo la mayor participación de mercado en 2024, impulsado por su confiabilidad, transmisión estable de datos e idoneidad para operaciones industriales críticas donde la conectividad ininterrumpida es esencial.

Se prevé que el segmento inalámbrico experimente el mayor crecimiento entre 2025 y 2032, impulsado por la creciente implementación de dispositivos a prueba de explosiones con IoT, soluciones de monitorización remota y sistemas de seguridad inteligentes. La conectividad inalámbrica permite una instalación flexible, alertas en tiempo real y una integración más sencilla con plataformas centralizadas de gestión de seguridad.

Análisis regional del mercado de equipos a prueba de explosiones en América del Norte

- El mercado estadounidense de equipos a prueba de explosiones capturó la mayor participación en los ingresos de América del Norte en 2024, impulsado por la creciente implementación de protocolos de seguridad industrial y la presencia de numerosas instalaciones de petróleo y gas, químicas y de fabricación.

- Las empresas están priorizando la mejora de la seguridad en el lugar de trabajo a través de dispositivos ignífugos certificados y soluciones de monitoreo habilitadas para IoT.

- La creciente tendencia de la automatización industrial, combinada con la demanda de sistemas de detección de peligros en tiempo real y de mantenimiento predictivo, está impulsando aún más el crecimiento del mercado.

- Además, la integración de sistemas a prueba de explosiones con plataformas industriales inteligentes está contribuyendo significativamente a la expansión del mercado.

Análisis del mercado canadiense de equipos a prueba de explosiones

Se prevé que el mercado canadiense de equipos a prueba de explosiones experimente un crecimiento sostenido entre 2025 y 2032, impulsado por las inversiones en las industrias de minería, arenas petrolíferas y procesamiento químico, que exigen altos estándares de seguridad. La adopción de sistemas de monitoreo avanzados y dispositivos de protección con IoT está en aumento, respaldada por las regulaciones gubernamentales de seguridad. Los operadores industriales en Canadá se centran en reducir el riesgo de accidentes y el tiempo de inactividad operativa, lo que impulsa aún más la adopción de equipos a prueba de explosiones.

Cuota de mercado de equipos a prueba de explosiones en América del Norte

La industria de equipos a prueba de explosiones de América del Norte está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- R. STAHL Inc. (EE. UU.)

- RAE Systems (Honeywell) (EE. UU.)

- Intertek Group PLC (EE. UU.)

- Adalet Inc. (EE. UU.)

- EX Industries (EE. UU.)

- Larson Electronics LLC (EE. UU.)

- Miretti Americas (EE. UU.)

- Industrias de América del Norte (NAI) (EE. UU.)

- MSA Safety Incorporated (EE. UU.)

- Applus+ QPS (EE. UU.)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.