North America Essential Oils Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

6,998.52

2022

2030

6,998.52

2022

2030

| 2023 –2030 | |

| USD 6,998.52 | |

|

|

|

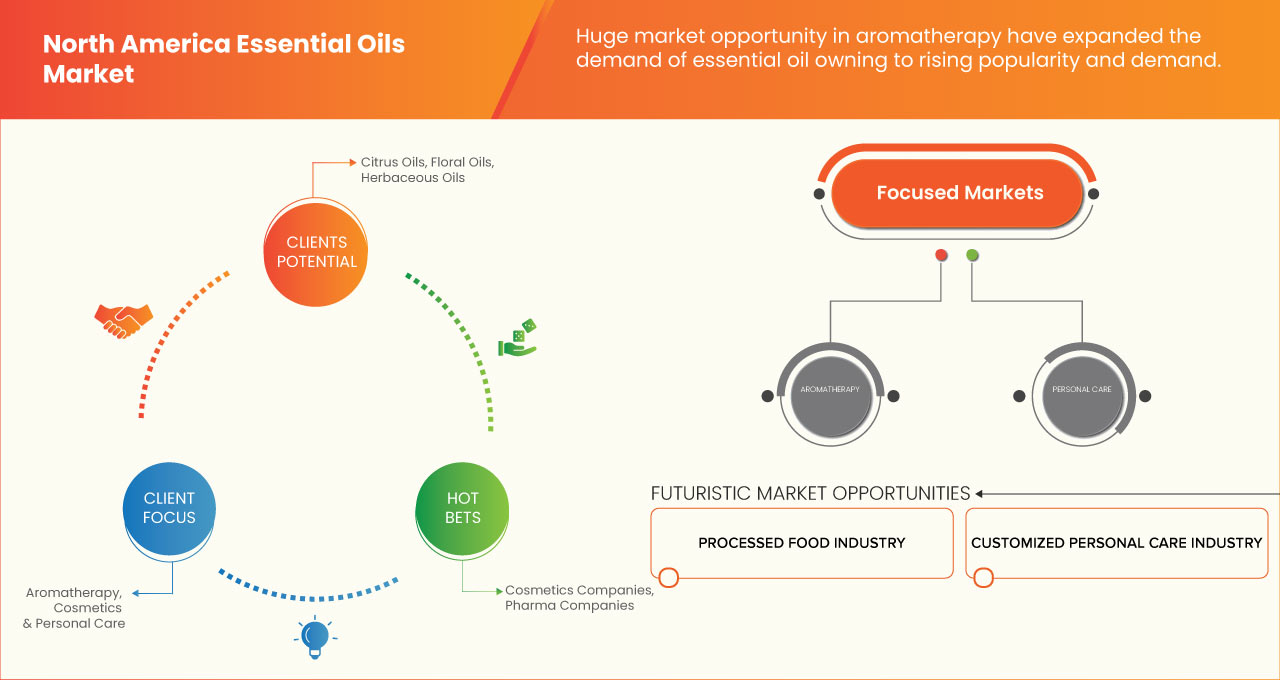

>Mercado de aceites esenciales de América del Norte, por producto ( aceites cítricos , aceites florales, aceites herbáceos, aceites alcanforados, aceites mentolados, aceites especiados, aceites resinosos/almizclados y aceites amaderados/terrosos), tipos (individuales y mezclas), categoría (convencional y orgánico), método de extracción (hidrodestilación o destilación al vapor, hidrodifusión, extracción por prensado en frío, destilación de agua, extracción con fluidos supercríticos, extracción por solventes, proceso asistido por microondas, extracción con dióxido de carbono y otros), aplicación (aromaterapia, cosméticos y cuidado personal, artículos de tocador y limpiadores, cuidado del hogar, agricultura, alimentos y bebidas, energía alternativa y médica, textiles, ambientador de automóviles, material de envasado de alimentos y otros), usuario final (empresas de cosméticos, empresas farmacéuticas, spa médico, clínicas de dermatología y otros), canal de distribución (directo e indirecto), tendencias de la industria y pronóstico hasta 2030.

Análisis y perspectivas del mercado de aceites esenciales de América del Norte

Los aceites esenciales pueden definirse como productos o mezclas de sustancias fragantes o como mezclas de sustancias fragantes e inodoras. Estas sustancias fragantes son compuestos químicamente puros que proporcionan una distinción respectiva. Se extraen mediante diversos métodos, como destilación, extracción por prensado en frío, extracción con disolventes, extracción enzimática y muchos otros. El uso de aceites esenciales está aumentando debido a la demanda de la industria de alimentos y bebidas para la preparación de diversos productos, como refrescos, productos de panadería, bebidas deportivas y muchos otros. Además, los aceites esenciales han ganado demanda debido a los centros de spa y relajación en todo el país. Sin embargo, ciertos aceites esenciales pueden causar efectos alergénicos, especialmente en personas propensas a erupciones cutáneas, y aquellos que tienen alergias al polen pueden obstaculizar el crecimiento del mercado.

Data Bridge Market Research analiza que se espera que el mercado de aceites esenciales de América del Norte alcance los USD 6.998,52 millones para 2030, con una CAGR del 9,7% durante el período de pronóstico.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2020-2016) |

|

Unidades cuantitativas |

Ingresos en millones de USD |

|

Segmentos cubiertos |

Por producto (aceites cítricos, aceites florales, aceites herbáceos, aceites alcanforados, aceites mentolados, aceites especiados, aceites resinosos/almizclados y aceites amaderados/terrosos), tipos (individuales y mezclas), categoría (convencional y orgánico), método de extracción (hidrodestilación o destilación al vapor, hidrodifusión, extracción por prensado en frío, destilación de agua, extracción con fluidos supercríticos, extracción por solventes, proceso asistido por microondas, extracción con dióxido de carbono y otros), aplicación ( aromaterapia , cosméticos y cuidado personal, artículos de tocador y limpiadores, cuidado del hogar, agricultura, alimentos y bebidas, energía alternativa y médica, textiles, ambientador de automóviles, material de envasado de alimentos y otros), usuario final (empresas de cosméticos, empresas farmacéuticas, spa médico, clínicas de dermatología y otros), canal de distribución (directo e indirecto). |

|

Países cubiertos |

Estados Unidos, Canadá y México |

|

Actores del mercado cubiertos |

Lebermuth, Inc., Floral Essential Oil, Kelvin Natural Mint Pvt Ltd, SOiL Organic Aromatherapy and Skincare, dōTERRA, Clive Teubes Group, Young Living Essential Oils, LC., Floracopeia, Robertet, Rocky Mountain Oils, LLC, Vigon International, LLC, Frontier Co-op., Synthite Industries Ltd., Silverline Chemicals, Phoenix Aromas & Essential Oils, LLC entre otros. |

Definición de mercado

Los aceites esenciales son extractos concentrados de plantas que conservan el olor, el sabor y la esencia naturales de su fuente. Los compuestos aromáticos únicos le dan a cada aceite esencial su esencia característica. Los aceites esenciales se obtienen mediante destilación (a través de vapor y agua) o métodos mecánicos, como el prensado en frío. Los aceites capturan el aroma, el sabor y la esencia de la planta. En su mayoría, reciben el nombre de la planta de la que se derivan. Las aplicaciones de los aceites esenciales son diversas. Ampliamente utilizados en cosméticos , perfumes , alimentos y bebidas, también tienen aplicaciones medicinales debido a sus propiedades terapéuticas y usos agroalimentarios por sus efectos antimicrobianos y antioxidantes.

Dinámica del mercado de aceites esenciales en América del Norte

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

CRECIENTE DEMANDA DE ACEITES ESENCIALES EN LA INDUSTRIA DEL CUIDADO PERSONAL Y FARMACÉUTICA

Las industrias cosmética, de cuidado personal y farmacéutica utilizan ampliamente aceites esenciales para formular productos de belleza, ya que confieren propiedades antienvejecimiento, antioxidantes y antiinflamatorias, lo que contribuye al crecimiento del mercado.

Se espera que la creciente demanda de productos de origen biológico en las industrias del cuidado personal y la cosmética aumente significativamente el crecimiento del mercado de aceites esenciales durante el período de pronóstico. Los aceites esenciales tienen importantes propiedades beneficiosas, como un alto valor nutricional, versatilidad de temperatura, alto contenido de escualeno y propiedades idénticas a las de la piel. El uso de aceites esenciales en la industria del cuidado personal ofrece una variedad de beneficios. La principal razón de su uso en cosmética es su agradable aroma. La aplicación de diversos aceites esenciales, como el de lavanda y el de árbol de té, sobre la piel proporciona una gran hidratación. Los aceites esenciales también se pueden añadir a lociones, cremas, champús y muchos otros.

Por lo tanto, se prevé que el crecimiento de los segmentos de aplicación y la creciente demanda de aceites esenciales impulsen el crecimiento del mercado de aceites esenciales de América del Norte.

AUMENTO DE LA ACEPTACIÓN DE PRODUCTOS NATURALES POR PARTE DE LOS CONSUMIDORES PARA UNA VIDA SALUDABLE

Los consumidores que están cambiando sus hábitos alimentarios son más proclives a los excesos conscientes, lo que significa que, si bien quieren darse el gusto de comer fuera y comer bien, quieren ser conscientes de lo que comen y elegirán los lugares donde comer después de una cuidadosa reflexión. Por ejemplo, alrededor del 78% de los millennials prefieren comprar alimentos saludables, lo que supone un 8% más que el mercado total. Alrededor del 54% de los millennials prefieren alimentos vegetarianos, lo que supone un 15% más que el mercado total.

El resultado de este cambio en el estilo de vida ha sido más directo en las categorías de productos de consumo natural de alto crecimiento, como el cuidado del bebé, el cuidado personal, los productos para el hogar y los cosméticos, que también han adaptado sus ofertas para atender a esta nueva generación de consumidores.

Restricción

FALTA DE DISPONIBILIDAD DE MATERIAS PRIMAS

La falta de disponibilidad de materias primas puede deberse a las condiciones climáticas. En condiciones climáticas desfavorables, a los agricultores les resulta difícil cultivar y hacer crecer plantas como hierbas, especias, menta, cítricos y otras, por lo que hay menos materias primas disponibles.

La fluctuación de la producción de estas plantas ha dado lugar a una oferta volátil de estas plantas en forma de semillas, raíces, hojas y otros productos. La oferta volátil de materias primas también impulsa los precios del producto final, estos aceites esenciales. Se espera que la disponibilidad limitada de materias primas obstaculice la cadena de valor general del mercado, un factor clave que limita el mercado de aceites esenciales de América del Norte.

Oportunidad

CAMBIO HACIA LA AROMATERAPIA

La aromaterapia se considera cada vez más una terapia popular, con la apertura de más spas en diversas áreas, aumentando la conciencia del consumidor sobre el bienestar, una mayor demanda de productos naturales y sus beneficios en la salud psicológica y fisiológica. El uso de aceites esenciales en aromaterapia con fines personales y terapéuticos ofrece un tremendo potencial de crecimiento. Esta terapia alternativa utiliza varias combinaciones de aceites esenciales para aliviar dolencias como la depresión, la indigestión, el dolor de cabeza, el insomnio , el dolor muscular, los problemas respiratorios y otros. Por ejemplo, el aceite esencial de tomillo se usa ampliamente en aromaterapia para ayudar a reducir la fatiga, el nerviosismo y el estrés. Se espera que la disponibilidad de una amplia gama de aceites aromáticos impulse el mercado de aceites esenciales de América del Norte. Por lo tanto, la demanda de aceite esencial permite a los fabricantes lanzar nuevos productos para expandirse aún más, lo que puede promover el crecimiento del mercado en el período de pronóstico.

Desafío

BAJOS VOLÚMENES DE PRODUCCIÓN DE ACEITES ESENCIALES Y AUMENTO DE LA DEMANDA DE LOS CONSUMIDORES

Se espera que los bajos volúmenes de producción de aceites esenciales y la creciente demanda de los consumidores afecten el crecimiento del mercado de aceites esenciales de América del Norte. Las altas tarifas de transporte, la mayor variabilidad de las precipitaciones y la intensa sequía estival pueden considerarse las principales limitaciones para la producción de estos cultivos. En tales condiciones, la adopción de prácticas agrícolas sostenibles y la introducción de cultivos nuevos o subutilizados, capaces de diversificar los sistemas de cultivo y mitigar los cambios climáticos, pueden representar estrategias prometedoras para abordar la sostenibilidad de los sistemas de cultivo, la mejora de los cultivos y la seguridad alimentaria.

Por lo tanto, la creciente demanda de aceite esencial no puede satisfacerse con los bajos volúmenes de producción y se espera que afecte el crecimiento del mercado debido a la incertidumbre climática y al lento proceso de extracción, así como al bajo contenido de aceite después de la extracción. Además, se espera que frene el crecimiento del mercado de aceites esenciales de América del Norte.

Impacto posterior a la COVID-19 en el mercado de aceites esenciales de América del Norte

Después de la pandemia, la demanda de aceites esenciales ha aumentado, ya que no habrá más restricciones de movimiento, por lo que el suministro de productos será fácil. Además, la creciente tendencia a utilizar aceites esenciales por sus propiedades terapéuticas e ingredientes naturales puede impulsar el crecimiento del mercado.

La mayor demanda de aceites esenciales permite a los fabricantes lanzar aceites esenciales innovadores y multifuncionales, lo que en última instancia aumenta la demanda de aceites esenciales y ha ayudado a que el mercado crezca.

Además, la alta demanda de aceites esenciales para alimentos, bebidas y productos de cuidado personal impulsará el crecimiento del mercado. Además, la mayor demanda de productos que refuerzan el sistema inmunológico después de la pandemia de COVID-19 resultó en un crecimiento del mercado, ya que los consumidores estaban más preocupados por su salud y bienestar. Además, se espera que el interés de los consumidores en nuevos sabores y fragancias mejoradas impulse el crecimiento del mercado de aceites esenciales de América del Norte.

Acontecimientos recientes

- En agosto de 2020, Young Living Essential Oils lanzó nuevos productos en la categoría de hogar feliz y saludable, incluidos el aceite de Cassia, el aceite de orégano ecuatoriano y el aceite esencial de un corazón.

- En octubre de 2020, Neptune Wellness Solutions lanzó una marca llamada Forest Remedies con una colección de productos desarrollados en colaboración con IFF, que lanzó seis aceites esenciales: limón, naranja dulce, bergamota, menta, eucalipto y aceite de árbol de té.

Alcance del mercado de aceites esenciales en América del Norte

El mercado de aceites esenciales de América del Norte está dividido en siete segmentos según el producto, los tipos, la categoría, el método de extracción, la aplicación, el usuario final y el canal de distribución. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas a fin de identificar las principales aplicaciones del mercado.

Producto

- Aceites cítricos

- Aceites de menta

- Aceites florales

- Aceites herbáceos

- Aceites alcanforados

- Aceites picantes

- Aceites resinosos/almizclados

- Aceites amaderados/terrosos

Sobre la base del producto, el mercado de aceites esenciales de América del Norte está segmentado en aceites cítricos, aceites herbáceos, aceites florales, aceites mentolados, aceites picantes, aceites alcanforados, aceites resinosos/almizclados y aceites amaderados/terrosos.

Método de extracción

- Destilación hidroeléctrica o por vapor

- Destilación de agua

- Extracción mediante prensado en frío

- Extracción de dióxido de carbono

- Extracción con disolventes

- Hidrodifusión

- Extracción con fluidos supercríticos

- Proceso asistido por microondas (Mapa)

- Otros

Sobre la base del método de extracción, el mercado de aceites esenciales de América del Norte está segmentado en prensado en frío, extracción con solventes, extracción supercrítica, extracción con dióxido de carbono, destilación hidroeléctrica o al vapor, destilación de agua, hidrodifusión, proceso asistido por microondas (MAP) y otros.

Categoría

- Orgánico

- Convencional

Según la categoría, el mercado de aceites esenciales de América del Norte está segmentado en orgánico y convencional.

Tipos

- Individual

- Mezclas

Según los tipos, el mercado de aceites esenciales de América del Norte está segmentado en aceites individuales y mezclas.

Solicitud

- Alimentos y bebidas

- Aromaterapia

- Cosméticos y cuidado personal

- Cuidados en el hogar

- Artículos de tocador y limpiadores

- Energía alternativa y medicina

- Textiles

- Ambientador para automóvil

- Agricultura

- Material de embalaje de alimentos

- Otros

Sobre la base de la aplicación, el mercado de aceites esenciales de América del Norte está segmentado en alimentos y bebidas, aromaterapia, cosméticos y cuidado personal, cuidado del hogar, artículos de tocador y limpiadores, energía alternativa y medicina, textiles, ambientadores de automóviles, agricultura, material de envasado de alimentos y otros.

Usuario final

- Empresas de Cosmética

- Compañías farmacéuticas

- Spa médico

- Clínicas de Dermatología

- Otros

Sobre la base del usuario final, el mercado de aceites esenciales de América del Norte está segmentado en empresas de cosméticos, empresas farmacéuticas, spa médicos, clínicas de dermatología y otras.

Canal de distribución

- Directo

- Indirecto

Sobre la base del canal de distribución, el mercado de aceites esenciales de América del Norte está segmentado en directo e indirecto.

Análisis y perspectivas regionales del mercado de aceites esenciales de América del Norte

Se analiza el mercado de aceites esenciales de América del Norte y se proporcionan información y tendencias del tamaño del mercado en función del producto, los tipos, la categoría, el método de extracción, la aplicación, el usuario final y el canal de distribución, como se mencionó anteriormente.

Los países incluidos en el informe sobre los mercados de aceites esenciales de América del Norte son Estados Unidos, Canadá y México. Se espera que Estados Unidos domine el mercado debido a la creciente conciencia de los beneficios para la salud de los aceites esenciales. La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en las regulaciones del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos, como las ventas nuevas y de reemplazo, la demografía del país, la epidemiología de las enfermedades y los aranceles de importación y exportación, son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para los países individuales. Además, se consideran la presencia y disponibilidad de las marcas de América del Norte y los desafíos que enfrentan debido a la alta competencia de las marcas locales y nacionales y el impacto de los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los aceites esenciales en América del Norte

El panorama competitivo del mercado de aceites esenciales de América del Norte proporciona detalles de los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores solo se relacionan con el enfoque de las empresas en el mercado de aceites esenciales de América del Norte.

Algunos de los principales actores que operan en el mercado de aceites esenciales de América del Norte son Lebermuth, Inc., Floral Essential Oil, Kelvin Natural Mint Pvt Ltd, SOiL Organic Aromatherapy and Skincare, dōTERRA, Clive Teubes Group, Young Living Essential Oils, LC., Floracopeia, Robertet, Rocky Mountain Oils, LLC, Vigon International, LLC, Frontier Co-op., Synthite Industries Ltd., Silverline Chemicals, Phoenix Aromas & Essential Oils, LLC, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA ESSENTIAL OILS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE ANALYSIS

4.2.1 BARGAINING POWER OF BUYERS/CONSUMERS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 THE THREAT OF NEW ENTRANTS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 RIVALRY AMONG EXISTING COMPETITORS

4.3 KEY PRICING STRATEGIES

4.3.1 MINIMUM ADVERTISED PRICING "MAP" POLICY

4.3.2 PRIORITIZING PURITY AND POTENCY

4.4 MERGERS & ACQUISITION

4.5 PATIENT TREATMENT SUCCESS RATES

5 REGULATORY SCENARIO

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING AWARENESS RELATED TO THE HEALTH BENEFITS OF ESSENTIAL OILS

6.1.2 RISING DEMAND FOR ESSENTIAL OILS IN THE PERSONAL CARE AND PHARMACEUTICAL INDUSTRY

6.1.3 INCREASING DEMAND FOR ESSENTIAL OILS IN THE FOOD & BEVERAGE INDUSTRY

6.1.4 INCREASE IN CONSUMER ACCEPTANCE OF NATURAL PRODUCTS FOR HEALTHY LIVING

6.2 RESTRAINTS

6.2.1 LACK OF AVAILABILITY OF RAW MATERIALS

6.2.2 HIGH PRODUCTION COST FOR ESSENTIAL OILS

6.3 OPPORTUNITIES

6.3.1 SHIFT TOWARDS AROMATHERAPY

6.3.2 GROWING APPLICATION OF ESSENTIAL OIL IN-HOME CARE

6.3.3 INTRODUCTION OF NEW MANUFACTURING TECHNOLOGIES

6.4 CHALLENGES

6.4.1 ALLERGIES FROM ESSENTIAL OILS DUE TO UNAWARENESS AMONG CONSUMERS

6.4.2 LOW PRODUCTION VOLUMES OF ESSENTIAL OILS AND INCREASING CONSUMER DEMAND

7 NORTH AMERICA ESSENTIAL OILS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 CITRUS OILS

7.2.1 CITRUS OILS, BY CATEGORY

7.2.1.1 CONVENTIONAL

7.2.1.2 ORGANIC

7.2.2 CITRUS OILS, BY TYPE

7.2.2.1 ORANGE OIL

7.2.2.2 LEMON OIL

7.2.2.3 LIME OIL

7.2.2.4 BERGAMOT OIL

7.2.2.5 GRAPEFRUIT OIL

7.2.2.6 LEMONGRASS OIL

7.2.2.7 MANDARIN OIL

7.2.2.8 TANGERINE OIL

7.2.2.9 CITROELLA OIL

7.2.2.10 LITSEA CUBEBA OIL

7.2.2.11 TAGETES OIL

7.3 MINTY OILS

7.3.1 MINTY OILS, BY CATEGORY

7.3.1.1 CONVENTIONAL

7.3.1.2 ORGANIC

7.3.2 MINTY OILS, BY TYPE

7.3.2.1 PEPPERMINT OIL

7.3.2.2 SPEARMINT OIL

7.3.2.3 WINTERGREEN OIL

7.3.2.4 OTHERS

7.4 FLORAL OILS

7.4.1 FLORAL OILS, BY CATEGORY

7.4.1.1 CONVENTIONAL

7.4.1.2 ORGANIC

7.4.2 FLORAL OILS, BY TYPE

7.4.2.1 LAVENDER OIL

7.4.2.2 ROSE OIL

7.4.2.3 JASMINE OIL

7.4.2.4 CHAMOMILE OIL

7.4.2.5 GERANIUM OIL

7.4.2.6 NEROLI OIL

7.4.2.7 ROSEWOOD OIL

7.4.2.8 YLANG-YLANG OIL

7.4.2.9 PETITGRAIN OIL

7.5 SPICY OILS

7.5.1 SPICY OILS, BY CATEGORY

7.5.1.1 CONVENTIONAL

7.5.1.2 ORGANIC

7.5.2 SPICY OILS, BY TYPE

7.5.2.1 CLOVE BUD OIL

7.5.2.2 BASIL OIL

7.5.2.3 CORIANDER OIL

7.5.2.4 GINGER OIL

7.5.2.5 CUMIN OIL

7.5.2.6 CINNAMON OIL

7.5.2.7 CARDAMOM OIL

7.5.2.8 BLACK PEPPER OIL

7.5.2.9 ALLSPICE OIL

7.5.2.10 NUTMEG OIL

7.5.2.11 ANISEED OIL

7.5.2.12 CASSIA OIL

7.5.2.13 OTHERS

7.6 CAMPHORACEOUS OILS

7.6.1 CAMPHORACEOUS OILS, BY CATEGORY

7.6.1.1 CONVENTIONAL

7.6.1.2 ORGANIC

7.6.2 CAMPHORACEOUS OILS, BY TYPE

7.6.2.1 CAMPHOR OIL

7.6.2.2 EUCALYPTUS OIL

7.6.2.3 LAVANDIN OIL

7.6.2.4 LAUREL LEAF OIL

7.6.2.5 PANNYROYAL OIL

7.6.2.6 CAJEPUT OIL

7.6.2.7 OTHERS

7.7 HERBACEOUS OILS

7.7.1 HERBACEOUS OILS, BY CATEGORY

7.7.1.1 CONVENTIONAL

7.7.1.2 ORGANIC

7.7.2 HERBACEOUS OILS, BY TYPE

7.7.2.1 OREGANO OIL

7.7.2.2 ROSEMARY OIL

7.7.2.3 THYME OIL

7.7.2.4 CHAMOMILE OIL

7.7.2.5 TEA TREE OIL

7.7.2.6 CLARY SAGE OIL

7.7.2.7 EUCALYTUS OIL

7.7.2.8 FENNEL OIL

7.7.2.9 SAGE DALMATIAN OIL

7.7.2.10 PARSLEY OIL

7.7.2.11 ANGELICA ROOT OIL

7.7.2.12 BAY LAUREL OIL

7.7.2.13 CATNIP OIL

7.7.2.14 HYSSOP OIL

7.7.2.15 MARJORAM OIL

7.7.2.16 MELISSA OIL

7.7.2.17 YARROW OIL

7.7.2.18 OTHERS

7.8 RESINOUS/MUSKY OILS

7.8.1 RESINOUS/MUSKY OILS, BY CATEGORY

7.8.1.1 CONVENTIONAL

7.8.1.2 ORGANIC

7.8.2 RESINOUS/MUSKY OILS, BY TYPE

7.8.2.1 BENZOIN OIL

7.8.2.2 ELEMI OIL

7.8.2.3 FRANKINCENSE OIL

7.8.2.4 MYRRH OIL

7.8.2.5 PERU BALSAM OIL

7.8.2.6 OTHERS

7.9 WOODY/EARTHY OILS

7.9.1 WOODY/EARTHY OILS, BY CATEGORY

7.9.1.1 CONVENTIONAL

7.9.1.2 ORGANIC

7.9.2 WOODY/EARTHY OILS, BY TYPE

7.9.2.1 ROSEWOOD OIL

7.9.2.2 SANDALWOOD OIL

7.9.2.3 VETIVER OIL

7.9.2.4 PINE OIL

7.9.2.5 CARROT SEED OIL

7.9.2.6 CEDARWOOD OIL

7.9.2.7 JUNIPER BERRY OIL

7.9.2.8 FIR OIL

7.9.2.9 VALERIAN OIL

7.9.2.10 CYPRESS OIL

7.9.2.11 PALO SANTO OIL

7.9.2.12 OTHERS

8 NORTH AMERICA ESSENTIAL OILS MARKET, BY TYPES

8.1 OVERVIEW

8.2 SINGLES

8.3 BLENDS

9 NORTH AMERICA ESSENTIAL OILS MARKET, BY CATEGORY

9.1 OVERVIEW

9.2 CONVENTIONAL

9.3 ORGANIC

10 NORTH AMERICA ESSENTIAL OILS MARKET, BY METHOD OF EXTRACTION

10.1 OVERVIEW

10.2 HYDRO- OR- STEAM- DISTILLATION

10.3 WATER DISTILLATION

10.4 COLD PRESS EXTRACTION

10.5 CARBONDIOXIDE EXTRACTION

10.6 SOLVENT EXTRACTION

10.7 HYDRODIFFUSION

10.8 SUPERCRITICAL FLUID EXTRACTION

10.9 MICROWAVE ASSISTED PROCESS (MAP)

10.1 OTHERS

11 NORTH AMERICA ESSENTIAL OILS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 FOOD & BEVERAGES

11.2.1 CONFECTIONERY

11.2.2 BEVERAGES

11.2.2.1 CARBONATED DRINKS

11.2.2.2 ALMOND MILK

11.2.2.3 ICED TEA

11.2.2.4 OTHERS

11.2.3 BAKERY

11.2.3.1 BREAD & BUNS

11.2.3.2 PASTRY

11.2.3.3 MUFFIN & CUPCAKES

11.2.3.4 OTHERS

11.2.4 DAIRY PRODUCTS

11.2.5 RTE MEALS

11.2.6 SNACKS & NUTRITIONAL BARS

11.2.7 MEAT, POULTRY & SEAFOOD

11.2.8 OTHERS

11.3 AROMATHERAPY

11.3.1 SPA & RELAXATION THERAPY

11.3.2 INSOMNIA THERAPY

11.3.3 PAIN MANAGEMENT

11.3.4 SKIN & HAIR CARE THERAPY

11.3.5 SCAR MANAGEMENT

11.3.6 COUGH & COLD THERAPY

11.4 COSMETICS & PERSONAL CARE

11.4.1 PERFUMES & BODY SPRAYS/MISTS

11.4.2 SKIN CARE

11.4.3 HAIR CARE

11.4.4 MAKEUP AND COLOR COSMETICS

11.4.5 SOAPS

11.5 HOME CARE

11.5.1 AIR FRESHER

11.5.2 SCENTED CANDLES

11.5.3 OTHERS

11.6 TOILETRIES AND CLEANERS

11.6.1 FABRIC CARE

11.6.2 DETERGENTS

11.6.3 HANDWASH

11.6.4 KITCHEN CLEANERS

11.6.5 BATHROOM CLEANER

11.6.6 FLOOR CLEANER

11.6.7 OTHERS

11.7 ALTERNATIVE ENERGY AND MEDICAL

11.7.1 INFLAMMATORY DISEASE

11.7.2 NERVOUS SYSTEM

11.7.3 MICROBIAL INFECTIONS

11.7.4 ALLERGIES

11.8 TEXTILES

11.9 AUTOMOBILE AIR FRESHER

11.1 AGRICULTURE

11.11 FOOD PACKAGING MATERIAL

11.12 OTHERS

12 NORTH AMERICA ESSENTIAL OILS MARKET, BY END USER

12.1 OVERVIEW

12.2 COSMETIC COMPANIES

12.3 PHARMA COMPANIES

12.4 MEDICAL SPA

12.5 DERMATOLOGY CLINICS

12.6 OTHERS

13 NORTH AMERICA ESSENTIAL OILS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT

13.3 INDIRECT

13.3.1 STORE-BASED RETAILING

13.3.1.1 WHOLESALERS

13.3.1.2 CONVENIENCE STORES

13.3.1.3 SPECIALTY STORES

13.3.1.4 SUPERMARKETS/HYPERMARKETS

13.3.1.5 GROCERY STORES

13.3.1.6 OTHERS

13.3.2 NON-STORE RETAILING

13.3.2.1 ONLINE

13.3.2.2 VENDING

14 NORTH AMERICA ESSENTIAL OILS MARKET, BY COUNTRY

14.1 U.S.

14.2 CANADA

14.3 MEXICO

15 COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 DOTERRA

17.1.1 COMPANY SNAPSHOT

17.1.2 PRODUCT PORTFOLIO

17.1.3 RECENT DEVELOPMENTS

17.2 YOUNG LIVING ESSENTIAL OILS.

17.2.1 COMPANY SNAPSHOT

17.2.2 PRODUCT PORTFOLIO

17.2.3 RECENT DEVELOPMENTS

17.3 ROBERTET

17.3.1 COMPANY SNAPSHOT

17.3.2 RECENT FINANCIALS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.4 SYNTHITE INDUSTRIES LTD.

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 RECENT DEVELOPMENT

17.5 FRONTIER CO-OP.

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT DEVELOPMENT

17.6 ARBRESSENCE

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 FLORACOPEIA

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 FLORAL ESSENTIAL OIL

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 KELVIN NATURAL MINT PVT. LTD.

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 LEBERMUTH, INC

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 PHOENIX AROMAS & ESSENTIAL OILS, LLC

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 ROCKY MOUNTAIN OILS, LLC

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 SILVERLINE CHEMICALS.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 SOIL ORGANIC AROMATHERAPY AND SKINCARE

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 VIGON INTERNATION LLC

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tablas

TABLE 1 MERGERS & ACQUISITION

TABLE 2 NORTH AMERICA ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 4 NORTH AMERICA ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (USD/TONS)

TABLE 5 NORTH AMERICA CITRUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 8 NORTH AMERICA CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 9 NORTH AMERICA MINTY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 12 NORTH AMERICA MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 13 NORTH AMERICA FLORAL OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 16 NORTH AMERICA FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 17 NORTH AMERICA SPICY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 20 NORTH AMERICA SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 21 NORTH AMERICA CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 24 NORTH AMERICA CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 25 NORTH AMERICA HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 28 NORTH AMERICA HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 29 NORTH AMERICA RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 32 NORTH AMERICA RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 33 NORTH AMERICA WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 36 NORTH AMERICA WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 37 NORTH AMERICA ESSENTIAL OILS MARKET, BY TYPES, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA ESSENTIAL OILS MARKET, BY METHOD OF EXTRACTION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA ESSENTIAL OILS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA FOOD & BEVERAGES IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA BEVERAGES IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA BAKERY IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA AROMATHERAPY IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA COSMETICS & PERSONAL CARE IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA HOME CARE IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA TOILETRIES AND CLEANERS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA ALTERNATIVE ENERGY AND MEDICAL IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA ESSENTIAL OILS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA ESSENTIAL OILS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA INDIRECT IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA STORE-BASED RETAILING IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 53 NORTH AMERICA NON-STORE RETAILING IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA ESSENTIAL OILS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA ESSENTIAL OILS MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 56 NORTH AMERICA ESSENTIAL OILS MARKET, BY COUNTRY, 2021-2030 (ASP/TONS)

TABLE 57 U.S. ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 58 U.S. ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 59 U.S. ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (USD/TONS)

TABLE 60 U.S. CITRUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 61 U.S. CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 62 U.S. CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 63 U.S. CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 64 U.S. FLORAL OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 65 U.S. FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 U.S. FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 67 U.S. FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 68 U.S. HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 69 U.S. HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 U.S. HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 71 U.S. HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 72 U.S. CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 73 U.S. CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 74 U.S. CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 75 U.S. CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 76 U.S. MINTY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 77 U.S. MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 U.S. MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 79 U.S. MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 80 U.S. SPICY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 81 U.S. SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 U.S. SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 83 U.S. SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 84 U.S. RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 85 U.S. RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 U.S. RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 87 U.S. RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 88 U.S. WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 89 U.S. WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 90 U.S. WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 91 U.S. WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 92 U.S. ESSENTIAL OILS MARKET, BY TYPES, 2021-2030 (USD MILLION)

TABLE 93 U.S. ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 94 U.S. ESSENTIAL OILS MARKET, BY METHOD OF EXTRACTION, 2021-2030 (USD MILLION)

TABLE 95 U.S. ESSENTIAL OILS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 96 U.S. FOOD & BEVERAGES IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 U.S. BAKERY IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 U.S. BEVERAGES IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 U.S. AROMATHERAPY IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 U.S. COSMETICS & PERSONAL CARE IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 101 U.S. TOILETRIES AND CLEANERS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 102 U.S. HOME CARE IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 103 U.S. ALTERNATIVE ENERGY AND MEDICAL IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 104 U.S. ESSENTIAL OILS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 105 U.S. ESSENTIAL OILS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 106 U.S. INDIRECT IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 U.S. STORE-BASED RETAILING IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 108 U.S. NON-STORE RETAILING IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 CANADA ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 110 CANADA ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 111 CANADA ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (USD/TONS)

TABLE 112 CANADA CITRUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 113 CANADA CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 114 CANADA CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 115 CANADA CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 116 CANADA FLORAL OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 117 CANADA FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 118 CANADA FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 119 CANADA FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 120 CANADA HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 121 CANADA HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 122 CANADA HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 123 CANADA HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 124 CANADA CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 125 CANADA CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 126 CANADA CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 127 CANADA CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 128 CANADA MINTY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 129 CANADA MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 CANADA MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 131 CANADA MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 132 CANADA SPICY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 133 CANADA SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 134 CANADA SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 135 CANADA SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 136 CANADA RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 137 CANADA RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 138 CANADA RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 139 CANADA RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 140 CANADA WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 141 CANADA WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 142 CANADA WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 143 CANADA WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 144 CANADA ESSENTIAL OILS MARKET, BY TYPES, 2021-2030 (USD MILLION)

TABLE 145 CANADA ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 146 CANADA ESSENTIAL OILS MARKET, BY METHOD OF EXTRACTION, 2021-2030 (USD MILLION)

TABLE 147 CANADA ESSENTIAL OILS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 148 CANADA FOOD & BEVERAGES IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 149 CANADA BAKERY IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 150 CANADA BEVERAGES IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 151 CANADA AROMATHERAPY IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 152 CANADA COSMETICS & PERSONAL CARE IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 153 CANADA TOILETRIES AND CLEANERS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 154 CANADA HOME CARE IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 155 CANADA ALTERNATIVE ENERGY AND MEDICAL IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 156 CANADA ESSENTIAL OILS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 157 CANADA ESSENTIAL OILS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 158 CANADA INDIRECT IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 159 CANADA STORE-BASED RETAILING IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 160 CANADA NON-STORE RETAILING IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 161 MEXICO ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 162 MEXICO ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 163 MEXICO ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (USD/TONS)

TABLE 164 MEXICO CITRUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 165 MEXICO CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 166 MEXICO CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 167 MEXICO CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 168 MEXICO FLORAL OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 169 MEXICO FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 170 MEXICO FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 171 MEXICO FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 172 MEXICO HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 173 MEXICO HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 174 MEXICO HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 175 MEXICO HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 176 MEXICO CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 177 MEXICO CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 178 MEXICO CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 179 MEXICO CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 180 MEXICO MINTY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 181 MEXICO MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 182 MEXICO MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 183 MEXICO MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 184 MEXICO SPICY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 185 MEXICO SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 186 MEXICO SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 187 MEXICO SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 188 MEXICO RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 189 MEXICO RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 190 MEXICO RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 191 MEXICO RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 192 MEXICO WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 193 MEXICO WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 194 MEXICO WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 195 MEXICO WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 196 MEXICO ESSENTIAL OILS MARKET, BY TYPES, 2021-2030 (USD MILLION)

TABLE 197 MEXICO ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 198 MEXICO ESSENTIAL OILS MARKET, BY METHOD OF EXTRACTION, 2021-2030 (USD MILLION)

TABLE 199 MEXICO ESSENTIAL OILS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 200 MEXICO FOOD & BEVERAGES IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 201 MEXICO BAKERY IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 202 MEXICO BEVERAGES IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 203 MEXICO AROMATHERAPY IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 204 MEXICO COSMETICS & PERSONAL CARE IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 205 MEXICO TOILETRIES AND CLEANERS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 206 MEXICO HOME CARE IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 207 MEXICO ALTERNATIVE ENERGY AND MEDICAL IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 208 MEXICO ESSENTIAL OILS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 209 MEXICO ESSENTIAL OILS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 210 MEXICO INDIRECT IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 211 MEXICO STORE-BASED RETAILING IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 212 MEXICO NON-STORE RETAILING IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA ESSENTIAL OILS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ESSENTIAL OILS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ESSENTIAL OILS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ESSENTIAL OILS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ESSENTIAL OILS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ESSENTIAL OILS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA ESSENTIAL OILS MARKET: DBMR SAFETY MARKET POSITION GRID

FIGURE 8 NORTH AMERICA ESSENTIAL OILS MARKET: APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA ESSENTIAL OILS MARKET: SEGMENTATION

FIGURE 10 INCREASE IN AWARENESS RELATED TO THE HEALTH BENEFITS OF ESSENTIAL OILS IS EXPECTED TO DRIVE THE NORTH AMERICA ESSENTIAL OILS MARKET IN THE FORECAST PERIOD

FIGURE 11 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ESSENTIAL OILS MARKET IN 2022 & 2029

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA ESSENTIAL OILS MARKET

FIGURE 13 NORTH AMERICA ESSENTIAL OILS MARKET: BY PRODUCT, 2022

FIGURE 14 NORTH AMERICA ESSENTIAL OILS MARKET: BY TYPES, 2022

FIGURE 15 NORTH AMERICA ESSENTIAL OILS MARKET: BY CATEGORY, 2022

FIGURE 16 NORTH AMERICA ESSENTIAL OILS MARKET: BY METHOD OF EXTRACTION, 2022

FIGURE 17 NORTH AMERICA ESSENTIAL OILS MARKET: BY APPLICATION, 2022

FIGURE 18 NORTH AMERICA ESSENTIAL OILS MARKET: BY END USER, 2022

FIGURE 19 NORTH AMERICA ESSENTIAL OILS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 20 NORTH AMERICA ESSENTIAL OILS MARKET: SNAPSHOT (2022)

FIGURE 21 NORTH AMERICA ESSENTIAL OILS MARKET: BY COUNTRY (2022)

FIGURE 22 NORTH AMERICA ESSENTIAL OILS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 23 NORTH AMERICA ESSENTIAL OILS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 24 NORTH AMERICA ESSENTIAL OILS MARKET: BY PRODUCT (2023-2030)

FIGURE 25 NORTH AMERICA ESSENTIAL OILS MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.