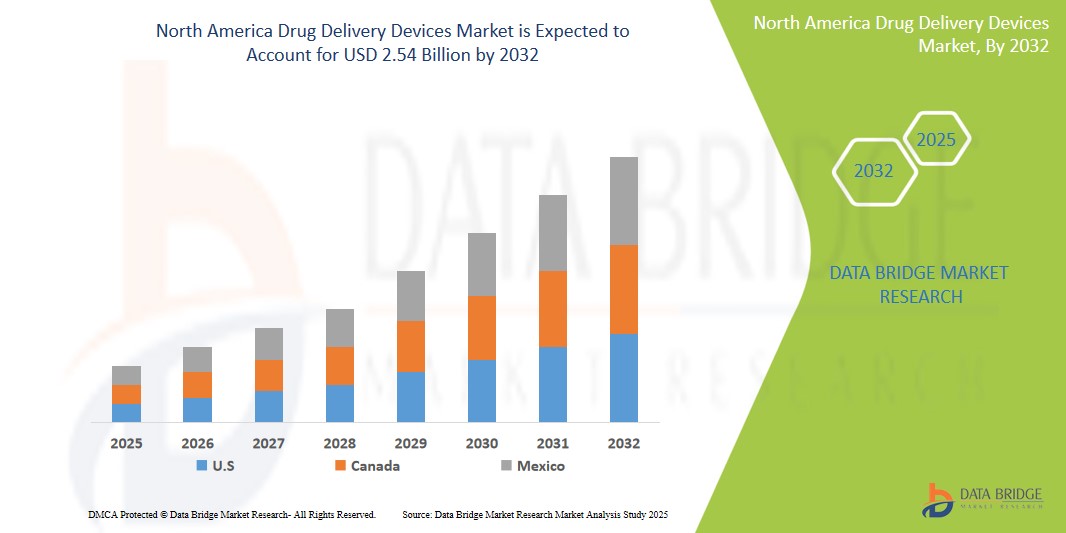

North America Drug Delivery Devices Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

1.44 Billion

USD

2.54 Billion

2024

2032

USD

1.44 Billion

USD

2.54 Billion

2024

2032

| 2025 –2032 | |

| USD 1.44 Billion | |

| USD 2.54 Billion | |

|

|

|

|

North America Drug Delivery Devices Market Segmentation, By Product Type (Oral Drug Delivery, Injectable Drug Delivery, Topical Drug Delivery, Ophthalmic Drug Delivery, Nasal Drug Delivery, Pulmonary Drug Delivery, Transmucosal Drug Delivery, and Implantable Drug Delivery), End User (Hospitals, Home Healthcare, Clinics, Community Healthcare, and Others), Distribution Channel (Direct Tenders, Hospital Pharmacies, Pharmacy Stores, and Online Pharmacy) - Industry Trends and Forecast to 2032

North America Drug Delivery Devices Market Size

- The North America drug delivery devices market size was valued atUSD 1.44 billion in 2024 and is expected to reachUSD 2.54 billion by 2032, at aCAGR of 7.30%during the forecast period

- This growth is driven by factors such as the increasing prevalence of chronic diseases, rising demand for self-administration and home healthcare solutions, and advancements in drug delivery technology

North America Drug Delivery Devices Market Analysis

- The North America drug delivery devices market is currently experiencing significant expansion due to the increasing focus on personalized and targeted therapies, which are boosting demand for innovative delivery technologies

- Growth in outpatient care and rising adoption of patient-centric drug delivery solutions are shaping the market, as healthcare providers prioritize ease of use and improved patient compliance

- U.S. is expected to dominate the North America drug delivery devices market due to its strong healthcare infrastructure, high adoption rate of advanced drug delivery technologies, and the presence of key pharmaceutical andmedical device manufacturers. The country's extensive research and development activities, along with robust regulatory frameworks, further bolster its leadership in the market.

- Canada is expected to be the fastest growing region in the North America drug delivery devices market during the forecast period due to the increasing prevalence of chronic diseases, a growing elderly population, and rising demand for more efficient drug delivery solutions. In addition, Canada's investment in healthcare innovation and technology adoption supports the rapid expansion of the drug delivery devices sector.

- The injectable drug delivery segment is expected to dominate the North America drug delivery devices market with the largest share of 64.8% in 2025 due to its growing use in the administration of biologics, vaccines, and chronic disease management, offering higher precision and faster therapeutic effects compared to other delivery methods.

Report Scope and North America Drug Delivery Devices Market Segmentation

|

Attributes |

North America Drug Delivery Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

North America Drug Delivery Devices Market Trends

“Rise of Connected Drug Delivery Devices in North America”

- Connected drug delivery devices, such as smart inhalers and autoinjectors, are gaining popularity for their ability to provide real-time data to both patients and healthcare providers, improving treatment outcomes and adherence

- For instance, the Propeller Health smart inhaler system has been adopted by healthcare systems in the U.S. to monitor asthma and COPD patients remotely

- The integration of digital health technologies into drug delivery devices allows for features such as dose tracking, reminders, and real-time data sharing, enabling personalized treatment plans and remote monitoring

- For instance, is the BD Libertas wearable injector, which offers connectivity features for tracking and reporting injection data in real-time

- Companies such as Jabil Healthcare and Aptar Pharma have introduced connected platforms and digital respiratory health solutions, respectively, showcasing the industry's commitment to innovation in this space

- The growing prevalence of chronic diseases and the shift towards patient-centric healthcare are driving the demand for connected drug delivery devices that empower patients in managing their treatments effectively

- The North American market's emphasis on technological adoption and supportive regulatory frameworks further accelerates the growth and acceptance of connected drug delivery solutions

North America Drug Delivery Devices Market Dynamics

Driver

“Rising prevalence of chronic diseases and aging population”

- The rising prevalence of chronic diseases such as diabetes, cardiovascular issues, and respiratory disorders is fueling demand for drug delivery devices in North America

- For instance, insulin pens are widely used by diabetic patients for accurate and convenient insulin administration

- Aging populations in the U.S. and Canada are increasing the need for self-administered, user-friendly drug delivery technologies

- For instance, Auto-injectors are helping elderly patients manage conditions such as rheumatoid arthritis without relying on caregivers

- Advanced drug delivery devices are easing medication routines by offering features such as dosage reminders, digital tracking, and ergonomic designs

- For instance, Smart inhalers, equipped with Bluetooth connectivity, help monitor asthma medication adherence in real time

- Growing healthcare awareness and patient education encourage the use of innovative devices that improve treatment outcomes

- Government initiatives supporting chronic disease management programs are accelerating the market penetration of these devices

Opportunity

“Technological innovations in personalized and connected drug delivery devices”

- There is a growing shift toward personalized medicine in North America, driving demand for smart and connected drug delivery devices

- For instance, digital pill dispensers are being developed to tailor doses based on patient-specific data

- These devices use integrated technologies such as sensors and Bluetooth to ensure precise dosage and monitor medication adherence

- For instance, Smart injectors for hormone therapy now track injection timing and dosage accuracy through mobile apps

- Wearable and implantable drug delivery systems are enabling continuous, lifestyle-based treatment aligned with individual patient needs

- For instance, Wearable insulin patches allow diabetic patients to receive controlled doses based on blood glucose levels

- Expansion of digital health platforms is bridging the gap between patients and providers, enabling remote monitoring and therapy adjustments

- Heavy investment in R&D by pharmaceutical and MedTech firms, combined with favorable regulations and consumer adoption, is accelerating innovation

Restraint/Challenge

“High development costs associated with drug delivery devices”

- Developing drug delivery devices requires significant investment in research, engineering, and regulatory compliance, leading to high upfront costs

- For instance, Collaborative input from pharmaceutical scientists, engineers, and compliance experts adds to development complexity

- Integrating advanced technologies such as sensors and wireless features further escalates design, testing, and approval expenses

- For instance, Smart injectors with Bluetooth capabilities demand more extensive prototyping and longer regulatory review

- Stringent regulatory processes by authorities such as the FDA led to prolonged approval timelines and additional clinical trials

- For instance, companies often undergo multiple rounds of clinical validation to meet safety and efficacy standards

- High initial costs particularly impact small and medium enterprises, limiting their ability to compete and innovate

- Post-approval, companies incur ongoing expenses for compliance, technology upgrades, and safety monitoring, making the market capital-intensive

North America Drug Delivery Devices Market Scope

The market is segmented on the basis of product type, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By End User |

|

|

By Distribution Channel |

|

In 2025, the injectable drug delivery is projected to dominate the market with a largest share in product type segment

The injectable drug delivery segment is expected to dominate the North America drug delivery devices market with the largest share of 64.8% in 2025 due to its growing use in the administration of biologics, vaccines, and chronic disease management, offering higher precision and faster therapeutic effects compared to other delivery methods.

The oral drug delivery is expected to account for the largest share during the forecast period in technology market

In 2025, the oral drug delivery segment is expected to dominate the market with the largest market share of 41.07% due to its non-invasive nature, patient convenience, lower cost of manufacturing, and high acceptance among patients for daily medication, making it the preferred choice for chronic disease management.

North America Drug Delivery Devices Market Regional Analysis

“U.S. Holds the Largest Share in the North America Drug Delivery Devices Market”

- The U.S. dominates the North America drug delivery devices market with a significant market share of approximately 70%

- The U.S. has the largest healthcare infrastructure in North America, driving the high demand for drug delivery devices across various therapeutic areas, especially chronic diseases

- The U.S. pharmaceutical industry invests heavily in research and development, leading to continuous innovations in drug delivery technologies such as smart injectors and connected systems

- With a well-established reimbursement system and high healthcare spending, the U.S. facilitates the wide adoption of advanced drug delivery devices, enhancing their availability and accessibility

- Regulatory agencies such as the FDA have streamlined approval processes for novel drug delivery technologies, further boosting the market growth in the U.S.

“Canada is Projected to Register the Highest CAGR in the North America Drug Delivery Devices Market”

- Canada is the fastest-growing country in the North America drug delivery devices market

- The rising prevalence of chronic diseases such as diabetes and respiratory disorders in Canada is fuelling the demand for efficient and user-friendly drug delivery solutions

- With a focus on improving patient care and expanding healthcare access, Canada has seen an increase in the adoption of technologies such as wearable injectors and smart inhalers

- Canada’s aging population is increasingly adopting drug delivery devices that offer convenience, such as insulin pens and auto-injectors, which align with the country’s healthcare goals

- The Canadian government’s investments in healthcare technology are supporting the growth of the drug delivery devices market, making it more accessible and affordable for patients

North America Drug Delivery Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- BD (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- 3M (U.S.)

- Gerresheimer AG (U.S.)

- OraSure Technologies Inc. (U.S.)

- Insulet Corporation (U.S.)

- Pfizer Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- Amgen Inc. (U.S.)

- AbbVie Inc. (U.S.)

- Elcam Medical (U.S.)

- SMC Ltd. (U.S.)

- West Pharmaceutical Services, Inc. (U.S.)

Latest Developments in North America Drug Delivery Devices Market

- In January 2025, Phillips Medisize, a subsidiary of Molex, completed the acquisition of Vectura Group Ltd., enhancing its capabilities in inhalation drug delivery. This strategic move integrates Vectura's expertise in dry powder inhalers, metered dose inhalers, nebulizers, and nasal inhalers, including proprietary platforms such as the Gyrohaler and FOX devices. The acquisition also brings Vectura's strengths in pharmaceutical analysis, process development, and regulatory services, bolstering Phillips Medisize's end-to-end development and manufacturing services. By adding approximately 350 employees to its global team, Phillips Medisize aims to meet the growing global demand for innovative therapies targeting chronic respiratory diseases such as asthma and chronic obstructive pulmonary disease (COPD), as well as non-respiratory conditions

- In January 2025, Nipro PharmaPackaging (Japan) and Nemera (France) successfully completed compatibility testing between Nemera’s UniSpray and Nipro’s unit-dose microvials. This collaboration aims to accelerate the time to market for combination products, particularly those used for rescue and crisis intervention. The rigorous testing confirmed that the combination product meets required dose delivery and reliability standards, ensuring its safety and performance. This development enhances the reliability of systemic drug administration via nasal delivery, benefiting patients requiring rapid treatment in emergency situations. The impact on the market includes the introduction of a reliable and efficient drug delivery system, potentially improving patient outcomes in critical care scenarios

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.