North America Disinfectant Wipes Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

3.92 Billion

USD

6.02 Billion

2024

2032

USD

3.92 Billion

USD

6.02 Billion

2024

2032

| 2025 –2032 | |

| USD 3.92 Billion | |

| USD 6.02 Billion | |

|

|

|

|

Segmentación del mercado de toallitas desinfectantes en Norteamérica: tipo de producto (compuestos de cloro, amonio cuaternario, agentes oxidantes, fenol, alcohol, compuestos de yodo, aldehídos, gluconato de clorhexidina, entre otros), usabilidad (desechables y no desechables), empaque (envase plano, bote, entre otros), tipo de material (toallitas de fibra textil, toallitas de fibra virgen, toallitas de fibra avanzada, entre otros), niveles de desinfección (alto, intermedio y bajo), sabor (lavanda y jazmín, limón, cítricos, coco, entre otros), tipo (bactericida, virucida, esporicida, tuberculicida, fungicida y germicida), uso final (sanidad, comercio, cocina industrial, transporte, óptica, electrónica e informática, entre otros), canal de distribución (licitaciones directas y venta minorista): tendencias y pronóstico del sector hasta 2032.

Tamaño del mercado de toallitas desinfectantes

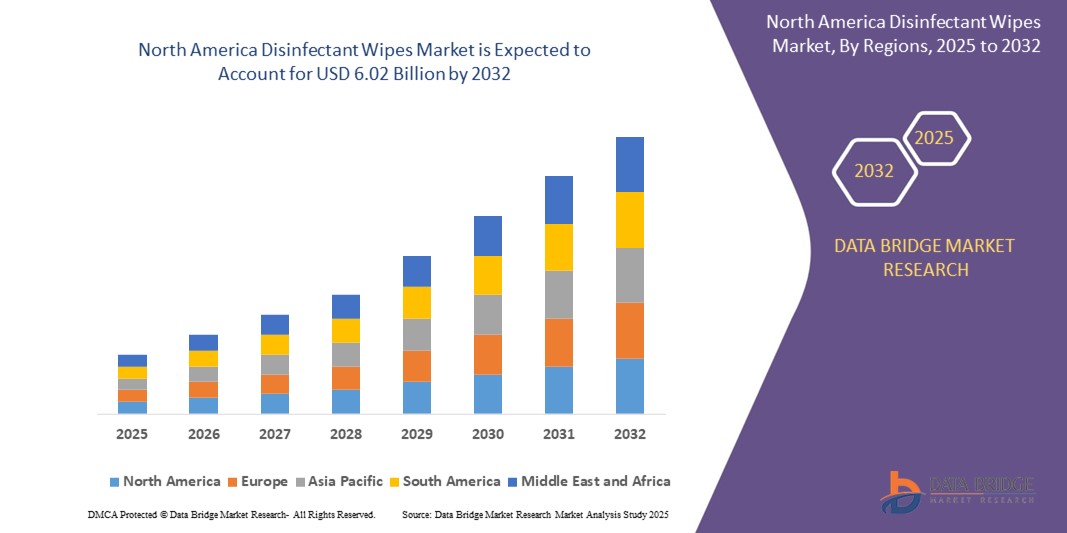

- El tamaño del mercado de toallitas desinfectantes de América del Norte se valoró en USD 3.92 mil millones en 2024 y se espera que alcance los USD 6.02 mil millones para 2032 , con una CAGR del 5,5% durante el período de pronóstico.

- El crecimiento del mercado se debe en gran medida a una mayor conciencia sobre la higiene después del COVID-19 y a la creciente adopción de toallitas desinfectantes en entornos sanitarios, comerciales y residenciales como una solución conveniente y eficaz para el control de infecciones a nivel de superficie.

- Además, la creciente demanda de productos desinfectantes listos para usar, portátiles y seguros para la piel está convirtiendo las toallitas desinfectantes en una alternativa preferida a los desinfectantes líquidos y aerosoles. Estos factores convergentes están acelerando el uso de toallitas desinfectantes en entornos de alto contacto, impulsando así significativamente el crecimiento del sector.

Análisis del mercado de toallitas desinfectantes

- Las toallitas desinfectantes son toallitas presaturadas con agentes antimicrobianos, diseñadas para eliminar bacterias, virus y hongos de superficies duras y blandas. Ofrecen una limpieza rápida y sin residuos, y se utilizan ampliamente en centros sanitarios, hogares, escuelas, oficinas y transporte público.

- La creciente demanda de toallitas desinfectantes se debe principalmente al aumento de los protocolos de prevención de infecciones, la creciente inclinación de los consumidores hacia métodos de limpieza higiénicos y convenientes y la expansión de opciones de productos ecológicos y biodegradables en el mercado.

- EE. UU. dominó el mercado de toallitas desinfectantes con una participación del 30,58 % en 2024, debido a la fuerte demanda en aplicaciones de limpieza en el sector sanitario, residencial y comercial. La adopción generalizada de toallitas desinfectantes en hospitales, oficinas, escuelas y hogares, junto con una mayor concienciación sobre la higiene tras la pandemia, ha consolidado a EE. UU. como líder regional.

- Canada is expected to be the fastest growing region in the disinfectant wipes market during the forecast period due to rising demand in healthcare, childcare, and public facilities

- Alcohol segment dominated the market with a market share of 42.5% in 2024, due to its quick action, ease of evaporation, and effectiveness against a wide array of pathogens. Alcohol-based wipes are widely preferred in medical, consumer, and office settings due to their convenience, non-residual properties, and compliance with infection control practices in high-touch environments

Report Scope and Disinfectant Wipes Market Segmentation

|

Attributes |

Disinfectant Wipes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Disinfectant Wipes Market Trends

“Increasing Hygiene Awareness”

- Una tendencia significativa y en aceleración en el mercado de toallitas desinfectantes es la mayor conciencia de la higiene y la prevención de infecciones tanto entre los consumidores como entre las empresas, especialmente después de la pandemia de COVID-19.

- Por ejemplo, la demanda de toallitas desinfectantes ha aumentado en entornos sanitarios, comerciales y residenciales, y hospitales, clínicas, oficinas y hogares dependen de estos productos para una limpieza rápida y eficaz de superficies para minimizar el riesgo de infecciones y contaminación cruzada.

- La introducción de toallitas desinfectantes ecológicas y biodegradables está ganando terreno, ya que los consumidores y las organizaciones buscan alternativas sostenibles que reduzcan el impacto ambiental sin comprometer la eficacia.

- Las grandes ciudades y las regiones densamente pobladas están siendo testigos de una mayor adopción de toallitas desinfectantes, impulsada por campañas de salud pública y la necesidad de mantener la limpieza en áreas de alto tráfico, como el transporte público, las escuelas y los espacios comerciales.

- El mercado también está experimentando innovación en las formulaciones de productos, el empaquetado y los canales de distribución, con los fabricantes enfocándose en la conveniencia, la portabilidad y el cumplimiento de los estándares regulatorios en evolución para satisfacer las diversas necesidades de los usuarios finales.

- Las empresas están invirtiendo en iniciativas de marketing y educación para reforzar la importancia de la desinfección regular, apoyando aún más el crecimiento continuo y la aceptación generalizada de las toallitas desinfectantes en varios sectores.

Dinámica del mercado de toallitas desinfectantes

Conductor

Aumento del uso de toallitas desinfectantes en aplicaciones comerciales

- El uso creciente de toallitas desinfectantes en aplicaciones comerciales es un impulsor importante del crecimiento del mercado, ya que las empresas priorizan la higiene para proteger a los empleados, los clientes y la continuidad operativa.

- Por ejemplo, industrias como la atención médica, la hotelería, los servicios de alimentación y el transporte están adoptando toallitas desinfectantes para la limpieza rutinaria de superficies, equipos y áreas comunes de alto contacto para cumplir con estrictas normas de salud y seguridad.

- El aumento de las infecciones adquiridas en el hospital y la necesidad de medidas estrictas de control de infecciones en las instalaciones médicas han llevado al uso generalizado de toallitas desinfectantes en unidades quirúrgicas, habitaciones de pacientes y áreas de espera públicas.

- Los minoristas, gimnasios y edificios de oficinas ofrecen cada vez más toallitas desinfectantes para uso de clientes y personal, lo que refuerza la confianza del público en los espacios compartidos y apoya la recuperación empresarial después de la pandemia.

- La conveniencia, la velocidad y la eficacia comprobada de las toallitas desinfectantes las convierten en herramientas indispensables para los protocolos de limpieza comercial, lo que impulsa una demanda sostenida en múltiples industrias.

- A medida que el sector comercial continúa creciendo y evolucionando, se espera que la integración de toallitas desinfectantes en los procedimientos operativos estándar siga siendo un impulsor clave del mercado.

Restricción/Desafío

Efectos secundarios del uso de toallitas desinfectantes

- Los posibles efectos secundarios asociados con el uso frecuente de toallitas desinfectantes representan un desafío importante para el mercado, ya que las preocupaciones sobre la irritación de la piel, las reacciones alérgicas y los problemas respiratorios pueden disuadir a algunos usuarios.

- Por ejemplo, los agentes químicos presentes en ciertas toallitas desinfectantes, como los compuestos de amonio cuaternario y los alcoholes, pueden causar sequedad, dermatitis o sensibilización con la exposición repetida, en particular entre los trabajadores sanitarios y el personal de limpieza que utilizan estos productos ampliamente.

- El uso inadecuado o excesivo de toallitas desinfectantes también puede provocar la acumulación de residuos químicos en las superficies, lo que puede suponer riesgos para la salud, especialmente en entornos sensibles como guarderías o áreas de preparación de alimentos.

- La creciente conciencia de los consumidores sobre estos riesgos, junto con el escrutinio regulatorio de los ingredientes químicos, está impulsando a los fabricantes a desarrollar fórmulas más seguras, amigables con la piel e hipoalergénicas para abordar las preocupaciones de los usuarios.

- El desafío de equilibrar una desinfección eficaz con la seguridad y comodidad del usuario está impulsando la investigación continua y la innovación de productos en el mercado, ya que las empresas buscan mantener la eficacia y minimizar los efectos adversos.

Alcance del mercado de toallitas desinfectantes

El mercado está segmentado en función del tipo de producto, facilidad de uso, embalaje, tipo de material, niveles de desinfección, sabor, tipo, uso final y canal de distribución.

- Por tipo de producto

Según el tipo de producto, el mercado de toallitas desinfectantes se segmenta en compuestos de cloro, amonio cuaternario, agentes oxidantes, fenol, alcohol, compuestos de yodo, aldehídos, gluconato de clorhexidina, entre otros. El segmento de alcohol representó la mayor participación en los ingresos, con un 42,5 %, en 2024, gracias a su rápida acción, fácil evaporación y eficacia contra una amplia gama de patógenos. Las toallitas con alcohol son ampliamente preferidas en entornos médicos, de consumo y de oficina debido a su comodidad, propiedades no residuales y cumplimiento de las prácticas de control de infecciones en entornos de alto contacto.

Se proyecta que el segmento de amonio cuaternario registre la tasa de crecimiento más rápida entre 2025 y 2032, impulsado por su actividad antimicrobiana de amplio espectro, su compatibilidad con una amplia gama de superficies y su mínimo olor. Este compuesto se utiliza ampliamente en desinfectantes de grado hospitalario, donde la eficacia y la seguridad de las superficies son clave. Además, su creciente adopción en productos de limpieza residenciales y comerciales está impulsando el dominio del segmento.

- Por usabilidad

En cuanto a la usabilidad, el mercado se divide en toallitas desinfectantes desechables y no desechables. El segmento desechable lideró el mercado en 2024, impulsado por su carácter higiénico de un solo uso, que minimiza la contaminación cruzada y cumple con los estándares de control de infecciones. El creciente uso en centros sanitarios y espacios públicos también está acelerando la demanda de variantes desechables.

Se prevé que el segmento de productos no desechables experimente la tasa de crecimiento anual compuesta (TCAC) más rápida durante el período de pronóstico, impulsado por la creciente preocupación por el medio ambiente y el creciente desarrollo de toallitas desinfectantes reutilizables. Estas toallitas están cobrando especial impulso entre los consumidores y las empresas con conciencia ecológica que buscan soluciones de saneamiento sostenibles.

- Por embalaje

En cuanto al empaque, el mercado se segmenta en envases planos, botes y otros. El segmento de botes dominó el mercado en 2024 gracias a su comodidad, durabilidad e idoneidad para su uso en centros de salud, gimnasios y oficinas. Los botes ofrecen una mayor vida útil y facilitan su dispensación, lo que los convierte en el formato preferido para el consumo a granel.

Se prevé que el segmento de envases planos crezca a un ritmo acelerado hasta 2032, ya que su diseño compacto y portátil atrae a los consumidores en constante movimiento. Este tipo de envase es especialmente popular en productos de cuidado personal y viajes, donde se prioriza la facilidad de transporte y eliminación.

- Por tipo de material

Según el tipo de material, el mercado se segmenta en toallitas de fibra textil, toallitas de fibra virgen, toallitas de fibra avanzada y otras. El segmento de toallitas de fibra virgen captó la mayor participación en 2024 debido a su alta absorbencia, resistencia y pureza, factores cruciales para una desinfección eficaz y constante. Estas toallitas se utilizan frecuentemente en entornos sanitarios críticos donde la garantía de calidad es fundamental.

Se proyecta que las toallitas de fibra avanzada exhiban la mayor tasa de crecimiento anual compuesto (TCAC) entre 2025 y 2032, impulsadas por innovaciones en materiales multicapa con nanotecnología que mejoran la tasa de eliminación de microbios, la durabilidad y la compatibilidad con diversas formulaciones desinfectantes. Estas se utilizan cada vez más en entornos de alto riesgo, como UCI y laboratorios farmacéuticos.

- Por niveles de desinfección

Según los niveles de desinfección, el mercado se clasifica en alto, intermedio y bajo. El segmento de desinfección de alto nivel registró la mayor participación en los ingresos en 2024, impulsado por el aumento de la demanda en entornos de cuidados críticos, como quirófanos, salas de aislamiento y laboratorios. Estas toallitas son esenciales para eliminar patógenos resistentes, como esporas y virus, lo que garantiza un control riguroso de las infecciones.

Se prevé que el segmento de desinfección de nivel intermedio experimente su mayor crecimiento entre 2025 y 2032 gracias a su versatilidad y rentabilidad en centros sanitarios, comerciales y educativos. Estas toallitas ofrecen un equilibrio entre eficacia y compatibilidad con las superficies, lo que las hace ideales para la limpieza rutinaria de zonas de alto contacto.

- Por sabor

En cuanto al sabor, el mercado se segmenta en lavanda y jazmín, limón, cítricos, coco y otros. El segmento de limón lideró el mercado en 2024, favorecido por su aroma fresco y su fuerte asociación con la limpieza. Las toallitas con sabor a limón se utilizan ampliamente en espacios residenciales y comerciales gracias a su gran atractivo y su capacidad para neutralizar olores.

Se prevé que la lavanda y el jazmín experimenten el mayor crecimiento durante el período de pronóstico, impulsado por la creciente preferencia de los consumidores por las fragancias relajantes y aromaterapéuticas. Esta tendencia es especialmente prominente en segmentos orientados al estilo de vida, como gimnasios, salones de belleza y cuidado personal, donde la experiencia sensorial añade valor a los productos de higiene.

- Por tipo

Según el tipo, el mercado de toallitas desinfectantes se segmenta en bactericidas, virucidas, esporicidas, tuberculicidas, fungicidas y germicidas. El segmento bactericida dominó la cuota de mercado en 2024 debido a su aplicación universal en las rutinas diarias de limpieza y desinfección de superficies. Las toallitas bactericidas son esenciales para controlar las infecciones asociadas a la atención médica (IAAS) comunes y gozan de amplia aceptación tanto en entornos residenciales como institucionales.

Se proyecta que el segmento virucida crecerá a su tasa de crecimiento anual compuesto (TCAC) más rápida entre 2025 y 2032, impulsado por una mayor concienciación tras los brotes virales mundiales y el énfasis en los protocolos antivirales de desinfección de superficies. La demanda de toallitas virucidas también está creciendo en el transporte y las instalaciones públicas, donde el riesgo de infección es alto y se requiere una acción rápida.

- Por uso final

Según el uso final, el mercado se segmenta en los sectores de la salud, el comercio, la cocina industrial, el transporte, la óptica, la electrónica y la informática, entre otros. El segmento de la salud tuvo la mayor participación en los ingresos en 2024, impulsado por las estrictas regulaciones de control de infecciones y la demanda constante en hospitales, clínicas y centros de diagnóstico. Estos entornos requieren una desinfección frecuente y eficaz de las superficies para mantener la higiene y prevenir la contaminación cruzada.

Se espera que la industria del transporte registre la mayor tasa de crecimiento durante el período de pronóstico, con un aumento de las inversiones en mantenimiento de la higiene en aerolíneas, ferrocarriles y sistemas de transporte público. Las expectativas de los consumidores tras la pandemia en cuanto a limpieza y seguridad siguen impulsando la adopción de toallitas desinfectantes para superficies de alto contacto en entornos de viaje.

- Por canal de distribución

Según el canal de distribución, el mercado se divide en licitaciones directas y ventas minoristas. El segmento de licitaciones directas captó la mayor cuota de mercado en 2024, gracias a las compras a granel de hospitales, organismos gubernamentales y compradores corporativos que buscan suministros estandarizados para la prevención de infecciones. Estos contratos garantizan cadenas de suministro estables y suelen estar respaldados por relaciones a largo plazo con los proveedores.

Se prevé que el segmento de ventas minoristas crezca a su tasa de crecimiento anual compuesto (TCAC) más rápida entre 2025 y 2032, impulsado por la creciente concienciación y demanda de productos de higiene para el hogar por parte de los consumidores. La disponibilidad de toallitas desinfectantes en supermercados, farmacias, plataformas de comercio electrónico y tiendas de conveniencia las hace muy accesibles para los consumidores finales.

Análisis regional del mercado de toallitas desinfectantes

- U.S. dominated the disinfectant wipes market with the largest revenue share of 30.58% in 2024, driven by strong demand across healthcare, residential, and commercial cleaning applications. The widespread adoption of disinfectant wipes in hospitals, offices, schools, and households, along with heightened hygiene awareness post-pandemic, has firmly established the U.S. as the regional leader

- Increasing preference for convenient, ready-to-use sanitation products, especially in high-touch environments, is fueling continued market expansion. Regulatory emphasis on infection control and the presence of established brands offering advanced antimicrobial formulations further boost product penetration

- The strong presence of key manufacturers, well-developed retail distribution channels, and ongoing innovations in biodegradable and skin-safe wipe formulations reinforce the U.S. as the dominant market for disinfectant wipes in North America

Canada Disinfectant Wipes Market Insight

Canada is projected to record the fastest CAGR in the North America disinfectant wipes market from 2025 to 2032, driven by rising demand in healthcare, childcare, and public facilities. Increasing awareness around personal hygiene, infection prevention, and eco-friendly product use is driving market growth. Supportive government regulations and the shift toward locally produced, sustainable disinfection solutions are further propelling the Canadian market forward

Mexico Disinfectant Wipes Market Insight

The Mexico disinfectant wipes market is expected to experience steady growth between 2025 and 2032, supported by expanding healthcare infrastructure, rising consumer awareness, and increasing use of disinfectant wipes in industrial and hospitality sectors. Growth is also bolstered by the expansion of domestic manufacturing capabilities and Mexico’s strategic role in regional exports and cross-border supply chains

Disinfectant Wipes Market Share

The disinfectant wipes industry is primarily led by well-established companies, including:

- GOJO Industries, Inc. (U.S.)

- PDI, Inc. (U.S.)

- Ecolab (U.S.)

- Reckitt Benckiser Group PLC (U.K.)

- KCWW (Kimberly-Clark Worldwide, Inc.) (U.S.)

- Parker Laboratories, Inc. (U.S.)

- Dreumex (Netherlands)

- Seventh Generation Inc. (U.S.)

- STERIS plc (Ireland)

- S.C. Johnson & Son Inc. (U.S.)

- The Claire Manufacturing Company (U.S.)

- Schülke & Mayr GmbH (Germany)

Latest Developments in North America Disinfectant Wipes Market

- In March 2024, Ecolab, a company known for its sustainability efforts and products for water, hygiene, and infection prevention, has been recognized as one of the World’s Most Ethical Companies by Ethisphere, a respected organization setting ethical business standards. This marks Ecolab's 18th consecutive year receiving the award since it was first introduced in 2007. This will strengthen the company’s credibility in the market

- En febrero de 2022, Reckitt Benckiser Group plc, conocido por marcas como Lysol y Dettol, y Diversey Holdings, Ltd., empresa líder en soluciones de higiene y limpieza, se unieron para una colaboración de distribución. Esta colaboración busca ampliar el acceso de las empresas a soluciones de higiene fiables, garantizando la seguridad del personal y de los clientes, previniendo la propagación de gérmenes que causan enfermedades.

- En junio de 2020, Reckitt Benckiser Group plc anunció que su marca Lysol puso en marcha el Programa Escuelas Saludables para llegar a los alumnos de las zonas más afectadas por la COVID-19 en EE. UU. y así prevenir la propagación de la pandemia. Esta iniciativa de la empresa ha fortalecido su credibilidad en el mercado.

- En noviembre de 2020, SC Johnson anunció su reconocimiento como Miembro del Año de la Red Hygieia 2020 de ISSA por los recursos y esfuerzos que brinda para impulsar la carrera profesional de las mujeres en la industria de la limpieza. Este reconocimiento ha fortalecido su credibilidad en el mercado.

- En mayo de 2022, GOJO Industries, Inc., conocida por sus productos PURELL, presentó las toallitas desinfectantes de superficies PURELL Healthcare, ampliando así su gama de soluciones de higiene de superficies. Estas toallitas ofrecen una gran eficacia eliminando gérmenes y brindan tranquilidad a los usuarios, combinando un rendimiento excepcional con tranquilidad. Esto ha mejorado la cartera de productos y ha contribuido a los ingresos totales de la empresa.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.