North America Deep Learning In Machine Vision Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

| 2023 –0 | |

|

|

|

|

>Mercado de aprendizaje profundo en visión artificial en América del Norte, por oferta (hardware, software y servicios), aplicación (inspección, análisis de imágenes, detección de anomalías, clasificación de objetos, seguimiento de objetos, conteo, detección de códigos de barras, detección de características, detección de ubicación, reconocimiento óptico de caracteres, reconocimiento facial, segmentación de instancias y otros), objeto (imagen y video), vertical (electrónica, fabricación, automotriz y transporte, alimentos y bebidas, aeroespacial, atención médica, construcción y materiales, energía y otros), país (EE. UU., Canadá, México) Tendencias de la industria y pronóstico hasta 2029

Análisis y perspectivas del mercado: mercado de aprendizaje profundo en visión artificial en América del Norte

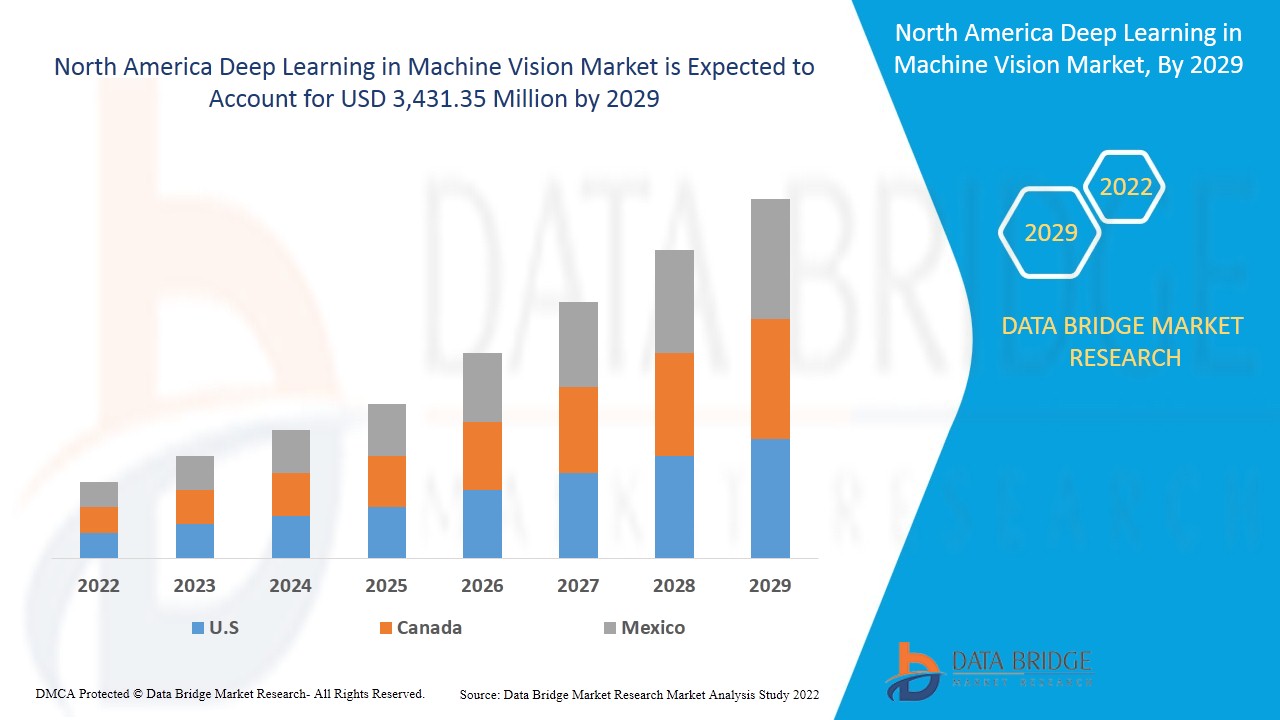

Se espera que el mercado de aprendizaje profundo en visión artificial de América del Norte gane crecimiento de mercado en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 12,8% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 3.431,35 millones para 2029.

El aprendizaje profundo en los sistemas de visión artificial son aquellos sistemas que pueden ver y comprender el mundo que los rodea al igual que los humanos; son las computadoras capaces de comprender imágenes y videos digitales. Esto es posible gracias al avance en la tecnología de los sistemas de visión, la inteligencia artificial y el poder computacional. Los principios fundamentales utilizados en estos sistemas son la adquisición de datos o imágenes, el procesamiento de datos o imágenes, la clasificación de datos o imágenes. Los datos adquiridos pueden ser en forma de imágenes o videos que se capturan utilizando cámaras de alta definición, cámaras inteligentes, sensores, entre otros.

Algunos de los factores que impulsan el mercado son la creciente adopción de nuevas tecnologías en aprendizaje profundo en unidades de visión artificial. El crecimiento creciente de grandes conjuntos de datos e inteligencia artificial está generando oportunidades de crecimiento en el mercado. Las amenazas de seguridad en las redes neuronales y el aprendizaje profundo están actuando como un desafío importante para el crecimiento del mercado.

Este informe de mercado sobre aprendizaje profundo en visión artificial proporciona detalles sobre la participación de mercado, los nuevos desarrollos y el análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un resumen analítico; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de aprendizaje profundo en visión artificial en América del Norte

El mercado de aprendizaje profundo en visión artificial de América del Norte está segmentado en función de la oferta, la aplicación, el objeto y la vertical. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

- On the basis of offering, the North America deep learning in machine vision market is segmented into hardware, software, and services. In 2022, the hardware held a larger share in the market as the need for smart hardware products has literally increased due to the domination of artificial intelligence and essential components for deep learning in machine vision market.

- On the basis of application, the North America deep learning in machine vision market has been segmented into inspection, image analysis, anomaly detection, object classification, object tracking, counting, bar code detection, feature detection, location detection, optical character recognition, face recognition, instance segmentation, and others. In 2022, inspection held a larger share in the market, due the increasing need for accurate and precise and finishing of manufactured products from various industries.

- On the basis of object, North America deep learning in machine vision market has been segmented into image and video. In 2022, image segment is expected to hold the major share in the market due to growing demand for high quality imaging specification in various machine vision hardware devices.

- On the basis of vertical, North America deep learning in machine vision market has been segmented into electronics, manufacturing, automotive and transportation, food & beverages, aerospace, healthcare, building and material, power, and others. In 2022, electronics segment is expected to hold the largest share in the market owing to factors such as growing demand for AI and machine learning in various electronics based hardware and systems.

North America Deep Learning in Machine Vision Market Country Level Analysis

The North America deep learning in machine vision market is analysed and market size information is provided by the country, component, application, vertical, and product.

The countries covered in North America deep learning in machine vision market report are the U.S., Canada and Mexico.

The U.S. accounted for maximum share in the North America deep learning in machine vision market owing to factors such as presence of large number of companies manufacturing deep learning in machine visions hardware and software and the companies are using AI and deep learning for their automation and optimizing there processes.

The country section of the North America deep learning in machine vision market report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export analysis are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Increasing Adoption of Contract Manufacturing

The North America deep learning in machine vision market also provides you with detailed market analysis for every country growth in installed base of different kind of products for North America deep learning in machine vision market, impact of technology using life line curves and changes in requirement of abrasives products, regulatory scenarios and their impact on the North America deep learning in machine vision market. The data is available for historic period of 2011-2020.

Competitive Landscape and North America Deep Learning in Machine Vision Market Share Analysis

The North America deep learning in machine vision market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, company strengths and weaknesses, product launch, clinical trials pipelines, brand analysis, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to North America deep learning in machine vision market.

Some of the major players operating in the global deep learning in machine vision market are Cognex Corporation, Intel Corporation, NATIONAL INSTRUMENTS CORP., SICK AG, Datalogic S.p.A., STEMMER IMAGING AG, Abto Software, Adaptive Vision Sp. z o.o. (subsidiary of Zebra Technologies Corporation), Autonics Corporation, Basler AG, Cyth Systems, Inc., EURESYS S.A., IDS Imaging Development Systems GmbH, Integro Technologies Corp., LeewayHertz, Matrox Imaging, MVTEC SOFTWARE GMBH, Omron Microscan Systems, Inc. (A Subsidiary of OMRON Corporation), perClass BV, Qualitas Technologies, RSIP Vision, USS Vision LLC, and Viska Automation Systems Ltd. T/A Viska Systems among others. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

For instance,

- En marzo de 2020, KEYENCE CORPORATION lanzó un nuevo producto en el sistema de visión con la serie CV-X de iluminación de proyección de patrones, que es capaz de realizar sistemas de visión de inspección 2D, extracción de altura e inspección 3D, entre otros. Está impulsado por un controlador de visión. Era un producto único que puede inspeccionar y analizar los defectos y puede usarse ampliamente en las empresas automotrices. Es un gran activo para la empresa debido a su confiabilidad en la detección de fallas.

- En abril de 2020, Cadence Design Systems, Inc. lanzó nuevos productos: los DSP Vision Q8 y Vision P1. Esto se hizo para satisfacer la creciente demanda en sectores como el automotriz, el móvil y el mercado de consumo. Como estos modelos se optimizaron para aplicaciones automotrices móviles y multicámara de alta gama, los productos mejoran el rendimiento cuatro veces. Esto fue realizado por la empresa para expandir su cartera de productos y ofrecer productos confiables a los consumidores.

Las asociaciones, las empresas conjuntas y otras estrategias mejoran la participación de mercado de la empresa con una mayor cobertura y presencia. También brindan a la organización el beneficio de mejorar su oferta para el mercado de aprendizaje profundo en visión artificial de América del Norte mediante una gama de productos ampliada.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN DEMAND FOR QUALITY SUPERVISION AND TECHNOLOGIES

5.1.2 INCREASE IN NEED FOR VISION-GUIDED ROBOTICS SYSTEMS

5.1.3 GROW IN ACCEPTANCE OF 3D MACHINE VISION SYSTEMS

5.1.4 INCREASE IN ADOPTION OF CLOUD-BASED TECHNOLOGY

5.2 RESTRAINTS

5.2.1 LACK OF TECHNICAL EXPERTISE

5.2.2 HIGH COST OF THE EQUIPMENT

5.2.3 SURGE IN RISK OF CYBER-ATTACKS ON INDUSTRIAL MACHINE ROBOTS AND DEVICES

5.3 OPPORTUNITIES

5.3.1 GROWTH IN MANUFACTURING OF HYBRID AND ELECTRIC CARS

5.3.2 GOVERNMENT INITIATIVES TO BOOST AI-RELATED AUTOMATION IN INDUSTRIES

5.3.3 INCREASING DEMAND FOR MACHINE VISION IN AUTOMOTIVE AND MANUFACTURING INDUSTRIES

5.3.4 INCREASE IN VARIOUS STRATEGIC DECISIONS SUCH AS PARTNERSHIP AND ACQUISITION

5.4 CHALLENGES

5.4.1 COMPLICATIONS IN INTEGRATING MACHINE VISION SYSTEMS

5.4.2 ABSENCE OF CUSTOMER KNOWLEDGE ABOUT SWIFTLY ADJUSTING CHANGING MACHINE VISION TECHNOLOGY

6 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING

6.1 OVERVIEW

6.2 HARDWARE

6.2.1 COMPUTATIONAL DEVICES

6.2.2 INPUT DEVICES

6.3 SOFTWARE

6.4 SERVICES

6.4.1 PROFESSIONAL SERVICES

6.4.1.1 TRAINING AND CONSULTING

6.4.1.2 IMPLEMENTATION

6.4.1.3 SUPPORT AND MAINTENANCE

6.4.2 MANAGED SERVICES

7 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 INSPECTION

7.3 IMAGE ANALYSIS

7.3.1 SINGLE IMAGE ANALYSIS

7.3.2 MULTI IMAGE ANALYSIS

7.4 ANOMALY DETECTION

7.5 OBJECT CLASSIFICATION

7.6 OBJECT TRACKING

7.7 COUNTING

7.8 BAR CODE DETECTION

7.9 FEATURE DETECTION

7.1 LOCATION DETECTION

7.11 OPTICAL CHARACTER RECOGNITION

7.12 FACE RECOGNITION

7.13 INSTANCE SEGMENTATION

7.14 OTHERS

8 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET, BY OBJECT

8.1 OVERVIEW

8.2 IMAGE

8.3 VIDEO

9 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET, BY VERTICAL

9.1 OVERVIEW

9.2 ELECTRONICS

9.2.1 HARDWARE

9.2.2 SOFTWARE

9.2.3 SERVICES

9.3 MANUFACTURING

9.3.1 HARDWARE

9.3.2 SOFTWARE

9.3.3 SERVICES

9.4 AUTOMOTIVE AND TRANSPORTATION

9.4.1 HARDWARE

9.4.2 SOFTWARE

9.4.3 SERVICES

9.5 FOOD & BEVERAGES

9.5.1 HARDWARE

9.5.2 SOFTWARE

9.5.3 SERVICES

9.6 AEROSPACE

9.6.1 HARDWARE

9.6.2 SOFTWARE

9.6.3 SERVICES

9.7 HEALTHCARE

9.7.1 HARDWARE

9.7.2 SOFTWARE

9.7.3 SERVICES

9.8 BUILDING AND MATERIAL

9.8.1 HARDWARE

9.8.2 SOFTWARE

9.8.3 SERVICES

9.9 POWER

9.9.1 HARDWARE

9.9.2 SOFTWARE

9.9.3 SERVICES

9.1 OTHERS

10 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET, BY REGION

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 COGNEX CORPORATION

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 INTEL CORPORATION

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 NATIONAL INSTRUMENTS CORP.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENT

13.4 SICK AG

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENTS

13.5 DATALOGIC S.P.A.

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 STEMMER IMAGING AG

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENTS

13.7 ABTO SOFTWARE

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 ADAPTIVE VISION SP. Z O.O.

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 AUTONICS CORPORATION

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 BASLER AG

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENTS

13.11 CYTH SYSTEMS, INC.

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 EURESYS S.A.

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENTS

13.13 IDS IMAGING DEVELOPMENT SYSTEMS GMBH

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENTS

13.14 INTEGRO TECHNOLOGIES CORP.

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 LEEWAYHERTZ

13.15.1 COMPANY SNAPSHOT

13.15.2 SERVICE PORTFOLIO

13.15.3 RECENT DEVELOPMENTS

13.16 MATROX IMAGING

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENTS

13.17 MVTEC SOFTWARE GMBH

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENTS

13.18 OMRON MICROSCAN SYSTEMS, INC.

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT DEVELOPMENTS

13.19 PERCLASS BV

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENTS

13.2 QUALITAS TECHNOLOGIES

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENTS

13.21 RSIP VISION

13.21.1 COMPANY SNAPSHOT

13.21.2 PRODUCT PORTFOLIO

13.21.3 RECENT DEVELOPMENTS

13.22 USS VISION LLC

13.22.1 COMPANY SNAPSHOT

13.22.2 PRODUCT PORTFOLIO

13.22.3 RECENT DEVELOPMENTS

13.23 VISKA AUTOMATION SYSTEMS LTD. T/A VISKA SYSTEMS

13.23.1 COMPANY SNAPSHOT

13.23.2 PRODUCT PORTFOLIO

13.23.3 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA HARDWARE IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA HARDWARE IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA SOFTWARE IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA SERVICES IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA SERVICES IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA PROFESSIONAL SERVICES IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA INSPECTION IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA IMAGE ANALYSIS IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA IMAGE ANALYSIS IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA ANOMALY DETECTION IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA OBJECT CLASSIFICATION IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA OBJECT TRACKING IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA COUNTING IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA BAR CODE DETECTION IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA FEATURE DETECTION IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA LOCATION DETECTION IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA OPTICAL CHARACTER RECOGNITION IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA FACE RECOGNITION IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA INSTANCE SEGMENTATION IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA OTHERS IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET, BY OBJECT, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA IMAGE IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA VIDEO IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA ELECTRONICS IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA ELECTRONICS IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA MANUFACTURING IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA MANUFACTURING IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA AUTOMOTIVE AND TRANSPORTATION IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA AUTOMOTIVE AND TRANSPORTATION IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA FOOD & BEVERAGES IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA FOOD & BEVERAGES IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA AEROSPACE IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA AEROSPACE IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA HEALTHCARE IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA HEALTHCARE IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA BUILDING AND MATERIAL IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA BUILDING AND MATERIAL IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA POWER IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA POWER IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA OTHERS IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA HARDWARE IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA SERVICES IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA PROFESSIONAL SERVICES IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA IMAGE ANALYSIS IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET, BY OBJECT, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA ELECTRONICS IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA MANUFACTURING IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA AUTOMOTIVE AND TRANSPORTATION IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA FOOD & BEVERAGES IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA AEROSPACE IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA HEALTHCARE IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA BUILDING AND MATERIAL IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA POWER IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 61 U.S. DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 62 U.S. HARDWARE IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 U.S. SERVICES IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 U.S. PROFESSIONAL SERVICES IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 U.S. DEEP LEARNING IN MACHINE VISION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 U.S. IMAGE ANALYSIS IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 U.S. DEEP LEARNING IN MACHINE VISION MARKET, BY OBJECT, 2020-2029 (USD MILLION)

TABLE 68 U.S. DEEP LEARNING IN MACHINE VISION MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 69 U.S. ELECTRONICS IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 70 U.S. MANUFACTURING IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 71 U.S. AUTOMOTIVE AND TRANSPORTATION IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 72 U.S. FOOD & BEVERAGES IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 73 U.S. AEROSPACE IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 74 U.S. HEALTHCARE IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 75 U.S. BUILDING AND MATERIAL IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 76 U.S. POWER IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 77 CANADA DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 78 CANADA HARDWARE IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 CANADA SERVICES IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 CANADA PROFESSIONAL SERVICES IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 CANADA DEEP LEARNING IN MACHINE VISION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 CANADA IMAGE ANALYSIS IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 CANADA DEEP LEARNING IN MACHINE VISION MARKET, BY OBJECT, 2020-2029 (USD MILLION)

TABLE 84 CANADA DEEP LEARNING IN MACHINE VISION MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 85 CANADA ELECTRONICS IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 86 CANADA MANUFACTURING IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 87 CANADA AUTOMOTIVE AND TRANSPORTATION IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 88 CANADA FOOD & BEVERAGES IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 89 CANADA AEROSPACE IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 90 CANADA HEALTHCARE IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 91 CANADA BUILDING AND MATERIAL IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 92 CANADA POWER IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 93 MEXICO DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 94 MEXICO HARDWARE IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 MEXICO SERVICES IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 MEXICO PROFESSIONAL SERVICES IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 MEXICO DEEP LEARNING IN MACHINE VISION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 MEXICO IMAGE ANALYSIS IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 MEXICO DEEP LEARNING IN MACHINE VISION MARKET, BY OBJECT, 2020-2029 (USD MILLION)

TABLE 100 MEXICO DEEP LEARNING IN MACHINE VISION MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 101 MEXICO ELECTRONICS IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 102 MEXICO MANUFACTURING IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 103 MEXICO AUTOMOTIVE AND TRANSPORTATION IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 104 MEXICO FOOD & BEVERAGES IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 105 MEXICO AEROSPACE IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 106 MEXICO HEALTHCARE IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 107 MEXICO BUILDING AND MATERIAL IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 108 MEXICO POWER IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: SEGMENTATION

FIGURE 11 RISING DEMAND FOR QUALITY SUPERVISION AND TECHNOLOGIES IS EXPECTED TO DRIVE NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET AND ASIA-PACIFIC IS EXPECTED TO GROW AT THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET

FIGURE 15 INSTALLED INDUSTRIAL ROBOTS PER 10,000 EMPLOYEES IN THE MANUFACTURING INDUSTRY, 2019

FIGURE 16 MOST USED CLOUD STORAGE SERVICES

FIGURE 17 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: BY OFFERING, 2021

FIGURE 18 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: BY APPLICATION, 2021

FIGURE 19 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: BY OBJECT, 2021

FIGURE 20 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: BY VERTICAL, 2021

FIGURE 21 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: SNAPSHOT (2021)

FIGURE 22 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: BY COUNTRY (2021)

FIGURE 23 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: BY OFFERING (2022-2029)

FIGURE 26 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.