North America Dandruff Treatment Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

1.65 Billion

USD

3.10 Billion

2024

2032

USD

1.65 Billion

USD

3.10 Billion

2024

2032

| 2025 –2032 | |

| USD 1.65 Billion | |

| USD 3.10 Billion | |

|

|

|

|

Segmentación del mercado norteamericano de tratamientos anticaspa por tipo (caspa fúngica, caspa relacionada con piel seca, caspa relacionada con cuero cabelludo graso y caspa relacionada con enfermedades), modalidad de prescripción (sin receta y con receta), producto (medicado y no medicado), tipo de fármaco (de marca y genérico), grupo de edad (adultos, pediatría y neonatos), género (masculino y femenino), usuario final (atención domiciliaria, centros dermatológicos, clínicas especializadas, etc.), tipo de distribución (supermercados/hipermercados, tiendas de conveniencia, farmacias, tiendas minoristas, tiendas en línea, etc.): tendencias del sector y pronóstico hasta 2032.

Tamaño del mercado de tratamiento de la caspa en América del Norte

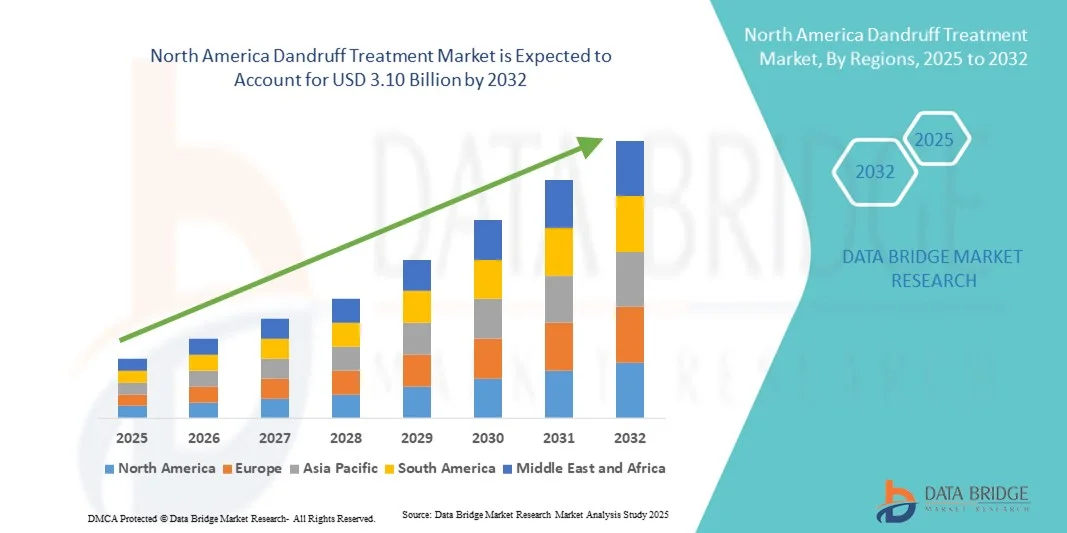

- El tamaño del mercado de tratamiento de la caspa en América del Norte se valoró en USD 1.650 millones en 2024 y se espera que alcance los USD 3.100 millones para 2032 , con una CAGR del 8,19 % durante el período de pronóstico.

- El crecimiento del mercado se debe en gran medida a la creciente conciencia sobre la salud del cuero cabelludo, la creciente prevalencia de la caspa y la creciente preferencia de los consumidores por soluciones anticaspa de venta libre y con receta.

- Además, la creciente adopción de fórmulas naturales y clínicamente probadas, junto con las innovaciones en champús, acondicionadores y tratamientos sin aclarado, está consolidando los tratamientos anticaspa como un segmento clave en el cuidado capilar. Estos factores, en conjunto, impulsan la demanda del mercado y aceleran el crecimiento de la industria en Norteamérica.

Análisis del mercado de tratamientos anticaspa en América del Norte

- Los tratamientos contra la caspa, incluidas las soluciones medicinales y no medicinales, se están volviendo componentes esenciales de las rutinas de cuidado personal tanto en entornos residenciales como profesionales debido a su eficacia para controlar la descamación, la picazón y la irritación del cuero cabelludo.

- La creciente demanda de tratamientos contra la caspa se debe principalmente a la creciente conciencia sobre la salud del cuero cabelludo, la creciente prevalencia de la caspa entre diferentes grupos de edad y la preferencia por soluciones para el cuidado del cabello clínicamente probadas, convenientes y fáciles de usar.

- Estados Unidos dominó el mercado norteamericano de tratamientos anticaspa, con la mayor participación en ingresos, un 42%, en 2024, gracias a la alta concienciación de los consumidores, un fuerte poder adquisitivo y una industria capilar consolidada. Los consumidores buscan cada vez más fórmulas innovadoras, incluyendo soluciones antifúngicas y para la caspa relacionada con la piel seca, respaldadas tanto por las principales marcas de cuidado personal como por empresas emergentes de nicho.

- Se espera que Canadá sea el país de más rápido crecimiento en el mercado de tratamiento de la caspa de América del Norte durante el período de pronóstico debido a la creciente urbanización, el aumento de los ingresos disponibles y la creciente adopción de productos de venta libre contra la caspa.

- El segmento de caspa fúngica dominó el mercado de tratamiento de la caspa en América del Norte por tipo, con una participación de mercado del 48,2 % en 2024, debido a su alta prevalencia, eficacia probada del tratamiento y preferencia entre los consumidores por formulaciones antimicóticas clínicamente validadas.

Alcance del informe y segmentación del mercado de tratamiento de la caspa en América del Norte

|

Atributos |

Análisis clave del mercado de tratamiento de la caspa en América del Norte |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de tratamientos anticaspa en América del Norte

Creciente popularidad de las fórmulas naturales y clínicamente probadas

- Una tendencia significativa y en aceleración en el mercado de tratamiento de la caspa en América del Norte es la creciente adopción de productos que combinan ingredientes antimicóticos clínicamente probados con componentes naturales o herbales, que ofrecen eficacia y una menor irritación del cuero cabelludo.

- Por ejemplo, el champú anticaspa Nizoral combina ketoconazol con agentes acondicionadores suaves, lo que proporciona un control eficaz de la caspa y minimiza la sequedad. De igual manera, Head & Shoulders Citrus Fresh incorpora piritionato de zinc con extractos botánicos para mejorar la salud del cuero cabelludo.

- Las fórmulas con beneficios adicionales, como hidratación, suavidad o fortalecimiento del cabello, están ganando terreno, ya que los consumidores buscan cada vez más productos multifuncionales para el cuidado capilar. Además, la creciente concienciación sobre los ingredientes respetuosos con el cuero cabelludo y sin químicos impulsa la innovación en productos.

- Estas fórmulas avanzadas satisfacen diversas necesidades de los consumidores, incluidos aquellos con cuero cabelludo sensible, caspa relacionada con piel grasa o seca y aquellos que prefieren soluciones naturales o no medicinales, lo que mejora la satisfacción y la lealtad del usuario.

- La tendencia hacia tratamientos contra la caspa más personalizados, efectivos y suaves está cambiando las expectativas de los consumidores en América del Norte, lo que impulsa a empresas como Selsun Blue a desarrollar productos dirigidos a tipos específicos de caspa con ingredientes clínicamente validados.

- La demanda de tratamientos innovadores, seguros y con múltiples beneficios para la caspa está aumentando entre los consumidores adultos y pediátricos, a medida que crece la conciencia sobre la salud del cuero cabelludo y el bienestar del cabello.

Dinámica del mercado de tratamientos anticaspa en América del Norte

Conductor

Creciente conciencia sobre la salud del cuero cabelludo y creciente prevalencia de la caspa

- La creciente preocupación por el cuidado personal y la salud del cuero cabelludo, junto con la creciente incidencia de la caspa entre varios grupos de edad, es un factor importante para la mayor demanda de tratamientos contra la caspa.

- Por ejemplo, los productos Nioxin Scalp Recovery se comercializan para combatir la caspa y mejorar el estado del cuero cabelludo, promoviendo su uso constante entre los consumidores con problemas recurrentes. Se espera que estas iniciativas de marcas líderes impulsen el crecimiento del mercado durante el período de pronóstico.

- A medida que los consumidores se vuelven más conscientes de los síntomas de la caspa, como la descamación y la picazón, las soluciones anticaspa brindan opciones confiables de tratamiento y prevención, ofreciendo una mejora significativa con respecto a los productos generales para el cuidado del cabello.

- Además, la popularidad de las soluciones anticaspa de venta libre y los productos con receta está aumentando, impulsada por la conveniencia, la accesibilidad y la eficacia comprobada en el control de la caspa fúngica y relacionada con la piel seca.

- La preferencia por champús, acondicionadores y tratamientos sin enjuague fáciles de usar que se puedan incorporar a las rutinas diarias está impulsando su adopción tanto en el cuidado domiciliario como en entornos de dermatología profesional.

Restricción/Desafío

Preocupaciones por la irritación y obstáculos para el cumplimiento normativo

- La preocupación por la posible irritación del cuero cabelludo o las reacciones alérgicas causadas por ingredientes activos como el ketoconazol, la piritiona de zinc o el sulfuro de selenio dificulta su adopción en el mercado. Dado que los tratamientos anticaspa interactúan directamente con la piel, los problemas de sensibilidad pueden reducir las compras recurrentes y la confianza del consumidor.

- Por ejemplo, los informes de sequedad o enrojecimiento del cuero cabelludo después de un uso prolongado han hecho que algunos consumidores duden en adoptar ciertos champús medicados o soluciones sin enjuague.

- Abordar estas preocupaciones mediante fórmulas hipoalergénicas, la educación del consumidor sobre el uso adecuado y productos dermatológicamente probados es crucial para generar confianza. Empresas como Neutrogena priorizan el uso de ingredientes suaves y clínicamente probados para tranquilizar a los compradores potenciales. Además, el cumplimiento normativo relacionado con las concentraciones de ingredientes, el etiquetado y las afirmaciones de marketing puede representar barreras tanto para las marcas consolidadas como para las emergentes.

- Si bien las soluciones naturales y no medicinales están ganando popularidad, la eficacia limitada percibida en comparación con los productos medicinales también puede obstaculizar su adopción entre los consumidores que buscan resultados rápidos.

- Superar estos desafíos mediante formulaciones más seguras, etiquetado claro y cumplimiento de las regulaciones regionales será vital para el crecimiento sostenido del mercado.

Alcance del mercado de tratamiento de la caspa en América del Norte

El mercado está segmentado según tipo, modo de prescripción, producto, tipo de medicamento, grupo de edad, género, usuario final y tipo de distribución.

- Por tipo

Según el tipo, el mercado norteamericano de tratamientos anticaspa se segmenta en caspa fúngica, caspa relacionada con la piel seca, caspa relacionada con el cuero cabelludo graso y caspa relacionada con enfermedades. El segmento de la caspa fúngica dominó el mercado con la mayor participación en los ingresos, con un 48,2 % en 2024, impulsado por la alta prevalencia de afecciones del cuero cabelludo inducidas por Malassezia y la fuerte preferencia de los consumidores por soluciones antifúngicas clínicamente probadas. Los productos dirigidos a la caspa fúngica, incluidos los champús y acondicionadores medicados, están ampliamente disponibles en los canales de venta libre y con receta, lo que contribuye a una demanda sostenida del mercado. Los consumidores perciben los tratamientos antifúngicos como eficaces para el control de la caspa a largo plazo, lo que genera compras recurrentes. Además, las principales marcas de cuidado personal se centran en la innovación en este segmento con fórmulas con múltiples beneficios, como propiedades antipicazón e hidratantes. Los centros de dermatología recomiendan con frecuencia soluciones para la caspa fúngica, lo que impulsa aún más su adopción. El dominio de este segmento también se sustenta en su compatibilidad con el uso tanto en adultos como en niños, lo que aumenta su atractivo en el mercado.

Se prevé que el segmento de la caspa relacionada con la piel seca experimente la tasa de crecimiento más rápida, del 19,5 %, entre 2025 y 2032, impulsada por una mayor concienciación sobre la hidratación del cuero cabelludo y las fórmulas suaves. Los problemas del cuero cabelludo seco suelen estar relacionados con los cambios estacionales y las prácticas de cuidado capilar agresivas, lo que impulsa a los consumidores a buscar soluciones no irritantes, tanto medicinales como no medicinales. La creciente demanda de ingredientes naturales y herbales en tratamientos para el cuero cabelludo seco impulsa aún más la expansión del mercado. Las redes sociales y la educación a través de influencers sobre el cuidado del cuero cabelludo están aumentando el interés de los consumidores en soluciones específicas. Los productos para la caspa relacionada con la piel seca suelen incluir beneficios hidratantes adicionales, lo que atrae a una base de consumidores preocupada por la salud. El crecimiento del segmento también se ve impulsado por la creciente adopción entre niños y adultos con cuero cabelludo sensible.

- Por modo de prescripción

Según el método de prescripción, el mercado norteamericano de tratamientos anticaspa se segmenta en productos de venta libre y con receta. El segmento de venta libre dominó el mercado con la mayor participación en ingresos, con un 62,4 % en 2024, gracias a su fácil disponibilidad, asequibilidad y la creciente preferencia de los consumidores por las soluciones de autocuidado. Los productos anticaspa de venta libre se distribuyen ampliamente a través de farmacias, tiendas minoristas y plataformas en línea, lo que mejora su accesibilidad. Las promociones frecuentes, la agrupación de productos y los programas de fidelización de marca contribuyen a un aumento de las ventas. Los productos de venta libre también se adaptan tanto a la población adulta como a la pediátrica, lo que los convierte en una opción versátil para el cuidado domiciliario y el uso en centros dermatológicos. Además, la confianza del consumidor en los champús medicados de venta libre para la caspa leve fomenta la repetición de compras. Este segmento se beneficia de la continua innovación de productos, como las fórmulas de champú y acondicionador 2 en 1.

Se prevé que el segmento de medicamentos con receta registre la tasa de crecimiento más rápida, del 17,8 %, entre 2025 y 2032, impulsada por la creciente concienciación de los dermatólogos y el aumento de casos de caspa grave o relacionada con enfermedades. Los productos con receta se prefieren por su mayor eficacia, sus fórmulas específicas y sus ingredientes antifúngicos o antiinflamatorios más potentes. Estas soluciones suelen recomendarse a pacientes que no responden a los tratamientos de venta libre, lo que impulsa su adopción. La creciente concienciación sobre las afecciones del cuero cabelludo entre adultos y niños aumenta la demanda de consultas profesionales. Los productos con receta también se integran cada vez más en los planes de tratamiento dermatológico, lo que impulsa el crecimiento del mercado. Los servicios de teledermatología facilitan aún más el acceso a los tratamientos con receta, acelerando el crecimiento de este segmento.

- Por producto

En cuanto al producto, el mercado norteamericano de tratamientos anticaspa se segmenta en productos medicados y no medicados. El segmento medicado dominó el mercado con la mayor participación en ingresos, un 55,6 %, en 2024, impulsado por la alta eficacia de ingredientes activos como el ketoconazol, la piritiona de zinc y el sulfuro de selenio para controlar la caspa y prevenir su reaparición. Los champús, acondicionadores y tratamientos sin aclarado medicados son recomendados por dermatólogos y se utilizan con frecuencia en las rutinas de cuidado en casa. La confianza del consumidor en productos clínicamente probados impulsa la repetición de compras, mientras que la innovación en fórmulas con múltiples beneficios aumenta la comodidad. Los productos medicados se dirigen a la caspa fúngica, grasa y relacionada con enfermedades, lo que aumenta su versatilidad. Su dominio se ve reforzado por su amplia disponibilidad en tiendas de venta libre, farmacias y canales online. Las campañas de marketing que destacan la eficacia y las recomendaciones de dermatólogos refuerzan la preferencia del consumidor.

Se espera que el segmento de productos no medicados experimente la tasa de crecimiento más rápida, del 18,9 %, entre 2025 y 2032, impulsada por el creciente interés de los consumidores en soluciones naturales, herbales y sin químicos. Los productos no medicados atraen a consumidores preocupados por su salud y con piel sensible que buscan un control suave de la caspa. Las fórmulas innovadoras que combinan ingredientes botánicos calmantes con beneficios para el cuidado del cuero cabelludo impulsan su adopción. La educación en redes sociales y la promoción de alternativas naturales por parte de influencers impulsan aún más la concienciación. Los productos no medicados son particularmente populares entre niños y adultos con caspa leve o problemas de sequedad del cuero cabelludo relacionados con la piel. La creciente tendencia del cuidado capilar casero y la preferencia por ingredientes sostenibles impulsan este crecimiento acelerado.

- Por tipo de fármaco

Según el tipo de medicamento, el mercado norteamericano de tratamientos anticaspa se segmenta en productos de marca y genéricos. El segmento de productos de marca dominó el mercado con la mayor participación en ingresos, un 63,2 %, en 2024, gracias al sólido reconocimiento de marca, la confianza del consumidor y el amplio marketing de las principales empresas de cuidado capilar. Los productos de marca se benefician de fórmulas con base científica y el respaldo de dermatólogos, lo que genera preferencia sobre los genéricos. Su disponibilidad en farmacias, tiendas minoristas y canales en línea fortalece la penetración en el mercado. La fidelidad a la marca entre los consumidores adultos y pediátricos garantiza la repetición de compras. La innovación continua, como la combinación de la acción anticaspa con propiedades fortalecedoras o hidratantes del cabello, mejora la fidelización de los consumidores. Las ofertas de marca también aprovechan las campañas de influencers y los programas de concienciación para educar a los consumidores sobre el uso correcto y sus beneficios.

Se prevé que el segmento de genéricos experimente la tasa de crecimiento más rápida, del 16,7 %, entre 2025 y 2032, impulsada por consumidores preocupados por los costos que buscan alternativas efectivas a los productos de marca. Los genéricos ofrecen ingredientes activos similares a precios más bajos, lo que atrae a un amplio grupo demográfico. La creciente disponibilidad en farmacias y plataformas de comercio electrónico mejora la accesibilidad. El conocimiento de la eficacia de los genéricos por parte de los consumidores está creciendo gracias a campañas digitales y recomendaciones profesionales. Los genéricos también atienden a los segmentos de venta libre y con receta, ampliando aún más su alcance en el mercado. La creciente sensibilidad a los costos de la atención médica y la demanda de soluciones con una buena relación calidad-precio impulsan el crecimiento de este segmento.

- Por grupo de edad

Según el grupo de edad, el mercado norteamericano de tratamientos anticaspa se segmenta en adultos, niños y neonatos. El segmento de adultos dominó el mercado con la mayor participación en los ingresos, un 68,5 %, en 2024, impulsado por la alta prevalencia de la caspa, la creciente concienciación sobre el cuidado personal y la preferencia por tratamientos profesionales. Los consumidores adultos son más propensos a invertir en soluciones médicas y de marca, lo que contribuye a la sostenibilidad de los ingresos. La influencia frecuente en las redes sociales y las recomendaciones profesionales guían la selección de productos. Los adultos también se benefician del fácil acceso a productos de venta libre, asesoramiento dermatológico y canales de compra en línea. El segmento abarca tanto a hombres como a mujeres, lo que amplía aún más su alcance. Las campañas de marketing centradas en productos de estilo de vida, conveniencia y multibeneficios impulsan la adopción.

Se prevé que el segmento pediátrico experimente la tasa de crecimiento más rápida, del 20,3 %, entre 2025 y 2032, impulsada por la creciente concienciación sobre la salud del cuero cabelludo infantil y la preferencia de los padres por productos suaves, seguros y clínicamente probados. Las fórmulas pediátricas específicas con agentes antifúngicos suaves e ingredientes hipoalergénicos se utilizan cada vez más. La creciente penetración del comercio electrónico y la disponibilidad de productos en supermercados y farmacias mejoran la accesibilidad. Las campañas de concienciación sobre dermatología pediátrica y las recomendaciones de los pediatras impulsan aún más la adopción. El segmento también se beneficia de la innovación en fórmulas sin fragancia ni irritantes.

- Por género

En cuanto al género, el mercado norteamericano de tratamientos anticaspa se segmenta en hombres y mujeres. El segmento masculino dominó el mercado con la mayor participación en ingresos, un 54,1%, en 2024, impulsado por una mayor prevalencia de caspa en hombres y una sólida estrategia de marketing de soluciones anticaspa específicas. Los consumidores masculinos suelen preferir champús y soluciones para el cuidado capilar prácticos y con múltiples beneficios, lo que contribuye a la repetición de compras. Los productos de venta libre y con receta son ampliamente accesibles, lo que garantiza un uso constante. Las recomendaciones profesionales y las campañas educativas en línea aumentan el conocimiento y la adopción. Las innovaciones de productos enfocadas en el público masculino, incluyendo champús medicados específicos para el cuero cabelludo, refuerzan aún más su dominio. Las campañas de marca que destacan el cuidado personal y la confianza masculina aumentan la cuota de mercado.

Se prevé que el segmento femenino experimente la tasa de crecimiento más rápida, del 19,2 %, entre 2025 y 2032, impulsada por la creciente concienciación sobre el cuidado del cabello y el cuero cabelludo, el aumento de la renta disponible y la preferencia por fórmulas suaves y con múltiples beneficios. Las mujeres adoptan cada vez más productos naturales y sin medicamentos, junto con soluciones medicadas. Las recomendaciones en redes sociales, influencers y dermatólogos impulsan la concienciación y la prueba. Las consumidoras también valoran los beneficios cosméticos, como el brillo, la suavidad y la fragancia, junto con el control de la caspa. La creciente base de clientes femenina del comercio electrónico impulsa la rápida adopción.

- Por el usuario final

En función del usuario final, el mercado norteamericano de tratamientos anticaspa se segmenta en atención domiciliaria, centros dermatológicos, clínicas especializadas y otros. Este segmento dominó el mercado con la mayor participación en ingresos, un 61,8 %, en 2024, gracias a la comodidad, la asequibilidad y la amplia disponibilidad de productos de venta libre. Los consumidores prefieren usar champús, acondicionadores y tratamientos sin enjuague en sus rutinas diarias para un control constante de la caspa. Las tiendas en línea y los puntos de venta minoristas mejoran aún más la accesibilidad. La adopción de la atención domiciliaria abarca adultos, niños y neonatos, ampliando la cobertura del mercado. Las campañas de marketing que enfatizan la facilidad de uso y las fórmulas con múltiples beneficios impulsan un crecimiento sostenido. El segmento de atención domiciliaria también se beneficia del conocimiento del producto a través de influencers y redes sociales.

Se prevé que el segmento de centros dermatológicos experimente la tasa de crecimiento más rápida, del 18,5 %, entre 2025 y 2032, impulsada por la mayor concienciación de los dermatólogos, la creciente prevalencia de casos graves de caspa y las recomendaciones de productos con prescripción médica. Los centros dermatológicos ofrecen orientación profesional para la selección óptima del tratamiento, garantizando un mejor cumplimiento y mejores resultados. Los servicios de teledermatología y las colaboraciones clínicas con marcas amplían el alcance. Este segmento es especialmente importante para el tratamiento de la caspa causada por hongos y otras enfermedades. La confianza del consumidor en el asesoramiento profesional impulsa la repetición de las visitas y la adopción de productos.

- Por tipo de distribución

Según el tipo de distribución, el mercado norteamericano de tratamientos anticaspa se segmenta en supermercados/hipermercados, tiendas de conveniencia, farmacias, tiendas minoristas, tiendas en línea y otros. El segmento de farmacias dominó el mercado con la mayor participación en ingresos, un 44,7%, en 2024, gracias a la fácil accesibilidad a productos de venta libre y con receta, la orientación profesional y las sólidas recomendaciones de los farmacéuticos. Las farmacias sirven como punto de venta confiable para adultos, niños y neonatos, lo que aumenta la confianza en la compra. Las campañas promocionales, la agrupación de productos y la visibilidad en tienda impulsan las ventas. La disponibilidad de productos en diferentes rangos de precios garantiza una amplia cobertura entre los consumidores. La fuerte presencia de medicamentos de marca y genéricos refuerza la adopción.

Se prevé que el segmento de tiendas en línea experimente la tasa de crecimiento más rápida, del 21,1 %, entre 2025 y 2032, impulsada por la creciente penetración del comercio electrónico, la comodidad de la entrega a domicilio y la creciente conciencia digital. Los consumidores pueden acceder a una amplia gama de productos de marca, genéricos, con y sin medicamentos. Los modelos de suscripción, los descuentos y los servicios de entrega a domicilio fomentan la repetición de compras. Las reseñas en línea, las recomendaciones de influencers y las comparaciones de productos facilitan la toma de decisiones informadas. El segmento se beneficia de la creciente adopción por parte de adultos y cuidadores de niños con conocimientos tecnológicos.

Análisis regional del mercado de tratamiento de la caspa en América del Norte

- Estados Unidos dominó el mercado de tratamiento de la caspa en América del Norte con la mayor participación en los ingresos del 42 % en 2024, impulsado por una alta conciencia del consumidor, un fuerte poder adquisitivo y una industria del cuidado del cabello bien establecida.

- Los consumidores de la región priorizan tratamientos efectivos, clínicamente probados que sean convenientes, seguros y adecuados para el uso diario, incluidos champús, acondicionadores y soluciones sin enjuague dirigidos a la caspa fúngica y relacionada con la piel seca.

- Esta adopción generalizada se ve respaldada además por los altos ingresos disponibles, el fácil acceso a farmacias y tiendas en línea, y la sólida presencia de marcas clave de cuidado personal. Las recomendaciones dermatológicas y las campañas de concienciación impulsadas por influencers también contribuyen a la popularidad de los productos anticaspa entre adultos y niños, consolidando los tratamientos anticaspa como la solución preferida tanto en el ámbito domiciliario como en el profesional.

Análisis del mercado de tratamientos anticaspa en América del Norte y EE. UU.

El mercado estadounidense de tratamientos anticaspa captó la mayor participación en los ingresos, con un 81%, en 2024 en Norteamérica, impulsado por la creciente concienciación sobre la salud del cuero cabelludo y la creciente prevalencia de la caspa en adultos y niños. Los consumidores priorizan cada vez más las soluciones clínicamente probadas, como champús, acondicionadores y tratamientos sin aclarado (con y sin receta), para controlar eficazmente la descamación, el picor y la irritación del cuero cabelludo. La creciente preferencia por fórmulas suaves y con múltiples beneficios que combinan acción antifúngica con propiedades hidratantes o calmantes impulsa aún más el mercado. Además, la amplia disponibilidad de productos en farmacias, tiendas online y puntos de venta, junto con las recomendaciones de dermatólogos, contribuye significativamente a la expansión del mercado. La innovación continua de las principales marcas, sumada a las campañas de marketing y concienciación, refuerza la adopción y la fidelización del consumidor.

Análisis del mercado canadiense de tratamientos anticaspa

Se proyecta que el mercado canadiense de tratamientos anticaspa crecerá a una tasa de crecimiento anual compuesta (TCAC) sustancial durante el período de pronóstico, impulsado principalmente por la creciente atención de los consumidores al cuidado personal y del cuero cabelludo. La creciente conciencia sobre la eficacia y seguridad de los productos, sumada a la demanda de fórmulas naturales y sin medicamentos, fomenta la adopción de tratamientos anticaspa. El mercado experimenta un creciente uso en adultos y niños, respaldado por la orientación profesional de dermatólogos y la disponibilidad en tiendas minoristas, farmacias y canales en línea. Las regulaciones gubernamentales y las normas de seguridad para los productos capilares también fomentan la confianza del consumidor. Además, el mercado se beneficia de la creciente penetración del comercio electrónico, que facilita el acceso a productos de marca y genéricos.

Análisis del mercado de tratamientos anticaspa en México

Se prevé que el mercado mexicano de tratamientos anticaspa crezca a una tasa de crecimiento anual compuesta (TCAC) notable durante el período de pronóstico, impulsado por la creciente urbanización, el aumento de los ingresos disponibles y una mayor concienciación sobre la salud del cabello y el cuero cabelludo. Los consumidores buscan soluciones eficaces y asequibles para controlar la caspa, incluyendo champús y acondicionadores de venta libre dirigidos a la caspa fúngica y la caspa relacionada con la piel seca. La creciente infraestructura minorista, que incluye supermercados, farmacias y plataformas en línea, facilita la accesibilidad a los productos. Además, las campañas de marketing de las principales marcas de cuidado personal y la disponibilidad de fórmulas aptas para niños contribuyen a una mayor adopción. La preferencia de los consumidores por soluciones prácticas para el cuidado del hogar impulsa aún más el crecimiento del mercado.

Cuota de mercado de tratamientos anticaspa en América del Norte

La industria del tratamiento de la caspa en América del Norte está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Procter & Gamble (EE. UU.)

- Unilever (Reino Unido)

- Johnson & Johnson y sus filiales (EE. UU.)

- L'Oréal (Francia)

- Henkel AG & Co. KGaA (Alemania)

- Church & Dwight Co., Inc. (EE. UU.)

- Shiseido Co., Ltd. (Japón

- BEIERSDORF (Alemania)

- Corporación Kao (Japón)

- Compañía de Bienestar Himalaya (India)

- Júpiter (EE.UU.)

- Numé Hair (EE. UU.)

- Better Scalp Company (Canadá)

- Dermatología Hadley (EE. UU.)

- Dermatology Associates (EE. UU.)

- Especialistas en dermatología avanzada y cáncer de piel (EE. UU.)

- Dermatología de vanguardia (EE. UU.)

¿Cuáles son los desarrollos recientes en el mercado de tratamiento de la caspa en América del Norte?

- En julio de 2025, OLAPLEX lanzó su Concentrado Reequilibrante Pro Scalp, un tratamiento capilar exclusivo para profesionales, diseñado para reducir los signos de estrés del cuero cabelludo causados por factores cotidianos o servicios de peluquería. El producto ayuda a combatir el envejecimiento prematuro del cuero cabelludo y promueve un entorno para un cabello sano, ofreciendo una solución especializada para la caspa y la salud del cuero cabelludo.

- En junio de 2025, las gotas para el tratamiento del cuero cabelludo de Briogeo se destacaron como un tratamiento de primera para el cuero cabelludo seco. Estas gotas hidratan y suavizan eficazmente el cuero cabelludo, aliviando la sequedad y el picor asociados con la caspa. Su popularidad subraya la creciente demanda de soluciones específicas para el cuidado del cuero cabelludo en el mercado norteamericano.

- En junio de 2025, Head & Shoulders presentó su Tratamiento Elixir para el Cuero Cabelludo, un producto diseñado para combatir la sequedad y el picor del cuero cabelludo. Este tratamiento combina la eficacia anticaspa de la marca con ingredientes calmantes, ideal para quienes buscan alivio de las molestias del cuero cabelludo.

- En abril de 2025, CLEAR, la marca profesional anticaspa premium de Unilever, presentó su primera gama SCALPCEUTICALS PRO a nivel mundial en TANK Shanghái. Esta serie representa los 50 años de investigación científica de la marca y aúna los esfuerzos de cinco laboratorios globales y más de 200 dermatólogos. Esta gama combate la grasa, la descamación y la sensibilidad del cuero cabelludo, lo que supone un avance significativo en las soluciones anticaspa.

- En noviembre de 2024, la marca farmacéutica francesa Vichy lanzó su línea de cuidado capilar Dercos en Estados Unidos. Esta línea aborda problemas comunes del cuero cabelludo, como la caspa y la sequedad, con un sistema de 3 pasos que incluye el champú anticaspa con sulfuro de selenio, el acondicionador hidratante para cabello y cuero cabelludo y el sérum anticaspa con ácido salicílico. Estos productos ofrecen resultados de salón a precios de farmacia, ampliando la disponibilidad de tratamientos anticaspa eficaces en EE. UU.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.