North America Clinical Laboratory Services Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

136.52 Billion

USD

239.89 Billion

2024

2032

USD

136.52 Billion

USD

239.89 Billion

2024

2032

| 2025 –2032 | |

| USD 136.52 Billion | |

| USD 239.89 Billion | |

|

|

|

|

Segmentación del mercado de servicios de laboratorio clínico en Norteamérica por tipo de servicio (análisis de rutina, análisis esotéricos y patología anatómica), especialidad (análisis de química clínica, hematología, microbiología, inmunología, drogas de abuso, citología y genética), proveedor (laboratorios hospitalarios, laboratorios independientes y de referencia, laboratorios de enfermería y consultorios médicos), aplicación (descubrimiento de fármacos, desarrollo de fármacos, bioanálisis y química de laboratorio, toxicología, terapia celular y génica, ensayos preclínicos y clínicos, y otros servicios de laboratorio clínico): tendencias y pronóstico del sector hasta 2032.

Tamaño del mercado de servicios de laboratorio clínico en América del Norte

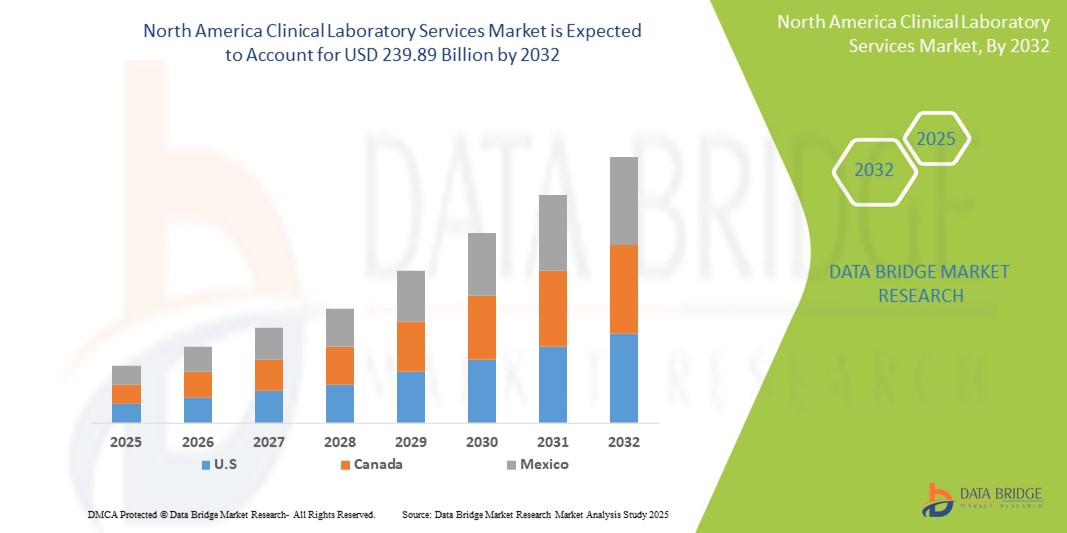

- El tamaño del mercado de servicios de laboratorio clínico de América del Norte se valoró en USD 136,52 mil millones en 2024 y se espera que alcance los USD 239,89 mil millones para 2032 , con una CAGR del 7,3% durante el período de pronóstico.

- El crecimiento del mercado se debe en gran medida a la creciente demanda de diagnóstico temprano de enfermedades, la creciente prevalencia de enfermedades crónicas y un aumento de los controles de salud preventivos en los EE. UU. y Canadá.

- Además, las crecientes inversiones en infraestructura de diagnóstico, los avances tecnológicos en la automatización de laboratorios y la creciente integración de plataformas de análisis basadas en IA están mejorando la calidad del servicio y la eficiencia operativa. Estos factores, en conjunto, impulsan la expansión de los servicios de laboratorio clínico en la región, consolidando su papel en los sistemas de salud modernos.

Análisis del mercado de servicios de laboratorio clínico en América del Norte

- Los servicios de laboratorio clínico, que abarcan pruebas de diagnóstico, patología y análisis genético, son componentes críticos del ecosistema de atención médica tanto en entornos hospitalarios como independientes, lo que garantiza la detección y el manejo oportunos de enfermedades mediante pruebas de alta precisión y conocimientos basados en datos.

- La creciente demanda de servicios de laboratorio clínico se ve impulsada principalmente por la creciente incidencia de enfermedades crónicas, una creciente población geriátrica y un enfoque cada vez mayor en la atención médica preventiva y el diagnóstico temprano.

- Estados Unidos dominó el mercado de servicios de laboratorio clínico de América del Norte con la mayor participación en los ingresos en 2024, impulsado por su infraestructura de atención médica avanzada, una amplia penetración de seguros y la adopción temprana de tecnologías de diagnóstico de precisión y pruebas moleculares, particularmente en laboratorios afiliados a hospitales e independientes.

- Se espera que México sea testigo de la mayor tasa de crecimiento anual compuesta (CAGR) en el mercado de servicios de laboratorio clínico de América del Norte debido a la creciente conciencia sobre la atención médica, la creciente penetración de los seguros de salud y la expansión de la infraestructura de atención médica privada.

- El segmento de pruebas de rutina dominó el mercado de servicios de laboratorio clínico de América del Norte con una participación de mercado del 39,5 % en 2024, impulsado por los altos volúmenes de pruebas para evaluaciones generales de salud, monitoreo de enfermedades crónicas y el uso creciente de programas de detección de salud preventiva en las poblaciones urbanas.

Alcance del informe y segmentación del mercado de servicios de laboratorio clínico en América del Norte

|

Atributos |

Perspectivas clave del mercado de servicios de laboratorio clínico en América del Norte |

|

Segmentos cubiertos |

|

|

Países cubiertos |

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis en profundidad de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de servicios de laboratorio clínico en América del Norte

Transformación digital y diagnósticos basados en IA

- Una tendencia significativa y en auge en el mercado norteamericano de servicios de laboratorio clínico es la rápida transformación digital y la creciente integración de la inteligencia artificial ( IA) en los flujos de trabajo de diagnóstico, lo que mejora la precisión, la eficiencia y la interpretación de datos de las pruebas. Este avance está transformando el panorama de la medicina de laboratorio y elevando el papel de los laboratorios en la atención centrada en el paciente.

- Por ejemplo, Labcorp y Quest Diagnostics han adoptado plataformas optimizadas con IA para optimizar las pruebas de alto volumen y el análisis de imágenes patológicas, lo que permite tiempos de respuesta más rápidos y una mayor precisión diagnóstica. Los algoritmos de IA ayudan a detectar patrones en conjuntos de datos complejos, lo que facilita una identificación más temprana y precisa de enfermedades.

- Los diagnósticos basados en IA son especialmente eficaces en áreas como la oncología, donde herramientas como Tempus y PathAI aplican el aprendizaje automático a datos genómicos y patológicos, lo que facilita la planificación personalizada del tratamiento. Además, las plataformas digitales ofrecen análisis predictivos para la progresión de enfermedades crónicas y la estratificación del riesgo.

- La integración de las historias clínicas digitales con los sistemas de información de laboratorio (LIS) está optimizando la toma de decisiones clínicas al permitir el acceso en tiempo real a los resultados de las pruebas y el historial de los pacientes entre los profesionales sanitarios. Esta conectividad fomenta la colaboración y el intercambio de datos en todo el proceso asistencial.

- Esta tendencia hacia ecosistemas de laboratorio inteligentes, automatizados y conectados impulsa la innovación y la eficiencia en el diagnóstico clínico. Como resultado, las empresas clave están invirtiendo en pruebas basadas en IA e infraestructura digital para satisfacer la creciente demanda de soluciones de diagnóstico más rápidas, precisas y escalables en Norteamérica.

Dinámica del mercado de servicios de laboratorio clínico en América del Norte

Conductor

Aumento de la carga de enfermedades crónicas y demanda de diagnóstico temprano

- La creciente prevalencia de enfermedades crónicas como diabetes, trastornos cardiovasculares y cáncer en América del Norte es un impulsor principal de la creciente demanda de servicios de laboratorio clínico, ya que el diagnóstico temprano y preciso se vuelve esencial para un tratamiento eficaz y el manejo de la enfermedad.

- Por ejemplo, en enero de 2024, Quest Diagnostics amplió sus capacidades de pruebas de diagnóstico avanzadas a través de una asociación con Paige AI para mejorar las ofertas de patología digital destinadas a mejorar el diagnóstico del cáncer en los EE. UU. Estas colaboraciones subrayan la evolución del mercado hacia la precisión y la eficiencia.

- A medida que la población envejece y aumenta la carga de enfermedades no transmisibles, los laboratorios clínicos se están volviendo indispensables para brindar información oportuna y basada en datos que respalde decisiones de atención médica proactivas y planes de tratamiento personalizados.

- Además, una mayor conciencia entre los pacientes y los proveedores de atención médica sobre los beneficios de las pruebas de detección regulares y tempranas ha resultado en un mayor volumen de pruebas, en particular para diagnósticos de rutina y especializados.

- La creciente integración de los servicios de laboratorio en los modelos de atención basados en el valor añadido y el énfasis en los chequeos médicos preventivos impulsan aún más el mercado. Con los avances en la automatización de laboratorios, el diagnóstico basado en IA y las pruebas compatibles con la telesalud, los servicios de laboratorio clínico están preparados para un crecimiento sostenido en el panorama sanitario norteamericano.

Restricción/Desafío

Preocupaciones sobre la privacidad de datos y un panorama regulatorio complejo

- El manejo de datos sensibles de pacientes y muestras biológicas somete a los laboratorios clínicos a un intenso escrutinio, lo que convierte la privacidad de los datos y el cumplimiento normativo en desafíos importantes para la expansión del mercado en Norteamérica. Los estrictos marcos legales de la región, como la HIPAA en EE. UU. y la PHIPA en Canadá, exigen estándares rigurosos para el almacenamiento, el acceso y la transmisión de datos.

- Por ejemplo, la creciente dependencia de los historiales médicos digitales y los sistemas de información de laboratorio (LIS) en la nube aumenta los riesgos de ciberseguridad, lo que genera preocupación por las filtraciones de datos y el acceso no autorizado. Los incidentes de alto perfil que involucran datos médicos comprometidos han aumentado la sensibilidad pública, lo que ha hecho que los proveedores de atención médica sean cautelosos a la hora de adoptar nuevas tecnologías de diagnóstico sin garantías de seguridad sólidas.

- Adherirse a las expectativas regulatorias cambiantes, mantener la certificación a través de organismos como CLIA y CAP y navegar por las leyes específicas de cada estado crean cargas operativas sustanciales, especialmente para los laboratorios independientes más pequeños.

- Además, garantizar la interoperabilidad entre los sistemas de laboratorio y los registros médicos electrónicos de los hospitales puede ser técnicamente complejo y costoso, lo que ralentiza los esfuerzos de integración que son esenciales para una atención fluida al paciente.

- Será esencial abordar estos desafíos mediante inversiones en infraestructura informática segura, la capacitación del personal en materia de cumplimiento normativo y la colaboración con los organismos reguladores. Mejorar la transparencia y reforzar la confianza en el diagnóstico digital desempeñará un papel fundamental para impulsar el crecimiento sostenible de los servicios de laboratorio clínico en toda la región.

Alcance del mercado de servicios de laboratorio clínico en América del Norte

El mercado está segmentado según el tipo de servicio, especialidad, proveedor y aplicación.

- Por tipo de servicio

Según el tipo de servicio, el mercado norteamericano de servicios de laboratorio clínico se segmenta en servicios de análisis de rutina, servicios esotéricos y servicios de anatomía patológica. El segmento de análisis de rutina dominó el mercado con la mayor participación en los ingresos, con un 39,5 % en 2024, impulsado por la alta demanda de pruebas como hemogramas completos, perfiles lipídicos y paneles metabólicos, utilizados en el control regular de la salud y el manejo de enfermedades crónicas. Estas pruebas constituyen la base de las estrategias de atención ambulatoria y preventiva en hospitales y clínicas.

Se proyecta que el segmento de servicios esotéricos experimentará el mayor crecimiento entre 2025 y 2032, impulsado por el creciente uso de pruebas especializadas y complejas, como paneles genéticos y diagnósticos moleculares, especialmente en oncología, cardiología y detección de enfermedades infecciosas. La creciente adopción de la medicina personalizada y los avances en la investigación de biomarcadores impulsan aún más la expansión de las pruebas esotéricas.

- Por especialidad

Según la especialidad, el mercado norteamericano de servicios de laboratorio clínico se segmenta en análisis de química clínica, hematología, microbiología, inmunología, drogas, citología y genética. Los análisis de química clínica tuvieron la mayor cuota de mercado en 2024, debido a la frecuente necesidad de análisis de función metabólica, hepática y renal en una amplia gama de pacientes.

Se prevé que el segmento de pruebas genéticas experimente su mayor crecimiento anual compuesto (TCAC) entre 2025 y 2032, impulsado por su creciente aplicación en la elaboración de perfiles de riesgo de enfermedades, el cribado de trastornos hereditarios y la farmacogenómica. Los avances tecnológicos en la secuenciación de nueva generación (NGS) y la creciente concienciación pública sobre la salud genética están acelerando la demanda en esta categoría.

Por proveedor

Según el proveedor, el mercado de servicios de laboratorio clínico en Norteamérica se segmenta en laboratorios hospitalarios, laboratorios independientes y de referencia, y laboratorios en consultorios médicos y de enfermería. Los laboratorios hospitalarios lideraron el mercado en 2024 gracias a su integración en los centros de salud, lo que permite una rápida entrega de pruebas, la alineación con los flujos de trabajo clínicos y una mayor confianza entre los pacientes.

Se prevé que el segmento de laboratorios independientes y de referencia experimente la mayor tasa de crecimiento durante el período de pronóstico. Su escalabilidad, rentabilidad y enfoque en diagnósticos especializados de alto volumen, junto con las alianzas con empresas farmacéuticas y biotecnológicas, respaldan su creciente papel en el ecosistema de pruebas en general.

- Por aplicación

Según la aplicación, el mercado norteamericano de servicios de laboratorio clínico se segmenta en servicios relacionados con el descubrimiento de fármacos, servicios relacionados con el desarrollo de fármacos, servicios de bioanálisis y química de laboratorio, servicios de pruebas toxicológicas, servicios relacionados con la terapia celular y génica, servicios relacionados con ensayos preclínicos y clínicos, y otros servicios de laboratorio clínico. Los servicios de bioanálisis y química de laboratorio representaron la mayor cuota de mercado en 2024 debido a su papel fundamental en la validación de la seguridad y la eficacia de los fármacos a lo largo de los ciclos de investigación y desarrollo.

Se prevé que el segmento de servicios relacionados con la terapia celular y genética crezca al ritmo más rápido durante el período de pronóstico, respaldado por el aumento de los ensayos clínicos para terapias avanzadas, las crecientes inversiones en medicina regenerativa y la necesidad de una infraestructura de laboratorio especializada para manejar materiales biológicos complejos.

Análisis regional del mercado de servicios de laboratorio clínico en América del Norte

- Estados Unidos lideró el mercado de servicios de laboratorio clínico de América del Norte con la mayor participación en los ingresos en 2024, impulsado por su infraestructura de atención médica avanzada, la amplia penetración de seguros y la adopción temprana de tecnologías de diagnóstico de precisión y pruebas moleculares, particularmente en laboratorios afiliados a hospitales e independientes.

- Los pacientes y proveedores de atención médica de EE. UU. valoran la alta precisión diagnóstica, el procesamiento rápido de las pruebas y la integración de los datos de laboratorio con los registros médicos electrónicos, lo que permite una toma de decisiones clínicas eficiente y la continuidad de la atención.

- La sólida posición de mercado del país se ve respaldada además por una gran población que envejece, una alta carga de enfermedades crónicas y sistemas de reembolso favorables, lo que convierte a EE. UU. en el principal impulsor del crecimiento dentro del panorama de servicios de laboratorio clínico de América del Norte.

Perspectiva del mercado de servicios de laboratorio clínico en América del Norte y EE. UU.

El mercado estadounidense de servicios de laboratorio clínico captó la mayor participación en los ingresos, con un 86,5 %, en 2024 en Norteamérica, impulsado por un sistema de salud consolidado, la creciente demanda de medicina personalizada y un alto volumen de pruebas diagnósticas. Estados Unidos se beneficia de una amplia cobertura de seguros, el envejecimiento de la población y la creciente prevalencia de enfermedades crónicas. Avances tecnológicos como el diagnóstico basado en IA, la patología digital y los sistemas integrados de información de laboratorio están impulsando aún más las capacidades de servicio. Además, la sólida colaboración entre proveedores de atención médica, empresas de diagnóstico e instituciones de investigación respalda la continua evolución de los servicios de laboratorio en el país.

Perspectiva del mercado de servicios de laboratorio clínico de Canadá y América del Norte

Se prevé que el mercado canadiense de servicios de laboratorio clínico crezca a una tasa de crecimiento anual compuesta (TCAC) constante durante el período de pronóstico, impulsado por un mayor enfoque en la detección temprana de enfermedades y la atención médica preventiva. El énfasis del gobierno canadiense en el acceso universal a la atención médica y los programas de salud pública contribuye a la demanda de pruebas de rutina. Además, el crecimiento de la telemedicina y la integración de historiales clínicos electrónicos está mejorando la eficiencia y la accesibilidad de los laboratorios. Las reformas sanitarias provinciales y las alianzas estratégicas entre laboratorios de salud pública y proveedores de diagnóstico privados también están impulsando la expansión del mercado en regiones urbanas y remotas.

Perspectiva del mercado de servicios de laboratorio clínico en México y Norteamérica

El mercado mexicano de servicios de laboratorio clínico se perfila para un crecimiento notable durante el período de pronóstico, impulsado por una mayor concienciación sobre la salud, la mayor penetración de los seguros médicos y la expansión de la infraestructura de salud privada. La urbanización y el crecimiento de la clase media contribuyen a una mayor demanda de pruebas rutinarias y especializadas. Además, las cadenas multinacionales de diagnóstico están expandiendo su presencia en México, mejorando el acceso a servicios de laboratorio de alta calidad. Se espera que los esfuerzos para modernizar los sistemas de salud pública y promover la detección temprana de enfermedades aceleren el desarrollo del mercado en zonas urbanas y semiurbanas.

Cuota de mercado de servicios de laboratorio clínico en América del Norte

La industria de servicios de laboratorio clínico de América del Norte está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- BD (EE. UU.)

- Abbott (EE. UU.)

- Laboratorios Charles River (EE. UU.)

- Labcorp. (EE. UU.)

- Fundación Mayo para la Educación e Investigación Médica (EE. UU.)

- DaVita Inc. (EE. UU.)

- Quest Diagnostics Incorporated (EE. UU.)

- Laboratorios ARUP (EE. UU.)

- Lifelabs (Canadá)

- BioReference Laboratories, Inc. (EE. UU.)

- NeoGenomics Laboratories, Inc. (EE. UU.)

- ACM Global Laboratories (EE. UU.)

¿Cuáles son los desarrollos recientes en el mercado de servicios de laboratorio clínico de América del Norte?

- En abril de 2024, Labcorp anunció la expansión de su oferta de diagnóstico de precisión mediante el lanzamiento de una nueva plataforma multiómica diseñada para integrar datos genómicos, proteómicos y metabolómicos. Esta innovación busca mejorar la detección temprana de enfermedades y las estrategias de tratamiento personalizadas, reforzando así el liderazgo de Labcorp en servicios de diagnóstico avanzado en Norteamérica. La iniciativa destaca la creciente transición hacia soluciones sanitarias holísticas basadas en datos en los laboratorios clínicos.

- En marzo de 2024, Quest Diagnostics se asoció con PathAI, una empresa de patología digital, para integrar la inteligencia artificial en los flujos de trabajo de patología, acelerando la precisión diagnóstica y los plazos de entrega. Esta colaboración destaca el papel cada vez más importante de la IA en la transformación de las operaciones de diagnóstico y apoya los esfuerzos para mejorar la detección del cáncer y la eficiencia de los informes en los laboratorios estadounidenses.

- En febrero de 2024, Mayo Clinic Laboratories presentó una nueva herramienta de apoyo a la toma de decisiones basada en IA, integrada en su sistema de información de laboratorio (LIS), diseñada para ayudar a los profesionales clínicos en la selección e interpretación de pruebas. Esta herramienta mejora la precisión diagnóstica y apoya las iniciativas de atención médica centradas en el valor, lo que destaca la continua innovación de Mayo en el diagnóstico clínico.

- En enero de 2024, Sonic Healthcare USA adquirió Medical Laboratory Associates, un laboratorio regional independiente en la región del Atlántico Medio, para ampliar su red de servicios y mejorar la accesibilidad en mercados desatendidos. La adquisición respalda la estrategia de Sonic de fortalecer su presencia en zonas urbanas y suburbanas de alta demanda en todo Estados Unidos.

- En diciembre de 2023, Dynacare, proveedor líder de diagnóstico en Canadá, lanzó su Programa de Diagnóstico de Atención Virtual, que ofrece kits de análisis de laboratorio compatibles con la telesalud para el monitoreo de enfermedades crónicas. Esta iniciativa refleja la creciente tendencia de integrar la salud digital con el diagnóstico de laboratorio, con el objetivo de mejorar la participación del paciente y el acceso a una atención oportuna en el cambiante panorama de la salud canadiense.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.