North America Ceramic Membranes Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

| 2024 –2030 | |

| USD 4,905,202.74 | |

|

|

|

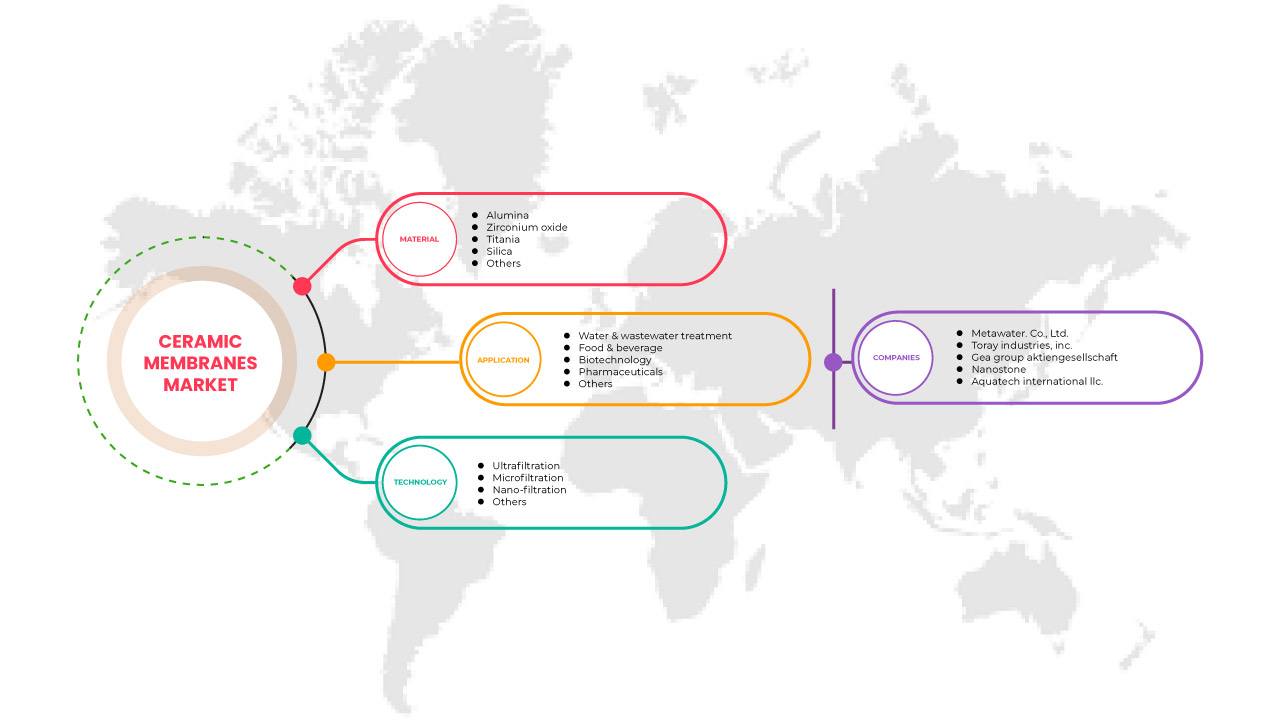

North America Ceramic Membranes Market, By Material (Alumina, Zirconium Oxide, Titania, Silica, Others), Application (Water & Wastewater Treatment, Food & Beverage, Pharmaceuticals, Biotechnology, Others), Technology (Ultrafiltration, Microfiltration, Nano-Filtration, Others) – Industry Trends and Forecast to 2030.

North America Ceramic Membranes Market Analysis and Insights

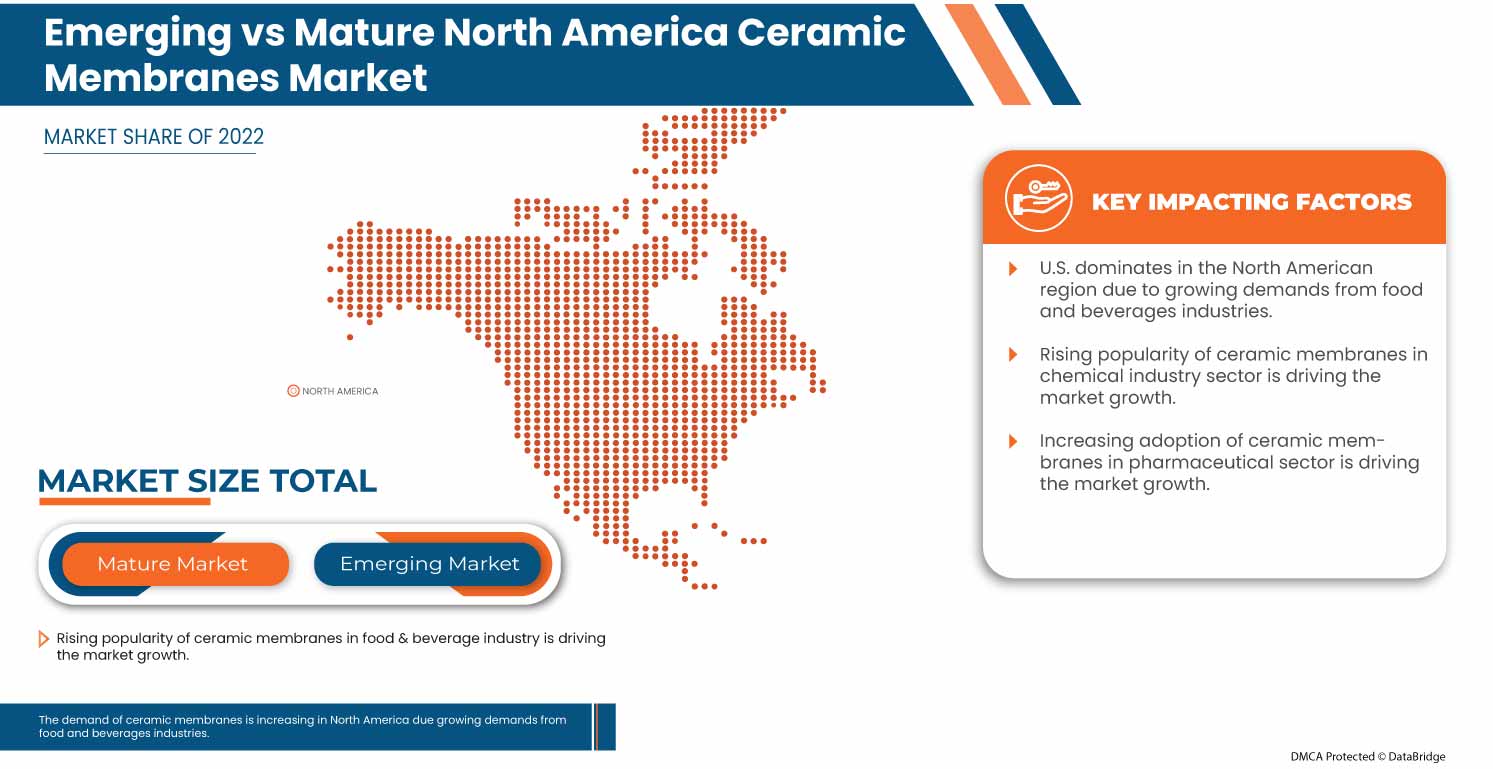

Increasing demand for ceramic membranes from water & wastewater treatment, food & beverage, pharmaceutical and biotechnological industries is an important driver for the North America ceramic membranes market. Growing emphasis on sustainability, quality, and efficiency of membranes in the filtration process is expected to propel the growth of the ceramic membranes market.

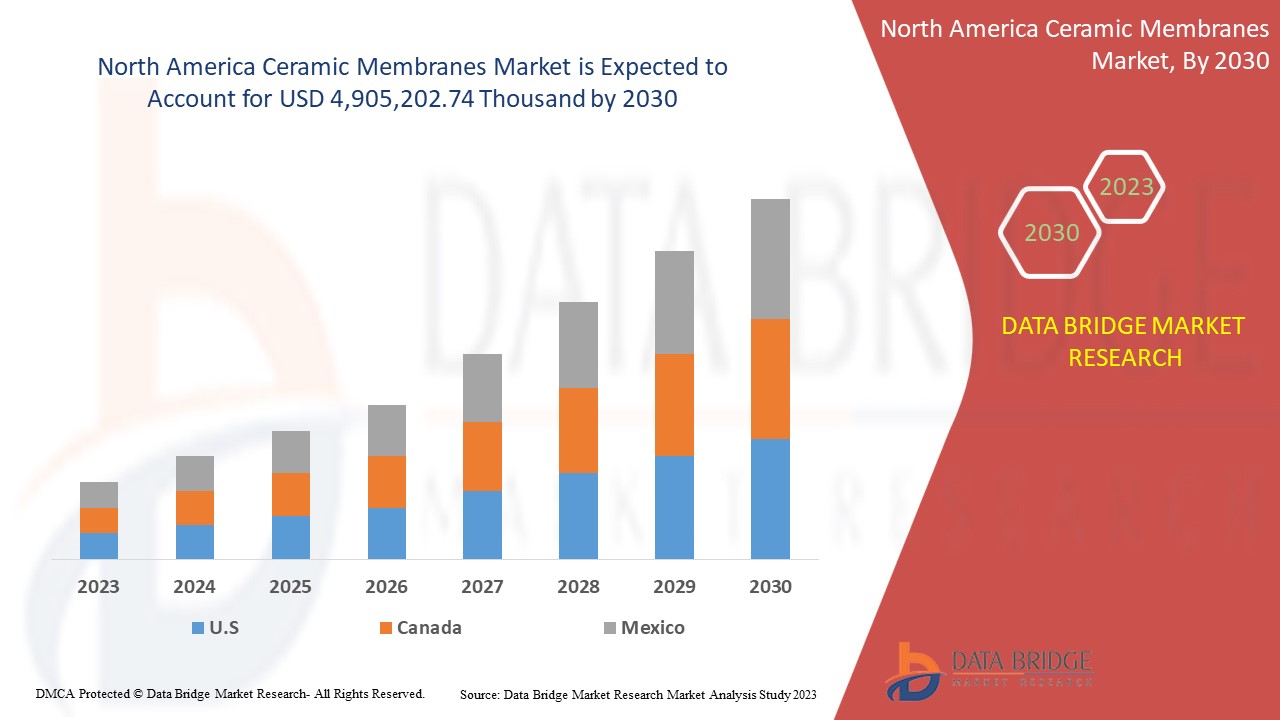

The ceramic membranes market is expected to gain significant growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 12.3% in the forecast period of 2023 to 2030 and is expected to reach USD 4,905,202.74 thousand by 2030.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2020 - 2015) |

|

Quantitative Units |

Revenue in USD Thousands |

|

Segments Covered |

By Material (Alumina, Zirconium Oxide, Titania, Silica, Others), Application (Water & Wastewater Treatment, Food & Beverage, Pharmaceuticals, Biotechnology, Others), Technology (Ultrafiltration, Microfiltration, Nano-Filtration, Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America |

|

Market Players Covered |

TAMI Industries, atech innovations gmbh, GEA Group Aktiengesellschaft, Nanostone, LiqTech Holding A/S, Qua Group LLC., TORAY INDUSTRIES, INC., SIVA Unit., METAWATER. CO., LTD., KERAFOL Ceramic Films GmbH & Co. KG, Aquatech International LLC., Paul Rauschert GmbH & Co. KG., HYDRASYST, Membratec SA and Mantec Filtration. |

Market Definition

The ceramic membranes is an artificial membranes manufactured from inorganic materials. The ceramic membranes is applied in industries such as filtration and liquid processing. Most industries where ceramic membranes are used include food & beverage, pharmaceuticals, biotechnology and water & wastewater treatment. The market's growth factors include increasing demand from pharmaceutical, water & wastewater treatment industries.

Ceramic Membranes Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Rising demand for ceramic membranes from the food and beverages industries

Food and beverages are one of the largest industries where the ceramic membranes is applied due to their various benefits such as filtering properties and antibacterial activity. In addition, high separation efficiency and good chemical stability make the ceramic membranes more essential for food and beverage industries.

The ceramic membranes can overcome the limitations of polymeric membranes. For this reason, most of the food and beverages industries, especially dairy product manufacturers, are shifting towards the application of Ceramic membranes over any other membranes services. The need for ceramic membranes in standard manufacturers for qualitative upgradation is increasing over time.

Moreover, technical applications where ceramic membranes are used include sweetner’s concentration and purification, concentrated milk proteins, and isolated milk proteins. Ceramic membranes crossflow filtration is used in several industries to purify aqueous products. For instance, wine, beer, juice of fruits and vegetable production. Cell separation in amino acid production and lactic acid production in dairy industries also have technological advances nowadays, and ceramic membranes have also been used in these sectors.

To meet the high demand, the food and beverages industries are growing and expanding their production rapidly. In this rising trend, the demand for ceramic membranes in their industries is also growing, which is expected to drive the market of ceramic membranes in the upcoming years. Thus, there is an increasing demand for ceramic membranes from food and beverages industries for various unique factors, which is expected to drive the demand and sales in the North America ceramic membranes market.

- Rising demand for ceramic membranes from water purification industries

The rapid growth of population and increasing amount of waste water is making the need for water purification and wastewater treatment services the priority. The ceramic membranes is one of the major applications in the water purification process. With several beneficial factors, including high mechanical strength, and chemical temperature resistance ceramic membranes are used in water and wastewater treatment.

Applications range of ceramic membranes in water treatment includes municipal water & wastewater treatment, industrial wastewater treatments. Industrial wastewater such as oily and textile industry produced waste water and printing, and dyeing wastewater must be treated regularly. With the increasing industrialization of water treatment industries in the North America market, the demand for Ceramic membranes is also growing, which can drive the North America ceramic membranes market in the future. A few instances of water treatment fields where ceramic membranes can be used are oil field injection water, Paper industry water, landfill leachate, palm oil wastewater, titanium dioxide wastewater and many more.

With the increasing need for water treatment and purification, demand and application of ceramic membranes are also rising. This rising trend is expected to drive market growth in the upcoming future. Hence, the increasing demand from water purification and water treatment industries is expected to drive the North America ceramic membranes market to grow in upcoming years.

Opportunities

- Applications of ceramic membranes in different industries

A vast range of industries where ceramic membranes are applicable and applied. The various utility of ceramic membranes technology makes it versatile in use. Different industries such as textile, food and beverages, chemical, and paper industries apply ceramic membranes for filtration, among others. Pharmaceutical industries are one of essential consumers of ceramic membranes technology. Due to their antibacterial and anti-microbial activity, ceramic membranes have been used for various sanitation purposes.

Furthermore, the efficiency of separating any kind of particular substance from liquid using ceramic membranes has been used in the food and beverages industry. For this reason, ceramic membranes is in increasing demand in food, beverages, and pharmaceutical industries. The increasing need for water treatment to meet the sustainable goals for water treatment to meet sustainable goals is creating an opportunity for the North America ceramic membranes market due to the wide applications of ceramic membranes in wastewater treatments.

- Technological advancements in ceramic membranes science

Technology significantly influences the North America ceramic membranes market, in terms of updating old methods and discovering new ways to manufacture ceramic technology with improved quality and cost reduction. Continuous innovation in this segment and their increasing trend can lead the North America ceramic membranes market to face extreme growth in the near future. All segments such as pharmaceuticals, biotechnology, and water treatment technology have essential to rely on the advancement in ceramic technology. There are several limitations present in ceramic membranes technology, such as brittleness, low ductility among others. However, researchers and the scientific community are working hard to overcome the limitations. For instance, for municipal wastewater treatment flat ceramic membranes technology has been used. Therefore, an opportunity is being created for the North America ceramic membranes market. Thus, the recent advancements in science and technology are providing constant support to the ceramic membranes market to grow.

Restraints/Challenges

- High-cost investment for manufacturing ceramic membranes

One of the restraints that affect the growth of the North America ceramic membranes market is its production cost. The investment cost associated with manufacturing ceramic membranes is higher than other similar types of membranes. Water treatment plants need membranes systems to filter waste water contaminant particles. However, when it comes to ceramic membranes installation, the number of full-pledged installation in water treatment industries is really low. Hence, the cost associated with the installation or manufacturing of ceramic membranes may restrict the growth of the North America ceramic membranes market.

- Performance issues due to the brittleness of ceramic membranes

Ceramic membranes consist of small porous substrates which are providing support to the thin dense membranes. In spite of having several beneficial factors such as chemical and thermal stability, these membranes can have subcritical cracks. It has been observed that in particular sensitivity, the ceramic membranes act as a very brittle component, and the growth of cracks within it can increase. Due to differences in thermal expansion, the ceramic membranes can act as a very brittle substance. Moreover, along with the brittleness, the ceramic membranes has negligible ductility, tensile strength, and other related concerns. Hence, this major drawback can restrain the market of North America ceramic membranes from growing in upcoming years.

Recent Development

- In October 2022, METAWATER CO., LTD. Announced their new order received from PWNT, Netherlands. This order is regarding ceramic membranes for Hampton Loade water treatment works in the United Kingdom. After completion, it will be the world's largest ceramic membranes water treatment plant. This announcement will create more customer attention and brand value for the company

- In September 2022, Nanostone ceramic ultrafiltration membranes technology achieved Regulation 31 approval in UK for use in drinking water treatment in the UK. It helps to improve the quality of the drinking water. This approval helps the company to showcase better standards among the competitors

Ceramic Membranes Market Scope

The ceramic membranes market is categorized based on material, application and technology. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Material

- ALUMINA

- ZIRCONIUM OXIDE

- TITANIA

- SILICA

- OTHERS

On the basis of material, the ceramic membranes market is classified into alumina, zirconium oxide, titania, silica, and others.

Application

- WATER & WASTEWATER TREATMENT

- FOOD & BEVERAGE

- BIOTECHNOLOGY

- PHARMACEUTICALS

- OTHERS

On the basis of application, the ceramic membranes market is classified into water & wastewater treatment, food & beverage, biotechnology, pharmaceuticals, and others.

Technology

- ULTRAFILTRATION

- MICROFILTRATION

- NANO-FILTRATION

- OTHERS

On the basis of technology, the ceramic membranes market is classified into ultrafiltration, microfiltration, nano-filtration, and others.

Ceramic Membranes Market Regional Analysis/Insights

The ceramic membranes market is segmented on the basis of material, application and technology.

The countries covered in the ceramic membranes market report are U.S., Canada and Mexico in North America.

In North America, the U.S. is expected to dominate the market due to the emerging technologies in the region.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Ceramic Membranes Market Share Analysis

The ceramic membranes market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product approvals, patents, product width and breadth, application dominance, product lifeline curve. The above data points provided are only related to the companies’ focus related to the ceramic membranes market.

Some of the major market players operating in the market are TAMI Industries, atech innovations gmbh, GEA Group Aktiengesellschaft, Nanostone, LiqTech Holding A/S, Qua Group LLC., TORAY INDUSTRIES, INC., SIVA Unit., METAWATER. CO., LTD., KERAFOL Ceramic Films GmbH & Co. KG, Aquatech International LLC., Paul Rauschert GmbH & Co. KG., HYDRASYST, Membratec SA and Mantec Filtration.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA CERAMIC MEMBRANE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MATERIAL LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 CERAMIC MEMBRANE MATERIAL LIFE LINE CURVE

2.9 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.1 DBMR MARKET POSITION GRID

2.11 MARKET APPLICATION COVERAGE GRID

2.12 DBMR MARKET CHALLENGE MATRIX

2.13 DBMR VENDOR SHARE ANALYSIS

2.14 IMPORT-EXPORT DATA

2.15 SECONDARY SOURCES

2.16 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES:

4.2.1 THE THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 VENDOR SELECTION CRITERIA

4.4 CLIMATE CHANGE SCENARIO

4.4.1 ENVIRONMENTAL CONCERNS

4.4.2 INDUSTRY RESPONSE

4.4.3 GOVERNMENT'S ROLE

4.4.4 ANALYST RECOMMENDATION

4.5 IMPORT EXPORT SCENARIO

4.6 PRODUCTION CONSUMPTION ANALYSIS- NORTH AMERICA CERAMIC MEMBRANE MARKET

4.7 RAW MATERIAL SOURCING ANALYSIS

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 OVERVIEW

4.8.2 LOGISTIC COST SCENARIO

4.8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.9 TECHNOLOGICAL ADVANCEMENTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR CERAMIC MEMBRANES FROM THE FOOD AND BEVERAGES INDUSTRIES

5.1.2 RISING DEMAND FOR CERAMIC MEMBRANES FROM WATER PURIFICATION INDUSTRIES

5.1.3 INCREASING DEMAND FOR CERAMIC MEMBRANES FROM PHARMACEUTICAL INDUSTRIES

5.2 RESTRAINTS

5.2.1 HIGH-COST INVESTMENT FOR MANUFACTURING CERAMIC MEMBRANES

5.2.2 PERFORMANCE ISSUES DUE TO THE BRITTLENESS OF CERAMIC MEMBRANES

5.3 OPPORTUNITIES

5.3.1 APPLICATIONS OF CERAMIC MEMBRANES IN DIFFERENT INDUSTRIES

5.3.2 TECHNOLOGICAL ADVANCEMENTS IN CERAMIC MEMBRANE SCIENCE

5.4 CHALLENGES

5.4.1 AVAILABILITY OF ALTERNATIVES SUCH AS POLYMERIC MEMBRANES

6 NORTH AMERICA CERAMIC MEMBRANE MARKET, BY MATERIAL

6.1 OVERVIEW

6.2 ALUMINA

6.3 ZIRCONIUM OXIDE

6.4 TITANIA

6.5 SILICA

6.6 OTHERS

7 NORTH AMERICA CERAMIC MEMBRANE MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 WATER & WASTEWATER TREATMENT

7.3 FOOD & BEVERAGE

7.4 PHARMACEUTICALS

7.5 BIOTECHNOLOGY

7.6 OTHERS

8 NORTH AMERICA CERAMIC MEMBRANE MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 ULTRAFILTERATION

8.3 MICROFILTERATION

8.4 NANO-FILTERATION

8.5 OTHERS

9 NORTH AMERICA CERAMIC MEMBRANE MARKET, BY REGION

9.1 NORTH AMERICA

9.1.1 U.S.

9.1.2 CANADA

9.1.3 MEXICO

10 NORTH AMERICA CERAMIC MEMBRANES MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

10.2 ANNOUNCEMENTS

10.3 DEVELOPMENT

10.4 PROJECT

10.5 TECHNOLOGY

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 METAWATER. CO., LTD.

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 SWOT

12.1.6 RECENT DEVELOPMENT

12.2 TORAY INDUSTRIES, INC. (2022)

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 SWOT

12.2.6 RECENT DEVELOPMENTS

12.3 GEA GROUP AKTIENGESELLSCHAFT

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 SWOT

12.3.6 RECENT DEVELOPMENTS

12.4 NANOSTONE

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 SWOT

12.4.5 RECENT UPDATES

12.5 AQUATECH INTERNATIONAL LLC.

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 SWOT

12.5.5 RECENT DEVELOPMENTS

12.6 A-TECH INNOVATION GMBH

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 SWOT

12.6.4 RECENT UPDATES

12.7 HYDRASYST

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 SWOT

12.7.4 RECENT UPDATES

12.8 KERAFOL CERAMIC FILMS GMBH & CO. KG

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 SWOT

12.8.4 RECENT DEVELOPMENTS

12.9 LIQTECH HOLDING A/S (2022)

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 PRODUCT PORTFOLIO

12.9.4 SWOT

12.9.5 RECENT DEVELOPMENTS

12.1 MANTEC FILTRATION

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 SWOT

12.10.4 RECENT UPDATES

12.11 MEMBRATEC SA

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 SWOT

12.11.4 RECENT UPDATES

12.12 PAUL RAUSCHERT GMBH & CO.KG

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 SWOT

12.12.4 RECENT UPDATES

12.13 QUA GROUP LLC.

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 SWOT

12.13.4 RECENT UPDATES

12.14 SIVA UNIT

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 SWOT

12.14.4 RECENT UPDATES

12.15 TAMI INDUSTRIES

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 SWOT

12.15.4 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

Lista de Tablas

TABLE 1 IMPORT DATA OF CERAMIC WARES FOR LABORATORY, CHEMICAL OR OTHER TECHNICAL USES, PORCELAIN OR CHINA (EXCLUDING REFRACTORY CERAMIC GOODS, ELECTRICAL DEVICES, INSULATORS AND OTHER ELECTRICAL INSULATING FITTINGS); HS CODE – 690911 (USD THOUSAND)

TABLE 2 EXPORT DATA OF CERAMIC WARES FOR LABORATORY, CHEMICAL OR OTHER TECHNICAL USES, PORCELAIN OR CHINA (EXCLUDING REFRACTORY CERAMIC GOODS, ELECTRICAL DEVICES, INSULATORS AND OTHER ELECTRICAL INSULATING FITTINGS); HS CODE – 690911 (USD THOUSAND)

TABLE 3 NORTH AMERICA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA ALUMINA IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA ZIRCONIUM OXIDE IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA TITANIA IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA SILICA IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA OTHERS IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA CERAMIC MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA WATER & WASTEWATER TREATMENT IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA FOOD & BEVERAGE IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA PHARMACEUTICALS IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA BIOTECHNOLOGY IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA OTHERS IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA CERAMIC MEMBRANE MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA ULTRAFILTERATION IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA MICROFILTERATION IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA NANO-FILTERATION IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA OTHERS IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA CERAMIC MEMBRANE MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA CERAMIC MEMBRANE MARKET, BY COUNTRY, 2021-2030 (THOUSAND UNITS)

TABLE 22 NORTH AMERICA CERAMIC MEMBRANE MARKET, BY COUNTRY, 2021-2030 (PRICE)

TABLE 23 NORTH AMERICA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 25 NORTH AMERICA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (PRICE)

TABLE 26 NORTH AMERICA CERAMIC MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA CERAMIC MEMBRANE MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 28 U.S. CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 29 U.S. CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 30 U.S. CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (PRICE)

TABLE 31 U.S. CERAMIC MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 32 U.S. CERAMIC MEMBRANE MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 33 CANADA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 34 CANADA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 35 CANADA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (PRICE)

TABLE 36 CANADA CERAMIC MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 37 CANADA CERAMIC MEMBRANE MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 38 MEXICO CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 39 MEXICO CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 40 MEXICO CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (PRICE)

TABLE 41 MEXICO CERAMIC MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 42 MEXICO CERAMIC MEMBRANE MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

Lista de figuras

FIGURE 1 NORTH AMERICA CERAMIC MEMBRANE MARKET

FIGURE 2 NORTH AMERICA CERAMIC MEMBRANE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA CERAMIC MEMBRANE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA CERAMIC MEMBRANE MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA CERAMIC MEMBRANE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA CERAMIC MEMBRANE MARKET: THE MATERIAL LIFE LINE CURVE

FIGURE 7 NORTH AMERICA CERAMIC MEMBRANE MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA LIFE LINE CURVE

FIGURE 9 NORTH AMERICA CERAMIC MEMBRANE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 10 NORTH AMERICA CERAMIC MEMBRANE MARKET: DBMR MARKET POSITION GRID

FIGURE 11 NORTH AMERICA CERAMIC MEMBRANE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 12 NORTH AMERICA CERAMIC MEMBRANE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 13 NORTH AMERICA CERAMIC MEMBRANE MARKET: VENDOR SHARE ANALYSIS

FIGURE 14 NORTH AMERICA CERAMIC MEMBRANE MARKET: SEGMENTATION

FIGURE 15 GROWING DEMAND FOR CERAMIC MEMBRANES ACROSS VARIOUS INDUSTRIES IS EXPECTED TO DRIVE NORTH AMERICA CERAMIC MEMBRANE MARKET IN THE FORECAST PERIOD

FIGURE 16 ALUMINA SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA CERAMIC MEMBRANE MARKET IN 2023 & 2030

FIGURE 17 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA CERAMIC MEMBRANES MARKET

FIGURE 19 NORTH AMERICA CERAMIC MEMBRANE MARKET: BY MATERIAL, 2022

FIGURE 20 NORTH AMERICA CERAMIC MEMBRANE MARKET: BY APPLICATION, 2022

TABLE 10 NORTH AMERICA WATER & WASTEWATER TREATMENT IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

FIGURE 21 NORTH AMERICA CERAMIC MEMBRANE MARKET: BY TECHNOLOGY, 2022

FIGURE 22 NORTH AMERICA CERAMIC MEMBRANE MARKET: SNAPSHOT (2022)

FIGURE 23 NORTH AMERICA CERAMIC MEMBRANE MARKET: BY COUNTRY (2022)

FIGURE 24 NORTH AMERICA CERAMIC MEMBRANE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 25 NORTH AMERICA CERAMIC MEMBRANE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 26 NORTH AMERICA CERAMIC MEMBRANE MARKET: BY MATERIAL (2023 & 2030)

FIGURE 27 NORTH AMERICA CERAMIC MEMBRANES MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.