North America Carpets And Rugs Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

17.16 Billion

USD

26.54 Billion

2024

2032

USD

17.16 Billion

USD

26.54 Billion

2024

2032

| 2025 –2032 | |

| USD 17.16 Billion | |

| USD 26.54 Billion | |

|

|

|

|

Mercado de alfombras y tapetes de América del Norte, tipo (alfombras y tapetes), producto (tufted, tejido, punzonado con aguja, tejido plano, con gancho, anudado, otros), materia prima (fibra sintética y fibra natural), aplicación (residencial y comercial), canal de distribución (fuera de línea y en línea) - Tendencias de la industria y pronóstico hasta 2032.

Tamaño del mercado de alfombras y tapetes de América del Norte

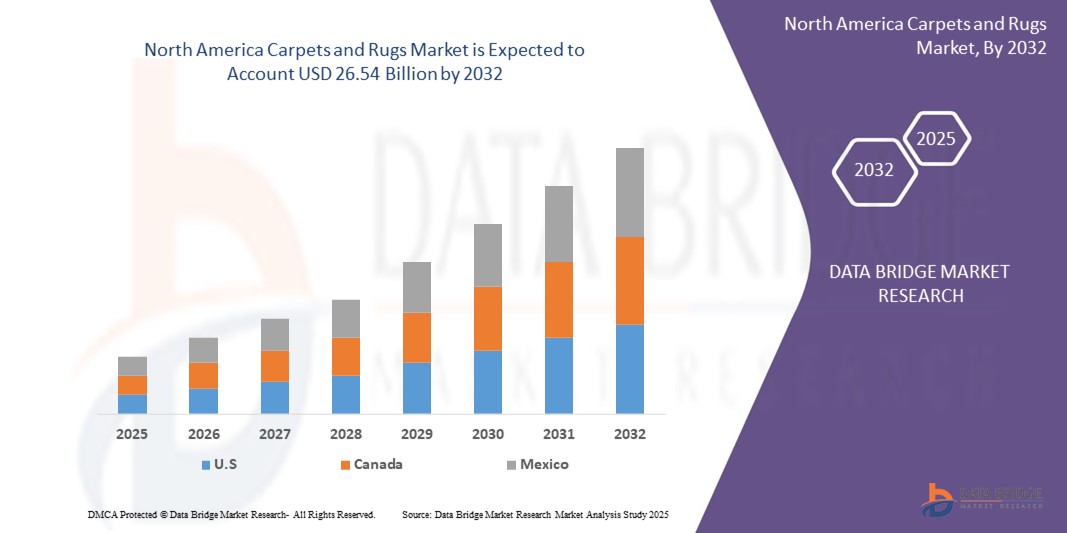

- El tamaño del mercado de alfombras y tapetes de América del Norte se valoró en USD 17,16 mil millones en 2024 y se espera que alcance los USD 26,54 mil millones para 2032 , con una CAGR del 5,6% durante el período de pronóstico.

- El crecimiento del mercado está impulsado principalmente por la creciente demanda de una decoración del hogar estéticamente atractiva y funcional, el aumento de las actividades de construcción residencial y comercial y los avances en tecnologías de fabricación de alfombras sostenibles y duraderas.

- La creciente preferencia de los consumidores por materiales ecológicos, como las fibras naturales, y el auge de las plataformas minoristas en línea para muebles para el hogar están acelerando aún más la expansión del mercado.

Análisis del mercado de alfombras y tapetes de América del Norte

- Las alfombras y tapetes son elementos esenciales del diseño de interiores, ya que aportan atractivo estético, comodidad y funcionalidad tanto en entornos residenciales como comerciales. Su versatilidad, sumada a los avances en diseño y materiales, las ha convertido en una parte integral de los espacios domésticos y de oficina modernos.

- La demanda de alfombras y tapetes se ve impulsada por la creciente urbanización, el aumento de los ingresos disponibles y un enfoque creciente en soluciones de interiores sostenibles y personalizables.

- Estados Unidos domina el mercado de alfombras y tapetes de América del Norte, con la mayor participación en los ingresos del 33,9 % en 2024, impulsado por el alto gasto de los consumidores en mejoras del hogar, un mercado inmobiliario sólido y la presencia de fabricantes y minoristas líderes.

- Se espera que Canadá sea la región de más rápido crecimiento en el mercado de alfombras y tapetes de América del Norte durante el período de pronóstico, impulsado por la creciente demanda de pisos acogedores y estéticamente agradables en entornos residenciales.

- El segmento de alfombras tuvo la mayor participación en los ingresos del mercado, con un 60 %, en 2024, impulsado por la creciente demanda de alfombras de pared a pared en espacios residenciales y comerciales, particularmente por sus propiedades de aislamiento y atractivo estético.

Alcance del informe y segmentación del mercado de alfombras y tapetes en Estados Unidos

|

Atributos |

Perspectivas clave del mercado de alfombras y tapetes en América del Norte |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis en profundidad de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de alfombras y tapetes en América del Norte

“Aumento de la integración de tecnología inteligente y materiales sostenibles”

- El mercado de alfombras y tapetes de América del Norte está experimentando una tendencia significativa hacia la integración de tecnología inteligente y materiales sostenibles.

- La tecnología inteligente, como las alfombras activadas por voz o con calefacción, permite funciones innovadoras como el enrollado automático y la regulación de la temperatura, mejorando la comodidad y conveniencia del usuario.

- Los materiales sostenibles, incluidas las fibras recicladas y las fibras naturales como la lana, el algodón y el yute, están ganando terreno debido a la creciente demanda de los consumidores de productos ecológicos y biodegradables.

- Por ejemplo, empresas como Interface y Bentley Mills están introduciendo losetas de alfombra con baja huella de carbono y productos fabricados con PET reciclado y fibras vegetales para cumplir con los objetivos de sostenibilidad.

- Estos avances mejoran la funcionalidad y el atractivo ambiental de las alfombras y tapetes, haciéndolos más atractivos tanto para los consumidores residenciales como comerciales.

- También se están diseñando alfombras inteligentes y sostenibles para alinearse con las tendencias modernas de diseño de interiores, ofreciendo patrones personalizables y una mayor durabilidad para áreas de alto tráfico.

Dinámica del mercado de alfombras y tapetes en América del Norte

Conductor

Creciente demanda de renovación de viviendas y diseño de interiores estético

- La creciente atención del consumidor a la renovación del hogar y la estética interior es un importante impulsor del mercado de alfombras y tapetes de América del Norte.

- Las alfombras y tapetes mejoran el atractivo visual y la comodidad de los espacios habitables, ofreciendo aislamiento, reducción de ruido y opciones de diseño personalizables para aplicaciones residenciales y comerciales.

- Los incentivos gubernamentales y el aumento de los ingresos disponibles, particularmente en los EE. UU., están impulsando la demanda de soluciones de pisos elegantes y funcionales.

- La proliferación de plataformas de comercio electrónico y el crecimiento de los sectores de la construcción y el sector inmobiliario están permitiendo aún más la expansión del mercado, proporcionando un acceso más fácil a una amplia gama de productos de alfombras y tapetes.

- Los fabricantes ofrecen cada vez más soluciones de alfombras personalizables e instaladas en fábrica para satisfacer las expectativas de los consumidores de diseños únicos y materiales de alta calidad.

- Se espera que Estados Unidos domine el mercado debido a su fuerte enfoque en las tendencias de decoración del hogar y las sólidas actividades de construcción.

Restricción/Desafío

Alto costo de los materiales sostenibles y competencia de los pisos duros

- Los altos costos iniciales asociados con la producción y compra de alfombras sustentables, particularmente aquellas hechas de fibras naturales o recicladas, pueden ser una barrera importante para su adopción, especialmente en mercados sensibles a los costos.

- La integración de tecnología inteligente en las alfombras, como sistemas de calefacción o automatización integrados, aumenta la complejidad y los gastos de producción e instalación.

- Además, la competencia de opciones alternativas de suelos, como la madera, el laminado, el vinilo y las baldosas, supone un gran reto. Estos materiales suelen ser los preferidos por su durabilidad, bajo mantenimiento y estética moderna.

- Los datos de los informes de la industria indican que las opciones de pisos duros están ganando popularidad en espacios comerciales de alto tráfico y diseños residenciales minimalistas, lo que potencialmente limita el crecimiento del mercado de alfombras y tapetes.

- Las preocupaciones de los consumidores sobre el mantenimiento, como la limpieza y la retención de alérgenos en las alfombras, complican aún más la adopción en regiones con alta conciencia de la higiene y facilidad de mantenimiento.

- El panorama regulatorio fragmentado con respecto a las normas ambientales y los requisitos de reciclaje en América del Norte también puede complicar las operaciones de los fabricantes y disuadir la expansión del mercado.

Alcance del mercado de alfombras y tapetes de América del Norte

El mercado está segmentado según tipo, producto, materia prima, aplicación y canal de distribución.

- Por tipo

Según el tipo, el mercado norteamericano de alfombras y tapetes se segmenta en alfombras y tapetes. El segmento de alfombras obtuvo la mayor participación en los ingresos del mercado, con un 60%, en 2024, impulsado por la creciente demanda de alfombras de pared a pared en espacios residenciales y comerciales, especialmente por sus propiedades aislantes y su atractivo estético. Las alfombras son populares por su capacidad para mejorar la comodidad y reducir los costos de energía, especialmente en regiones con climas fríos.

Se prevé que el segmento de alfombras experimente la tasa de crecimiento más rápida, del 6,2 %, entre 2025 y 2032, impulsada por el creciente interés de los consumidores en revestimientos de suelo personalizables y móviles que añaden elementos decorativos a zonas específicas. El auge de los proyectos de reforma del hogar y la influencia de las tendencias de diseño de interiores en las redes sociales aceleran aún más su adopción.

- Por producto

En cuanto al producto, el mercado norteamericano de alfombras y tapetes se segmenta en mechones, tejidos, punzonados, planos, de gancho, anudados, entre otros. El segmento de mechones dominó con una participación en los ingresos del 62,3 % en 2024, gracias a su rentable proceso de producción y a la versatilidad de su diseño, lo que lo hace ideal tanto para aplicaciones residenciales como comerciales. Las alfombras y tapetes de mechones son altamente personalizables y ofrecen una gama de patrones, colores y texturas que satisfacen las diversas preferencias de los consumidores.

Se prevé que el segmento de alfombras anudadas experimente la tasa de crecimiento más rápida, del 4,9 %, entre 2025 y 2032, impulsada por la creciente demanda de decoración artesanal. Las alfombras anudadas, a menudo fabricadas con materiales de primera calidad como lana y seda, atraen a consumidores adinerados que buscan soluciones de suelos lujosos y de alta calidad.

- Por materia prima

En cuanto a la materia prima, el mercado norteamericano de alfombras y tapetes se segmenta en fibras sintéticas y fibras naturales. El segmento de fibras sintéticas obtuvo la mayor participación en los ingresos del mercado, con un 65,8 % en 2024. Este predominio se debe a su durabilidad, resistencia a las manchas y precio asequible, lo que las hace ideales para zonas de alto tráfico, tanto residenciales como comerciales.

Se proyecta que el segmento de fibras naturales, que comprende lana, algodón, yute y seda, experimentará un crecimiento significativo entre 2025 y 2032. La creciente preferencia de los consumidores por materiales ecológicos y sostenibles, junto con la comodidad superior y el atractivo estético de las fibras naturales, impulsa el crecimiento de este segmento, particularmente en el mercado de lujo.

- Por aplicación

Según su aplicación, el mercado norteamericano de alfombras y tapetes se segmenta en residencial y comercial. El segmento residencial representó el 72 % de los ingresos del mercado en 2024, impulsado por el aumento del gasto en reformas de viviendas y la creciente popularidad de las alfombras y tapetes para mejorar la estética y el confort interior. Las alfombras de pared a pared son especialmente populares en entornos residenciales por sus beneficios de aislamiento.

Se prevé que el segmento comercial crezca a un ritmo sólido del 6,5 % entre 2025 y 2032, impulsado por la creciente demanda de soluciones de suelos duraderos, de bajo mantenimiento y estéticamente agradables en oficinas, hoteles y comercios. Los avances en materiales resistentes a las manchas y ecológicos impulsan aún más su adopción en entornos comerciales.

- Por canal de distribución

Según el canal de distribución, el mercado norteamericano de alfombras y tapetes se segmenta en presencial y en línea. El segmento presencial, que incluye tiendas especializadas, grandes almacenes y supermercados/hipermercados, obtuvo la mayor cuota de mercado con un 68,4 % en 2024. Esto se debe a la preferencia del consumidor por evaluar físicamente la textura, la calidad y el color de las alfombras y tapetes antes de comprarlas, especialmente en tiendas locales y exposiciones.

Se prevé que el segmento online experimente la tasa de crecimiento más rápida, del 8,3 %, entre 2025 y 2032, impulsada por la comodidad y variedad que ofrecen plataformas de comercio electrónico como Amazon, Wayfair y los sitios web de fabricantes. La expansión del comercio digital y la creciente comodidad del consumidor al comprar productos de decoración para el hogar en línea son factores clave del crecimiento.

Análisis regional del mercado de alfombras y tapetes de América del Norte

- Se espera que Estados Unidos domine el mercado de alfombras y tapetes de América del Norte, con la mayor participación en los ingresos del 33,9 % en 2024, impulsado por el alto gasto de los consumidores en mejoras del hogar, un mercado inmobiliario sólido y la presencia de fabricantes y minoristas líderes.

- Los consumidores priorizan las alfombras y tapetes para mejorar la comodidad interior, mejorar la acústica y agregar atractivo estético, particularmente en regiones con diversas condiciones climáticas que requieren pisos duraderos y versátiles.

- El crecimiento está respaldado por avances en las tecnologías de fabricación, como opciones de fibras sintéticas y naturales ecológicas, junto con una creciente adopción en aplicaciones residenciales y comerciales a través de canales de distribución en línea y fuera de línea.

Perspectiva del mercado de alfombras y tapetes en EE. UU.

Se prevé que Estados Unidos domine el mercado norteamericano de alfombras y tapetes, con la mayor cuota de mercado, un 62,67%, en 2024, impulsado por la fuerte demanda en los sectores residencial y comercial y la creciente concienciación de los consumidores sobre las opciones de suelos sostenibles y elegantes. La tendencia hacia la renovación de viviendas y la personalización de interiores impulsa aún más la expansión del mercado. La disponibilidad de diversos productos, como alfombras tuftadas, tejidas, punzonadas, de tejido plano, con gancho y anudadas, complementa las ventas tanto en línea como fuera de línea, creando un sólido ecosistema de mercado.

Análisis del mercado de alfombras y tapetes de Canadá

Se espera que el mercado canadiense de alfombras y tapetes experimente un crecimiento significativo, impulsado por la creciente demanda de pisos acogedores y estéticos en entornos residenciales. Los consumidores buscan productos que ofrezcan aislamiento térmico y durabilidad, con preferencia por materiales sostenibles como las fibras naturales. El crecimiento es notable en las zonas urbanas, impulsado por el aumento de la construcción y la popularidad de los canales de distribución en línea para facilitar las compras.

Cuota de mercado de alfombras y tapetes en América del Norte

La industria de alfombras y tapetes de América del Norte está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- MOHAWK INDUSTRIES, INC. (EE. UU.)

- Shaw Industries Group, Inc. (EE. UU.)

- Mannington Mills, Inc. (EE. UU.)

- Interface, Inc. (EE. UU.)

- The Dixie Group, Inc. (EE. UU.)

- Tarkett (Francia)

- TEJEDORES ORIENTALES (Egipto)

- Belysse (Bélgica)

- Revestimientos de suelos internacionales (EE. UU.)

- Bentley Mills (EE. UU.)

- Pisos de ingeniería (EE. UU.)

- Superficie de pisos InJ&J (EE. UU.)

- Alfombra Stark (EE. UU.)

- Milliken & Company (EE. UU.)

- Alfombras Masland (EE. UU.)

¿Cuáles son los desarrollos recientes en el mercado de alfombras y tapetes de América del Norte?

- En marzo de 2025, Interface destinó 45 millones de dólares para ampliar la producción de losetas de moqueta modulares en sus instalaciones de Georgia. Esta inversión se centra en aumentar la capacidad de fabricación e integrar equipos avanzados diseñados para nailon 100 % reciclado. La iniciativa se alinea con los objetivos de sostenibilidad de Interface y refuerza su compromiso con las soluciones de suelos ecológicos. Al aumentar la producción, la empresa busca satisfacer la creciente demanda del mercado y, al mismo tiempo, promover prácticas de economía circular. Se espera que la expansión fortalezca la posición de Interface en el sector de los suelos comerciales.

- En enero de 2025, Oriental Weavers presentará sus últimas novedades en alfombras y tapetes en la feria comercial Heimtextil de Fráncfort, Alemania. La empresa destacará sus colecciones ecológicas, productos de fibras naturales y sus galardonadas alfombras plegables y lavables, diseñadas para una fácil limpieza en lavadoras convencionales. La colección de Oriental Weavers para 2025 se inspira en la rica historia de Egipto, combinando patrones clásicos con diseños contemporáneos. La feria tendrá lugar del 14 al 17 de enero, y Oriental Weavers presentará sus innovaciones en el stand B80 del pabellón 5.1, dentro de la creciente sección de Alfombras y Tapetes.

- En febrero de 2024, Shaw Floors presentó seis nuevos estilos de alfombras Pet Perfect+, diseñados específicamente para hogares que admiten mascotas. Estas alfombras cuentan con la tecnología LifeGuard Spill-Proof, que garantiza mayor durabilidad, resistencia a las manchas y fácil mantenimiento. Esta innovación busca brindar a los propietarios soluciones de pisos que resistan la suciedad causada por las mascotas, ofreciendo comodidad, estilo y protección duradera. La colección incluye diversas texturas y patrones, que se adaptan a diferentes preferencias estéticas y mantienen altos estándares de rendimiento. Shaw Floors continúa priorizando las innovaciones que admiten mascotas, reforzando su compromiso con la calidad y la sostenibilidad.

- En marzo de 2023, Mohawk Industries, Inc. presentó su colección de alfombras PetProof, con tecnología mejorada de resistencia a manchas y olores. Esta innovación se diseñó para satisfacer la creciente demanda de soluciones para pisos aptos para mascotas, garantizando durabilidad, fácil mantenimiento y protección duradera contra accidentes de mascotas. La colección incorpora la tecnología patentada EasyClean™ de Mohawk, que proporciona una resistencia superior a las manchas y la suciedad, facilitando la limpieza.

- En noviembre de 2022, Tarkett SA presentó la colección de losetas de moqueta Desso Origin, fabricada con hilo 100 % reciclado y con la huella de carbono circular más baja de Europa. La colección incluye los diseños Recharge y Retrace, ambos con hasta un 61,1 % de contenido reciclado. Tarkett prioriza el reciclaje de circuito cerrado, lo que garantiza que estas losetas se puedan desmontar y reutilizar en nuevos productos. Este lanzamiento se alinea con el compromiso de Tarkett con la sostenibilidad, utilizando energía 100 % verde en su fabricación.

- En marzo de 2025, Interface destinó 45 millones de dólares para ampliar la producción de losetas de moqueta modulares en sus instalaciones de Georgia. Esta inversión se centra en aumentar la capacidad de fabricación e integrar equipos avanzados diseñados para nailon 100 % reciclado. La iniciativa se alinea con los objetivos de sostenibilidad de Interface y refuerza su compromiso con las soluciones de suelos ecológicos. Al aumentar la producción, la empresa busca satisfacer la creciente demanda del mercado y, al mismo tiempo, promover prácticas de economía circular. Se espera que la expansión fortalezca la posición de Interface en el sector de los suelos comerciales.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA CARPETS AND RUGS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELLING

2.8 TYPE TIMELINE CURVE

2.9 APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING FOCUS ON INTERIOR DESIGN AND AESTHETICS IN COMMERCIAL SPACES

5.1.2 RECYCLABILITY AND REUSABILITY OF CARPET

5.1.3 EASY AND SPEEDY INSTALLATION

5.1.4 INCREASING PREFERENCE OVER OTHER FLOORING MATERIAL IN DEVELOPING COUNTRIES

5.2 RESTRAINTS

5.2.1 INCREASING RAW MATERIAL PRICE

5.2.2 HIGH MAINTENANCE COST

5.3 OPPORTUNITIES

5.3.1 RISE IN ECO-FRIENDLY CARPETS & RUGS

5.3.2 INCREASE IN E-COMMERCE AND ONLINE SALES

5.3.3 STRATEGIC INITIATIVES BY THE MARKET PLAYERS

5.4 CHALLENGE

5.4.1 HIGHLY SUSCEPTIBLE TO ALLERGENS

5.4.2 STRINGENT REGULATIONS REGARDING LEED CERTIFICATION

6 NORTH AMERICA CARPETS AND RUGS MARKET, BY TYPE

6.1 OVERVIEW

6.2 CARPET

6.2.1 CUT PILE CARPET

6.2.2 LOOP PILE CARPET

6.2.3 CUT LOOP CARPET

6.2.4 SHAG CARPET

6.2.5 OTHERS

6.3 RUGS

6.3.1 DISTRESSED RUGS

6.3.2 COASTAL RUGS

6.3.3 CHEVRON RUGS

6.3.4 BORDER RUGS

6.3.5 FLORAL RUGS

6.3.6 IKAT RUGS

6.3.7 ANIMAL PRINT RUGS

6.3.8 OTHERS

7 NORTH AMERICA CARPETS AND RUGS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 TUFTED

7.3 WOVEN

7.4 NEEDLE-PUNCHED

7.5 FLAT-WEAVE

7.6 HOOKED

7.7 KNOTTED

7.8 OTHERS

8 NORTH AMERICA CARPETS AND RUGS MARKET, BY RAW MATERIAL

8.1 OVERVIEW

8.2 SYNTHETIC FIBER

8.2.1 NYLON

8.2.2 POLYESTER

8.2.3 POLYPROPYLENE

8.2.4 OTHERS

8.3 NATURAL FIBER

8.3.1 WOOL

8.3.2 COTTON

8.3.3 SISAL

8.3.4 SEAGRASS

8.3.5 JUTE

8.3.6 COIR

8.3.7 OTHERS

9 NORTH AMERICA CARPETS AND RUGS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 RESIDENTIAL

9.2.1 SINGLE-FAMILY HOMES

9.2.2 CONDOMINIUMS

9.2.3 TOWNHOUSE

9.2.4 MULTI-FAMILY HOME

9.2.5 OTHERS

9.3 COMMERCIAL

9.3.1 COMMERCIAL BUILDINGS

9.3.2 PUBLIC BUILDINGS

9.3.3 RETAIL

9.3.4 LEISURE & HOSPITALITY

9.3.5 HEALTHCARE

9.3.6 EDUCATION

9.3.7 OTHERS

10 NORTH AMERICA CARPETS AND RUGS MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 OFFLINE

10.2.1 SPECIALTY STORES

10.2.2 SUPERMARKET/HYPERMARKETS

10.2.3 HOME CENTERS

10.2.4 OTHERS

10.3 ONLINE

11 NORTH AMERICA CARPETS AND RUGS MARKET, BY COUNTRY

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA CARPETS AND RUGS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 MOHAWK INDUSTRIES, INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 SHAW INDUSTRIES GROUP, INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 PRODUCT PORTFOLIO

14.2.3 RECENT DEVELOPMENTS

14.3 MANNINGTON MILLS, INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 RECENT DEVELOPMENTS

14.4 INTERFACE, INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 THE DIXIE GROUP, INC.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENTS

14.6 AMER RUGS

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 AXMINSTER CARPETS

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 BEAULIEU INTERNATIONAL GROUP

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 BELYSSE

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 BRINTONS CARPETS LIMITED

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 FLOOR COVERINGS INTERNATIONAL

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 HAIMA GROUP

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 HOUSE OF TAI PING

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENT

14.14 INTER IKEA SYSTEMS B.V.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 MILLIKEN

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 ORIENTAL WEAVERS

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 STEVENS OMNI

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 TARKETT

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

14.19 VICTORIA PLC

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 RECYCLED CONTENT FOR CARPET

TABLE 2 NORTH AMERICA CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 3 NORTH AMERICA CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (MILLION SQ FT)

TABLE 4 NORTH AMERICA CARPET IN CARPETS AND RUGS MARKET, BY CARPET TYPE, 2022-2031 (USD MILLION)

TABLE 5 NORTH AMERICA RUGS IN CARPETS AND RUGS MARKET, BY RUGS TYPE, 2022-2031 (USD MILLION)

TABLE 6 NORTH AMERICA CARPETS AND RUGS MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 7 NORTH AMERICA CARPETS AND RUGS MARKET, BY PRODUCT, 2022-2031 (MILLION SQ FT)

TABLE 8 NORTH AMERICA CARPETS AND RUGS MARKET, BY RAW MATERIAL, 2022-2031 (USD MILLION)

TABLE 9 NORTH AMERICA CARPETS AND RUGS MARKET, BY RAW MATERIAL, 2022-2031 (MILLION SQ FT)

TABLE 10 NORTH AMERICA SYNTHETIC FIBER IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 11 NORTH AMERICA NATURAL FIBER IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 12 NORTH AMERICA CARPETS AND RUGS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 13 NORTH AMERICA RESIDENTIAL FIBER IN CARPETS AND RUGS MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 14 NORTH AMERICA COMMERCIAL IN CARPETS AND RUGS MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 15 NORTH AMERICA CARPETS AND RUGS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 16 NORTH AMERICA OFFLINE IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 17 NORTH AMERICA CARPETS AND RUGS MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 18 NORTH AMERICA CARPETS AND RUGS MARKET, BY COUNTRY, 2022-2031 (MILLION SQ FT)

TABLE 19 U.S. CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 20 U.S. CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (MILLION SQ FT)

TABLE 21 U.S. CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 22 U.S. CARPET IN CARPETS AND RUGS MARKET, BY CARPET TYPE, 2022-2031 (USD MILLION)

TABLE 23 U.S. RUGS IN CARPETS AND RUGS MARKET, BY RUGS TYPE, 2022-2031 (USD MILLION)

TABLE 24 U.S. CARPETS AND RUGS MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 25 U.S. CARPETS AND RUGS MARKET, BY PRODUCT, 2022-2031 (MILLION SQ FT)

TABLE 26 U.S. CARPETS AND RUGS MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 27 U.S. CARPETS AND RUGS MARKET, BY RAW MATERIAL, 2022-2031 (USD MILLION)

TABLE 28 U.S. CARPETS AND RUGS MARKET, BY RAW MATERIAL, 2022-2031 (MILLION SQ FT)

TABLE 29 U.S. CARPETS AND RUGS MARKET, BY RAW MATERIAL, 2022-2031 (ASP)

TABLE 30 U.S. SYNTHETIC FIBER IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 31 U.S. NATURAL FIBER IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 32 U.S. CARPETS AND RUGS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 33 U.S. RESIDENTIAL FIBER IN CARPETS AND RUGS MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 34 U.S. COMMERCIAL IN CARPETS AND RUGS MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 35 U.S. CARPETS AND RUGS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 36 U.S. OFFLINE IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 37 CANADA CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 38 CANADA CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (MILLION SQ FT)

TABLE 39 CANADA CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 40 CANADA CARPET IN CARPETS AND RUGS MARKET, BY CARPET TYPE, 2022-2031 (USD MILLION)

TABLE 41 CANADA RUGS IN CARPETS AND RUGS MARKET, BY RUGS TYPE, 2022-2031 (USD MILLION)

TABLE 42 CANADA CARPETS AND RUGS MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 43 CANADA CARPETS AND RUGS MARKET, BY PRODUCT, 2022-2031 (MILLION SQ FT)

TABLE 44 CANADA CARPETS AND RUGS MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 45 CANADA CARPETS AND RUGS MARKET, BY RAW MATERIAL, 2022-2031 (USD MILLION)

TABLE 46 CANADA CARPETS AND RUGS MARKET, BY RAW MATERIAL, 2022-2031 (MILLION SQ FT)

TABLE 47 CANADA CARPETS AND RUGS MARKET, BY RAW MATERIAL, 2022-2031 (ASP)

TABLE 48 CANADA SYNTHETIC FIBER IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 49 CANADA NATURAL FIBER IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 50 CANADA CARPETS AND RUGS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 51 CANADA RESIDENTIAL FIBER IN CARPETS AND RUGS MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 52 CANADA COMMERCIAL IN CARPETS AND RUGS MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 53 CANADA CARPETS AND RUGS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 54 CANADA OFFLINE IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 55 MEXICO CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 56 MEXICO CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (MILLION SQ FT)

TABLE 57 MEXICO CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 58 MEXICO CARPET IN CARPETS AND RUGS MARKET, BY CARPET TYPE, 2022-2031 (USD MILLION)

TABLE 59 MEXICO RUGS IN CARPETS AND RUGS MARKET, BY RUGS TYPE, 2022-2031 (USD MILLION)

TABLE 60 MEXICO CARPETS AND RUGS MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 61 MEXICO CARPETS AND RUGS MARKET, BY PRODUCT, 2022-2031 (MILLION SQ FT)

TABLE 62 MEXICO CARPETS AND RUGS MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 63 MEXICO CARPETS AND RUGS MARKET, BY RAW MATERIAL, 2022-2031 (USD MILLION)

TABLE 64 MEXICO CARPETS AND RUGS MARKET, BY RAW MATERIAL, 2022-2031 (MILLION SQ FT)

TABLE 65 MEXICO CARPETS AND RUGS MARKET, BY RAW MATERIAL, 2022-2031 (ASP)

TABLE 66 MEXICO SYNTHETIC FIBER IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 67 MEXICO NATURAL FIBER IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 68 MEXICO CARPETS AND RUGS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 69 MEXICO RESIDENTIAL FIBER IN CARPETS AND RUGS MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 70 MEXICO COMMERCIAL IN CARPETS AND RUGS MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 71 MEXICO CARPETS AND RUGS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 72 MEXICO OFFLINE IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA CARPETS AND RUGS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA CARPETS AND RUGS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA CARPETS AND RUGS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA CARPETS AND RUGS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA CARPETS AND RUGS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA CARPETS AND RUGS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA CARPETS AND RUGS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA CARPETS AND RUGS MARKET: MULTIVARIATE MODELLING

FIGURE 9 NORTH AMERICA CARPETS AND RUGS MARKET: TYPE TIMELINE CURVE

FIGURE 10 NORTH AMERICA CARPETS AND RUGS MARKET: APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA CARPETS AND RUGS MARKET: SEGMENTATION

FIGURE 12 INCREASING DEMAND FOR INTERIOR IN COMMERCIAL SPACE IS EXPECTED TO DRIVE THE GROWTH OF THE NORTH AMERICA CARPETS AND RUGS MARKET IN THE FORECAST PERIOD

FIGURE 13 CARPET IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA CARPETS AND RUGS MARKET FROM 2024 AND 2031

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA CARPETS AND RUGS MARKET

FIGURE 15 NORTH AMERICA CARPETS AND RUGS MARKET: TYPE, 2023

FIGURE 16 NORTH AMERICA CARPETS AND RUGS MARKET: PRODUCT, 2023

FIGURE 17 NORTH AMERICA CARPETS AND RUGS MARKET: RAW MATERIAL, 2023

FIGURE 18 NORTH AMERICA CARPETS AND RUGS MARKET: APPLICATION, 2023

FIGURE 19 NORTH AMERICA CARPETS AND RUGS MARKET: DISTRIBUTION CHANNEL, 2023

FIGURE 20 NORTH CARPETS AND RUGS MARKET: SNAPSHOT (2023)

FIGURE 21 NORTH AMERICA CARPETS AND RUGS MARKET: COMPANY SHARE 2023 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.