North America Bladder Disorders Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

4,332.44 Million

USD

10,554.59 Million

2021

2029

USD

4,332.44 Million

USD

10,554.59 Million

2021

2029

| 2022 –2029 | |

| USD 4,332.44 Million | |

| USD 10,554.59 Million | |

|

|

|

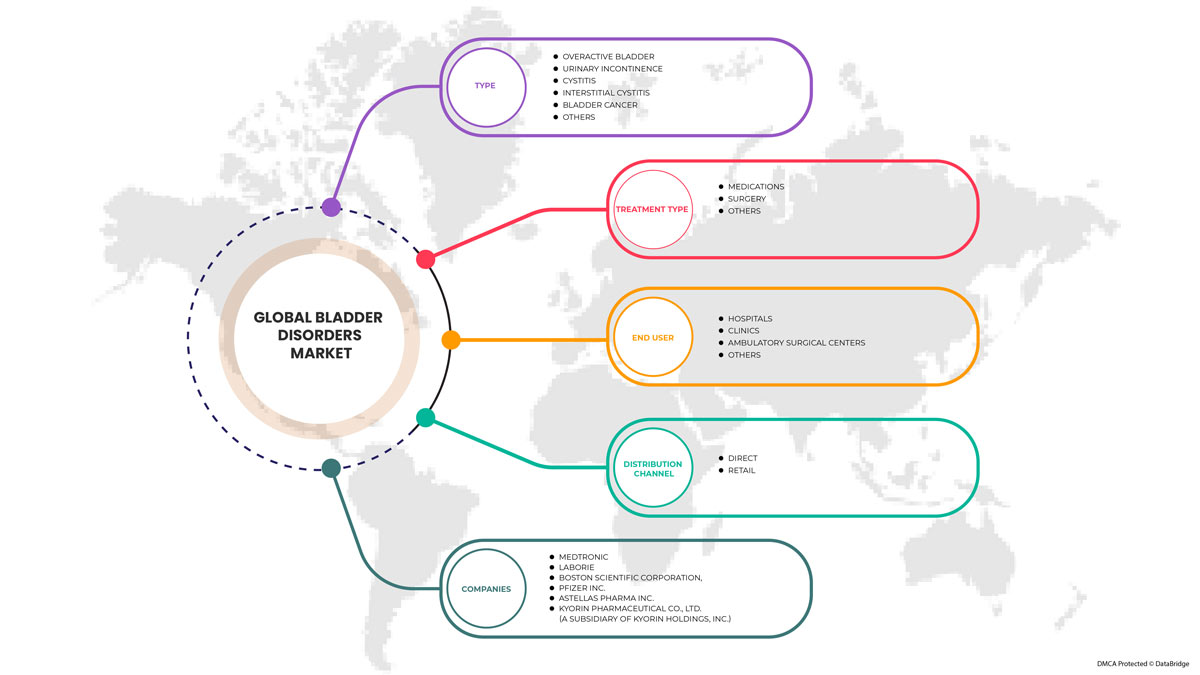

Mercado de trastornos de la vejiga en América del Norte, por tipo (cistitis, incontinencia urinaria, vejiga hiperactiva, cistitis intersticial , cáncer de vejiga), tipo de tratamiento (cirugía, medicación, no quirúrgico), usuario final (hospitales, clínicas, centros de cirugía ambulatoria, otros), canal de distribución (directo, minorista) - Tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado de trastornos de la vejiga en América del Norte

Los trastornos de la vejiga son un grupo de trastornos que pueden afectar la actividad diaria de la vida humana. Algunos de los trastornos de la vejiga más comunes son la cistitis, en la que la vejiga se infecta y causa inflamación; la incontinencia urinaria (pérdida del control de la vejiga); la cistitis intersticial (dolor de vejiga y micción frecuente y urgente); y la vejiga hiperactiva (una afección en la que la vejiga comprime la orina). Los trastornos de la vejiga pueden afectar la calidad de vida y causar otros problemas de salud. Los cambios y problemas de salud, incluidos los factores del sistema nervioso y del estilo de vida, pueden causar o contribuir a la IU en hombres y mujeres.

Los trastornos de vejiga más comunes son la vejiga hiperactiva y la incontinencia urinaria. Estos problemas están asociados con el sistema nervioso. Los nervios transmiten mensajes desde el cerebro hasta la vejiga, indicando que los músculos se contraen o se relajan.

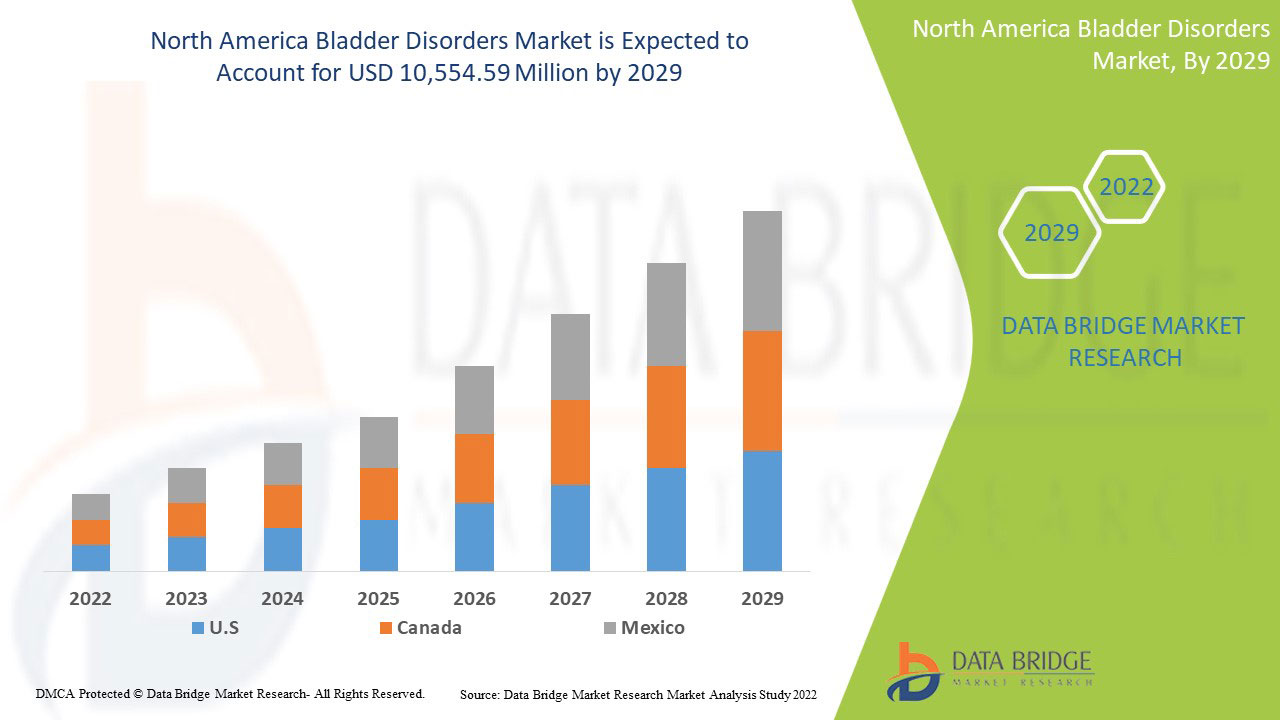

Se espera que el mercado de trastornos de la vejiga en América del Norte crezca en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 11,8% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 10.554,59 millones para 2029 desde USD 4.332,44 millones en 2021.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable 2019-2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD |

|

Segmentos cubiertos |

Por tipo (cistitis, incontinencia urinaria, vejiga hiperactiva, cistitis intersticial, cáncer de vejiga), tipo de tratamiento (cirugía, medicación, no quirúrgico), usuario final (hospitales, clínicas, centros de cirugía ambulatoria, otros), canal de distribución (directo, minorista) |

|

Países cubiertos |

Estados Unidos, Canadá, México |

|

Actores del mercado cubiertos |

Las principales empresas que operan en el mercado son Medtronic, Laborie, Boston Scientific Corporation, Pfizer Inc., Astellas Pharma Inc., KYORIN Pharmaceutical Co., Ltd. (una subsidiaria de KYORIN Holdings, Inc.), Bristol-Myers Squibb Company, una subsidiaria de Johnson & Johnson Services, Inc., Axonics, Inc., Merck & Co., Inc., Viatris Inc., Blue Wind Medical, Valencia Technologies, Gaylord Chemical Company, LLC, Coloplast Corp, AbbVie Inc., Sun Pharmaceutical Industries Ltd., Zydus Group, Urovant Sciences, entre otras. |

Definición del mercado de trastornos de la vejiga en América del Norte

Los trastornos relacionados con la vejiga incluyen cistitis (inflamación de la vejiga, a menudo causada por una infección), incontinencia urinaria (pérdida del control de la vejiga), vejiga hiperactiva (una afección en la que la vejiga expulsa la orina en el momento equivocado), cistitis intersticial (un problema crónico que causa dolor de vejiga y micción frecuente y urgente) y cáncer de vejiga.

Los médicos realizan diferentes pruebas para diagnosticar el trastorno de la vejiga, que incluyen radiografías, análisis de orina y un examen de la pared de la vejiga con un instrumento llamado cistoscopio. El tratamiento del trastorno depende de la causa del problema e incluye medicamentos, cirugías (en casos graves) y procedimientos no quirúrgicos.

Los medicamentos anticolinérgicos son la primera línea de farmacoterapia en el síndrome de vejiga hiperactiva (VHA). La VHA es un síntoma clínico que se caracteriza por la urgencia de orinar, que es difícil de posponer; por lo general, se considera que la frecuencia de orinar más de ocho veces al día forma parte de la VHA. Los medicamentos anticolinérgicos inhiben los receptores muscarínicos en el músculo detrusor que reducen la contractilidad de la vejiga. Para reducir los efectos secundarios, se están desarrollando nuevos medicamentos con una selectividad vesical mejorada y formulaciones de liberación prolongada. La mayoría de los medicamentos más recientes son igualmente eficaces para reducir los síntomas de la vejiga hiperactiva.

Dinámica del mercado de trastornos de la vejiga en América del Norte

Conductores

-

INICIATIVAS ESTRATÉGICAS ADOPTADAS POR LOS AGENTES DEL MERCADO

Los trastornos de la vejiga son una serie de problemas de la vejiga que pueden afectar las actividades físicas diarias. Los trastornos de la vejiga más comunes son la cistitis, la cistitis intersticial, la vejiga hiperactiva, la incontinencia urinaria y el cáncer de vejiga. La mayoría de los problemas de vejiga son causados por una infección bacteriana que ingresa en el tracto urinario.

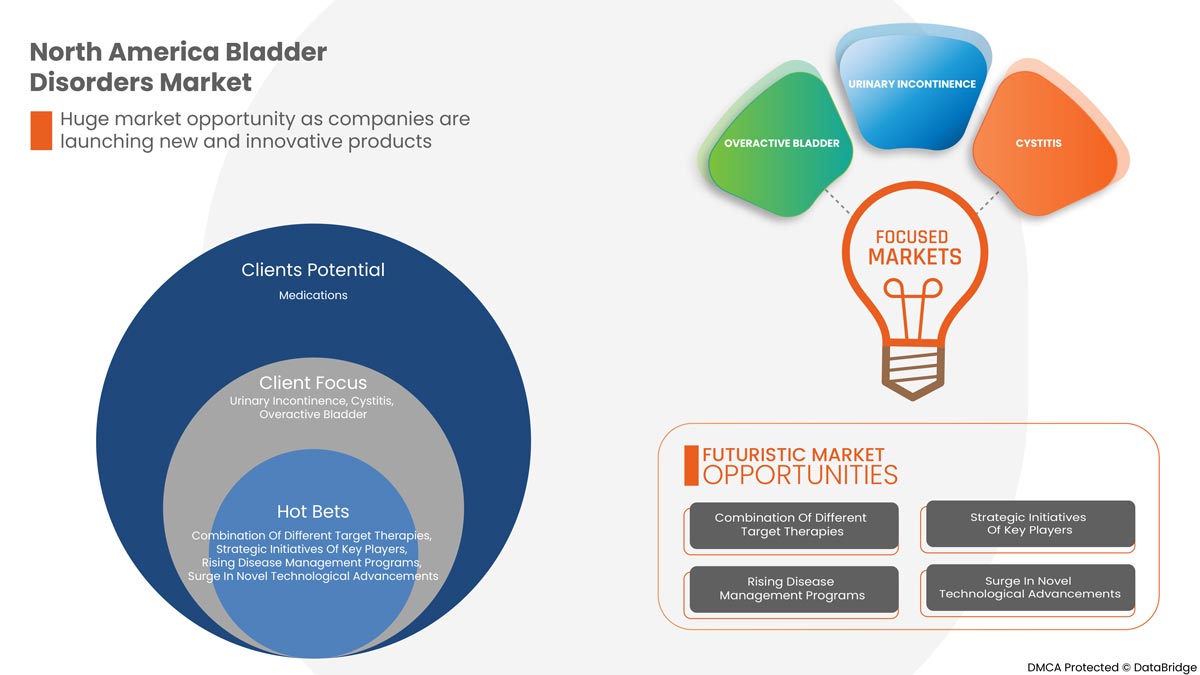

Varias iniciativas estratégicas de los actores del mercado en términos de colaboración, adquisición, asociación y otros, les permiten aumentar la cartera de productos de su empresa, lo que lleva a la expansión del mercado y, por lo tanto, mejora la demanda de productos entre los clientes, lo que en última instancia proporciona a los actores del mercado la posibilidad de obtener los máximos ingresos.

-

CRECIMIENTO DE LA POBLACIÓN GERIÁTRICA

El envejecimiento es un factor de riesgo importante que puede asociarse con trastornos relacionados con la vejiga. El envejecimiento provoca cambios neurológicos, anatómicos y bioquímicos en la función de la vejiga, lo que puede predisponer al desarrollo de VAH. La vejiga hiperactiva es el problema más común entre la población geriátrica. La población que envejece sufre diversos problemas y trastornos asociados con la vejiga, por lo que son los usuarios predominantes de servicios y soluciones de gestión de la salud crónica.

Según el estudio Noble, la tasa de prevalencia de vejiga hiperactiva es de aproximadamente 16,9 en mujeres y hombres, alrededor del 16,0%, y la prevalencia de VAH está creciendo con la edad. Sin embargo, las pautas de tratamiento especifican las estrategias de terapia de primera, segunda y tercera línea preferidas para la VAH. Los trastornos de la vejiga están asociados con los trastornos neurológicos como la demencia y en este grupo de edad la VAH es un gran desafío para la población de edad avanzada. En las últimas décadas, la población de edad avanzada ha estado creciendo drásticamente en todo el mundo.

-

AUMENTO DE LAS INVERSIONES EN I+D Y LANZAMIENTO DE NUEVAS TERAPIAS EN LOS PRÓXIMOS AÑOS

Existen diversas opciones de tratamiento y terapias innovadoras para la vejiga hiperactiva y otros trastornos de la vejiga. Muchas compañías biofarmacéuticas y farmacéuticas están invirtiendo en diversas terapias no convencionales para los trastornos de la vejiga, que se espera que se lancen durante el período de pronóstico.

-

COMBINACIÓN DE DIFERENTES TERAPIAS OBJETIVO

Las terapias combinadas son mucho más efectivas que la monoterapia y no tienen efectos secundarios adicionales. Las terapias combinadas son una alternativa segura y efectiva para las personas con afecciones de vejiga refractarias. La combinación de diferentes estrategias de terapia dirigida es el mejor enfoque para aliviar a los pacientes con trastornos de vejiga. Se debe considerar la medicación oral y la terapia conductual para el tratamiento refractario de los pacientes. Existen varias terapias dirigidas avanzadas, como la neuromodulación sacra, la inyección intradetrusor de toxina botulínica A y la estimulación percutánea del nervio tibial. Estos son tratamientos avanzados y más efectivos en comparación con los agentes orales.

Oportunidades

-

AUMENTO DE NUEVOS AVANCES TECNOLÓGICOS

Las enfermedades crónicas se consideran una de las principales causas de muerte en los países en desarrollo de todo el mundo. Por lo tanto, la gestión sanitaria de las enfermedades crónicas es cada vez más importante entre los profesionales de la salud pública.

En la actualidad, el tratamiento de los trastornos de la vejiga se centra en ayudar a los pacientes con diversas alternativas de autocuidado y una variedad de servicios de consulta para educarlos sobre su estado de enfermedad y seguir adelante. Estas terapias también ayudan a los pacientes a superar el trauma emocional y la ansiedad, que pueden actuar como un mecanismo de contraprotección.

Los avances tecnológicos cada vez más importantes permiten a las organizaciones de atención médica explorar servicios y soluciones innovadores para el tratamiento de los trastornos crónicos de la vejiga. Como no es necesario que los pacientes permanezcan en el hospital durante un período prolongado, también se han reducido los costos y el volumen de pacientes. Además, la reducción de las visitas y las estadías en el hospital hace que este desarrollo sea conveniente para los adultos mayores. Teniendo en cuenta los aspectos favorables, muchas organizaciones y empresas están desarrollando e implementando las tecnologías más recientes para el tratamiento de enfermedades crónicas con el fin de mejorar los resultados de los pacientes.

-

AUMENTO DE LOS PROGRAMAS DE GESTIÓN DE ENFERMEDADES

Las personas con problemas de vejiga suelen necesitar más servicios médicos, como internaciones, visitas al médico y medicamentos recetados. El aumento de la cantidad de personas que viven más tiempo con muchos problemas crónicos, junto con el aumento de los gastos de atención médica, ha fomentado la implementación de mejores planes de atención médica.

El manejo de enfermedades es una estrategia que intenta mejorar la atención y al mismo tiempo reducir los gastos de atención de los enfermos crónicos. Los programas de manejo de enfermedades tienen como objetivo mejorar la salud de las personas con ciertos trastornos crónicos, como los trastornos de la vejiga, al tiempo que reducen la demanda de servicios médicos y los gastos asociados a las consecuencias que se pueden evitar, como las estancias en el hospital y las visitas de urgencia. Estos programas también incluyen información sobre los servicios y soluciones para el manejo de enfermedades crónicas. Estos programas se están volviendo muy populares debido a la creciente prevalencia de enfermedades crónicas en todo el mundo. Los gobiernos y las organizaciones de atención médica han organizado e implementado estas enfermedades crónicas con múltiples programas de manejo de enfermedades, como el cáncer de vejiga, la cistitis intersticial y los programas de manejo de la vejiga hiperactiva. Dado que los programas de manejo de enfermedades pueden mejorar significativamente las prácticas de autocuidado y reducir las visitas al hospital y los períodos de estadía en un grado más excelente, reciben más atención entre las personas.

Restricciones/Desafíos

Sin embargo, la dificultad para diagnosticar la enfermedad y el costo de los tratamientos y diagnósticos son altos debido a los procedimientos de varios puntos de control junto con las tecnologías y modalidades de alta tecnología para realizar los procedimientos. El costo del procedimiento generalmente aumenta debido al alto precio de los dispositivos tecnológicos avanzados utilizados en el tratamiento, lo que se espera que frene el crecimiento del mercado.

Este informe sobre el mercado de trastornos de la vejiga en América del Norte proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado por categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de trastornos de la vejiga en América del Norte, comuníquese con Data Bridge Market Research para obtener un informe de analista. Nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Impacto posterior al COVID-19 en el mercado de trastornos de la vejiga en América del Norte

La COVID-19 ha afectado positivamente al mercado. Los confinamientos y el aislamiento durante las pandemias complican el manejo de las enfermedades y la adherencia a la medicación. Por ello, el uso de diversos medicamentos de tratamiento ha aumentado ampliamente en la población mundial. Por tanto, la pandemia ha afectado positivamente a este mercado.

Desarrollo reciente

- En junio de 2022, Valencia Technologies Corporation anunció el producto de tecnología de neuromodulación implantable eCoin®, que está redefiniendo la prestación de terapias a largo plazo para el control de la vejiga, es un implante tibial para la incontinencia urinaria de urgencia (IUU). eCoin® recibió la aprobación previa a la comercialización (PMA) de la Administración de Alimentos y Medicamentos de los EE. UU. (FDA) en marzo de 2022, lo que lo convierte en el primer y único neuroestimulador tibial implantable aprobado por la FDA indicado para el tratamiento de la incontinencia urinaria de urgencia (IUU). Este nuevo producto ha ayudado a la empresa a aumentar su cartera.

Alcance del mercado de trastornos de la vejiga en América del Norte

El mercado de trastornos de la vejiga en América del Norte está segmentado por tipo, tipo de tratamiento, usuario final y canal de distribución. El crecimiento entre estos segmentos le ayudará a analizar segmentos de crecimiento reducido en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Cistitis

- Incontinencia urinaria

- Vejiga hiperactiva

- Cistitis intersticial

- Cáncer de vejiga

Según el tipo, el mercado de trastornos de la vejiga en América del Norte está segmentado en cistitis, incontinencia urinaria, vejiga hiperactiva, cistitis intersticial y cáncer de vejiga.

Tipo de tratamiento

- Cirugía

- Medicamentos

- Otros

Sobre la base del producto, el mercado de trastornos de la vejiga en América del Norte está segmentado en cirugía, medicación y otros.

Usuario final

- Hospital

- Clínicas

- Centros de Cirugía Ambulatoria

- Otros

Sobre la base de los usuarios finales, el mercado de trastornos de la vejiga en América del Norte está segmentado en hospitales, clínicas, centros de cirugía ambulatoria y otros.

Canal de distribución

- Directo

- Minorista

Sobre la base del canal de distribución, el mercado de trastornos de la vejiga en América del Norte está segmentado en directo y minorista.

Análisis y perspectivas regionales del mercado de trastornos de la vejiga en América del Norte

Se analiza el mercado de trastornos de la vejiga en América del Norte y se proporcionan información y tendencias sobre el tamaño del mercado por país, tipo, tipo de tratamiento, usuario final y canal de distribución como se menciona anteriormente.

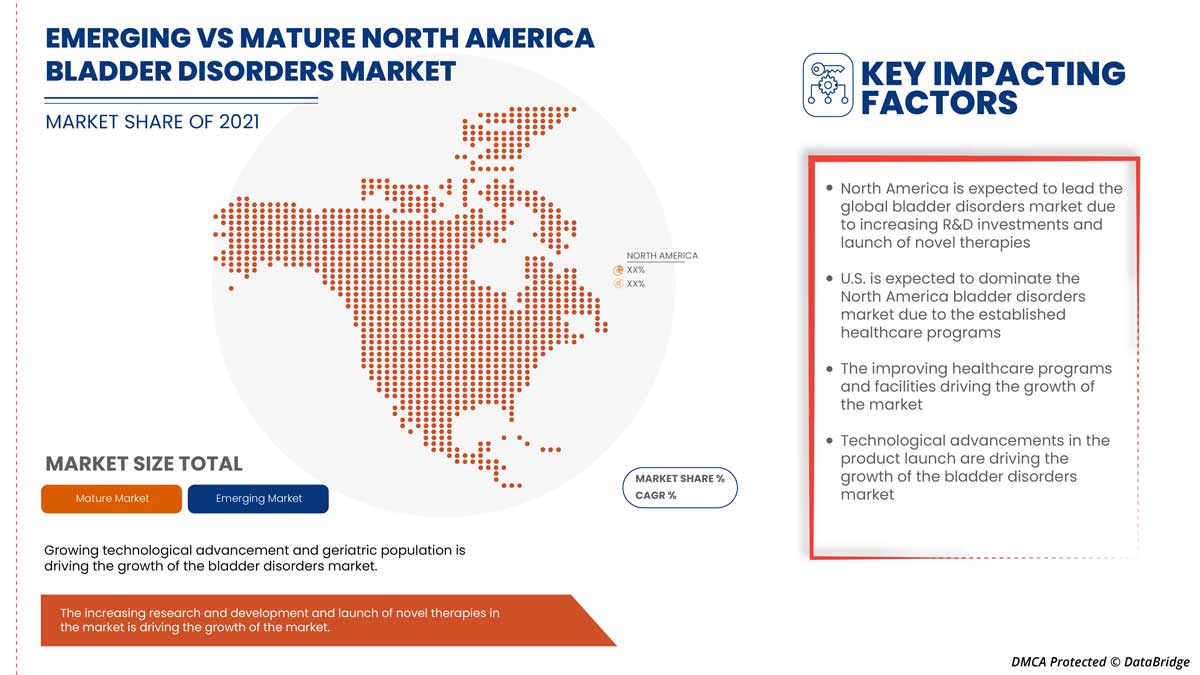

Los países que abarca este mercado son Estados Unidos, Canadá y México. Estados Unidos domina el mercado de trastornos de la vejiga en América del Norte en términos de participación de mercado e ingresos y seguirá aumentando su dominio durante el período de pronóstico. Esto se debe a la alta prevalencia del trastorno de vejiga hiperactiva en la región, y las crecientes inversiones en I+D y el lanzamiento de nuevas terapias están impulsando el mercado.

La sección de países del informe también proporciona factores de impacto individuales en el mercado y cambios en las regulaciones del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos, como las ventas de productos nuevos y de reemplazo, la demografía del país, la epidemiología de las enfermedades y los aranceles de importación y exportación, son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para cada país. Además, se consideran la presencia y disponibilidad de marcas de América del Norte y los desafíos que enfrentan debido a la alta competencia de las marcas locales y nacionales y el impacto de los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los trastornos de la vejiga en América del Norte

El panorama competitivo del mercado de trastornos de la vejiga en América del Norte proporciona detalles sobre los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la extensión de los productos y el dominio de las aplicaciones. Los puntos de datos anteriores solo están relacionados con el enfoque de la empresa en el mercado de trastornos de la vejiga en América del Norte.

Algunos de los principales actores que operan en el mercado de trastornos de la vejiga en América del Norte son Medtronic, Laborie, Boston Scientific Corporation, Pfizer Inc., Astellas Pharma Inc., KYORIN Pharmaceutical Co., Ltd. (una subsidiaria de KYORIN Holdings, Inc.), Bristol-Myers Squibb Company, Johnson & Johnson Services, Inc., Axonics, Inc., Merck & Co., Inc., Viatris Inc., Blue Wind Medical, Valencia Technologies, Gaylord Chemical Company, LLC, Coloplast Corp, AbbVie Inc., Sun Pharmaceutical Industries Ltd., Zydus Group, Swati Spentose, Urovant Sciences, entre otros.

Metodología de la investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. Los datos del mercado se analizan y estiman utilizando modelos estadísticos y coherentes del mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen la cuadrícula de posicionamiento de proveedores, el análisis de la línea de tiempo del mercado, la descripción general y la guía del mercado, la cuadrícula de posicionamiento de la empresa, el análisis de la participación de mercado de la empresa, los estándares de medición, NA frente a regional y el análisis de la participación de los proveedores. Solicite una llamada de un analista en caso de tener más consultas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA BLADDER DISORDERS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES

4.3 NORTH AMERICA BLADDER DISORDERS MARKET, PIPELINE ANALYSIS

5 NORTH AMERICA BLADDER DISORDER MARKET: REGULATIONS

5.1 THE U.S. REGULATORY FRAMEWORK FOR BLADDER DISOREDER MEDICATION

5.2 EUROPE REGULATORY FRAMEWORK FOR BLADDER DISORDER DRUGS

5.3 JAPAN REGULATORY GUIDANCE ON BLADDER DISORDER DRUGS

6 NORTH AMERICA BLADDER DISORDERS MARKET OVERVIEW

6.1 DRIVERS

6.1.1 STRATEGIC INITIATIVES ADOPTED BY MARKET PLAYERS

6.1.2 GROWING GERIATRIC POPULATION

6.1.3 RISING R&D INVESTMENTS AND LAUNCH OF NOVEL THERAPIES IN UPCOMING YEARS

6.1.4 COMBINATION OF DIFFERENT TARGET THERAPIES

6.2 RESTRAINTS

6.2.1 HIGH COST ASSOCIATED WITH BLADDER DISORDER DIAGNOSTIC TREATMENT

6.2.2 PRODUCTS RECALLS FROM MARKET

6.3 OPPORTUNITIES

6.3.1 SURGE IN NOVEL TECHNOLOGICAL ADVANCEMENTS

6.3.2 RISING DISEASE MANAGEMENT PROGRAMS

6.4 CHALLENGES

6.4.1 LACK OF AWARENESS ABOUT BLADDER DISORDERS RELATED PROBLEMS

6.4.2 PATENT EXPIRY OF DRUGS

7 NORTH AMERICA BLADDER DISORDERS MARKET, BY TYPE

7.1 OVERVIEW

7.2 OVERACTIVE BLADDER

7.3 URINARY INCONTINENCE

7.4 CYSTITIS

7.5 INTERSTITIAL CYSTITIS

7.6 BLADDER CANCER

7.7 OTHERS

8 NORTH AMERICA BLADDER DISORDERS MARKET, BY TREATMENT TYPE

8.1 OVERVIEW

8.2 MEDICATION

8.2.1 TOLTERODINE

8.2.2 MIRABEGRON

8.2.3 FESOTERODINE

8.2.4 OXYBUTYNIN

8.2.5 SOLIFENACIN

8.2.6 DARIFENACIN

8.2.7 TROSPIUM

8.2.8 OTHERS

8.3 SURGERY

8.3.1 SURGERY TO INCREASE BLADDER CAPACITY

8.3.2 BLADDER REMOVAL

8.3.3 OTHERS

8.4 OTHERS

9 NORTH AMERICA BLADDER DISORDERS MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 DIRECT

9.3 RETAIL

10 NORTH AMERICA BLADDER DISORDERS MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITALS

10.3 CLINICS

10.4 AMBULATORY SURGICAL CENTERS

10.5 OTHERS

11 NORTH AMERICA BLADDER DISORDERS MARKET, BY GEOGRAPHY

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA BLADDER DISORDERS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 MERCK AND CO. INC. (2021)

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 ASTELLAS PHARMA INC. (2021)

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 BRISTOL-MYERS SQUIBB COMPANY (2021)

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 BOSTON SCIENTIFIC CORPORATION (2021)

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 VIATRIS INC. (2021)

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 ABBVIE (2021)

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 AXONICS, INC. (2021)

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 BLUE WIND MEDICAL (2021)

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 COLOPLAST CORP. (2021)

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.1 GAYLORD CHEMICAL COMPANY, LLC (2021)

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 JOHNSON & JOHNSON SERVICES, INC. (2021)

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 KYORIN PHARMACEUTICAL CO., LTD. (A SUBSIDIARY OF KYORIN HOLDINGS, INC.) (2021)

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 LABORIE (2021)

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 MEDTRONIC (2021)

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 PFIZER INC. (2021)

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENTS

14.16 VALENCIA TECHNOLOGIES (2021)

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 SUN PHAMACEUTICAL INDUSTRIES LTD. (2021)

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENT

14.18 SWATI SPENTOSE (2021)

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 UROVANT SCIENCES (2021)

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 ZYDUS GROUP (2021)

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA BLADDER DISORDERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA OVERACTIVE BLADDER IN BLADDER DISORDERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA URINARY INCONTINENCE IN BLADDER DISORDERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA CYSTITIS IN BLADDER DISORDERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA INTERSTITIAL CYSTITIS IN BLADDER DISORDERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA BLADDER CANCER IN BLADDER DISORDERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA OTHERS IN BLADDER DISORDERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA BLADDER DISORDERS MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA MEDICATION IN BLADDER DISORDERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA MEDICATIONS IN BLADDER DISORDERS MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA SURGERY IN BLADDER DISORDERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA SURGERY IN BLADDER DISORDERS MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA OTHERS IN BLADDER DISORDERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA BLADDER DISORDERS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA DIRECT IN BLADDER DISORDERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA RETAIL IN BLADDER DISORDERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA BLADDER DISORDERS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA HOSPITALS IN BLADDER DISORDERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA CLINICS IN BLADDER DISORDERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN BLADDER DISORDERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA OTHERS IN BLADDER DISORDERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA BLADDER DISORDERS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA BLADDER DISORDERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA BLADDER DISORDERS MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA MEDICATIONS IN BLADDER DISORDERS MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA SURGERY IN BLADDER DISORDERS MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA BLADDER DISORDERS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA BLADDER DISORDERS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 29 U.S. BLADDER DISORDERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 U.S. BLADDER DISORDERS MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 31 U.S. MEDICATIONS IN BLADDER DISORDERS MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 32 U.S. SURGERY IN BLADDER DISORDERS MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 33 U.S. BLADDER DISORDERS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 34 U.S. BLADDER DISORDERS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 35 CANADA BLADDER DISORDERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 CANADA BLADDER DISORDERS MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 37 CANADA MEDICATIONS IN BLADDER DISORDERS MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 38 CANADA SURGERY IN BLADDER DISORDERS MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 39 CANADA BLADDER DISORDERS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 40 CANADA BLADDER DISORDERS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 41 MEXICO BLADDER DISORDERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 MEXICO BLADDER DISORDERS MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 43 MEXICO MEDICATIONS IN BLADDER DISORDERS MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 44 MEXICO SURGERY IN BLADDER DISORDERS MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 45 MEXICO BLADDER DISORDERS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 46 MEXICO BLADDER DISORDERS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA BLADDER DISORDERS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA BLADDER DISORDERS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA BLADDER DISORDERS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA BLADDER DISORDERS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA BLADDER DISORDERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA BLADDER DISORDERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA BLADDER DISORDERS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA BLADDER DISORDERS MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA BLADDER DISORDERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA BLADDER DISORDERS MARKET: SEGMENTATION

FIGURE 11 RISING EPIDEMIC AND PANDEMIC OUTBREAK AND INCREASING PREVALENCE OF BLADDER DISORDERS EXPECTED TO DRIVE THE NORTH AMERICA BLADDER DISORDERS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 OVERACTIVE BLADDER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA BLADDER DISORDERS MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA BLADDER DISORDER MARKET

FIGURE 14 NORTH AMERICA BLADDER DISORDERS MARKET: BY TYPE, 2021

FIGURE 15 NORTH AMERICA BLADDER DISORDERS MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 16 NORTH AMERICA BLADDER DISORDERS MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 17 NORTH AMERICA BLADDER DISORDERS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA BLADDER DISORDERS MARKET: BY TREATMENT TYPE, 2021

FIGURE 19 NORTH AMERICA BLADDER DISORDERS MARKET: BY TREATMENT TYPE, 2022-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA BLADDER DISORDERS MARKET: BY TREATMENT TYPE, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA BLADDER DISORDERS MARKET: BY TREATMENT TYPE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA BLADDER DISORDERS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 23 NORTH AMERICA BLADDER DISORDERS MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA BLADDER DISORDERS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA BLADDER DISORDERS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 26 NORTH AMERICA BLADDER DISORDERS MARKET: BY END USER, 2021

FIGURE 27 NORTH AMERICA BLADDER DISORDERS MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA BLADDER DISORDERS MARKET: BY END USER, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA BLADDER DISORDERS MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 NORTH AMERICA BLADDER DISORDERS MARKET: SNAPSHOT (2021)

FIGURE 31 NORTH AMERICA BLADDER DISORDERS MARKET: BY COUNTRY (2021)

FIGURE 32 NORTH AMERICA BLADDER DISORDERS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 33 NORTH AMERICA BLADDER DISORDERS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 34 NORTH AMERICA BLADDER DISORDERS MARKET: BY TYPE (2022-2029)

FIGURE 35 NORTH AMERICA BLADDER DISORDERS MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.