North America Bioinformatics Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

| 2015 –0 | |

|

|

|

|

Mercado de bioinformática de América del Norte, por tipo (herramientas de gestión del conocimiento, software y servicios de bioinformática), sector (biotecnología médica, académicos, biotecnología animal, biotecnología agrícola, biotecnología ambiental, biotecnología forense y otros), aplicación (genómica y desarrollo de fármacos, proteómica, estudios evolutivos, estudios agrícolas, ciencias veterinarias, metabolómica , transcriptómica y otros), modo de compra (compra grupal y compra individual), método (genómica y proteómica), usuario final (institutos de investigación y académicos, organización de investigación clínica, empresas biotecnológicas y farmacéuticas, laboratorios de investigación, hospital y otros) - Tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado de bioinformática en América del Norte

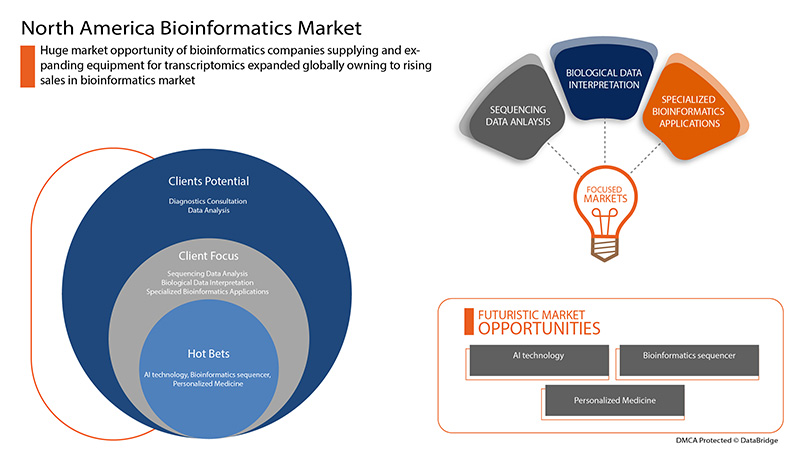

Los factores que impulsan el crecimiento del mercado de la bioinformática son el menor coste de la secuenciación genética por base, la creciente necesidad de bioinformática, la amplia cartera de productos que ofrecen los principales actores del mercado y el uso de la bioinformática en la medicina personalizada, así como el aumento de la financiación de los sectores público y privado para la bioinformática. Sin embargo, los factores que se espera que limiten el crecimiento del mercado son el aumento del coste de la instrumentación, la dificultad del análisis bioinformático clínico y la ciberseguridad en la bioinformática.

Por otra parte, las iniciativas estratégicas de los actores del mercado, el desarrollo de productos, los avances en la tecnología bioinformática y el aumento del gasto sanitario pueden actuar como una oportunidad para el crecimiento del mercado de la bioinformática. Sin embargo, la necesidad de conocimientos especializados, los desafíos en la implementación de la tecnología bioinformática en los laboratorios clínicos y la aprobación regulatoria pueden crear desafíos para el mercado de la bioinformática. Hay desarrollos recientes relacionados con el mercado mundial de la bioinformática.

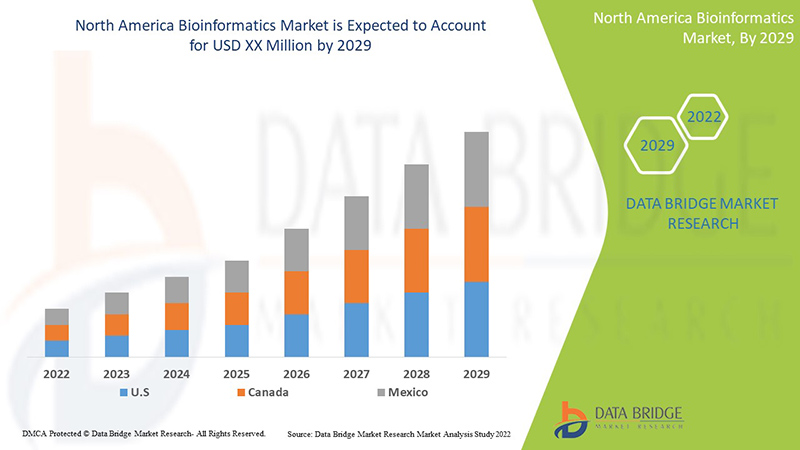

Se espera que la creciente demanda del uso de la bioinformática en el desarrollo y diseño de fármacos impulse el crecimiento del mercado en América del Norte. Data Bridge Market Research analiza que el mercado de la bioinformática en América del Norte crecerá a una tasa compuesta anual del 21,8 % durante el período de pronóstico de 2022 a 2029.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Por tipo (herramientas de gestión del conocimiento, software y servicios de bioinformática), sector (biotecnología médica, académica, biotecnología animal, biotecnología agrícola, biotecnología ambiental, biotecnología forense y otras), aplicación (genómica y desarrollo de fármacos, proteómica, estudios evolutivos, estudios agrícolas, ciencias veterinarias, metabolómica, transcriptómica y otras), modo de compra (compra grupal y compra individual), método (genómica y proteómica), usuario final (institutos de investigación y académicos, organización de investigación clínica, empresas biotecnológicas y farmacéuticas, laboratorios de investigación, hospitales y otros) |

|

Países cubiertos |

Estados Unidos, Canadá y México |

|

Market Players Covered |

Thermo Fisher Scientific Inc., Illumina, Inc., Agilent Technologies, Inc., QIAGEN, SOPHiA GENETICS., BGI, Eurofins Scientific, Water Corporation, Partek Incorporated, DNASTAR, Dassault Systèmes, Bayer AG, DNANEXUS, INC., PerkinElmer Inc., Seven Bridges Genomics, Quest Diagnostics Incorporated., AstridBio Technologies Inc., BioBam, GenoFAB, Inc. Among others |

Market Definition

Bioinformatics combines computer programming, big data, and Molecular Biology, which enables scientists to understand and identify patterns in biological data. It is particularly useful in studying genomes and DNA sequencing, as it allows scientists to organize large amounts of data.

From genetics to toxicology to mycology and radiobiology, there are scores of branches of Biology to specialize in. And out of the many, Bioinformatics is one of the intriguing fields which enables you to identify, evaluate, store, and retrieve biological information. Being an interdisciplinary field of study, it incorporates various applications of Computer Science, Statistics, and Biology to develop software applications for understanding biological data like DNA sequencing, protein analysis, evolutionary genetics, etc.

In the coming future, important decisions related to bioinformatics on drug discovery will be made by individuals who not only understand the biology but can also use the bioinformatics tools and the knowledge they release to develop hypotheses and identify quality targets

North America Bioinformatics Market Dynamics

Drivers

- Decrease in The Cost of Genetic Sequencing Per Base

Oral health is one of the most important aspects of maintaining the health of gums, teeth and the oral-facial system, which allows for speaking, chewing and smiling. According to World Health Organization's report on March 25th, 2020, around 2.3 billion people worldwide are suffering from caries of a permanent tooth, among which around 530 million children suffer from caries of the primary tooth. In North America, periodontal disease has a high prevalence among all age groups. Thereby due to rising periodontal dental disorders, the availability and usage of intraoral scanners are anticipated to boost the market's growth.

- Growing Need for Bioinformatics

As genomics-focused pharmacology continues to play a greater role in the treatment of various chronic diseases, especially cancer, next-generation sequencing (NGS) is evolving as a powerful tool for providing a deeper and more precise insight into the molecular underpinnings of individual tumors and specific receptors. Informatics is essential in biological research involving biologists who learn programming, computer programmers, mathematicians, or database managers who learn the foundations of biology.

Opportunities

- Product Development in Recent Years

The growth curve for bioinformatics market clinical applications is following an upward trend as established applications are gaining momentum and new ones are finding a foothold. Product development in the past years has helped the market size to grow. This also shows the support of the regulatory agency for allowing these products in the market.

For instance-

- In June 2021, Agilent Technologies, Inc. released a new exome design called Sure Select Human All Exon V8 that offers specific content and current coverage of protein-coding areas from Refuses, CCDS and GENCODE. Additionally, it includes exons that are challenging to capture and the TERT promoter, which are neglected by competing exomes

The product development in recent years has shown the potential of these technologies and the companies working in this market are trying to get the more advanced product in the market, which is expected to create a lucrative opportunity for market growth in the forecast period.

- Strategic Initiatives by Market Players

The demand for bioinformatics is increasing in the market owing to the increased levels of research and development along with the growth of the bioinformatics services market aided by the desire for innovative medications. Thus, the top market players have implemented a new strategy by developing new products and collaborating with other market players to improve business operations and profitability.

For instance-

- In January 2020, Charles River underwent a strategic alliance with FiOS Genomics to acquire knowledge in bioinformatics, statistics and biology to help with the collection and analysis of high-dimensional, multi-variant datasets related to drug development, such as microarrays, next-generation sequencing (NGS), proteomics, metabolomics and epigenetics, as well as the related meta-data

These strategic initiatives by the market players, including acquisition, conferences and focused segment product launches, are helping them grow and improve the company's product portfolio, ultimately leading to more revenue generation. Hence, these strategic initiatives by the market players may be expected to as an opportunity that is expected to drive market growth.

Restraints/Challenges

- Difficulty in Clinical Bioinformatics Analysis

The largely untapped potential of big data analytics is a feed buzz that has been exacerbated by the production of many next-generation data sets that seek to answer long-standing questions about the biology of human diseases. Although these approaches are likely to be a powerful means of unveiling new biological insights, several significant challenges currently hinder efforts to harness the power of big data. Typical challenges include the effective assessment of analytical software tools, the speeding up of the overall process using hybrid parallel computing (HPC) parallelization and acceleration technology, the advancement of automation strategies, data storage alternatives, and, finally, the development of new methods for the full utilization of results across multiple experimental conditions.

- Challenges to Implementing Bioinformatics Technology in The Clinical Labs

Bioinformatics technologies can perform massively complicated biological data analysis. This capacity simultaneously facilitates the computational tools for the organization and analysis of biological data, which helps improve diagnostic screening. The application of these powerful technologies in a clinical laboratory poses a challenge because of the data's scope, quantity and medico-technical consequences.

Various challenges of implementing next-generation sequencing in the clinical laboratory are as follows-

- One of the first areas where problems can creep in is often the most overlooked: "sample quality". Although platforms are often tested and compared using highly curated samples (such as the reference material from the Genome in a Bottle Consortium), real-world samples often present much more of a challenge and hence act as a challenge for the rise in demand

- High turn-around time is also a major challenge for the instruments working in this market

COVID-19 Impact on the North America Bioinformatics Market

During the pandemic, the North Bioinformatics sector is one that focuses on using a combination of biology and information technology. At the heart of the industry is biological data, which is analyzed and transformed using IT techniques. Bioinformatics has always had huge potential in providing essential support to many areas of scientific research. The tools that Bioinformatics can provide allow scientists to get to grips with larger data sets and to mine and analyze them to discover crucial information that could lead to key discoveries. Genetics and genomes have been the primary focus of Bioinformatics in recent years, including comparative genomics, DNA microarrays, and functional genomics.

Recent Developments

- In March 2022, Thermo Fisher Scientific Inc launched the CE-IVD Marked Next-Generation Sequencing (NGS) Instrument for Use in Clinical Labs. The CE-IVD Marked Next-Generation Sequencing Instrument is used to perform diagnostic testing and clinical research on a single instrument. The launch of the instrument resulted in the addition of a new product in the product range and the distribution of the NGS instrument, which is expected to increase the product revenue.

North America Bioinformatics Market Scope

North America bioinformatics market is segmented on the basis of six segments: type, sector, application, purchase mode, genomics, and end user. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Knowledge Management Tools

- Bioinformatics Software

- Services

On the basis of type, the North America bioinformatics market is segmented into knowledge management tools, bioinformatics software, and services.

Sector

- Medical biotechnology

- Academics

- Animal Biotechnology

- Agricultural biotechnology

- Environmental Biotechnology

- Forensic biotechnology

- Others

On the basis of sector, the North America bioinformatics market is segmented into medical biotechnology, academics, animal biotechnology, agricultural biotechnology, environmental biotechnology, forensic biotechnology, and others.

Application

- Genomics and Drug Development

- Proteomics

- Evolutionary Studies

- Agricultural Studies

- Veterinary Science

- Metabolomics

- Transcriptomics

- Others

On the basis of application, the North America bioinformatics market is segmented into genomics and drug development, proteomics, evolutionary studies, agricultural studies, veterinary science, metabolomics, transcriptomics, and others.

Purchase Mode

- Group Purchase

- Individual Purchase

On the basis of purchase mode, the North America bioinformatics market is segmented into group purchases and individual purchases.

Method

- Genomics

- Proteomics

On the basis of method, the North America bioinformatics market is segmented into genomics and proteomics.

End User

- Research and Academic Institutes

- Clinical Research Organization

- Biotech and Pharmaceutical Companies

- Research Laboratories

- Hospital

- Others

On the basis of end-user, the North America Bioinformatics market is segmented into research and academic institutes, clinical research organizations, biotech and pharmaceutical companies, research laboratories, hospitals, and others.

Pipeline Analysis

North America Bioinformatics Market Regional Analysis/Insights

North America bioinformatics market is analyzed, and market size insights and trends are provided by regions, type, sector, application, purchase mode, genomics, and end-user. as referenced above.

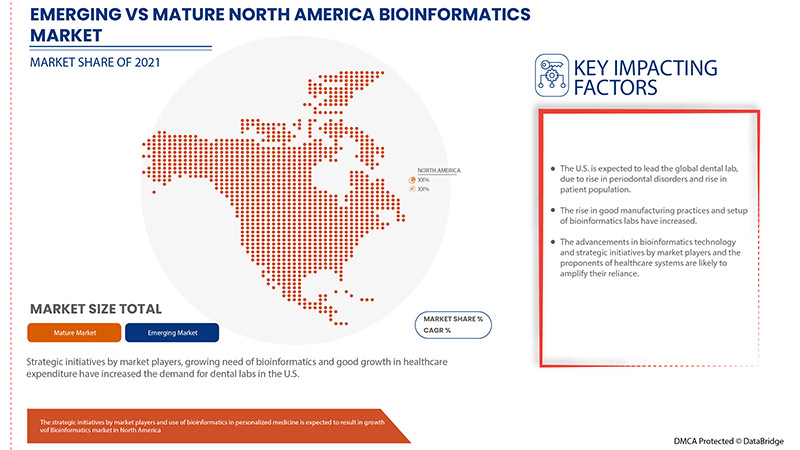

Los países incluidos en el informe sobre el mercado de bioinformática en América del Norte son Estados Unidos, Canadá y Nuevo México. Se espera que Estados Unidos domine el mercado debido al aumento de la incidencia de enfermedades periodontales, el aumento del turismo médico, el crecimiento de las innovaciones tecnológicas en bioinformática y el aumento de la actividad de investigación y desarrollo.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en las regulaciones en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, epidemiología de enfermedades y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas y sus desafíos enfrentados debido a la gran o escasa competencia de las marcas locales y nacionales que impactan en los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de la bioinformática en América del Norte

El panorama competitivo del mercado de bioinformática de América del Norte proporciona detalles sobre el competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de bioinformática de América del Norte.

Algunos de los principales actores que operan en el mercado de bioinformática de América del Norte son Thermo Fisher Scientific Inc., Illumina, Inc., Agilent Technologies, Inc., QIAGEN, SOPHiA GENETICS., BGI, Eurofins Scientific, Water Corporation, Partek Incorporated, DNASTAR, Dassault Systèmes, Bayer AG, DNANEXUS, INC., PerkinElmer Inc., Seven Bridges Genomics, Quest Diagnostics Incorporated., AstridBio Technologies Inc., BioBam, GenoFAB, Inc. entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA BIOINFORMATICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHIC SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 RESEARCH METHODOLOGY

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 MULTIVARIATE MODELLING

2.8 TYPE SEGMENT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 THE CATEGORY VS TIME GRID

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

5 REGULATIONS OF THE NORTH AMERICA BIOINFORMATICS MARKET

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 DECREASE IN THE COST OF GENETIC SEQUENCING PER BASE

6.1.2 GROWING NEED FOR BIOINFORMATICS

6.1.3 WIDE PRODUCT PORTFOLIO OFFERED BY MAJOR PLAYERS

6.1.4 USE OF BIOINFORMATICS IN PERSONALIZED MEDICINE

6.1.5 INCREASING PUBLIC-PRIVATE SECTOR FUNDING FOR BIOINFORMATICS

6.2 RESTRAINTS

6.2.1 HIGH COST OF INSTRUMENTATION

6.2.2 DIFFICULTY IN CLINICAL BIOINFORMATICS ANALYSIS

6.2.3 CYBER SECURITY CONCERNS IN BIOINFORMATICS

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVES BY THE KEY MARKET PLAYER

6.3.2 PRODUCT DEVELOPMENT IN RECENT YEARS

6.3.3 ADVANCEMENT IN BIOINFORMATICS TECHNOLOGY

6.4 CHALLENGES

6.4.1 LACK OF SKILLED PROFESSIONALS TO PERFORM BIOINFORMATICS TECHNOLOGY

6.4.2 CHALLENGES TO IMPLEMENTING BIOINFORMATICS TECHNOLOGY IN THE CLINICAL LABS

7 NORTH AMERICA BIOINFORMATICS MARKET, BY TYPE

7.1 OVERVIEW

7.2 SERVICES

7.2.1 DIAGNOSTICS CONSULTATION

7.2.2 DATA ANALYSIS

7.2.2.1 STRUCTURAL

7.2.2.2 FUNCTIONAL

7.3 BIOINFORMATICS SOFTWARE

7.3.1 INFORMATICS INFRASTRUCTURE AND PIPELINE SETUP

7.3.2 SAMPLE AND EXPERIMENT MANAGEMENT

7.3.3 SEQUENCING DATA ANALYSIS

7.3.3.1 SEQUENCE ANALYSIS PLATFORM

7.3.3.2 SEQUENCE ALIGNMENT PLATFORM

7.3.3.3 SEQUENCE MANIPULATION PLATFORM

7.3.3.4 STRUCTURAL ANALYSIS PLATFORM

7.3.3.5 OTHERS

7.3.4 BIOLOGICAL DATA INTERPRETATION

7.3.5 SPECIALIZED BIOINFORMATICS APPLICATIONS

7.3.5.1 SINGLE CELL GENE EXPRESSION

7.3.5.2 GENE EXPRESSION

7.3.5.3 VARIANT DETECTION

7.3.5.4 CNV ANALYSIS

7.3.5.5 METAGENOMICS

7.3.5.6 METHYLATION

7.3.5.7 CHIP-SEQ

7.3.5.8 NON-CODING RNA EXPRESSION

7.3.5.9 OTHERS

7.3.6 OTHERS

7.4 KNOWLEDGE MANAGEMENT TOOLS

7.4.1 GENERALIZED KNOWLEDGE MANAGEMENT TOOLS

7.4.2 SPECIALIZED KNOWLEDGE MANAGEMENT TOOLS

8 NORTH AMERICA BIOINFORMATICS MARKET, BY SECTOR

8.1 OVERVIEW

8.2 MEDICAL BIOTECHNOLOGY

8.3 ACADEMICS

8.4 ANIMAL BIOTECHNOLOGY

8.5 AGRICULTURAL BIOTECHNOLOGY

8.6 ENVIRONMENTAL BIOTECHNOLOGY

8.7 FORENSIC BIOTECHNOLOGY

8.8 OTHERS

9 NORTH AMERICA BIOINFORMATICS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 GENOMICS & DRUG DEVELOPMENT

9.2.1 SERVICES

9.2.2 SEQUENCING PLATFORMS

9.2.3 KNOWLEDGE MANAGEMENT TOOLS

9.2.4 GENOMICS & DRUG DEVELOPMENT BY TYPE

9.2.4.1 PREVENTIVE MEDICINE

9.2.4.2 MOLECULAR MEDICINE

9.2.4.3 PERSONALIZED MEDICINE

9.2.4.4 CHEMOINFORMATICS AND DRUG DESIGN

9.2.4.5 ANTIBIOTIC RESISTANCE

9.3 PROTEOMICS

9.3.1 SERVICES

9.3.2 SERVICES SEQUENCING PLATFORMS

9.3.3 KNOWLEDGE MANAGEMENT TOOLS

9.4 AGRICULTURAL STUDIES

9.4.1 SERVICES

9.4.2 SERVICES SEQUENCING PLATFORMS

9.4.3 KNOWLEDGE MANAGEMENT TOOLS

9.5 TRANSCRIPTOMICS

9.5.1 SERVICES

9.5.2 SERVICES SEQUENCING PLATFORMS

9.5.3 KNOWLEDGE MANAGEMENT TOOLS

9.6 METABOLOMICS

9.6.1 SERVICES

9.6.2 SERVICES SEQUENCING PLATFORMS

9.6.3 KNOWLEDGE MANAGEMENT TOOLS

9.7 EVOLUTIONARY STUDIES

9.7.1 SERVICES

9.7.2 SERVICES SEQUENCING PLATFORMS

9.7.3 KNOWLEDGE MANAGEMENT TOOLS

9.8 VETERINARY SCIENCE

9.8.1 SERVICES

9.8.2 SERVICES SEQUENCING PLATFORMS

9.8.3 KNOWLEDGE MANAGEMENT TOOLS

9.9 OTHERS

9.9.1 SERVICES

9.9.2 SERVICES SEQUENCING PLATFORMS

9.9.3 KNOWLEDGE MANAGEMENT TOOLS

10 NORTH AMERICA BIOINFORMATICS MARKET, BY PURCHASE MODE

10.1 OVERVIEW

10.2 GROUP PURCHASE

10.3 INDIVIDUAL PURCHASE

11 NORTH AMERICA BIOINFORMATICS MARKET, BY METHOD

11.1 OVERVIEW

11.2 GENOMICS

11.2.1 DNA

11.2.2 RNA

11.3 PROTEOMICS

12 NORTH AMERICA BIOINFORMATICS MARKET, BY END USER

12.1 OVERVIEW

12.2 RESEARCH AND ACADEMIC INSTITUTES

12.3 CLINICAL RESEARCH ORGANIZATION

12.4 BIOTECH AND PHARMACEUTICAL COMPANIES

12.5 RESEARCH LABORATORIES

12.6 HOSPITALS

12.7 OTHERS

13 NORTH AMERICA BIOINFORMATICS MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA BIOINFORMATICS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 BAYER AG

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 THERMO FISHER SCIENTIFIC INC

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 EUROFINS SCIENTIFIC

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 DASSAULT SYSTÈMES

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 AGILENT TECHNOLOGIES, INC

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ASTRIDBIO TECHNOLOGIES INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 BGI (A SUBSIDIARY OF BGI GROUP)

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 BIOBAM

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 DNANEXUS INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 DNASTAR

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 GENOFAB, INC

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 ILLUMINA, INC

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 PARTEK INCORPORATED

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 PERKINELMER INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 QIAGEN

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 QUEST DIAGNOSTICS INCORPORATED (2021)

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 SEVEN BRIDGES GENOMICS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 SOPHIA GENETICS

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 STRAND LIFE SCIENCES

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 WATERS CORPORATION

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 BIOINFORMATICSCOST PER SAMPLE

TABLE 2 NORTH AMERICA BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA SERVICES IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA SERVICES IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA SEQUENCING DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA SPECIALIZED BIOINFORMATICS APPLICATIONS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA MEDICAL BIOTECHNOLOGY IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA ACADEMICS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA ANIMAL TECHNOLOGY IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA AGRICULTURAL BIOTECHNOLOGY IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA ENVIRONMENTAL BIOTECHNOLOGY IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA FORENSIC BIOTECHNOLOGY IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA OTHERS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA GENOMICS & DRUG DEVELOPMENT BY TYPE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA PROTEOMICS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA PROTEOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA TRANSCRIPTOMICS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA TRANSCRIPTOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA METABOLOMICS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA METABOLOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA OTHERS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA OTHERS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA BIOINFORMATICS MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA GROUP PURCHASE IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA INDIVIDUAL PURCHASE IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA GENOMICS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA GENOMICS IN BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA PROTEOMICS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA BIOINFORMATICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA RESEARCH AND ACADEMIC INSTITUTES IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA CLINICAL RESEARCH ORGANIZATION IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA BIOTECH AND PHARMACEUTICAL COMPANIES IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA RESEARCH LABORATORIES IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA HOSPITALS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA OTHERS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA BIOINFORMATICS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA SERVICES IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA SEQUENCING DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA SPECIALIZED BIOINFORMATICS APPLICATIONS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA GENOMICS & DRUG DEVELOPMENT BY TYPE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA PROTEOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA METABOLOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA OTHERS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA BIOINFORMATICS MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA GENOMICS IN BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA. BIOINFORMATICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 75 U.S. BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 U.S. SERVICES IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 U.S. DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 U.S. BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 U.S. SEQUENCING DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 U.S. SPECIALIZED BIOINFORMATICS APPLICATIONS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 U.S. KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 U.S. BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 83 U.S. BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 U.S. GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 U.S. GENOMICS & DRUG DEVELOPMENT BY TYPE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 86 U.S. PROTEOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 87 U.S. AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 88 U.S. TRANSCRIPTOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 89 U.S. METABOLOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 U.S. EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 91 U.S. VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 U.S. OTHERS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 93 U.S. BIOINFORMATICS MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 94 U.S. BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 95 U.S GENOMICS IN BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 96 U.S. BIOINFORMATICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 97 CANADA BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 CANADA SERVICES IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 CANADA DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 CANADA BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 CANADA SEQUENCING DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 CANADA SPECIALIZED BIOINFORMATICS APPLICATIONS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 CANADA KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 CANADA BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 105 CANADA BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 106 CANADA GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 107 CANADA GENOMICS & DRUG DEVELOPMENT BY TYPE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 108 CANADA PROTEOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 CANADA AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 CANADA TRANSCRIPTOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 111 CANADA METABOLOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 112 CANADA EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 113 CANADA VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 114 CANADA OTHERS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 115 CANADA BIOINFORMATICS MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 116 CANADA BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 117 CANADA GENOMICS IN BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 118 CANADA BIOINFORMATICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 119 MEXICO BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 MEXICO SERVICES IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 MEXICO DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 MEXICO BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 MEXICO SEQUENCING DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 MEXICO SPECIALIZED BIOINFORMATICS APPLICATIONS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 MEXICO KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 MEXICO BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 127 MEXICO BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 128 MEXICO GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 129 MEXICO GENOMICS & DRUG DEVELOPMENT BY TYPE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 130 MEXICO PROTEOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 131 MEXICO AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 132 MEXICO TRANSCRIPTOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 133 MEXICO METABOLOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 MEXICO EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 135 MEXICO VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 MEXICO OTHERS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 137 MEXICO BIOINFORMATICS MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 138 MEXICO BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 139 MEXICO GENOMICS IN BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 140 MEXICO BIOINFORMATICS MARKET, BY END USER, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA BIOINFORMATICS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA BIOINFORMATICS MARKET: GEOGRAPHIC SCOPE

FIGURE 3 NORTH AMERICA BIOINFORMATICS MARKET: DATA TRIANGULATION

FIGURE 4 NORTH AMERICA BIOINFORMATICS MARKET: SNAPSHOT

FIGURE 5 NORTH AMERICA BIOINFORMATICS MARKET: BOTTOM-UP APPROACH

FIGURE 6 NORTH AMERICA BIOINFORMATICS MARKET: TOP-DOWN APPROACH

FIGURE 7 NORTH AMERICA BIOINFORMATICS MARKET: INTERVIEWS BY REGION AND DESIGNATION

FIGURE 8 NORTH AMERICA BIOINFORMATICS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA BIOINFORMATICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA BIOINFORMATICS MARKET: APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA BIOINFORMATICS MARKET: THE CATEGORY VS TIME GRID

FIGURE 12 NORTH AMERICA BIOINFORMATICS MARKET SEGMENTATION

FIGURE 13 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE NORTH AMERICA DENTAL LABMARKET AND IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 GROWING APPLICATIONS OF BIOINFORMATICS AND LOW COST OF BIOINFORMATICS SEQUENCING ARE EXPECTED TO DRIVE THE MARKET FOR NORTH AMERICA BIOINFORMATICS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 SERVICES SEGMENT ARE EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA BIOINFORMATICS MARKET IN 2019 & 2026

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA BIOINFORMATICS MARKET

FIGURE 17 DECREASE IN COST OF PER BASE SEQUENCING

FIGURE 18 GROWING NEED FOR BIOINFORMATICS IN VITAL APPLICATIONS

FIGURE 19 NORTH AMERICA BIOINFORMATICS MARKET: BY TYPE, 2021

FIGURE 20 NORTH AMERICA BIOINFORMATICS MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 21 NORTH AMERICA BIOINFORMATICS MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 22 NORTH AMERICA BIOINFORMATICS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 23 NORTH AMERICA BIOINFORMATICS MARKET: BY SECTOR, 2021

FIGURE 24 NORTH AMERICA BIOINFORMATICS MARKET: BY SECTOR, 2022-2029 (USD MILLION)

FIGURE 25 NORTH AMERICA BIOINFORMATICS MARKET: BY SECTOR, CAGR (2022-2029)

FIGURE 26 NORTH AMERICA BIOINFORMATICS MARKET: BY SECTOR, LIFELINE CURVE

FIGURE 27 NORTH AMERICA BIOINFORMATICS MARKET: BY APPLICATION, 2021

FIGURE 28 NORTH AMERICA BIOINFORMATICS MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 29 NORTH AMERICA BIOINFORMATICS MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 30 NORTH AMERICA BIOINFORMATICS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 31 NORTH AMERICA BIOINFORMATICS MARKET: BY PURCHASE MODE, 2021

FIGURE 32 NORTH AMERICA BIOINFORMATICS MARKET: BY PURCHASE MODE, 2022-2029 (USD MILLION)

FIGURE 33 NORTH AMERICA BIOINFORMATICS MARKET: BY PURCHASE MODE, CAGR (2022-2029)

FIGURE 34 NORTH AMERICA BIOINFORMATICS MARKET: BY PURCHASE MODE, LIFELINE CURVE

FIGURE 35 NORTH AMERICA BIOINFORMATICS MARKET: BY METHOD, 2021

FIGURE 36 NORTH AMERICA BIOINFORMATICS MARKET: BY METHOD, 2022-2029 (USD MILLION)

FIGURE 37 NORTH AMERICA BIOINFORMATICS MARKET: BY METHOD, CAGR (2022-2029)

FIGURE 38 NORTH AMERICA BIOINFORMATICS MARKET: BY METHOD, LIFELINE CURVE

FIGURE 39 NORTH AMERICA BIOINFORMATICS MARKET: BY END USER, 2021

FIGURE 40 NORTH AMERICA BIOINFORMATICS MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 41 NORTH AMERICA BIOINFORMATICS MARKET: BY END USER, CAGR (2022-2029)

FIGURE 42 NORTH AMERICA BIOINFORMATICS MARKET: BY END USER, LIFELINE CURVE

FIGURE 43 NORTH AMERICA BIOINFORMATICS MARKET: SNAPSHOT (2021)

FIGURE 44 NORTH AMERICA BIOINFORMATICS MARKET: BY COUNTRY (2021)

FIGURE 45 NORTH AMERICA BIOINFORMATICS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 46 NORTH AMERICA BIOINFORMATICS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 47 NORTH AMERICA BIOINFORMATICS MARKET: BY TYPE (2022-2029)

FIGURE 48 NORTH AMERICA BIOINFORMATICS MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.