North America Balloon Catheter Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

1.83 Billion

USD

2.97 Billion

2024

2032

USD

1.83 Billion

USD

2.97 Billion

2024

2032

| 2025 –2032 | |

| USD 1.83 Billion | |

| USD 2.97 Billion | |

|

|

|

|

Segmentación del mercado de catéteres con balón en Norteamérica, por tipo (catéteres con balón para ACTP, catéteres con balón para CTO y microcatéteres), tipo de producto (catéter con balón normal, catéter con balón liberador de fármacos, catéter con balón de corte, catéter con balón para endoprótesis vascular y catéter con balón de puntuación), plataforma de administración (catéter con balón de intercambio rápido [RX]/monorraíl, catéter con balón sobre guía [OTW] y catéter con balón de guía fija [FW]), cumplimiento (no conforme, semi conforme y conforme), material del balón ( nailontereftalato de polietileno [PET], polietileno [PE], silicona, copolímero de poliolefina y otros), tipo de balón (balones de alta presión y balones elastoméricos), aplicación (enfermedad arterial coronaria, enfermedad arterial periférica y otras), usuario final (hospitales, centros especializados, centros de cirugía ambulatoria y otros), canal de distribución (licitación directa, distribución a terceros y otros) Tendencias de la industria y pronóstico hasta 2032

Tamaño del mercado de catéteres con balón en América del Norte

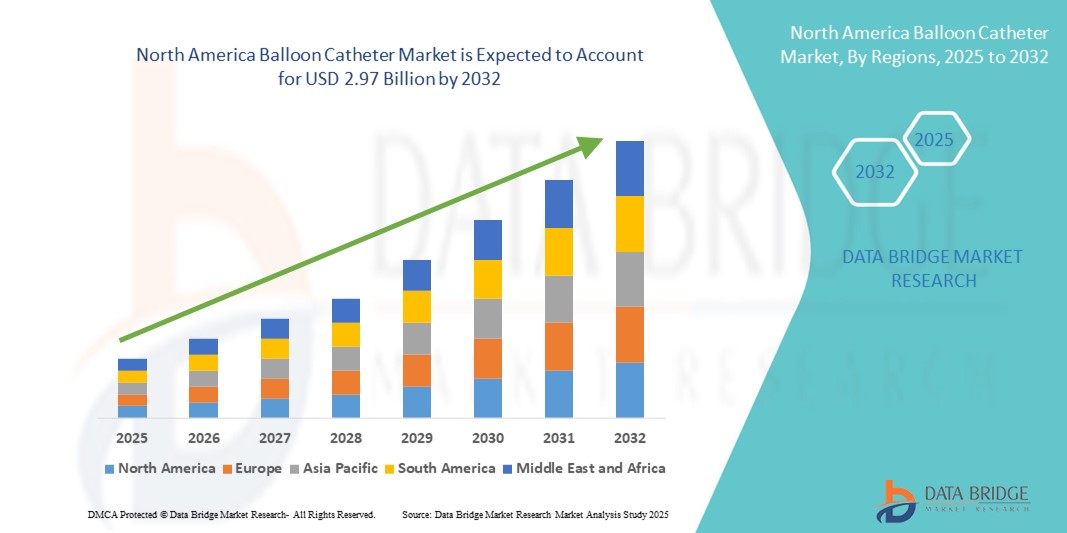

- El tamaño del mercado de catéteres con balón de América del Norte se valoró en USD 1.830 millones en 2024 y se espera que alcance los USD 2.970 millones para 2032 , con una CAGR del 6,20 % durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente incidencia de enfermedades cardiovasculares, la creciente demanda de procedimientos mínimamente invasivos y los avances continuos en la tecnología de catéteres, que están impulsando la adopción generalizada de catéteres con balón en toda la región de América del Norte.

- Además, el aumento del gasto sanitario, las mejoras en la infraestructura hospitalaria y un enfoque cada vez mayor en el diagnóstico temprano y el tratamiento intervencionista están acelerando la adopción de soluciones de catéter con balón en América del Norte, lo que impulsa significativamente el crecimiento de la industria.

Análisis del mercado de catéteres con balón en Norteamérica

- Los catéteres con balón son componentes cada vez más vitales del panorama de la cardiología y radiología intervencionista de América del Norte, especialmente en hospitales y clínicas especializadas, debido a la creciente prevalencia de enfermedades cardiovasculares y arteriales periféricas, los avances en procedimientos mínimamente invasivos y una mayor conciencia sobre la intervención temprana.

- La creciente demanda de tratamientos basados en catéteres con balón se ve impulsada principalmente por la creciente carga de afecciones relacionadas con el estilo de vida, como la diabetes y la hipertensión, las inversiones gubernamentales en infraestructura de atención médica y la creciente adopción de procedimientos de angioplastia en las economías emergentes de la región.

- Estados Unidos dominó el mercado de catéteres con balón en América del Norte con la mayor participación en los ingresos del 39,6 % en 2024, impulsado por una infraestructura de atención médica avanzada, altos volúmenes de procedimientos en cardiología intervencionista e inversiones significativas en I+D para terapias vasculares mínimamente invasivas.

- Se espera que Canadá sea el país de más rápido crecimiento en el mercado de catéteres con balón de América del Norte durante el período de pronóstico, impulsado por una mayor conciencia sobre la salud cardiovascular, una población que envejece cada vez más y las iniciativas lideradas por el gobierno destinadas a mejorar el diagnóstico temprano y el acceso a los procedimientos endovasculares.

- El segmento de balones de alta presión dominó el mercado de catéteres con balón de América del Norte con una participación de mercado del 61,8 % en 2024, favorecido para su uso en lesiones muy calcificadas, donde la fuerza radial mejorada y el inflado controlado son fundamentales para la dilatación exitosa de la lesión y el despliegue del stent.

Alcance del informe y segmentación del mercado de catéteres con balón en América del Norte

|

Atributos |

Perspectivas clave del mercado de catéteres con balón en América del Norte |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de catéteres con balón en América del Norte

Avances tecnológicos e integración perfecta de sistemas

- Una tendencia significativa y en auge en el mercado norteamericano de catéteres con balón es la creciente integración de tecnologías avanzadas que optimizan la eficiencia de los procedimientos y los resultados para los pacientes. Las innovaciones en el diseño de catéteres, la ciencia de los materiales y la compatibilidad con imágenes en tiempo real están mejorando significativamente la precisión y la seguridad de los procedimientos de angioplastia con balón, tanto en intervenciones coronarias como periféricas.

- Por ejemplo, los catéteres balón liberadores de fármacos modernos se están adaptando para lesiones complejas y aplicaciones en vasos sanguíneos más pequeños, lo que permite a los cardiólogos intervencionistas administrar terapia dirigida con un menor riesgo de reestenosis. De igual manera, los catéteres balón de corte y ranurado se están optimizando para lesiones calcificadas, lo que garantiza un mayor éxito del procedimiento en casos difíciles.

- Estos avances también se apoyan en herramientas inteligentes de planificación de procedimientos y retroalimentación diagnóstica en tiempo real de sistemas de imagen como IVUS (ultrasonido intravascular) y OCT (tomografía de coherencia óptica), que guían la colocación del catéter con mayor precisión. La adopción de estas salas de intervención integradas está en rápido aumento en hospitales terciarios y centros cardíacos especializados en Norteamérica.

- Además, la compatibilidad perfecta entre los catéteres con balón y las nuevas plataformas de intervención asistida por robot está impulsando un nuevo estándar en la atención vascular mínimamente invasiva. Estos sistemas robóticos permiten una navegación precisa de los catéteres a través de anatomías tortuosas, lo que reduce la fatiga del operador y la exposición a la radiación, a la vez que mejora el control del procedimiento.

- Esta tendencia hacia una mayor interoperabilidad, automatización y personalización está transformando las expectativas de los médicos y los estándares de atención al paciente en la región. En consecuencia, los fabricantes están desarrollando catéteres con balón de última generación con características como tecnología de detección de presión, maniobrabilidad y perfiles de inflado personalizados que se adaptan en tiempo real a las características vasculares.

- La demanda de estas soluciones de catéter con balón avanzadas, intuitivas e integradas está creciendo rápidamente en los países de América del Norte, impulsada por la creciente carga de enfermedades cardiovasculares, el aumento de las inversiones en la modernización de los laboratorios de cateterismo y un mayor énfasis en los resultados basados en el valor en los sistemas de atención médica.

Dinámica del mercado de catéteres con balón en América del Norte

Conductor

Necesidad creciente debido a la creciente carga de enfermedades cardiovasculares y los avances tecnológicos

- La creciente prevalencia de enfermedades cardiovasculares (ECV) en América del Norte, combinada con el envejecimiento de la población y patrones de estilo de vida poco saludables, está impulsando significativamente la demanda de procedimientos con catéter con balón, en particular para intervenciones en las arterias coronarias y periféricas.

- Por ejemplo, en marzo de 2024, el Ministerio de Salud de Arabia Saudí lanzó una iniciativa nacional de cribado cardiovascular dirigida a la detección temprana de obstrucciones arteriales en poblaciones de alto riesgo, lo que incrementó la demanda de intervenciones avanzadas con catéteres en los hospitales públicos. Se espera que estas estrategias gubernamentales impulsen el crecimiento de la industria de catéteres con balón en Norteamérica durante el período de pronóstico.

- A medida que aumenta la conciencia sobre las opciones de tratamiento mínimamente invasivas, tanto pacientes como profesionales de la salud optan cada vez más por los procedimientos con catéter balón debido a su menor tiempo de recuperación, mínimo trauma quirúrgico y altas tasas de éxito. Este cambio es particularmente notable en los centros de salud urbanos, donde los laboratorios de cateterismo se están expandiendo rápidamente.

- Además, avances tecnológicos como los balones liberadores de fármacos, los balones de puntuación y los catéteres de balón de alta presión se están integrando en los protocolos de cardiología intervencionista, lo que ofrece una mejor preparación de las lesiones y mejores resultados posdilatación. Estas innovaciones permiten el tratamiento de lesiones complejas con mayor precisión y seguridad.

- La creciente demanda de soluciones rentables y de alto rendimiento, junto con el creciente número de laboratorios de cateterismo en países como EE. UU., México y Canadá, está impulsando la adopción de catéteres con balón. Las políticas de reembolso favorables y las iniciativas de turismo médico también están impulsando la expansión del mercado.

Restricción/Desafío

Acceso limitado a infraestructura avanzada y altos costos de procedimiento

- La disponibilidad de laboratorios de cateterismo avanzado y cardiólogos intervencionistas capacitados sigue siendo desigual en América del Norte, especialmente en las regiones rurales y de bajos ingresos, lo que limita el acceso a los procedimientos con catéter con balón para una gran parte de la población.

- Por ejemplo, los países del África subsahariana a menudo enfrentan demoras en la importación de dispositivos médicos de alta tecnología debido a cuellos de botella regulatorios y desafíos de infraestructura, lo que afecta la entrega oportuna de intervenciones con catéter con balón.

- El alto costo asociado con los catéteres de balón liberadores de fármacos y de puntuación también constituye un obstáculo para su adopción en hospitales y proveedores de atención médica pública con limitaciones presupuestarias. Si bien estas tecnologías ofrecen resultados superiores, su asequibilidad y disponibilidad siguen siendo obstáculos críticos.

- Además, el mantenimiento de las cadenas de suministro estériles, la capacitación para el manejo de dispositivos y la infraestructura de monitoreo posterior al procedimiento requieren una inversión sustancial, lo que puede disuadir a los hospitales más pequeños y las clínicas especializadas de adoptar dichos sistemas.

- Superar estos desafíos a través de la fabricación regional, asociaciones de distribución local, inversión en programas de capacitación en cardiología intervencionista y la simplificación regulatoria será esencial para garantizar el acceso equitativo y el crecimiento a largo plazo del mercado de catéteres con balón de América del Norte.

Alcance del mercado de catéteres con balón en América del Norte

El mercado está segmentado según el tipo, tipo de producto, plataforma de entrega, cumplimiento, material del globo, tipo de globo, aplicación, usuario final y canal de distribución.

- Por tipo

Según el tipo, el mercado norteamericano de catéteres con balón se segmenta en catéteres con balón para ACTP, catéteres con balón para CTO y microcatéteres. El segmento de catéteres con balón para ACTP dominó el mercado con la mayor participación en los ingresos, con un 54,2 % en 2024, gracias a su uso generalizado en el tratamiento de la enfermedad coronaria y al creciente número de intervenciones coronarias percutáneas en la región.

Se anticipa que el segmento de catéteres con balón CTO experimentará la tasa de crecimiento más rápida del 20,6 % entre 2025 y 2032, impulsada por su creciente utilización en el tratamiento de oclusiones totales crónicas en casos cardiovasculares complejos.

- Por tipo de producto

Según el tipo de producto, el mercado se segmenta en catéteres balón normales, catéteres balón liberadores de fármacos, catéteres balón de corte, catéteres balón para stents y catéteres balón de puntuación. El segmento de catéteres balón normales obtuvo la mayor cuota de mercado, con un 38,9%, en 2024, gracias a su uso rutinario en intervenciones coronarias y periféricas y a su amplia accesibilidad.

Se proyecta que el segmento de catéteres con balón liberadores de fármacos crecerá a la CAGR más rápida del 21,3 % entre 2025 y 2032, impulsado por una mayor adopción en la prevención de la reestenosis y en los casos en los que los stents no son adecuados.

- Por plataforma de entrega

Según la plataforma de administración, el mercado se segmenta en catéteres de balón de intercambio rápido (RX)/monorraíl, catéteres de balón sobre guía (OTW) y catéteres de balón de guía fija (FW). El segmento de intercambio rápido (RX) dominó el mercado con una participación en los ingresos del 51,4 % en 2024, favorecido por su rapidez de procedimiento y su uso por un solo operador en cardiología intervencionista.

Se espera que el segmento Over-The-Wire (OTW) crezca a la CAGR más rápida del 18,4 % entre 2025 y 2032, debido a su capacidad superior de empuje y dirección en anatomías complejas y tortuosas.

- Por Cumplimiento

En función de la conformidad, el mercado se segmenta en balones no conformes, semi conformes y conformes. El segmento semi conforme lideró con la mayor cuota de mercado, con un 46,8 % en 2024, gracias a su equilibrio entre flexibilidad y resistencia a altas presiones, lo que los hace ideales para diversos tipos de lesiones.

Se proyecta que el segmento no compatible crecerá a una CAGR del 17,9 % entre 2025 y 2032, debido a su utilidad en los procedimientos de posdilatación y optimización dentro del stent.

- Por material de globo

Según el material del globo, el mercado se segmenta en nailon, tereftalato de polietileno (PET), polietileno (PE), silicona, copolímero de poliolefina y otros. El segmento de PET tuvo la mayor participación, con un 42,3 %, en 2024, debido a su alta presión de ruptura y su incumplimiento de las normas.

Se espera que los globos a base de silicona crezcan a la CAGR más rápida del 19,2 % entre 2025 y 2032, impulsados por su uso en intervenciones neurovasculares y pediátricas.

- Por tipo de globo

Según el tipo de balón, el mercado se segmenta en balones de alta presión y balones elastoméricos. Los balones de alta presión dominaron el mercado con una participación del 61,8 % en 2024, siendo los preferidos para su uso en lesiones con alta calcificación.

Se proyecta que los globos elastoméricos crecerán a una CAGR del 18,8 % entre 2025 y 2032, y se utilizarán en aplicaciones que requieren menor presión con alta flexibilidad.

- Por aplicación

Según la aplicación, el mercado se segmenta en enfermedad arterial coronaria, enfermedad arterial periférica y otras. El segmento de enfermedad arterial coronaria (EAC) obtuvo la mayor participación en los ingresos, con un 59,4 %, en 2024, impulsado por la alta incidencia de enfermedades cardiovasculares y el creciente volumen de procedimientos.

Se proyecta que la enfermedad arterial periférica (EAP) crecerá a la tasa compuesta anual más rápida del 20,1 % entre 2025 y 2032, atribuida a la creciente prevalencia de diabetes y enfermedades vasculares relacionadas con el tabaquismo.

- Por el usuario final

Según el usuario final, el mercado se segmenta en hospitales, centros de especialidades, centros de cirugía ambulatoria y otros. Los hospitales dominaron el mercado con la mayor participación en los ingresos, con un 64,8 % en 2024, gracias a una infraestructura avanzada y un alto volumen de procedimientos.

Se espera que los centros de cirugía ambulatoria registren la CAGR más rápida del 21,6%, lo que refleja un cambio hacia tratamientos ambulatorios mínimamente invasivos.

- Por canal de distribución

Sobre la base del canal de distribución, el mercado está segmentado en licitación directa, distribución de terceros y otros. El segmento de licitación directa representó el 58,1% de la participación de mercado en 2024, impulsado por compras institucionales a granel y adquisiciones centralizadas.

Se espera que la distribución de terceros experimente la CAGR más rápida entre 2025 y 2032, respaldada por la expansión de las cadenas de hospitales privados y las redes de distribuidores.

Análisis regional del mercado de catéteres con balón en América del Norte

- El mercado de catéteres con balón de América del Norte está experimentando un sólido crecimiento impulsado por la creciente carga de enfermedades cardiovasculares, el aumento de la población geriátrica y un fuerte cambio hacia procedimientos mínimamente invasivos para intervenciones coronarias y periféricas.

- La infraestructura de atención médica bien establecida de la región, el entorno de reembolso favorable y la adopción temprana de tecnologías de intervención avanzadas son impulsores clave que aceleran la expansión del mercado.

- Los altos volúmenes de procedimientos en hospitales y centros quirúrgicos ambulatorios, combinados con la disponibilidad de dispositivos de última generación, como catéteres liberadores de fármacos, de puntuación y de balón de alta presión, están reforzando el liderazgo de la región en el mercado global.

Perspectiva del mercado de catéteres con balón en EE. UU.

El mercado estadounidense de catéteres con balón es el más grande y maduro de Norteamérica, impulsado por una alta incidencia de enfermedades cardiovasculares, una infraestructura sanitaria avanzada y la innovación continua en tecnologías mínimamente invasivas. La presencia de fabricantes líderes de dispositivos médicos y la adopción generalizada de prácticas de cardiología intervencionista de vanguardia impulsan el uso de catéteres con balón de alta presión, de liberación de fármacos y de puntuación. Estados Unidos dominó el mercado norteamericano de catéteres con balón, con la mayor participación en los ingresos, un 39,6 % en 2024, gracias a un volumen significativo de procedimientos, políticas de reembolso favorables y una alta concentración de centros de atención cardíaca. Además, las inversiones gubernamentales y del sector privado en investigación y ensayos clínicos siguen impulsando la expansión del mercado, especialmente en el tratamiento de enfermedades coronarias y arteriales periféricas complejas.

Análisis del mercado de catéteres con balón en Canadá

Se prevé que el mercado canadiense de catéteres con balón sea el de mayor crecimiento en Norteamérica durante el período de pronóstico, impulsado por el envejecimiento de la población, la creciente prevalencia de factores de riesgo cardiovascular y la expansión de las capacidades de cardiología intervencionista en las provincias. El aumento de la financiación para la sanidad pública, junto con la adquisición estratégica de sistemas avanzados de catéteres con balón por parte de los hospitales, está impulsando su adopción. El enfoque de Canadá en el diagnóstico precoz y las terapias mínimamente invasivas, especialmente dentro de su marco de atención médica universal, está generando un mayor uso de catéteres con balón, tanto compatibles como no compatibles, y recubiertos con fármacos. Las colaboraciones entre instituciones académicas y fabricantes de dispositivos están acelerando aún más la innovación y el despliegue de soluciones de catéteres de última generación en las especialidades cardíacas y vasculares.

Análisis del mercado de catéteres con balón en México

El mercado mexicano de catéteres balón está cobrando impulso gracias a la mejora del acceso a la atención cardíaca especializada, el crecimiento de la inversión en el sector privado de la salud y la creciente concienciación sobre las opciones de tratamiento intervencionista para enfermedades cardíacas y vasculares. La urbanización y el aumento de la prevalencia de la obesidad, la diabetes y la hipertensión están incrementando la demanda de procedimientos cardiovasculares mínimamente invasivos. Hospitales en grandes ciudades como la Ciudad de México, Guadalajara y Monterrey están adoptando cada vez más catéteres balón para el tratamiento de la enfermedad arterial coronaria y periférica. Además, la proximidad de México a Estados Unidos facilita la importación de tecnologías médicas avanzadas, lo que favorece la disponibilidad de diversos tipos de catéteres balón, incluyendo ACTP, de puntuación y variantes liberadoras de fármacos.

Cuota de mercado de catéteres con balón en América del Norte

La industria de catéteres con balón de América del Norte está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Boston Scientific Corporation (EE. UU.)

- Medtronic (Irlanda)

- Abbott (EE. UU.)

- Corporación Terumo (Japón)

- BD (EE. UU.)

- B. Braun SE (Alemania)

- Koninklijke Philips NV (Países Bajos)

- Teleflex Incorporated (EE. UU.)

- Cook (EE.UU.)

- Lepu Medical Technology (Beijing) Co., Ltd. (China)

- KANEKA CORPORATION (Japón)

- Corporación Científica MicroPort (China)

- Acrostak Int. Distr. Sàrl (Suiza)

- Biotronik (Alemania)

- Alvimedica (Turquía)

- SMT (India)

- BALTON (Polonia)

- APR Medtech Ltd (Inglaterra)

- Advin Health Care (India)

Últimos avances en el mercado de catéteres con balón en América del Norte

- En junio de 2025 , se celebró en Berlín el 8.º Congreso Mundial sobre Terapia con Fagos Dirigidos , que reunió a más de 75 expertos de 27 países. El evento se centró en la aplicación de la investigación sobre fagos a la práctica clínica, abarcando temas como fagos modificados, marcos regulatorios, producción según las BPM y estudios de casos clínicos de infecciones multirresistentes.

- En julio de 2025 , Cellexus (Reino Unido) destacó el impacto real de la terapia con fagos, destacando su potencial para reducir los costes sanitarios y mejorar los resultados en Europa. El artículo describió cómo los tratamientos con fagos respaldan los esfuerzos contra la resistencia a los antimicrobianos (RAM) a gran escala.

- En noviembre de 2023, Boston Scientific concluyó la adquisición de Relevant Medsystems, incorporando el sistema de ablación nerviosa intraósea Intracept a su cartera de productos para el dolor crónico. La adquisición, con un coste inicial de 850 millones de dólares estadounidenses más pagos contingentes, amplía el acceso al tratamiento del dolor vertebrogénico mediante cobertura nacional, beneficiando a más de 150 millones de personas.

- En abril de 2023, Abbott completó la adquisición de Cardiovascular Systems, Inc., una empresa conocida por su innovador sistema de aterectomía para el tratamiento de enfermedades vasculares. El sistema de CSI, que prepara los vasos sanguíneos para la angioplastia o la implantación de stents, pasó a formar parte de la cartera vascular de Abbott. Las acciones de CSI dejaron de cotizar en el Nasdaq ese mismo día.

- En agosto de 2022, Boston Scientific anunció la adquisición de Obsidio, Inc., empresa responsable de la tecnología GEM para la embolización en la vasculatura periférica. El material semisólido GEM, recientemente aprobado por la FDA, simplifica los procedimientos de embolización gracias a sus propiedades únicas de gel. No se esperaba que la transacción afectara significativamente las ganancias de Boston Scientific en 2022.

- En febrero de 2022, Medtronic recibió la aprobación de la FDA para sus catéteres Freezor y Freezor Xtra para el tratamiento de la taquicardia por reentrada del nódulo auriculoventricular (TAVR) pediátrica. Esta terapia de crioablación, eficaz para más de 140 000 pacientes en todo el mundo, aborda las arritmias cardíacas en niños, ayudando a prevenir complicaciones potencialmente mortales y a mantener una función cardíaca normal.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.