Mercado de máquinas envasadoras Bag-in-Box en Norteamérica , por tipo de máquina (autónoma, integrada), tipo de automatización (semiautomática, automática, manual), material de envasado (plástico, papel y cartón, metal, otros), capacidad de producción (10 bolsas/min, 11-50 bolsas/min, 51-100 bolsas/min, más de 100 bolsas/min), tecnología de llenado (aséptica, no aséptica), usuario final (alimentos y bebidas, pinturas y lubricantes, cuidado personal, productos para el hogar, atención médica, otros): tendencias de la industria y pronóstico hasta 2029

Análisis y tamaño del mercado

La tecnología de llenado generalmente prefiere la tecnología de llenado aséptico en las máquinas de envasado bag-in-box en lugar de la tecnología de llenado no aséptico. La tecnología de llenado aséptico extiende la vida útil del producto envasado en su interior y, por lo tanto, es más común en las máquinas de envasado bag-in-box que la tecnología de llenado no aséptico. Las bebidas seguirán representando más de la mitad de la industria mundial del envasado aséptico. Se espera que el envasado aséptico de bebidas se beneficie del crecimiento de la productividad, así como de la expansión de las aplicaciones.

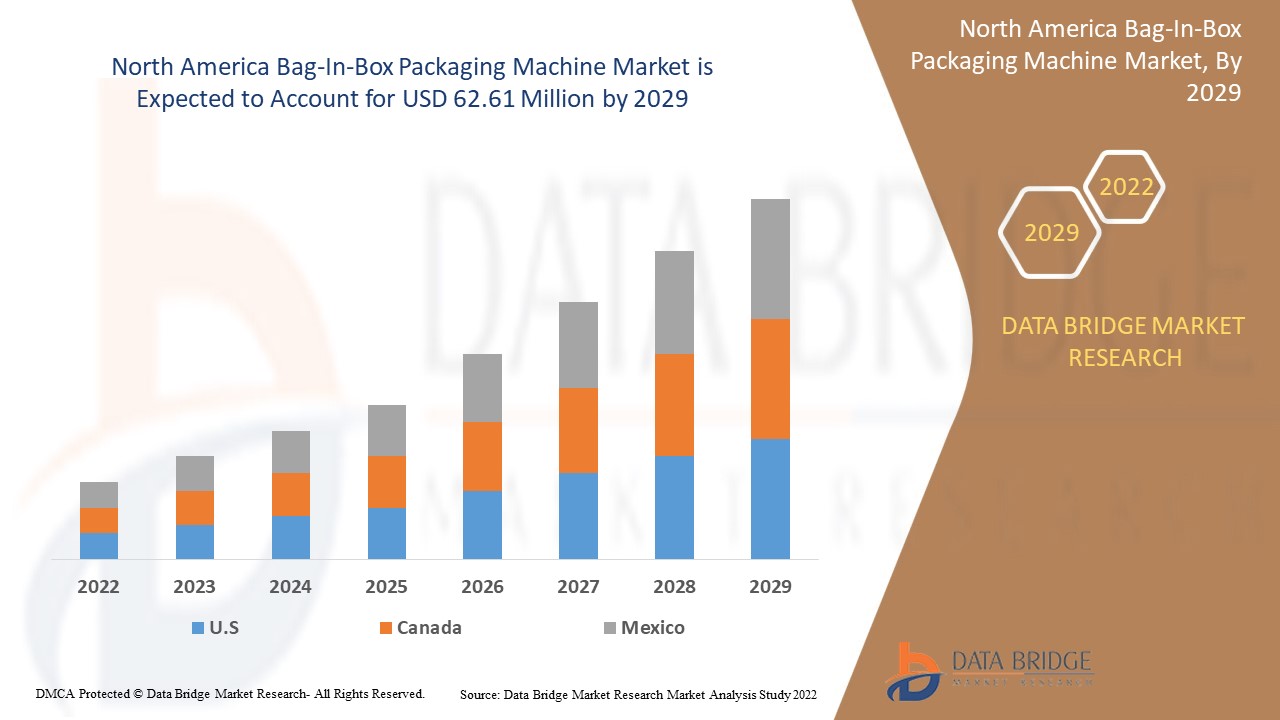

Data Bridge Market Research analiza que el mercado de máquinas envasadoras bag-in-box de América del Norte se valoró en USD 45,4 millones en 2021 y se espera que alcance los USD 62,61 millones para 2029, registrando una CAGR del 4,10 % durante el período de pronóstico de 2022 a 2029. El informe de mercado curado por el equipo de Data Bridge Market Research incluye un análisis de expertos en profundidad, análisis de importación / exportación, análisis de precios, análisis de consumo de producción, análisis de patentes y avances tecnológicos.

Definición de mercado

Las máquinas envasadoras bag-in-box pueden llenar bolsas de plástico tipo almohada con capacidades que van desde 1,5 litros hasta 25 litros o más. Las máquinas envasadoras bag-in-box automáticas tienen una gran demanda, ya que ayudan a aumentar la cantidad de fabricación de cualquier tipo de bebida para satisfacer la creciente demanda. Durante el proceso aséptico, el envasado bag-in-box se utiliza con frecuencia para envasar jugos de frutas procesados y productos lácteos. Los alimentos pasteurizados envasados en bag-in-box son estables y no requieren refrigeración.

Alcance del informe y segmentación del mercado

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2014 - 2019) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Tipo de máquina (autónoma, integrada), tipo de automatización (semiautomática, automática, manual), material de embalaje (plástico, papel y cartón, metal, otros), capacidad de salida (10 bolsas/min, 11-50 bolsas/min, 51-100 bolsas/min, más de 100 bolsas/min), tecnología de llenado (aséptica, no aséptica), usuario final (alimentos y bebidas, pinturas y lubricantes, cuidado personal, productos para el hogar, atención médica, otros) |

|

Países cubiertos |

Estados Unidos, Canadá, México y resto de América del Norte |

|

Actores del mercado cubiertos |

Liquibox (EE. UU.), DS Smith (Reino Unido), Robert Bosch GmbH (Alemania), Alfa Laval (Suecia), Engi-O (Norteamérica), Pattyn (Bélgica), SACMI (Italia), Scholle IPN (EE. UU.), Technibag (Francia), Franz Haniel & Cie (Alemania), ProXES GmbH (Alemania), Flexifill Ltd (Reino Unido), TORR Industries (EE. UU.), ABCO Automation, Inc (EE. UU.), IC Filling Systems (Reino Unido), Kreuzmayr Maschinenbau GmbH (Austria), Gossamer Structures (Pty) Ltd (Sudáfrica), Triangle Package Machinery Co (EE. UU.), voran Maschinen GmbH (Austria), Smurfit Kappa (Irlanda) |

|

Oportunidades de mercado |

|

Dinámica del mercado de máquinas envasadoras Bag-in-Box en América del Norte

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

Conductores

- Aumentar el consumo de bebidas alcohólicas

El crecimiento del mercado de los envases bag-in-box está influenciado por la rápida industrialización. La creciente demanda de máquinas envasadoras bag-in-box para alimentos y bebidas de uso final impulsa el mercado de las máquinas envasadoras bag-in-box.

- Embalaje de bajo coste con menos negociación

El coste que supone para el comprador cambiar un producto de la máquina envasadora Bag-in-box es bajo y el proveedor tiene menos poder de negociación. Los productos de la máquina envasadora Bag-in-box son menos variados y el riesgo de que entren nuevos competidores es cada vez mayor. La amenaza de sustitutos aumenta con el bajo coste del cambio para los consumidores y la disponibilidad de terapias alternativas.

Oportunidades

- Aumento de la demanda de envases ecológicos

El crecimiento del mercado de máquinas envasadoras bag-in-box en el período de pronóstico se debe al aumento de la necesidad de soluciones de envasado respetuosas con el medio ambiente. Además, se prevé que la creciente demanda de envasado aséptico en las industrias alimentaria y farmacéutica impulse aún más el mercado de máquinas envasadoras bag-in-box. Además, se estima que el aumento de la conciencia del consumidor y la creciente necesidad de alimentos y bebidas envasados como resultado del aumento de la población amortiguarán aún más el crecimiento del mercado de máquinas envasadoras bag-in-box.

Restricciones/ Desafíos

El impacto negativo de la COVID-19 hizo que el costo de las materias primas se elevara, lo que actuó como una restricción del mercado y desafió aún más la tasa de crecimiento del mercado. La falta de disponibilidad de soporte de asa y el alto costo del transporte obstaculizaron el crecimiento del mercado de máquinas envasadoras bag-in-box y la imposibilidad de transportar mercancías pesadas son las principales restricciones del mercado que obstruirán la tasa de crecimiento del mercado.

El informe de mercado de máquinas envasadoras bag-in-box de América del Norte proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de máquinas envasadoras bag-in-box de América del Norte, comuníquese con Data Bridge Market Research para obtener un informe de analista, nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Impacto de COVID-19 en el mercado de máquinas envasadoras Bag-in-Box de América del Norte

La pandemia de COVID-19 tuvo un impacto significativo en el segmento comercial y la industria. Los fabricantes están comprendiendo enfoques para recuperarse de la situación reciente mediante la reestructuración de sus canales de venta y la innovación de productos. El período del brote del virus sigue siendo un factor clave para evaluar el impacto total de la pandemia. Sin embargo, se espera que la industria de las máquinas envasadoras bag-in-box se estabilice después de 2021. La industria de los licores no se vio afectada de manera cruel por la pandemia.

Desarrollo reciente

- En octubre de 2019, Rapak aumentó la capacidad de producción de envases bag-in-box en sus instalaciones de Auckland, Nueva Zelanda, debido a la demanda en la región Asia Pacífico. Se espera que aumente su resultado de fabricación en más del 125 % en los próximos años.

- En septiembre de 2019, la división Rapak de DS Smith PLC desarrolló una solución duradera de envases en bolsa para detergentes líquidos en respuesta al aumento de la demanda de detergentes para ropa y otros productos envasados para el consumidor en el comercio electrónico . Esta unidad de envases en bolsa especialmente diseñada está compuesta por una laminación de nailon orientado biaxialmente (BON), lo que le confiere una buena barrera y una alta resistencia a la perforación.

- En marzo de 2019, Liqui-Box Corp. acordó adquirir la división de plásticos de DS Smith (Reino Unido). DS Smith es un importante proveedor de embalajes de cartón ondulado en todo el mundo. Su división de plásticos incluye el negocio de Rapak y Global Dispensers. Esta adquisición proporcionaría una presencia mundial, capacidades de diseño y una plataforma de servicios que ofrecerá a los clientes las soluciones de embalaje más atractivas.

Alcance del mercado de máquinas envasadoras Bag-in-Box en América del Norte

El mercado de máquinas envasadoras bag-in-box de América del Norte está segmentado en función del tipo de máquina, el tipo de automatización, la capacidad de producción, la tecnología de llenado y el usuario final. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Máquina

- Autónomo

- Integrado

Tipo de automatización

- Semiautomático

- Automático

- Manual

Capacidad de salida

- 10 bolsas/min

- 11-50 bolsas/min

- 51-100 bolsas/min

- Más de 100 bolsas/min

Tecnología de llenado

- Aséptico

- No aséptico

Usuario final

- Alimentos y bebidas

- Pinturas y Lubricantes

- Cuidado personal

- Productos domésticos

- Cuidado de la salud

- Otros

Análisis y perspectivas regionales del mercado de máquinas envasadoras Bag-in-Box de América del Norte

Se analiza el mercado de máquinas envasadoras bag-in-box de América del Norte y se proporcionan información y tendencias sobre el tamaño del mercado por país, materiales, capacidad de producción, automatización, tecnología de llenado y usuario final como se menciona anteriormente.

Los países cubiertos en el informe del mercado de máquinas envasadoras bag-in-box de América del Norte son EE. UU., Canadá, México y el resto de América del Norte.

Estados Unidos tiene el mayor potencial en el mercado de máquinas envasadoras bag-in-box en términos de participación de mercado e ingresos durante el período de pronóstico. Esto se debe a la creciente demanda de consumo de alcohol que aumenta la producción de máquinas envasadoras bag-in-box en este país. Estados Unidos también lidera el camino en términos de producción y consumo de máquinas envasadoras bag-in-box reutilizables y ecológicas. Debido a la facilidad de producción de máquinas reutilizables y ecológicas, la tasa de crecimiento de este país aumenta.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Puntos de datos como análisis de la cadena de valor aguas arriba y aguas abajo, tendencias técnicas y análisis de las cinco fuerzas de Porter, estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de las máquinas envasadoras Bag-in-Box en América del Norte

El panorama competitivo del mercado de máquinas envasadoras bag-in-box de América del Norte proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos, el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de máquinas envasadoras bag-in-box de América del Norte.

Algunos de los principales actores que operan en el mercado de máquinas envasadoras Bag-in-Box de América del Norte son:

- Liquibox (Estados Unidos)

- DS Smith (Reino Unido)

- Robert Bosch GmbH (Alemania)

- Alfa Laval (Suecia)

- Engi-O (América del Norte)

- Pattyn (Bélgica)

- SACMI (Italia)

- Scholle IPN (Estados Unidos)

- Technibag (Francia)

- Franz Haniel & Cie (Alemania)

- ProXES GmbH (Alemania)

- Flexifill Ltd (Reino Unido)

- Industrias TORR (Estados Unidos)

- ABCO Automation, Inc. (Estados Unidos)

- Sistemas de llenado de IC (Reino Unido)

- Kreuzmayr Maschinenbau GmbH (Austria)

- Gossamer Structures (Pty) Ltd (Sudáfrica)

- Triangle Package Machinery Co (Estados Unidos)

- Voran Maschinen GmbH (Austria)

- Smurfit Kappa (Irlanda)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET : GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 DBMR VENDOR SHARE ANALYSIS

2.9 MULTIVARIATE MODELING

2.1 PRODUCTS LIFELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.1.1 INCREASED BENEFITS OF BAG-IN-BOX PACKAGING

3.1.2 INCREASED APPLICATION OF BAG-IN-BOX PACKAGING IN VARIOUS INDUSTRIES

3.1.3 GROWTH OF THE NORTH AMERICA RETAIL INDUSTRY

3.1.4 GROWING DEMAND OF BEVERAGE PRODUCTS

3.2 RESTRAINTS

3.2.1 HIGH COST OF EQUIPMENT

3.2.2 STRINGENT REGULATIONS FOR THE MACHINERIES

3.3 OPPORTUNITIES

3.3.1 STRATEGIC INITIATIVES BY THE COMPANIES

3.3.2 GROWING DEMAND OF ASEPTIC PACKAGING

3.3.3 INCREASING DEMAND OF AUTOMATIC PACKAGING MACHINE

3.4 CHALLENGES

3.4.1 LACK OF SKILLED LABOUR FORCE

3.4.2 CHALLENGES IN PACKAGING INDUSTRY

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

6 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY MACHINE TYPE

6.1 OVERVIEW

6.2 STANDALONE

6.2.1 FOOD & BEVERAGES

6.2.2 PAINTS & LUBRICANTS

6.2.3 PERSONAL CARE

6.2.4 HOUSEHOLD PRODUCTS

6.2.5 HEALTHCARE

6.2.6 OTHERS

6.3 INTEGRATED

6.3.1 FOOD & BEVERAGES

6.3.2 PAINTS & LUBRICANTS

6.3.3 PERSONAL CARE

6.3.4 HOUSEHOLD PRODUCTS

6.3.5 HEALTHCARE

6.3.6 OTHERS

7 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY AUTOMATION TYPE

7.1 SEMI-AUTOMATIC

7.2 AUTOMATIC

7.3 MANUAL

8 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY PACKAGING MATERIAL

8.1 OVERVIEW

8.2 PLASTIC

8.2.1 POLYETHYLENE

8.2.1.1 LDPE

8.2.1.2 HDPE

8.2.1.3 LLDPE

8.2.2 POLYPROPYLENE

8.2.3 POLYVINYL CHLORIDE

8.2.4 OTHERS

8.3 PAPER & PAPERBOARD

8.4 METAL

8.4.1 ALUMINUM

8.5 OTHERS

9 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY OUTPUT CAPACITY

9.1 OVERVIEW

9.2 BAGS/MIN

9.3 -50 BAGS/MIN

9.4 -100 BAGS/MIN

9.5 ABOVE 100 BAGS/MIN

10 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY FILLING TECHNOLOGY

10.1 OVERVIEW

10.2 ASEPTIC

10.3 NON-ASEPTIC

11 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY END USER

11.1 OVERVIEW

11.2 FOOD & BEVERAGES

11.2.1 BAKERY & CEREALS PACKAGING

11.2.2 BOTTOMS UP PACKAGING

11.2.3 CONFECTIONERY PACKAGING

11.2.4 TRAILBLAZING TRANSPARENCY PACKAGING

11.2.5 HEALTHIER INDULGENCE PACKAGING

11.2.6 FAST-FOOD PACKAGING

11.2.7 OTHERS

11.3 HEALTHCARE

11.3.1 CLINICAL FEEDING

11.3.2 MEDICAL POUCHES

11.3.3 CELL CULTURE MEDIA

11.3.4 VACUUM BAGS

11.3.5 OTHERS

11.4 PERSONAL CARE

11.4.1 LOTION

11.4.2 SHAMPOO & CONDITIONER

11.4.3 HAND SOAP

11.4.4 HAND SANITIZER

11.4.5 BODY WASH

11.4.6 HAIR DYE

11.4.7 HAIR GEL

11.4.8 OTHERS

11.5 PAINTS & LUBRICANTS

11.5.1 CHEMICALS

11.5.2 COATINGS

11.5.3 AUTOMOTIVE OILS

11.5.4 ADHESIVES

11.5.5 LUBRICANTS

11.5.6 PAINTS

11.5.7 PETROLEUM

11.5.8 OTHERS

11.6 HOUSEHOLD PRODUCTS

11.6.1 LIQUID SOAPS

11.6.2 FLOOR CLEANER

11.6.3 OTHERS

11.7 OTHERS

12 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY GEOGRAPHY

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT & DBMR ANALYSIS

14.1 SWOT ANALYSIS

14.2 DATA BRIDGE MARKET RESEARCH ANALYSIS

15 COMPANY PROFILE

15.1 SMURFIT KAPPA

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 DS SMITH

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 ROBERT BOSCH GMBH

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 ALFA LAVAL

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 ABCO AUTOMATION, INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 ENGI-O

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 FLEXIFILL LTD.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 FRANZ HANIEL & CIE. GMBH

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.9 GOSSAMER STRUCTURES (PTY) LTD

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 IC FILLING SYSTEMS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 KREUZMAYR MASCHINENBAU GMBH

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 LIQUI-BOX

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 PATTYN GROUP

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 PROXES GMBH

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 QUADRANT EQUIPMENT

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 SACMI

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 SCHOLLE IPN

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 TECHNIBAG

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 TORR INDUSTRIES

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 TRIANGLE PACKAGE MACHINERY CO.

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 VORAN MASCHINEN GMBH

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

16 CONCLUSION

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 NATIONAL RETAIL SALES (2017)

TABLE 2 EU LEGISLATIVE OVERVIEW

TABLE 3 RESEARCH AND DEVELOPMENT (USD MILLION)

TABLE 4 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY MACHINE TYPE, 2017-2026 (USD MILLION)

TABLE 5 NORTH AMERICA STANDALONE IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 6 NORTH AMERICA STANDALONE IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY APPLICATION, 2017-2026 (USD MILLION)

TABLE 7 NORTH AMERICA INTEGRATED IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 8 NORTH AMERICA INTEGRATED IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY APPLICATION, 2017-2026 (USD MILLION)

TABLE 9 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY AUTOMATION TYPE, 2017-2026 (USD MILLION)

TABLE 10 NORTH AMERICA SEMI-AUTOMATIC IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 11 NORTH AMERICA AUTOMATIC IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 12 NORTH AMERICA MANUAL IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 13 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 14 NORTH AMERICA PLASTIC IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 15 NORTH AMERICA PLASTIC IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 16 NORTH AMERICA POLYETHYLENE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 17 NORTH AMERICA PAPER & PAPERBOARD IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 18 NORTH AMERICA METAL IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 19 NORTH AMERICA METAL IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 20 NORTH AMERICA OTHERS IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 21 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY OUTPUT CAPACITY, 2017-2026 (USD MILLION)

TABLE 22 NORTH AMERICA 10 BAGS/MIN IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 23 NORTH AMERICA 11-50 BAGS/MIN IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 24 NORTH AMERICA 51-100 BAGS/MIN IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 25 NORTH AMERICA ABOVE 100 BAGS/MIN IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 26 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY FILLING TECHNOLOGY, 2017-2026 (USD MILLION)

TABLE 27 NORTH AMERICA ASEPTIC IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 28 NORTH AMERICA NON-ASEPTIC IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 29 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 30 NORTH AMERICA FOOD & BEVERAGES IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 31 NORTH AMERICA FOOD & BEVERAGES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 32 NORTH AMERICA HEALTHCARE IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 33 NORTH AMERICA HEALTHCARE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 34 NORTH AMERICA PERSONAL CARE IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 35 NORTH AMERICA PERSONAL CARE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 36 NORTH AMERICA PAINTS & LUBRICANTS IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 37 NORTH AMERICA PAINTS & LUBRICANTS IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 38 NORTH AMERICA HOUSEHOLD PRODUCTS IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 39 NORTH AMERICA PAINTS & LUBRICANTS IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 40 NORTH AMERICA OTHERS IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 41 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY COUNTRY, 2017-2026 (USD MILLION)

TABLE 42 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY MACHINE TYPE, 2017-2026 (USD MILLION)

TABLE 43 NORTH AMERICA STANDALONE MACHINES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY APPLICATION, 2017-2026 (USD MILLION)

TABLE 44 NORTH AMERICA INTEGRATED MACHINES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY APPLICATION, 2017-2026 (USD MILLION)

TABLE 45 NORTH AMERICA BAG-IN-BOX MACHINE PACKAGING MARKET, BY AUTOMATION TYPE, 2017-2026 (USD MILLION)

TABLE 46 NORTH AMERICA BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 47 NORTH AMERICA PLASTIC IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 48 NORTH AMERICA POLYETHYLENE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 49 NORTH AMERICA METAL IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 50 NORTH AMERICA BAG-IN-BOX MACHINE PACKAGING MARKET, BY OUTPUT CAPACITY, 2017-2026 (USD MILLION)

TABLE 51 NORTH AMERICA BAG-IN-BOX MACHINE PACKAGING MARKET, BY FILLING TECHNOLOGY, 2017-2026 (USD MILLION)

TABLE 52 NORTH AMERICA BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 53 NORTH AMERICA FOOD & BEVERAGES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 54 NORTH AMERICA HEALTHCARE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 55 NORTH AMERICA PERSONAL CARE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 56 NORTH AMERICA PAINTS & LUBRICANTS IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 57 NORTH AMERICA HOUSEHOLD PRODUCTS IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 58 U.S. BAG-IN-BOX PACKAGING MACHINE MARKET, BY MACHINE TYPE, 2017-2026 (USD MILLION)

TABLE 59 U.S. STANDALONE MACHINES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY APPLICATION, 2017-2026 (USD MILLION)

TABLE 60 U.S. INTEGRATED MACHINES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY APPLICATION, 2017-2026 (USD MILLION)

TABLE 61 U.S. BAG-IN-BOX MACHINE PACKAGING MARKET, BY AUTOMATION TYPE, 2017-2026 (USD MILLION)

TABLE 62 U.S. BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 63 U.S. PLASTIC IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 64 U.S. POLYETHYLENE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 65 U.S. METAL IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 66 U.S. BAG-IN-BOX MACHINE PACKAGING MARKET, BY OUTPUT CAPACITY, 2017-2026 (USD MILLION)

TABLE 67 U.S. BAG-IN-BOX MACHINE PACKAGING MARKET, BY FILLING TECHNOLOGY, 2017-2026 (USD MILLION)

TABLE 68 U.S. BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 69 U.S. FOOD & BEVERAGES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 70 U.S. HEALTHCARE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 71 U.S. PERSONAL CARE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 72 U.S. PAINTS & LUBRICANTS IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 73 U.S. HOUSEHOLD PRODUCTS IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 74 CANADA BAG-IN-BOX PACKAGING MACHINE MARKET, BY MACHINE TYPE, 2017-2026 (USD MILLION)

TABLE 75 CANADA STANDALONE MACHINES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY APPLICATION, 2017-2026 (USD MILLION)

TABLE 76 CANADA INTEGRATED MACHINES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY APPLICATION, 2017-2026 (USD MILLION)

TABLE 77 CANADA BAG-IN-BOX MACHINE PACKAGING MARKET, BY AUTOMATION TYPE, 2017-2026 (USD MILLION)

TABLE 78 CANADA BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 79 CANADA PLASTIC IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 80 CANADA POLYETHYLENE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 81 CANADA METAL IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 82 CANADA BAG-IN-BOX MACHINE PACKAGING MARKET, BY OUTPUT CAPACITY, 2017-2026 (USD MILLION)

TABLE 83 CANADA BAG-IN-BOX MACHINE PACKAGING MARKET, BY FILLING TECHNOLOGY, 2017-2026 (USD MILLION)

TABLE 84 CANADA BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 85 CANADA FOOD & BEVERAGES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 86 CANADA HEALTHCARE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 87 CANADA PERSONAL CARE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 88 CANADA PAINTS & LUBRICANTS IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 89 CANADA HOUSEHOLD PRODUCTS IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 90 MEXICO BAG-IN-BOX PACKAGING MACHINE MARKET, BY MACHINE TYPE, 2017-2026 (USD MILLION)

TABLE 91 MEXICO STANDALONE MACHINES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY APPLICATION, 2017-2026 (USD MILLION)

TABLE 92 MEXICO INTEGRATED MACHINES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY APPLICATION, 2017-2026 (USD MILLION)

TABLE 93 MEXICO BAG-IN-BOX MACHINE PACKAGING MARKET, BY AUTOMATION TYPE, 2017-2026 (USD MILLION)

TABLE 94 MEXICO BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 95 MEXICO PLASTIC IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 96 MEXICO POLYETHYLENE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 97 MEXICO METAL IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 98 MEXICO BAG-IN-BOX MACHINE PACKAGING MARKET, BY OUTPUT CAPACITY, 2017-2026 (USD MILLION)

TABLE 99 MEXICO BAG-IN-BOX MACHINE PACKAGING MARKET, BY FILLING TECHNOLOGY, 2017-2026 (USD MILLION)

TABLE 100 MEXICO BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 101 MEXICO FOOD & BEVERAGES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 102 MEXICO HEALTHCARE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 103 MEXICO PERSONAL CARE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 104 MEXICO PAINTS & LUBRICANTS IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 105 MEXICO HOUSEHOLD PRODUCTS IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET

FIGURE 2 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: DATA VALIDATION MODEL

FIGURE 3 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: NORTH AMERICA VS REGIONAL

FIGURE 5 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: DBMR VENDOR SHARE ANALYSIS

FIGURE 9 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET

FIGURE 10 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: SEGMENTATION

FIGURE 11 INCREASED BENEFITS OF BAG-IN-BOX PACKAGING AND INCREASED APPLICATION OF BAG-IN-BOX PACKAGING IN VARIOUS INDUSTRIES ARE EXPECTED TO DRIVE THE NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET IN THE FORECAST PERIOD OF 2019 TO 2026

FIGURE 12 STANDALONE MACHINE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET IN THE FORECAST PERIOD OF 2019 TO 2026

FIGURE 13 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: BY MACHINE TYPE, 2018

FIGURE 14 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: BY AUTOMATION TYPE, 2018

FIGURE 15 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: BY PACKAGING MATERIAL, 2018

FIGURE 16 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: BY AUTOMATION TYPE, 2018

FIGURE 17 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: BY FILLING TECHNOLOGY, 2018

FIGURE 18 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: BY END USER, 2018

FIGURE 19 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: SNAPSHOT (2018)

FIGURE 20 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: BY COUNTRY (2018)

FIGURE 21 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: BY COUNTRY (2019 & 2026)

FIGURE 22 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: BY COUNTRY (2018 & 2026)

FIGURE 23 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: BY MACHINE TYPE (2019-2026)

FIGURE 24 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: COMPANY SHARE 2018 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.