North America Autonomous Self Driving Cars Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

29,548.86 million

USD

178,171.68 million

2022

2030

USD

29,548.86 million

USD

178,171.68 million

2022

2030

| 2023 –2030 | |

| USD 29,548.86 million | |

| USD 178,171.68 million | |

|

|

|

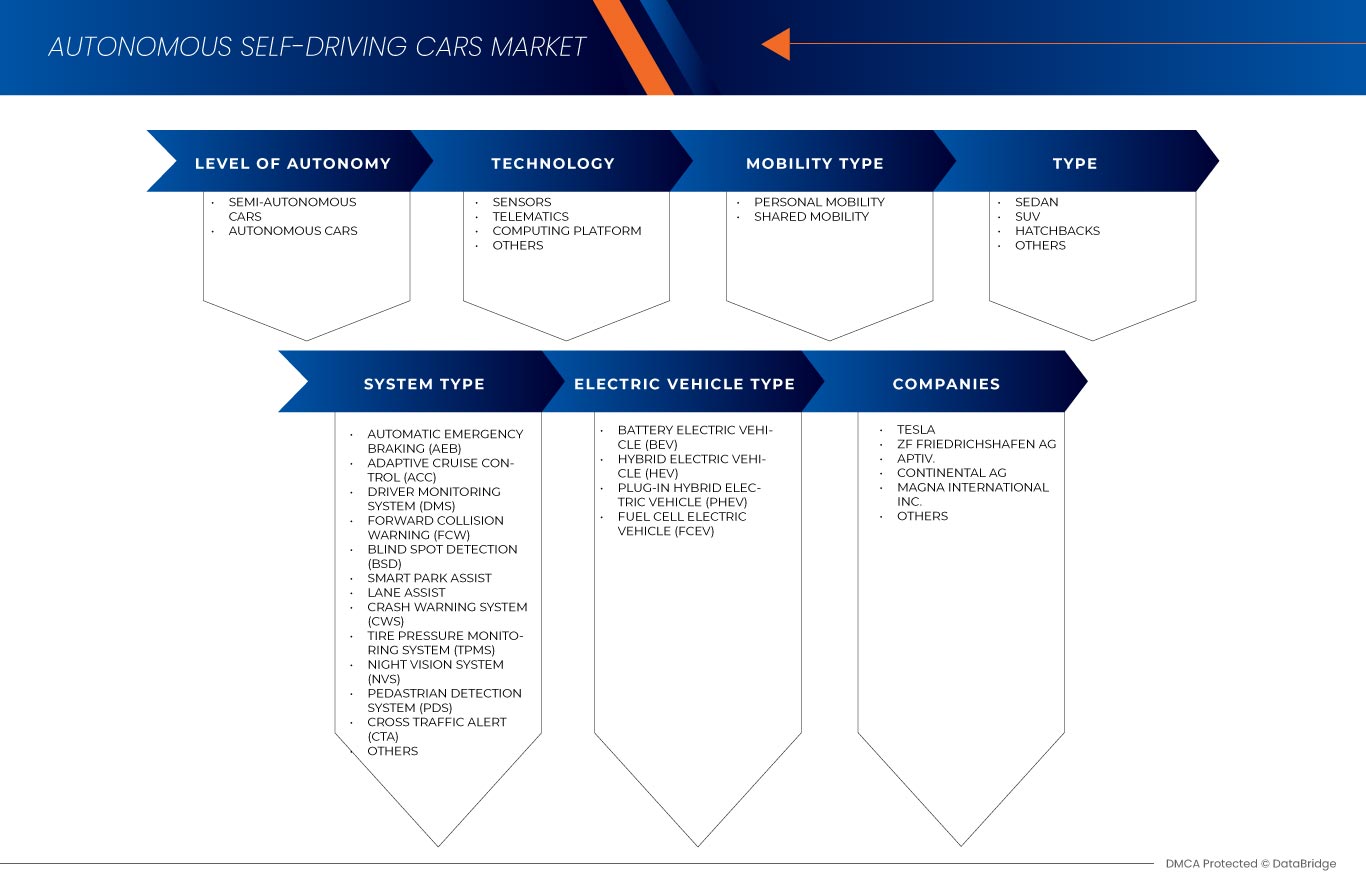

Mercado de automóviles autónomos/sin conductor en América del Norte, por nivel de autonomía (automóviles semiautónomos y automóviles autónomos), tecnología (sensores, telemática, plataforma informática y otros), tipo de movilidad (movilidad personal y movilidad compartida), tipo (SUV, hatchbacks, sedán y otros), tipo de sistema (asistente de carril, frenado automático de emergencia (AEB), asistente de estacionamiento inteligente, sistema de advertencia de colisión (CWS), control de crucero adaptativo (ACC), alerta de tráfico cruzado (CTA), detección de punto ciego (BSD), advertencia de colisión frontal (FCW), sistema de monitoreo de presión de neumáticos (TPMS), sistema de visión nocturna (NVS), sistema de monitoreo del conductor (DMS), sistema de detección de peatones (PDS) y otros), tipo de vehículo eléctrico (vehículo eléctrico de batería (BEV), vehículos eléctricos híbridos (HEV), vehículos eléctricos híbridos enchufables (PHEV) y vehículos eléctricos de celda de combustible (FCEV)) - Tendencias de la industria y pronóstico hasta 2030.

Análisis y perspectivas del mercado de vehículos autónomos y sin conductor en América del Norte

El mercado de los vehículos autónomos ha ido evolucionando debido a diversos factores, como las ventajas en materia de seguridad y los avances tecnológicos, que se espera que impulsen el crecimiento del mercado. La principal limitación que está afectando al mercado es la falta de infraestructura en los países emergentes, la vulnerabilidad de los sistemas y la susceptibilidad a las violaciones de la ciberseguridad . Se espera que el aumento de las plataformas de movilidad como servicio (MaaS) y el creciente gasto en I+D en el desarrollo de vehículos autónomos actúen como oportunidades para el mercado en el futuro. Sin embargo, los altos costes de los sistemas y componentes y el elevado mantenimiento y servicio son desafíos para el mercado.

Data Bridge Market Research analiza que se espera que el mercado de automóviles autónomos/sin conductor de América del Norte alcance un valor de USD 178.171,68 millones para 2030, desde USD 29.548,86 millones en 2022, creciendo a una CAGR del 26,3% durante el período de pronóstico.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2015 – 2020) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en miles de unidades |

|

Segmentos cubiertos |

Nivel de autonomía (automóviles semiautónomos y autónomos), tecnología (sensores, telemática, plataforma informática y otros), tipo de movilidad (movilidad personal y movilidad compartida), tipo (SUV, hatchbacks, sedán y otros), tipo de sistema (asistencia de carril, frenado automático de emergencia (AEB), asistencia de estacionamiento inteligente, sistema de advertencia de colisión (CWS), control de crucero adaptativo (ACC), alerta de tráfico cruzado (CTA), detección de punto ciego (BSD), advertencia de colisión frontal (FCW), sistema de monitoreo de presión de neumáticos (TPMS), sistema de visión nocturna (NVS), sistema de monitoreo del conductor (DMS), sistema de detección de peatones (PDS) y otros), tipo de vehículo eléctrico (vehículo eléctrico de batería (BEV), vehículos eléctricos híbridos (HEV), vehículos eléctricos híbridos enchufables (PHEV) y vehículos eléctricos de celda de combustible (FCEV)) |

|

Regiones cubiertas |

Estados Unidos, Canadá y México |

|

Actores del mercado cubiertos |

Waymo LLC (una subsidiaria de Alphabet Inc), Nuro, Inc., Huawei Technologies Co., Ltd., NVIDIA Corporation, Mobileye, Latitude AI LLC (una subsidiaria de Ford Motor), Aurora Innovation Inc., RENESAS ELECTRONICS CORPORATION, Mercedes-Benz AG, Infineon Technologies AG, Continental AG, Volkswagen, Tesla, Valeo, Robert Bosch LLC, Aptiv., Hitachi Astemo, Ltd, HELLA GmbH & Co. KGaA, Magna International Inc., ZF Friedrichshafen AG y TEXAS INSTRUMENTS INCORPORATED, entre otros. |

Definición de mercado

Los vehículos autónomos o que se conducen solos son vehículos equipados con sensores avanzados, cámaras, radares y tecnología de inteligencia artificial (IA) que les permiten navegar y operar sin intervención humana directa. Estos vehículos pueden percibir su entorno, interpretar los datos y tomar decisiones para conducir de forma segura, respetando las normas de tránsito y adaptándose a las condiciones cambiantes de la carretera. Los vehículos autónomos suelen tener diferentes niveles de autonomía, que van desde funciones básicas de asistencia al conductor hasta autonomía total, en la que no se necesita intervención humana durante todo el viaje.

Dinámica del mercado de vehículos autónomos y sin conductor en América del Norte

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

Conductor

- Beneficios de seguridad de los automóviles/coches autónomos

Los numerosos accidentes de alto perfil que ocurrieron en los últimos años en los que estaban involucrados vehículos conducidos por humanos han puesto de relieve la necesidad urgente de alternativas de transporte más seguras. Los automóviles autónomos ofrecen el potencial de reducir drásticamente las tasas de accidentes al aprovechar sensores avanzados, inteligencia artificial y procesamiento de datos en tiempo real. A medida que aumenta la conciencia pública sobre estos beneficios, existe una mayor demanda de vehículos autónomos que prioricen la seguridad. Los consumidores están reconociendo el potencial de reducir las colisiones, las lesiones y las muertes, lo que hace de la seguridad un factor clave en sus decisiones de compra.

Oportunidad

- Aumento de las plataformas de movilidad como servicio (MaaS)

Las plataformas representan una oportunidad importante para el mercado de los vehículos autónomos. MaaS es un concepto revolucionario que integra varios servicios de transporte en una única solución de movilidad sin fisuras a la que se puede acceder a través de plataformas digitales. Esta convergencia se alinea perfectamente con el desarrollo y la implementación de vehículos autónomos, ya que los proveedores de MaaS pueden aprovechar estos vehículos para ofrecer opciones de transporte más eficientes, convenientes y rentables a los consumidores.

Restricciones /Desafíos

- Alto mantenimiento y servicio de vehículos automotores/automóviles autónomos

El mercado es muy prometedor, pero el desafío de los altos costos de los sistemas y los componentes plantea un obstáculo importante. La intrincada tecnología, las complejidades de la integración y las estrictas normas de seguridad contribuyen a aumentar los gastos. Superar este desafío requiere esfuerzos continuos de investigación y desarrollo para agilizar los procesos de fabricación, reducir los costos de los componentes y cumplir con los requisitos regulatorios sin comprometer la seguridad y la calidad. Solo mediante esfuerzos colaborativos entre la industria, los organismos reguladores y los proveedores de tecnología se puede abordar eficazmente la barrera de los altos costos, lo que permitirá que el mercado de vehículos autónomos alcance su potencial de revolucionar el transporte. Por lo tanto, se espera que el alto costo de los sistemas y los componentes de los automóviles autónomos/de conducción autónoma suponga un desafío para el crecimiento del mercado.

- Falta de infraestructura en los países emergentes

Los vehículos autónomos requieren un sistema de infraestructura sólido e integrado para funcionar de manera eficiente y segura. Esto incluye redes viales de alta calidad, sistemas avanzados de gestión del tráfico, redes de comunicación confiables y estaciones de carga o reabastecimiento de combustible para automóviles eléctricos e híbridos. La ausencia de una infraestructura adecuada en los países emergentes presenta varios obstáculos para la adopción de automóviles autónomos. Además, la falta de estaciones de carga o reabastecimiento de combustible para automóviles eléctricos autónomos limita su alcance y facilidad de uso, socavando los posibles beneficios ambientales.

Acontecimientos recientes

- En enero de 2021, Infineon presentó una serie avanzada de microcontroladores AURIX. Estos microcontroladores suponen un gran avance que impulsa a la industria automotriz hacia soluciones más eléctricas y digitales. Este lanzamiento ayuda a Infineon a posicionarse como líder en innovación automotriz, satisfaciendo la creciente demanda de electrificación y digitalización en los vehículos.

- En septiembre de 2022, Waymo LLC se asoció con Swiss Re para desarrollar métodos innovadores de evaluación de riesgos para el sector de seguros ante los avances en la conducción autónoma. Al pasar de los factores de riesgo centrados en el ser humano a los orientados al vehículo y reconocer las limitaciones de los análisis retrospectivos, esta colaboración allana el camino para nuevos modelos de seguros que respalden la integración segura de los vehículos autónomos. La asociación tiene el potencial de mejorar los enfoques de evaluación de la seguridad y ofrecer al público una nueva perspectiva sobre la evaluación de la tecnología de los vehículos autónomos.

Alcance del mercado de vehículos autónomos y sin conductor en América del Norte

El mercado de vehículos autónomos se divide en seis segmentos importantes según el nivel de autonomía, la tecnología, el tipo de movilidad, el tipo, el tipo de sistema y el tipo de vehículo eléctrico. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Nivel de autonomía

- Autos semiautónomos

- Coches autónomos

En función del nivel de autonomía, el mercado se segmenta en coches semiautónomos y coches autónomos.

Tecnología

- Sensor

- Telemática

- Plataforma informática

- Otros

Sobre la base de la tecnología, el mercado está segmentado en sensores, telemática, plataforma informática y otros.

Tipo de movilidad

- Movilidad personal

- Movilidad compartida

Según el tipo de movilidad, el mercado se segmenta en movilidad personal y movilidad compartida.

Tipo

- Todoterreno

- Hatchbacks

- Sedán

- Otros

Según el tipo, el mercado está segmentado en SUV, hatchbacks, sedán y otros.

Tipo de sistema

- Frenado automático de emergencia (AEB)

- Control de crucero adaptativo (ACC)

- Sistema de monitoreo del conductor (DMS)

- Advertencia de colisión frontal (FCW)

- Detección de puntos ciegos (BSD)

- Asistente de estacionamiento inteligente

- Asistente de carril

- Sistema de advertencia de colisiones (CWS)

- Sistema de control de presión de neumáticos (TPMS)

- Sistema de visión nocturna (NVS)

- Sistema de detección de peatones (PDS)

- Alerta de tráfico cruzado (CTA)

- Otros

Según el tipo de sistema, el mercado está segmentado en asistencia de carril, frenado automático de emergencia (AEB), asistencia de estacionamiento inteligente, sistema de advertencia de colisión (CWS), control de crucero adaptativo (ACC), alerta de tráfico cruzado (CTA), detección de punto ciego (BSD), advertencia de colisión frontal (FCW), sistema de monitoreo de presión de neumáticos (TPMS), sistema de visión nocturna (NVS), sistema de monitoreo del conductor (DMS), sistema de detección de peatones (PDS) y otros.

Tipo de vehículo eléctrico

- Vehículo eléctrico de batería (VEB)

- Vehículos eléctricos híbridos (HEV)

- Vehículos eléctricos híbridos enchufables (PHEV)

- Vehículos eléctricos de pila de combustible (FCEV)

Sobre la base del tipo de vehículo eléctrico, el mercado está segmentado en vehículos eléctricos de batería (BEV), vehículos eléctricos híbridos (HEV), vehículos eléctricos híbridos enchufables (PHEV) y vehículos eléctricos de pila de combustible (FCEV).

Análisis y perspectivas de la región de mercado de vehículos autónomos y sin conductor de América del Norte

Se analiza el mercado de automóviles autónomos/sin conductor de América del Norte y se proporcionan información y tendencias sobre el tamaño del mercado por país, nivel de autonomía, tecnología, tipo de movilidad, tipo, tipo de sistema y tipo de vehículo eléctrico como se menciona anteriormente.

Los países cubiertos en este informe de mercado son Estados Unidos, Canadá y México.

Se espera que Estados Unidos domine el mercado de automóviles autónomos/sin conductor en América del Norte debido a la creciente inclinación de los clientes hacia los automóviles autónomos.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas regionales y sus desafíos afrontados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y la cuota de mercado de los vehículos autónomos en América del Norte

El panorama competitivo del mercado de vehículos autónomos/sin conductor de América del Norte proporciona detalles de los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en I+D, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las aprobaciones de productos, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de vida útil de los tipos de productos. Los puntos de datos proporcionados anteriormente solo están relacionados con el enfoque de la empresa en el mercado.

Algunos de los principales actores del mercado que operan en el mercado de automóviles autónomos/sin conductor son Waymo LLC (una subsidiaria de Alphabet Inc), Nuro, Inc., Huawei Technologies Co., Ltd., NVIDIA Corporation, Mobileye, Latitude AI LLC (una subsidiaria de Ford Motor), Aurora Innovation Inc., RENESAS ELECTRONICS CORPORATION, Mercedes-Benz AG, Infineon Technologies AG, Continental AG, Volkswagen, Tesla, Valeo, Robert Bosch LLC, Aptiv., Hitachi Astemo, Ltd, HELLA GmbH & Co. KGaA, Magna International Inc., ZF Friedrichshafen AG y TEXAS INSTRUMENTS INCORPORATED, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA AUTONOMOUS/SELF-DRIVING CARS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 LEVEL OF AUTONOMY TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SAFETY BENEFITS OF AUTOMOTIVE/SELF-DRIVING CARS

5.1.2 TECHNOLOGY ADVANCEMENTS IN AUTOMOTIVE/SELF-DRIVING CARS

5.2 RESTRAINTS

5.2.1 LACK OF INFRASTRUCTURE IN EMERGING COUNTRIES

5.2.2 VULNERABILITY IN SYSTEMS AND SUSCEPTIBILITY TO CYBERSECURITY BREACHES

5.3 OPPORTUNITIES

5.3.1 RISE IN MOBILITY-AS-A-SERVICE (MAAS) PLATFORMS

5.3.2 GROWING R&D SPENDING IN AUTONOMOUS VEHICLE DEVELOPMENT

5.4 CHALLENGES

5.4.1 HIGH SYSTEM AND COMPONENT COST OF AUTOMOTIVE/SELF-DRIVING CARS

5.4.2 HIGH MAINTENANCE AND SERVICE OF AUTOMOTIVE/SELF-DRIVING CARS

6 NORTH AMERICA AUTONOMOUS/ SELF-DRIVING CARS MARKET, BY LEVEL OF AUTONOMY

6.1 OVERVIEW

6.2 SEMI-AUTONOMOUS CARS

6.2.1 LEVEL 2

6.2.2 LEVEL 1

6.2.3 LEVEL 3

6.3 AUTONOMOUS CARS

6.3.1 LEVEL 4

6.3.2 LEVEL 5

7 NORTH AMERICA AUTONOMOUS/ SELF-DRIVING CARS MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 SENSORS

7.2.1 CAMERAS

7.2.2 RADAR

7.2.3 LIDAR SENSORS

7.2.4 ULTRASONIC SENSORS

7.2.5 INFRARED SENSORS

7.2.6 INERTIAL NAVIGATION SYSTEM

7.3 TELEMATICS

7.3.1 ELECTRONIC MAP

7.3.2 MOBILE CONNECTIVITY

7.3.3 LOCATION TRACKING

7.3.4 V2V & V2I COMMUNICATION

7.4 COMPUTING PLATFORM

7.4.1 ARTIFICIAL INTELLIGENCE

7.4.2 MACHINE LEARNING

7.4.3 DEEP LEARNING

7.4.4 SENSOR FUSION

7.4.5 COMPUTER VISION

7.4.6 INTERPRETATION & DECISION MAKING

7.5 OTHERS

8 NORTH AMERICA AUTONOMOUS/ SELF-DRIVING CARS MARKET, BY MOBILITY TYPE

8.1 OVERVIEW

8.2 PERSONAL MOBILITY

8.3 SHARED MOBILITY

9 NORTH AMERICA AUTONOMOUS/ SELF-DRIVING CARS MARKET, BY TYPE

9.1 OVERVIEW

9.2 SEDAN

9.3 SUV

9.4 HATCHBACKS

9.5 OTHERS

10 NORTH AMERICA AUTONOMOUS/ SELF-DRIVING CARS MARKET, BY SYSTEM TYPE

10.1 OVERVIEW

10.2 AUTOMATIC EMERGENCY BRAKING (AEB)

10.3 ADAPTIVE CRUISE CONTROL (ACC)

10.4 DRIVER MONITORING SYSTEM (DMS)

10.5 FORWARD COLLISION WARNING (FCW)

10.6 BLIND SPOT DETECTION (BSD)

10.7 SMART PARK ASSIST

10.8 LANE ASSIST

10.9 CRASH WARNING SYSTEM (CWS)

10.1 TIRE PRESSURE MONITORING SYSTEM (TPMS)

10.11 NIGHT VISION SYSTEM (NVS)

10.12 PEDESTRIAN DETECTION SYSTEM (PDS)

10.13 CROSS TRAFFIC ALERT (CTA)

10.14 OTHERS

11 NORTH AMERICA AUTONOMOUS/ SELF-DRIVING CARS MARKET, BY ELECTRIC VEHICLE TYPE

11.1 OVERVIEW

11.2 BATTERY ELECTRIC VEHICLE (BEV)

11.2.1 BY SEMI-AUTONOMOUS CARS

11.2.1.1 LEVEL 2

11.2.1.2 LEVEL 1

11.2.1.3 LEVEL 3

11.2.2 BY AUTONOMOUS CARS

11.2.2.1 LEVEL 4

11.2.2.2 LEVEL 5

11.3 HYBRID ELECTRIC VEHICLE (HEV)

11.3.1 BY SEMI-AUTONOMOUS CARS

11.3.1.1 LEVEL 2

11.3.1.2 LEVEL 1

11.3.1.3 LEVEL 3

11.3.2 BY AUTONOMOUS CARS

11.3.2.1 LEVEL 4

11.3.2.2 LEVEL 5

11.4 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

11.4.1 BY SEMI-AUTONOMOUS CARS

11.4.1.1 LEVEL 2

11.4.1.2 LEVEL 1

11.4.1.3 LEVEL 3

11.4.2 BY AUTONOMOUS CARS

11.4.2.1 LEVEL 4

11.4.2.2 LEVEL 5

11.5 FUEL CELL ELECTRIC VEHICLE (FCEV)

11.5.1 BY SEMI-AUTONOMOUS CARS

11.5.1.1 LEVEL 2

11.5.1.2 LEVEL 1

11.5.1.3 LEVEL 3

11.5.2 BY AUTONOMOUS CARS

11.5.2.1 LEVEL 4

11.5.2.2 LEVEL 5

12 NORTH AMERICA AUTONOMOUS/SELF-DRIVING CARS MARKET: BY COUNTRY

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA AUTONOMOUS/SELF-DRIVING CARS MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 TESLA

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 ZF FRIEDRICHSHAFEN AG

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 APTIV.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCTS PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 CONTINENTAL AG

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 MAGNA INTERNATIONAL INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 AURORA INNOVATION INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 HELLA GMBH & CO. KGAA

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 HITACHI ASTEMO, LTD.

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCTS PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.9 HUAWEI TECHNOLOGIES CO., LTD.

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 RECENT DEVELOPMENTS

15.1 INFINEON TECHNOLOGIES AG

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

15.11 LATITUDE AI LLC ( A SUBSIDIARY OF FORD MOTOR )

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 SOLUTION PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 MERCEDES-BENZ AG

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.13 MOBILEYE

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 SOLUTION PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 NURO, INC.

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 NVIDIA CORPORATION

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 SOLUTION PORTFOLIO

15.15.4 RECENT DEVELOPMENTS

15.16 RENESAS ELECTRONICS CORPORATION

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENTS

15.17 ROBERT BOSCH LLC

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCTS PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

15.18 TEXAS INSTRUMENTS INCORPORATE

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 SOLUTIONS PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.19 VALEO

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCTS PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 VOLKSWAGEN

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENTS

15.21 WAYMO LLC

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 SOLUTION PORTFOLIO

15.21.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA AUTONOMOUS/ SELF-DRIVING CARS MARKET, BY LEVEL OF AUTONOMY, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA SEMI-AUTONOMOUS CARS IN AUTONOMOUS/ SELF-DRIVING CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA AUTONOMOUS CARS IN AUTONOMOUS/ SELF-DRIVING CARS MARKET, BY TYPE, 2021-2030 (USDMILLION)

TABLE 4 NORTH AMERICA AUTONOMOUS/SELF-DRIVING CARS MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA SENSORS IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA TELEMATICS IN AUTONOMOUS/ SELF-DRIVING CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA COMPUTING PLATFORM IN AUTONOMOUS/ SELF-DRIVING CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA AUTONOMOUS/ SELF-DRIVING CARS MARKET, BY MOBILITY TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA AUTONOMOUS/ SELF-DRIVING CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA AUTONOMOUS/ SELF-DRIVING CARS MARKET, BY SYSTEM TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA AUTONOMOUS/ SELF-DRIVING CARS MARKET, BY SYSTEM TYPE, 2021-2030 (THOUSAND UNIT)

TABLE 12 NORTH AMERICA AUTONOMOUS/ SELF-DRIVING CARS MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA AUTONOMOUS/ SELF-DRIVING CARS MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2030 (THOUSAND UNIT)

TABLE 14 NORTH AMERICA BATTERY ELECTRIC VEHICLE (BEV) IN AUTONOMOUS/ SELF-DRIVING CARS MARKET, BY SEMI-AUTONOMOUS CARS, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA BATTERY ELECTRIC VEHICLE (BEV) IN AUTONOMOUS/ SELF-DRIVING CARS MARKET, BY AUTONOMOUS CARS, 2021-2030 (USDMILLION)

TABLE 16 NORTH AMERICA HYBRID ELECTRIC VEHICLE (HEV) IN AUTONOMOUS/ SELF-DRIVING CARS MARKET, BY SEMI-AUTONOMOUS CARS, 2021-2030 (USDMILLION)

TABLE 17 NORTH AMERICA HYBRID ELECTRIC VEHICLE (HEV) IN AUTONOMOUS/ SELF-DRIVING CARS MARKET, BY AUTONOMOUS CARS, 2021-2030 (USDMILLION)

TABLE 18 NORTH AMERICA PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN AUTONOMOUS/ SELF-DRIVING CARS MARKET, BY SEMI-AUTONOMOUS CARS, 2021-2030 (USDMILLION)

TABLE 19 NORTH AMERICA PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN AUTONOMOUS/ SELF-DRIVING CARS MARKET, BY AUTONOMOUS CARS, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA FUEL CELL ELECTRIC VEHICLE (FCEV) IN AUTONOMOUS/ SELF-DRIVING CARS MARKET, BY SEMI-AUTONOMOUS CARS, 2021-2030 (USDMILLION)

TABLE 21 NORTH AMERICA FUEL CELL ELECTRIC VEHICLE (FCEV) IN AUTONOMOUS/ SELF-DRIVING CARS MARKET, BY AUTONOMOUS CARS, 2021-2030 (USDMILLION)

TABLE 22 NORTH AMERICA AUTONOMOUS/SELF-DRIVING CARS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA AUTONOMOUS/SELF-DRIVING CARS MARKET, BY COUNTRY, 2021-2030 (THOUSAND UNIT)

TABLE 24 NORTH AMERICA AUTONOMOUS/SELF-DRIVING CARS MARKET, BY LEVEL OF AUTONOMY, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA SEMI-AUTONOMOUS CARS IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA AUTONOMOUS CARS IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA AUTONOMOUS/SELF-DRIVING CARS MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA SENSORS IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA TELEMATICS IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA COMPUTING PLATFORM IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA AUTONOMOUS/SELF-DRIVING CARS MARKET, BY MOBILITY TYPE, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA AUTONOMOUS/SELF-DRIVING CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA AUTONOMOUS/SELF-DRIVING CARS MARKET, BY SYSTEM TYPE, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA AUTONOMOUS/SELF-DRIVING CARS MARKET, BY SYSTEM TYPE, 2021-2030 (THOUSAND UNIT)

TABLE 35 NORTH AMERICA AUTONOMOUS/SELF-DRIVING CARS MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA AUTONOMOUS/SELF-DRIVING CARS MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2030 (THOUSAND UNIT)

TABLE 37 NORTH AMERICA BATTERY ELECTRIC VEHICLE (BEV) IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY SEMI-AUTONOMOUS CARS, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA BATTERY ELECTRIC VEHICLE (BEV) IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY AUTONOMOUS CARS, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA HYBRID ELECTRIC VEHICLE (HEV) IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY SEMI-AUTONOMOUS CARS, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA HYBRID ELECTRIC VEHICLE (HEV) IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY AUTONOMOUS CARS, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY SEMI-AUTONOMOUS CARS, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY AUTONOMOUS CARS, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA FUEL CELL ELECTRIC VEHICLE (FCEV) IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY SEMI-AUTONOMOUS CARS, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA FUEL CELL ELECTRIC VEHICLE (FCEV) IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY AUTONOMOUS CARS, 2021-2030 (USD MILLION)

TABLE 45 U.S. AUTONOMOUS/SELF-DRIVING CARS MARKET, BY LEVEL OF AUTONOMY, 2021-2030 (USD MILLION)

TABLE 46 U.S. SEMI-AUTONOMOUS CARS IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 U.S. AUTONOMOUS CARS IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 U.S. AUTONOMOUS/SELF-DRIVING CARS MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 49 U.S. SENSORS IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 U.S. TELEMATICS IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 U.S. COMPUTING PLATFORM IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 U.S. AUTONOMOUS/SELF-DRIVING CARS MARKET, BY MOBILITY TYPE, 2021-2030 (USD MILLION)

TABLE 53 U.S. AUTONOMOUS/SELF-DRIVING CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 U.S. AUTONOMOUS/SELF-DRIVING CARS MARKET, BY SYSTEM TYPE, 2021-2030 (USD MILLION)

TABLE 55 U.S. AUTONOMOUS/SELF-DRIVING CARS MARKET, BY SYSTEM TYPE, 2021-2030 (THOUSAND UNIT)

TABLE 56 U.S. AUTONOMOUS/SELF-DRIVING CARS MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 57 U.S. AUTONOMOUS/SELF-DRIVING CARS MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2030 (THOUSAND UNIT)

TABLE 58 U.S. BATTERY ELECTRIC VEHICLE (BEV) IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY SEMI-AUTONOMOUS CARS, 2021-2030 (USD MILLION)

TABLE 59 U.S. BATTERY ELECTRIC VEHICLE (BEV) IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY AUTONOMOUS CARS, 2021-2030 (USD MILLION)

TABLE 60 U.S. HYBRID ELECTRIC VEHICLE (HEV) IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY SEMI-AUTONOMOUS CARS, 2021-2030 (USD MILLION)

TABLE 61 U.S. HYBRID ELECTRIC VEHICLE (HEV) IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY AUTONOMOUS CARS, 2021-2030 (USD MILLION)

TABLE 62 U.S. PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY SEMI-AUTONOMOUS CARS, 2021-2030 (USD MILLION)

TABLE 63 U.S. PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY AUTONOMOUS CARS, 2021-2030 (USD MILLION)

TABLE 64 U.S. FUEL CELL ELECTRIC VEHICLE (FCEV) IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY SEMI-AUTONOMOUS CARS, 2021-2030 (USD MILLION)

TABLE 65 U.S. FUEL CELL ELECTRIC VEHICLE (FCEV) IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY AUTONOMOUS CARS, 2021-2030 (USD MILLION)

TABLE 66 CANADA AUTONOMOUS/SELF-DRIVING CARS MARKET, BY LEVEL OF AUTONOMY, 2021-2030 (USD MILLION)

TABLE 67 CANADA SEMI-AUTONOMOUS CARS IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 CANADA AUTONOMOUS CARS IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 CANADA AUTONOMOUS/SELF-DRIVING CARS MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 70 CANADA SENSORS IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 CANADA TELEMATICS IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 72 CANADA COMPUTING PLATFORM IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 73 CANADA AUTONOMOUS/SELF-DRIVING CARS MARKET, BY MOBILITY TYPE, 2021-2030 (USD MILLION)

TABLE 74 CANADA AUTONOMOUS/SELF-DRIVING CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 75 CANADA AUTONOMOUS/SELF-DRIVING CARS MARKET, BY SYSTEM TYPE, 2021-2030 (USD MILLION)

TABLE 76 CANADA AUTONOMOUS/SELF-DRIVING CARS MARKET, BY SYSTEM TYPE, 2021-2030 (THOUSAND UNIT)

TABLE 77 CANADA AUTONOMOUS/SELF-DRIVING CARS MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 78 CANADA AUTONOMOUS/SELF-DRIVING CARS MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2030 (THOUSAND UNIT)

TABLE 79 CANADA BATTERY ELECTRIC VEHICLE (BEV) IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY SEMI-AUTONOMOUS CARS, 2021-2030 (USD MILLION)

TABLE 80 CANADA BATTERY ELECTRIC VEHICLE (BEV) IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY AUTONOMOUS CARS, 2021-2030 (USD MILLION)

TABLE 81 CANADA HYBRID ELECTRIC VEHICLE (HEV) IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY SEMI-AUTONOMOUS CARS, 2021-2030 (USD MILLION)

TABLE 82 CANADA HYBRID ELECTRIC VEHICLE (HEV) IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY AUTONOMOUS CARS, 2021-2030 (USD MILLION)

TABLE 83 CANADA PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY SEMI-AUTONOMOUS CARS, 2021-2030 (USD MILLION)

TABLE 84 CANADA PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY AUTONOMOUS CARS, 2021-2030 (USD MILLION)

TABLE 85 CANADA FUEL CELL ELECTRIC VEHICLE (FCEV) IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY SEMI-AUTONOMOUS CARS, 2021-2030 (USD MILLION)

TABLE 86 CANADA FUEL CELL ELECTRIC VEHICLE (FCEV) IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY AUTONOMOUS CARS, 2021-2030 (USD MILLION)

TABLE 87 MEXICO AUTONOMOUS/SELF-DRIVING CARS MARKET, BY LEVEL OF AUTONOMY, 2021-2030 (USD MILLION)

TABLE 88 MEXICO SEMI-AUTONOMOUS CARS IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 89 MEXICO AUTONOMOUS CARS IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 90 MEXICO AUTONOMOUS/SELF-DRIVING CARS MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 91 MEXICO SENSORS IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 92 MEXICO TELEMATICS IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 93 MEXICO COMPUTING PLATFORM IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 94 MEXICO AUTONOMOUS/SELF-DRIVING CARS MARKET, BY MOBILITY TYPE, 2021-2030 (USD MILLION)

TABLE 95 MEXICO AUTONOMOUS/SELF-DRIVING CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 96 MEXICO AUTONOMOUS/SELF-DRIVING CARS MARKET, BY SYSTEM TYPE, 2021-2030 (USD MILLION)

TABLE 97 MEXICO AUTONOMOUS/SELF-DRIVING CARS MARKET, BY SYSTEM TYPE, 2021-2030 (THOUSAND UNIT)

TABLE 98 MEXICO AUTONOMOUS/SELF-DRIVING CARS MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 99 MEXICO AUTONOMOUS/SELF-DRIVING CARS MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2030 (THOUSAND UNIT)

TABLE 100 MEXICO BATTERY ELECTRIC VEHICLE (BEV) IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY SEMI-AUTONOMOUS CARS, 2021-2030 (USD MILLION)

TABLE 101 MEXICO BATTERY ELECTRIC VEHICLE (BEV) IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY AUTONOMOUS CARS, 2021-2030 (USD MILLION)

TABLE 102 MEXICO HYBRID ELECTRIC VEHICLE (HEV) IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY SEMI-AUTONOMOUS CARS, 2021-2030 (USD MILLION)

TABLE 103 MEXICO HYBRID ELECTRIC VEHICLE (HEV) IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY AUTONOMOUS CARS, 2021-2030 (USD MILLION)

TABLE 104 MEXICO PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY SEMI-AUTONOMOUS CARS, 2021-2030 (USD MILLION)

TABLE 105 MEXICO PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY AUTONOMOUS CARS, 2021-2030 (USD MILLION)

TABLE 106 MEXICO FUEL CELL ELECTRIC VEHICLE (FCEV) IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY SEMI-AUTONOMOUS CARS, 2021-2030 (USD MILLION)

TABLE 107 MEXICO FUEL CELL ELECTRIC VEHICLE (FCEV) IN AUTONOMOUS/SELF-DRIVING CARS MARKET, BY AUTONOMOUS CARS, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA AUTONOMOUS/SELF-DRIVING CARS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA AUTONOMOUS/SELF-DRIVING CARS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA AUTONOMOUS/SELF-DRIVING CARS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA AUTONOMOUS/SELF-DRIVING CARS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA AUTONOMOUS/SELF-DRIVING CARS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA AUTONOMOUS/SELF-DRIVING CARS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA AUTONOMOUS/SELF-DRIVING CARS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA AUTONOMOUS/SELF-DRIVING CARS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA AUTONOMOUS/SELF-DRIVING CARS MARKET: MULTIVARIATE MODELLING

FIGURE 10 NORTH AMERICA AUTONOMOUS/SELF-DRIVING CARS MARKET: LEVEL OF AUTONOMY TIMELINE CURVE

FIGURE 11 NORTH AMERICA AUTONOMOUS/SELF-DRIVING CARS MARKET: SEGMENTATION

FIGURE 12 TECHNOLOGICAL ADVANCEMENTS IN AUTONOMOUS/SELF-DRIVING CARS ARE EXPECTED TO DRIVE THE GROWTH OF THE NORTH AMERICA AUTONOMOUS/SELF-DRIVING CARS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 SEMI-AUTONOMOUS CARS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA AUTONOMOUS/SELF-DRIVING CARS MARKET FROM 2023 TO 2030

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA AUTONOMOUS/SELF-DRIVING CARS MARKET

FIGURE 15 NORTH AMERICA AUTONOMOUS/ SELF-DRIVING CARS MARKET: BY LEVEL OF AUTONOMY, 2022

FIGURE 16 NORTH AMERICA AUTONOMOUS/ SELF-DRIVING CARS MARKET: BY TECHNOLOGY, 2022

FIGURE 17 NORTH AMERICA AUTONOMOUS/ SELF-DRIVING CARS MARKET: BY MOBILITY TYPE, 2022

FIGURE 18 NORTH AMERICA AUTONOMOUS/ SELF-DRIVING CARS MARKET: BY TYPE, 2022

FIGURE 19 NORTH AMERICA AUTONOMOUS/ SELF-DRIVING CARS MARKET: BY SYSTEM TYPE, 2022

FIGURE 20 NORTH AMERICA AUTONOMOUS/ SELF-DRIVING CARS MARKET: BY ELECTRIC VEHICLE TYPE, 2022

FIGURE 21 NORTH AMERICA AUTONOMOUS/SELF-DRIVING CARS MARKET: SNAPSHOT (2022)

FIGURE 22 NORTH AMERICA AUTONOMOUS/SELF-DRIVING CARS MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.