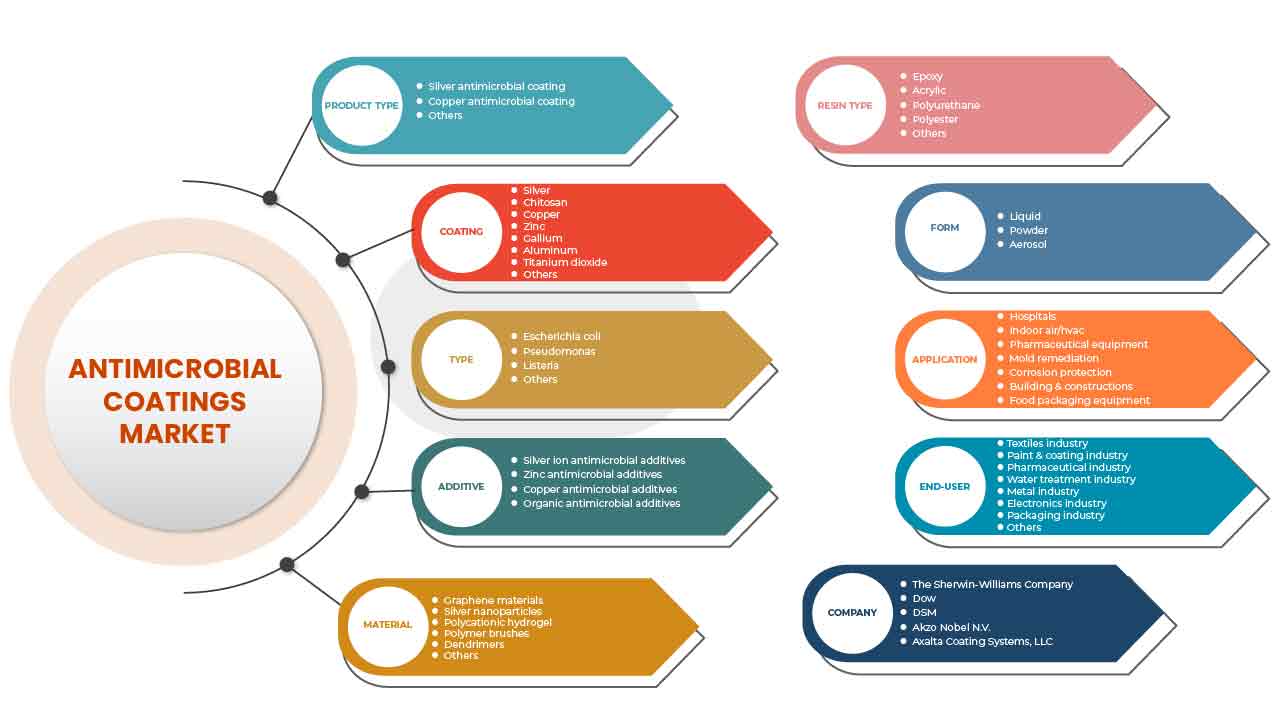

North America Antimicrobial Coatings Market, By Product Type (Silver Antimicrobial Coating, Copper Antimicrobial Coating, Others), Coating (Silver, Chitosan, Titanium Dioxide, Aluminum, Copper, Zinc, Gallium, Others), Type (Escherichia Coli, Pseudomonas, Listeria, Others), Additives (Silver Ion Antimicrobial Additives, Organic Antimicrobial Additives, Copper Antimicrobial Additives, Zinc Antimicrobial Additives), Material (Graphene Materials, Silver Nanoparticles, Polycationic Hydrogel, Polymer Brushes, Dendrimers, Others), Resin Type (Epoxy, Acrylic, Polyurethane, Polyester, Others), Form (Liquid, Powder, Aerosol), Application (Hospitals, Indoor Air/HVAC, Pharmaceutical Equipment, Mold Remediation, Corrosion Protection, Building & Construction and Food Packaging Equipment), End-Users (Pharmaceutical Industry, Paint and Coating Industry, Packaging Industry, Textiles Industry, Electronics Industry, Metal Industry, Water Treatment Industry, and Others) - Industry Trends and Forecast to 2029.

Market Analysis and Insights

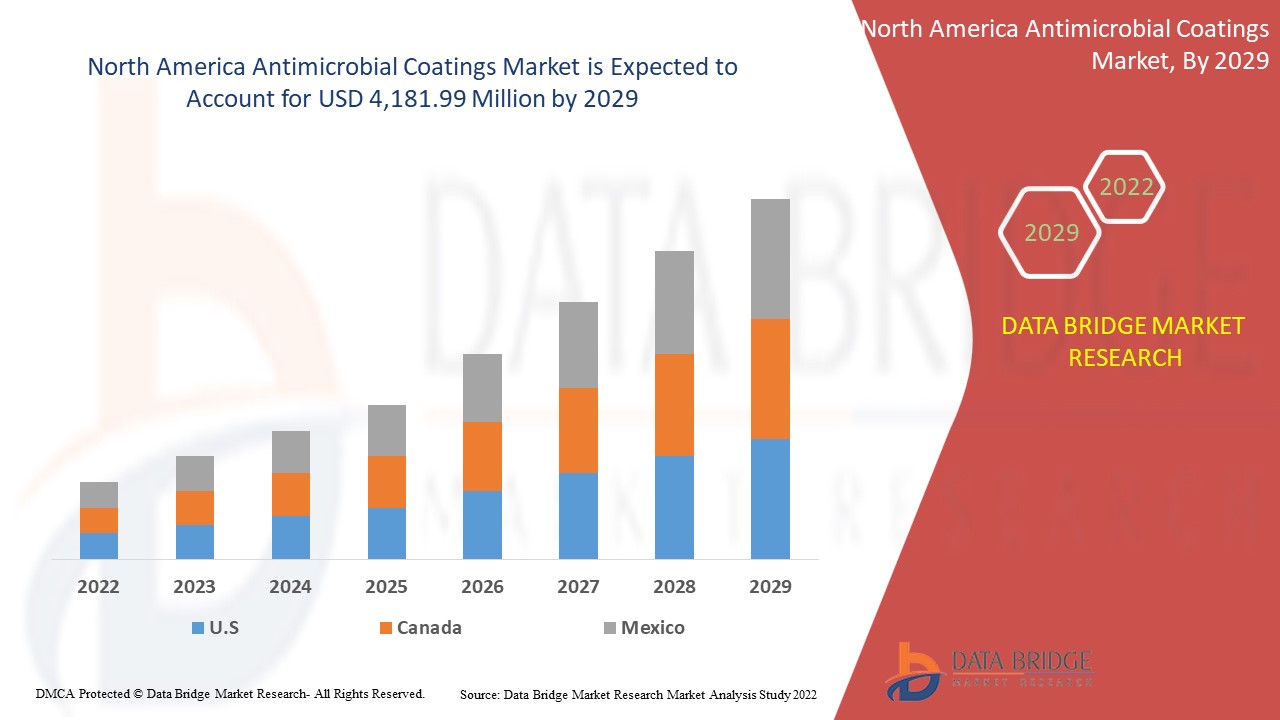

The North America antimicrobial coatings market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 11.5% in the forecast period of 2022 to 2029 and is expected to reach USD 4,181.99 million by 2029. The major factor driving the growth of the North America antimicrobial coatings market is the growing demand for heating, ventilation, and air conditioning to improve indoor air quality

Antimicrobial coatings assist in maintaining the quality of applied surfaces by preventing the growth of microorganisms such as fungi, parasites, and bacteria. The usage of these antimicrobial coatings provides improved cleanliness and hygiene as they end the requirement of frequent cleaning. As a result, antimicrobial coatings are more cost-effective and offer lasting protection against pathogens. These coatings are generally applied on walls, vents, counters, and door handles. Moreover, as these coatings help sterilize medical tools, surgical masks, gloves, and clothing, they find vast applications in clinics, hospitals, and healthcare centers.

The application of antimicrobial coatings improves the durability and appearance of the applied surface and aids in shielding the surface from the attack of microbes. As a result, these coatings are widely used to eliminate the germination of pathogens that can cause infectious diseases such as Ebola, influenza, mumps, measles, chickenpox, and rubella.

Growing demand for heating, ventilation, and air conditioning to improve indoor air quality and rising awareness regarding healthcare-associated infections (HCAI) are expected to boost market antimicrobial coatings demand. With the increasing consumption of antimicrobial coatings globally, major companies are expanding their production capacities in different countries to strengthen their presence of these products in the market.

The major restraint which may impact the market is stringent regulations associated with antimicrobial coatings. Also, the emission of active ingredients into the environment is a restraining factor for the North America antimicrobial coatings market.

North America antimicrobial coatings market report provides details of market share, new developments, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief; our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in Million, Pricing in USD |

|

Segments Covered |

By Product Type (Silver Antimicrobial Coating, Copper Antimicrobial Coating, Others), By Coating (Silver, Chitosan, Titanium Dioxide, Aluminum, Copper, Zinc, Gallium, Others), By Type (Escherichia Coli, Pseudomonas, Listeria, Others), By Additives (Silver Ion Antimicrobial Additives, Organic Antimicrobial Additives, Copper Antimicrobial Additives, Zinc Antimicrobial Additives), By Material (Graphene Materials, Silver Nanoparticles, Polycationic Hydrogel, Polymer Brushes, Dendrimers, Others), By Resin Type (Epoxy, Acrylic, Polyurethane, Polyester, Others), By Form (Liquid, Powder, Aerosol), By Application (Hospitals, Indoor Air/HVAC, Pharmaceutical Equipment, Mold Remediation, Corrosion Protection, Building & Construction and Food Packaging Equipment), By End-Users (Pharmaceutical Industry, Paint and Coating Industry, Packaging Industry, Textiles Industry, Electronics Industry, Metal Industry, Water Treatment Industry, and Others) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

Axalta Coating Systems, LLC, Akzo Nobel N.V., SANITIZED AG, PPG Industries Inc., The Sherwin-Williams Company, Microban International, Fiberlock, Burke Industrial Coatings, Aereus Technologies, Linetec, Katilac Coatings, Dow, Kastus Technologies Company Limited, Specialty Coating Systems Inc., DuPont, Flowcrete, Nano Care Deutschland AG, among others |

Market Definition

Antimicrobial coatings are microbe-resistant coatings that include antimicrobial agents preventing microbial impurities. They have extensive application utilization in the construction, food, and healthcare industry. They are applied to the doors, glass panels, walls, doors, HVAC tents, counters, and so forth. The antimicrobial coating is an application of a chemical agent on the surface which can stop the growth of disease-causing microorganisms. Apart from this, the antimicrobial coating helps to increase the surface durability, appearance, corrosion resistance, and others. These coatings are used for medical devices in order to destroy or inhibit the growth of microorganisms and protect humans from getting infected by infectious diseases. The antimicrobial coating is known to be a powerful weapon against healthcare-related infections. The antimicrobial coating features a highly effective viable antimicrobial coating and modifications precisely dosed and delivered right from the surface of the medical device. Antimicrobial coating focuses on the reduction of accumulation on biomedical devices through changing interfacial features.

North America Antimicrobial Coatings Market Dynamics

Drivers

- Growing Demand For Heating, Ventilation, And Air Conditioning To Improve Indoor Air Quality

The North American region is the house of many large buildings that house huge offices and residential places. With the increasing infrastructural development in the region, there has been growing awareness of good indoor air quality owing to the increased spread of diseases. Thus, there is an increased demand for effective heating, ventilation, and air conditioning to improve indoor air quality, which is expected to drive the North America antimicrobial coatings market.

- Significant Demand from The Medical Device Industry

The ability and potential of antimicrobial coatings to prevent and control pathogen growth on any surface especially in the healthcare sector, is surging its demand in the medical devices industry. Thus, the significant demand from the healthcare sector and facilities such as clinics and hospitals for the medical device industry is expected to act as a driver for the North America antimicrobial coatings market.

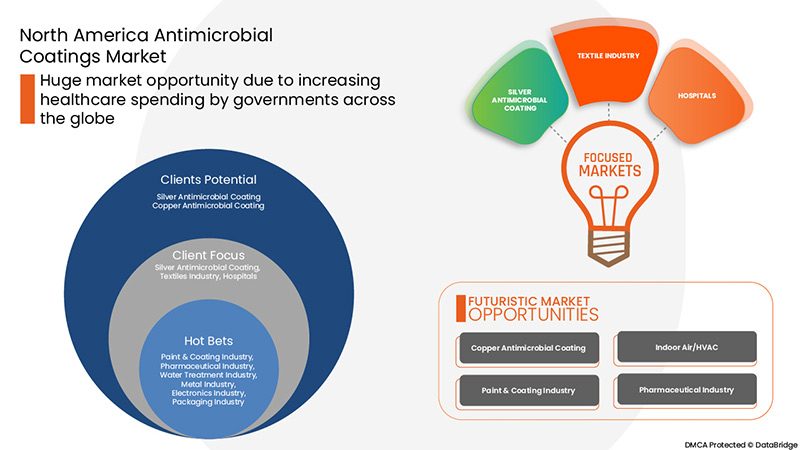

Opportunities

- Rising Usage Across Key Novel Applications

With the growing concern and rising awareness regarding safety and hygiene across developed countries such as the U.S. and Canada, various companies are focusing on developing antimicrobial and antibacterial products to ensure the safety of their customers. Moreover, this helps to comply with changing consumer preferences and helps increase the market demand for antimicrobial-coated products, thus providing a lucrative opportunity for the growth of the North America antimicrobial coatings market.

- Technological Advancements In Antimicrobial Coatings

Rapid development in antimicrobial coating technology coupled with growing demand for advanced antimicrobial coatings products for use in different industries is anticipated to create an opportunity for the antimicrobial coatings market over the forecast period

Restraints/Challenges

- Emission Of Active Ingredients Into The Environment

Antimicrobial coatings are applied on any product or surface to prevent the spread of infections to human beings and other organisms. However, the use of antimicrobial coatings can also cause health hazards when used for a very long period. Most of the antimicrobial coatings are made up of ingredients such as zinc, silver, and copper and actively emit these ingredients back to the environment. These active ingredients enter the air surrounding and other water bodies slowly and cause harm to the ecosystem.

Thus, adverse effects of antimicrobial coatings on the environment coupled with a lack of awareness and information regarding minimizing its adverse effects on the environment may restrain the North America antimicrobial coatings market.

- Stringent Regulations Associated with Antimicrobial Coatings

Strict regulations on the usage of antimicrobial coatings by various organizations such as the Environmental Protection Agency (EPA), FDA and REACH among others, are likely to hamper the growth of the North America antimicrobial coatings market.

- Increasing Concerns Regarding the Toxicity Of Nanoparticles

Long-time exposure to nanoparticles toxicity released from the antimicrobial coatings may result in serious health issues, which raises concerns and may challenge the North America antimicrobial coatings market's growth.

- High Cost of Products and Supply Chain Disruptions Due To COVID-19 Pandemic

The outbreak of COVID-19 is expected to act as a challenge to the growth of the North America antimicrobial coatings market in the forecast period due to nationwide lockdowns, which negatively impacted the demand and sales of antimicrobial coatings. However, with the ease of lockdown, the workflow has started increasing, which has helped the manufacturers to make a comeback in the market. Also, supportive government regulations regarding the growth in the economy and rising startups may surge the demand for the antimicrobial coatings market during the forecast period.

Recent Developments

- In March 2021, Specialty Coating Systems, Inc., a global leader in Parylene conformal coating services and technology, announced its acquisition of Diamond-MT, Inc., a provider of Parylene and liquid conformal coating services. This development will give new growth opportunities to the company.

- In November 2021, DuPont entered into a definitive agreement to acquire Rogers Corporation ("Rogers") for USD 5.2 Billion. DuPont announced a series of actions advancing its strategy as a premier multi-industrial company focused on market-leading high-growth, high-margin businesses with complementary technology and financial characteristics. This development will help DuPont to expand its business with the help of Rogers Corporation.

North America Antimicrobial Coatings Market Scope

North America antimicrobial coatings market is categorized based on product type, coating, type, material, additive, resin type, form, application, and end-users.

Product Type

- Silver Antimicrobial Coatings

- Copper Antimicrobial Coatings

- Others

On the basis of product type, North America antimicrobial coatings market is segmented into silver antimicrobial coatings, copper antimicrobial coatings, and others.

Coating

- Silver

- Chitosan

- Copper

- Zinc

- Gallium

- Aluminum

- Titanium Dioxide

- Others

On the basis of coating, North America antimicrobial coatings market is segmented into silver, chitosan, copper, zinc, gallium, aluminum, titanium dioxide, and others.

Type

- Escherichia Coli

- Pseudomonas

- Listeria

- Others

On the basis of type, North America antimicrobial coatings market is segmented into Escherichia coli, pseudomonas, listeria, and others.

Additive

- Silver Ion Antimicrobial Additives

- Zinc Antimicrobial Additives

- Copper Antimicrobial Additives

- Organic Antimicrobial Additives

On the basis of additive, North America antimicrobial coatings market is segmented into silver ion antimicrobial additives, zinc antimicrobial additives, copper antimicrobial additives, and organic antimicrobial additives.

Material

- Graphene Materials

- Polycationic Hydrogel

- Silver Nanoparticles

- Polymer Brushes

- Dendrimers

- Others

On the basis of material, North America antimicrobial coatings market is segmented into graphene materials, silver nanoparticles, polycationic hydrogel, polymer brushes, dendrimers, and others.

Resin Type

- Acrylic

- Polyester

- Polyurethane

- Epoxy

- Others

On the basis of resin type, North America antimicrobial coatings market is segmented into epoxy, acrylic, polyurethane, polyesters, and others.

Form

- Liquid

- Aerosol

- Powder

On the basis of form, North America antimicrobial coatings market is segmented into liquid, aerosol, and powder.

Application

- Hospitals

- Indoor Air/HVAC

- Pharmaceutical Equipment

- Mold Remediation

- Corrosion Protection

- Building & Construction

- Food Packaging Equipment

- Others

On the basis of application, North America antimicrobial coatings market is segmented into hospitals, indoor air/HVAC, pharmaceutical equipment, mold remediation, corrosion protection, building & construction, food packaging equipment, and others.

End-Users

- Pharmaceutical Industry

- Paint and Coating Industry

- Packaging Industry

- Textiles Industry

- Electronics Industry

- Metal Industry

- Water Treatment Industry

- Others

On the basis of end-users, North America antimicrobial coatings market is segmented into the pharmaceutical industry, paint and coating industry, packaging industry, textiles industry, electronics industry, metal industry, water treatment industry, and others.

North America Antimicrobial Coatings Regional Analysis/Insights

The North America antimicrobial coatings market is categorized based on country, product type, coating, type, material, additive, resin type, form, application, and end-users.

North America antimicrobial coatings market is further segmented into the U.S., Canada, and Mexico.

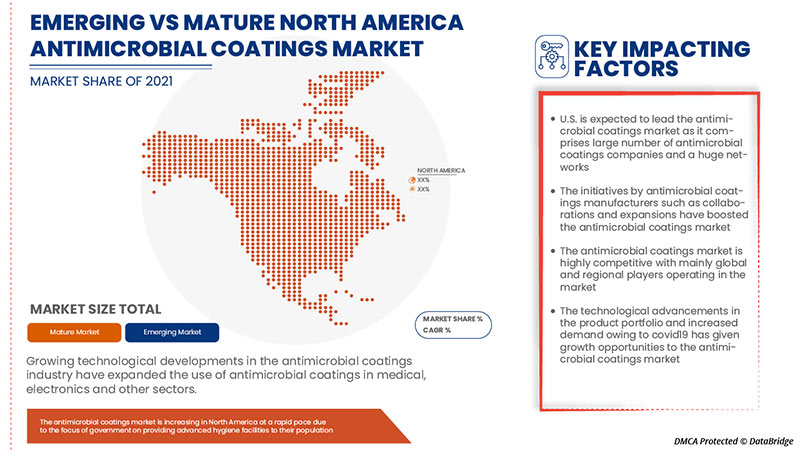

U.S. is expected to dominate the North America antimicrobial coatings market in terms of market share and revenue and will continue to flourish its dominance during the forecast period. This is due to the increasing need for safe environments in the country.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of North American brands and their challenges faced due to high competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Antimicrobial Coatings Market Share Analysis

North America antimicrobial coatings market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies' focus related to the North America antimicrobial coatings market.

Some of the prominent participants operating in the North America antimicrobial coatings market are Axalta Coating Systems, LLC, Akzo Nobel N.V., SANITIZED AG, PPG Industries Inc., The Sherwin-Williams Company, Microban International, Fiberlock, Burke Industrial Coatings, Aereus Technologies, Linetec, Katilac Coatings, Dow, Kastus Technologies Company Limited, Specialty Coating Systems Inc., DuPont, Flowcrete, Nano Care Deutschland AG, among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, North America Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA ANTIMICROBIAL COATINGS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR HEATING, VENTILATION, AND AIR CONDITIONING TO IMPROVE INDOOR AIR QUALITY

5.1.2 RISING AWARENESS REGARDING HEALTHCARE ASSOCIATED INFECTIONS (HCAI)

5.1.3 SIGNIFICANT DEMAND FROM THE MEDICAL DEVICE INDUSTRY

5.1.4 INCREASING ADOPTION ACROSS VARIOUS INDUSTRIAL APPLICATIONS

5.2 RESTRAINTS

5.2.1 EMISSION OF ACTIVE INGREDIENTS INTO THE ENVIRONMENT

5.2.2 STRINGENT REGULATIONS ASSOCIATED WITH ANTIMICROBIAL COATINGS

5.3 OPPORTUNITIES

5.3.1 RISING USAGE ACROSS KEY NOVEL APPLICATIONS

5.3.2 TECHNOLOGICAL ADVANCEMENTS IN ANTIMICROBIAL COATINGS

5.3.3 INCREASING HEALTHCARE SPENDING BY GOVERNMENTS ACROSS THE GLOBE

5.4 CHALLENGES

5.4.1 INCREASING CONCERNS REGARDING THE TOXICITY OF NANOPARTICLES

5.4.2 HIGH COST OF PRODUCTS AND SUPPLY CHAIN DISRUPTIONS DUE TO COVID-19 PANDEMIC

6 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 SILVER ANTIMICROBIAL COATINGS

6.3 COPPER ANTIMICROBIAL COATINGS

6.4 OTHERS

7 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY COATINGS

7.1 OVERVIEW

7.2 SILVER

7.3 CHITOSAN

7.4 TITANIUM DIOXIDE

7.5 ALUMINUM

7.6 COPPER

7.7 ZINC

7.8 GALLIUM

7.9 OTHERS

8 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY TYPE

8.1 OVERVIEW

8.2 ESCHERICHIA COLI

8.3 PSEUDOMONAS

8.4 LISTERIA

8.5 OTHERS

9 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY ADDITIVE

9.1 OVERVIEW

9.2 SILVER ION ANTIMICROBIAL ADDITIVES

9.3 ORGANIC ANTIMICROBIAL ADDITIVES

9.4 COPPER ANTIMICROBIAL ADDITIVES

9.5 ZINC ANTIMICROBIAL ADDITIVES

10 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY MATERIAL

10.1 OVERVIEW

10.2 GRAPHENE MATERIALS

10.3 SILVER NANOPARTICLES

10.4 POLYCATIONIC HYDROGEL

10.5 POLYMER BRUSHES

10.5.1 FUNCTIONALIZED POLYMER BRUSHES

10.5.2 NON-FOULING POLYMER BRUSHES

10.5.3 BRUSHES COMPRISING BACTERIAL POLYMERS

10.6 DENDRIMERS

10.7 OTHERS

11 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY RESIN TYPE

11.1 OVERVIEW

11.2 EPOXY

11.3 ACRYLIC

11.4 POLYURETHANE

11.5 POLYESTER

11.6 OTHERS

12 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY FORM

12.1 OVERVIEW

12.2 LIQUID

12.3 POWDER

12.4 AEROSOL

13 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 HOSPITALS

13.3 INDOOR AIR/HVAC

13.4 PHARMACEUTICAL EQUIPMENT

13.5 MOLD REMEDIATION

13.6 CORROSION PROTECTION

13.7 BUILDING & CONSTRUCTIONS

13.8 FOOD PACKAGING EQUIPMENT

13.9 OTHERS

14 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY END USER

14.1 OVERVIEW

14.2 TEXTILES INDUSTRY

14.2.1 SILVER ANTIMICROBIAL COATING

14.2.2 COPPER ANTIMICROBIAL COATING

14.2.3 OTHERS

14.3 PAINT & COATING INDUSTRY

14.3.1 SILVER ANTIMICROBIAL COATING

14.3.2 COPPER ANTIMICROBIAL COATING

14.3.3 OTHERS

14.4 PHARMACEUTICAL INDUSTRY

14.4.1 SILVER ANTIMICROBIAL COATING

14.4.2 COPPER ANTIMICROBIAL COATING

14.4.3 OTHERS

14.5 WATER TREATMENT INDUSTRY

14.5.1 SILVER ANTIMICROBIAL COATING

14.5.2 COPPER ANTIMICROBIAL COATING

14.5.3 OTHERS

14.6 METAL INDUSTRY

14.6.1 SILVER ANTIMICROBIAL COATING

14.6.2 COPPER ANTIMICROBIAL COATING

14.6.3 OTHERS

14.7 ELECTRONICS INDUSTRY

14.7.1 SILVER ANTIMICROBIAL COATING

14.7.2 COPPER ANTIMICROBIAL COATING

14.7.3 OTHERS

14.8 PACKAGING INDUSTRY

14.8.1 SILVER ANTIMICROBIAL COATING

14.8.2 COPPER ANTIMICROBIAL COATING

14.8.3 OTHERS

14.9 OTHERS

14.9.1 SILVER ANTIMICROBIAL COATING

14.9.2 COPPER ANTIMICROBIAL COATING

14.9.3 OTHERS

15 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY REGION

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.2 MERGERS & ACQUISITIONS

16.3 EXPANSIONS

16.4 NEW PRODUCT DEVELOPMENTS

17 SWOT ANALYSIS

18 COMPANY PROFILES

18.1 THE SHERWIN-WILLIAMS COMPANY

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT UPDATES

18.2 DOW

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT UPDATES

18.3 DSM

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT UPDATE

18.4 AKZO NOBEL N.V.

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT UPDATES

18.5 AXALTA COATING SYSTEMS, LLC

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT UPDATES

18.6 AEREUS TECHNOLOGIES

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT UPDATES

18.7 ARXADA AG

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT UPDATES

18.8 BURKE INDUSTRIAL COATINGS

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT UPDATE

18.9 DUPONT

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT UPDATE

18.1 FIBERLOCK

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT UPDATES

18.11 FLOWCRETE

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT UPDATE

18.12 GBNEUHAUS GMBH

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT UPDATE

18.13 LINETEC

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT UPDATE

18.14 KASTUS TECHNOLOGIES COMPANY LIMITED

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT UPDATE

18.15 KATILAC COATINGS

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT UPDATE

18.16 MICROBAN INTERNATIONAL

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT UPDATE

18.17 NANO CARE DEUTSCHLAND AG

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT UPDATE

18.18 SANITIZED AG

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT UPDATES

18.19 SPECIALTY COATING SYSTEMS INC.

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT UPDATES

18.2 PPG INDUSTRIES, INC.

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 RECENT UPDATES

19 QUESTIONNAIRE

20 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONNES)

TABLE 3 NORTH AMERICA SILVER ANTIMICROBIAL COATINGS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA SILVER ANTIMICROBIAL COATINGS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (KILO TONNES)

TABLE 5 NORTH AMERICA COPPER ANTIMICROBIAL COATINGS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA COPPER ANTIMICROBIAL COATINGS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (KILO TONNES)

TABLE 7 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (KILO TONNES)

TABLE 9 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY COATINGS, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA SILVER IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA CHITOSAN IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA TITANIUM DIOXIDE IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA ALUMINUM IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA COPPER IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA ZINC IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA GALLIUM IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA ESCHERICHIA COLI IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA PSEUDOMONAS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA LISTERIA IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY ADDITIVE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA SILVER ION ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA ORGANIC ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA COPPER ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA ZINC ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA GRAPHENE MATERIALS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA SILVER NANOPARTICLES IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA POLYCATIONIC HYDROGEL IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA POLYMER BRUSHES IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA POLYMER BRUSHES IN ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA DENDRIMERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA EPOXY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA ACRYLIC IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA POLYURETHANE IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA POLYESTER IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA LIQUID IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA POWDER IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA AEROSOL IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA HOSPITALS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA INDOOR AIR/HVAC IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA PHARMACEUTICAL EQUIPMENT IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA MOLD REMEDIATION IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA CORROSION PROTECTION IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA BUILDING & CONSTRUCTIONS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA FOOD PACKAGING EQUIPMENT IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA TEXTILES INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA TEXTILES INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA PAINT & COATING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA PAINT & COATING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA PHARMACEUTICAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA PHARMACEUTICAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA WATER TREATMENT INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA WATER TREATMENT INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA METAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA METAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA ELECTRONICS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA ELECTRONICS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA PACKAGING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA PACKAGING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY COUNTRY, 2020-2029 (KILO TONNES)

TABLE 74 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 75 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONNES)

TABLE 76 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY COATINGS, 2020-2029 (USD MILLION)

TABLE 77 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY ADDITIVE, 2020-2029 (USD MILLION)

TABLE 79 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 80 NORTH AMERICA POLYMER BRUSHES IN ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 81 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 82 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 83 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 85 NORTH AMERICA TEXTILES INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 86 NORTH AMERICA PAINT & COATINGS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 87 NORTH AMERICA PHARMACEUTICAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 88 NORTH AMERICA WATER TREATMENT INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 89 NORTH AMERICA METAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 NORTH AMERICA ELECTRONICS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 91 NORTH AMERICA PACKAGING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 92 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 93 U.S. ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 94 U.S. ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONNES)

TABLE 95 U.S. ANTIMICROBIAL COATINGS MARKET, BY COATINGS, 2020-2029 (USD MILLION)

TABLE 96 U.S. ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 U.S. ANTIMICROBIAL COATINGS MARKET, BY ADDITIVE, 2020-2029 (USD MILLION)

TABLE 98 U.S. ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 99 U.S. POLYMER BRUSHES IN ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 100 U.S. ANTIMICROBIAL COATINGS MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 101 U.S. ANTIMICROBIAL COATINGS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 102 U.S. ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 103 U.S. ANTIMICROBIAL COATINGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 104 U.S. TEXTILES INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 105 U.S. PAINT & COATINGS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 106 U.S. PHARMACEUTICAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 107 U.S. WATER TREATMENT INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 108 U.S. METAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 109 U.S. ELECTRONICS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 110 U.S. PACKAGING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 111 U.S. OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 112 CANADA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 113 CANADA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONNES)

TABLE 114 CANADA ANTIMICROBIAL COATINGS MARKET, BY COATINGS, 2020-2029 (USD MILLION)

TABLE 115 CANADA ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 CANADA ANTIMICROBIAL COATINGS MARKET, BY ADDITIVE, 2020-2029 (USD MILLION)

TABLE 117 CANADA ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 118 CANADA POLYMER BRUSHES IN ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 119 CANADA ANTIMICROBIAL COATINGS MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 120 CANADA ANTIMICROBIAL COATINGS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 121 CANADA ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 CANADA ANTIMICROBIAL COATINGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 123 CANADA TEXTILES INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 124 CANADA PAINT & COATINGS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 125 CANADA PHARMACEUTICAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 126 CANADA WATER TREATMENT INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 127 CANADA METAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 128 CANADA ELECTRONICS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 129 CANADA PACKAGING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 130 CANADA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 131 MEXICO ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 132 MEXICO ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONNES)

TABLE 133 MEXICO ANTIMICROBIAL COATINGS MARKET, BY COATINGS, 2020-2029 (USD MILLION)

TABLE 134 MEXICO ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 MEXICO ANTIMICROBIAL COATINGS MARKET, BY ADDITIVE, 2020-2029 (USD MILLION)

TABLE 136 MEXICO ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 137 MEXICO POLYMER BRUSHES IN ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 138 MEXICO ANTIMICROBIAL COATINGS MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 139 MEXICO ANTIMICROBIAL COATINGS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 140 MEXICO ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 141 MEXICO ANTIMICROBIAL COATINGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 142 MEXICO TEXTILES INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 143 MEXICO PAINT & COATINGS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 144 MEXICO PHARMACEUTICAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 145 MEXICO WATER TREATMENT INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 146 MEXICO METAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 147 MEXICO ELECTRONICS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 148 MEXICO PACKAGING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 149 MEXICO OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: PRODUCT TYPE LIFELINE CURVE

FIGURE 7 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: SEGMENTATION

FIGURE 14 NORTH AMERICA IS EXPECTED TO DOMINATE THE NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 GROWING DEMAND FOR HEATING, VENTILATION, AND AIR CONDITIONING TO IMPROVE INDOOR AIR QUALITY IS EXPECTED TO DRIVE THE NORTH AMERICA ANTIMICROBIAL COATINGS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 SILVER ANTIMICROBIAL COATINGS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ANTIMICROBIAL COATINGS MARKET IN 2022 & 2029

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA ANTIMICROBIAL COATINGS MARKET

FIGURE 18 RELATIVE CONTRIBUTIONS TO U.S. HEALTH EXPENDITURES, 2020

FIGURE 19 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY PRODUCT TYPE, 2021

FIGURE 20 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY COATINGS, 2021

FIGURE 21 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY TYPE, 2021

FIGURE 22 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY ADDITIVE, 2021

FIGURE 23 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY MATERIAL, 2021

FIGURE 24 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY RESIN TYPE, 2021

FIGURE 25 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY FORM, 2021

FIGURE 26 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY APPLICATION, 2021

FIGURE 27 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY END USER, 2021

FIGURE 28 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: SNAPSHOT (2021)

FIGURE 29 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY COUNTRY (2021)

FIGURE 30 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 31 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 32 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 33 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.