North America Anti Money Laundering Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

1.17 Billion

USD

3.62 Billion

2024

2032

USD

1.17 Billion

USD

3.62 Billion

2024

2032

| 2025 –2032 | |

| USD 1.17 Billion | |

| USD 3.62 Billion | |

|

|

|

|

Segmentación del mercado de lucha contra el blanqueo de capitales en Norteamérica por oferta (soluciones y servicios), función (gestión de cumplimiento, gestión de identidad del cliente, monitorización de transacciones, informes de transacciones de divisas y otros), implementación (nube y local), tamaño de la empresa (grandes empresas, pequeñas y medianas empresas), uso final (bancos e instituciones financieras, aseguradoras, gobierno, juegos de azar y apuestas, y otros): tendencias de la industria y pronóstico hasta 2032.

Tamaño del mercado de lucha contra el blanqueo de capitales

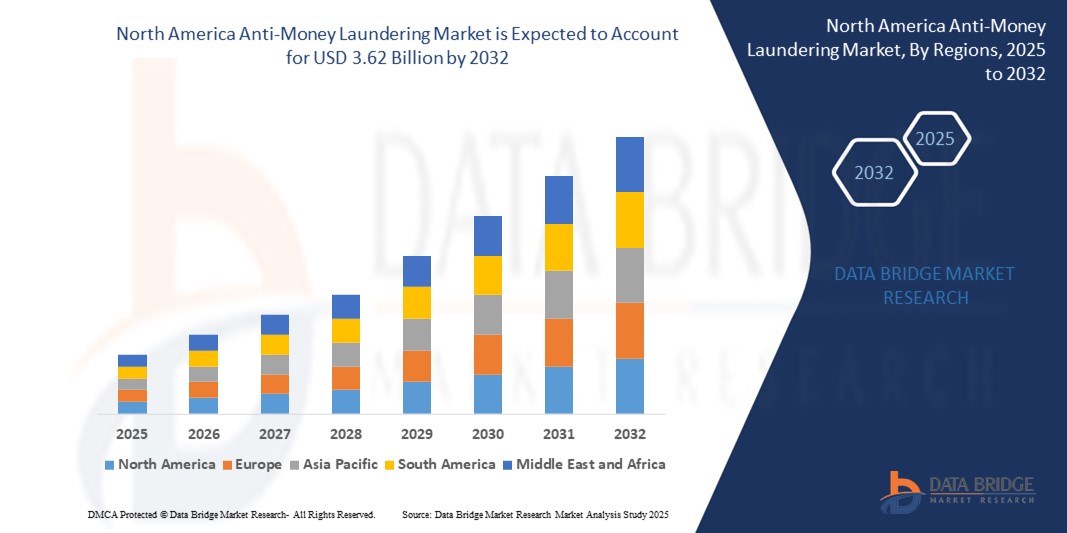

- El tamaño del mercado de lucha contra el blanqueo de dinero de América del Norte se valoró en 1.170 millones de dólares en 2024 y se espera que alcance los 3.620 millones de dólares en 2032 , con una CAGR del 15,1 % durante el período de pronóstico.

- El crecimiento del mercado está impulsado principalmente por el creciente escrutinio regulatorio, los avances en la tecnología financiera y la creciente adopción de soluciones de banca digital, lo que requiere sistemas sólidos contra el lavado de dinero (AML).

- Además, una mayor conciencia sobre los delitos financieros, como el lavado de dinero y el financiamiento del terrorismo, junto con estrictas regulaciones gubernamentales, está impulsando la demanda de soluciones avanzadas de AML en varios sectores.

Análisis del mercado contra el blanqueo de capitales

- Las soluciones contra el lavado de dinero, que abarcan software y servicios diseñados para detectar y prevenir delitos financieros, son fundamentales para garantizar el cumplimiento de los marcos regulatorios y salvaguardar los sistemas financieros en América del Norte.

- El aumento de la demanda de soluciones contra el lavado de dinero está impulsado por la creciente complejidad de las transacciones financieras, la creciente digitalización de los servicios bancarios y la necesidad de monitoreo de transacciones en tiempo real para combatir actividades ilícitas.

- Estados Unidos dominó el mercado de lucha contra el blanqueo de dinero en América del Norte con la mayor participación en los ingresos, un 65,4 %, en 2024, impulsado por estrictos requisitos regulatorios, un sector financiero bien establecido e importantes inversiones en tecnologías de lucha contra el blanqueo de dinero por parte de bancos e instituciones financieras.

- Se espera que Canadá sea el país de más rápido crecimiento en el mercado de lucha contra el blanqueo de dinero de América del Norte durante el período de pronóstico, atribuido al aumento de las iniciativas gubernamentales para combatir los delitos financieros, la rápida transformación digital en el sector financiero y la creciente adopción de soluciones de lucha contra el blanqueo de dinero basadas en la nube.

- El segmento de soluciones tuvo la mayor participación en los ingresos del mercado con un 60,2 % en 2024, impulsado por la creciente demanda de software avanzado contra el lavado de dinero que permite el monitoreo de transacciones en tiempo real, la gestión del cumplimiento y la verificación de la identidad del cliente.

Alcance del informe y segmentación del mercado de lucha contra el blanqueo de capitales

|

Atributos |

Perspectivas clave del mercado contra el blanqueo de capitales |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos del mercado, como el valor de mercado, la tasa de crecimiento, los segmentos del mercado, la cobertura geográfica, los actores del mercado y el escenario del mercado, el informe de mercado elaborado por el equipo de investigación de mercado de Data Bridge incluye un análisis en profundidad de expertos, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y análisis pestle. |

Tendencias del mercado contra el blanqueo de capitales

“Aumento de la integración de las tecnologías de IA y aprendizaje automático”

- El mercado de lucha contra el lavado de dinero (AML) de América del Norte está experimentando una tendencia significativa hacia la integración de tecnologías de inteligencia artificial (IA) y aprendizaje automático (ML).

- Estas tecnologías permiten el procesamiento y análisis avanzado de datos, brindando conocimientos más profundos sobre los patrones de transacciones, el comportamiento del cliente y los posibles riesgos de delitos financieros.

- Las soluciones antilavado de dinero impulsadas por IA facilitan la gestión proactiva de riesgos al identificar actividades y patrones sospechosos antes de que se conviertan en problemas de cumplimiento importantes.

- Por ejemplo, empresas como ThetaRay y Oracle están desarrollando plataformas impulsadas por IA que analizan datos transaccionales para detectar delitos financieros como lavado de dinero, financiamiento del terrorismo y fraude, al tiempo que optimizan los procesos de cumplimiento.

- Esta tendencia mejora la eficiencia y precisión de los sistemas AML, haciéndolos más atractivos para instituciones financieras, organismos gubernamentales y otras entidades reguladas.

- Los algoritmos de IA pueden analizar grandes conjuntos de datos, incluidos comportamientos de transacciones inusuales, actividades transfronterizas y patrones históricos, para reducir los falsos positivos y mejorar la precisión de la detección.

Dinámica del mercado contra el blanqueo de capitales

Conductor

Creciente demanda de cumplimiento normativo y detección avanzada de fraudes

- El creciente escrutinio regulatorio y la demanda de marcos de cumplimiento sólidos, impulsados por leyes como la Ley de Secreto Bancario de los EE. UU. (BSA), la Ley Patriota de los EE. UU. y la Ley de Producto del Delito (Lavado de Dinero) y Financiamiento del Terrorismo de Canadá, son los principales impulsores del mercado ALD de América del Norte.

- Los sistemas contra el lavado de dinero mejoran la seguridad financiera al brindar funciones como monitoreo de transacciones en tiempo real, verificación de la identidad del cliente e informes automatizados de actividades sospechosas.

- Los mandatos gubernamentales en los EE. UU. y Canadá están impulsando a las instituciones financieras a adoptar soluciones avanzadas contra el lavado de dinero para cumplir con los estrictos requisitos de cumplimiento.

- La proliferación de la banca digital, los pagos en línea y las transacciones de criptomonedas está expandiendo aún más las aplicaciones contra el lavado de dinero, respaldadas por una transmisión de datos más rápida y una menor latencia que permite la tecnología 5G.

- Las instituciones financieras están adoptando cada vez más sistemas integrados contra el lavado de dinero como soluciones estándar para cumplir con las expectativas regulatorias y mejorar la integridad operativa.

Restricción/Desafío

Altos costos de implementación y preocupaciones sobre la privacidad de los datos

- La importante inversión inicial requerida para el hardware, el software y la integración contra el lavado de dinero puede ser una barrera importante para la adopción, en particular para las pequeñas y medianas empresas (PYME) en América del Norte.

- Implementar sistemas contra el lavado de dinero en las infraestructuras financieras existentes puede ser complejo y costoso, y requiere experiencia y recursos especializados.

- Las preocupaciones sobre la seguridad y la privacidad de los datos son un desafío crítico, ya que los sistemas contra el lavado de dinero recopilan y transmiten grandes volúmenes de datos confidenciales de clientes y transacciones, lo que aumenta los riesgos de infracciones o uso indebido.

- El panorama regulatorio fragmentado en Estados Unidos y Canadá con respecto a la protección de datos y los estándares de cumplimiento complica las operaciones de las organizaciones multinacionales y los proveedores de servicios.

- Estos factores pueden disuadir la adopción, particularmente en regiones con alta sensibilidad a los costos o mayor conciencia de las cuestiones de privacidad de datos, lo que potencialmente limita el crecimiento del mercado.

Alcance del mercado de lucha contra el blanqueo de capitales

El mercado está segmentado en función de la oferta, la función, la implementación, el tamaño de la empresa y el uso final.

- Ofreciendo

En función de la oferta, el mercado norteamericano de prevención del blanqueo de capitales se segmenta en soluciones y servicios. El segmento de soluciones obtuvo la mayor cuota de mercado en ingresos, con un 60,2%, en 2024, impulsado por la creciente demanda de software avanzado de prevención del blanqueo de capitales que permite la monitorización de transacciones en tiempo real, la gestión del cumplimiento normativo y la verificación de la identidad del cliente. Estas soluciones aprovechan la IA y el aprendizaje automático para optimizar la detección de delitos financieros como el blanqueo de capitales y la financiación del terrorismo.

Se prevé que el segmento de servicios experimente la tasa de crecimiento más rápida, del 15,8 %, entre 2025 y 2032, impulsada por la creciente necesidad de asesoramiento experto y servicios gestionados para adaptarse a las complejas regulaciones contra el blanqueo de capitales. Las instituciones financieras externalizan cada vez más las tareas de cumplimiento normativo para garantizar un cumplimiento normativo rentable y reducir los riesgos operativos.

- Por función

En función de su función, el mercado norteamericano de prevención del blanqueo de capitales se segmenta en gestión de cumplimiento, gestión de identidad de clientes, monitoreo de transacciones, informes de transacciones de divisas, entre otros. El segmento de gestión de cumplimiento dominó el mercado con una participación del 32,6 % en los ingresos en 2024, debido a las estrictas regulaciones y a la necesidad de que las instituciones financieras fortalezcan sus marcos de prevención del blanqueo de capitales para evitar sanciones y garantizar el cumplimiento normativo.

Se prevé que el segmento de monitoreo de transacciones experimente la tasa de crecimiento más rápida del 16,4% entre 2025 y 2032, impulsado por la creciente adopción de sistemas impulsados por IA que mejoran la detección de transacciones sospechosas y reducen los falsos positivos, mejorando la eficiencia en la lucha contra los delitos financieros.

- Por implementación

En función de su implementación, el mercado norteamericano de prevención del blanqueo de capitales se segmenta en la nube y en instalaciones locales. El segmento de la nube obtuvo la mayor cuota de mercado en ingresos, con un 54,4 % en 2024, gracias a su flexibilidad, escalabilidad y rentabilidad, lo que permite a las instituciones financieras integrar tecnologías avanzadas como la IA y el análisis en tiempo real sin realizar inversiones significativas en infraestructura.

Se prevé un crecimiento significativo del segmento local entre 2025 y 2032, impulsado por las organizaciones que priorizan el control y la seguridad sobre sus sistemas de cumplimiento. Las soluciones locales ofrecen personalización e integración con la infraestructura de TI existente, lo cual es crucial para grandes empresas con necesidades regulatorias complejas.

- Por tamaño de empresa

En función del tamaño de las empresas, el mercado norteamericano de prevención del blanqueo de capitales se segmenta en grandes empresas y pequeñas y medianas empresas (PYME). El segmento de grandes empresas dominó el mercado con una participación del 56,8 % en los ingresos en 2024, impulsado por su enfoque en los sistemas de pago digitales y la necesidad de soluciones robustas de prevención del blanqueo de capitales para abordar los requisitos de monitoreo de transacciones y cumplimiento normativo en operaciones financieras de alto volumen.

Se prevé que el segmento de las PYMES crezca rápidamente a una CAGR del 17,2 % entre 2025 y 2032, impulsado por una mayor conciencia de las regulaciones contra el lavado de dinero y la adopción de soluciones rentables basadas en la nube que atienden a organizaciones más pequeñas con recursos limitados.

- Por uso final

En función del uso final, el mercado norteamericano de prevención del blanqueo de capitales se segmenta en bancos e instituciones financieras, aseguradoras, gobierno, juegos de azar y apuestas, entre otros. El segmento de bancos e instituciones financieras obtuvo la mayor participación en los ingresos del mercado, con un 45,3 % en 2024, impulsado por la apremiante necesidad de soluciones antilavado de dinero para combatir delitos financieros como el fraude, la financiación del terrorismo y el blanqueo de capitales en el sector bancario.

Se espera que el segmento de juegos y apuestas sea testigo de la tasa de crecimiento más rápida del 18,1% entre 2025 y 2032, impulsada por la creciente adopción de soluciones contra el lavado de dinero para monitorear las transacciones de alto riesgo y garantizar el cumplimiento de las regulaciones, particularmente en las plataformas de juegos de azar en línea donde los flujos financieros ilícitos son una preocupación.

Análisis regional del mercado de lucha contra el blanqueo de capitales

- Estados Unidos dominó el mercado de lucha contra el blanqueo de dinero en América del Norte con la mayor participación en los ingresos, un 65,4 %, en 2024, impulsado por estrictos requisitos regulatorios, un sector financiero bien establecido e importantes inversiones en tecnologías de lucha contra el blanqueo de dinero por parte de bancos e instituciones financieras.

- La tendencia hacia la banca digital y las estrictas regulaciones, como la Ley de Secreto Bancario y la Ley Patriota de EE. UU., impulsan aún más la expansión del mercado. La creciente adopción por parte de las instituciones financieras de soluciones antilavado de dinero basadas en IA y aprendizaje automático complementa las medidas de cumplimiento tradicionales, creando un sólido ecosistema de mercado.

Perspectivas del mercado canadiense contra el blanqueo de capitales

Se prevé que Canadá experimente el mayor crecimiento en el mercado de lucha contra el blanqueo de capitales de América del Norte, impulsado por el creciente énfasis regulatorio en la prevención de delitos financieros y la creciente adopción de tecnologías avanzadas de lucha contra el blanqueo de capitales. Las instituciones financieras buscan soluciones que mejoren la supervisión de las transacciones y la gestión de la identidad de los clientes, garantizando al mismo tiempo el cumplimiento de la Ley de Productos del Delito (Lavado de Dinero) y Financiamiento del Terrorismo. Este crecimiento es notable tanto en las grandes instituciones financieras como en las pequeñas empresas, con una adopción significativa debido a la creciente preocupación por los delitos cibernéticos y el volumen de transacciones digitales.

Perspectivas del mercado europeo de lucha contra el blanqueo de capitales

Se prevé un crecimiento significativo del mercado europeo de prevención del blanqueo de capitales, respaldado por marcos regulatorios rigurosos y un enfoque en la transparencia financiera. Las organizaciones buscan soluciones de prevención del blanqueo de capitales que mejoren la gestión del cumplimiento normativo y la supervisión de transacciones, a la vez que abordan patrones complejos de delitos financieros. El crecimiento es notable tanto en las implementaciones en la nube como locales, con países como Alemania y el Reino Unido mostrando una mayor adopción debido al mayor escrutinio regulatorio y los riesgos de delitos financieros.

Cuota de mercado en materia de lucha contra el blanqueo de capitales

La industria de lucha contra el blanqueo de dinero está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- NIZA (Israel)

- IBM (EE.UU.)

- sanciones.io (EE. UU.)

- Intel Corporation (EE. UU.)

- Oracle (EE. UU.)

- SAP SE (Alemania)

- Accenture (EE. UU.)

- Solución de información de Experian

- Inc. (Irlanda)

- Open Text Corporation (Canadá)

- BAE Systems (Reino Unido)

- SAS Institute Inc (EE. UU.)

- ACI Worldwide (EE. UU.)

- Cognizant (EE. UU.)

- Trulioo (Canadá)

- Sede de Temenos SA (Suiza)

- WorkFusion, Inc. (EE. UU.)

- Vixio Regulatory Intelligence (Inglaterra)

¿Cuáles son los avances recientes en el mercado de lucha contra el blanqueo de dinero en América del Norte?

- En abril de 2025, FIS anunció la adquisición del negocio de Soluciones para Emisores de Global Payments, consolidando su posición como líder global en tecnología financiera. El acuerdo incorpora una sólida gama de servicios de procesamiento de crédito, prevención del fraude, fidelización y valor añadido a las capacidades existentes de débito y banca de FIS, creando una oferta integral para las instituciones financieras. Se espera que la adquisición genere sinergias en ingresos anuales y 150 millones de dólares en sinergias de EBITDA en un plazo de tres años. Esta estrategia también respalda el cumplimiento de la normativa contra el blanqueo de capitales (AML), amplía el alcance de FIS a más de 75 países y sustituye su participación minoritaria en Worldpay por ingresos recurrentes de alto margen.

- En febrero de 2025, LexisNexis Risk Solutions, filial de RELX, completó la adquisición de IDVerse™, empresa pionera en autenticación de documentos y detección de fraude con IA. Fundada en Australia, IDVerse utiliza redes neuronales profundas y algoritmos biométricos para verificar más de 16 000 tipos de documentos de identidad a nivel mundial. La tecnología se integrará en RiskNarrative®, IDU® y Dynamic Decision Platform® de LexisNexis, lo que mejorará sus capacidades de verificación de identidad multicapa y cumplimiento de la normativa AML. Esta estrategia refuerza las defensas contra el fraude generado por IA, incluyendo los deepfakes, y promueve la inclusión financiera al permitir una integración segura y escalable en todos los sectores.

- En octubre de 2024, Oracle Financial Services lanzó su Investigation Hub, basado en IA, una solución de gestión de casos basada en la nube diseñada para transformar las investigaciones de delitos financieros. Desarrollada sobre Oracle Cloud Infrastructure (OCI), la plataforma aprovecha el análisis de gráficos y la IA integrada para automatizar tareas manuales, eliminar silos de datos y generar narrativas automáticas que reducen el tiempo de investigación hasta en un 70 %. La herramienta se integra a la perfección con la suite FCCM de Oracle y con proveedores de datos externos, lo que permite a los equipos de cumplimiento colaborar de forma más eficaz y centrarse en análisis de alto valor. Esta innovación respalda las iniciativas de lucha contra el blanqueo de capitales (AML) al mejorar la velocidad, la precisión y la adaptabilidad regulatoria en todas las instituciones financieras.

- En abril de 2024, Oracle Financial Services presentó Compliance Agent, un servicio en la nube basado en IA, diseñado para ayudar a los bancos a combatir proactivamente los riesgos de la lucha contra el blanqueo de capitales (ALD). Mediante pruebas de escenarios hipotéticos, la plataforma permite a las instituciones optimizar los sistemas de monitorización de transacciones (TMS), evaluar los perfiles de riesgo de nuevos productos y optimizar los controles para tipos de alto riesgo, como la trata de personas. Al automatizar el análisis de riesgos de los modelos y respaldar decisiones basadas en evidencia, Compliance Agent reduce los costes de cumplimiento normativo y mejora la preparación regulatoria. Este lanzamiento subraya la creciente adopción de la IA y las tecnologías en la nube para la prevención de delitos financieros y refleja el compromiso de Oracle con las soluciones de cumplimiento escalables y basadas en datos.

- En noviembre de 2023, SAS Institute firmó un acuerdo de colaboración estratégica (SCA) con Amazon Web Services (AWS) para mejorar el análisis nativo de la nube y el rendimiento de los datos para clientes empresariales. La alianza incluye la integración de SAS Customer Intelligence 360 en AWS Marketplace, lo que simplifica el acceso a herramientas de interacción con el cliente basadas en IA. Si bien no se trata de un lanzamiento específico para la lucha contra el blanqueo de capitales (AML), este avance en la infraestructura de la nube respalda plataformas escalables y seguras que pueden respaldar soluciones contra el blanqueo de capitales (AML), la detección de fraude y el análisis de cumplimiento normativo. La colaboración también sienta las bases para la futura integración con Amazon Bedrock y SAS Viya, ampliando las capacidades de IA generativa en los servicios financieros y otros sectores regulados.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.