North America Anti Aging Skincare Ingredients Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

457.37 Million

USD

667.04 Million

2024

2032

USD

457.37 Million

USD

667.04 Million

2024

2032

| 2025 –2032 | |

| USD 457.37 Million | |

| USD 667.04 Million | |

|

|

|

|

Segmentación del mercado de ingredientes para el cuidado de la piel antienvejecimiento en Norteamérica, por producto (retinoide, ácido hialurónico, antioxidantes, péptidos, niacinamida (vitamina B3), alfahidroxiácidos (AHAS), ceramidas, óxido de zinc y dióxido de titanio, betahidroxiácido (BHA), coenzima Q10 (ubiquinona), extracto de té verde, ácido alfa lipoico, cafeína, bakuchiol, escualano, ácido kójico, alfa-arbutina, isoflavonas de soja y otros), forma (polvo, líquido y granulado), función (humectante, potenciador de colágeno, protección solar, exfoliante, aclarador de la piel, antiinflamatorio, reparador de la piel y otros), aplicación (antiarrugas, antipigmentación, antioxidante, rellenos dérmicos y otros), uso final (suero, humectante, limpiador, crema para ojos, aceite facial, mascarilla, tónico y otros). Tendencias de la industria y pronóstico hasta 2032

Tamaño del mercado de ingredientes antienvejecimiento para el cuidado de la piel en América del Norte

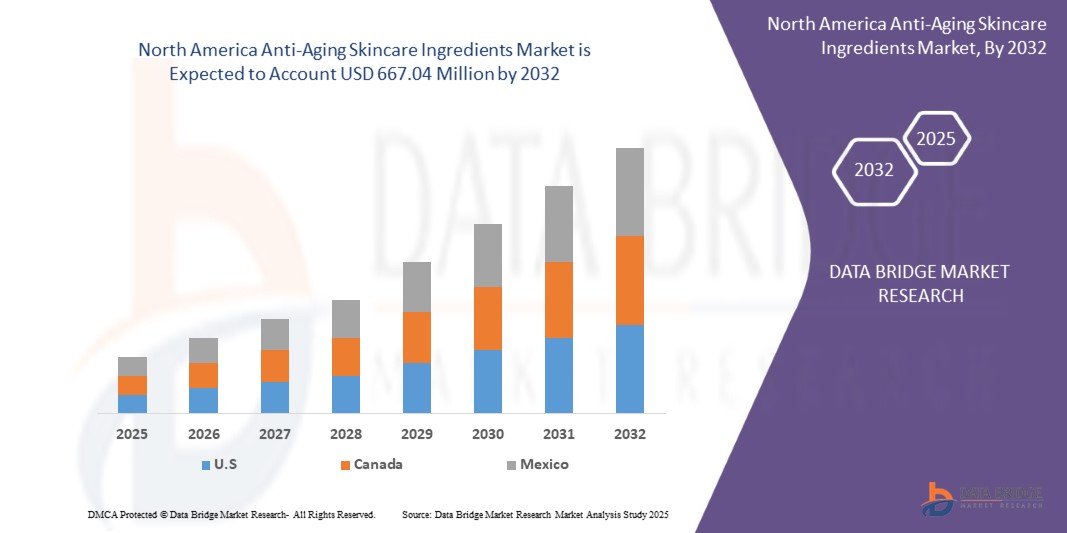

- El tamaño del mercado de ingredientes para el cuidado de la piel antienvejecimiento de América del Norte se valoró en USD 457,37 millones en 2024 y se espera que alcance los USD 667,04 millones para 2032 , con una CAGR del 4,83 % durante el período de pronóstico.

- El crecimiento del mercado se debe en gran medida a la creciente conciencia de los consumidores sobre el cuidado de la piel, la creciente demanda de soluciones preventivas y antienvejecimiento y las innovaciones tecnológicas en ingredientes bioactivos y multifuncionales, que permiten formulaciones más efectivas para la reducción de arrugas, el aclaramiento de la piel y la hidratación.

- Además, la creciente preferencia por ingredientes naturales, de origen sostenible y de producción ética está impulsando la adopción de fórmulas antienvejecimiento de alta calidad. Estos factores convergentes están acelerando la adopción de ingredientes avanzados para el cuidado de la piel, impulsando así significativamente el crecimiento de la industria.

Análisis del mercado de ingredientes antienvejecimiento para el cuidado de la piel en América del Norte

- Los ingredientes antienvejecimiento para el cuidado de la piel incluyen compuestos bioactivos como retinoides, péptidos, ácido hialurónico, antioxidantes y ceramidas, que ayudan a reducir los signos visibles del envejecimiento, mejorar la elasticidad de la piel y promover su salud general. Estos ingredientes se incorporan ampliamente en sérums, cremas, mascarillas y protectores solares, tanto para uso preventivo como correctivo.

- La creciente demanda de ingredientes antienvejecimiento para el cuidado de la piel se debe principalmente al creciente envejecimiento de la población, el aumento de la renta disponible, la creciente atención del consumidor al cuidado personal y la creciente penetración de productos premium para el cuidado de la piel tanto en mercados desarrollados como emergentes. La creciente interacción digital y la adopción del comercio electrónico están impulsando aún más la accesibilidad de los productos y el crecimiento del mercado.

- Estados Unidos dominó el mercado de ingredientes para el cuidado de la piel antienvejecimiento en América del Norte en 2024, debido a una industria de cuidado personal madura, un alto gasto de los consumidores en productos de cuidado de la piel de primera calidad y fuertes inversiones en investigación y desarrollo de ingredientes bioactivos avanzados.

- Se espera que Canadá sea el país de más rápido crecimiento en el mercado de ingredientes para el cuidado de la piel antienvejecimiento de América del Norte durante el período de pronóstico debido a la creciente conciencia de las rutinas preventivas de cuidado de la piel, el aumento de los ingresos disponibles y la mayor demanda de ingredientes naturales y de origen sostenible.

- El segmento de antioxidantes dominó el mercado con una cuota de mercado del 34,2 % en 2024, gracias a su probada capacidad para neutralizar los radicales libres, proteger contra el estrés oxidativo y retrasar los signos visibles del envejecimiento, como arrugas y líneas de expresión. Antioxidantes como la vitamina C, la vitamina E, el extracto de té verde y la coenzima Q10 se incorporan ampliamente en sérums, cremas y protectores solares, lo que los hace muy versátiles en las formulaciones de productos. Su función multifuncional para iluminar la piel, mejorar la estabilidad del colágeno y brindar protección contra agresiones ambientales como la radiación UV y la contaminación ha consolidado su posición como un pilar fundamental en el cuidado de la piel antiedad.

Alcance del informe y segmentación del mercado de ingredientes antienvejecimiento para el cuidado de la piel en América del Norte

|

Atributos |

Perspectivas clave del mercado de ingredientes antienvejecimiento para el cuidado de la piel en América del Norte |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis en profundidad de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de ingredientes antienvejecimiento para el cuidado de la piel en América del Norte

Cambio de preferencia hacia productos naturales y orgánicos

- El mercado norteamericano de ingredientes para el cuidado de la piel antienvejecimiento está experimentando una transformación a medida que los consumidores priorizan los compuestos naturales y orgánicos, buscando alternativas más seguras a los químicos sintéticos. Esta preferencia está abriendo nuevas vías de crecimiento e impulsando la innovación de productos tanto en el segmento masivo como en el premium.

- Por ejemplo, marcas como Shiseido y Lady Green han lanzado sérums y cremas faciales antiedad orgánicos con ingredientes botánicos biofermentados y principios activos vegetales. Estos lanzamientos están ganando terreno entre los millennials y los consumidores preocupados por su salud que buscan soluciones éticas y sostenibles para el cuidado de la piel.

- Los avances tecnológicos en los sistemas de administración de ingredientes están mejorando la eficacia y la confianza del consumidor. Las empresas utilizan la encapsulación, la microfluídica y la biotecnología para aumentar la biodisponibilidad y potenciar los activos antienvejecimiento naturales, como el ácido hialurónico y los péptidos, en aplicaciones tópicas.

- La demanda de transparencia en los ingredientes y formulaciones seguras está en aumento, y los consumidores optan por productos de etiqueta limpia y con certificación vegana. Las afirmaciones sobre sostenibilidad y abastecimiento ético son importantes impulsores de compra, lo que influye en el posicionamiento global de las marcas de sus productos antienvejecimiento.

- Los tratamientos de belleza personalizados con ingredientes naturales antienvejecimiento son cada vez más comunes. Los consumidores buscan soluciones específicas para problemas específicos como arrugas, pigmentación o pérdida de elasticidad, lo que exige que las marcas ofrezcan mezclas personalizadas y kits holísticos para el cuidado de la piel.

- Los productos antienvejecimiento multifuncionales y minimalistas, elaborados con ingredientes naturales de alta calidad, han ganado popularidad. Las marcas los comercializan como soluciones eficaces para un estilo de vida ajetreado y una menor exposición a aditivos innecesarios, siguiendo las tendencias en bienestar general y autocuidado.

Dinámica del mercado de ingredientes antienvejecimiento para el cuidado de la piel en América del Norte

Conductor

Actividades innovadoras de marca y publicidad de productos

- Las estrategias efectivas de branding y publicidad están impulsando el crecimiento del mercado al hacer que los ingredientes antienvejecimiento para el cuidado de la piel sean fácilmente reconocibles, mejorando la interacción del consumidor y reforzando la fidelidad en un entorno competitivo. Las marcas aprovechan el diseño, las redes sociales y las experiencias inmersivas para diferenciar sus ofertas.

- Por ejemplo, DSM y las principales empresas de belleza han utilizado colaboraciones con influencers y campañas online específicas para destacar los beneficios antienvejecimiento clínicamente probados de ingredientes naturales como péptidos y antioxidantes. Sus estrategias de branding basadas en datos amplían su alcance y aceleran la conversión de ventas en mercados clave.

- Las tecnologías digitales avanzadas permiten a las marcas interactuar directamente con los consumidores, fortaleciendo el conocimiento y la prueba de productos innovadores para el cuidado de la piel. Las pruebas virtuales, la personalización generada por IA y la publicidad omnicanal integrada están moldeando las preferencias por el lanzamiento de nuevos ingredientes en un mercado global dinámico.

- La innovación continua de productos mantiene el entusiasmo del consumidor, ya que las marcas presentan historias de ingredientes antienvejecimiento centradas en la eficacia, la ciencia y el bienestar. Campañas estratégicas posicionan estos productos como esenciales en rutinas de cuidado de la piel de varios pasos y regímenes de salud holística para todas las edades.

- La interacción en redes sociales y la retroalimentación de los clientes ayudan a las marcas a adaptar rápidamente sus ofertas. Las empresas optimizan la marca y los mensajes para abordar las cambiantes prioridades de los consumidores, creando un entorno de mercado receptivo que impulsa la demanda sostenida y la expansión del mercado.

Restricción/Desafío

Aumento de los efectos secundarios de algunos ingredientes para el cuidado de la piel

- Los efectos secundarios asociados con algunos ingredientes antienvejecimiento representan un desafío persistente, que afecta la confianza del consumidor y la supervisión regulatoria. Los informes de reacciones alérgicas, erupciones cutáneas y sensibilidad cutánea causados por aditivos sintéticos o productos falsificados minan la confianza en las soluciones antienvejecimiento convencionales.

- Por ejemplo, la creciente concienciación sobre los parabenos, los sulfatos y las fragancias artificiales ha provocado retiradas de productos y restricciones en varios países. Este escrutinio obliga a los fabricantes a replantear sus formulaciones y a cumplir con las normativas de seguridad en constante evolución, lo que añade complejidad a las operaciones del mercado.

- Los largos procesos de aprobación de productos y los rigurosos requisitos de prueba ralentizan la introducción de nuevos ingredientes. Los marcos regulatorios, especialmente en Europa y Norteamérica, exigen ensayos exhaustivos para verificar la seguridad y la eficacia, lo que retrasa los lanzamientos y aumenta los costos de desarrollo para los proveedores.

- Los productos falsificados y de baja calidad agravan los desafíos del mercado, ya que la amplia disponibilidad y los precios competitivos atraen a los consumidores hacia alternativas inseguras. Estos problemas impulsan una mayor inversión de la industria en campañas de autenticidad, seguimiento y educación del consumidor.

- La creciente demanda de soluciones orgánicas y naturales, impulsada por la preocupación por los efectos secundarios, aumenta la presión sobre las cadenas de suministro de ingredientes. Las marcas deben garantizar la consistencia, la trazabilidad y la seguridad, a la vez que gestionan las fluctuaciones de costos y los problemas de escalabilidad de los extractos botánicos y los activos naturales.

Alcance del mercado de ingredientes antienvejecimiento para el cuidado de la piel en América del Norte

El mercado está segmentado en función del producto, la forma, la función, la aplicación y el uso final.

• Por producto

Según el producto, el mercado norteamericano de ingredientes para el cuidado de la piel antienvejecimiento se segmenta en retinoides, ácido hialurónico, antioxidantes, péptidos, niacinamida (vitamina B3), alfahidroxiácidos (AHA), ceramidas, óxido de zinc y dióxido de titanio, betahidroxiácido (BHA), coenzima Q10 (ubiquinona), extracto de té verde, ácido alfa lipoico, cafeína, bakuchiol, escualano, ácido kójico, alfa-arbutina, isoflavonas de soja y otros. El segmento de antioxidantes dominó la mayor cuota de mercado en ingresos, con un 34,2%, en 2024, gracias a su probada capacidad para neutralizar los radicales libres, proteger contra el estrés oxidativo y retrasar los signos visibles del envejecimiento, como las arrugas y las líneas de expresión. Los antioxidantes, como la vitamina C, la vitamina E, el extracto de té verde y la coenzima Q10, se incorporan ampliamente en sérums, cremas y protectores solares, lo que los hace muy versátiles en las formulaciones de productos. Su papel multifuncional para iluminar la piel, mejorar la estabilidad del colágeno y brindar protección contra los agresores ambientales como la radiación UV y la contaminación ha consolidado su posición como piedra angular en el cuidado de la piel antienvejecimiento.

Se prevé que el segmento del ácido hialurónico experimente su mayor crecimiento entre 2025 y 2032, impulsado por la creciente demanda de soluciones antienvejecimiento basadas en la hidratación. El ácido hialurónico es ampliamente valorado por sus propiedades de retención de humedad, que mejoran la elasticidad de la piel y reducen la aparición de arrugas. Su inclusión en sérums, mascarillas y cremas hidratantes se alinea con la tendencia de las marcas limpias, ya que se produce de forma natural en el cuerpo y es bien tolerado por todo tipo de piel. El creciente atractivo de los tratamientos de hidratación no invasivos y su creciente uso en formulaciones de rellenos dérmicos refuerzan aún más su rápida adopción.

• Por formulario

Según su presentación, el mercado se segmenta en polvo, líquido y granulado. El segmento líquido dominó la mayor cuota de mercado en 2024, principalmente debido a su alta aplicabilidad en sueros, cremas hidratantes y cremas. Los líquidos permiten una mejor solubilidad de los ingredientes, una absorción cutánea más rápida y una fácil formulación en productos antienvejecimiento multifuncionales. Esto los convierte en la opción preferida entre los fabricantes que buscan combinar múltiples ingredientes activos, como antioxidantes, péptidos y retinoides, en una sola formulación.

Se prevé que el segmento de polvos experimente la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, ya que las marcas optan cada vez más por ingredientes en polvo para lograr estabilidad y una mayor vida útil. Los polvos permiten a los usuarios finales mezclar los productos antes de su aplicación, lo que preserva su potencia y reduce la necesidad de conservantes. El formato también está ganando popularidad en el cuidado de la piel casero, las rutinas de belleza minimalistas y los envases sostenibles, en línea con las tendencias de consumo con conciencia ecológica.

• Por función

Según su función, el mercado se segmenta en hidratantes, potenciadores de colágeno, protección solar, exfoliantes, iluminadores, antiinflamatorios, reparadores cutáneos, entre otros. El segmento hidratante tuvo la mayor cuota de mercado en 2024, ya que la hidratación sigue siendo el beneficio más buscado en el cuidado de la piel antienvejecimiento. Ingredientes hidratantes como el ácido hialurónico, las ceramidas y el escualano mejoran la función de barrera cutánea, lo que los convierte en productos básicos en prácticamente todas las fórmulas antienvejecimiento. Este segmento se beneficia de su aplicación universal en todos los grupos de edad, tipos de piel y climas, lo que consolida su dominio a largo plazo.

Se proyecta que el segmento de productos para el aumento de colágeno crecerá a su ritmo más rápido entre 2025 y 2032, impulsado por la creciente demanda de una piel más firme y de aspecto juvenil. Ingredientes como péptidos, retinoides y vitamina C se utilizan cada vez más en fórmulas antienvejecimiento por su capacidad para estimular la síntesis de colágeno y reducir los signos visibles del envejecimiento. El creciente interés en el cuidado preventivo de la piel en edades tempranas, junto con las innovaciones científicas en la tecnología de péptidos, está impulsando una adopción acelerada.

• Por aplicación

Según su aplicación, el mercado se segmenta en antiarrugas, antipigmentación, antioxidantes, rellenos dérmicos y otros. El segmento antiarrugas dominó la mayor cuota de mercado en 2024, debido a su posición como el principal impulsor de la demanda de los consumidores en el sector antienvejecimiento. Con ingredientes como retinoides, péptidos y ácido hialurónico que abordan directamente la reducción de arrugas, esta categoría recibe una fuerte inversión en desarrollo de productos y afirmaciones clínicas. La prevalencia del envejecimiento de la población en los mercados desarrollados consolida aún más su dominio.

Se prevé que el segmento de productos antipigmentación registre el mayor crecimiento entre 2025 y 2032, impulsado por la creciente concienciación de los consumidores sobre la hiperpigmentación, el tono desigual y las manchas solares. Ingredientes como la niacinamida, el ácido kójico y la alfa-arbutina están experimentando una alta adopción en fórmulas iluminadoras y antimanchas. Esta tendencia se ve reforzada por la creciente demanda en los mercados de Asia-Pacífico, donde la uniformidad del tono de la piel es una prioridad fundamental en belleza, y en los mercados occidentales, donde se prioriza cada vez más la corrección del daño solar.

• Por uso final

Según el uso final, el mercado se segmenta en sérums, hidratantes, limpiadores, contorno de ojos, aceites faciales, mascarillas, tónicos, entre otros. El segmento de sérums obtuvo la mayor cuota de mercado en 2024, ya que ofrecen una administración concentrada de ingredientes activos antienvejecimiento. Su fórmula ligera y su profunda penetración en la piel los hacen altamente efectivos para la reducción de arrugas, la luminosidad y la hidratación, lo que tiene un gran éxito tanto entre los consumidores premium como entre los del mercado general. La creciente preferencia de los consumidores por los sérums multifuncionales que contienen mezclas de antioxidantes, péptidos y potenciadores de la hidratación consolida aún más el liderazgo de este segmento.

Se prevé que el segmento de cremas para el contorno de ojos experimente el mayor crecimiento entre 2025 y 2032, lo que refleja la creciente concienciación sobre los primeros signos de la edad que suelen aparecer en la delicada zona de los ojos. Las cremas para el contorno de ojos están formuladas con ingredientes específicos como cafeína, péptidos y ácido hialurónico para combatir la hinchazón, las líneas de expresión y las ojeras. La creciente demanda de soluciones preventivas entre los jóvenes y las crecientes innovaciones en fórmulas aptas para pieles sensibles impulsan su crecimiento.

Análisis regional del mercado de ingredientes antienvejecimiento para el cuidado de la piel en América del Norte

- Estados Unidos dominó el mercado de ingredientes para el cuidado de la piel antienvejecimiento de América del Norte con la mayor participación en los ingresos en 2024, impulsado por una industria de cuidado personal madura, un alto gasto de los consumidores en productos de cuidado de la piel de primera calidad y fuertes inversiones en investigación y desarrollo de ingredientes bioactivos avanzados.

- El país se beneficia de una sólida infraestructura de fabricación de cosméticos, estrictos estándares regulatorios y la presencia de proveedores líderes mundiales de ingredientes para el cuidado de la piel. La creciente demanda de fórmulas multifuncionales, de etiqueta limpia y con respaldo científico impulsa aún más el crecimiento del mercado.

- La creciente adopción del comercio electrónico, las estrategias de marketing digital y el enfoque del consumidor en soluciones preventivas y antienvejecimiento para el cuidado de la piel continúan reforzando la expansión del mercado de sueros, cremas, mascarillas y productos de protección solar.

Análisis del mercado de ingredientes antienvejecimiento para el cuidado de la piel en Canadá y América del Norte

Se proyecta que Canadá registrará la tasa de crecimiento anual compuesta (TCAC) más rápida del mercado norteamericano entre 2025 y 2032, impulsada por la creciente concienciación sobre las rutinas preventivas de cuidado de la piel, el aumento de los ingresos disponibles y la mayor demanda de ingredientes naturales y de origen sostenible. La expansión de los canales de venta minorista en línea, sumada al creciente interés en fórmulas antienvejecimiento multifuncionales, está impulsando la adopción de productos. La preferencia de los consumidores canadienses por ingredientes de alta calidad y probados por dermatólogos impulsa aún más el crecimiento del mercado.

Perspectiva del mercado de ingredientes antienvejecimiento para el cuidado de la piel en México y Norteamérica

Se prevé que México experimente un crecimiento sostenido entre 2025 y 2032, impulsado por la creciente urbanización, el aumento del ingreso disponible y la creciente concienciación sobre las soluciones avanzadas para el cuidado de la piel. La expansión de tiendas minoristas modernas, clínicas de belleza y plataformas de comercio electrónico facilita el acceso a ingredientes antienvejecimiento premium y multifuncionales. Las colaboraciones entre fabricantes locales y proveedores internacionales de ingredientes impulsan la innovación de productos y mejoran la disponibilidad de fórmulas de alto rendimiento para el cuidado de la piel.

Cuota de mercado de ingredientes antienvejecimiento para el cuidado de la piel en América del Norte

La industria de ingredientes para el cuidado de la piel antienvejecimiento está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- ADEKA CORPORATION (Japón)

- Beiersdorf AG (Alemania)

- Croda International Plc (Reino Unido)

- BASF SE (Alemania)

- Wacker Chemie AG (Alemania)

- Lonza (Suiza)

- CLARIANT (Suiza)

- Evonik Industries AG (Alemania)

- DSM (Países Bajos)

- Corporación Kao (Japón)

- BioThrive Sciences (EE. UU.)

- Contipro as (República Checa)

Últimos avances en el mercado de ingredientes antienvejecimiento para el cuidado de la piel en América del Norte

- En febrero de 2025, Estée Lauder Companies (ELC) colaboró con Serpin Pharma para desarrollar innovadores ingredientes antienvejecimiento para el cuidado de la piel enfocados en la longevidad. Esta alianza aprovecha la experiencia de Serpin Pharma en la investigación de antiinflamatorios, en particular los inhibidores de la serina proteasa, que ayudan al cuerpo a reparar las células inflamadas. Se espera que esta colaboración fortalezca la cartera de ELC en soluciones avanzadas para el cuidado de la piel, mejorando la eficacia de los productos y atrayendo a consumidores que buscan beneficios antienvejecimiento duraderos y con respaldo científico.

- En febrero de 2025, NIVEA MEN presentó la línea de cuidado de la piel Age Defense, que combate los signos comunes del envejecimiento, como arrugas, sequedad, textura áspera, opacidad y pérdida de firmeza. La gama incorpora ingredientes clave como el tiamidol y el ácido hialurónico para ofrecer resultados visibles con una rutina sencilla. El lanzamiento, que incluye sérums avanzados, contornos de ojos y una crema hidratante diaria con FPS 30, probablemente ampliará la cuota de mercado de la marca, atrayendo a los consumidores masculinos que buscan soluciones antiedad completas y prácticas.

- En enero de 2025, Croda International anunció el lanzamiento de LongevityActive, un ingrediente bioactivo diseñado para combatir el envejecimiento celular y el estrés oxidativo. Este ingrediente promueve la reparación de la piel y potencia las defensas antioxidantes naturales, lo que favorece la formulación de sérums y humectantes avanzados. Se espera que este lanzamiento impulse la diferenciación y la adopción de productos entre las marcas premium de cuidado de la piel centradas en soluciones antienvejecimiento eficaces.

- En septiembre de 2023, BASF amplió su producción en la región Asia-Pacífico con Uvinul A Plus, uno de los pocos filtros UVA fotoestables disponibles que protege contra los dañinos rayos UVA, los radicales libres y el daño cutáneo. Su presentación en gránulos oleosolubles ofrece flexibilidad de formulación, alta eficacia a bajas concentraciones y beneficios sin conservantes, lo que favorece la protección solar de larga duración y los productos antienvejecimiento. Se espera que esta expansión fortalezca la posición de BASF en el creciente sector del cuidado de la piel en Asia-Pacífico.

- En marzo de 2023, DSM amplió su portafolio de PARSOL con el lanzamiento de PARSOL® DHHB, un filtro UVA versátil, ideal para productos multifuncionales para el cuidado de la piel. Su excelente solubilidad y amplia compatibilidad de formulaciones permiten la creación de protectores solares, productos de cuidado facial y cosméticos de color con protección UVA adecuada y alta clasificación ecológica. Esta innovación ofrece a los formuladores la flexibilidad necesaria para satisfacer la creciente demanda de productos antienvejecimiento sostenibles, multifuncionales y de alto rendimiento para el cuidado de la piel.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.