North America Ai In Bioinformatics Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

1,000.00 Million

USD

19,677.40 Million

2021

2029

USD

1,000.00 Million

USD

19,677.40 Million

2021

2029

| 2022 –2029 | |

| USD 1,000.00 Million | |

| USD 19,677.40 Million | |

|

|

|

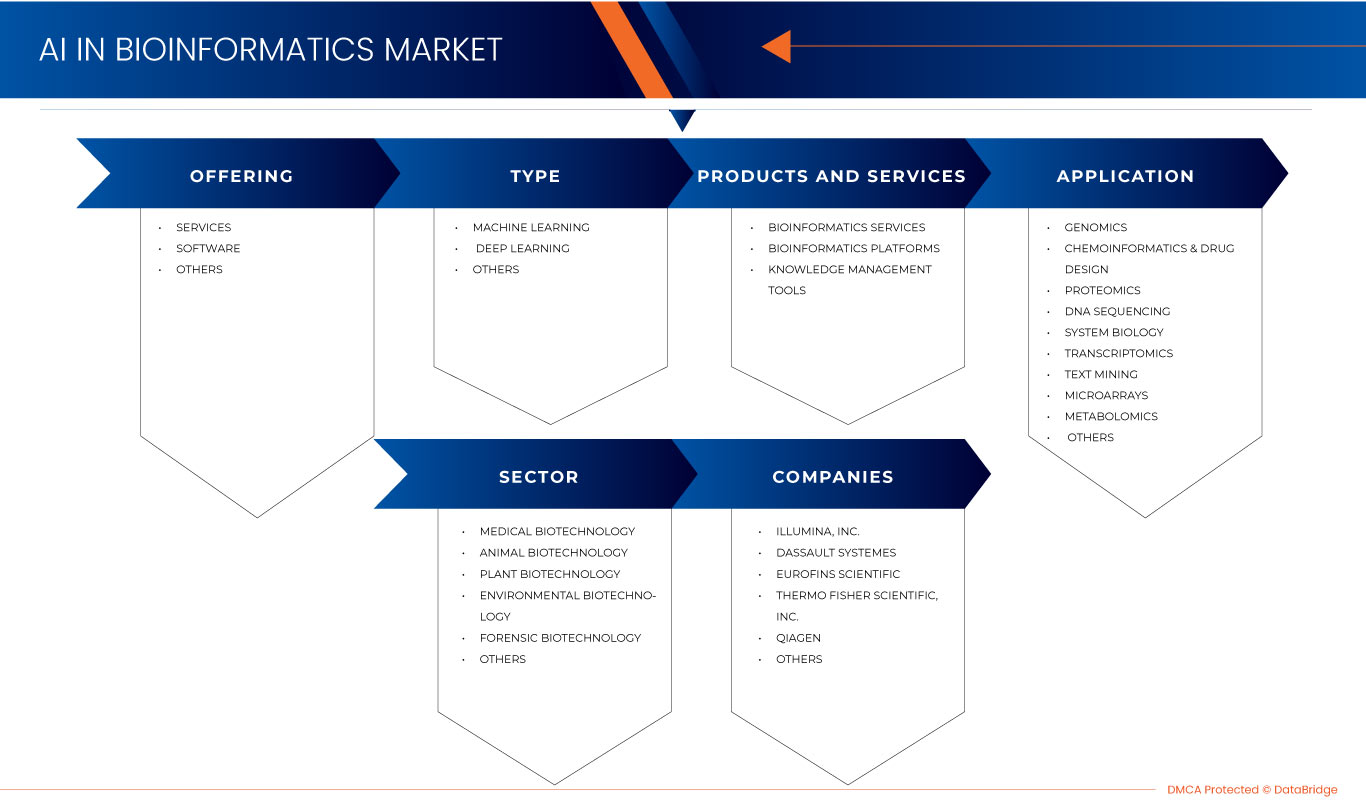

Mercado de bioinformática de IA de América del Norte, por oferta (servicios, software y otros), tipo (aprendizaje automático, aprendizaje profundo y otros), producto y servicios (servicios de bioinformática, plataformas de bioinformática y herramientas de gestión del conocimiento), aplicación ( genómica , quimioinformática y diseño de fármacos, proteómica, secuenciación de ADN, biología de sistemas, transcriptómica, minería de texto, microarrays, metabolómica y otros), sector (biotecnología médica, biotecnología animal, biotecnología vegetal, biotecnología ambiental, biotecnología forense y otros) - Tendencias de la industria y pronóstico hasta 2029.

Análisis y tamaño del mercado de inteligencia artificial en bioinformática de América del Norte

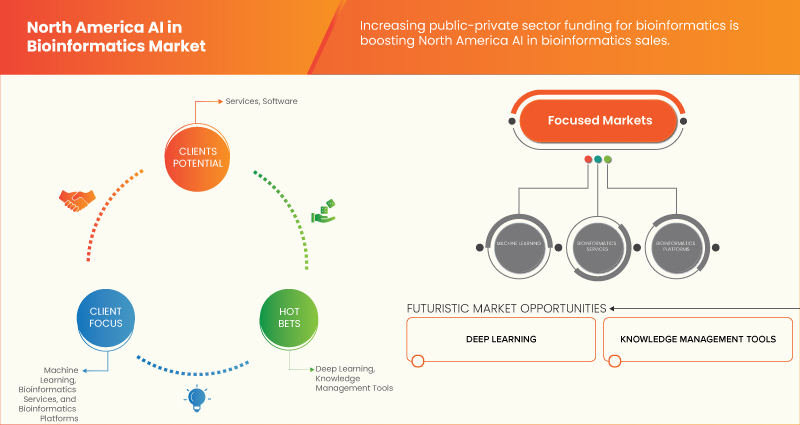

La reducción del coste de la secuenciación genética ha mejorado la demanda del mercado. El aumento del gasto sanitario para mejorar los servicios sanitarios también contribuye al crecimiento del mercado. Los principales actores del mercado se centran en el lanzamiento y la aprobación de diversos servicios durante este período crucial. Además, la creciente demanda de bioinformática y el aumento de la financiación del sector público y privado para la bioinformática también contribuyen al aumento de la demanda del mercado.

El mercado de IA en bioinformática de América del Norte está creciendo en el año de pronóstico debido al aumento de los actores del mercado y la disponibilidad de servicios avanzados. Junto con esto, los fabricantes están involucrados en actividades de I+D para lanzar servicios novedosos en el mercado. Los avances crecientes en la tecnología bioinformática están impulsando aún más el crecimiento del mercado. Sin embargo, el alto costo de los instrumentos y las preocupaciones de ciberseguridad en bioinformática podrían obstaculizar el crecimiento del mercado de IA en bioinformática de América del Norte en el período de pronóstico.

El creciente progreso técnico y la modernización, así como las iniciativas estratégicas de los actores del mercado, están generando oportunidades de mercado. Sin embargo, la falta de profesionales capacitados para implementar tecnología bioinformática basada en IA y los desafíos para implementar tecnología bioinformática en laboratorios clínicos son desafíos clave para el crecimiento del mercado.

Data Bridge Market Research analiza que se espera que el mercado de IA en bioinformática de América del Norte alcance un valor de USD 19.677,40 millones para 2030, con una CAGR del 45,2 % durante el período de pronóstico. El informe del mercado de IA en bioinformática de América del Norte también cubre de manera integral el análisis de precios, el análisis de patentes y los avances tecnológicos.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019-2014) |

|

Unidades cuantitativas |

Ingresos en millones, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Oferta (servicios, software y otros), tipo (aprendizaje automático, aprendizaje profundo y otros), producto y servicios (servicios de bioinformática, plataformas de bioinformática y herramientas de gestión del conocimiento), aplicación (genómica, quimioinformática y diseño de fármacos, proteómica, secuenciación de ADN, biología de sistemas, transcriptómica, minería de textos, microarrays, metabolómica y otros), sector (biotecnología médica, biotecnología animal, biotecnología vegetal, biotecnología ambiental, biotecnología forense y otros) |

|

Países cubiertos |

Estados Unidos, Canadá y México |

|

Actores del mercado cubiertos |

Análisis de datos de JADBio y Gnosis, SOPHiA GENETICS, Biomax Informatics AG, DNASTAR, Ardigen, QIAGEN, Source BioScience, NeoGenomics Laboratories, Eurofins Scientific, Illumina, Inc., Thermo Fisher Scientific Inc., CelbridgeScience, Dassault Systemes, Fios Genomics, Insilico Medicine, Strand Life Sciences, Paige AI, Inc., SomaLogic Operating Co., Inc. y iNDX. Ai. Elucidata. |

Definición de mercado

El mercado de IA en bioinformática de América del Norte se refiere al sector dentro de la región de América del Norte donde se aplican tecnologías de inteligencia artificial (IA) en el campo de la bioinformática. La bioinformática implica el uso de métodos y técnicas computacionales para analizar e interpretar datos biológicos, como secuencias genómicas, estructuras de proteínas y experimentos biológicos a gran escala.

La bioinformática combina la programación informática, el big data y la biología molecular, lo que permite a los científicos comprender e identificar patrones en los datos biológicos. Es especialmente útil para estudiar genomas y secuenciación de ADN, ya que permite a los científicos organizar grandes cantidades de datos.

Existen decenas de ramas de la biología en las que especializarse, desde genética, toxicología, micología y radiobiología. Y de entre ellas, la bioinformática es uno de los campos más interesantes que permite identificar, evaluar, almacenar y recuperar información biológica. Al ser un campo de estudio interdisciplinario, incorpora diversas aplicaciones de la informática, la estadística y la biología para desarrollar aplicaciones de software que permitan comprender datos biológicos, como la secuenciación de ADN, el análisis de proteínas, la genética evolutiva y otros.

Dinámica del mercado de la IA en bioinformática en América del Norte

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- Reducción del coste de la secuenciación genética

La fuerte demanda de reducción de los costes de la genómica y la predicción de biomarcadores ha contribuido a la creación de una secuenciación genómica de alto rendimiento, que a menudo se realiza mediante secuenciación de nueva generación (NGS). Se generan simultáneamente miles o millones de secuencias en un solo ciclo bioinformático. Las mejoras drásticas de las tecnologías industriales de NGS han dado lugar a importantes reducciones del coste por base de la secuenciación de ADN. Por tanto, las principales técnicas de secuenciación se han convertido recientemente en el tema clave de la investigación, y la optimización del diseño de muestras ha pasado a un segundo plano.

Con su capacidad paralela para manejar cientos de millones de plantillas de ADN, la secuenciación de próxima generación ha mejorado enormemente la eficiencia de la secuenciación y ha reducido los costos de secuenciación. Además, el costo de la bioinformática ha disminuido drásticamente desde la finalización del Proyecto Genoma Humano, superando la Ley de Moore. Illumina ha ayudado a reducir el costo de la instrumentación bioinformática a través de la innovación continua, lo que ha permitido el genoma humano de USD 1000.

- Demanda creciente de bioinformática

A medida que la farmacología centrada en la genómica sigue desempeñando un papel cada vez más importante en el tratamiento de diversas enfermedades crónicas, especialmente el cáncer, la secuenciación de nueva generación (NGS) está evolucionando como una herramienta poderosa para proporcionar una visión más profunda y precisa de las bases moleculares de tumores individuales y receptores específicos. La informática es esencial en la investigación biológica que involucra a biólogos que aprenden programación, programadores informáticos, matemáticos o administradores de bases de datos que aprenden los fundamentos de la biología.

La NGS ofrece ventajas en cuanto a precisión, sensibilidad y velocidad en comparación con los métodos tradicionales que tienen el potencial de tener un impacto significativo en el campo de la oncología. Debido a que la NGS puede evaluar múltiples genes en un solo ensayo, se elimina la necesidad de solicitar múltiples pruebas para identificar la mutación causal. La IA en bioinformática es importante para la gestión de datos en la biología y la medicina modernas.

El uso creciente de la bioinformática está impulsado por la explosión de datos biológicos, la necesidad de integración y análisis de datos, sus aplicaciones en el descubrimiento de fármacos y la medicina personalizada, su contribución a la comprensión de sistemas biológicos complejos y su papel en la biología evolutiva y la filogenética. La bioinformática desempeña un papel importante en el avance de la investigación biológica, la mejora de la atención sanitaria y la solución de diversos desafíos en las ciencias de la vida.

Oportunidad

- Aumento del gasto sanitario

El aumento del gasto sanitario por parte de los gobiernos se ha observado en muchos países del mundo. El gasto sanitario ha aumentado en todo el mundo a medida que aumenta el ingreso disponible de las personas en varios países. Además, para satisfacer las necesidades de la población, los organismos gubernamentales y las organizaciones sanitarias están tomando la iniciativa acelerando el gasto sanitario. A medida que las poblaciones envejecen, aumenta la demanda de servicios sanitarios, incluida la gestión de enfermedades crónicas, la atención a largo plazo y la atención al final de la vida. La población de edad avanzada tiende a requerir más recursos y servicios sanitarios, lo que genera mayores gastos sanitarios. Hay algunos casos en los que muchas organizaciones gubernamentales mejoraron la financiación sólida para la atención sanitaria, lo que impulsó el mercado de la atención sanitaria y creó una oportunidad significativa para la IA de América del Norte en el mercado de la bioinformática.

Restricción/Desafío

- Preocupaciones sobre la ciberseguridad en la bioinformática

Los conjuntos de datos bioinformáticos contienen información confidencial, como datos genómicos, información sanitaria personal y datos de investigación. Si personas no autorizadas obtienen acceso a estos datos mediante brechas en las defensas de ciberseguridad, pueden producirse violaciones de la privacidad, robo de identidad o uso indebido de los datos.

Sin embargo, la creciente informatización de la tecnología del ADN y, en términos más generales, de la biotecnología plantea nuevas preocupaciones en materia de bioseguridad cibernética. Las vulnerabilidades que suelen asociarse a los sistemas informáticos tradicionales (como el procesamiento de datos no fiables, las fugas de información en canales secundarios, la autenticación deficiente, la falsificación de datos y las vulnerabilidades en los sistemas ciberfísicos) ya existen en la biotecnología. Las nuevas amenazas a la bioseguridad cibernética han puesto en peligro los sistemas de información del ADN en la bioinformática.

Impacto posterior a la COVID-19 en el mercado de la IA en bioinformática de América del Norte

La IA en la industria de la bioinformática ha experimentado una disminución de la demanda debido al confinamiento y al COVID-19. Las leyes gubernamentales, como el cierre de instalaciones de fabricación y servicios, han tenido un gran impacto en varias industrias, ya que casi todos los países han optado por el cierre de todas las instalaciones, excepto las que se dedican al segmento de bienes esenciales. El gobierno ha tomado algunas medidas estrictas, como el cierre de instalaciones y la venta de bienes no esenciales, el bloqueo del comercio internacional y muchas más para evitar la propagación del COVID-19. Esto ha impulsado el mercado de la IA en bioinformática de América del Norte, ya que los consumidores estaban contratando seguros para evitar grandes pagos de capital en los hospitales en caso de necesidades médicas. Por lo tanto, el COVID-19 ha tenido un impacto positivo en la IA de América del Norte en el mercado de la bioinformática.

Acontecimientos recientes

- En septiembre de 2022, Elucidata, una empresa de TechBio, recaudó con éxito 16 millones de dólares en una ronda de financiación de Serie A. La financiación estuvo liderada por Eight Roads Ventures. La empresa planea utilizar el capital recién adquirido para mejorar las capacidades de los productos en la investigación de fármacos traslacionales y mercados relacionados. Además, los fondos respaldarán la expansión de las iniciativas de comercialización y permitirán a la empresa hacer crecer sus operaciones a nivel mundial.

- En enero de 2022, Shanghai Fosun Pharmaceutical (Group) Co., Ltd, un grupo de atención médica internacional líder impulsado por la innovación en China, e Insilico Medicine, una empresa de desarrollo y descubrimiento de fármacos impulsada por inteligencia artificial (IA) de extremo a extremo. La empresa firmó un acuerdo de colaboración para avanzar en el descubrimiento y desarrollo de medicamentos dirigidos a varios objetivos a nivel mundial a través de la tecnología de IA. Esto ha ayudado a la empresa a ampliar su cartera de productos de mercado y aumentar su presencia global.

Alcance del mercado de IA en bioinformática en América del Norte

El mercado de IA en bioinformática de América del Norte está segmentado en función de la oferta, el tipo, el producto y los servicios, la aplicación y el sector. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducidos en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Ofrenda

- Servicios

- Software

- Otros

Sobre la base de la oferta, el mercado de IA en bioinformática de América del Norte está segmentado en servicios, software y otros.

Tipo

- Aprendizaje automático

- Aprendizaje profundo

- Otros

Según el tipo, el mercado de IA en bioinformática de América del Norte se segmenta en aprendizaje automático, aprendizaje profundo y otros.

Productos y servicios

- Servicios de Bioinformática

- Plataformas de bioinformática

- Herramientas de gestión del conocimiento

Sobre la base de productos y servicios, el mercado de IA en bioinformática de América del Norte está segmentado en servicios de bioinformática, plataformas de bioinformática y herramientas de gestión del conocimiento.

Solicitud

- Genómica

- Quimioinformática y diseño de fármacos

- Proteómica

- Secuenciación de ADN

- Biología de sistemas

- Transcriptómica

- Minería de texto

- Microarrays

- Metabolómica

- Otros

Sobre la base de la aplicación, el mercado de IA en bioinformática de América del Norte está segmentado en genómica, quimioinformática y diseño de fármacos, proteómica, secuenciación de ADN, biología de sistemas, transcriptómica, minería de texto, microarrays, metabolómica y otros.

Sector

- Biotecnología médica

- Biotecnología animal

- Biotecnología vegetal

- Biotecnología ambiental

- Biotecnología forense

- Otros

Sobre la base del sector, el mercado de IA en bioinformática de América del Norte está segmentado en biotecnología médica, biotecnología animal, biotecnología vegetal, biotecnología ambiental, biotecnología forense y otras.

Análisis y perspectivas regionales del mercado de IA en bioinformática de América del Norte

Se analiza el mercado de IA en bioinformática de América del Norte y se proporcionan información y tendencias del tamaño del mercado por país, oferta, tipo, productos y servicios, aplicación y sector como se menciona anteriormente.

Los países incluidos en el informe sobre el mercado de la IA en bioinformática en América del Norte son Estados Unidos, Canadá y México. Estados Unidos domina la región de América del Norte debido a la alta demanda de IA en dispositivos bioinformáticos. Además, Estados Unidos tiene un sólido ecosistema de I+D con una importante inversión en investigación científica. Las principales universidades e instituciones de investigación del país han hecho contribuciones sustanciales al campo de la bioinformática, incluida la aplicación de técnicas de IA.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, así como los estudios de casos, son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se consideran la presencia y disponibilidad de marcas de América del Norte y los desafíos que enfrentan debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y la cuota de mercado de la IA en bioinformática en América del Norte

El panorama competitivo del mercado de IA en bioinformática de América del Norte proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la extensión de los productos y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de IA en bioinformática de América del Norte.

Algunos de los principales actores que operan en el mercado de IA en bioinformática de América del Norte son JADBio & Gnosis Data Analysis, SOPHiA GENETICS, Biomax Informatics AG, DNASTAR, Ardigen, QIAGEN, Source BioScience, NeoGenomics Laboratories, Eurofins Scientific, Illumina, Inc., Thermo Fisher Scientific Inc., CelbridgeScience, Dassault Systemes Fios Genomics, Insilico Medicine, Strand Life Sciences, Paige AI, Inc., SomaLogic Operating Co., Inc., iNDX. Ai. y Elucidata, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA AI IN BIOINFORMATICS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 OFFERING LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET SECTOR COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES

5 NORTH AMERICA AI IN BIOINFORMATICS MARKET :MARKET OVERVIEW

5.1 DRIVERS

5.1.1 REDUCTION IN THE GENETIC SEQUENCING COST

5.1.2 GROWING DEMAND FOR BIOINFORMATICS

5.1.3 INCREASING PUBLIC-PRIVATE SECTOR FUNDING FOR BIOINFORMATICS

5.2 RESTRAINTS

5.2.1 HIGH COST OF INSTRUMENTATION

5.2.2 CYBERSECURITY CONCERNS IN BIOINFORMATICS

5.3 OPPORTUNITIES

5.3.1 RISE IN HEALTHCARE EXPENDITURE

5.3.2 STRATEGIC INITIATIVES BY KEY PLAYERS

5.3.3 ADVANCEMENT IN BIOINFORMATICS TECHNOLOGY

5.4 CHALLENGES

5.4.1 LACK OF SKILLED PROFESSIONALS TO PERFORM AI-BASED BIOINFORMATICS TECHNOLOGY

5.4.2 CHALLENGES OF IMPLEMENTING BIOINFORMATIC TECHNOLOGY IN THE CLINICAL LAB

6 NORTH AMERICA AI IN BIOINFORMATICS MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SERVICES

6.3 SOFTWARE

6.4 OTHERS

7 NORTH AMERICA AI IN BIOINFORMATICS MARKET, BY TYPE

7.1 OVERVIEW

7.2 MACHINE LEARNING

7.3 DEEP LEARNING

7.4 OTHERS

8 NORTH AMERICA AI IN BIOINFORMATICS MARKET, BY PRODUCTS AND SERVICES

8.1 OVERVIEW

8.2 BIOINFORMATICS SERVICES

8.2.1 DATA ANALYSIS

8.2.2 SEQUENCING SERVICES

8.2.3 DATABASE MANAGEMENT

8.2.4 OTHERS

8.3 BIOINFORMATICS PLATFORMS

8.3.1 SEQUENCE ANALYSIS PLATFORMS

8.3.2 SEQUENCE ALIGNMENT PLATFORMS

8.3.3 STRUCTURAL ANALYSIS PLATFORMS

8.3.4 SEQUENCE MANIPULATION PLATFORMS

8.3.5 OTHERS

8.4 KNOWLEDGE MANAGEMENT TOOLS

8.4.1 GENERALIZED KNOWLEDGE MANAGEMENT TOOLS

8.4.2 SPECIALIZED KNOWLEDGE MANAGEMENT TOOLS

9 NORTH AMERICA AI IN BIOINFORMATICS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 GENOMICS

9.3 CHEMOINFORMATICS & DRUG DESIGN

9.4 PROTEOMICS

9.5 DNA SEQUENCING

9.6 SYSTEM BIOLOGY

9.7 TRANSCRIPTOMICS

9.8 TEXT MINING

9.9 MICROARRAYS

9.1 METABOLOMICS

9.11 OTHERS

10 NORTH AMERICA AI IN BIOINFORMATICS MARKET, BY SECTOR

10.1 OVERVIEW

10.2 MEDICAL BIOTECHNOLOGY

10.3 ANIMAL BIOTECHNOLOGY

10.4 PLANT BIOTECHNOLOGY

10.5 ENVIRONMENTAL BIOTECHNOLOGY

10.6 FORENSIC BIOTECHNOLOGY

10.7 OTHERS

11 NORTH AMERICA AI IN BIOINFORMATICS MARKET, BY COUNTRY

11.1 U.S.

11.2 CANADA

11.3 MEXICO

12 NORTH AMERICA AI IN BIOINFORMATICS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 ILLUMINA, INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 DASSAULT SYSTEMES

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 EUROFINS SCIENTIFIC

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 THERMO FISHER SCIENTIFIC INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 QIAGEN

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENT

14.6 ARDIGEN

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 BIOMAX INFORMATICS AG

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 CELBRIDGESCIENCE.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 DNASTAR

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 ELUCIDATA

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 INDX. AI.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 INSILICO MEDICINE

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 JADBIO & GNOSIS DATA ANALYSIS

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 NEOGENOMICS LABORATORIES

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENT

14.15 PAIGE AI, INC.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 SOMALOGIC OPERATING CO., INC.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 SOPHIA GENETICS

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 SOURCE BIOSCIENCE.

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 BIOINFORMATICS COST PER SAMPLE

TABLE 2 NORTH AMERICA AI IN BIOINFORMATICS MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA AI IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA AI IN BIOINFORMATICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA BIOINFORMATICS SERVICES IN AI IN BIOINFORMATICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA BIOINFORMATICS PLATFORMS IN AI IN BIOINFORMATICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA KNOWLEDGE MANAGEMENT TOOLS IN AI IN BIOINFORMATICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA AI IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA AI IN BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA AI IN BIOINFORMATICS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 11 U.S. AI IN BIOINFORMATICS MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 12 U.S. AI IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 U.S. AI IN BIOINFORMATICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 14 U.S. BIOINFORMATICS SERVICES IN AI IN BIOINFORMATICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 15 U.S. BIOINFORMATICS PLATFORMS IN AI IN BIOINFORMATICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 16 U.S. KNOWLEDGE MANAGEMENT TOOLS IN AI IN BIOINFORMATICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 17 U.S. AI IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 U.S. AI IN BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 19 CANADA AI IN BIOINFORMATICS MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 20 CANADA AI IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 CANADA AI IN BIOINFORMATICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 22 CANADA BIOINFORMATICS SERVICES IN AI IN BIOINFORMATICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 23 CANADA BIOINFORMATICS PLATFORMS IN AI IN BIOINFORMATICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 24 CANADA KNOWLEDGE MANAGEMENT TOOLS IN AI IN BIOINFORMATICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 25 CANADA AI IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 CANADA AI IN BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 27 MEXICO AI IN BIOINFORMATICS MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 28 MEXICO AI IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 MEXICO AI IN BIOINFORMATICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 30 MEXICO BIOINFORMATICS SERVICES IN AI IN BIOINFORMATICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 31 MEXICO BIOINFORMATICS PLATFORMS IN AI IN BIOINFORMATICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 32 MEXICO KNOWLEDGE MANAGEMENT TOOLS IN AI IN BIOINFORMATICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 33 MEXICO AI IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 34 MEXICO AI IN BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA AI IN BIOINFORMATICS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA AI IN BIOINFORMATICS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA AI IN BIOINFORMATICS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA AI IN BIOINFORMATICS MARKET: NORTH AMERICA VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA AI IN BIOINFORMATICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA AI IN BIOINFORMATICS MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA AI IN BIOINFORMATICS MARKET: OFFERING LIFELINE CURVE

FIGURE 8 NORTH AMERICA AI IN BIOINFORMATICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA AI IN BIOINFORMATICS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA AI IN BIOINFORMATICS MARKET: MARKET SECTOR COVERAGE GRID

FIGURE 11 NORTH AMERICA AI IN BIOINFORMATICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 NORTH AMERICA AI IN BIOINFORMATICS MARKET: SEGMENTATION

FIGURE 13 THE REDUCTION IN THE GENETIC SEQUENCING COST AND GROWING DEMAND FOR BIOINFORMATICS ARE EXPECTED TO DRIVE THE NORTH AMERICA AI IN BIOINFORMATICS MARKET IN THE FORECAST PERIOD

FIGURE 14 THE SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA AI IN BIOINFORMATICS MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA AI IN BIOINFORMATICS MARKET

FIGURE 16 COST OF GENETIC SEQUENCING IN USD (YEAR WISE)

FIGURE 17 POSSIBLE IMPACT OF CYBER ATTACKS ON BIOINFORMATICS

FIGURE 18 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY OFFERING, 2021

FIGURE 19 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY OFFERING, 2022-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY OFFERING, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY OFFERING, LIFELINE CURVE

FIGURE 22 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY TYPE, 2021

FIGURE 23 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 26 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY PRODUCTS AND SERVICES, 2021

FIGURE 27 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY PRODUCTS AND SERVICES, 2022-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY PRODUCTS AND SERVICES, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY PRODUCTS AND SERVICES, LIFELINE CURVE

FIGURE 30 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY APPLICATION, 2021

FIGURE 31 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 32 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 33 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 34 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY SECTOR, 2021

FIGURE 35 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY SECTOR, 2022-2029 (USD MILLION)

FIGURE 36 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY SECTOR, CAGR (2022-2029)

FIGURE 37 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY SECTOR, LIFELINE CURVE

FIGURE 38 NORTH AMERICA AI IN BIOINFORMATICS MARKET: SNAPSHOT (2021)

FIGURE 39 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY COUNTRY (2021)

FIGURE 40 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 41 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 42 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY OFFERING (2022-2029)

FIGURE 43 NORTH AMERICA AI IN BIOINFORMATICS MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.