North America Active Medical Implantable Devices Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

10.08 Billion

USD

18.51 Billion

2025

2033

USD

10.08 Billion

USD

18.51 Billion

2025

2033

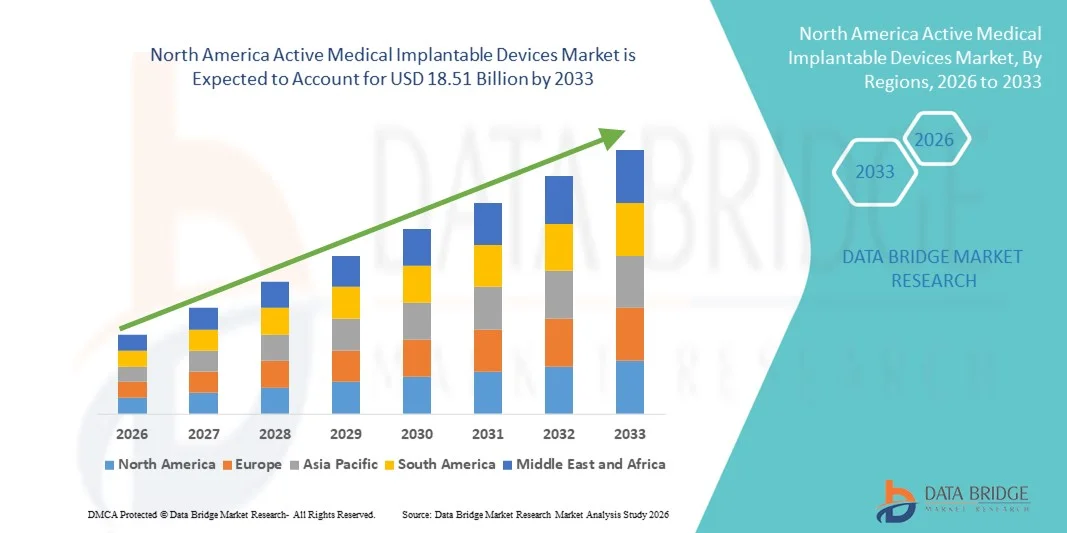

| 2026 –2033 | |

| USD 10.08 Billion | |

| USD 18.51 Billion | |

|

|

|

|

Segmentación del mercado de dispositivos médicos implantables activos en Norteamérica, por producto (dispositivos de terapia de resincronización cardíaca [TRC-D], desfibriladores cardioversores implantables, marcapasos cardíacos implantables, implantes oculares, neuroestimuladores, dispositivos auditivos implantables activos, dispositivos de asistencia ventricular, monitores cardíacos implantables/registradores de bucle insertables, braquiterapia, monitores de glucosa implantables, implantes de pie caído, implantes de hombro, bombas de infusión implantables y accesorios implantables), tipo de cirugía (métodos quirúrgicos tradicionales y cirugía mínimamente invasiva), procedimiento (neurovascular, cardiovascular, auditivo y otros), usuario final (hospitales, clínicas especializadas, centros de cirugía ambulatoria y clínicas): tendencias de la industria y pronóstico hasta 2033.

Tamaño del mercado de dispositivos médicos implantables activos en América del Norte

- El tamaño del mercado de dispositivos médicos implantables activos de América del Norte se valoró en USD 10.08 mil millones en 2025 y se espera que alcance los USD 18.51 mil millones para 2033 , con una CAGR del 7,9% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la infraestructura de atención médica avanzada, la creciente prevalencia de enfermedades crónicas y las innovaciones tecnológicas continuas en soluciones implantables que mejoran los resultados de los pacientes tanto en hospitales como en entornos de atención especializada.

- Además, la creciente demanda de dispositivos terapéuticos de alta precisión, mínimamente invasivos y con monitorización remota, sumada a políticas de reembolso favorables y la adopción temprana de tecnologías médicas de vanguardia, está consolidando la posición de Norteamérica como mercado regional líder en dispositivos implantables activos. Estos factores convergentes están acelerando la adopción de soluciones implantables avanzadas, impulsando así significativamente el crecimiento de la industria.

Análisis del mercado de dispositivos médicos implantables activos en América del Norte

- Los dispositivos médicos implantables activos, incluidos los dispositivos de terapia de resincronización cardíaca (TRC-D), los desfibriladores implantables, los marcapasos, los neuroestimuladores, los implantes oculares y los dispositivos auditivos activos, son componentes cada vez más vitales de la atención médica moderna en los EE. UU. y ofrecen monitoreo continuo, intervención terapéutica precisa y mejores resultados para los pacientes en aplicaciones cardiovasculares, neurológicas y sensoriales.

- La creciente demanda de dispositivos implantables activos se ve impulsada principalmente por la creciente prevalencia de enfermedades crónicas, el envejecimiento de la población y la creciente adopción de tecnologías médicas avanzadas que permiten procedimientos mínimamente invasivos, monitoreo remoto y una mejor atención al paciente.

- Estados Unidos dominó el mercado de dispositivos médicos implantables activos de América del Norte con la mayor participación en los ingresos del 74,9 % en 2025, caracterizado por una infraestructura de atención médica avanzada, un alto gasto en atención médica y una fuerte presencia de actores clave de la industria, con hospitales y clínicas especializadas que experimentaron un crecimiento sustancial en la adopción de implantes cardíacos y neurológicos, impulsados por innovaciones tanto de empresas de dispositivos médicos establecidas como de nuevas empresas centradas en dispositivos habilitados para IA y conectados digitalmente.

- Se espera que Canadá sea el país de más rápido crecimiento en el mercado de dispositivos médicos implantables activos de América del Norte durante el período de pronóstico debido al aumento de las inversiones en atención médica, la creciente conciencia de las terapias implantables y la mejora del acceso a tecnologías médicas avanzadas.

- El segmento de desfibriladores cardioversores implantables dominó el mercado con una participación del 45,3% en 2025, impulsado por la alta prevalencia de enfermedades cardiovasculares, los avances tecnológicos en desfibriladores y la creciente preferencia de los pacientes por dispositivos con capacidades de monitoreo remoto.

Alcance del informe y segmentación del mercado de dispositivos médicos implantables activos en América del Norte

|

Atributos |

Perspectivas clave del mercado de dispositivos médicos implantables activos en América del Norte |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, epidemiología de pacientes, análisis de canalización, análisis de precios y marco regulatorio. |

Tendencias del mercado de dispositivos médicos implantables activos en América del Norte

Integración de monitorización avanzada y terapias basadas en IA

- Una tendencia significativa y en aceleración en el mercado estadounidense de dispositivos médicos implantables activos es la incorporación de monitoreo habilitado por IA, conectividad remota y análisis predictivos, que mejoran la atención al paciente y brindan a los médicos información en tiempo real sobre el rendimiento del dispositivo y la salud del paciente.

- Por ejemplo, los marcapasos de Medtronic con IA pueden ajustar automáticamente la estimulación en función de la actividad del paciente y sus datos de salud, lo que permite una terapia más personalizada y reduce las visitas al hospital. De igual manera, los monitores cardíacos implantables de Abbott transmiten alertas de arritmia en tiempo real a los médicos a través de plataformas seguras en la nube.

- La integración de IA en estos dispositivos permite funciones como el aprendizaje de patrones cardíacos o neurológicos específicos del paciente para sugerir ajustes terapéuticos y generar alertas predictivas ante posibles complicaciones. Por ejemplo, los neuroestimuladores de Boston Scientific analizan los patrones de movimiento del paciente para optimizar los parámetros de estimulación y alertar a los médicos en caso de anomalías.

- La conectividad remota permite a pacientes y profesionales sanitarios monitorizar el rendimiento del dispositivo y las métricas fisiológicas desde casa, lo que mejora el cumplimiento y la detección temprana de eventos adversos. A través de una única plataforma, los profesionales sanitarios pueden gestionar múltiples dispositivos implantables junto con los datos de salud del paciente, creando una experiencia de atención integrada y automatizada.

- Esta tendencia hacia dispositivos implantables más inteligentes, interconectados y centrados en el paciente está redefiniendo las expectativas sobre la funcionalidad de los dispositivos médicos. En consecuencia, empresas como Biotronik están desarrollando desfibriladores y marcapasos con IA, algoritmos de terapia adaptativa y monitorización en la nube.

- La demanda de dispositivos implantables con monitoreo y gestión remota habilitados por IA está creciendo rápidamente tanto en hospitales como en clínicas especializadas, a medida que los pacientes y los proveedores priorizan cada vez más la conveniencia, la precisión y los mejores resultados clínicos.

- Además, la integración con dispositivos portátiles y aplicaciones de salud móviles permite a los pacientes realizar un seguimiento activo de sus métricas de salud junto con los datos de los dispositivos implantables, lo que crea un enfoque más holístico para el manejo de la enfermedad.

Dinámica del mercado de dispositivos médicos implantables activos en América del Norte

Conductor

Aumento de la prevalencia de enfermedades crónicas y adopción de tecnología

- La creciente prevalencia de trastornos cardiovasculares, neurológicos y sensoriales, junto con la adopción de tecnologías implantables avanzadas, es un impulsor importante de la demanda en el mercado estadounidense.

- Por ejemplo, en marzo de 2025, Abbott anunció la expansión de su sistema de monitoreo cardíaco implantable con detección de arritmias basada en IA, mejorando la intervención temprana y el manejo del paciente.

- A medida que los proveedores de atención médica se centran en reducir las readmisiones hospitalarias y mejorar los resultados de los pacientes, los dispositivos implantables ofrecen funciones avanzadas como monitoreo continuo, ajuste automatizado de la terapia y transmisión segura de datos, lo que proporciona una alternativa convincente a las intervenciones tradicionales.

- Además, la creciente preferencia por procedimientos mínimamente invasivos y monitoreo remoto está haciendo que los dispositivos implantables sean un componente integral de la terapia moderna, permitiendo a los médicos brindar atención más precisa y específica para cada paciente.

- La facilidad de integración con los sistemas informáticos de salud hospitalaria, las plataformas de monitorización remota y el diagnóstico asistido por IA es un factor clave que impulsa su adopción en hospitales y clínicas especializadas. La tendencia hacia la atención centrada en el paciente y las soluciones de salud digital contribuye aún más al crecimiento del mercado.

- Por ejemplo, los neuroestimuladores con sistemas de circuito cerrado se adoptan cada vez más para optimizar la administración de la terapia para el dolor crónico y la enfermedad de Parkinson, lo que impulsa la expansión del mercado en clínicas especializadas.

- Además, el creciente uso de dispositivos auditivos implantables para poblaciones pediátricas y geriátricas está impulsando la demanda, ya que más pacientes buscan una mejor salud auditiva con intervenciones mínimamente invasivas.

Restricción/Desafío

Altos costos y obstáculos para el cumplimiento normativo

- La preocupación por los altos costos de los dispositivos, los procedimientos quirúrgicos complejos y los estrictos requisitos regulatorios plantean importantes desafíos para una mayor penetración en el mercado. Dado que estos dispositivos requieren tecnología avanzada y monitorización clínica, suelen ser costosos y requieren experiencia especializada en implantación.

- Por ejemplo, los retiros de alto perfil de ciertos dispositivos cardíacos implantables debido a problemas con la batería o el software han hecho que algunos proveedores sean cautelosos a la hora de adoptar nuevas tecnologías.

- Abordar estos desafíos mediante una sólida validación clínica, la capacitación de médicos y el cumplimiento de las normas regulatorias de la FDA e ISO es crucial para la expansión del mercado. Empresas como Medtronic y Boston Scientific priorizan rigurosos protocolos de pruebas y cumplimiento para garantizar la seguridad de médicos y pacientes. Además, el costo relativamente alto de algunos dispositivos implantables avanzados, en comparación con la terapia tradicional, puede ser un obstáculo para los hospitales con limitaciones presupuestarias.

- Si bien los precios están disminuyendo gradualmente y la cobertura del seguro está mejorando, la prima asociada con los dispositivos implantables avanzados aún puede obstaculizar su adopción generalizada, en particular en clínicas más pequeñas o entornos de atención médica con menos fondos.

- Superar estos desafíos mediante la optimización de costos, el apoyo a los reembolsos y un mejor cumplimiento normativo será vital para el crecimiento sostenido del mercado estadounidense de dispositivos médicos implantables activos.

- Por ejemplo, el cumplimiento de las regulaciones actualizadas de ciberseguridad y privacidad de datos para dispositivos implantables conectados es cada vez más complejo y requiere inversiones adicionales por parte de los fabricantes y los proveedores de atención médica.

- Además, los requisitos de capacitación para procedimientos de implantación mínimamente invasivos y el monitoreo posoperatorio de dispositivos agregan desafíos operativos que pueden limitar su adopción, en particular en centros de atención médica rurales o con recursos insuficientes.

Mercado de dispositivos médicos implantables activos en América del Norte

El mercado está segmentado según el producto, el tipo de cirugía, el procedimiento y el usuario final.

- Por producto

Sobre la base del producto, el mercado de dispositivos médicos implantables activos de América del Norte está segmentado en Dispositivos de Terapia de Resincronización Cardíaca (TRC-D), desfibriladores cardioversores implantables (dci), marcapasos cardíacos implantables, implantes oculares, neuroestimuladores, dispositivos auditivos implantables activos, dispositivos de asistencia ventricular, monitores cardíacos implantables/registradores de bucle insertables, braquiterapia, monitores de glucosa implantables, implantes de pie caído, implantes de hombro, bombas de infusión implantables y accesorios implantables. El segmento de desfibriladores cardioversores implantables (DCI) dominó el mercado con la mayor participación en los ingresos del 45,3% en 2025, impulsado por la alta prevalencia de enfermedades cardiovasculares como arritmias y paro cardíaco repentino en los EE. UU. Los hospitales y las clínicas especializadas a menudo priorizan los DCI para pacientes de alto riesgo debido a su eficacia comprobada para restaurar los ritmos cardíacos normales. La demanda está respaldada además por los avances tecnológicos, que incluyen la monitorización remota y las alertas predictivas habilitadas por IA, que mejoran la seguridad del paciente. Los DCI son compatibles con las plataformas de salud digital, lo que permite a los profesionales sanitarios realizar un seguimiento de los datos de los pacientes en tiempo real. El segmento se beneficia de políticas de reembolso consolidadas y de la amplia familiaridad de los profesionales sanitarios, lo que refuerza su posición dominante. Además, la innovación continua en la duración de las baterías, la miniaturización y la comunicación inalámbrica fortalece la adopción en el mercado y la generación de ingresos.

Se prevé que el segmento de monitores cardíacos implantables/registradores de bucle insertables experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente adopción, tanto en hospitales como en clínicas ambulatorias especializadas, para la detección temprana de arritmias y el riesgo de ictus. Estos dispositivos proporcionan una monitorización continua a largo plazo, lo que reduce la necesidad de frecuentes visitas al hospital. Los pacientes prefieren cada vez más soluciones de monitorización mínimamente invasivas, que mejoran la comodidad y la practicidad. La integración con aplicaciones móviles y plataformas en la nube permite el intercambio remoto de datos y el análisis predictivo, lo que hace que estos dispositivos sean más atractivos tanto para médicos como para pacientes. La creciente concienciación sobre la detección temprana de enfermedades cardiovasculares y las políticas de reembolso favorables contribuyen aún más a la rápida aceptación en el mercado. El segmento también está experimentando innovaciones tecnológicas, como dispositivos más pequeños y una mayor duración de la batería, lo que aumenta su atractivo entre las poblaciones geriátricas y de alto riesgo.

- Por tipo de cirugía

Según el tipo de cirugía, el mercado se segmenta en métodos quirúrgicos tradicionales y cirugía mínimamente invasiva. El segmento de cirugía mínimamente invasiva dominó el mercado en 2025 debido a su menor riesgo de complicaciones, tiempos de recuperación más rápidos y estancias hospitalarias más cortas. Los hospitales y las clínicas especializadas prefieren cada vez más la implantación mínimamente invasiva de dispositivos cardíacos, neurovasculares y ortopédicos, lo que mejora la satisfacción del paciente y los resultados clínicos. Los cirujanos están adoptando técnicas avanzadas de imagenología y asistidas por robot para mejorar la precisión de los procedimientos. La creciente preferencia de los pacientes por procedimientos menos invasivos también impulsa su adopción. Las cirugías mínimamente invasivas son compatibles con la mayoría de los dispositivos implantables modernos, lo que respalda el crecimiento continuo. Además, los programas de reembolso de la atención médica y las guías clínicas a menudo favorecen los métodos mínimamente invasivos, lo que refuerza aún más su dominio del mercado.

Se prevé que el segmento de Métodos Quirúrgicos Tradicionales experimente el mayor crecimiento entre 2026 y 2033, especialmente en regiones con experiencia quirúrgica consolidada y para dispositivos que requieren una implantación compleja, como dispositivos de asistencia ventricular o neuroestimuladores avanzados. Los hospitales continúan utilizando técnicas tradicionales para procedimientos de alto riesgo o que requieren múltiples dispositivos gracias a su familiaridad y a sus resultados comprobados. Este segmento se beneficia de programas de formación continua, la estandarización de procedimientos y la actualización de protocolos clínicos. Los métodos tradicionales también permiten la implantación simultánea de múltiples dispositivos cuando es necesario. Además, el aumento de la investigación clínica que respalda la eficacia de los dispositivos mediante abordajes quirúrgicos tradicionales fomenta su adopción. La creciente concienciación de los pacientes y la confianza de los médicos en las implantaciones complejas contribuyen al crecimiento previsto de este segmento.

- Por procedimiento

Según el procedimiento, el mercado se segmenta en neurovascular, cardiovascular, auditivo y otros. El segmento de procedimientos cardiovasculares dominó el mercado con la mayor participación en 2025, impulsado por la alta incidencia de insuficiencia cardíaca, arritmia y paro cardíaco repentino en EE. UU. Los hospitales priorizan dispositivos como DCI, marcapasos y TRC-D para intervenciones que salvan vidas. Los implantes cardiovasculares se benefician de una sólida cobertura de reembolso y la familiaridad del médico. La monitorización continua y la conectividad remota de estos dispositivos mejoran el cumplimiento del paciente y los resultados clínicos. Los avances tecnológicos en la miniaturización de dispositivos, la monitorización con IA y la transferencia inalámbrica de datos impulsan aún más su adopción. El segmento también recibe una atención significativa de los fabricantes por su innovación, la mejora de la fiabilidad, la seguridad y la experiencia del paciente, lo que refuerza su dominio del mercado.

Se prevé que el segmento de procedimientos auditivos experimente el mayor crecimiento entre 2026 y 2033, debido a la creciente prevalencia de la discapacidad auditiva en la población pediátrica y geriátrica. Los dispositivos auditivos implantables activos, como los implantes cocleares y los sistemas osteointegrados, se utilizan cada vez más en hospitales y clínicas especializadas. La integración con plataformas digitales y aplicaciones móviles permite la sintonización y la monitorización remotas, lo que mejora la comodidad del paciente. Las campañas de concienciación y la mejora del acceso a la atención auditiva impulsan la adopción. Los avances tecnológicos, como implantes más pequeños y algoritmos mejorados de procesamiento de sonido, impulsan el atractivo de este segmento. Además, la expansión de la cobertura de reembolso en los sistemas de salud públicos y privados respalda el rápido crecimiento previsto.

- Por el usuario final

En función del usuario final, el mercado se segmenta en hospitales, clínicas especializadas, centros de cirugía ambulatoria y clínicas. El segmento de hospitales dominó el mercado en 2025 gracias a su avanzada infraestructura quirúrgica, personal clínico cualificado y un alto volumen de pacientes para procedimientos con dispositivos implantables. Los hospitales gestionan implantes cardíacos, neurovasculares y ortopédicos complejos, lo que los convierte en el principal punto de atención para dispositivos de alto valor, como desfibriladores cardioversores implantables (DCI) y dispositivos de terapia de resincronización cardíaca (TRC-D). La integración con los sistemas informáticos del hospital permite la monitorización y la gestión de datos en tiempo real. Un sólido sistema de reembolsos y servicios de seguimiento a largo plazo de los pacientes refuerzan aún más su dominio. Los hospitales también actúan como centros de innovación para ensayos de dispositivos, formación y adopción de nuevas tecnologías, manteniendo así su liderazgo.

Se prevé que el segmento de Clínicas Especializadas experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente demanda de procedimientos de implantes mínimamente invasivos y soluciones de monitorización ambulatoria. Las clínicas especializadas ofrecen atención especializada en cardiología, neurología y trastornos auditivos, brindando comodidad y un tratamiento personalizado. Los pacientes prefieren las clínicas para el seguimiento, los ajustes de dispositivos y la integración de la monitorización remota. Este segmento se beneficia de herramientas de diagnóstico avanzadas, plataformas de salud móvil y colaboraciones con fabricantes de dispositivos. La creciente concienciación de los pacientes, la asequibilidad y la mejora del acceso a la atención especializada están impulsando la rápida expansión de este segmento de usuarios finales.

Análisis regional del mercado de dispositivos médicos implantables activos en América del Norte

- Estados Unidos dominó el mercado de dispositivos médicos implantables activos de América del Norte con la mayor participación en los ingresos del 74,9 % en 2025, caracterizado por una infraestructura de atención médica avanzada, un alto gasto en atención médica y una fuerte presencia de actores clave de la industria.

- Los pacientes y los proveedores de atención médica de la región valoran mucho la precisión, el monitoreo continuo y los mejores resultados clínicos que ofrecen los dispositivos implantables, como los DCI, los marcapasos y los neuroestimuladores.

- Esta adopción generalizada está respaldada además por hospitales avanzados y clínicas especializadas, profesionales de la salud capacitados y una creciente conciencia de los procedimientos mínimamente invasivos, lo que establece los dispositivos médicos implantables activos como soluciones terapéuticas esenciales tanto en entornos hospitalarios como ambulatorios.

Perspectiva del mercado de dispositivos médicos implantables activos en EE. UU.

El mercado estadounidense de dispositivos médicos implantables activos captó la mayor participación en los ingresos, con un 74,9 %, en 2025 en Norteamérica, impulsado por la adopción generalizada de dispositivos cardíacos, neuroestimuladores y ortopédicos avanzados. Los hospitales y las clínicas especializadas priorizan cada vez más los DCI, marcapasos y TRC-D debido a su potencial para salvar vidas y sus capacidades terapéuticas de precisión. Pacientes y profesionales sanitarios están adoptando procedimientos mínimamente invasivos y sistemas de monitorización basados en IA, lo que mejora los resultados del tratamiento. La creciente concienciación sobre las enfermedades crónicas, sumada a los marcos de reembolso favorables, está impulsando la expansión del mercado. Además, la integración con la monitorización remota y las plataformas de atención médica basadas en la nube contribuye significativamente a la adopción. El crecimiento del mercado se ve respaldado por una sólida presencia de fabricantes de dispositivos consolidados y la continua innovación tecnológica.

Análisis del mercado de dispositivos médicos implantables activos en Canadá

Se espera que el mercado canadiense de dispositivos médicos implantables activos experimente el crecimiento más rápido de Norteamérica durante el período de pronóstico, impulsado por el aumento de las inversiones en atención médica, la creciente prevalencia de trastornos cardiovasculares y neurológicos, y la creciente concienciación sobre las terapias implantables. Hospitales y clínicas especializadas están adoptando procedimientos de implantación mínimamente invasivos y soluciones de monitorización remota para mejorar la atención al paciente. Las iniciativas gubernamentales para mejorar el acceso a tecnologías sanitarias avanzadas y la creciente preferencia de los pacientes por los servicios ambulatorios y de clínicas especializadas están impulsando una rápida adopción. El mercado también se beneficia de las mejoras en la infraestructura médica y los programas de formación para profesionales clínicos. Avances tecnológicos como los desfibriladores con IA, los neuroestimuladores y los dispositivos de monitorización remota de pacientes están contribuyendo a un crecimiento acelerado.

Análisis del mercado de dispositivos médicos implantables activos en México

El mercado mexicano de dispositivos médicos implantables activos experimenta un crecimiento constante, impulsado por la creciente concienciación sobre las enfermedades cardiovasculares y neurológicas crónicas y el mayor acceso a la atención médica avanzada. Hospitales y clínicas especializadas en centros urbanos están adoptando dispositivos cardíacos implantables, neuroestimuladores e implantes auditivos para mejorar los resultados de los pacientes. Las iniciativas gubernamentales para mejorar la infraestructura sanitaria y los programas de salud pública están impulsando la expansión del mercado. Los pacientes prefieren cada vez más los procedimientos mínimamente invasivos y las soluciones de monitorización remota, lo que impulsa su adopción. Las redes de distribución locales y las colaboraciones con fabricantes internacionales de dispositivos médicos están mejorando la disponibilidad de los dispositivos. Además, las inversiones continuas en la formación de profesionales sanitarios y la ampliación de la cobertura de reembolso contribuyen a la creciente participación del país en el mercado norteamericano.

Cuota de mercado de dispositivos médicos implantables activos en América del Norte

La industria de dispositivos médicos implantables activos de América del Norte está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Medtronic (Irlanda)

- Abbott (EE. UU.)

- Boston Scientific Corporation (EE. UU.)

- Cochlear Ltd (Australia)

- Biotronik (Alemania)

- LivaNova PLC (Reino Unido)

- MED EL Electrónica Médica (Austria)

- Sonova (Suiza)

- Axonics, Inc. (EE. UU.)

- NeuroPace, Inc. (EE. UU.)

- NEVRO CORP (EE. UU.)

- Zhejiang Nurotron Biotechnology Co., Ltd (China)

- Demant A/S (Dinamarca)

- Oticon Medical (Dinamarca)

- Sonova Holding AG (Suiza)

- Microson (Australia)

- Nano Retina (Israel)

- GluSense (EE. UU.)

- Segunda vista (EE. UU.)

¿Cuáles son los desarrollos recientes en el mercado de dispositivos médicos implantables activos de América del Norte?

- En noviembre de 2025, Boston Scientific anunció que adquiriría el capital restante de Nalu Medical por aproximadamente USD 533 millones, ampliando su cartera de neuroestimulación para el dolor crónico al incorporar la tecnología de estimulación nerviosa periférica de Nalu diseñada para brindar alivio del dolor dirigido a través de implantes inalámbricos sin batería controlados mediante aplicaciones para teléfonos inteligentes.

- En julio de 2025, Cochlear Limited anunció la aprobación por parte de la FDA del sistema Cochlear™ Nucleus® Nexa™, el primer sistema de implante coclear inteligente del mundo con firmware interno actualizable que permite futuras actualizaciones de funciones sin necesidad de reemplazar el hardware. Esta innovación permite a los usuarios acceder a nuevas mejoras con el tiempo, reduce la necesidad de reemplazos externos de hardware y mejora el rendimiento auditivo general con procesadores más pequeños y ligeros.

- En febrero de 2025, la Administración de Alimentos y Medicamentos de EE. UU. (FDA) aprobó el primer marcapasos cerebral adaptativo para el tratamiento del párkinson, desarrollado por Medtronic, lo que marca un hito significativo en la tecnología de interfaz cerebro-computadora. El dispositivo adaptativo puede responder en tiempo real a las necesidades del paciente, reduciendo los movimientos involuntarios y mejorando el manejo de los síntomas en pacientes con párkinson, lo que subraya el apoyo de la FDA a los implantes neurológicos avanzados.

- En enero de 2024, Neuralink, de Elon Musk, implantó con éxito su chip de interfaz cerebro-computadora en el primer paciente humano, iniciando así los primeros ensayos clínicos destinados a permitir que pacientes con parálisis o afecciones neurológicas interactúen con computadoras y herramientas digitales utilizando únicamente el pensamiento. Esto representó un gran avance para las BCI implantables en el uso clínico real.

- En septiembre de 2023, Neuralink abrió el proceso de selección para su primer ensayo clínico en humanos de su interfaz cerebro-computadora implantable, tras la aprobación de la FDA a principios de ese mismo año. El ensayo tuvo como objetivo evaluar la seguridad y la funcionalidad, lo que marcó un hito regulatorio y clínico clave para la incorporación de la neurotecnología implantable a aplicaciones médicas en EE. UU.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.