Middle East And Africa White Goods Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

33.54 Billion

USD

50.55 Billion

2024

2032

USD

33.54 Billion

USD

50.55 Billion

2024

2032

| 2025 –2032 | |

| USD 33.54 Billion | |

| USD 50.55 Billion | |

|

|

|

|

Segmentación del mercado de electrodomésticos de Oriente Medio y África por producto (refrigeradores, aires acondicionados, lavadoras, cocinas, hornos, lavavajillas, dispensadores de agua/sistemas de ósmosis inversa, ventiladores, calentadores eléctricos y a gas, congeladores, productos de cuidado personal, dispositivos médicos inteligentes y otros): tendencias de la industria y pronóstico hasta 2032

Análisis del mercado de electrodomésticos

El mercado de electrodomésticos está experimentando un crecimiento sólido, impulsado por la tendencia hacia modelos avanzados de refrigeradores. A medida que la industria de electrodomésticos de Oriente Medio y África continúa expandiéndose, el consumo de lavadoras en los centros médicos está creciendo. Las iniciativas gubernamentales en favor de electrodomésticos energéticamente eficientes y las marcas electrónicas emergentes con nuevas tecnologías están brindando oportunidades para el mercado. La dinámica del mercado también se ve influenciada por los altos costos de mantenimiento y servicio de los refrigeradores. En general, se espera que el mercado continúe expandiéndose, con un enfoque en la innovación y la sostenibilidad para satisfacer las demandas industriales en evolución.

Tamaño del mercado de electrodomésticos

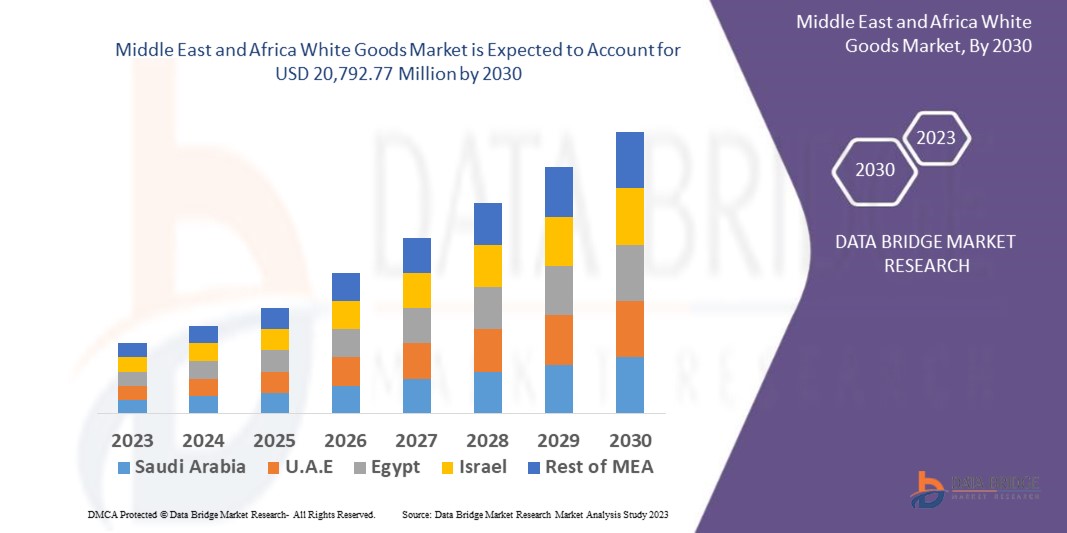

El tamaño del mercado de electrodomésticos de Oriente Medio y África se valoró en 33.540 millones de dólares en 2024 y se proyecta que alcance los 50.550 millones de dólares en 2032, con una CAGR del 5,26% durante el período de pronóstico de 2025 a 2032. Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, epidemiología de pacientes, análisis de la cartera de proyectos, análisis de precios y marco regulatorio.

Tendencias del mercado de electrodomésticos

“Aumento de las cuotas de las tiendas minoristas organizadas”

El aumento de los puntos de venta minorista ha hecho posible que los consumidores accedan fácilmente a los productos en cualquier lugar y en cualquier momento. Los consumidores pueden llegar directamente a su punto de venta minorista más cercano y preguntar por el producto específico que desean comprar. El comercio minorista actúa como un modo de promoción de los productos. Las marcas suelen colocar grandes vallas publicitarias en los comercios minoristas como un método para atraer a los consumidores. Dado que el número de puntos de venta minoristas está aumentando, significa que la participación de mercado de un producto en particular está aumentando, lo que sugiere una mayor venta de ese producto. Además, los actores del mercado están llegando con más puntos de venta minoristas para cubrir la gran participación del mercado. En lugar de puntos de venta minoristas de una sola marca, los minoristas están adoptando una nueva estrategia al vender productos de diferentes marcas en el mismo punto de venta minorista. Como ofrece más opciones a los clientes y las posibilidades de compra aumentan, si algún cliente no está satisfecho con el producto de una marca, puede cambiar a otra marca. Por ejemplo, en octubre de 2024, según un artículo publicado por Forbes Middle East, la industria minorista de Oriente Medio ha prosperado gracias a un sólido crecimiento económico y al aumento de los ingresos de los consumidores, aunque ahora se enfrenta a la madurez, ya que muchos minoristas globales experimentan un crecimiento estancado o negativo. A medida que la tecnología reconfigura las expectativas de los consumidores, los principales minoristas están mejorando su presencia digital a través de inversiones en comercio electrónico. El panorama minorista de la región es diverso pero concentrado, dominado por unas pocas empresas familiares que poseen franquicias de marcas internacionales, especialmente en el segmento de lujo. Este artículo destaca las cadenas minoristas más grandes, teniendo en cuenta factores como la cantidad de empleados, el alcance geográfico, la diversidad de marcas y el espacio de las tiendas.

Además, la creciente concienciación, el cambio de estilo de vida y el fácil acceso a los productos han hecho que los clientes recurran a los puntos de venta minoristas. Por tanto, la mayor participación del comercio minorista organizado está aumentando las ventas de electrodomésticos y, por lo tanto, se espera que impulse el crecimiento del mercado de electrodomésticos en Oriente Medio y África.

Alcance del informe y segmentación del mercado de electrodomésticos

|

Atributos |

Perspectivas clave del mercado de electrodomésticos |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Arabia Saudita, Emiratos Árabes Unidos, Egipto, Qatar, Kuwait, Omán, Argelia, Marruecos, Túnez, Libia y el resto de Oriente Medio y África |

|

Actores clave del mercado |

SAMSUNG (Corea del Sur), LG Electronics (Corea del Sur), Whirlpool Corporation (EE. UU.), Haier Group (China), Robert Bosch GmbH (Alemania), AB Electrolux (Suecia), Nikai Group (EAU), Super General (EAU), Mitsubishi Electric Corporation (Japón), The Middleby Corporation (EE. UU.) |

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de la información sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis profundo de expertos, epidemiología de pacientes, análisis de canalización, análisis de precios y marco regulatorio. |

Definición del mercado de electrodomésticos

Los electrodomésticos son electrodomésticos de gran tamaño diseñados principalmente para el uso diario en entornos domésticos. Por lo general, incluyen refrigeradores, lavadoras, hornos, lavavajillas y aires acondicionados. Estos electrodomésticos, que reciben su nombre por su tradicional acabado de esmalte blanco, desempeñan un papel crucial en la mejora de la comodidad, la eficiencia y la conveniencia en los hogares. Los electrodomésticos se caracterizan generalmente por su mayor tamaño y capacidad en comparación con los electrodomésticos más pequeños, y a menudo requieren una instalación permanente. Contribuyen significativamente a los estilos de vida modernos al automatizar tareas como la conservación de alimentos, el lavado de ropa y la cocina. En los últimos años, la definición se ha ampliado para incluir electrodomésticos inteligentes y de bajo consumo que integran tecnología para mejorar la funcionalidad y la experiencia del usuario. En general, los electrodomésticos son componentes esenciales de la vida doméstica contemporánea.

Dinámica del mercado de electrodomésticos

Conductores

- Inclinación hacia el modelo avanzado de refrigeradores

La conciencia tecnológica en los refrigeradores ha aumentado el mercado de modelos avanzados de refrigeradores. Los modelos avanzados de refrigeradores incluyen características modernas como controles automáticos de temperatura, enfriador, estilo de puerta y sensores de iluminación, entre otros. El mercado se está inclinando hacia el modelo avanzado debido al aumento del poder adquisitivo, el avance tecnológico y los refrigeradores inteligentes que se pueden controlar mediante teléfonos inteligentes y Wi-Fi.

En los últimos años, los refrigeradores se han modificado de tal manera que consumen menos electricidad y ahorran energía a los clientes. En otras palabras, los modelos de bajo consumo energético tienen una gran demanda, ya que son rentables y consumen menos energía. Además, los refrigeradores inteligentes han inclinado el mercado hacia los refrigeradores avanzados que se instalan con la función Wi-Fi y se pueden controlar a través de dispositivos inteligentes como teléfonos inteligentes y computadoras portátiles. Los refrigeradores inteligentes tienen una gran demanda, ya que se pueden controlar desde cualquier ubicación a través del móvil y lo único que requieren es una conexión a Internet.

Además de Wi-Fi, los refrigeradores están equipados con dispositivos de detección. Los dispositivos de detección que se utilizan en los refrigeradores realizan varias funciones, como el sensor de huellas dactilares que permite que cualquiera abra la puerta del refrigerador con solo tocarlo y el sensor de calor reduce la temperatura cuando es necesario. Además, la refrigeración antimicrobiana es una característica más importante de los refrigeradores avanzados que está inclinando el mercado hacia el modelo avanzado de refrigeradores. Los bordes de los refrigeradores están recubiertos con una línea de plata para que los microbios que ingresan durante la apertura y el cierre continuos de los refrigeradores no dañen los alimentos orgánicos dentro de los refrigeradores.

Por ejemplo,

En mayo de 2024, según un artículo publicado por Hindustan Times, los refrigeradores modernos están transformando el almacenamiento de alimentos con características avanzadas como sistemas de enfriamiento duales y tecnologías de purificación de aire. A diferencia de los modelos tradicionales, estos diseños innovadores ofrecen zonas de enfriamiento separadas para una frescura óptima. Las configuraciones como los refrigeradores de puerta francesa combinan estilo y funcionalidad, con compartimentos de refrigerador espaciosos y congeladores extraíbles convenientes. Con estantes ajustables y conectividad inteligente, atienden a familias más numerosas o aquellos que buscan un electrodoméstico de alta gama. Estos refrigeradores no solo maximizan el almacenamiento, sino que también mejoran la estética de la cocina, lo que los hace ideales para quienes valoran la comodidad y la elegancia.

Por lo tanto, la automatización y el avance en los modelos de refrigeradores han aumentado la demanda de electrodomésticos y se espera que impulsen el crecimiento del mercado de electrodomésticos en Medio Oriente y África.

- Creciente consumo de lavadoras en centros médicos

Las lavadoras se utilizan para eliminar la suciedad de la ropa. En los hospitales, el servicio de lavandería es importante desde el punto de vista sanitario. Los hospitales reciben a diario a cientos de pacientes que padecen distintas enfermedades. Su ropa se infecta por los efectos bacterianos y las enfermedades que transmite.

En general, los hospitales utilizan lavadoras diseñadas para agua a alta temperatura. Generalmente, la ropa se lava a una temperatura de entre 60 y 70 grados para eliminar las bacterias y las enfermedades. La ropa suele dejarse en la lavadora durante al menos 10 minutos para el lavado.

Las lavadoras ayudan a controlar las enfermedades infecciosas que pueden transmitirse de una persona a otra. Las lavadoras son necesarias para mantener el nivel de higiene en los hospitales. Se utilizan detergentes especiales que pueden matar bacterias como el Staphylococcus aureus resistente a la meticilina y otros microbios durante el lavado de la ropa para evitar el riesgo de infección cruzada.

No siempre es posible deshacerse de la ropa infectada. Tirar ropa infectada también contamina el entorno, lo que provoca la contaminación del suelo y del aire. El lavado de ropa es, en primer lugar, una opción adecuada para todos estos posibles problemas. Por ello, la demanda de lavadoras está aumentando en los hospitales.

Por ejemplo,

En mayo de 2022, según un artículo publicado por DANUBE INTERNATIONAL, Todos los derechos reservados., En los hospitales, mantener altos estándares de higiene es crucial, por lo que la instalación de equipos de lavandería eficientes es esencial para prevenir infecciones por la ropa de cama y la ropa. Las instalaciones de lavandería diseñadas adecuadamente optimizan el uso de agua y energía, lo que influye en las decisiones de gestión. Las consideraciones clave incluyen la sensibilidad a la contaminación, la selección de telas apropiadas y la gestión eficaz de las operaciones de lavandería. La programación de tareas garantiza la limpieza diaria, mientras que las máquinas avanzadas como las lavadoras extractoras y las lavadoras de barrera mejoran la eficiencia y minimizan el contacto con gérmenes. En general, la elección del equipo de lavandería debe estar alineada con los requisitos de higiene y las necesidades operativas de la instalación.

En conclusión, el aumento en el número de pacientes y hospitales en la región y los países también actúa como uno de los factores para el creciente consumo de lavadoras en los hospitales y, por lo tanto, se espera que impulse el crecimiento del mercado de electrodomésticos en Medio Oriente y África.

Oportunidades

- Iniciativas gubernamentales para electrodomésticos energéticamente eficientes

Los electrodomésticos inteligentes incluyen tecnología avanzada de automatización del hogar y la cocina que mejora la forma en que los gobiernos monitorean y controlan la maquinaria, la calefacción, la refrigeración y los sistemas de iluminación en las zonas residenciales de los países, aumentando la eficiencia de estos sistemas. En los últimos años, los gobiernos de Oriente Medio y los países africanos han realizado diversas actividades de investigación e inversiones para desarrollar electrodomésticos innovadores y avanzados para el hogar y la cocina, como refrigeradores inteligentes, que serían más eficientes energéticamente a largo plazo.

La iniciativa de hogares inteligentes permite a los gobiernos marcar una verdadera diferencia mediante la implementación de tecnologías innovadoras e identificando oportunidades para ahorrar energía. A través de la iniciativa de hogares inteligentes, el gobierno está adoptando continuamente varias medidas para mejorar la gestión del rendimiento energético tanto en edificios residenciales como comerciales. Esto conducirá a una reducción de la huella ambiental y de los costos de energía mediante la implementación de sistemas inteligentes de automatización de cocinas y hogares.

La eficiencia energética implica la utilización eficiente de los recursos energéticos, lo que promueve el desarrollo sostenible. En el contexto de las economías en crecimiento y el aumento simultáneo de los ingresos en Oriente Medio y África, el sector inmobiliario de la región ha experimentado una transformación drástica en los últimos años. Las políticas gubernamentales de los países de Oriente Medio y África han sido fundamentales, ya que han proporcionado un estímulo vital para el crecimiento de la industria y han animado a los pequeños y medianos interesados a invertir en el sector inmobiliario.

Por ejemplo,

En junio de 2021, según un artículo publicado por Zawya, los países de Oriente Medio están implementando planes de acción nacionales para promover una economía más verde, centrándose en la eficiencia energética. Iniciativas como Egypt Vision 2030 y Saudi Vision 2030 tienen como objetivo combatir el cambio climático y mejorar la eficiencia energética.

Además, las inversiones en materia de desarrollo sostenible para fabricar electrodomésticos y aparatos de cocina que generen menos emisiones están contribuyendo a aumentar la demanda de electrodomésticos, lo que, a su vez, se espera que genere oportunidades de crecimiento para el mercado de electrodomésticos en Oriente Medio y África.

- Marcas electrónicas emergentes con nuevas tecnologías

El sector de la electrónica se divide generalmente entre electrónica de consumo, servicios públicos de electricidad y electrónica general, donde la electrónica de consumo impulsa la mayor parte del crecimiento del sector, que incluye principalmente electrodomésticos inteligentes para el hogar y la cocina. La creciente demanda de teléfonos inteligentes, inteligencia artificial y tecnología de reconocimiento de voz, y los crecientes ciclos de reemplazo de electrodomésticos viejos y manuales han fomentado el consumo de dispositivos electrónicos inteligentes.

La industria de los electrodomésticos, altamente competitiva y madura, se ha centrado durante mucho tiempo en la innovación de productos. La exageración en el desarrollo de nuevos productos acelera la innovación de productos, lo que a su vez facilita la creación de marcas. Las innovaciones de productos son eficaces para cambiar el entorno de la industria electrónica e inventar nuevas marcas de acuerdo con los patrones de demanda actuales de los consumidores. Dentro del sector de la electrónica de consumo, las empresas que se centran en la tecnología emergente están impulsando un crecimiento significativo del mercado de electrodomésticos.

Las tendencias de innovación de marcas en la industria de los electrodomésticos inteligentes se consideran una de las estrategias corporativas más competitivas y maduras que ofrecen oportunidades de crecimiento. Especialmente en un mercado extremadamente competitivo, varias unidades de producción de productos electrónicos se enfrentan a muchas marcas falsificadas emergentes. A medida que cambia la demanda, nuevas marcas de diferentes productos electrónicos de consumo se unirán para abrir nuevas oportunidades en toda la industria de los productos electrónicos de consumo, incluido el mercado de los electrodomésticos.

Por ejemplo,

En septiembre de 2023, según un artículo publicado por Evolute, el sector de servicios de fabricación de productos electrónicos (EMS) está evolucionando rápidamente debido a las tecnologías emergentes que mejoran el diseño y la producción de productos. Las innovaciones clave incluyen Internet de las cosas (IoT), inteligencia artificial (IA), robótica, 5G, realidad aumentada y virtual, impresión 3D y prácticas de fabricación sostenibles. Estos avances permiten a los proveedores de EMS producir componentes miniaturizados más eficientes, mejorar el control de calidad y adoptar prácticas ecológicas. Además, tecnologías como blockchain y materiales avanzados están mejorando la transparencia de la cadena de suministro y la funcionalidad del producto. A medida que continúan estas tendencias, las empresas de EMS están posicionadas para liderar la innovación en la industria electrónica.

Además, el aumento de las actividades de comercio electrónico y el desarrollo de tecnología avanzada en la fabricación de productos electrónicos en la industria de electrodomésticos inteligentes han aumentado la demanda de electrodomésticos. Se espera que esto, a su vez, mejore el crecimiento del mercado de electrodomésticos en Oriente Medio y África.

Restricciones/Desafíos

- Baja tasa de reemplazo debido a la vida útil de los refrigeradores

Los refrigeradores están diseñados para durar, y suelen funcionar bien durante 10 a 15 años. Esta durabilidad significa que los consumidores tienen menos probabilidades de reemplazarlos con frecuencia. En la región de Oriente Medio y África, muchos hogares priorizan la longevidad de sus electrodomésticos y se concentran en las reparaciones en lugar de los reemplazos cuando surgen problemas. Esta tendencia desacelera la rotación del mercado, ya que un inventario estable de refrigeradores en funcionamiento significa menos ventas nuevas.

Además, las condiciones económicas de los países de Oriente Medio y África influyen significativamente en el comportamiento de los consumidores. En muchos países africanos, una gran parte de la población es sensible a los precios, a menudo debido a los menores ingresos disponibles y a la inestabilidad económica. Como resultado, los consumidores tienden a reparar sus refrigeradores actuales en lugar de comprar nuevos, ya que las reparaciones suelen ser más asequibles que el costo de un nuevo electrodoméstico. Esta preferencia es común tanto en los centros urbanos como en las zonas rurales, donde las limitaciones económicas dictan el gasto de los hogares.

Las actitudes culturales hacia el consumo también influyen en las tasas de sustitución. En muchas sociedades de Oriente Medio y África, existe una fuerte tendencia a conservar los artículos del hogar durante períodos prolongados, valorando la fiabilidad y la durabilidad por encima de las tendencias. Esta preferencia cultural da lugar a una adopción más lenta de nuevos modelos de frigoríficos, ya que los consumidores pueden considerar innecesario sustituir los electrodomésticos, especialmente si los que tienen en la actualidad siguen funcionando adecuadamente.

La baja tasa de reemplazo genera desafíos y oportunidades para el mercado de electrodomésticos. Un ciclo de reemplazo estancado puede limitar el crecimiento de los ingresos de los fabricantes, ya que se venden menos unidades nuevas. Sin embargo, esta situación también abre oportunidades para las empresas centradas en los servicios de mantenimiento y reparación. Las empresas que ofrecen garantías extendidas, contratos de servicio o repuestos para modelos antiguos pueden encontrar un mercado lucrativo entre los consumidores reacios a actualizar, lo que garantiza ingresos constantes por servicios en lugar de nuevas ventas.

Para contrarrestar los efectos de las bajas tasas de reemplazo, los fabricantes pueden adoptar estrategias centradas en la innovación y la sostenibilidad. La introducción de modelos energéticamente eficientes con funciones avanzadas puede motivar a los consumidores a actualizar sus equipos. Los refrigeradores modernos que prometen facturas de electricidad más bajas, mejor conservación de los alimentos y tecnología inteligente pueden resultar atractivos para los consumidores que buscan valor a largo plazo. Las estrategias de marketing eficaces que destaquen estos beneficios pueden ayudar a cambiar las actitudes de los consumidores hacia los modelos más nuevos, fomentando reemplazos más frecuentes.

Por ejemplo,

Según un artículo publicado por Truearth, los refrigeradores son electrodomésticos esenciales para el hogar y maximizar su vida útil es crucial para aprovechar al máximo su inversión. Por lo general, los refrigeradores duran entre 10 y 20 años, y la mayoría tiene un promedio de 14 a 17 años. Para extender su durabilidad, elija modelos de alta calidad y de bajo consumo de energía, realice un mantenimiento regular y mantenga configuraciones de temperatura óptimas. Controlar los sellos de las puertas, evitar la sobrecarga e inspeccionar los componentes también puede ayudar. Tenga en cuenta el estado de su refrigerador; signos como reparaciones frecuentes o enfriamiento ineficiente pueden indicar que es hora de reemplazarlo. El cuidado proactivo garantiza que su refrigerador siga siendo energéticamente eficiente y duradero.

La baja tasa de reemplazo de refrigeradores en la región MEA afecta significativamente el crecimiento del mercado de electrodomésticos. Este fenómeno plantea desafíos para el crecimiento de las ventas, ya que se compran menos unidades nuevas, lo que limita el potencial de ingresos para los fabricantes. Además, la vida útil prolongada de estos electrodomésticos, influenciada por factores económicos y actitudes culturales, contribuye a un ciclo de reemplazo estancado. Comprender estas dinámicas es esencial para las partes interesadas en el mercado, ya que deben navegar en un panorama moldeado por comportamientos y preferencias únicos de los consumidores. Las tendencias actuales resaltan la complejidad de involucrar a los consumidores en un mercado donde la longevidad a menudo supera el deseo de nuevas compras.

- Dificultades en el reciclaje de materiales de desecho

El mercado de electrodomésticos de Oriente Medio y África se enfrenta a importantes desafíos en materia de reciclaje de materiales de desecho, en particular porque la demanda de electrodomésticos sigue aumentando. Este crecimiento va acompañado de un aumento de los residuos electrónicos, en los que los electrodomésticos como frigoríficos, lavadoras y hornos contribuyen sustancialmente a la carga medioambiental.

Uno de los principales problemas es la falta de sistemas estructurados de gestión de residuos en muchos países de Oriente Medio y África. La falta de infraestructuras adecuadas hace que los desechos electrónicos se eliminen a menudo de forma inadecuada, lo que genera contaminación ambiental y riesgos para la salud. Muchos países carecen de instalaciones de reciclaje específicas para electrodomésticos, lo que hace que estos acaben en vertederos, donde los materiales peligrosos pueden filtrarse al suelo y a los sistemas hídricos. El sector informal de recogida de residuos suele ser el predominante, lo que complica la capacidad de garantizar que los materiales se reciclen de forma eficaz y segura.

Las complejidades técnicas también obstaculizan las iniciativas de reciclaje. Los electrodomésticos están hechos de diversos materiales, incluidos metales, plásticos y refrigerantes, cada uno de los cuales requiere procesos especializados para su extracción y reciclaje. Muchas instalaciones de reciclaje locales en la región de Oriente Medio y África carecen de la tecnología y la experiencia necesarias para manipular estos materiales de manera adecuada. En consecuencia, quedan recursos valiosos sin recuperar, mientras que las sustancias nocivas plantean riesgos tanto para el medio ambiente como para la salud pública.

Los factores económicos complican aún más el panorama del reciclaje. Establecer y mantener instalaciones de reciclaje puede resultar prohibitivamente costoso, lo que desalienta la inversión en soluciones adecuadas de gestión de residuos. Además, el mercado de materiales reciclados está subdesarrollado, lo que ofrece incentivos financieros mínimos para que las empresas participen en operaciones de reciclaje. Esta falta de motivación económica socava los esfuerzos por crear una economía circular en la que los materiales se reutilicen y reciclen de manera eficaz.

En muchos países de Oriente Medio y África, los marcos regulatorios en materia de gestión y reciclaje de residuos suelen ser débiles o inexistentes. Sin regulaciones sólidas y mecanismos de cumplimiento, los fabricantes y los consumidores no son responsables de la eliminación de los electrodomésticos. Si bien algunos gobiernos están comenzando a reconocer la necesidad de políticas que promuevan el reciclaje y la gestión de residuos responsables, los avances varían significativamente en la región.

Por ejemplo,

En abril de 2022, según un artículo publicado por Colorado, el reciclaje suele considerarse una solución sencilla para los residuos plásticos, pero la industria se enfrenta a varios desafíos que los consumidores pueden ayudar a aliviar. Muchas personas carecen de conocimientos sobre lo que se puede reciclar, lo que provoca la contaminación de los materiales reciclables. Los trabajadores del sector del reciclaje se enfrentan a riesgos de seguridad y algunas ciudades carecen de recursos para ofrecer servicios de reciclaje eficaces. Además, la baja demanda del mercado de materiales reciclados hace que sea menos atractivo para las empresas invertir en reciclaje. Sin embargo, el reciclaje sigue siendo fundamental para abordar la contaminación por plásticos, y las personas pueden contribuir educándose y apoyando los productos fabricados con materiales reciclados.

Este informe de mercado proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado, comuníquese con Data Bridge Market Research para obtener un informe de analista, nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Alcance del mercado de electrodomésticos

El mercado está segmentado en función del producto. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Producto

- Refrigerador

- Acondicionadores de aire

- Lavadoras

- Estufa

- Hornos

- Lavavajillas

- Dispensador de agua/sistema de ósmosis inversa

- Aficionados

- Calentadores eléctricos y de gas

- Congeladores

- Cuidado personal

- Dispositivo médico inteligente

- Otros

Análisis regional del mercado de electrodomésticos

Se analiza el mercado y se proporcionan información sobre el tamaño del mercado y las tendencias por país y producto, como se menciona anteriormente.

Los países cubiertos en el informe de mercado son Arabia Saudita, Emiratos Árabes Unidos, Egipto, Qatar, Kuwait, Omán, Argelia, Marruecos, Túnez, Libia y el resto de Medio Oriente y África.

Se espera que Arabia Saudita domine el mercado debido a la creciente demanda de temperaturas elevadas y los niveles de humedad han incrementado la demanda de acondicionadores de aire y las crecientes participaciones de las tiendas minoristas organizadas.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor aguas arriba y aguas abajo, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Cuota de mercado de electrodomésticos

El panorama competitivo del mercado proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado.

Los líderes del mercado de electrodomésticos que operan en el mercado son:

- SAMSUNG (Corea del Sur)

- LG Electronics (Corea del Sur)

- Corporación Whirlpool (Estados Unidos)

- Grupo Haier (China)

- Robert Bosch GmbH (Alemania)

- AB Electrolux (Suecia)

- Grupo Nikai (EAU)

- Super General (EAU)

- Mitsubishi Electric Corporation (Japón)

- La Corporación Middleby (Estados Unidos)

Últimos avances en el mercado de electrodomésticos

- En mayo de 2024, LG Electronics presentó su última línea de entretenimiento en el hogar para la región de Medio Oriente y África (MEA), que muestra tecnología de vanguardia y características innovadoras. La nueva gama incluye televisores OLED con calidad de imagen mejorada, experiencias de audio envolventes y capacidades impulsadas por IA que elevan la experiencia de visualización. El compromiso de LG con la sostenibilidad también es evidente, ya que la empresa incorpora prácticas ecológicas en sus procesos de producción. Esta nueva línea está diseñada para satisfacer las demandas cambiantes de los consumidores en la región MEA, posicionando a LG como líder en el sector del entretenimiento en el hogar.

- En septiembre de 2024, LG Electronics lanzó su innovadora WashTower en Qatar, revolucionando la comodidad de la lavandería con un diseño compacto y que ahorra espacio. La WashTower combina una lavadora y secadora de alta eficiencia en una sola unidad vertical, lo que permite una gestión perfecta de la ropa sin comprometer el rendimiento. Equipada con tecnología avanzada como AI DD™ para ciclos de lavado y secado optimizados, la WashTower mejora la experiencia del usuario al tiempo que garantiza un cuidado óptimo de las telas. Este lanzamiento subraya el compromiso de LG de satisfacer las diversas necesidades de los consumidores en Medio Oriente, ofreciendo soluciones innovadoras que se adaptan a los estilos de vida modernos.

- En abril de 2024, Arçelik completó la adquisición de las filiales de Whirlpool en Marruecos y los Emiratos Árabes Unidos, junto con sus operaciones en la región MENA. Esta operación forma parte de la estrategia de Arçelik de ampliar su presencia y fortalecer su posición de mercado en el sector de los electrodomésticos. Se espera que la adquisición mejore la cartera y las capacidades operativas de Arçelik en estos mercados clave.

- En marzo de 2023, LG Electronics Oriente Medio y África (MEA) lanzó una gama única de productos innovadores de electrodomésticos diseñados para satisfacer las diversas necesidades de los consumidores de la región. Esta nueva línea incluye tecnologías avanzadas como lavadoras impulsadas por IA y refrigeradores de bajo consumo energético, destinadas a mejorar la comodidad y la sostenibilidad en las tareas domésticas diarias. LG enfatiza las funciones inteligentes que se integran perfectamente en los estilos de vida modernos, ofreciendo a los usuarios un mayor control y eficiencia. Esta iniciativa refleja el compromiso de LG con la innovación y la satisfacción del consumidor en el mercado de electrodomésticos, consolidando aún más su posición como líder en la región.

- En junio de 2022, Samsung anunció una política de garantía extendida para sus electrodomésticos en los Emiratos Árabes Unidos, que ofrece una garantía de tres años para todos los clientes. Esta iniciativa refleja el compromiso de Samsung de mejorar la satisfacción del cliente y garantizar la confianza en la durabilidad y confiabilidad de sus productos.

- En septiembre de 2021, GE Appliances presentó el lavavajillas GE Profile UltraFresh System con tecnología antimicrobiana Microban, que ayuda a reducir el crecimiento de bacterias dentro y sobre el lavavajillas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.