Mercado de sistemas de gestión de almacenes en Oriente Medio y África, por componente (hardware, software y servicios), implementación (basada en la nube y local), tipo de nivel (avanzado, intermedio y básico), canal de distribución (en línea y fuera de línea), usuario final (alimentos y bebidas, comercio electrónico , automoción, logística de terceros , atención médica, electricidad y electrónica, metales y maquinaria, productos químicos, otros): tendencias de la industria y pronóstico hasta 2029

Análisis y tamaño del mercado

La tecnología de máquina a máquina (M2M) se está volviendo cada vez más popular en la gestión de almacenes porque permite que las máquinas o dispositivos intercambien información y realicen funciones de forma independiente. La tecnología M2M permite que un sistema de gestión de almacenes se conecte y reciba datos de instrumentos como cintas transportadoras, equipos de selección y líneas de montaje.

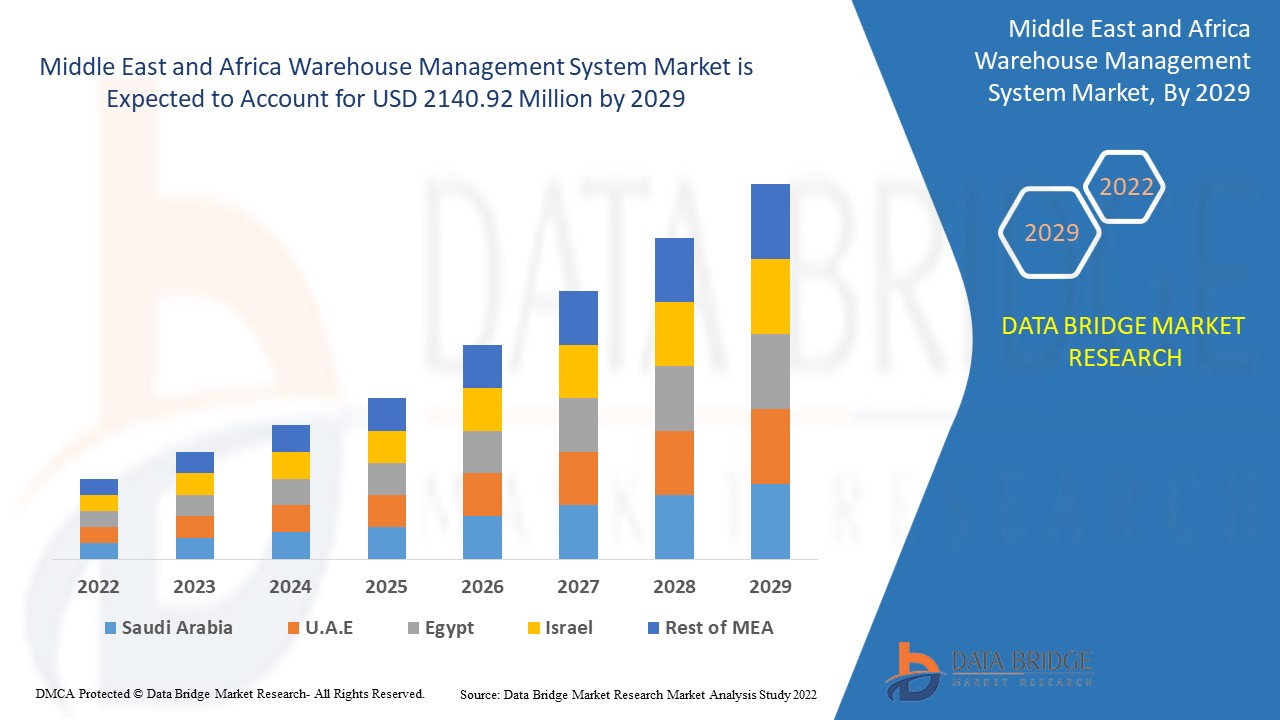

Data Bridge Market Research analiza que el mercado de sistemas de gestión de almacenes se valoró en 695,02 y se espera que alcance el valor de USD 2140,92 millones para 2029, con una CAGR del 15,1% durante el período de pronóstico de 2022-2029.

Definición de mercado

Al pasar a una red que cualquier servidor de productos básicos puede manejar potencialmente bajo el control del operador de red, el mercado de sistemas de gestión de almacenes está trabajando para simplificar la red y su administración. El funcionamiento de la red puede ser flexible, lo que genera una serie de ventajas para el público objetivo que adopta sus nuevos servicios. El uso generalizado de v-CPE por parte de los proveedores de red puede dar como resultado la simplificación y aceleración de la prestación de servicios, así como la configuración y la gestión de dispositivos desde ubicaciones remotas.

Alcance del informe y segmentación del mercado

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2014 - 2019) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Componente (hardware, software y servicios), implementación (en la nube y en las instalaciones), tipo de nivel (avanzado, intermedio y básico), canal de distribución (en línea y fuera de línea), usuario final (alimentos y bebidas, comercio electrónico, automoción, logística de terceros, atención médica, electricidad y electrónica, metales y maquinaria, productos químicos, otros) |

|

Países cubiertos |

Emiratos Árabes Unidos, Israel, Arabia Saudita, Egipto, Sudáfrica, Resto de Oriente Medio y África |

|

Actores del mercado cubiertos |

Oracle (EE. UU.), Manhattan Associates (EE. UU.), THE DESCARTES SYSTEMS GROUP INC (Canadá), CTSI-GLOBAL (EE. UU.), Alpega Group (Bélgica), BluJay Solutions Ltd. (EE. UU.), Metro Infrasys Pvt. Ltd. (India), Software Group (Bulgaria), 3GTMS (EE. UU.), Infor (EE. UU.), CH Robinson Worldwide, Inc (EE. UU.), THE DESCARTES SYSTEMS GROUP INC (Canadá), BluJay Solutions Ltd. (EE. UU.), MercuryGate (EE. UU.), Omnitracs (EE. UU.), Next Generation Logistics, Inc (EE. UU.) |

|

Oportunidades |

|

Dinámica del mercado de sistemas de gestión de almacenes

Conductores

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

- Crecimiento rápido del comercio electrónico

El rápido crecimiento de la digitalización y la adopción más amplia de las industrias de comercio electrónico por parte de los consumidores en sus actividades diarias están impulsando el mercado de sistemas de gestión de almacenes. El mercado está desarrollando una creciente necesidad de movilidad y existe una mayor demanda de soluciones y servicios virtuales en el área de redes. Están surgiendo demandas de tráfico variables y todos estos factores están acelerando la demanda del mercado.

- Aumento de los avances de software

El sistema de gestión de almacenes mejora la precisión del inventario, reduce el tiempo de entrega y cumplimiento, maximiza la utilización del espacio, mejora el servicio al cliente y optimiza la productividad del almacén. Todos estos factores están provocando un aumento en el mercado global de sistemas de gestión de almacenes.

Oportunidad

Hay un aumento en las diferentes demandas de tráfico, y todos estos factores están acelerando la demanda del mercado al final del pronóstico para Medio Oriente y África.

Restricciones

La falta de conocimiento sobre los sistemas de gestión de almacenes en las pequeñas y medianas empresas puede suponer un reto para diversos fabricantes del mercado. Un sistema de almacenamiento requiere una inversión inicial significativa para soportar el crecimiento del mercado en el futuro cercano.

Este informe de mercado de sistemas de gestión de almacenes proporciona detalles de nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de sistemas de gestión de almacenes, comuníquese con Data Bridge Market Research para obtener un informe de analista, nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Impacto de COVID-19 en el mercado de sistemas de gestión de almacenes

A pesar del caos inicial causado por la pandemia de COVID-19, el rápido crecimiento de la industria del comercio electrónico y la mayor conciencia de los usuarios sobre los beneficios de los WMS permitieron que este mercado se expandiera de manera constante. Además, la crisis ha acelerado la adopción por parte de la industria de herramientas de automatización de almacenes como WMS. Además, la automatización se acelerará para proteger a las empresas de futuras interrupciones en la cadena de suministro. El crecimiento del mercado de WMS está siendo impulsado por industrias como el comercio electrónico, 3PL, atención médica y alimentos y bebidas. Por otro lado, las empresas están experimentando graves problemas de flujo de efectivo como resultado de la imposición de bloqueos en varios países. En Oriente Medio y África, la detención o desaceleración de la producción en las industrias automotriz, de metales y maquinaria, y otras, ha provocado una caída de la demanda.

Desarrollo reciente

- En mayo de 2020, Manhattan Associates, Inc. presentará la solución de gestión activa de almacenes Manhattan. Es el primer sistema de gestión de almacenes (WMS) de clase empresarial nativo en la nube del mundo que integra todos los aspectos de la distribución y no requiere mantenimiento.

- En abril de 2019, HighJump (Körber) lanzó HighJump CLASS, su última solución para simulación y diseño de almacenamiento y logística. HighJump CLASS permite a las empresas de todo el mundo seguir siendo competitivas y estar conectadas con la cadena de suministro del futuro.

- JDA Luminate fue lanzado en mayo de 2019 por JDA Software. JDA Luminate está construido sobre una plataforma abierta, conectada y cognitiva que adopta tecnología de vanguardia digital como software como servicio (SaaS) , inteligencia artificial y análisis avanzados.

Alcance del mercado de sistemas de gestión de almacenes en Oriente Medio y África

El mercado de sistemas de gestión de almacenes está segmentado en función de los componentes, la implementación, el tipo de nivel, el canal de distribución y el usuario final. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Componentes

- Software

- Hardware

- Servicios

En función de los componentes, el mercado de sistemas de gestión de almacenes de Oriente Medio y África se segmenta en hardware, software y servicios. En 2020, el segmento de software domina el mercado porque la mayoría de los países desarrollados y en desarrollo prefieren utilizar software en línea, ya que es posible utilizarlo.

Despliegue

- Basado en la nube

- En las instalaciones

En función de la implementación, el mercado de sistemas de gestión de almacenes de Oriente Medio y África se segmenta en sistemas basados en la nube y locales. En 2020, el segmento local domina el mercado, ya que aloja sus propios servidores y compra licencias que aumentan la precisión del trabajo y también reducen las posibilidades de desastre.

Nivel

- avanzado

- intermedio

- básico

Según el tipo de nivel, el mercado de sistemas de gestión de almacenes de Oriente Medio y África se segmenta en avanzado, intermedio y básico. En 2020, el segmento avanzado domina el mercado, ya que protege el tiempo de los consumidores al proporcionar a los gerentes de los centros de distribución potentes capacidades de inventario y logística con herramientas para programar, rastrear y coordinar la actividad diaria, lo que reduce las posibilidades de fallas y desastres.

Canal de distribución

- En línea

- Desconectado

En función del canal de distribución, el mercado de sistemas de gestión de almacenes de Oriente Medio y África se segmenta en en línea y fuera de línea. En 2020, el segmento fuera de línea domina el crecimiento del mercado, ya que es el uso más eficaz de la mano de obra y el espacio, lo que también es muy factible para los clientes.

Usuario final

- Comida y bebidas

- cuidado de la salud

- automotor

- comercio electrónico

- electricidad y electrónica

- logística de terceros

- metales y maquinaria

- productos químicos

- otros

En función del usuario final, el mercado de sistemas de gestión de almacenes de Oriente Medio y África se segmenta en alimentos y bebidas, atención sanitaria, automoción, comercio electrónico, electricidad y electrónica, logística de terceros, metales y maquinaria, productos químicos y otros. En 2020, el segmento de alimentos y bebidas está dominando debido a la mayor demanda de las economías desarrolladas y en desarrollo que necesitan una gestión de almacenes adecuada para garantizar un envío adecuado a tiempo sin roturas, fugas ni deterioro de los alimentos.

Análisis y perspectivas regionales del mercado de sistemas de gestión de almacenes

Se analiza el mercado del sistema de gestión de almacenes y se proporcionan información y tendencias del tamaño del mercado por país, componente, implementación, tipo de nivel, canal de distribución y usuario final como se mencionó anteriormente.

Los países cubiertos en el informe del mercado del sistema de gestión de almacenes son los Emiratos Árabes Unidos, Israel, Arabia Saudita, Egipto, Sudáfrica, el resto de Medio Oriente y África.

América del Norte domina el mercado de sistemas de gestión de almacenes. Estados Unidos domina la región de América del Norte debido a la fuerte presencia de proveedores de ERP, lo que impulsa el crecimiento del mercado de gestión de almacenes. El país tiene una gran demanda de una amplia variedad de alimentos y bebidas, lo que requiere un suministro continuo desde los almacenes porque agrega eficiencia, consistencia y control de calidad al proceso al ayudar a los fabricantes a mover las mercancías a la máxima velocidad según la demanda del consumidor. Mientras que en Europa, Alemania domina el mercado debido a la creciente adopción de sistemas de gestión de almacenes multicanal en la región y la región de Asia-Pacífico.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Puntos de datos como análisis de la cadena de valor aguas arriba y aguas abajo, tendencias técnicas y análisis de las cinco fuerzas de Porter, estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de Medio Oriente y África y sus desafíos afrontados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los sistemas de gestión de almacenes

El panorama competitivo del mercado de sistemas de gestión de almacenes proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en Oriente Medio y África, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos, el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de sistemas de gestión de almacenes.

Algunos de los principales actores que operan en el mercado de sistemas de gestión de almacenes son:

- Oracle (Estados Unidos)

- Manhattan Associates. (Estados Unidos)

- EL GRUPO DESCARTES SYSTEMS INC (Canadá)

- CTSI-GLOBAL (Estados Unidos)

- Grupo Alpega (Bélgica)

- BluJay Solutions Ltd. (Estados Unidos)

- Metro Infrasys Pvt. Ltd. (India)

- Grupo de software (Bulgaria)

- 3GTMS (Estados Unidos)

- Información (EE.UU.)

- CH Robinson Worldwide, Inc (Estados Unidos)

- EL GRUPO DESCARTES SYSTEMS INC (Canadá)

- BluJay Solutions Ltd. (Estados Unidos)

- MercuryGate (Estados Unidos)

- Omnitracs (Estados Unidos)

- Next Generation Logistics, Inc. (Estados Unidos)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

6 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT

6.1 OVERVIEW

6.2 SOFTWARE

6.2.1 BILLING & YARD MANAGEMENT

6.2.2 ANALYTICS & OPTIMIZATION

6.2.3 LABOR MANAGEMENT SYSTEM

6.3 HARDWARE

6.3.1 CRANE

6.3.2 AUTOMATED STORAGE AND RETRIEVAL SYSTEM (ASRS)

6.3.3 ROBOT

6.3.4 CONVEYOR AND SORTATION SYSTEM

6.3.5 AUTOMATED GUIDED VEHICLE (AGV)

6.4 SERVICES

6.4.1 SUPPORT AND MAINTENANCE

6.4.2 INTEGRATION AND MIGRATION

6.4.3 TRAINING AND EDUCATION

6.4.4 CONSULTING

7 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT

7.1 OVERVIEW

7.2 ON-PREMISE

7.3 CLOUD-BASED

8 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY TYPE OF TIER

8.1 OVERVIEW

8.2 ADVANCED

8.3 INTERMEDIATE

8.4 BASIC

9 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 OFFLINE

9.3 ONLINE

10 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY END-USER

10.1 OVERVIEW

10.2 FOOD & BEVERAGES

10.3 E-COMMERCE

10.4 AUTOMOTIVE

10.5 THIRD-PARTY LOGISTICS

10.6 HEALTHCARE

10.7 ELECTRICAL & ELECTRONICS

10.8 METALS AND MACHINERY

10.9 CHEMICALS

10.1 OTHERS

11 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY GEOGRAPHY

11.1 MIDDLE EAST AND AFRICA

11.1.1 U.A.E

11.1.2 ISRAEL

11.1.3 SAUDI ARABIA

11.1.4 EGYPT

11.1.5 SOUTH AFRICA

11.1.6 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

13 COMPANY PROFILE

13.1 SAP SE

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT UPDATE

13.2 ORACLE

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT UPDATE

13.3 IBM CORPORATION

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT UPDATE

13.4 PSI LOGISTICS GMBH (A SUBSIDIARY OF PSI SOFTWARE AG)

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 SOLUTION PORTFOLIO

13.4.5 RECENT UPDATE

13.5 MANHATTAN ASSOCIATES

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT UPDATE

13.6 BASTIAN SOLUTIONS, INC.

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT UPDATES

13.7 BLUE YONDER GROUP, INC.

13.7.1 COMPANY SNAPSHOT

13.7.2 SOLUTION PORTFOLIO

13.7.3 RECENT UPDATES

13.8 CODEWORKS, LLC

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT UPDATE

13.9 DATAPEL.

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT UPDATES

13.1 EPICOR SOFTWARE CORPORATION

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT UPDATES

13.11 HAL SYSTEMS.

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT UPDATE

13.12 HIGHJUMP (A SUBSIDIARY OF KÖRBER AG)

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT UPDATES

13.13 INFOR

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT UPDATE

13.14 DASAULT SYSTEMES (IQMS)

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT UPDATE

13.15 MAGAYA CORPORATION

13.15.1 COMPANY SNAPSHOT

13.15.2 SOLUTION PORTFOLIO

13.15.3 RECENT UPDATES

13.16 PRIMA SOLUTIONS LTD.

13.16.1 COMPANY SNAPSHOT

13.16.2 SOLUTION PORTFOLIO

13.16.3 RECENT UPDATE

13.17 PTC

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT UPDATE

13.18 SOFTEON

13.18.1 COMPANY SNAPSHOT

13.18.2 SOLUTION PORTFOLIO

13.18.3 RECENT UPDATES

13.19 SYNERGY LTD

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT UPDATES

13.2 TECSYS INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 SOLUTION PORTFOLIO

13.20.4 RECENT UPDATES

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tablas

LIST OF TABLES

TABLE 1 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 2 MIDDLE EAST AND AFRICA SOFTWARE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 3 MIDDLE EAST AND AFRICA SOFTWARE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY SOFTWARE COMPONENT, 2018-2027 (USD MILLION)

TABLE 4 MIDDLE EAST AND AFRICA HARDWARE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 5 MIDDLE EAST AND AFRICA HARDWARE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY HARDWARE COMPONENT, 2018-2027 (USD MILLION)

TABLE 6 MIDDLE EAST AND AFRICA SERVICES IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 7 MIDDLE EAST AND AFRICA SERVICES IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY SERVICES COMPONENT, 2018-2027 (USD MILLION)

TABLE 8 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT, 2018-2027 (USD MILLION)

TABLE 9 MIDDLE EAST AND AFRICA ON-PREMISE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 10 MIDDLE EAST AND AFRICA CLOUD-BASED IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 11 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY TYPE OF TIER, 2018-2027 (USD MILLION)

TABLE 12 MIDDLE EAST AND AFRICA ADVANCED IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 13 MIDDLE EAST AND AFRICA INTERMEDIATE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 14 MIDDLE EAST AND AFRICA BASIC IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 15 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 16 MIDDLE EAST AND AFRICA OFFLINE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 17 MIDDLE EAST AND AFRICA ONLINE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 18 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 19 MIDDLE EAST AND AFRICA FOOD & BEVERAGES IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 20 MIDDLE EAST AND AFRICA E-COMMERCE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 21 MIDDLE EAST AND AFRICA AUTOMOTIVE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 22 MIDDLE EAST AND AFRICA THIRD-PARTY LOGISTICS IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 23 MIDDLE EAST AND AFRICA HEALTHCARE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 24 MIDDLE EAST AND AFRICA ELECTRICAL & ELECTRONICS IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA METALS AND MACHINERY IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA CHEMICALS IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA OTHERS IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA SOFTWARE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA HARDWARE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY HARDWARE COMPONENT, 2018-2027 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA SERVICES IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT, 2018-2027 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY TYPE OF TIER, 2018-2027 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 37 U.A.E WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 38 U.A.E SOFTWARE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 39 U.A.E HARDWARE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY HARDWARE COMPONENT, 2018-2027 (USD MILLION)

TABLE 40 U.A.E SERVICES IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 41 U.A.E WAREHOUSE MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT, 2018-2027 (USD MILLION)

TABLE 42 U.A.E WAREHOUSE MANAGEMENT SYSTEM MARKET, BY TYPE OF TIER, 2018-2027 (USD MILLION)

TABLE 43 U.A.E WAREHOUSE MANAGEMENT SYSTEM MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 44 U.A.E WAREHOUSE MANAGEMENT SYSTEM MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 45 ISRAEL WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 46 ISRAEL SOFTWARE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 47 ISRAEL HARDWARE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY HARDWARE COMPONENT, 2018-2027 (USD MILLION)

TABLE 48 ISRAEL SERVICES IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 49 ISRAEL WAREHOUSE MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT, 2018-2027 (USD MILLION)

TABLE 50 ISRAEL WAREHOUSE MANAGEMENT SYSTEM MARKET, BY TYPE OF TIER, 2018-2027 (USD MILLION)

TABLE 51 ISRAEL WAREHOUSE MANAGEMENT SYSTEM MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 52 ISRAEL WAREHOUSE MANAGEMENT SYSTEM MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 53 SAUDI ARABIA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 54 SAUDI ARABIA SOFTWARE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 55 SAUDI ARABIA HARDWARE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY HARDWARE COMPONENT, 2018-2027 (USD MILLION)

TABLE 56 SAUDI ARABIA SERVICES IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 57 SAUDI ARABIA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT, 2018-2027 (USD MILLION)

TABLE 58 SAUDI ARABIA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY TYPE OF TIER, 2018-2027 (USD MILLION)

TABLE 59 SAUDI ARABIA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 60 SAUDI ARABIA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 61 EGYPT WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 62 EGYPT SOFTWARE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 63 EGYPT HARDWARE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY HARDWARE COMPONENT, 2018-2027 (USD MILLION)

TABLE 64 EGYPT SERVICES IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 65 EGYPT WAREHOUSE MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT, 2018-2027 (USD MILLION)

TABLE 66 EGYPT WAREHOUSE MANAGEMENT SYSTEM MARKET, BY TYPE OF TIER, 2018-2027 (USD MILLION)

TABLE 67 EGYPT WAREHOUSE MANAGEMENT SYSTEM MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 68 EGYPT WAREHOUSE MANAGEMENT SYSTEM MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 69 SOUTH AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 70 SOUTH AFRICA SOFTWARE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 71 SOUTH AFRICA HARDWARE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY HARDWARE COMPONENT, 2018-2027 (USD MILLION)

TABLE 72 SOUTH AFRICA SERVICES IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 73 SOUTH AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT, 2018-2027 (USD MILLION)

TABLE 74 SOUTH AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY TYPE OF TIER, 2018-2027 (USD MILLION)

TABLE 75 SOUTH AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 76 SOUTH AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 77 REST OF MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

Lista de figuras

LIST OF FIGURES

FIGURE 1 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET: SEGMENTATION

FIGURE 10 MIDDLE EAST AND AFRICAIZATION OF THE DISTRIBUTION AND SUPPLY CHAIN NETWORK IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 11 SOFTWARE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET IN 2020 & 2027

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEMS MARKET

FIGURE 13 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET: BY COMPONENT, 2019

FIGURE 14 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET: BY DEPLOYMENT, 2019

FIGURE 15 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET: BY TYPE OF TIER, 2019

FIGURE 16 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET: BY DISTRIBUTION CHANNEL, 2019

FIGURE 17 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET: BY END-USER, 2019

FIGURE 18 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM: COMPANY SHARE 2019 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.