>Mercado de carne procesada de Oriente Medio y África, por tipo de producto ( carne de rescerdo , cabra, cordero, pollo , pavo, pato, pescado ), tipo (carne procesada fresca, carne congelada, carne refrigerada , carne enlatada, carne seca / semiseca, carne fermentada, otros), categoría (curada, sin curar), naturaleza (convencional, orgánica ), tipo de embalaje (bandejas, bolsas, cajas, botes, otros), material de embalaje (plástico, vidrio , papel / cartón, metal, otros), usuario final (sector de servicios de alimentos, hogar), canal de distribución (minoristas en tiendas, minoristas que no son tiendas), país (Sudáfrica, Emiratos Árabes Unidos, Qatar, Arabia Saudita, Kuwait, Omán y resto de Oriente Medio y África), tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado de carne procesada en Oriente Medio y África

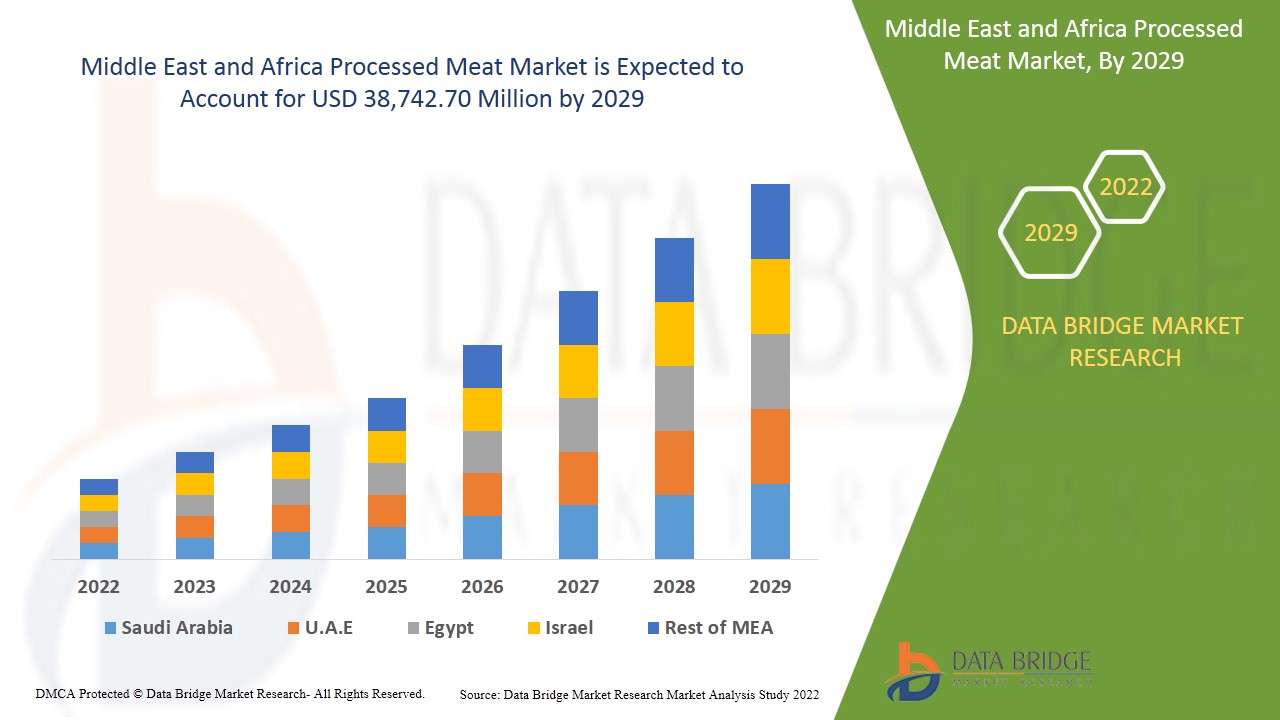

Se espera que el mercado de carne procesada de Oriente Medio y África gane crecimiento de mercado en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 4,2% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 38.742,70 millones para 2029. El aumento de la demanda de carne procesada en las industrias alimentaria y farmacéutica puede impulsar el crecimiento en el mercado de carne procesada de Oriente Medio y África.

La carne procesada se puede definir como carne suplementada con varios aditivos y conservantes, como acidificantes, minerales, sales y otros condimentos y agentes aromatizantes. La carne se procesa principalmente para mejorar su calidad, evitar la degeneración y agregar sabores a su composición original. Puede ser carne roja o carne blanca de cerdo, aves, ganado o carne de animales marinos.

Carnes como la de res, cerdo, pavo, pollo y cordero se utilizan habitualmente para producir carne procesada. Entre los productos cárnicos procesados se encuentran el pepperoni, la cecina, los hot dogs y las salchichas. Se añaden ciertos conservantes a la carne para evitar que las bacterias y otros organismos la echen a perder.

Los principales factores que se espera que impulsen el crecimiento del mercado de carne procesada de Oriente Medio y África en el período de pronóstico son el aumento de los ingresos disponibles. Además, se estima que la disminución del tiempo que se tarda en cocinar carne en casa debido al estilo de vida agitado complementará aún más el crecimiento del mercado de carne procesada de Oriente Medio y África.

- Por otra parte, se prevé que el aumento de la incidencia de la obesidad debido al elevado consumo de productos cárnicos procesados impida el crecimiento del mercado de carne procesada de Oriente Medio y África en el período de referencia. Además, el crecimiento de las cadenas de comida rápida y restaurantes puede ofrecer otras oportunidades potenciales para el crecimiento del mercado de carne procesada en los próximos años. Sin embargo, las estrictas regulaciones gubernamentales podrían suponer un reto adicional para el crecimiento del mercado de carne procesada de Oriente Medio y África.

The Middle East and Africa processed meat market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the processed meat market scenario, contact Data Bridge Market Research for an Analyst Brief; our team will help you create a revenue impact solution to achieve your desired goal.

Middle East and Africa Processed Meat Market Scope and Market Size

Middle East and Africa processed meat market is segmented based on product type, type, category, nature, packaging type, packaging material, end-user and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of type, the Middle East and Africa processed meat market is segmented into fresh processed meat, frozen meat, chilled meat, canned meat, dried/semi dried meat, fermented meat, and others. In 2022, the fresh processed meat segment is expected to dominate the market due to the growing demand for fresh processed meat in the region.

- On the basis of product type, the Middle East and Africa processed meat market is segmented into beef, pork, goat, lamb, chicken, turkey, duck, and fish. In 2022, the chicken segment is expected to dominate the market due to the growing demand for chicken in the region.

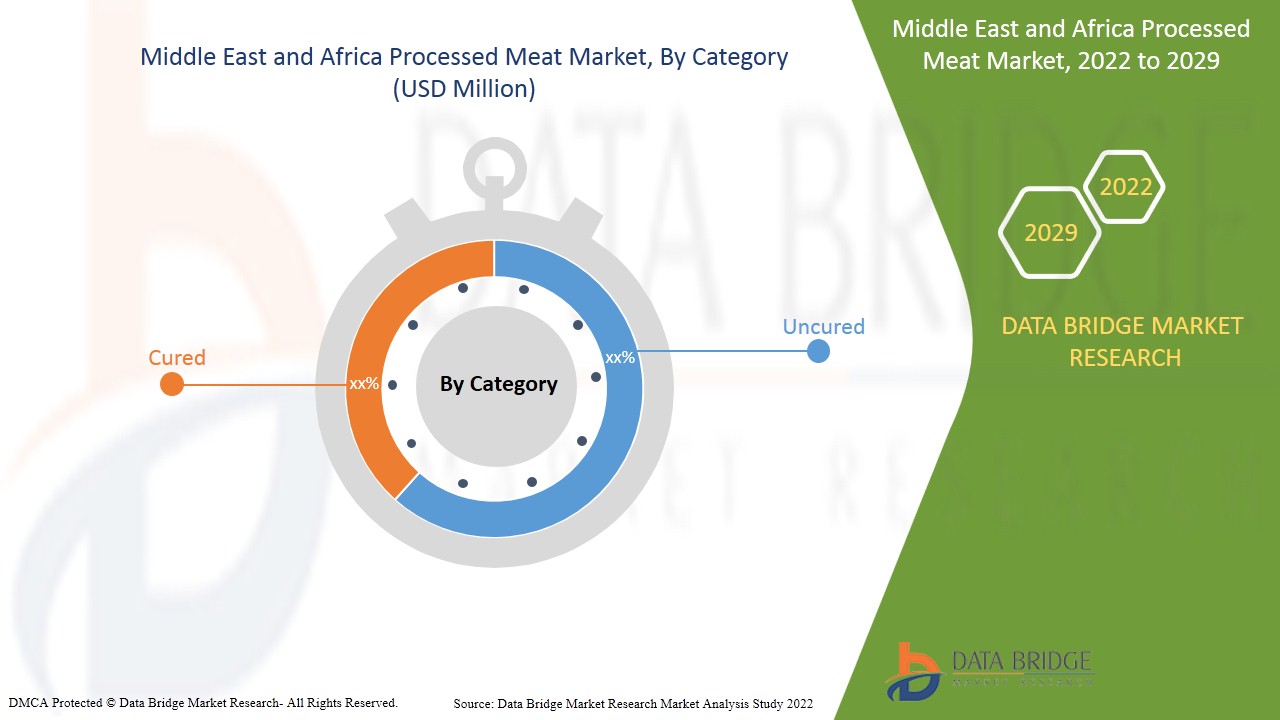

- On the basis of category, the Middle East and Africa processed meat market is segmented into cured and uncured. In 2022, the cured segment is expected to dominate the market as cured meat can be stored for a longer period.

- On the basis of nature, the Middle East and Africa processed meat market is segmented into organic and conventional. In 2022, the conventional segment is expected to dominate the market due to the cheaper availability of conventional meat in the region

- On the basis of packaging type, the Middle East and Africa processed meat market is segmented into trays, pouches, boxes, cannisters, and others. In 2022, the pouches segment is expected to dominate the market due to the low weight of pouches.

- On the basis of packaging material, the Middle East and Africa processed meat market is segmented into plastic, glass, paper/cardboard, metal, and others. In 2022, the plastic segment is expected to dominate the market easy to handle nature of plastic packages.

- On the basis of end-user, the Middle East and Africa processed meat market is segmented into household and food service sector. In 2022, the food service sector segment is expected to dominate the processed meat market due to the growing popularity and wide expansion of various foodservice outlets in the region.

- On the basis of distribution channel, the Middle East and Africa processed meat market is segmented into store based retailers and non-store based retailers. In 2022, the store based retailers segment is expected to dominate the market due to greater availability of meat products in the store based retailers.

Middle East and Africa Processed Meat Market Country Level Analysis

Middle East and Africa processed meat market is segmented based on product type, type, category, nature, packaging type, packaging material, end-user and distribution channel.

The countries covered in the Middle East and Africa processed meat market report are South Africa, U.A.E, Qatar, Saudi Arabia, Kuwait, Oman and Rest of the Middle East and Africa.

South Africa is expected to dominate the Middle East and Africa processed meat market because of the growing popularity of processed meat in the region. Saudi Arabia is projected to dominate the region due to growing urbanization increased consumption of processed meat products.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of the Middle East and African brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Growing Strategic Activities by Major Market Players is Boosting the Market Growth of Middle East and Africa Processed Meat Market

Middle East and Africa processed meat market also provides you with detailed market analysis for every country's growth in a particular market. Additionally, it provides detailed information regarding the market players’ strategy and geographical presence. The data is available for the historical period 2011 to 2020.

Competitive Landscape and Middle East and Africa Processed Meat Market Share Analysis

Middle East and Africa processed meat market competitive landscape provide details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width, and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to the Middle East and Africa processed meat market.

Algunas de las principales empresas que operan en el mercado de carne procesada de Oriente Medio y África son Cargill, Incorporated, JBS Foods, Tyson Foods, Inc., Smithfield Foods, Inc, Hormel Foods Corporation, NH Foods Ltd., Louis Dreyfus Company, HKScan, Gruppo Veronesi, OSI Group, Charoen Pokphand Foods PCL., The Kraft Heinz Company, entre otros actores nacionales. Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado.

Numerosos contratos y acuerdos son iniciados también por empresas de todo el mundo, lo que también acelera el mercado de carne procesada en Oriente Medio y África.

Por ejemplo,

- En mayo de 2021, Charoen Pokphand Foods PLC (CPF) lanzó “MEAT ZERO”, la carne elaborada a partir de plantas y fabricada para que tenga el tacto, el sabor y la apariencia de la carne real. Se esperaba que el nuevo producto atrajera a los consumidores preocupados por la salud. El producto es asequible y está disponible como material listo para cocinar y un menú listo para comer a través de 7-Eleven y puntos de venta modernos en toda Tailandia.

La colaboración, el lanzamiento de productos, la expansión comercial, los premios y reconocimientos, las empresas conjuntas y otras estrategias de los actores del mercado están mejorando la presencia de la empresa en el mercado de carne procesada, lo que también brinda beneficios para el crecimiento de las ganancias de la organización.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA PROCESSED MEAT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS (VOLUME %)

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND COMPETITIVE ANALYSIS

4.2 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET- INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.2.1 GROWING UTILIZATION OF NEW TECHNOLOGIES IN MEAT PROCESSING

4.2.2 GROWING COLLABORATIONS AND PARTNERSHIPS

4.2.3 CONSUMER OPTING FOR HEALTHEIR MEAT PRODUCTS WITH DECREASED FAT LEVEL, CHOLESTEROL,

5 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET: REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWTH IN INVESTMENTS & COLLABORATIONS IN MEAT PROCESSING BUSINESS

6.1.2 PREFERENCE FOR ANIMAL-BASED PROTEINS OVER PLANT-BASED PROTEINS

6.1.3 GROWING URBANIZATION AND INCREASED ADOPTION OF HEALTHY LIFESTYLE

6.1.4 GROWING POPULARITY OF CANNED AND FROZEN MEAT FOOD

6.2 RESTRAINTS

6.2.1 HIGH INVESTMENT COST IN POULTRY BUSINESS

6.2.2 RISING VEGAN POPULATION AND INCREASING DEMAND FOR MEAT ALTERNATIVES

6.3 OPPORTUNITIES

6.3.1 GROWING FAST FOOD AND RESTAURANT CHAINS

6.3.2 INCREASING AUTOMATION IN MEAT PROCESSING INDUSTRY

6.3.3 GROWING PREFERENCE FOR ORGANIC MEAT

6.4 CHALLENGES

6.4.1 STRINGENT GOVERNMENT REGULATIONS

6.4.2 DISTURBANCE IN SUPPLY CHAIN DUE TO COVID-19 PANDEMIC

7 COVID-19 IMPACT ON MIDDLE EAST & AFRICA PROCESSED MEAT MARKET

7.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST MIDDLE EAST & AFRICA PROCESSED MEAT MARKET

7.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

7.3 IMPACT ON PRICE

7.4 IMPACT ON DEMAND

7.5 IMPACT ON SUPPLY CHAIN

7.6 CONCLUSION

8 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET, BY TYPE

8.1 FRESH PROCESSED MEAT

8.2 FROZEN MEAT

8.3 CHILLED MEAT

8.4 CANNED MEAT

8.5 DRIED/SEMI DRIED MEAT

8.6 FERMENTED MEAT

9 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET, BY PRODUCT TYPE:

9.1 OVERVIEW:

9.2 BEEF

9.3 PORK

9.4 GOAT

9.5 LAMB

9.6 CHICKEN

9.7 TURKEY

9.8 DUCK

9.9 FISH

10 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET, BY PACKAGING TYPE

10.1 TRAYS

10.2 POUCHES

10.3 BOXES

10.4 CANNISTERS

10.5 OTHERS

11 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET, BY END USER:

11.1 OVERVIEW:

11.2 HOUSEHOLD

11.3 FOOD SERVICE SECTOR

12 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET, BY CATEGORY:

12.1 OVERVIEW:

12.2 CURED

12.3 UNCURED

13 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET, BY NATURE:

13.1 OVERVIEW:

13.2 ORGANIC

13.3 CONVENTIONAL

14 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET, BY DISTRIBUTION CHANNEL

14.1 STORE BASED RETAILER

14.2 NON-STORE BASED RETAILER

15 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET, BY REGION

15.1 MIDDLE EAST AND AFRICA

15.1.1 SOUTH AFRICA

15.1.2 SAUDI ARABIA

15.1.3 UAE

15.1.4 QATAR

15.1.5 KUWAIT

15.1.6 OMAN

15.1.7 REST OF MIDDLE EAST AND AFRICA

16 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 JBS FOODS

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUS ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 TYSON FOODS, INC.

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUS ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 VION FOOD GROUP

18.3.1 COMPANY SNAPSHOT

18.3.2 COMPANY SHARE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT DEVELOPMENTS

18.4 CARGILL, INCORPORATED

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUS ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENT

18.5 DANISH CROWN A.M.B.A

18.5.1 COMPANY SNAPSHOT

18.5.2 COMPANY SHARE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT DEVELOPMENTS

18.6 CHAROEN POKPHAND FOODS PUBLIC CO. LTD.

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENT

18.7 SMITHFIELD FOODS, INC

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENTS

18.8 TÖNNIES GROUP

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 HORMEL FOODS CORPORATION

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUS ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENT

18.1 NATIONAL BEEF PACKING COMPANY L.L.C.

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 GAUSEPOHL FLEISCH DEUTSCHLAND GMBH

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENT

18.12 GROUPE BIGARD

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 GRUPPO VERONESI

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUS ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENT

18.14 HKSCAN

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUS ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENTS

18.15 KOCH FOODS.

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENT

18.16 LOUIS DREYFUS COMPANY

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.17 MARFRIG

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.18 MÜLLER GRUPPE

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENT

18.19 NH FOODS LTD.

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUS ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENT

18.2 OSI GROUP

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENTS

18.21 PERDUE FARMS INC.

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENT

18.22 SANDERSON FARMS, INCORPORATED.

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENT

18.23 TERRENA

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENT

18.24 THE KRAFT HEINZ COMPANY

18.24.1 COMPANY SNAPSHOT

18.24.2 REVENUE ANALYSIS

18.24.3 PRODUCT PORTFOLIO

18.24.4 RECENT DEVELOPMENT

18.25 WESTFLEISCH SCE MBH

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

Lista de figuras

FIGURE 1 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET: MIDDLE EAST & AFRICA VS REGIONAL ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET: DBMR POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET: SEGMENTATION

FIGURE 10 ASIA-PACIFIC REGION IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA PROCESSED MEAT MARKET AND GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 GROWTH IN INVESTMENTS & COLLABORATIONS IN MEAT PROCESSING BUSINESS IS DRIVING THE GROWTH OF MIDDLE EAST & AFRICA PROCESSED MEAT MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA PROCESSED MEAT MARKET IN 2022 & 2029

FIGURE 13 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET: SUPPLY CHAIN ANALYSIS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA PROCESSED MEAT MARKET

FIGURE 15 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET, BY TYPE (2021)

FIGURE 16 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET, BY PRODUCT TYPE (2021)

FIGURE 17 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET, BY PACKAGING TYPE (2021)

FIGURE 18 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET, BY END-USER (2021)

FIGURE 19 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET, BY CATEGORY

FIGURE 20 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET, BY NATURE (2021)

FIGURE 21 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET, BY DISTRIBUTION CHANNEL (2021)

FIGURE 22 MIDDLE EAST & AFRICA SNAPSHOT, 2021

FIGURE 23 MIDDLE EAST & AFRICA SUMMARY, 2021

FIGURE 24 MIDDLE EAST & AFRICA SUMMARY, 2022 & 2029

FIGURE 25 MIDDLE EAST & AFRICA SUMMARY, 2021 & 2029

FIGURE 26 MIDDLE EAST & AFRICA SUMMARY BY PRODUCT, 2022 - 2029

FIGURE 27 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET: COMPANY SHARE 2021 (VOLUME %)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.