Mercado de polietilenglicol en Oriente Medio y África, por grado (PEG 200, PEG 300, PEG 400, PEG 600, PEG 1000, PEG 3350, PEG 4000, PEG 6000, PEG 8000, PEG 10000 y PEG 20000), forma (líquido opaco, sólido ceroso blanco y copos/polvo), tamaño del envase (botellas y tambores de plástico), aplicación (atención sanitaria, construcción, industrial, cosmética /cuidado personal y otros), tendencias de la industria y pronóstico hasta 2030.

Análisis y tamaño del mercado de polietilenglicol en Oriente Medio y África

El mercado de polietilenglicol en Oriente Medio y África está impulsado por la industria farmacéutica, que es un factor clave que impulsa la expansión del mercado. Los polietilenglicoles son componentes cruciales de las formulaciones farmacéuticas que se utilizan para crear tratamientos tópicos, orales, oftálmicos y rectales. En una serie de aplicaciones medicinales, sirven como lubricantes y agentes de recubrimiento. Además, el uso de polietilenglicol en productos de pintura y recubrimiento abrirá más potencial comercial para los mercados de polietilenglicol. Sin embargo, las estrictas regulaciones gubernamentales pueden restringir el crecimiento del mercado.

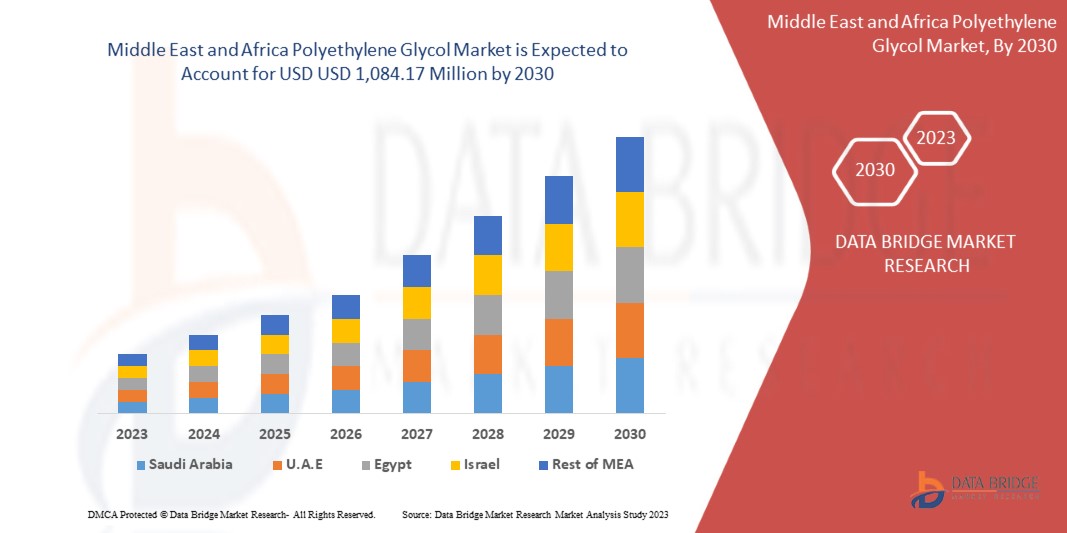

Data Bridge Market Research analiza que se espera que el mercado de polietilenglicol de Oriente Medio y África alcance un valor de USD 1.084,17 millones para 2030, con una CAGR del 6,0% durante el período de pronóstico.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Año histórico |

2021 (Personalizable para 2020-2016) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en toneladas, precios en USD |

|

Segmentos cubiertos |

Por grado (PEG 200, PEG 300, PEG 400, PEG 600, PEG 1000, PEG 3350, PEG 4000, PEG 6000, PEG 8000, PEG 10000 y PEG 20000), forma (líquido opaco, sólido ceroso blanco y copos/polvo), tamaño del envase (botellas y tambores de plástico), aplicación (atención sanitaria, construcción, industrial, cosméticos/cuidado personal y otros). |

|

Países cubiertos |

Sudáfrica, Emiratos Árabes Unidos, Arabia Saudita, Egipto, Qatar, Omán, Kuwait, Bahréin, Resto de Oriente Medio y África. |

|

Actores del mercado cubiertos |

Entre otras, se encuentran SABIC, Dow, BASF SE, Merck KGaA, INEOS, Croda International Plc, Clariant, India Glycols Limited, Pro Chem, Inc., GFS Chemicals, Inc., Liaoning Oxiranchem Inc., Liaoning Kelong Fine Chemical Co., Ltd., LOTTE Chemical Corporation, Hefei TNJ Chemical Industry Co., Ltd., Noah Chemicals y Mil-Spec Industries Corporation. |

Definición de mercado

El PEG o polietilenglicol es un material polimérico compuesto por óxido de etileno y agua como monómeros que no sólo son hidrófilos sino también biocompatibles. Sin embargo, se trata de una molécula sintética sintetizada mediante la polimerización del óxido de etileno donde se produce una apertura de anillo. Al estar compuesto de agua y óxido de etileno, encuentra innumerables aplicaciones en industrias que van desde la farmacéutica hasta la construcción.

Los polietilenglicoles se vuelven reactivos mediante la sustitución del grupo hidroxilo terminal por varios grupos funcionales reactivos, como tioles, grupos carboxilo, ésteres de N-hidroxisuccinimida, azidas o grupos alquino reactivos, que inician la formación de enlaces cruzados. Es la química de conjugación la que desempeña un papel importante en su síntesis y, dependiendo del grupo funcional unido, se eligen diferentes condiciones y métodos. Por ejemplo, los polietilenglicoles con terminación en acrilato podrían experimentar una reacción rápida en condiciones de reacción suaves. Es incoloro, poco tóxico, no irritante por naturaleza y tiene una biocompatibilidad muy alta. Se utiliza ampliamente como agente antiespumante, lubricante, agente dispersante y laxante. Es aplicable a una variedad de industrias, como la farmacéutica, la atención sanitaria, la construcción, el cuidado personal y la cosmética.

Dinámica del mercado del polietilenglicol en Oriente Medio y África

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

Conductores:

- Creciente demanda de medicamentos

El descubrimiento de fármacos es un proceso tedioso que lleva muchos años. La investigación y el desarrollo para crear nuevos fármacos innovadores están adquiriendo importancia debido al aumento de la cantidad de enfermedades crónicas, el envejecimiento de la población y la entrada de competidores genéricos en el mercado futuro.

La industria farmacéutica está creciendo a un ritmo acelerado en Oriente Medio y África, y los medicamentos de Pfizer tienen la tasa de ventas más alta del mercado. El departamento de investigación y desarrollo de Pfizer también predijo que la investigación principal se atribuye a medicamentos oncológicos y analgésicos, reguladores de lípidos, antidiabéticos, agentes respiratorios y otros, y que Estados Unidos muestra el mayor crecimiento de los ingresos.

En la evaluación de la farmacodinámica de los compuestos candidatos, el metabolismo de los fármacos desempeña un papel directo. El polietilenglicol actúa como ingrediente inactivo en la industria farmacéutica, generalmente como agente humectante y espesante en ungüentos y cremas, y se utiliza para añadir recubrimientos protectores a los comprimidos. Además, su uso como solución electrolítica para el examen de trastornos y disfunciones en el colon de los seres humanos es bien conocido.

- Uso de la tecnología de PEGlicación en aplicaciones biotecnológicas y farmacéuticas

La pegilación es una técnica de modificación de productos biofarmacéuticos que contienen polietilenglicol para mejorar las propiedades farmacológicas de las proteínas y otras moléculas grandes en los fármacos bioterapéuticos. La técnica prolonga el período de vida media de los fármacos originales y mejora la solubilidad acuosa de las sustancias farmacológicas.

La PEGilación de moléculas de proteínas implica la adición de moléculas de PEG a la estructura de la proteína, lo que cambia sus propiedades farmacocinéticas y reduce la inmunogenicidad de las moléculas que ayudan a prevenir infecciones, específicamente en la terapia del cáncer. La técnica implica la conjugación de moléculas de proteína que prolonga la circulación sanguínea de las proteínas con la reducción de la inmunogenicidad. Esto se debe a que ciertos grupos de anticuerpos, llamados Anti-PEG, en el sistema inmunológico reconocen y se unen a las moléculas de polietilenglicoles. Los anticuerpos anti-PEG no son tóxicos por naturaleza y no causan daño a los tejidos humanos.

Oportunidades

- Producción de polietilenglicol-400 para aplicaciones en gotas oftálmicas

El polietilenglicol-400 es un líquido transparente e incoloro derivado principalmente del petróleo que posee las características de un polietilenglicol de petróleo estándar. La vida útil de estas gotas oftálmicas es de un año si se almacenan en un lugar fresco y bien ventilado.

El polietilenglicol-400 es un compuesto de bajo peso molecular con menor toxicidad. Es muy hidrófilo, lo que lo hace útil en formulaciones de medicamentos. Su principal aplicación radica en una solución oftálmica, que generalmente se utiliza para el tratamiento del ardor, el malestar o la sequedad de los ojos. Existen varios nombres, como lágrimas en gel blink, lágrimas blink o lágrimas líquidas vision true, para las soluciones de gotas para los ojos que contienen el mismo compuesto.

RESTRICCIONES/ DESAFÍOS

- Problemas de estabilidad de la viscosidad en PEG

El polietilenglicol es un compuesto ampliamente utilizado en formulaciones farmacéuticas, incluidas todas las variedades de preparaciones para trastornos parenterales, tópicos, orales, rectales y oftálmicos. Los grados sólidos de polietilenglicol con la adición de polietilenglicol de grado líquido se pueden utilizar en ungüentos tópicos y como bases de ungüentos. Además, estos polietilenglicoles líquidos se utilizan como disolventes solubles en agua en cápsulas de gelatina blanda.

Sin embargo, la adsorción de humedad por parte del polietilenglicol de la gelatina puede a veces provocar el endurecimiento de la cubierta de la cápsula, lo que a su vez puede afectar a la salud del paciente que la consume.

Impacto posterior a la COVID-19 en el mercado del polietilenglicol en Oriente Medio y África

Después de la pandemia, la demanda de productos de polietilenglicol ha aumentado, ya que no habrá más restricciones de movimiento, por lo que el suministro de productos será fácil. Además, las empresas desarrollaron sus unidades de procesamiento para fabricar productos a base de polietilenglicol, y la demanda de polietilenglicol en las industrias de la belleza y la atención médica también ha aumentado, lo que puede impulsar el crecimiento del mercado.

La mayor demanda en el sector de la construcción permite a los fabricantes producir más productos nuevos, lo que en última instancia aumenta la demanda de polietilenglicol y ha ayudado a que el mercado crezca.

Además, la alta demanda en las industrias de la salud impulsará el crecimiento del mercado. Además, la demanda de polietilenglicol en las industrias de la salud después de la pandemia de COVID-19 ha aumentado debido a que existe una mayor conciencia sobre los beneficios para la salud y la alta demanda del sector de servicios de salud resultó en el crecimiento del mercado. Además, se espera que el interés de los consumidores en el nuevo polietilenglicol y el desarrollo de la investigación impulsen el crecimiento del mercado de polietilenglicol en Oriente Medio y África.

Acontecimientos recientes

- En mayo de 2022, EA Pharma Co., Ltd. anunció el lanzamiento de MOVICOL® HD, una nueva forma de dosificación que se agrega por primera vez en Japón al tratamiento del estreñimiento crónico con polietilenglicol. MOVICOL® HD es una formulación de dosis alta del "MOVICOL® LD" existente, el primer polietilenglicol indicado para el tratamiento del estreñimiento crónico.

- En octubre de 2021, Camber Consumer Care presentó cuatro nuevos productos de venta libre, incluido el polvo de polietilenglicol. La empresa ahora ofrece medicamentos de venta libre genéricos en una variedad de concentraciones y dosis para aliviar las alergias, el dolor y el tracto gastrointestinal, lo que beneficia a una amplia gama de pacientes.

Alcance del mercado de polietilenglicol en Oriente Medio y África

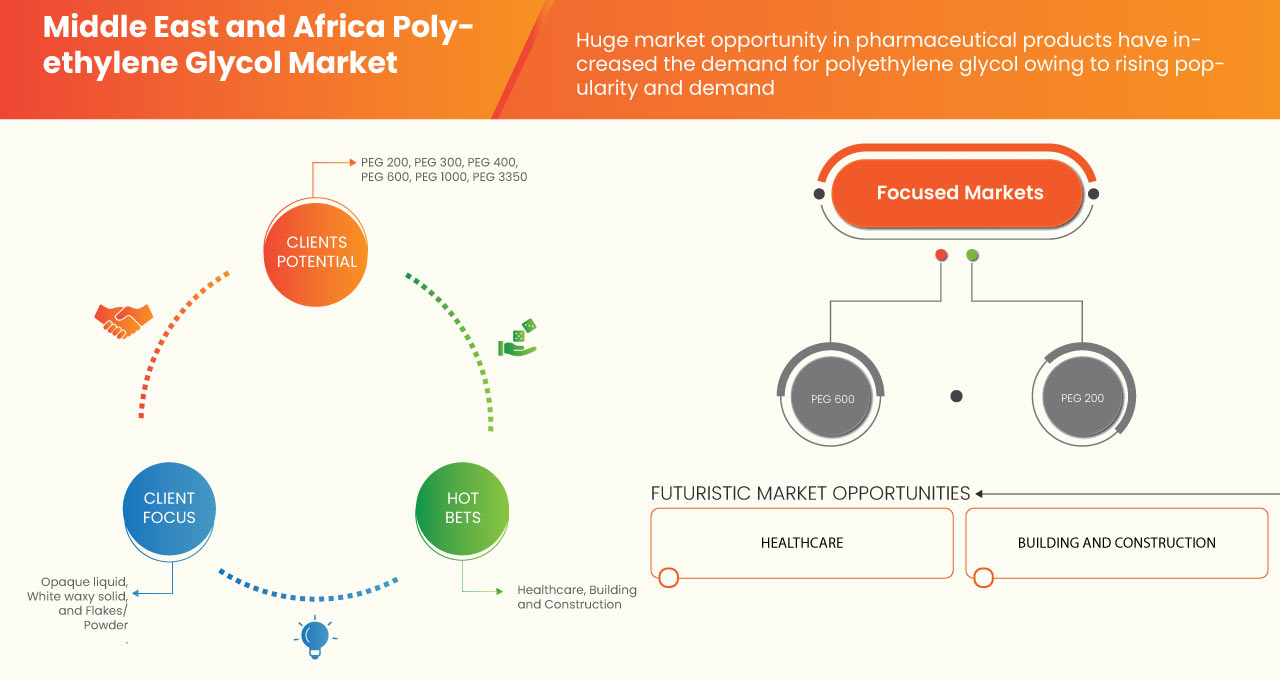

El mercado de polietilenglicol de Oriente Medio y África se clasifica en cuatro segmentos importantes: grado, forma, tamaño del envase y aplicación. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Calificación

- PEG 200

- PEG 300

- PEG 400

- PEG 600

- PEG 1000

- PEG3350

- PEG 4000

- PEG 6000

- PEG8000

- PEG 10000

- Pegamento de 20000 mm

Según el grado, el mercado está segmentado en PEG 200, PEG 300, PEG 400, PEG 600, PEG 1000, PEG 3350, PEG 4000, PEG 6000, PEG 8000, PEG 10000 y PEG 20000.

Forma

- Líquido opaco,

- Sólido ceroso blanco

- Copos/Polvo

Según la forma, el mercado está segmentado en líquido opaco, sólido ceroso blanco y copos/polvo.

Tamaño del embalaje

- Botellas de plástico

- Bolsas para tambores

En función del tamaño del envase, el mercado está segmentado en botellas y bidones de plástico.

Solicitud

- Cuidado de la salud

- Construcción y edificación

- Industrial

- Cosméticos/Cuidado Personal

- Otros

Sobre la base de la aplicación, el mercado está segmentado en atención médica, construcción y edificación, industrial, cosméticos/cuidado personal y otros.

Análisis y perspectivas regionales del mercado de polietilenglicol en Oriente Medio y África

Se analiza el mercado de polietilenglicol y se proporcionan información y tendencias del tamaño del mercado por país sobre grado, forma, tamaño del empaque, aplicación y se proporcionan información y tendencias del tamaño del mercado según lo mencionado anteriormente.

Los países cubiertos en el informe del mercado de polietilenglicol de Medio Oriente y África son Sudáfrica, Emiratos Árabes Unidos, Arabia Saudita, Egipto, Qatar, Omán, Kuwait, Bahréin, resto de Medio Oriente y África.

Arabia Saudita domina el mercado de polietilenglicol en Oriente Medio y África. El polietilenglicol y sus derivados tienen una amplia gama de aplicaciones en medicamentos, diagnósticos y dispositivos médicos, lo que es la principal razón del crecimiento del mercado de polietilenglicol en Arabia Saudita. Sin embargo, se espera que los problemas de estabilidad de la viscosidad del PEG restrinjan el crecimiento del mercado.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Puntos de datos como análisis de la cadena de valor aguas arriba y aguas abajo, tendencias técnicas y análisis de las cinco fuerzas de Porter, estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de Medio Oriente y África y sus desafíos afrontados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado del polietilenglicol en Oriente Medio y África

El panorama competitivo del mercado de polietilenglicol en Oriente Medio y África ofrece detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en Oriente Medio y África, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en el mercado de polietilenglicol.

Algunos de los principales actores que operan en el mercado de polietilenglicol de Oriente Medio y África son SABIC, Dow, BASF SE, Merck KGaA, INEOS, Croda International Plc, Clariant, India Glycols Limited, Pro Chem, Inc., GFS Chemicals, Inc, Liaoning Oxiranchem Inc., Liaoning Kelong Fine Chemical Co., Ltd., LOTTE Chemical Corporation, Hefei TNJ Chemical Industry Co., Ltd., Noah Chemicals y Mil-Spec Industries Corporation, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA POLYETHYLENE GLYCOL MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TREATMENT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES:

4.3 REGULATORY FRAMEWORK

4.4 IMPORT EXPORT SCENARIO

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 RAW MATERIAL COVERAGE – MIDDLE EAST & AFRICA POLYETHYLENE GLYCOL MARKET

4.7 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.8 VENDOR SELECTION CRITERIA

5 MIDDLE EAST & AFRICA POLYETHYLENE GLYCOL MARKET: PRICE INDEX

6 PRODUCTION CAPACITY

7 SUPPLY CHAIN ANALYSIS

7.1 OVERVIEW

7.2 LOGISTIC COST SCENARIO

7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 GROWING DEMAND FOR MEDICINES

8.1.2 HIGH DEMAND OF ICE-CREAMS

8.1.3 USAGE OF PEGLYCATION TECHNOLOGY IN BIOTECHNOLOGICAL AND PHARMACEUTICAL APPLICATIONS

8.1.4 HIGH DEMAND FOR WATER-BASED PAINTS

8.2 RESTRAINTS

8.2.1 VISCOSITY STABILITY ISSUES IN PEG

8.2.2 STRICT REGULATIONS IN THE PHARMACEUTICAL INDUSTRY

8.2.3 ENVIRONMENTAL REGULATIONS

8.2.4 HIGH DEMAND FOR SUBSTITUTES

8.3 OPPORTUNITIES

8.3.1 PRODUCTION OF POLYETHYLENE GLYCOL- 400 FOR EYE DROP APPLICATIONS

8.3.2 PRODUCTION OF PEG FOR SKIN THERAPY AND OINTMENT APPLICATIONS

8.3.3 USE OF POLYETHYLENE GLYCOL AS AN ADDITIVES TO IMPROVE THE PROPERTIES OF PAINT AND COATINGS

8.4 CHALLENGES

8.4.1 FLUCTUATING RAW MATERIAL PRICES

8.4.2 HIGH IMPORT TARIFFS AND REGULATIONS

8.4.3 IMMEDIATE ALLERGIC REACTIONS OF PEG

9 MIDDLE EAST & AFRICA POLYETHYLENE GLYCOL MARKET, BY GRADE

9.1 OVERVIEW

9.2 PEG 400

9.3 PEG 600

9.4 PEG 200

9.5 PEG 300

9.6 PEG 1000

9.7 PEG 3350

9.8 PEG 4000

9.9 PEG 8000

9.1 PEG 6000

9.11 PEG 10000

9.12 PEG 20000

10 MIDDLE EAST & AFRICA POLYETHYLENE GLYCOL MARKET, BY FORM

10.1 OVERVIEW

10.2 OPAQUE LIQUID

10.3 FLAKES/POWDER

10.4 WHITE WAXY SOLID

11 MIDDLE EAST & AFRICA POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE

11.1 OVERVIEW

11.2 DRUMS

11.3 PLASTIC BOTTLES

12 MIDDLE EAST & AFRICA POLYETHYLENE GLYCOL MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 HEALTHCARE

12.2.1 PHARMACEUTICALS

12.2.1.1 TABLETS

12.2.1.2 OINTMENTS

12.2.2 COLONOSCOPY

12.2.3 BARIUM ENEMA PREPARATION

12.3 INDUSTRIAL

12.4 COSMETICS/PERSONAL CARE

12.4.1 SKIN CREAM

12.4.2 TOOTHPASTE

12.4.3 PERSONAL LUBRICANTS

12.4.4 OTHERS

12.5 BUILDING AND CONSTRUCTION

12.5.1 PAINTS AND COATINGS

12.5.2 CERAMIC TILES

12.5.3 OTHERS

12.6 OTHERS

13 MIDDLE EAST & AFRICA POLYETHYLENE GLYCOL MARKET, BY REGION

13.1 MIDDLE EAST AND AFRICA

13.1.1 SAUDI ARABIA

13.1.2 EGYPT

13.1.3 SOUTH AFRICA

13.1.4 QATAR

13.1.5 UNITED ARAB EMIRATES

13.1.6 OMAN

13.1.7 KUWAIT

13.1.8 BAHRAIN

13.1.9 REST OF MIDDLE EAST AND AFRICA

14 COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 SABIC

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 MERCK KGAA

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 DOW

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 BASF SE

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 INEOS

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 LOTTE CHEMICAL CORPORATION

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 COMPANY SHARE ANALYSIS

16.6.4 PRODUCT PORTFOLIO

16.6.5 RECENT DEVELOPMENTS

16.7 HEFEI TNJ CHEMICAL INDUSTRY CO., LTD.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 CLARIANT

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENT

16.9 CRODA INTERNATIONAL PLC

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 GFS CHEMICALS, INC.

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 INDIA GLYCOLS LIMITED

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 LIAONING KELONG FINE CHEMICAL CO., LTD.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 LIAONING OXIRANCHEM INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 MIL-SPEC INDUSTRIES CORPORATION

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 NOAH CHEMICALS

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 PROCHEM, INC

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 MIDDLE EAST & AFRICA POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 3 MIDDLE EAST & AFRICA PEG 400 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA PEG 400 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 5 MIDDLE EAST & AFRICA PEG 600 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA PEG 600 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 7 MIDDLE EAST & AFRICA PEG 200 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA PEG 200 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 9 MIDDLE EAST & AFRICA PEG 300 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION

TABLE 10 MIDDLE EAST & AFRICA PEG 300 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 11 MIDDLE EAST & AFRICA PEG 1000 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA PEG 1000 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 13 MIDDLE EAST & AFRICA PEG 3350 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA PEG 3350 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 15 MIDDLE EAST & AFRICA PEG 4000 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA PEG 4000 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 17 MIDDLE EAST & AFRICA PEG 8000 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA PEG 8000 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 19 MIDDLE EAST & AFRICA PEG 6000 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA PEG 6000 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 21 MIDDLE EAST & AFRICA PEG 10000 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA PEG 10000 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 23 MIDDLE EAST & AFRICA PEG 20000 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA PEG 20000 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 25 MIDDLE EAST & AFRICA POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (TONS)

TABLE 27 MIDDLE EAST & AFRICA OPAQUE LIQUID IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA OPAQUE LIQUID IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 29 MIDDLE EAST & AFRICA FLAKES/POWDER IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA FLAKES/POWDER IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 31 MIDDLE EAST & AFRICA WHITE WAXY SOLID IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA WHITE WAXY SOLID IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 33 MIDDLE EAST & AFRICA POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (TONS)

TABLE 35 MIDDLE EAST & AFRICA DRUMS IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA DRUMS IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 37 MIDDLE EAST & AFRICA PLASTIC BOTTLES IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA PLASTIC BOTTLES IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 39 MIDDLE EAST & AFRICA POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 41 MIDDLE EAST & AFRICA HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 43 MIDDLE EAST & AFRICA HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 45 MIDDLE EAST & AFRICA PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (TONS)

TABLE 47 MIDDLE EAST & AFRICA INDUSTRIAL IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA INDUSTRIAL IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 49 MIDDLE EAST & AFRICA COSMETIC/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA COSMETIC/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 51 MIDDLE EAST & AFRICA COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 53 MIDDLE EAST & AFRICA BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 55 MIDDLE EAST & AFRICA BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 57 MIDDLE EAST & AFRICA OTHERS IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA OTHERS IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 59 MIDDLE EAST AND AFRICA POLYETHYLENE GLYCOL MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 60 MIDDLE EAST AND AFRICA POLYETHYLENE GLYCOL MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 61 MIDDLE EAST AND AFRICA POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 62 MIDDLE EAST AND AFRICA POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 63 MIDDLE EAST AND AFRICA POLYETHYLENE GLYCOL MARKET, BY GRADE ASP, 2021-2030 (USD/TON)

TABLE 64 MIDDLE EAST AND AFRICA POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 65 MIDDLE EAST AND AFRICA POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (TONS)

TABLE 66 MIDDLE EAST AND AFRICA POLYETHYLENE GLYCOL MARKET, BY FORM ASP, 2021-2030 (USD/TON)

TABLE 67 MIDDLE EAST AND AFRICA POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 68 MIDDLE EAST AND AFRICA POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (TONS)

TABLE 69 MIDDLE EAST AND AFRICA POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE ASP, 2021-2030 (USD/ TON)

TABLE 70 MIDDLE EAST AND AFRICA POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 71 MIDDLE EAST AND AFRICA POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 72 MIDDLE EAST AND AFRICA POLYETHYLENE GLYCOL MARKET, BY APPLICATION ASP, 2021-2030 (USD/TON)

TABLE 73 MIDDLE EAST AND AFRICA HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 74 MIDDLE EAST AND AFRICA HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 75 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 76 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (TONS)

TABLE 77 MIDDLE EAST AND AFRICA COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 78 MIDDLE EAST AND AFRICA COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 79 MIDDLE EAST AND AFRICA BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 80 MIDDLE EAST AND AFRICA BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 81 SAUDI ARABIA POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 82 SAUDI ARABIA POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 83 SAUDI ARABIA POLYETHYLENE GLYCOL MARKET, BY GRADE ASP, 2021-2030 (USD/TON)

TABLE 84 SAUDI ARABIA POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 85 SAUDI ARABIA POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (TONS)

TABLE 86 SAUDI ARABIA POLYETHYLENE GLYCOL MARKET, BY FORM ASP, 2021-2030 (USD/TON)

TABLE 87 SAUDI ARABIA POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 88 SAUDI ARABIA POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (TONS)

TABLE 89 SAUDI ARABIA POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE ASP, 2021-2030 (USD/ TON)

TABLE 90 SAUDI ARABIA POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 91 SAUDI ARABIA POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 92 SAUDI ARABIA POLYETHYLENE GLYCOL MARKET, BY APPLICATION ASP, 2021-2030 (USD/TON)

TABLE 93 SAUDI ARABIA HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 94 SAUDI ARABIA HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 95 SAUDI ARABIA PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 96 SAUDI ARABIA PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (TONS)

TABLE 97 SAUDI ARABIA COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 98 SAUDI ARABIA COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 99 SAUDI ARABIA BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 100 SAUDI ARABIA BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 101 EGYPT POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 102 EGYPT POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 103 EGYPT POLYETHYLENE GLYCOL MARKET, BY GRADE ASP, 2021-2030 (USD/TON)

TABLE 104 EGYPT POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 105 EGYPT POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (TONS)

TABLE 106 EGYPT POLYETHYLENE GLYCOL MARKET, BY FORM ASP, 2021-2030 (USD/TON)

TABLE 107 EGYPT POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 108 EGYPT POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (TONS)

TABLE 109 EGYPT POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE ASP, 2021-2030 (USD/ TON)

TABLE 110 EGYPT POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 111 EGYPT POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 112 EGYPT POLYETHYLENE GLYCOL MARKET, BY APPLICATION ASP, 2021-2030 (USD/TON)

TABLE 113 EGYPT HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 114 EGYPT HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 115 EGYPT PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 116 EGYPT PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (TONS)

TABLE 117 EGYPT COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 118 EGYPT COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 119 EGYPT BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 120 EGYPT BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 121 SOUTH AFRICA POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 122 SOUTH AFRICA POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 123 SOUTH AFRICA POLYETHYLENE GLYCOL MARKET, BY GRADE ASP, 2021-2030 (USD/TON)

TABLE 124 SOUTH AFRICA POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 125 SOUTH AFRICA POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (TONS)

TABLE 126 SOUTH AFRICA POLYETHYLENE GLYCOL MARKET, BY FORM ASP, 2021-2030 (USD/TON)

TABLE 127 SOUTH AFRICA POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 128 SOUTH AFRICA POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (TONS)

TABLE 129 SOUTH AFRICA POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE ASP, 2021-2030 (USD/ TON)

TABLE 130 SOUTH AFRICA POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 131 SOUTH AFRICA POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 132 SOUTH AFRICA POLYETHYLENE GLYCOL MARKET, BY APPLICATION ASP, 2021-2030 (USD/TON)

TABLE 133 SOUTH AFRICA HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 134 SOUTH AFRICA HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 135 SOUTH AFRICA PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 136 SOUTH AFRICA PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (TONS)

TABLE 137 SOUTH AFRICA COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 138 SOUTH AFRICA COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 139 SOUTH AFRICA BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 140 SOUTH AFRICA BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 141 QATAR POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 142 QATAR POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 143 QATAR POLYETHYLENE GLYCOL MARKET, BY GRADE ASP, 2021-2030 (USD/TON)

TABLE 144 QATAR POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 145 QATAR POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (TONS)

TABLE 146 QATAR POLYETHYLENE GLYCOL MARKET, BY FORM ASP, 2021-2030 (USD/TON)

TABLE 147 QATAR POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 148 QATAR POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (TONS)

TABLE 149 QATAR POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE ASP, 2021-2030 (USD/ TON)

TABLE 150 QATAR POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 151 QATAR POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 152 QATAR POLYETHYLENE GLYCOL MARKET, BY APPLICATION ASP, 2021-2030 (USD/TON)

TABLE 153 QATAR HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 154 QATAR HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 155 QATAR PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 156 QATAR PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (TONS)

TABLE 157 QATAR COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 158 QATAR COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 159 QATAR BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 160 QATAR BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 161 UNITED ARAB EMIRATES POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 162 UNITED ARAB EMIRATES POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 163 UNITED ARAB EMIRATES POLYETHYLENE GLYCOL MARKET, BY GRADE ASP, 2021-2030 (USD/TON)

TABLE 164 UNITED ARAB EMIRATES POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 165 UNITED ARAB EMIRATES POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (TONS)

TABLE 166 UNITED ARAB EMIRATES POLYETHYLENE GLYCOL MARKET, BY FORM ASP, 2021-2030 (USD/TON)

TABLE 167 UNITED ARAB EMIRATES POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 168 UNITED ARAB EMIRATES POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (TONS)

TABLE 169 UNITED ARAB EMIRATES POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE ASP, 2021-2030 (USD/ TON)

TABLE 170 UNITED ARAB EMIRATES POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 171 UNITED ARAB EMIRATES POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 172 UNITED ARAB EMIRATES POLYETHYLENE GLYCOL MARKET, BY APPLICATION ASP, 2021-2030 (USD/TON)

TABLE 173 UNITED ARAB EMIRATES HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 174 UNITED ARAB EMIRATES HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 175 UNITED ARAB EMIRATES PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 176 UNITED ARAB EMIRATES PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (TONS)

TABLE 177 UNITED ARAB EMIRATES COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 178 UNITED ARAB EMIRATES COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 179 UNITED ARAB EMIRATES BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 180 UNITED ARAB EMIRATES BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 181 OMAN POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 182 OMAN POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 183 OMAN POLYETHYLENE GLYCOL MARKET, BY GRADE ASP, 2021-2030 (USD/TON)

TABLE 184 OMAN POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 185 OMAN POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (TONS)

TABLE 186 OMAN POLYETHYLENE GLYCOL MARKET, BY FORM ASP, 2021-2030 (USD/TON)

TABLE 187 OMAN POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 188 OMAN POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (TONS)

TABLE 189 OMAN POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE ASP, 2021-2030 (USD/ TON)

TABLE 190 OMAN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 191 OMAN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 192 OMAN POLYETHYLENE GLYCOL MARKET, BY APPLICATION ASP, 2021-2030 (USD/TON)

TABLE 193 OMAN HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 194 OMAN HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 195 OMAN PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 196 OMAN PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (TONS)

TABLE 197 OMAN COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 198 OMAN COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 199 OMAN BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 200 OMAN BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 201 KUWAIT POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 202 KUWAIT POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 203 KUWAIT POLYETHYLENE GLYCOL MARKET, BY GRADE ASP, 2021-2030 (USD/TON)

TABLE 204 KUWAIT POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 205 KUWAIT POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (TONS)

TABLE 206 KUWAIT POLYETHYLENE GLYCOL MARKET, BY FORM ASP, 2021-2030 (USD/TON)

TABLE 207 KUWAIT POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 208 KUWAIT POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (TONS)

TABLE 209 KUWAIT POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE ASP, 2021-2030 (USD/ TON)

TABLE 210 KUWAIT POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 211 KUWAIT POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 212 KUWAIT POLYETHYLENE GLYCOL MARKET, BY APPLICATION ASP, 2021-2030 (USD/TON)

TABLE 213 KUWAIT HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 214 KUWAIT HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 215 KUWAIT PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 216 KUWAIT PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (TONS)

TABLE 217 KUWAIT COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 218 KUWAIT COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 219 KUWAIT BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 220 KUWAIT BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 221 BAHRAIN POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 222 BAHRAIN POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 223 BAHRAIN POLYETHYLENE GLYCOL MARKET, BY GRADE ASP, 2021-2030 (USD/TON)

TABLE 224 BAHRAIN POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 225 BAHRAIN POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (TONS)

TABLE 226 BAHRAIN POLYETHYLENE GLYCOL MARKET, BY FORM ASP, 2021-2030 (USD/TON)

TABLE 227 BAHRAIN POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 228 BAHRAIN POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (TONS)

TABLE 229 BAHRAIN POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE ASP, 2021-2030 (USD/ TON)

TABLE 230 BAHRAIN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 231 BAHRAIN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 232 BAHRAIN POLYETHYLENE GLYCOL MARKET, BY APPLICATION ASP, 2021-2030 (USD/TON)

TABLE 233 BAHRAIN HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 234 BAHRAIN HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 235 BAHRAIN PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 236 BAHRAIN PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (TONS)

TABLE 237 BAHRAIN COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 238 BAHRAIN COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 239 BAHRAIN BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 240 BAHRAIN BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 241 REST OF MIDDLE EAST AND AFRICA POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 242 REST OF MIDDLE EAST AND AFRICA POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 243 REST OF MIDDLE EAST AND AFRICA POLYETHYLENE GLYCOL MARKET, BY GRADE ASP, 2021-2030 (USD/TON)

Lista de figuras

FIGURE 1 MIDDLE EAST & AFRICA POLYETHYLENE GLYCOL MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA POLYETHYLENE GLYCOL MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA POLYETHYLENE GLYCOL MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA POLYETHYLENE GLYCOL MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA POLYETHYLENE GLYCOL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA POLYETHYLENE GLYCOL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA POLYETHYLENE GLYCOL MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA POLYETHYLENE GLYCOL MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 MIDDLE EAST & AFRICA POLYETHYLENE GLYCOL MARKET: SEGMENTATION

FIGURE 10 THE GROWTH IN CONSTRUCTION AND BUILDING INDUSTRIES AND RISING DEMAND FOR WATER-BASED PAINTS TO PROVIDE A HIGH QUALITY PROTECTIVE COATING IS DRIVING THE GROWTH OF THE MIDDLE EAST & AFRICA POLYETHYLENE GLYCOL MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 PEG 400 SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA POLYETHYLENE GLYCOL MARKET IN 2023- 2030

FIGURE 12 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA POLYETHYLENE GLYCOL MARKET

FIGURE 14 MIDDLE EAST & AFRICA POLYETHYLENE GLYCOL MARKET, BY GRADE, 2022

FIGURE 15 MIDDLE EAST & AFRICA POLYETHYLENE GLYCOL MARKET, BY FORM, 2022

FIGURE 16 MIDDLE EAST & AFRICA POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2022

FIGURE 17 MIDDLE EAST & AFRICA POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2022

FIGURE 18 MIDDLE EAST AND AFRICA POLYETHYLENE GLYCOL MARKET: SNAPSHOT (2022)

FIGURE 19 MIDDLE EAST AND AFRICA POLYETHYLENE GLYCOL MARKET: BY COUNTRY (2022)

FIGURE 20 MIDDLE EAST AND AFRICA POLYETHYLENE GLYCOL MARKET: BY COUNTRY (2023 & 2030)

FIGURE 21 MIDDLE EAST AND AFRICA POLYETHYLENE GLYCOL MARKET: BY COUNTRY (2022 & 2030)

FIGURE 22 MIDDLE EAST AND AFRICA POLYETHYLENE GLYCOL MARKET: BY GRADE (2023-2030)

FIGURE 23 MIDDLE EAST & AFRICA POLYETHYLENE GLYCOL MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.