Mercado de leches vegetales en Oriente Medio y África, por tipo ( leche de almendras , leche de coco, leche de anacardo, leche de nueces, leche de avellanas, leche de soja, leche de avena, leche de arroz, leche de lino y otras), tipo de producto (leche refrigerada y leche estable), categoría (orgánica y convencional), formulación (endulzada y sin endulzar), sabor (original/sin sabor, vainilla, chocolate, miel, mezcla de coco, mezcla de avellanas, caramelo, arce, café y otros), fortificación (regular y fortificada), naturaleza (OGM y no OGM), declaración (regular, sin gluten, sin frutos secos, sin soja, sin conservantes artificiales ni colorantes y otros), tamaño del envase (menos de 100 ml, 110 ml, 250 ml, 500 ml, 1000 ml y más de 1000 ml), tipo de envase (tetrapacks, botellas y latas) y canal de distribución (en tiendas) Minoristas y minoristas no basados en tiendas: tendencias de la industria y pronóstico hasta 2030.

Análisis y tamaño del mercado de leches vegetales en Oriente Medio y África

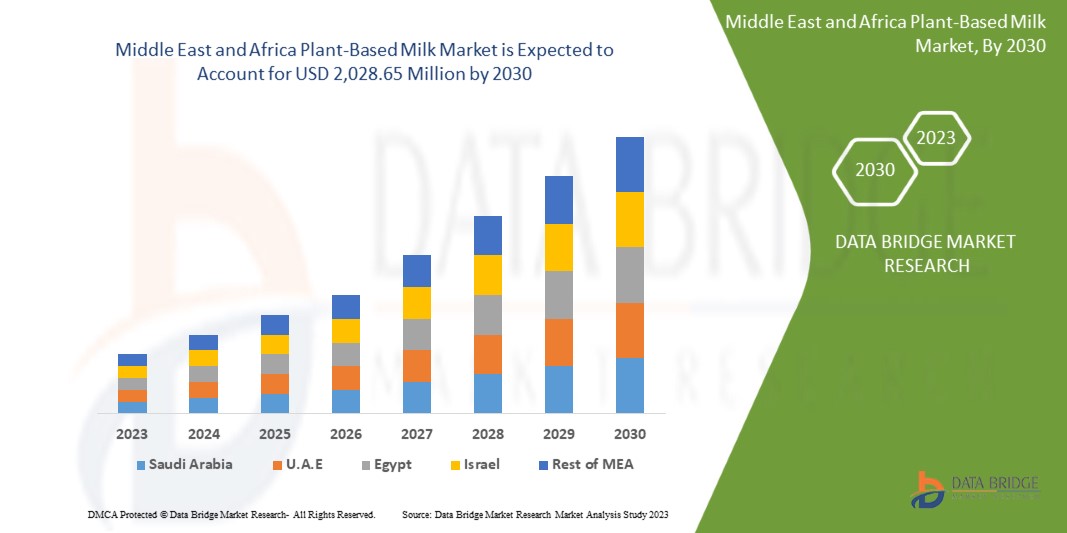

Se espera que el mercado de leches vegetales de Oriente Medio y África crezca significativamente en el período de pronóstico de 2023 a 2030. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 10,6% en el período de pronóstico de 2023 a 2030 y se espera que alcance los USD 2028,65 millones para 2030. El aumento de la población vegana en todo el mundo es el factor clave que impulsa la expansión del mercado de leches vegetales.

La disponibilidad de una gama más amplia de productos lácteos de origen vegetal está impulsando la expansión del mercado. Además, el mercado se ve influenciado aún más por un aumento en la población intolerante a la lactosa. Además, el aumento de las actividades de promoción y el marketing en las redes sociales para la leche de origen vegetal ha impulsado el mercado. Además de las expansiones, la I+D y la modernización de los productos de origen vegetal en el mercado han abierto más potencial comercial para la leche de origen vegetal.

El informe sobre el mercado de leches vegetales en Oriente Medio y África proporciona detalles sobre la participación de mercado, los nuevos desarrollos y el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un informe de analista. Nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2020 - 2015) |

|

Unidades cuantitativas |

Ingresos en millones de USD |

|

Segmentos cubiertos |

Por tipo (leche de almendras, leche de coco, leche de anacardo, leche de nueces, leche de avellanas, leche de soja, leche de avena, leche de arroz , leche de lino y otras), tipo de producto (leche refrigerada y leche estable), categoría (orgánica y convencional), formulación (endulzada y sin endulzar), sabor (original/sin sabor, vainilla, chocolate, miel, mezcla de coco, mezcla de avellanas, caramelo, arce, café y otros), fortificación (regular y fortificada), naturaleza (OGM y no OGM), declaración (regular, sin gluten, sin frutos secos, sin soja, sin conservantes artificiales ni colorantes y otros), tamaño del envase (menos de 100 ml, 110 ml, 250 ml, 500 ml, 1000 ml y más de 1000 ml), tipo de envase (tetrapacks, botellas y latas) y canal de distribución (minoristas en tiendas y minoristas fuera de tiendas) |

|

Países cubiertos |

Sudáfrica, Emiratos Árabes Unidos, Arabia Saudita, Kuwait y resto de Oriente Medio y África |

|

Actores del mercado cubiertos |

Silk, Alpro y THE HAIN CELESTIAL GROUP, INC., entre otros. |

Definición de mercado

La leche vegetal es una bebida hecha a partir de plantas que se parecen a la leche en apariencia. La leche vegetal es una bebida no láctea aromatizada y perfumada con extractos de plantas a base de agua. La leche vegetal se consume como una alternativa vegana a la leche de vaca. La leche vegetal tiene una textura cremosa en comparación con la leche de vaca. Para la producción de leche vegetal, se utilizan varias plantas. Entre las leches vegetales más populares a nivel mundial se encuentran la leche de almendras, avena, soja, coco y anacardo. Desde la antigüedad, la gente ha bebido bebidas elaboradas a partir de plantas.

Dinámica del mercado de leches vegetales en Oriente Medio y África

Conductor

- Aumento de la población vegana en todo el mundo

El mercado vegano ha aumentado exponencialmente en los últimos diez años, lo que ha hecho que cada año más personas recurran a dietas basadas en plantas. La mayor conciencia de la salud ha aumentado la demanda de alimentos naturales y orgánicos. Esto ha llevado a una gran parte de la población a cambiar drásticamente su estilo de vida y dieta. La comunidad vegana se concentra en comer alimentos que tienen ingredientes u otros componentes que provienen de plantas. El riesgo de varias enfermedades, como enfermedades cardíacas, diabetes tipo 2, hipertensión, ciertos tipos de cáncer y obesidad, se reduce con dietas veganas adecuadamente planificadas, según la Academia de Nutrición y Dietética. Como resultado, algunos de estos clientes vegetarianos o veganos han comenzado a prestar atención a la leche de origen vegetal en su dieta diaria.

Por lo tanto, el rápido crecimiento de la población vegana en todo el mundo y la adopción por parte de los consumidores de dietas vegetarianas o flexitarianas cada vez más veganas también aumentarán el mercado de alimentos y bebidas de origen vegetal. Esto, a su vez, también ayudará a impulsar el crecimiento del mercado de leches de origen vegetal en Oriente Medio y África.

Oportunidad

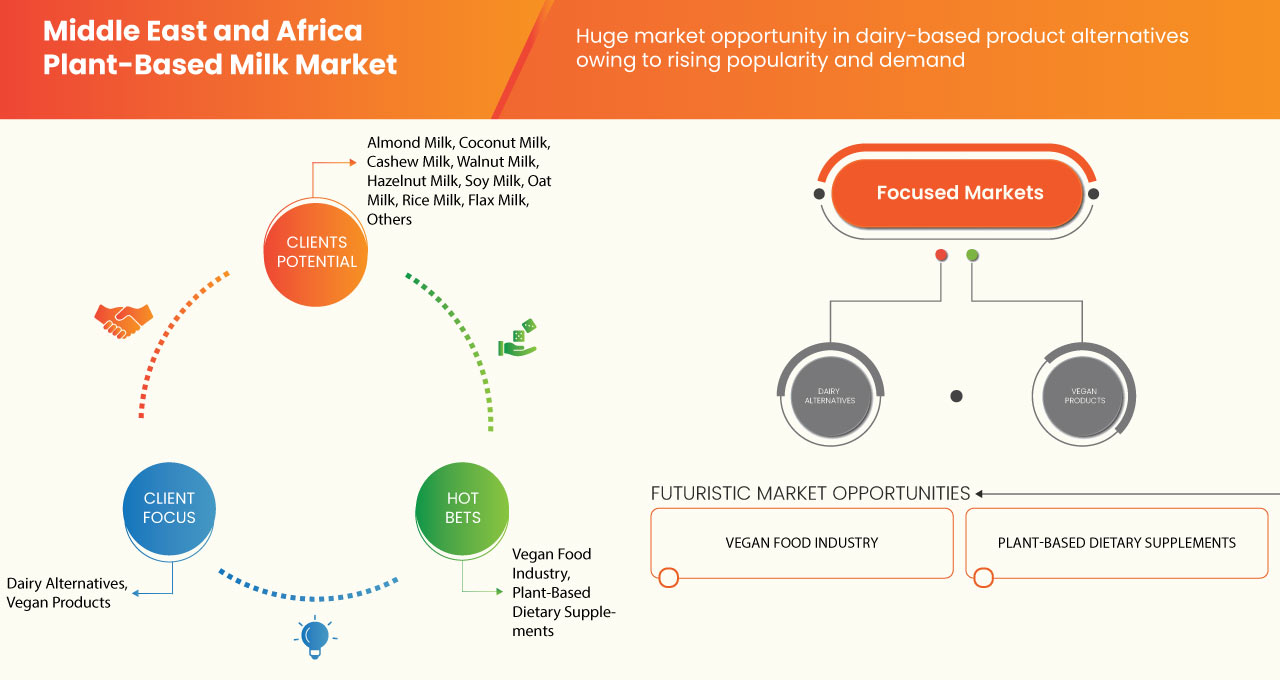

- Crecientes lanzamientos de nuevos productos y nuevas asociaciones, adquisiciones entre actores clave

Los consumidores, los fabricantes de alimentos y bebidas están adoptando diversas medidas y tomando decisiones estratégicas para hacer crecer sus negocios y hacer frente a la creciente demanda de alimentos de origen vegetal, como la leche vegetal. Desde lanzamientos de nuevos productos hasta inversiones y adquisiciones, los principales actores del mercado están evolucionando sus prácticas comerciales y ampliando sus carteras de productos.

Por lo tanto, estos avances generarán más oportunidades de crecimiento para el mercado de leches vegetales de Oriente Medio y África y atraerán cada vez a más consumidores al mercado de leches elaboradas a base de frutos secos.

Restricción/Desafío

- Aumentan las alergias a los frutos secos entre los consumidores

Las alergias a los frutos secos son un tipo de alergia alimentaria que puede provocar reacciones graves y potencialmente mortales, como la anafilaxia. Los distintos frutos secos son una causa bien definida de alergia alimentaria. Parece que existen diferencias en la frecuencia de la alergia a los frutos secos entre países debido a otros hábitos alimentarios y procedimientos de cocción. La alergia a los frutos secos es muy común, especialmente en niños y adultos, y esta población aumenta día a día. El crecimiento de las ventas ha ido disminuyendo desde que los consumidores son más conscientes de sus opciones de salud.

Además, los frutos secos y las semillas son algunos de los alimentos que provocan con mayor frecuencia reacciones alérgicas graves que pueden poner en peligro la vida. En Europa, las alergias a los frutos secos son comunes, siendo la alergia a las avellanas la más frecuente. Los anacardos son el segundo fruto seco más alérgico y un problema de salud importante en los EE. UU. Aparte de evitar los frutos secos y los alimentos que los contienen, no existe ningún tratamiento para las alergias a los frutos secos. Como resultado, esto ha afectado significativamente a la industria de los frutos secos y se prevé que continúe.

Impacto de la COVID-19 en el mercado de leches vegetales en Oriente Medio y África

Sin embargo, el mercado de leches vegetales en Oriente Medio y África se enfrenta a una tendencia al alza. El consumo de leches vegetales, como la leche de almendras, la leche de anacardos y la leche de avellanas, ha aumentado entre los consumidores. La razón de esta mayor demanda es la creciente conciencia de la salud entre los consumidores y, además, durante estos tiempos peligrosos, los consumidores han mostrado un gran interés en la conservación del medio ambiente.

Teniendo en cuenta las importantes caídas en numerosas industrias, el gobierno, los líderes empresariales y los consumidores deben trabajar juntos para derrotar al COVID-19. En esta situación, el impacto de la pandemia del COVID-19 en el mercado de la leche de origen vegetal en Oriente Medio y África es algo beneficioso. Los gobiernos de todo el mundo se adhieren estrictamente a las medidas generales de salud pública, que incluyen la sensibilización sobre la obesidad y los alimentos y bebidas con valor nutricional añadido. El conocimiento de los consumidores sobre la alta inmunidad se ha convertido en una preocupación legítima durante la pandemia. Los clientes hacen cada vez más compras más saludables en lugar de más sabrosas en términos de alimentos. En este escenario, la leche de origen vegetal mejoró en términos de uso entre los consumidores debido a sus beneficios. Otra razón para el florecimiento del mercado en la era de la pandemia es su versatilidad. Por ejemplo, en el mercado hay disponibles diferentes tipos de sabores, orígenes, formulaciones y fortificaciones. Además, en esta era pospandémica, la situación ha sido mejor debido al aumento de la demanda de los consumidores y al cambio hacia productos de origen vegetal en lugar de productos de origen animal.

Acontecimientos recientes

- En enero de 2023, Reitan, un importante minorista de la región nórdica y báltica, y Oatly Inc. anunciaron recientemente la ampliación de su relación. Reitan posee y opera alrededor de 300 tiendas de conveniencia Pressbyrn y 90 7-Eleven en toda Suecia. Esta asociación ayudará a la empresa a impulsar su negocio y atraer una nueva base de consumidores.

- En 2021, Silk anunció el lanzamiento de su nuevo producto, Silk Oat. Este lanzamiento le ha dado a la empresa una cartera más amplia y ha atraído a una base de consumidores más amplia.

Alcance del mercado de leches vegetales en Oriente Medio y África

El mercado de leches vegetales de Oriente Medio y África está segmentado en once segmentos notables según el tipo, el tipo de producto, la categoría, la formulación, el sabor, la fortificación, la naturaleza, la afirmación, el tamaño del envase, el tipo de envase y el canal de distribución. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y proporcionará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

POR TIPO

- Leche de avena

- Leche de soja

- Leche de almendras

- Leche de coco

- Leche de arroz

- Leche de anacardo

- Leche de nueces

- Leche de avellanas

- Leche de lino

- Otros

Según el tipo, el mercado de leche vegetal de Oriente Medio y África está segmentado en leche de almendras, leche de coco, leche de anacardo, leche de nueces, leche de avellanas, leche de soja, leche de avena, leche de arroz, leche de lino y otras.

POR TIPO DE PRODUCTO

- Leche refrigerada

- Leche estable

Según el tipo de producto, el mercado de leche vegetal de Oriente Medio y África está segmentado en leche refrigerada y leche estable.

POR CATEGORÍA

- Convencional

- Orgánico

Según la categoría, el mercado de leche vegetal de Oriente Medio y África está segmentado en orgánico y convencional.

POR FORMULACIÓN

- Sin azúcar

- Endulzado

Sobre la base de la formulación, el mercado de leches vegetales de Oriente Medio y África está segmentado en endulzadas y sin endulzar.

POR SABOR

- Original/Sin sabor

- Vainilla

- Chocolate

- Coffee

- Coconut Blend

- Caramel

- Honey

- Hazelnut Blend

- Maple

- Others

On the basis of flavor, the Middle East and Africa plant-based milk market is segmented into original/unflavored, vanilla, chocolate, honey, coconut blend, hazelnut blend, caramel, maple, coffee, and others.

BY FORTIFICATION

- Regular

- Fortified

On the basis of fortification, the Middle East and Africa plant-based milk market is segmented into regular and fortified.

BY NATURE

- Non-GMO

- GMO

On the basis of nature, the Middle East and Africa plant-based milk market is segmented into GMO and non-GMO.

BY CLAIM

- Regular

- Gluten Free

- Artificial Preservatives & Color Free

- Soy Free

- Nut Free

- Others

On the basis of claim, the Middle East and Africa plant-based milk market is segmented into regular, gluten free, nut free, soy free, artificial preservatives, color free, and others.

BY PACKAGING SIZE

- 1000 ML

- 250 ML

- 500 ML

- 110 ML

- More Than 1000 ML

- Less Than 100 ML

On the basis of packaging size, the Middle East and Africa plant-based milk market is segmented into less than 100 ml, 110 ml, 250 ml, 500 ml, 1000 ml, and more than 1000 ml.

BY PACKAGING TYPE

- Tetra Packs

- Bottles

- Can

On the basis of packaging type, the Middle East and Africa plant-based milk market is segmented into tetra packs, bottles, and can.

BY DISTRIBUTION CHANNEL

- Non-Store Retailers

- Store Based Retailers

On the basis of distribution channel, the Middle East and Africa plant-based milk market is segmented into store based retailers and non-store based retailers.

Middle East and Africa Plant-Based Milk Market Regional Analysis/Insights

The Middle East and Africa plant-based milk market is segmented on the basis of type, product type, category, formulation, flavor, fortification, nature, claim, packaging size, packaging type, and distribution channel.

Some countries in the Middle East and Africa plant-based milk market are South Africa, Saudi Arabia, United Arab Emirates, Kuwait, and the Rest of the Middle East and Africa.

The United Arab Emirates is expected to dominate the Middle East and Africa plant-based milk market with a CAGR of around 11.3%. The availability of a wide range of plant-based milk with different characteristics in the United Arab Emirates is a factor promoting the growth of the plant-based milk market.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and African brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa Plant-Based Milk Market Share Analysis

El panorama competitivo del mercado de leches vegetales de Oriente Medio y África ofrece detalles por competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de supervivencia de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de leches vegetales de Oriente Medio y África.

Algunos de los participantes destacados que operan en el mercado de leche vegetal de Medio Oriente y África son Silk, Alpro y THE HAIN CELESTIAL GROUP, INC., entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TREATMENT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SUPPLY CHAIN OF MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET

4.1.1 RAW MATERIAL PROCUREMENT

4.1.2 PROCESSING

4.1.3 MANUFACTURING

4.1.4 MARKETING AND DISTRIBUTION

4.1.5 END USERS

4.2 BRAND COMPARATIVE ANALYSIS

4.3 CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

4.3.1 OVERVIEW

4.3.1.1 SOCIAL FACTORS

4.3.1.2 CULTURAL FACTORS

4.3.1.3 PSYCHOLOGICAL FACTORS

4.3.1.4 PERSONAL FACTORS

4.3.1.5 ECONOMIC FACTORS

4.3.2 PRODUCT TRAITS

4.3.2.1 MARKET ATTRIBUTES

4.3.2.2 CONSUMERS' DISPOSABLE INCOME/SPEND DYNAMICS

4.4 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.4.1 RISING ADOPTION OF ADVANCED TECHNOLOGIES IN THE PLANT-BASED MILK INDUSTRY

4.4.2 CERTIFICATIONS AND LABELLING CLAIMS AMONG MANUFACTURERS

4.4.3 BUSINESS EXPANSIONS THROUGH DIFFERENT STRATEGIC DECISIONS

4.5 NEW PRODUCT LAUNCH STRATEGY

4.5.1 OVERVIEW

4.5.1.1 LINE EXTENSION

4.5.1.2 NEW PACKAGING

4.5.1.3 RELAUNCHED

4.5.1.4 NEW FORMULATION

4.6 CONSUMER LEVEL TRENDS AND MEETING CONSUMERS' REQUIREMENTS

4.6.1 GROWING CONSUMERS' INTEREST IN PLANT-BASED DIETS

4.6.2 LACTOSE INTOLERANCE

4.6.3 VARIETY OF FLAVORS

4.7 FACTORS INFLUENCING PURCHASE DECISION

4.7.1 LARGE PRODUCT RANGE

4.7.2 PRODUCT PRICING

4.7.3 AUTHENTICITY OF PRODUCT

4.8 SHOPPING BEHAVIOR AND DYNAMICS

4.8.1 RECOMMENDATIONS FROM FAMILY AND FRIENDS

4.8.2 RESEARCH

4.8.3 IMPULSIVE

4.8.4 ADVERTISEMENT

4.8.5 TELEVISION ADVERTISEMENT

4.8.5.1 ONLINE ADVERTISEMENT

4.8.5.2 IN-STORE ADVERTISEMENT

4.8.5.3 OUTDOOR ADVERTISEMENT

4.9 PRIVATE LABEL VS BRAND LABEL

4.1 PROMOTIONAL ACTIVITIES

5 REGULATIONS, CERTIFICATIONS, AND LABELING CLAIMS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASE IN VEGAN POPULATION AROUND THE GLOBE

6.1.2 INCREASE IN LACTOSE INTOLERANT POPULATION

6.1.3 RISE IN PROMOTIONAL ACTIVITIES AND SOCIAL MEDIA MARKETING

6.1.4 AVAILABILITY AND ACCESSIBILITY OF A WIDER RANGE OF PLANT-BASED MILK PRODUCTS

6.2 RESTRAINTS

6.2.1 HIGH PRICE OF PLANT-BASED MILK IN COMPARISON TO DAIRY-BASED MILK

6.2.2 TASTE AND TEXTURE ISSUES ASSOCIATED WITH PLANT-BASED MILK

6.2.3 FLUCTUATING RAW MATERIAL PRICES

6.3 OPPORTUNITIES

6.3.1 RISING AWARENESS REGARDING ENVIRONMENTAL CONCERNS IS FUELING THE MARKET GROWTH

6.3.2 GROWING NEW PRODUCT LAUNCHES AND NEW PARTNERSHIPS, ACQUISITION AMONG KEY PLAYERS

6.3.3 INCREASED DEMAND FOR FORTIFIED BEVERAGES IN THE MARKET

6.4 CHALLENGES

6.4.1 RISE IN NUT ALLERGIES AMONG CONSUMERS

6.4.2 STRINGENT GOVERNMENT REGULATIONS

6.4.3 RISE IN THE NUMBER OF PLANT-BASED MILK PRODUCERS IN THE MARKET

7 IMPACT OF COVID-19

7.1 CONSUMERS WITH CARDIOVASCULAR DISEASE AND OBESITY AT HIGH RISK OF COVID-19

7.2 INCREASED DEMAND FOR SPECIFIC FOOD PRODUCTS FOR VEGAN DIETS

7.3 IMPACT ON DEMAND

7.4 IMPACT ON SUPPLY

7.5 CONCLUSION

8 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY TYPE

8.1 OVERVIEW

8.2 OAT MILK

8.2.1 OAT MILK, BY FORMULATION

8.2.1.1 UNSWEETENED

8.2.1.2 SWEETENED

8.3 SOY MILK

8.3.1 SOY MILK, BY FORMULATION

8.3.1.1 UNSWEETENED

8.3.1.2 SWEETENED

8.4 ALMOND MILK

8.4.1 ALOMIN MILK, BY FORMULATION

8.4.1.1 UNSWEETENED

8.4.1.2 SWEETENED

8.5 COCONUT MILK

8.5.1 COCONUT MILK, BY FORMULATION

8.5.1.1 UNSWEETENED

8.5.1.2 SWEETENED

8.6 RICE MILK

8.6.1 RICE MILK, BY FORMULATION

8.6.1.1 UNSWEETENED

8.6.1.2 SWEETENED

8.7 CASHEW NUT MILK

8.7.1 CASHEW MILK, BY FORMULATION

8.7.1.1 UNSWEETENED

8.7.1.2 SWEETENED

8.8 WALNUT MILK

8.8.1 WALNUT MILK, BY FORMULATION

8.8.1.1 UNSWEETENED

8.8.1.2 SWEETENED

8.9 HAZELNUT MILK

8.9.1 HAZELNUT MILK, BY FORMULATION

8.9.1.1 UNSWEETENED

8.9.1.2 SWEETENED

8.1 FLAX MILK

8.10.1 FLAX MILK, BY FORMULATION

8.10.1.1 UNSWEETENED

8.10.1.2 SWEETENED

8.11 OTHERS

8.11.1 OTHERS, BY FORMULATION

8.11.1.1 UNSWEETENED

8.11.1.2 SWEETENED

9 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 REFRIGERATED MILK

9.3 SHELF STABLE MILK

10 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY FORMULATION

10.1 OVERVIEW

10.2 UNSWEETENED

10.3 SWEETENED

11 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY CATEGORY

11.1 OVERVIEW

11.2 CONVENTIONAL

11.3 ORGANIC

12 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY FLAVOR

12.1 OVERVIEW

12.2 ORIGINAL/UNFLAVORED

12.2.1 ORIGINAL/UNFLAVORED, BY MILK TYPE

12.2.1.1 ALMOND MILK

12.2.1.2 OAT MILK

12.2.1.3 SOY MILK

12.2.1.4 COCONUT MILK

12.2.1.5 RICE MILK

12.2.1.6 CASHEW NUT MILK

12.2.1.7 FLAX MILK

12.2.1.8 WALNUT MILK

12.2.1.9 HAZELNUT MILK

12.2.1.10 OTHERS

12.3 VANILLA

12.3.1 VANILLA, BY MILK TYPE

12.3.1.1 ALMOND MILK

12.3.1.2 OAT MILK

12.3.1.3 SOY MILK

12.3.1.4 COCONUT MILK

12.3.1.5 RICE MILK

12.3.1.6 CASHEW NUT MILK

12.3.1.7 FLAX MILK

12.3.1.8 WALNUT MILK

12.3.1.9 HAZELNUT MILK

12.3.1.10 OTHERS

12.4 CHOCOLATE

12.4.1 CHOCOLATE, BY MILK TYPE

12.4.1.1 ALMOND MILK

12.4.1.2 OAT MILK

12.4.1.3 SOY MILK

12.4.1.4 COCONUT MILK

12.4.1.5 RICE MILK

12.4.1.6 CASHEW NUT MILK

12.4.1.7 FLAX MILK

12.4.1.8 WALNUT MILK

12.4.1.9 HAZELNUT MILK

12.4.1.10 OTHERS

12.5 COFFEE

12.5.1 COFFEE, BY MILK TYPE

12.5.1.1 ALMOND MILK

12.5.1.2 OAT MILK

12.5.1.3 SOY MILK

12.5.1.4 COCONUT MILK

12.5.1.5 RICE MILK

12.5.1.6 CASHEW NUT MILK

12.5.1.7 FLAX MILK

12.5.1.8 WALNUT MILK

12.5.1.9 HAZELNUT MILK

12.5.1.10 OTHERS

12.6 COCONUT BLEND

12.6.1 COCONUT BLEND, BY MILK TYPE

12.6.1.1 ALMOND MILK

12.6.1.2 OAT MILK

12.6.1.3 SOY MILK

12.6.1.4 COCONUT MILK

12.6.1.5 RICE MILK

12.6.1.6 CASHEW NUT MILK

12.6.1.7 FLAX MILK

12.6.1.8 WALNUT MILK

12.6.1.9 HAZELNUT MILK

12.6.1.10 OTHERS

12.7 CARAMEL

12.7.1 CARAMEL, BY MILK TYPE

12.7.1.1 ALMOND MILK

12.7.1.2 OAT MILK

12.7.1.3 SOY MILK

12.7.1.4 COCONUT MILK

12.7.1.5 RICE MILK

12.7.1.6 CASHEW NUT MILK

12.7.1.7 FLAX MILK

12.7.1.8 WALNUT MILK

12.7.1.9 HAZELNUT MILK

12.7.1.10 OTHERS

12.8 HONEY

12.8.1 HONEY, BY MILK TYPE

12.8.1.1 ALMOND MILK

12.8.1.2 OAT MILK

12.8.1.3 SOY MILK

12.8.1.4 COCONUT MILK

12.8.1.5 RICE MILK

12.8.1.6 CASHEW NUT MILK

12.8.1.7 FLAX MILK

12.8.1.8 WALNUT MILK

12.8.1.9 HAZELNUT MILK

12.8.1.10 OTHERS

12.9 HAZELNUT BLEND

12.9.1 HAZELNUT BLEND, BY MILK TYPE

12.9.1.1 ALMOND MILK

12.9.1.2 OAT MILK

12.9.1.3 SOY MILK

12.9.1.4 COCONUT MILK

12.9.1.5 RICE MILK

12.9.1.6 CASHEW NUT MILK

12.9.1.7 FLAX MILK

12.9.1.8 WALNUT MILK

12.9.1.9 HAZELNUT MILK

12.9.1.10 OTHERS

12.1 MAPLE

12.10.1 MAMPLE, BY MILK TYPE

12.10.1.1 ALMOND MILK

12.10.1.2 OAT MILK

12.10.1.3 SOY MILK

12.10.1.4 COCONUT MILK

12.10.1.5 RICE MILK

12.10.1.6 CASHEW NUT MILK

12.10.1.7 FLAX MILK

12.10.1.8 WALNUT MILK

12.10.1.9 HAZELNUT MILK

12.10.1.10 OTHERS

12.11 OTHERS

12.11.1 OTHERS, BY MILK TYPE

12.11.1.1 ALMOND MILK

12.11.1.2 OAT MILK

12.11.1.3 SOY MILK

12.11.1.4 COCONUT MILK

12.11.1.5 RICE MILK

12.11.1.6 CASHEW NUT MILK

12.11.1.7 FLAX MILK

12.11.1.8 WALNUT MILK

12.11.1.9 HAZELNUT MILK

12.11.1.10 OTHERS

13 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY FORTIFICATION

13.1 OVERVIEW

13.2 REGULAR

13.3 FORTIFIED

14 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY NATURE

14.1 OVERVIEW

14.2 NON-GMO

14.3 GMO

15 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY CLAIM

15.1 OVERVIEW

15.2 REGULAR

15.3 GLUTEN FREE

15.4 ARTIFICIAL PRESERVATIVES & COLOR FREE

15.5 SOY FREE

15.6 NUT FREE

15.7 OTHERS

16 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY PACKAGING SIZE

16.1 OVERVIEW

16.2 1000 ML

16.3 250 ML

16.4 500 ML

16.5 110 ML

16.6 MORE THAN 1000 ML

16.7 LESS THAN 100 ML

17 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY PACKAGING TYPE

17.1 OVERVIEW

17.2 TETRA PACKS

17.2.1 GLASS

17.2.2 PLASTICS

17.2.3 OTHERS

17.3 BOTTLES

17.4 CAN

18 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL

18.1 OVERVIEW

18.2 NON-STORE RETAILERS

18.2.1 ONLINE RETAILERS

18.2.2 COMPANY WEBSITES

18.2.3 VENDING

18.3 STORE BASED RETAILERS

18.3.1 SUPERMARKETS/HYPERMARKETS

18.3.2 CONVENIENCE STORES

18.3.3 GROCERY STORES

18.3.4 SPECIALTY STORES

18.3.5 OTHERS

19 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY REGION

19.1 MIDDLE EAST & AFRICA

19.1.1 UAE

19.1.2 SAUDI ARABIA

19.1.3 KUWAIT

19.1.4 SOUTH AFRICA

19.1.5 REST OF MIDDLE EAST & AFRICA

20 COMPANY LANDSCAPE

20.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

21 SWOT ANALYSIS

22 COMPANY PROFILES

22.1 ALPRO

22.1.1 COMPANY SNAPSHOT

22.1.2 COMPANY SHARE ANALYSIS

22.1.3 PRODUCT PORTFOLIO

22.1.4 RECENT DEVELOPMENTS

22.2 OATLY INC

22.2.1 COMPANY SNAPSHOT

22.2.2 REVENUE ANALYSIS

22.2.3 COMPANY SHARE ANALYSIS

22.2.4 PRODUCT PORTFOLIO

22.2.5 RECENT DEVELOPMENTS

22.3 THE HAIN CELESTIAL GROUP, INC.

22.3.1 COMPANY SNAPSHOT

22.3.2 REVENUE ANALYSIS

22.3.3 COMPANY SHARE ANALYSIS

22.3.4 PRODUCT PORTFOLIO

22.3.5 RECENT DEVELOPMENT

22.4 SANITARIUM

22.4.1 COMPANY SNAPSHOT

22.4.2 COMPANY SHARE ANALYSIS

22.4.3 PRODUCT PORTFOLIO

22.4.4 RECENT DEVELOPMENT

22.5 CALIFIA FARMS, LLC

22.5.1 COMPANY SNAPSHOT

22.5.2 COMPANY SHARE ANALYSIS

22.5.3 PRODUCT PORTFOLIO

22.5.4 RECENT DEVELOPMENTS

22.6 AUSTRALIA'S OWN

22.6.1 COMPANY SNAPSHOT

22.6.2 PRODUCT PORTFOLIO

22.6.3 RECENT DEVELOPMENTS

22.7 ELMHURST MILKED DIRECT LLC

22.7.1 COMPANY SNAPSHOT

22.7.2 PRODUCT PORTFOLIO

22.7.3 RECENT DEVELOPMENTS

22.8 HERSHEY INDIA PRIVATE LIMITED

22.8.1 COMPANY SNAPSHOT

22.8.2 PRODUCT PORTFOLIO

22.8.3 RECENT DEVELOPMENT

22.9 HP HOOD LLC.

22.9.1 COMPANY SNAPSHOT

22.9.2 PRODUCT PORTFOLIO

22.9.3 RECENT DEVELOPMENT

22.1 LIFE HEALTH FOODS

22.10.1 COMPANY SNAPSHOT

22.10.2 PRODUCT PORTFOLIO

22.10.3 RECENT DEVELOPMENT

22.11 MANITOBA MILLING COMPANY

22.11.1 COMPANY SNAPSHOT

22.11.2 PRODUCT PORTFOLIO

22.11.3 RECENT DEVELOPMENTS

22.12 NATUR-A

22.12.1 COMPANY SNAPSHOT

22.12.2 PRODUCT PORTFOLIO

22.12.3 RECENT DEVELOPMENTS

22.13 NOTCO

22.13.1 COMPANY SNAPSHOT

22.13.2 PRODUCT PORTFOLIO

22.13.3 RECENT DEVELOPMENT

22.14 NUTRISSLIM

22.14.1 COMPANY SNAPSHOT

22.14.2 PRODUCT PORTFOLIO

22.14.3 RECENT DEVELOPMENTS

22.15 PLENISH

22.15.1 COMPANY SNAPSHOT

22.15.2 PRODUCT PORTFOLIO

22.15.3 RECENT DEVELOPMENTS

22.16 PROVAMEL ORGANIC-BIO

22.16.1 COMPANY SNAPSHOT

22.16.2 PRODUCT PORTFOLIO

22.16.3 RECENT DEVELOPMENT

22.17 RUDE HEALTH

22.17.1 COMPANY SNAPSHOT

22.17.2 PRODUCT PORTFOLIO

22.17.3 RECENT DEVELOPMENTS

22.18 SILK

22.18.1 COMPANY SNAPSHOT

22.18.2 PRODUCT PORTFOLIO

22.18.3 RECENT DEVELOPMENTS

22.19 SIMPLE FOODS

22.19.1 COMPANY SNAPSHOT

22.19.2 PRODUCT PORTFOLIO

22.19.3 RECENT DEVELOPMENT

22.2 SUNOPTA GRAINS AND FOODS INC.

22.20.1 COMPANY SNAPSHOT

22.20.2 PRODUCT PORTFOLIO

22.20.3 RECENT DEVELOPMENTS

22.21 VALSOIA S.P.A

22.21.1 COMPANY SNAPSHOT

22.21.2 REVENUE ANALYSIS

22.21.3 PRODUCT PORTFOLIO

22.21.4 RECENT DEVELOPMENT

22.22 YEO HIAP SENG LTD.

22.22.1 COMPANY SNAPSHOT

22.22.2 REVENUE ANALYSIS

22.22.3 PRODUCT PORTFOLIO

22.22.4 RECENT DEVELOPMENT

23 QUESTIONNAIRE

24 RELATED REPORTS

Lista de Tablas

TABLE 1 BRAND COMPARATIVE ANALYSIS

TABLE 2 LACTOSE INTOLERANT POPULATION IN THE YEAR 2023

TABLE 3 TEN COUNTRIES WITH THE HIGHEST PREVALENCE OF LACTOSE INTOLERANCE

TABLE 4 PRICES FOR PLANT-BASED MILK

TABLE 5 PRICES FOR ANIMAL MILK

TABLE 6 SOYBEAN PRICES OVER THE YEARS (2019-2023)

TABLE 7 OAT PRICES OVER THE YEARS (2019-2023)

TABLE 8 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA OAT MILK IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA OAT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA SOY MILK IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA SOY MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA ALMOND MILK IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA ALMOND MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA COCONUT MILK IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA COCONUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA RICE MILK IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA RICE MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA CASHEW NUT MILK IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA CASHEW NUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA WALNUT MILK IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA WALNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA FLAX MILK IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA FLAX MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA OTHERS IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA OTHERS IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA REFRIGERATED MILK IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA SHELF STABLE MILK IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA UNSWEETENED IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA SWEETENED IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA CONVENTIONAL IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA ORGANIC IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY FLAVOR, 2021-2030 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA ORIGINAL/UNFLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA VANILLA IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA CHOCOLATE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA COFFEE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA COCONUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA CARAMEL IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA HONEY IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA HAZELNUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA MAPLE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA OTHERS IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY FORTIFICATION, 2021-2030 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA REGULAR IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 51 MIDDLE EAST & AFRICA FORTIFIED IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY NATURE, 2021-2030 (USD MILLION)

TABLE 53 MIDDLE EAST & AFRICA NON-GMO IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA GMO IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 55 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY CLAIM, 2021-2030 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA REGULAR IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 57 MIDDLE EAST & AFRICA GLUTEN FREE IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA ARTIFICIAL PRESERVATIVES & COLOR FREE IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 59 MIDDLE EAST & AFRICA SOY FREE IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA NUT FREE IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 61 MIDDLE EAST & AFRICA OTHERS IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 62 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 63 MIDDLE EAST & AFRICA 1000 ML IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 64 MIDDLE EAST & AFRICA 250 ML IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 65 MIDDLE EAST & AFRICA 500 ML IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 66 MIDDLE EAST & AFRICA 110 ML IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 67 MIDDLE EAST & AFRICA MORE THAN 1000 ML IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 68 MIDDLE EAST & AFRICA LESS THAN 100 ML IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 69 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 70 MIDDLE EAST & AFRICA TETRA PACKS IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 71 MIDDLE EAST & AFRICA BOTTLES PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 72 MIDDLE EAST & AFRICA BOTTLES IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 73 MIDDLE EAST & AFRICA CAN IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 74 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 75 MIDDLE EAST & AFRICA NON-STORE RETAILERS IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 76 MIDDLE EAST & AFRICA NON-STORE RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 77 MIDDLE EAST & AFRICA STORE BASED RETAILERS IN PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 78 MIDDLE EAST & AFRICA STORE BASED RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 79 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 80 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 MIDDLE EAST & AFRICA ALMOND MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 82 MIDDLE EAST & AFRICA OAT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 83 MIDDLE EAST & AFRICA SOY NUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 84 MIDDLE EAST & AFRICA COCONUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 85 MIDDLE EAST & AFRICA CASHEW NUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 86 MIDDLE EAST & AFRICA WALNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 87 MIDDLE EAST & AFRICA HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 88 MIDDLE EAST & AFRICA RICE MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 89 MIDDLE EAST & AFRICA FLAX MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 90 MIDDLE EAST & AFRICA OTHERS IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 91 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 92 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 93 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 94 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY FLAVOR, 2021-2030 (USD MILLION)

TABLE 95 MIDDLE EAST & AFRICA ORIGINAL/UNFLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 96 MIDDLE EAST & AFRICA VANILLA IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 MIDDLE EAST & AFRICA CHOCOLATE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 MIDDLE EAST & AFRICA COFFEE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 MIDDLE EAST & AFRICA COCONUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 MIDDLE EAST & AFRICA CARAMEL IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 101 MIDDLE EAST & AFRICA HONEY IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 102 MIDDLE EAST & AFRICA HAZELNUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 103 MIDDLE EAST & AFRICA MAPLE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 104 MIDDLE EAST & AFRICA OTHERS IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 105 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY FORTIFICATION, 2021-2030 (USD MILLION)

TABLE 106 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY NATURE, 2021-2030 (USD MILLION)

TABLE 107 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY CLAIM, 2021-2030 (USD MILLION)

TABLE 108 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 109 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 110 MIDDLE EAST & AFRICA BOTTLES PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 111 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 112 MIDDLE EAST & AFRICA STORE BASED RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 113 MIDDLE EAST & AFRICA NON-STORE RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 114 UAE PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 115 UAE ALMOND MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 116 UAE OAT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 117 UAE SOY NUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 118 UAE COCONUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 119 UAE CASHEW NUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 120 UAE WALNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 121 UAE HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 122 UAE RICE MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 123 UAE FLAX MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 124 UAE OTHERS IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 125 UAE PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 126 UAE PLANT-BASED MILK MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 127 UAE PLANT-BASED MILK, BY FORTIFICATION, 2021- 2023 (USD MILLION)

TABLE 128 UAE PLANT-BASED MILK MARKET, BY FLAVOR, 2021-2030 (USD MILLION)

TABLE 129 UAE ORIGINAL/UNFLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 UAE VANILLA IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 131 UAE CHOCOLATE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 132 UAE COFFEE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 133 UAE COCONUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 134 UAE CARAMEL IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 135 UAE HONEY IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 136 UAE HAZELNUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 137 UAE MAPLE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 138 UAE OTHERS IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 139 UAE PLANT-BASED MILK MARKET, BY FORTIFICATION, 2021-2030 (USD MILLION)

TABLE 140 UAE PLANT-BASED MILK MARKET, BY NATURE, 2021-2030 (USD MILLION)

TABLE 141 UAE PLANT-BASED MILK MARKET, BY CLAIM, 2021-2030 (USD MILLION)

TABLE 142 UAE PLANT-BASED MILK MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 143 UAE PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 144 UAE BOTTLES PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 145 UAE PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 146 UAE STORE BASED RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 147 UAE NON-STORE RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 148 SAUDI ARABIA PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 149 SAUDI ARABIA ALMOND MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 150 SAUDI ARABIA OAT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 151 SAUDI ARABIA SOY NUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 152 SAUDI ARABIA COCONUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 153 SAUDI ARABIA CASHEW NUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 154 SAUDI ARABIA WALNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 155 SAUDI ARABIA HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 156 SAUDI ARABIA RICE MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 157 SAUDI ARABIA FLAX MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 158 SAUDI ARABIA OTHERS IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 159 SAUDI ARABIA PLANT-BASED MILK MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 160 SAUDI ARABIA PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 161 SAUDI ARABIA PLANT-BASED MILK MARKET, BY FLAVOR, 2021-2030 (USD MILLION)

TABLE 162 SAUDI ARABIA ORIGINAL/UNFLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 163 SAUDI ARABIA VANILLA IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 164 SAUDI ARABIA CHOCOLATE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 165 SAUDI ARABIA COFFEE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 166 SAUDI ARABIA COCONUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 167 SAUDI ARABIA CARAMEL IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 168 SAUDI ARABIA HONEY IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 169 SAUDI ARABIA HAZELNUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 170 SAUDI ARABIA MAPLE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 171 SAUDI ARABIA OTHERS IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 172 SAUDI ARABIA PLANT-BASED MILK MARKET, BY FORTIFICATION, 2021-2030 (USD MILLION)

TABLE 173 SAUDI ARABIA PLANT-BASED MILK MARKET, BY NATURE, 2021-2030 (USD MILLION)

TABLE 174 SAUDI ARABIA PLANT-BASED MILK MARKET, BY CLAIM, 2021-2030 (USD MILLION)

TABLE 175 SAUDI ARABIA PLANT-BASED MILK MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 176 SAUDI ARABIA PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 177 SAUDI ARABIA BOTTLES PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 178 SAUDI ARABIA PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 179 SAUDI ARABIA STORE BASED RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 180 SAUDI ARABIA NON-STORE RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 181 KUWAIT PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 182 KUWAIT ALMOND MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 183 KUWAIT OAT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 184 KUWAIT SOY NUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 185 KUWAIT COCONUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 186 KUWAIT CASHEW NUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 187 KUWAIT WALNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 188 KUWAIT HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 189 KUWAIT RICE MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 190 KUWAIT FLAX MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 191 KUWAIT OTHERS IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 192 KUWAIT PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 193 KUWAIT PLANT-BASED MILK MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 194 KUWAIT PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 195 KUWAIT PLANT-BASED MILK MARKET, BY FLAVOR, 2021-2030 (USD MILLION)

TABLE 196 KUWAIT ORIGINAL/UNFLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 197 KUWAIT VANILLA IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 198 KUWAIT CHOCOLATE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 199 KUWAIT COFFEE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 200 KUWAIT COCONUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 201 KUWAIT CARAMEL IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 202 KUWAIT HONEY IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 203 KUWAIT HAZELNUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 204 KUWAIT MAPLE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 205 KUWAIT OTHERS IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 206 KUWAIT PLANT-BASED MILK MARKET, BY FORTIFICATION, 2021-2030 (USD MILLION)

TABLE 207 KUWAIT PLANT-BASED MILK MARKET, BY NATURE, 2021-2030 (USD MILLION)

TABLE 208 KUWAIT PLANT-BASED MILK MARKET, BY CLAIM, 2021-2030 (USD MILLION)

TABLE 209 KUWAIT PLANT-BASED MILK MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 210 KUWAIT PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 211 KUWAIT BOTTLES PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 212 KUWAIT PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 213 KUWAIT STORE BASED RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 214 KUWAIT NON-STORE RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 215 SOUTH AFRICA ALMOND MILK IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 216 SOUTH AFRICA ALMOND MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 217 SOUTH AFRICA OAT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 218 SOUTH AFRICA SOY MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 219 SOUTH AFRICA COCONUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 220 SOUTH AFRICA CASHEW NUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 221 SOUTH AFRICA WALNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 222 SOUTH AFRICA HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 223 SOUTH AFRICA RICE MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 224 SOUTH AFRICA FLAX MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 225 SOUTH AFRICA OTHERS IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 226 SOUTH AFRICA PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 227 SOUTH AFRICA PLANT-BASED MILK MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 228 SOUTH AFRICA PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 229 SOUTH AFRICA PLANT-BASED MILK MARKET, BY FLAVOR, 2021-2030 (USD MILLION)

TABLE 230 SOUTH AFRICA ORIGINAL/UNFLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 231 SOUTH AFRICA VANILLA IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 232 SOUTH AFRICA CHOCOLATE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 233 SOUTH AFRICA COFFEE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 234 SOUTH AFRICA COCONUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 235 SOUTH AFRICA CARAMEL IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 236 SOUTH AFRICA HONEY IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 237 SOUTH AFRICA HAZELNUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 238 SOUTH AFRICA MAPLE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 239 SOUTH AFRICA OTHERS IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 240 SOUTH AFRICA PLANT-BASED MILK MARKET, BY FORTIFICATION, 2021-2030 (USD MILLION)

TABLE 241 SOUTH AFRICA PLANT-BASED MILK MARKET, BY NATURE, 2021-2030 (USD MILLION)

TABLE 242 SOUTH AFRICA PLANT-BASED MILK MARKET, BY CLAIM, 2021-2030 (USD MILLION)

TABLE 243 SOUTH AFRICA PLANT-BASED MILK MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 244 SOUTH AFRICA PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 245 SOUTH AFRICA BOTTLES PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 246 SOUTH AFRICA PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 247 SOUTH AFRICA STORE BASED RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 248 SOUTH AFRICA NON-STORE RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 249 REST OF MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: SEGMENTATION

FIGURE 9 INCREASE IN VEGAN POPULATION AROUND THE GLOBE IS DRIVING THE GROWTH OF THE MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET IN THE FORECAST PERIOD

FIGURE 10 OAT MILK SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET IN 2023 & 2030

FIGURE 11 SUPPLY CHAIN OF MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET

FIGURE 12 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: FACTORS AFFECTING DISPOSABLE INCOME OR SPENDING DYNAMICS OF THE CONSUMERS

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET

FIGURE 14 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: BY TYPE, 2022

FIGURE 15 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: BY PRODUCT TYPE, 2022

FIGURE 16 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: BY FORMULATION, 2022

FIGURE 17 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: BY CATEGORY, 2022

FIGURE 18 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: BY FLAVOR, 2022

FIGURE 19 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: BY FORTIFICATION, 2022

FIGURE 20 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: BY NATURE, 2022

FIGURE 21 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: BY CLAIM, 2022

FIGURE 22 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: BY PACKAGING SIZE, 2022

FIGURE 23 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2022

FIGURE 24 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 25 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: SNAPSHOT (2022)

FIGURE 26 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: BY COUNTRY (2022)

FIGURE 27 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: BY COUNTRY (2023 & 2030)

FIGURE 28 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: BY COUNTRY (2022 & 2030)

FIGURE 29 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: BY TYPE (2023-2030)

FIGURE 30 MIDDLE EAST & AFRICA PLANT-BASED MILK MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.