Middle East And Africa Oil Field Specialty Chemicals Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

192.61 Million

USD

273.92 Million

2025

2033

USD

192.61 Million

USD

273.92 Million

2025

2033

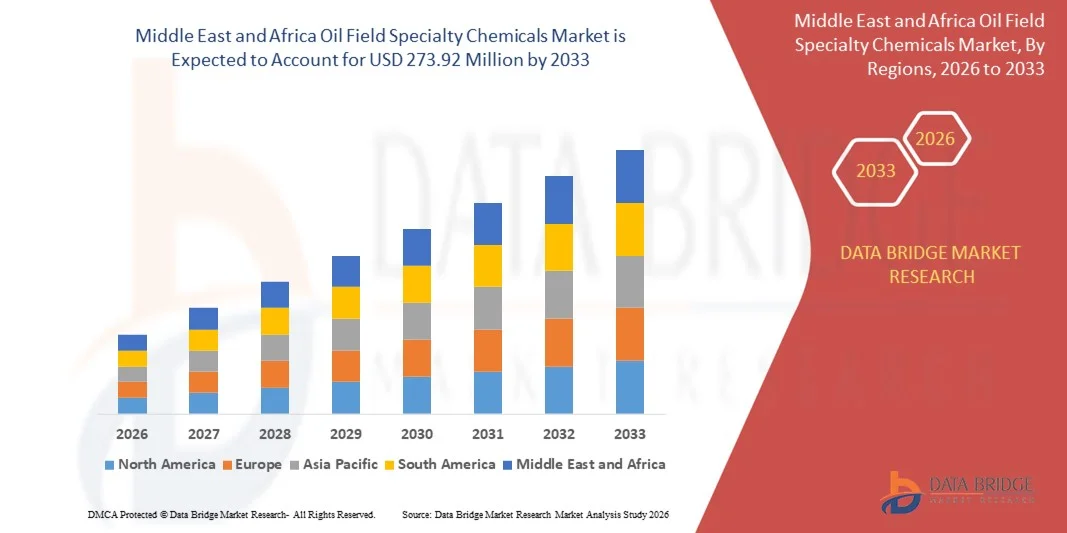

| 2026 –2033 | |

| USD 192.61 Million | |

| USD 273.92 Million | |

|

|

|

|

Segmentación del mercado de productos químicos especializados para yacimientos petrolíferos en Oriente Medio y África, por tipo (tensioactivos, demulsionantes, inhibidores, biocidas, aditivos, ácidos, deformadores, polímeros, reductores de fricción, emulsionantes, agentes de control de hierro, dispersantes, viscosificantes, agentes humectantes, retardantes y otros), ubicación (en tierra y en alta mar), aplicación (perforación, estimulación, producción, recuperación mejorada de petróleo (EOR), cementación, reacondicionamiento y terminación, y otros) - Tendencias de la industria y pronóstico hasta 2033

¿Cuál es el tamaño y la tasa de crecimiento del mercado de productos químicos especializados en yacimientos petrolíferos de Oriente Medio y África?

- El tamaño del mercado de productos químicos especiales para yacimientos petrolíferos de Oriente Medio y África se valoró en 192,61 millones de dólares en 2025 y se espera que alcance los 273,92 millones de dólares en 2033 , con una CAGR del 4,50 % durante el período de pronóstico.

- El aumento de las actividades de exploración y producción de petróleo y gas, la creciente demanda de técnicas de recuperación mejorada de petróleo (EOR), el crecimiento de las operaciones de perforación en aguas profundas y ultraprofundas, el mayor uso de inhibidores de corrosión y demulsionantes, la expansión del desarrollo de gas de esquisto y el creciente enfoque en mejorar la eficiencia de los pozos y la garantía de flujo son algunos de los principales factores que se espera que impulsen el crecimiento del mercado de productos químicos especializados para yacimientos petrolíferos.

¿Cuáles son las principales conclusiones del mercado de productos químicos especializados para campos petrolíferos?

- Se espera que las crecientes inversiones en proyectos upstream de petróleo y gas en las economías en desarrollo, junto con la creciente adopción de fluidos de perforación avanzados y productos químicos de producción, creen importantes oportunidades de crecimiento para el mercado de productos químicos especiales para yacimientos petrolíferos.

- Se espera que la volatilidad de los precios del petróleo crudo, las estrictas regulaciones ambientales, los altos costos operativos y las preocupaciones relacionadas con la eliminación y toxicidad de productos químicos actúen como factores restrictivos clave para el crecimiento del mercado de productos químicos especializados en yacimientos petrolíferos.

- Arabia Saudita dominó el mercado de productos químicos especializados para yacimientos petrolíferos de Oriente Medio y África con la mayor participación en los ingresos, un 38,7 % en 2024, impulsada por importantes inversiones en operaciones upstream y downstream de petróleo y gas.

- El mercado de productos químicos especializados para yacimientos petrolíferos de los Emiratos Árabes Unidos está experimentando un sólido crecimiento con una CAGR del 10,2 %, impulsado por proyectos petrolíferos a gran escala e inversiones en técnicas de recuperación mejorada de petróleo (EOR).

- El segmento de surfactantes dominó el mercado con una participación del 28,6 % en 2025, gracias a su amplio uso en fluidos de perforación, recuperación mejorada de petróleo (EOR) y operaciones de producción. Los surfactantes desempeñan un papel fundamental en la reducción de la tensión interfacial, la mejora de la eficiencia del desplazamiento del petróleo y la optimización del rendimiento de los fluidos en yacimientos convencionales y no convencionales.

Alcance del informe y segmentación del mercado de productos químicos especializados para yacimientos petrolíferos

|

Atributos |

Perspectivas clave del mercado de productos químicos especializados para yacimientos petrolíferos |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Oriente Medio y África

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

¿Cuál es la tendencia clave en el mercado de productos químicos especializados para campos petrolíferos?

Cambio creciente hacia productos químicos especializados de alto rendimiento, ecológicos y específicos para cada aplicación en yacimientos petrolíferos

- El mercado de productos químicos especializados para yacimientos petrolíferos está siendo testigo de una creciente adopción de productos químicos de alto rendimiento y específicos para cada aplicación, diseñados para mejorar la eficiencia de la perforación, la optimización de la producción y el rendimiento del yacimiento en entornos petrolíferos complejos.

- Los fabricantes están desarrollando cada vez más surfactantes, inhibidores, polímeros y reductores de fricción avanzados que ofrecen una mejor estabilidad térmica, resistencia a la corrosión y compatibilidad con pozos de alta presión y alta temperatura (HPHT).

- El creciente interés por las formulaciones químicas biodegradables y respetuosas con el medio ambiente está impulsando la innovación para cumplir con las estrictas regulaciones ambientales, especialmente en regiones sensibles y en alta mar.

- Por ejemplo, empresas como BASF SE, Halliburton, Baker Hughes y Clariant han introducido soluciones químicas para yacimientos petrolíferos de baja toxicidad, a base de agua y alta eficiencia para mejorar la sostenibilidad operativa.

- La creciente demanda de recuperación mejorada de petróleo (EOR), desarrollo de gas de esquisto y exploración en aguas profundas está acelerando el cambio hacia formulaciones químicas especializadas y de alto valor.

- A medida que las operaciones de petróleo y gas se vuelven más complejas y orientadas a la eficiencia, los productos químicos especializados para yacimientos petrolíferos seguirán siendo fundamentales para maximizar la recuperación, reducir el tiempo de inactividad y mejorar la economía general del pozo.

¿Cuáles son los impulsores clave del mercado de productos químicos especializados para campos petrolíferos?

- La creciente demanda de productos químicos eficientes para perforación, estimulación y producción con el fin de mejorar la productividad de los pozos, la garantía del flujo y la longevidad de los yacimientos está impulsando el crecimiento del mercado.

- Por ejemplo, durante 2024-2025, los principales proveedores de servicios petrolíferos como Schlumberger, Halliburton y Baker Hughes ampliaron sus carteras de productos químicos especializados para respaldar proyectos no convencionales y de aguas profundas.

- Las crecientes inversiones en la exploración de petróleo y gas upstream, incluidos los yacimientos de esquisto, petróleo de esquisto y petróleo offshore, están impulsando la demanda de surfactantes, demulsionantes, inhibidores de corrosión y biocidas en Estados Unidos, Medio Oriente y Medio Oriente y África.

- Los avances en las tecnologías de formulación química, incluidos los aditivos nanométricos y los polímeros de alto rendimiento, están mejorando la eficiencia al tiempo que reducen el consumo de productos químicos.

- La creciente adopción de técnicas de recuperación mejorada de petróleo (EOR), como la inundación química y la inyección de polímeros, está creando una demanda sostenida de productos químicos especiales para yacimientos petrolíferos.

- Con el respaldo de la creciente demanda de energía, las tecnologías de perforación mejoradas y las iniciativas de optimización de la recuperación, se espera que el mercado de productos químicos especializados para yacimientos petrolíferos sea testigo de un crecimiento constante a largo plazo.

¿Qué factor está obstaculizando el crecimiento del mercado de productos químicos especializados para campos petrolíferos?

- La volatilidad en los precios del petróleo crudo impacta significativamente el gasto en exploración y producción, lo que afecta la demanda de productos químicos especiales para yacimientos petrolíferos.

- Por ejemplo, durante 2024-2025, la fluctuación de los precios del petróleo y los retrasos en los proyectos llevaron a una reducción en las compras de productos químicos en varios proyectos upstream en Oriente Medio y África.

- Las estrictas regulaciones ambientales relacionadas con la toxicidad química, la eliminación y los vertidos en alta mar aumentan los costos de cumplimiento y limitan el uso de ciertas formulaciones.

- Los altos costos operativos y de formulación asociados con productos químicos avanzados, compatibles con HPHT y que cumplen con las normas ambientales restringen su adopción entre operadores más pequeños.

- Las interrupciones de la cadena de suministro y las fluctuaciones de los precios de las materias primas crean presiones de costos para los fabricantes y reducen los márgenes de ganancia.

- Para superar estos desafíos, las empresas se están centrando en formulaciones sostenibles, métodos de producción rentables y soluciones químicas específicas para cada región para fortalecer la adopción en el mercado de productos químicos especializados para campos petrolíferos.

¿Cómo está segmentado el mercado de productos químicos especializados para campos petrolíferos?

El mercado está segmentado según el tipo, la ubicación y la aplicación .

- Por tipo

Según el tipo, el mercado de productos químicos especializados para yacimientos petrolíferos se segmenta en surfactantes, demulsionantes, inhibidores, biocidas, aditivos, ácidos, deformadores, polímeros, reductores de fricción, emulsionantes, agentes de control de hierro, dispersantes, viscosificantes, agentes humectantes, retardantes y otros. El segmento de surfactantes dominó el mercado con una participación del 28,6 % en 2025, gracias a su amplio uso en fluidos de perforación, recuperación mejorada de petróleo (EOR) y operaciones de producción. Los surfactantes desempeñan un papel fundamental en la reducción de la tensión interfacial, la mejora de la eficiencia del desplazamiento de petróleo y la optimización del rendimiento de los fluidos en yacimientos convencionales y no convencionales. Su amplia aplicabilidad, rentabilidad y las continuas mejoras en la formulación respaldan la fuerte demanda en los yacimientos petrolíferos de Oriente Medio y África.

Se prevé que el segmento de polímeros experimente su mayor crecimiento anual compuesto (TCAC) entre 2026 y 2033, impulsado por la creciente adopción de la inyección de polímeros en la recuperación mejorada de petróleo (EOR), el aumento de la exploración de gas de esquisto y la creciente demanda de control de la viscosidad y reducción de pérdidas de fluidos. Los avances en polímeros resistentes a altas temperaturas y alta salinidad están acelerando aún más el crecimiento.

- Por ubicación

Según la ubicación, el mercado de productos químicos especializados para yacimientos petrolíferos se segmenta en Onshore y Offshore. El segmento Onshore dominó el mercado con una participación del 64,2 % en 2025, gracias a las extensas actividades de exploración de petróleo y gas en tierra, especialmente en formaciones de esquisto, yacimientos de petróleo de esquisto y campos maduros en Estados Unidos, China y Oriente Medio. Las operaciones en tierra requieren grandes volúmenes de fluidos de perforación, productos químicos de producción, inhibidores de corrosión y biocidas, lo que impulsa una demanda sostenida de productos químicos especializados. Los menores costos operativos y la logística más sencilla en comparación con los proyectos offshore refuerzan aún más el dominio de las operaciones en tierra.

Se proyecta que el segmento Offshore crecerá a la tasa de crecimiento anual compuesta (TCAC) más alta entre 2026 y 2033, impulsado por el aumento de las actividades de exploración en aguas profundas y ultraprofundas en regiones como el Golfo de México, Brasil y África Occidental. La creciente inversión en desarrollos offshore y los estrictos requisitos de garantía de flujo están impulsando la demanda de productos químicos especializados de alto rendimiento y que cumplan con las normas ambientales.

- Por aplicación

Según su aplicación, el mercado de productos químicos especializados para yacimientos petrolíferos se segmenta en Perforación, Estimulación, Producción, Recuperación Mejorada de Petróleo (EOR), Cementación, Reparación y Terminación, y Otros. El segmento de Producción dominó el mercado con una participación del 31,4 % en 2025, ya que las operaciones de producción requieren el uso continuo de inhibidores de corrosión, demulsionantes, inhibidores de incrustaciones y biocidas para mantener la seguridad del flujo, la integridad de los equipos y la eficiencia operativa durante toda la vida útil del pozo. El creciente enfoque en maximizar la producción de yacimientos maduros ha fortalecido aún más la demanda de productos químicos de producción en Oriente Medio y África.

Se prevé que el segmento de Recuperación Mejorada de Petróleo (EOR) registre la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2026 y 2033, impulsado por la disminución de las reservas convencionales y la creciente adopción de técnicas de EOR químicas, como la inyección de polímeros y la inyección de surfactantes. El creciente énfasis en mejorar las tasas de recuperación y prolongar la vida útil de los yacimientos está acelerando significativamente la demanda de productos químicos especializados en aplicaciones de EOR.

¿Qué región posee la mayor participación en el mercado de productos químicos especializados para yacimientos petrolíferos?

- Arabia Saudita dominó el mercado de productos químicos especializados para yacimientos petrolíferos de Oriente Medio y África con la mayor participación en los ingresos, un 38,7 % en 2024, impulsada por importantes inversiones en operaciones upstream y downstream de petróleo y gas.

- El enfoque del país en expandir la capacidad de producción petrolera, sumado a las iniciativas gubernamentales para modernizar refinerías y plantas petroquímicas, está impulsando la demanda de productos químicos especializados. Fabricantes locales e internacionales como SABIC (Arabia Saudita) y Clariant (Suiza) están innovando en surfactantes, biocidas e inhibidores de corrosión para mejorar la eficiencia y la sostenibilidad.

- Las iniciativas actuales de la Visión 2030 de Arabia Saudita, que hacen hincapié en la diversificación industrial y la I+D tecnológica, consolidan su posición como centro regional para la innovación y el crecimiento de las exportaciones de productos químicos especializados en yacimientos petrolíferos de Oriente Medio y África.

Análisis del mercado de productos químicos especializados para yacimientos petrolíferos de los EAU

El mercado de productos químicos especializados para yacimientos petrolíferos de los EAU experimenta un sólido crecimiento con una tasa de crecimiento anual compuesta (TCAC) del 10,2 %, impulsado por proyectos petrolíferos a gran escala e inversiones en técnicas de recuperación mejorada de petróleo (EOR). La demanda es especialmente alta en las operaciones de perforación offshore y petroquímica, donde los aditivos de alto rendimiento, los reductores de fricción y los demulsionantes son esenciales. Las zonas industriales y francas respaldadas por el gobierno están atrayendo a fabricantes químicos multinacionales, lo que fomenta la innovación en formulaciones de alta eficiencia y que cumplen con las normas ambientales. La ubicación estratégica y la infraestructura logística de los EAU impulsan aún más la expansión del mercado en toda la región.

Análisis del mercado de productos químicos especializados para yacimientos petrolíferos de Nigeria

El mercado nigeriano de productos químicos especializados para yacimientos petrolíferos se encuentra en constante expansión, impulsado por el crecimiento de las actividades de exploración y producción petrolera en la región del Delta del Níger. La creciente demanda de inhibidores, biocidas y polímeros para una mayor eficiencia productiva está impulsando su adopción en el mercado. Los incentivos gubernamentales para el desarrollo de contenido local, junto con las inversiones continuas en infraestructura de refinación y oleoductos, están creando oportunidades para los fabricantes. Nigeria se perfila como un mercado clave en África Occidental para soluciones químicas para yacimientos petrolíferos rentables y de alto rendimiento.

Análisis del mercado de productos químicos especializados en yacimientos petrolíferos de Egipto

Se proyecta que el mercado egipcio de productos químicos especializados para yacimientos petrolíferos crecerá a una tasa de crecimiento anual compuesta (TCAC) del 9,1 %, impulsado por el aumento de la exploración de petróleo y gas en el Desierto Occidental y las cuencas marinas del Mediterráneo. Los productos químicos especializados, como surfactantes, demulsionantes y modificadores de viscosidad, tienen una gran demanda para aplicaciones de perforación y producción. El apoyo regulatorio de Egipto al uso sostenible y eficiente de productos químicos, junto con la creciente inversión extranjera directa en infraestructura de petróleo y gas, está impulsando el crecimiento del mercado. El país se está posicionando como un centro regional de fabricación y distribución de productos químicos para yacimientos petrolíferos en el norte de África.

¿Cuáles son las principales empresas del mercado de productos químicos especializados para campos petrolíferos?

La industria de productos químicos especializados para yacimientos petrolíferos está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- BASF SE (Alemania)

- Solvay (Bélgica)

- Dow (EE.UU.)

- Baker Hughes Company (EE. UU.)

- Clariant (Suiza)

- Evonik Industries AG (Alemania)

- Kemira (Finlandia)

- Thermax Limited (India)

- Huntsman International LLC. (EE. UU.)

- Colonial Chemical Inc. (EE. UU.)

- Zirax (Rusia)

- Innospec (EE. UU.)

- CES Energy Solutions Corp. (Canadá)

- Compañía Stepan (EE. UU.)

- EMEC (Italia)

- Chevron Phillips Chemical Company LLC (EE. UU.)

- CORPORACIÓN KRATON. (EE. UU.)

- Jiaxing Midas Oilfield Chemical Mfg Co., Ltd. (China)

- Versalis SpA (Italia)

- Halliburton (EE. UU.)

- Corporación Albemarle (EE. UU.)

¿Cuáles son los desarrollos recientes en el mercado de productos químicos especializados para campos petrolíferos en Medio Oriente y África?

- En mayo de 2024, la industria fue testigo de una creciente adopción de tecnologías de digitalización y automatización, con proveedores de productos químicos especializados para yacimientos petrolíferos desarrollando soluciones monitoreadas y controladas de forma remota para optimizar los procesos de tratamiento y mejorar la eficiencia operativa, lo que destaca el cambio del sector hacia operaciones de yacimientos petrolíferos más inteligentes y eficientes.

- En marzo de 2024, la actividad de consolidación continuó dentro del mercado de productos químicos especializados para yacimientos petrolíferos, ya que los actores líderes participaron en fusiones y adquisiciones para expandir las carteras de productos y fortalecer la presencia geográfica, lo que indica un enfoque de toda la industria en la escala, la competitividad y el crecimiento a largo plazo.

- En octubre de 2023, The Lubrizol Corporation anunció un nuevo acuerdo de distribución con IMCD Group, un distribuidor y desarrollador líder de productos químicos e ingredientes especiales en Oriente Medio y África, lo que refuerza el alcance de mercado de Lubrizol y las capacidades de la cadena de suministro.

- En julio de 2022, Solvay SA declaró que buscaría el apoyo asesor de Bank of America para evaluar la posible venta de su negocio de productos químicos para yacimientos petrolíferos como parte de una revisión estratégica, lo que refleja los esfuerzos para optimizar las operaciones y reenfocarse en las áreas de crecimiento centrales.

- En marzo de 2022, Halliburton inauguró su primera planta de fabricación de productos químicos especializados para yacimientos petrolíferos en Arabia Saudita para respaldar soluciones químicas de próxima generación y fortalecer las capacidades de producción regionales, lo que marca una expansión significativa de la presencia de la empresa en el hemisferio oriental.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.