Mercado de mantenimiento de equipos médicos en Oriente Medio y África, por tipo de dispositivo (equipo de diagnóstico por imágenes, dispositivos endoscópicos, instrumentos quirúrgicos, equipo electromédico , otro equipo médico), tipo de servicio (rendimiento/operativo, preventivo, correctivo), proveedores de servicios (proveedores de servicios externos, proveedores de servicios internos), nivel de mantenimiento (usuario de nivel 1 (o de primera línea), técnico de nivel 2, especializado de nivel 3), usuario final (hospitales, clínicas, laboratorios, otros centros de atención médica), país (Israel, Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Egipto, Qatar, Kuwait, Omán, Bahréin y resto de Oriente Medio y África), tendencias de la industria y pronóstico hasta 2029

Análisis y perspectivas del mercado : mercado de mantenimiento de equipos médicos en Oriente Medio y África

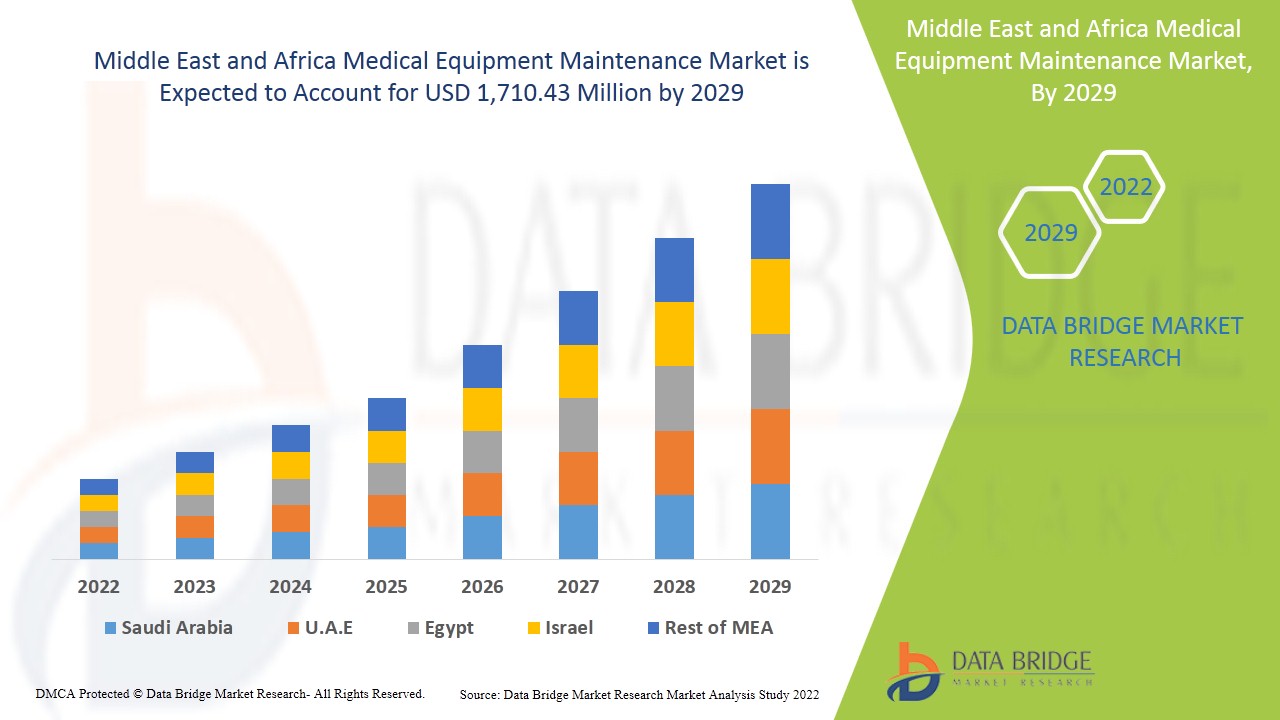

Se espera que el mercado de mantenimiento de equipos médicos de Oriente Medio y África gane crecimiento de mercado en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 7,9% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 1.710,43 millones para 2029. El avance tecnológico en la prestación de servicios de atención médica efectivos puede impulsar el mercado del mercado de mantenimiento.

El mantenimiento de equipos médicos implica actividades relacionadas con la prestación de un nivel adecuado de servicio para mantener el equipo médico. El objetivo principal de esto es reducir el tiempo de inactividad de los dispositivos médicos en las instalaciones, lo que puede conducir a una productividad óptima, ahorrar costos y brindar mejores servicios de atención médica a sus consumidores. Hay dos tipos de técnicas de mantenimiento de equipos médicos que son bastante populares y se clasifican como mantenimiento preventivo y mantenimiento correctivo. El mantenimiento preventivo es un método de servicio en el que se inician de manera proactiva las tareas de los planes de mantenimiento para evitar que se produzcan fallas en los equipos; también predice la falla del equipo, por lo que también se lo denomina mantenimiento predictivo. El objetivo principal del mantenimiento preventivo es minimizar las consecuencias de la falla o determinar el riesgo de falla. Es un procedimiento o rutina establecida para inspeccionar periódicamente el equipo, notar pequeños problemas y solucionarlos antes de que se conviertan en problemas mayores. Por otro lado, el mantenimiento correctivo se realiza después de que se ha producido la falla. Esto se hace de manera inmediata para reducir el tiempo de inactividad del equipo.

La creciente prevalencia de enfermedades crónicas en toda la región es el principal factor impulsor del mercado. La falta de infraestructura en los servicios de atención médica puede resultar un desafío, sin embargo, la aparición de soluciones que ahorren tiempo y de diversos estándares puede resultar una oportunidad. La limitación es el mayor costo asociado con el mantenimiento del equipo médico. También los desafíos que se enfrentan debido al impacto de Covid-19 en la cadena de suministro de las materias primas son factores limitantes.

Este informe de mercado de mantenimiento de equipos médicos proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un resumen de analistas; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de mantenimiento de equipos médicos en Oriente Medio y África

El mercado de mantenimiento de equipos médicos de Oriente Medio y África está segmentado en función del tipo de dispositivo, el tipo de servicio, los proveedores de servicios, el nivel de mantenimiento y el usuario final. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

- Según el tipo de dispositivo, el mercado de mantenimiento de equipos médicos de Oriente Medio y África se segmenta en equipos de diagnóstico por imágenes, dispositivos endoscópicos, instrumentos quirúrgicos, equipos electromédicos y otros equipos médicos. En 2022, los equipos de diagnóstico por imágenes tuvieron una mayor participación en el mercado de mantenimiento de equipos médicos debido a la creciente inclinación de los hospitales y las empresas de salud hacia la automatización y digitalización de la radiología y la creciente adopción de procedimientos mínimamente invasivos, incluidos los sistemas de diagnóstico por imágenes en hospitales y clínicas para mejorar la calidad de la atención al paciente con marcas mínimamente invasivas.

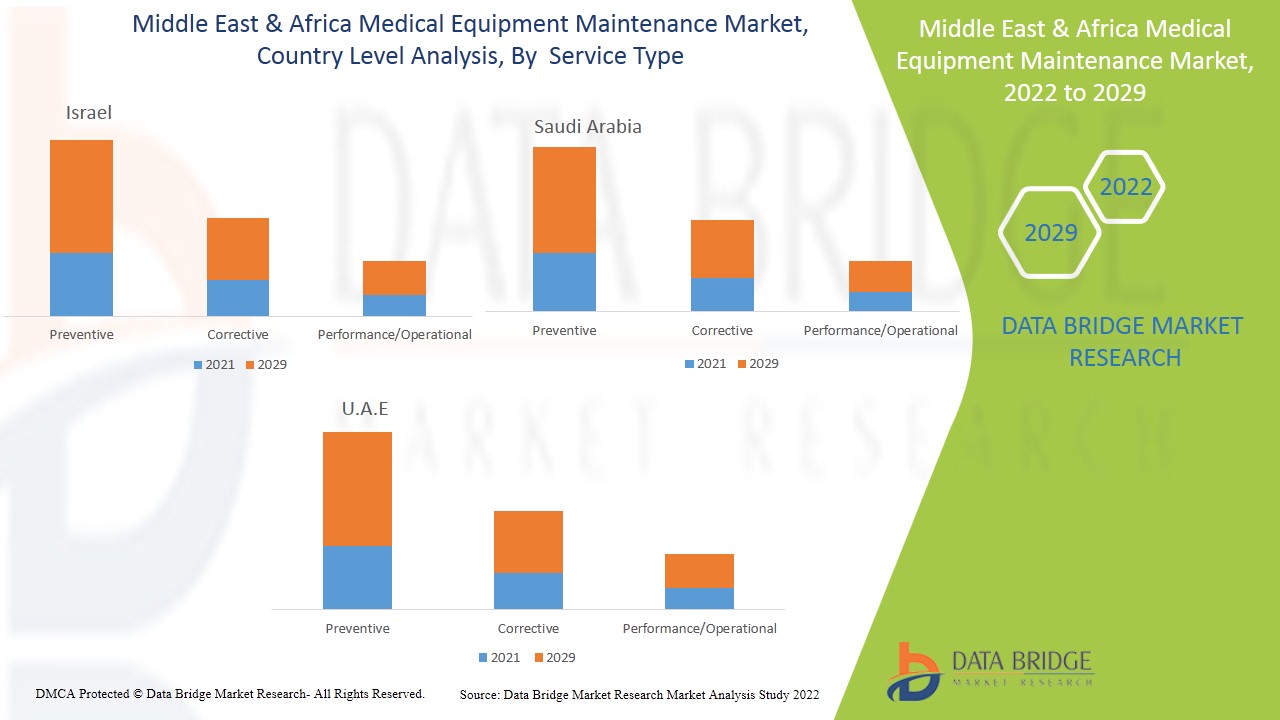

- En función del tipo de servicio, el mercado de mantenimiento de equipos médicos de Oriente Medio y África se ha segmentado en rendimiento/operativo, preventivo y correctivo. En 2022, el segmento preventivo tuvo una mayor participación en el mercado de mantenimiento de equipos médicos debido a factores como la creciente demanda de mejorar la experiencia del cliente para los servicios de equipos médicos, impulsar la operación, el rendimiento económico del servicio al cliente y la mejora de la política de internalización, subcontratación o re-internalización del servicio al cliente puede impulsar el crecimiento de los servicios de mantenimiento. El objetivo principal de estos servicios es mejorar la calidad del servicio, la velocidad a la que se ofrece el servicio, la confiabilidad, la flexibilidad y el costo ofrecido por los servicios.

- En función de los proveedores de servicios, el mercado de mantenimiento de equipos médicos de Oriente Medio y África se ha segmentado en proveedores de servicios externos y proveedores de servicios internos. En 2022, el segmento de proveedores de servicios internos tuvo una mayor participación en el mercado de mantenimiento de equipos médicos debido a factores como el aumento de casos de trastornos crónicos que está impulsando la demanda de equipos médicos. Debido a esta creciente demanda de equipos médicos que salvan vidas y productos de ingeniería médica, las organizaciones se enfrentan a la dificultad de mantenerse al día con la demanda. Los proveedores de servicios desempeñan un papel importante para mantener la funcionalidad de la organización, ya que pueden garantizar la uniformidad, la precisión, la coherencia y la responsabilidad de los equipos médicos.

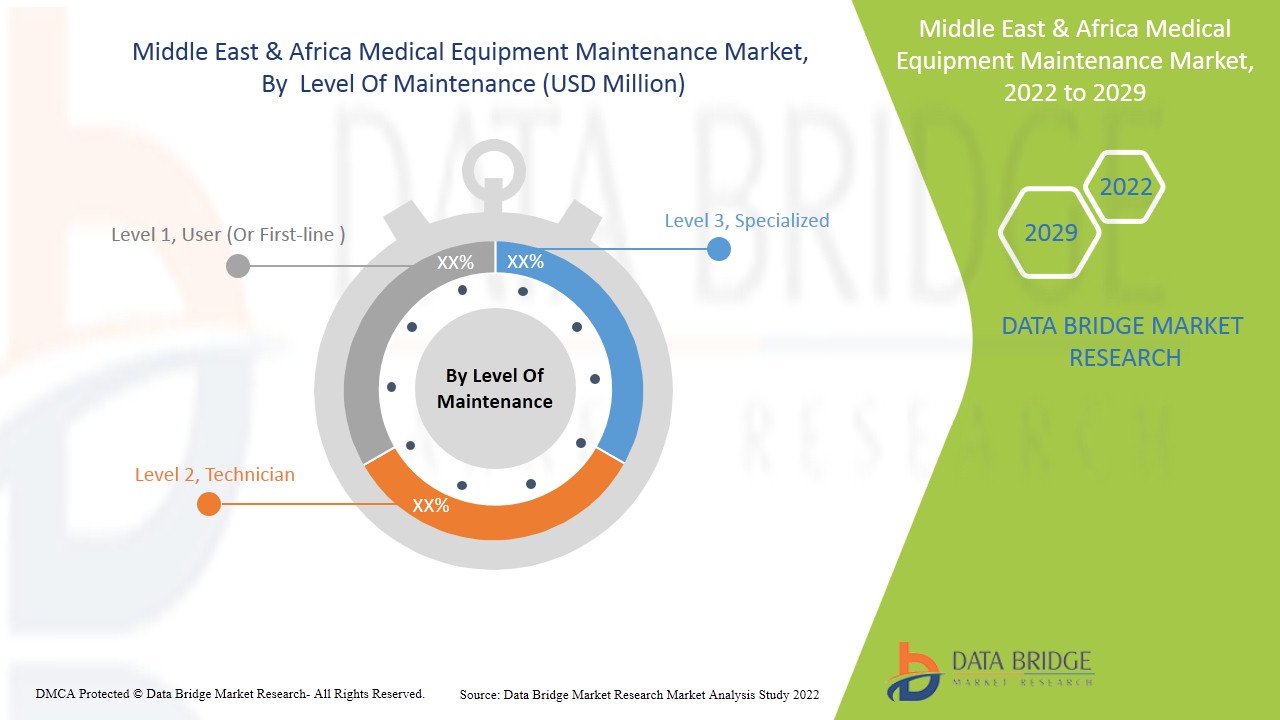

- En función del nivel de mantenimiento, el mercado de mantenimiento de equipos médicos de Oriente Medio y África se ha segmentado en usuario de nivel 1 (o de primera línea), técnico de nivel 2 y especializado de nivel 3. En 2022, el segmento especializado de nivel 3 tuvo una mayor participación en el mercado de mantenimiento de equipos médicos debido a factores como el aumento de la pandemia en todo el mundo, que ha impulsado significativamente a los pacientes que optan por el tratamiento médico, para brindar servicios a estos pacientes, los equipos médicos funcionan con el tiempo. Esto conduce a fallas en los equipos, dependiendo de la naturaleza de la falla, se pueden ofrecer servicios de mantenimiento.

- En función del usuario final, el mercado de mantenimiento de equipos médicos de Oriente Medio y África se ha segmentado en hospitales, clínicas, laboratorios y otros centros de atención médica. En 2022, el segmento Hospitales tuvo una mayor participación en el mercado de mantenimiento de equipos médicos debido a factores como la creciente demanda de equipos médicos como implantes y prótesis ortopédicas, dispositivos cardiovasculares, dispositivos neurovasculares, equipos y suministros generales, equipos de monitoreo de pacientes, dispositivos oftálmicos en hospitales, que necesitan un mantenimiento regular para mantener su eficiencia y productividad con el fin de mantener el servicio ofrecido a sus solicitantes.

Análisis a nivel de país del mercado de mantenimiento de equipos médicos en Oriente Medio y África

Se analiza el mercado de mantenimiento de equipos médicos de Medio Oriente y África y se proporciona información sobre el tamaño del mercado por tipo de dispositivo, tipo de servicio, proveedores de servicios, nivel de mantenimiento y usuario final.

Los países cubiertos en el informe del mercado de mantenimiento de equipos médicos de Medio Oriente y África son Israel, Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Egipto, Qatar, Kuwait, Omán, Bahréin y el resto de Medio Oriente y África.

Israel es el país dominante en esta región debido al rápido crecimiento de la infraestructura de atención médica y las iniciativas gubernamentales. Arabia Saudita ocupa el segundo lugar en esta región debido al aumento de la conciencia sobre la salud y el uso de equipos médicos. Los Emiratos Árabes Unidos son el tercer país dominante debido a la creciente tendencia tecnológica en el sector de la atención médica.

Israel es el país dominante en esta región debido al rápido crecimiento de la infraestructura de atención médica y las iniciativas gubernamentales. También hay una creciente automatización y digitalización de la radiología y la adopción de procedimientos mínimamente invasivos, incluidos los sistemas de diagnóstico por imágenes en los hospitales para mejorar la calidad de la atención al paciente con marcas mínimamente invasivas. Esta demanda de equipos médicos puede impulsar el mercado del mantenimiento.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de Medio Oriente y África y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Creciente demanda de mantenimiento de equipos médicos en Oriente Medio y África.

El mercado de mantenimiento de equipos médicos también le proporciona un análisis detallado del mercado para el crecimiento de la industria en cada país con ventas, ventas de componentes, impacto del desarrollo tecnológico en el mantenimiento de equipos médicos y cambios en los escenarios regulatorios con su apoyo al mercado de mantenimiento de equipos médicos. Los datos están disponibles para el período histórico de 2011 a 2020.

Análisis del panorama competitivo y de la cuota de mercado de mantenimiento de equipos médicos en Oriente Medio y África

El panorama competitivo del mercado de mantenimiento de equipos médicos de Oriente Medio y África proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en Oriente Medio y África, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la profundidad de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de mantenimiento de equipos médicos de Oriente Medio y África.

Los principales actores incluidos en el informe son Koninklijke Philips NV, Siemens Healthcare GmbH, General Electric Company, FUJIFILM Holdings Corporation, CANON MEDICAL SYSTEMS CORPORATION, Drägerwerk AG & Co. KGaA, Shimadzu Corporation, Hitachi, Ltd., Agfa-Gevaert Group, Olympus Corporation, Medtronic, Carestream Health, KARL STORZ SE & Co. KG, Richard Wolf GmbH, Cook, SAMSUNGHEALTHCARE.COM y Terumo Corporation, entre otros. Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado. Muchas empresas de todo el mundo también inician desarrollos de productos que también están acelerando el crecimiento del mercado de mantenimiento de equipos médicos.

Por ejemplo,

- En septiembre de 2021, Shimadzu Corporation lanzó el sistema de inspección por rayos X Microfocus Xslicer SMX-1010/1020 junto con sus servicios. Este producto se lanzó para fortalecer la cartera de radiología de la empresa. Además, la empresa también se centró en su segmento de servicios, como los servicios de mantenimiento y reparación. Esto ha ayudado a la empresa a expandir su mercado.

- En abril de 2021, Carestream Health se asoció con Ziehm Imaging. La característica principal de esta asociación fue desarrollar una cartera de productos de diagnóstico por imagen innovadores y ofrecer sus servicios. Estos productos y servicios innovadores ofrecidos por estas empresas ayudarán a la empresa a expandir su presencia en Oriente Medio y África al ofrecer estos productos innovadores.

Las asociaciones, las empresas conjuntas y otras estrategias mejoran la participación de mercado de la empresa con una mayor cobertura y presencia. También brindan a las organizaciones la ventaja de mejorar su oferta para el mercado de mantenimiento de equipos médicos a través de una gama más amplia de tamaños.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 SERVICE TYPE TIMELINE CURVE

2.9 END-USER COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 REGULATORY SCENARIO

5.1 STANDARDS FOR MEDICAL EQUIPMENT MAINTENANCE

5.2 COUNTRY WISE REGULATION IN THE MIDDLE EAST & AFRICA

5.2.1 UNITED ARAB EMIRATES (U.A.E):

5.2.2 KUWAIT:

5.2.3 BAHRAIN:

5.2.4 OMAN:

5.2.5 QATAR:

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF CHRONIC DISEASES ACROSS THE REGION

6.1.2 TECHNOLOGICAL ADVANCEMENTS IN DELIVERING EFFECTIVE HEALTHCARE SERVICES

6.1.3 INCREASING FOCUS ON THE BENEFIT OF PREVENTIVE MEDICAL EQUIPMENT MAINTENANCE

6.1.4 SURGE ON STRATEGIC SOURCING DEMAND FOR SERVICE & MAINTENANCE PROJECT

6.2 RESTRAINTS

6.2.1 HIGHER COSTS ASSOCIATED WITH THE MAINTENANCE OF THE MEDICAL EQUIPMENT

6.2.2 STRINGENT REGULATORY FRAMEWORK BY GOVERNMENT IN THE HEALTHCARE SECTOR

6.3 OPPORTUNITIES

6.3.1 RISE IN STRATEGIC ACQUISITION & PARTNERSHIP AMONG THE ORGANIZATIONS

6.3.2 EMERGENCE OF TIME-EFFICIENT SERVICES & VARIOUS STANDARDS

6.4 CHALLENGES

6.4.1 LACK OF INFRASTRUCTURE IN HEALTHCARE SERVICES

6.4.2 SHORTAGE OF SKILLED PERSONNEL IN HEALTHCARE SECTOR

7 IMPACT OF COVID-19 ON MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET

7.1 ANALYSIS ON IMPACT OF COVID-19 ON MEDICAL EQUIPMENT MAINTENANCE MARKET

7.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

7.3 STRATEGIC DECISIONS FOR SERVICE PROVIDERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

7.4 IMPACT ON PRICE

7.5 IMPACT ON DEMAND AND SUPPLY CHAIN

7.6 CONCLUSION

8 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE

8.1 OVERVIEW

8.2 PREVENTIVE

8.2.1 IN-HOUSE SERVICE PROVIDERS

8.2.2 EXTERNAL SERVICE PROVIDERS

8.2.2.1 ORIGINAL EQUIPMENT MANUFACTURERS (OEM)

8.2.2.1.1 SINGLE-VENDOR OEMS

8.2.2.1.2 MULTI-VENDOR OEMS

8.2.2.2 INDEPENDENT SERVICE ORGANIZATIONS (ISM)

8.3 CORRECTIVE

8.3.1 IN-HOUSE SERVICE PROVIDERS

8.3.2 EXTERNAL SERVICE PROVIDERS

8.3.2.1 ORIGINAL EQUIPMENT MANUFACTURERS (OEM)

8.3.2.1.1 SINGLE-VENDOR OEMS

8.3.2.1.2 MULTI-VENDOR OEMS

8.3.2.2 INDEPENDENT SERVICE ORGANIZATIONS (ISM)

8.4 PERFORMANCE/OPERATIONAL

8.4.1 IN-HOUSE SERVICE PROVIDERS

8.4.2 EXTERNAL SERVICE PROVIDERS

8.4.2.1 ORIGINAL EQUIPMENT MANUFACTURERS (OEM)

8.4.2.1.1 SINGLE-VENDOR OEMS

8.4.2.1.2 MULTI-VENDOR OEMS

8.4.2.2 INDEPENDENT SERVICE ORGANIZATIONS (ISM)

9 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDERS

9.1 OVERVIEW

9.2 IN-HOUSE SERVICE PROVIDERS

9.3 EXTERNAL SERVICE PROVIDERS

9.3.1 ORIGINAL EQUIPMENT MANUFACTURERS (OEM)

9.3.1.1 SINGLE-VENDOR OEMS

9.3.1.2 MULTI-VENDOR OEMS

9.3.2 INDEPENDENT SERVICE ORGANIZATIONS (ISM)

10 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE

10.1 OVERVIEW

10.2 IMAGING EQUIPMENT

10.2.1 ADVANCED MODALITIES

10.2.1.1 CT

10.2.1.2 MRI

10.2.1.3 VASCULAR ANGIOGRAPHY SYSTEMS

10.2.1.4 OTHER ADVANCED MEDICAL IMAGING MODALITIES

10.2.2 PRIMARY MODALITIES

10.2.2.1 DIGITAL X-RAY

10.2.2.2 ULTRASOUND

10.2.2.2.1 DIAGNOSTIC ULTRASOUND

10.2.2.2.1.1 2D ASPIRATOR

10.2.2.2.1.2 3D & 4D ULTRASOUND

10.2.2.2.1.3 ULTRASONIC ASPIRATOR

10.2.2.2.1.4 DOPPLER ULTRASOUND

10.2.2.2.2 THERAPEUTIC ULTRASOUND

10.2.2.2.2.1 HIGH INTENSITY FOCUSED ULTRASOUND (HIFU)

10.2.2.2.2.2 EXTRACORPOREAL SHOCKWAVE LITHOTRIPSY (ESWL)

10.2.2.3 OTHER PRIMARY MEDICAL IMAGING MODALITIES

10.3 ENDOSCOPIC DEVICES

10.3.1 ARTHROSCOPY

10.3.2 HYSTEROSCOPY

10.3.3 LAPAROSCOPY

10.3.4 CYSTOSCOPY

10.3.5 BRONCHOSCOPY

10.3.6 OTHERS

10.4 ELECTROMEDICAL EQUIPMENT

10.5 SURGICAL INSTRUMENTS

10.5.1 ELECTROSURGICAL DEVICES

10.5.2 HANDHELD SURGICAL DEVICES

10.5.2.1 CUTTER INSTRUMENTS

10.5.2.2 AUXILIARY INSTRUMENTS

10.5.2.3 REFRACTORS

10.5.2.4 DILATORS

10.5.2.5 FORCEPS AND SPATULAS

10.5.2.6 GRASPERS

10.5.2.7 OTHERS

10.5.3 OTHERS

10.6 OTHER MEDICAL EQUIPMENT

10.6.1 LIFE SUPPORT DEVICES

10.6.1.1 VENTILATORS

10.6.1.2 ANESTHETIC DEVICES

10.6.1.3 OTHERS

10.6.2 DENTAL EQUIPMENT

11 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET, BY LEVEL OF MAINTENANCE

11.1 OVERVIEW

11.2 LEVEL 3, SPECIALIZED

11.3 LEVEL 2, TECHNICIAN

11.4 LEVEL 1, USER (OR FIRST-LINE)

12 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS

12.3 CLINICS

12.4 LABORATORY

12.5 OTHER HEALTH CARE CENTERS

13 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET, BY COUNTRY

13.1 ISRAEL

13.2 SAUDI ARABIA

13.3 U.A.E.

13.4 SOUTH AFRICA

13.5 EGYPT

13.6 QATAR

13.7 KUWAIT

13.8 OMAN

13.9 BAHRAIN

13.1 REST OF MIDDLE EAST & AFRICA

14 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

15 SWOT ANALYSIS

16 COMPANY SHARE ANALYSIS

16.1 GENERAL ELECTRIC COMPANY

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 SERVICE PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 SIEMENS HEALTHINEERS AG

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 SERVICE PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 MEDTRONIC

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 SERVICE PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 DRÄGERWERK AG & CO. KGAA

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 SERVICE PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 KONINKLIJKE PHILIPS N.V

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 SERVICE PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 AGFA-GEVAERT GROUP

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 SERVICES PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 CANON MEDICAL SYSTEMS CORPORATION

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 SERVICEPORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 CARESTREAM HEALTH

16.8.1 COMPANY SNAPSHOT

16.8.2 SERVICE PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 COOK

16.9.1 COMPANY SNAPSHOT

16.9.2 SERVICE CATEGORY

16.9.3 RECENT DEVELOPMENT

16.1 FUJIFILM HOLDINGS CORPORATION

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 SERVICE PORTFOLIO

16.10.4 RECENT DEVELOPMENT

16.11 HITACHI, LTD.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 SERVICE PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 KARL STORZ SE & CO. KG

16.12.1 COMPANY SNAPSHOT

16.12.2 SERVICE PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 OLYMPUS CORPORATION

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 SERVICE PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 RICHARD WOLF GMBH

16.14.1 COMPANY SNAPSHOT

16.14.2 SERVICE PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 SAMSUNGHEALTHCARE.COM

16.15.1 COMPANY SNAPSHOT

16.15.2 SERVICE PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 SHIMADZU CORPORATION

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 SERVICE PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 TERUMO CORPORATION

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 SERVICES PORTFOLIO

16.17.4 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 MIDDLE EAST & AFRICA REGULATORY BODY:

TABLE 2 PRICES OF MEDICAL EQUIPMENT AND MAINTENANCE COST (USD)

TABLE 3 OVERVIEW OF MEDICAL DEVICE REGULATION IN THE MIDDLE EAST & AFRICA

TABLE 4 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA PREVENTIVE IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA EXTERNAL SERVICE PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA ORIGINAL EQUIPMENT MANUFACTURERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA CORRECTIVE IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA EXTERNAL SERVICE PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA ORIGINAL EQUIPMENT MANUFACTURERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA PERFORMANCE/OPERATIONAL IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA EXTERNAL SERVICE PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA ORIGINAL EQUIPMENT MANUFACTURERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDERS, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA EXTERNAL SERVICE PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA ORIGINAL EQUIPMENT MANUFACTURERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA IMAGING EQUIPMENT IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA ADVANCED MODALITIES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA PRIMARY MODALITIES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA ULTRASOUND IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA DIAGNOSTIC ULTRASOUND IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA THERAPEUTIC ULTRASOUND IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA ENDOSCOPIC DEVICES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE,2022-2029, (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA SURGICAL INSTRUMENTS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA HANDHELD SURGICAL DEVICES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA OTHER MEDICAL EQUIPMENT IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA LIFE SUPPORT DEVICES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET, BY LEVEL OF MAINTENANCE, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 32 ISRAEL MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 33 ISRAEL PREVENTIVE IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 ISRAEL EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 ISRAEL ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 ISRAEL CORRECTIVE IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 ISRAEL EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 ISRAEL ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 ISRAEL PERFORMANCE/OPERATIONAL IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 ISRAEL EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 ISRAEL ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 ISRAEL MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDERS, 2020-2029 (USD MILLION)

TABLE 43 ISRAEL EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 ISRAEL ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 ISRAEL MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 46 ISRAEL IMAGING EQUIPMENT IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 ISRAEL ADVANCED MODALITIES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 ISRAEL PRIMARY MODALITIES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 ISRAEL ULTRASOUND IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 ISRAEL DIAGNOSTIC ULTRASOUND IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 ISRAEL THERAPEUTIC ULTRASOUND IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 ISRAEL ENDOSCOPIC DEVICES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 ISRAEL SURGICAL INSTRUMENTS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 ISRAEL HANDHELD SURGICAL DEVICES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 ISRAEL OTHER MEDICAL EQUIPMENT IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 ISRAEL LIFE SUPPORT DEVICES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 ISRAEL MEDICAL EQUIPMENT MAINTENANCE MARKET, BY LEVEL OF MAINTENANCE, 2020-2029 (USD MILLION)

TABLE 58 ISRAEL MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 59 SAUDI ARABIA MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 60 SAUDI ARABIA PREVENTIVE IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 SAUDI ARABIA EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 SAUDI ARABIA ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 SAUDI ARABIA CORRECTIVE IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 SAUDI ARABIA EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 SAUDI ARABIA ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 SAUDI ARABIA PERFORMANCE/OPERATIONAL IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 SAUDI ARABIA EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 SAUDI ARABIA ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 SAUDI ARABIA MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDERS, 2020-2029 (USD MILLION)

TABLE 70 SAUDI ARABIA EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 SAUDI ARABIA ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 SAUDI ARABIA MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 73 SAUDI ARABIA IMAGING EQUIPMENT IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 SAUDI ARABIA ADVANCED MODALITIES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 SAUDI ARABIA PRIMARY MODALITIES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 SAUDI ARABIA ULTRASOUND IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 SAUDI ARABIA DIAGNOSTIC ULTRASOUND IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 SAUDI ARABIA THERAPEUTIC ULTRASOUND IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 SAUDI ARABIA ENDOSCOPIC DEVICES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 SAUDI ARABIA SURGICAL INSTRUMENTS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 SAUDI ARABIA HANDHELD SURGICAL DEVICES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 SAUDI ARABIA OTHER MEDICAL EQUIPMENT IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 SAUDI ARABIA LIFE SUPPORT DEVICES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 SAUDI ARABIA MEDICAL EQUIPMENT MAINTENANCE MARKET, BY LEVEL OF MAINTENANCE, 2020-2029 (USD MILLION)

TABLE 85 SAUDI ARABIA MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 86 U.A.E. MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 87 U.A.E. PREVENTIVE IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 U.A.E. EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 U.A.E. ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 U.A.E. CORRECTIVE IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 U.A.E. EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 U.A.E. ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 U.A.E. PERFORMANCE/OPERATIONAL IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 U.A.E. EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 U.A.E. ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 U.A.E. MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDERS, 2020-2029 (USD MILLION)

TABLE 97 U.A.E. EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 U.A.E. ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 U.A.E. MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 100 U.A.E. IMAGING EQUIPMENT IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 U.A.E. ADVANCED MODALITIES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 U.A.E. PRIMARY MODALITIES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 U.A.E. ULTRASOUND IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 U.A.E. DIAGNOSTIC ULTRASOUND IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 U.A.E. THERAPEUTIC ULTRASOUND IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 U.A.E. ENDOSCOPIC DEVICES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 U.A.E. SURGICAL INSTRUMENTS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 U.A.E. HANDHELD SURGICAL DEVICES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 U.A.E. OTHER MEDICAL EQUIPMENT IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 U.A.E. LIFE SUPPORT DEVICES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 U.A.E. MEDICAL EQUIPMENT MAINTENANCE MARKET, BY LEVEL OF MAINTENANCE, 2020-2029 (USD MILLION)

TABLE 112 U.A.E. MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 113 SOUTH AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 114 SOUTH AFRICA PREVENTIVE IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 SOUTH AFRICA EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 SOUTH AFRICA ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 SOUTH AFRICA CORRECTIVE IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 SOUTH AFRICA EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 SOUTH AFRICA ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 SOUTH AFRICA PERFORMANCE/OPERATIONAL IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 SOUTH AFRICA EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 SOUTH AFRICA ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 SOUTH AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDERS, 2020-2029 (USD MILLION)

TABLE 124 SOUTH AFRICA EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 SOUTH AFRICA ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 SOUTH AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 127 SOUTH AFRICA IMAGING EQUIPMENT IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 SOUTH AFRICA ADVANCED MODALITIES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 SOUTH AFRICA PRIMARY MODALITIES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 SOUTH AFRICA ULTRASOUND IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 SOUTH AFRICA DIAGNOSTIC ULTRASOUND IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 SOUTH AFRICA THERAPEUTIC ULTRASOUND IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 SOUTH AFRICA ENDOSCOPIC DEVICES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 SOUTH AFRICA SURGICAL INSTRUMENTS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 SOUTH AFRICA HANDHELD SURGICAL DEVICES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 SOUTH AFRICA OTHER MEDICAL EQUIPMENT IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 SOUTH AFRICA LIFE SUPPORT DEVICES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 SOUTH AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET, BY LEVEL OF MAINTENANCE, 2020-2029 (USD MILLION)

TABLE 139 SOUTH AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 140 EGYPT MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 141 EGYPT PREVENTIVE IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 EGYPT EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 EGYPT ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 EGYPT CORRECTIVE IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 EGYPT EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 EGYPT ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 EGYPT PERFORMANCE/OPERATIONAL IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 EGYPT EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 EGYPT ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 EGYPT MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDERS, 2020-2029 (USD MILLION)

TABLE 151 EGYPT EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 152 EGYPT ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 153 EGYPT MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 154 EGYPT IMAGING EQUIPMENT IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 EGYPT ADVANCED MODALITIES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 EGYPT PRIMARY MODALITIES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 EGYPT ULTRASOUND IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 EGYPT DIAGNOSTIC ULTRASOUND IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 EGYPT THERAPEUTIC ULTRASOUND IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 EGYPT ENDOSCOPIC DEVICES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 161 EGYPT SURGICAL INSTRUMENTS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 EGYPT HANDHELD SURGICAL DEVICES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 163 EGYPT OTHER MEDICAL EQUIPMENT IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 EGYPT LIFE SUPPORT DEVICES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 EGYPT MEDICAL EQUIPMENT MAINTENANCE MARKET, BY LEVEL OF MAINTENANCE, 2020-2029 (USD MILLION)

TABLE 166 EGYPT MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 167 QATAR MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 168 QATAR PREVENTIVE IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 169 QATAR EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 QATAR ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 171 QATAR CORRECTIVE IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 QATAR EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 173 QATAR ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 QATAR PERFORMANCE/OPERATIONAL IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 175 QATAR EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 QATAR ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 QATAR MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDERS, 2020-2029 (USD MILLION)

TABLE 178 QATAR EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 179 QATAR ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 QATAR MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 181 QATAR IMAGING EQUIPMENT IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 182 QATAR ADVANCED MODALITIES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 183 QATAR PRIMARY MODALITIES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 184 QATAR ULTRASOUND IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 185 QATAR DIAGNOSTIC ULTRASOUND IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 186 QATAR THERAPEUTIC ULTRASOUND IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 187 QATAR ENDOSCOPIC DEVICES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 188 QATAR SURGICAL INSTRUMENTS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 189 QATAR HANDHELD SURGICAL DEVICES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 QATAR OTHER MEDICAL EQUIPMENT IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 QATAR LIFE SUPPORT DEVICES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 192 QATAR MEDICAL EQUIPMENT MAINTENANCE MARKET, BY LEVEL OF MAINTENANCE, 2020-2029 (USD MILLION)

TABLE 193 QATAR MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 194 KUWAIT MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 195 KUWAIT PREVENTIVE IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 KUWAIT EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 197 KUWAIT ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 KUWAIT CORRECTIVE IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 199 KUWAIT EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 200 KUWAIT ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 201 KUWAIT PERFORMANCE/OPERATIONAL IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 202 KUWAIT EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 203 KUWAIT ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 204 KUWAIT MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDERS, 2020-2029 (USD MILLION)

TABLE 205 KUWAIT EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 206 KUWAIT ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 207 KUWAIT MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 208 KUWAIT IMAGING EQUIPMENT IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 209 KUWAIT ADVANCED MODALITIES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 210 KUWAIT PRIMARY MODALITIES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 211 KUWAIT ULTRASOUND IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 KUWAIT DIAGNOSTIC ULTRASOUND IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 213 KUWAIT THERAPEUTIC ULTRASOUND IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 214 KUWAIT ENDOSCOPIC DEVICES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 215 KUWAIT SURGICAL INSTRUMENTS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 216 KUWAIT HANDHELD SURGICAL DEVICES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 217 KUWAIT OTHER MEDICAL EQUIPMENT IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 218 KUWAIT LIFE SUPPORT DEVICES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 219 KUWAIT MEDICAL EQUIPMENT MAINTENANCE MARKET, BY LEVEL OF MAINTENANCE, 2020-2029 (USD MILLION)

TABLE 220 KUWAIT MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 221 OMAN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 222 OMAN PREVENTIVE IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 223 OMAN EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 224 OMAN ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 225 OMAN CORRECTIVE IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 226 OMAN EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 227 OMAN ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 228 OMAN PERFORMANCE/OPERATIONAL IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 229 OMAN EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 230 OMAN ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 231 OMAN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDERS, 2020-2029 (USD MILLION)

TABLE 232 OMAN EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 233 OMAN ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 234 OMAN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 235 OMAN IMAGING EQUIPMENT IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 236 OMAN ADVANCED MODALITIES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 237 OMAN PRIMARY MODALITIES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 238 OMAN ULTRASOUND IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 239 OMAN DIAGNOSTIC ULTRASOUND IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 240 OMAN THERAPEUTIC ULTRASOUND IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 241 OMAN ENDOSCOPIC DEVICES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 242 OMAN SURGICAL INSTRUMENTS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 243 OMAN HANDHELD SURGICAL DEVICES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 244 OMAN OTHER MEDICAL EQUIPMENT IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 245 OMAN LIFE SUPPORT DEVICES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 246 OMAN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY LEVEL OF MAINTENANCE, 2020-2029 (USD MILLION)

TABLE 247 OMAN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 248 BAHRAIN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 249 BAHRAIN PREVENTIVE IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 250 BAHRAIN EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 251 BAHRAIN ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 252 BAHRAIN CORRECTIVE IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 253 BAHRAIN EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 254 BAHRAIN ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 255 BAHRAIN PERFORMANCE/OPERATIONAL IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 256 BAHRAIN EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 257 BAHRAIN ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 258 BAHRAIN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDERS, 2020-2029 (USD MILLION)

TABLE 259 BAHRAIN EXTERNAL SERVICES PROVIDERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 260 BAHRAIN ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 261 BAHRAIN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 262 BAHRAIN IMAGING EQUIPMENT IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 263 BAHRAIN ADVANCED MODALITIES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 264 BAHRAIN PRIMARY MODALITIES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 265 BAHRAIN ULTRASOUND IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 266 BAHRAIN DIAGNOSTIC ULTRASOUND IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 267 BAHRAIN THERAPEUTIC ULTRASOUND IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 268 BAHRAIN ENDOSCOPIC DEVICES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 269 BAHRAIN SURGICAL INSTRUMENTS IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 270 BAHRAIN HANDHELD SURGICAL DEVICES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 271 BAHRAIN OTHER MEDICAL EQUIPMENT IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 272 BAHRAIN LIFE SUPPORT DEVICES IN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 273 BAHRAIN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY LEVEL OF MAINTENANCE, 2020-2029 (USD MILLION)

TABLE 274 BAHRAIN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 275 REST OF MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET: SEGMENTATION

FIGURE 10 INCREASING FOCUS ON PREVENTIVE MEDICAL EQUIPMENT MAINTENANCE IS EXPECTED TO DRIVE MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET IN THE FORECAST PERIOD OF 2022 - 2029

FIGURE 11 PREVENTIVE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET IN 2022- 2029

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, CHALLENGES FOR MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET

FIGURE 13 ITC SURVEYS FOR COUNTRIES WITH MOST DIFFICULTIES TO IMPORT MEDICAL SUPPLIES (2010-2017)

FIGURE 14 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET: BY SERVICE TYPE, 2021

FIGURE 15 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET: BY SERVICE PROVIDERS, 2021

FIGURE 16 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET: BY DEVICE TYPE, 2021

FIGURE 17 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET: BY LEVEL OF MAINTENANCE, 2021

FIGURE 18 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET: BY END USER, 2021

FIGURE 19 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET: SNAPSHOT (2021)

FIGURE 20 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET: BY COUNTRY (2021)

FIGURE 21 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 22 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 23 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET: BY SERVICE TYPE (2022-2029)

FIGURE 24 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT MAINTENANCE MARKET: COMPANY SHARE 2020 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.