Middle East And Africa Medical Device Outsourcing Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

8.43 Billion

USD

21.47 Billion

2025

2033

USD

8.43 Billion

USD

21.47 Billion

2025

2033

| 2026 –2033 | |

| USD 8.43 Billion | |

| USD 21.47 Billion | |

|

|

|

|

Segmentación del mercado de externalización de dispositivos médicos en Oriente Medio y África, por servicios (garantía de calidad, asuntos regulatorios, diseño y desarrollo de productos, pruebas y esterilización de productos, implementación de productos, actualización de productos, mantenimiento de productos, materias primas, equipos electromédicos, fabricación por contrato, caracterización química y de materiales), producto (productos terminados y electrónicos, materias primas), tipo de dispositivo (clase I, clase II y clase III), aplicación (cardiología, diagnóstico por imagen, ortopedia, IVD, oftalmología, cirugía general y plástica, administración de fármacos, odontología, endoscopia, diabetes, etc.), usuario final (pequeña, mediana y gran empresa de dispositivos médicos, etc.): tendencias del sector y pronóstico hasta 2033.

Tamaño del mercado de subcontratación de dispositivos médicos en Oriente Medio y África

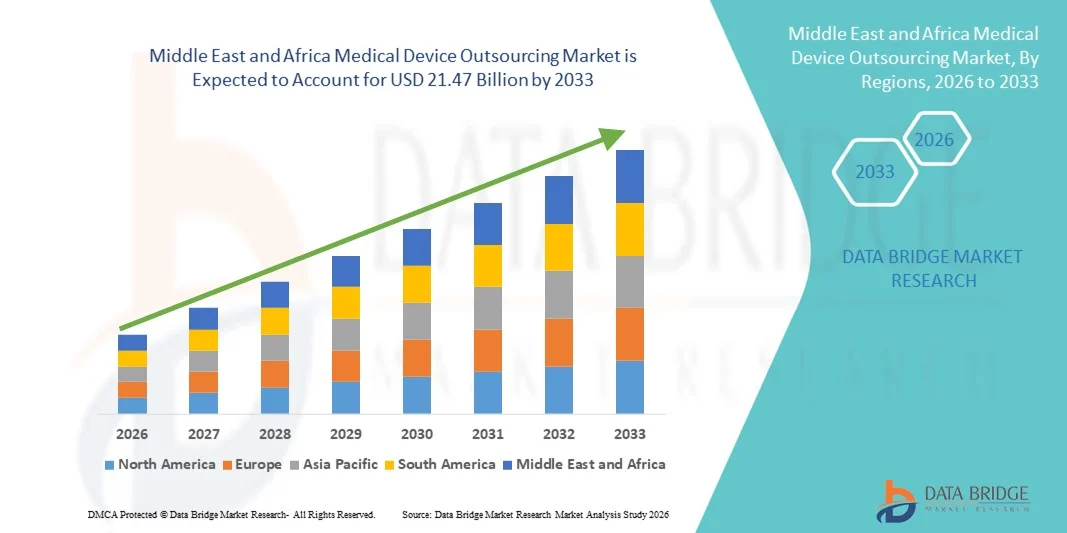

- El tamaño del mercado de subcontratación de dispositivos médicos de Medio Oriente y África se valoró en USD 8.43 mil millones en 2025 y se espera que alcance los USD 21.47 mil millones para 2033 , con una CAGR del 12,40% durante el período de pronóstico.

- El crecimiento del mercado se ve impulsado en gran medida por la creciente complejidad de los dispositivos médicos, los crecientes requisitos de cumplimiento normativo y la creciente presión sobre los OEM para reducir los costos operativos y el tiempo de comercialización, lo que genera una mayor dependencia de socios de subcontratación especializados en actividades de diseño, fabricación y garantía de calidad.

- Además, la creciente demanda de tecnologías médicas avanzadas, la creciente adopción de fabricación por contrato y servicios de I+D, y la necesidad de soluciones de producción escalables y de alta calidad están acelerando la adopción de servicios de subcontratación de dispositivos médicos, lo que impulsa significativamente el crecimiento general del mercado.

Análisis del mercado de subcontratación de dispositivos médicos en Oriente Medio y África

- La subcontratación de dispositivos médicos, que incluye la fabricación por contrato, el diseño y desarrollo de productos, el control de calidad y los servicios regulatorios, se ha convertido en una estrategia fundamental para los fabricantes de equipos originales (OEM) de dispositivos médicos debido a la creciente complejidad de los dispositivos, los estrictos requisitos regulatorios y la necesidad de optimizar los costos y el tiempo de comercialización.

- La creciente demanda de subcontratación de dispositivos médicos está impulsada por la creciente innovación en tecnologías médicas, un mayor enfoque en el cumplimiento de los estándares internacionales de calidad y la preferencia de los OEM de concentrarse en las competencias centrales mientras subcontratan operaciones no centrales.

- Arabia Saudita dominó el mercado de subcontratación de dispositivos médicos con una participación en los ingresos de aproximadamente el 31,5 % en 2025, respaldada por una inversión gubernamental sustancial en infraestructura de atención médica, un número creciente de fabricantes de dispositivos médicos, políticas favorables para las asociaciones extranjeras y una creciente demanda de fabricación por contrato de alta calidad y servicios de I+D.

- Se espera que los Emiratos Árabes Unidos (EAU) sean el país de más rápido crecimiento en el mercado de subcontratación de dispositivos médicos durante el período de pronóstico, impulsado por la rápida expansión de las instalaciones de atención médica, la creciente adopción de tecnologías médicas avanzadas, las iniciativas gubernamentales de apoyo a la innovación en tecnología médica y un fuerte enfoque en atraer empresas de subcontratación internacionales.

- El segmento de productos terminados y electrónica representó la mayor participación en los ingresos del mercado, aproximadamente el 62,1% en 2025, impulsado por los altos volúmenes de subcontratación de dispositivos completos y subconjuntos electrónicos.

Alcance del informe y segmentación del mercado de subcontratación de dispositivos médicos

|

Atributos |

Perspectivas clave del mercado de la subcontratación de dispositivos médicos |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Oriente Medio y África

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis en profundidad de expertos, epidemiología de pacientes, análisis de la cartera de productos, análisis de precios y marco regulatorio. |

Tendencias del mercado de subcontratación de dispositivos médicos en Oriente Medio y África

Creciente adopción de la subcontratación integral y de capacidades de fabricación avanzadas

- Una tendencia significativa y en aceleración en el mercado global de subcontratación de dispositivos médicos es el cambio creciente hacia soluciones de subcontratación de extremo a extremo, que abarcan el diseño de productos, la creación de prototipos, la fabricación, las pruebas, el apoyo regulatorio y los servicios posteriores a la comercialización.

- Las empresas de dispositivos médicos se asocian cada vez más con fabricantes contratados especializados para agilizar las operaciones, reducir el tiempo de comercialización y centrarse en competencias centrales como la innovación y la comercialización.

- Por ejemplo, los principales proveedores de subcontratación como Integer Holdings Corporation y Jabil Healthcare están ampliando sus ofertas de servicios integrados para respaldar dispositivos médicos complejos, incluidos dispositivos implantables, equipos de diagnóstico y tecnologías médicas portátiles, lo que permite a los OEM escalar de manera eficiente y al mismo tiempo mantener altos estándares de calidad.

- Los avances en las tecnologías de fabricación, como el mecanizado de precisión, la automatización, la fabricación aditiva y el ensamblaje en salas blancas, están mejorando las capacidades de los socios de externalización. Estas tecnologías permiten a los fabricantes subcontratados satisfacer la creciente demanda de dispositivos médicos miniaturizados, de alta precisión y tecnológicamente avanzados en todas las áreas terapéuticas.

- La creciente complejidad de los dispositivos médicos, impulsada por la integración de electrónica, software y materiales avanzados, anima a los fabricantes de equipos originales (OEM) a recurrir a socios de externalización especializados con experiencia multidisciplinaria. Esta tendencia favorece una mayor consistencia del producto, el cumplimiento de las estrictas normas regulatorias y la optimización de costes.

- El creciente énfasis en el cumplimiento normativo y la garantía de calidad está fortaleciendo aún más las asociaciones de subcontratación, ya que los proveedores de servicios experimentados ofrecen sistemas sólidos de gestión de calidad y experiencia regulatoria en múltiples geografías.

- Esta tendencia hacia las relaciones de subcontratación estratégica está transformando la cadena de valor global de los dispositivos médicos, posicionando a las empresas de subcontratación como socios fundamentales para respaldar la innovación, la escalabilidad y la eficiencia operativa en toda la industria de dispositivos médicos.

Dinámica del mercado de subcontratación de dispositivos médicos en Oriente Medio y África

Conductor

Optimización de costos y creciente complejidad de los dispositivos médicos

- La creciente necesidad de reducir los costos operativos y, al mismo tiempo, gestionar la creciente complejidad de los productos es un factor clave en el mercado global de externalización de dispositivos médicos. Los fabricantes de equipos originales (OEM) se encuentran bajo presión constante para mejorar los márgenes y, al mismo tiempo, cumplir con estrictos requisitos regulatorios y de calidad, lo que convierte la externalización en una opción estratégica atractiva.

- Por ejemplo, muchos fabricantes globales de dispositivos médicos están subcontratando procesos de fabricación intensivos en mano de obra y la producción de componentes a fabricantes contratados especializados en regiones rentables, lo que permite reducciones significativas en los gastos generales y de producción.

- A medida que los dispositivos médicos se vuelven tecnológicamente más sofisticados, incorporando electrónica avanzada, software y componentes inteligentes, los OEM dependen cada vez más de socios de subcontratación con capacidades técnicas e infraestructura especializadas.

- Además, la creciente demanda de dispositivos médicos impulsada por el envejecimiento de la población, la creciente prevalencia de enfermedades crónicas y la expansión del acceso a la atención médica a nivel mundial está impulsando a los fabricantes a escalar la producción rápidamente, acelerando aún más la adopción de modelos de subcontratación.

- La capacidad de los socios de subcontratación para proporcionar capacidad de fabricación flexible, acortar los plazos de desarrollo y garantizar una calidad constante es un factor clave que impulsa el crecimiento del mercado en los mercados de atención médica desarrollados y emergentes.

Restricción/Desafío

Riesgos de cumplimiento normativo y preocupaciones sobre propiedad intelectual

- Uno de los principales desafíos que enfrenta el mercado global de subcontratación de dispositivos médicos es la complejidad del cumplimiento normativo en las diferentes regiones. Los dispositivos médicos deben cumplir con los estrictos requisitos regulatorios establecidos por autoridades como la FDA de EE. UU., la Agencia Europea de Medicamentos (EMA) y otros organismos reguladores nacionales, lo que aumenta la carga de cumplimiento tanto para los fabricantes de equipos originales (OEM) como para los socios de subcontratación.

- Por ejemplo, las variaciones en los estándares regulatorios, los requisitos de documentación y los plazos de aprobación entre regiones pueden crear desafíos operativos y retrasar la comercialización de productos cuando las actividades de subcontratación abarcan varios países.

- Las preocupaciones relacionadas con la protección de la propiedad intelectual y la seguridad de los datos también plantean desafíos, en particular cuando se subcontratan el diseño, el desarrollo de software o los procesos de fabricación propietarios a proveedores externos.

- Además, la dependencia de socios externos puede exponer a los OEM a riesgos como interrupciones en la cadena de suministro, inconsistencias de calidad o control operativo limitado si no se gestionan mediante marcos contractuales y de gobernanza sólidos.

- Abordar estos desafíos requiere sistemas sólidos de gestión de calidad, una comunicación transparente, una sólida experiencia regulatoria y mecanismos bien definidos de protección de la propiedad intelectual. Superar estas barreras será fundamental para mantener el crecimiento y la confianza a largo plazo en el mercado global de subcontratación de dispositivos médicos.

Alcance del mercado de subcontratación de dispositivos médicos en Oriente Medio y África

El mercado está segmentado en función de los servicios, el producto, el tipo de dispositivo, la aplicación y el usuario final.

- Por Servicios

En cuanto a los servicios, el mercado de subcontratación de dispositivos médicos se segmenta en control de calidad, servicios de asuntos regulatorios, servicios de diseño y desarrollo de productos, servicios de prueba y esterilización de productos, servicios de implementación de productos, servicios de actualización de productos, servicios de mantenimiento de productos, servicios de materias primas, servicios de equipos electromédicos, fabricación por contrato y caracterización química y de materiales. El segmento de fabricación por contrato dominó la mayor cuota de mercado en ingresos, con aproximadamente el 34,6 % en 2025, impulsado por la creciente presión sobre los fabricantes de equipos originales (OEM) para reducir los costes operativos y mejorar la escalabilidad. Los fabricantes de dispositivos médicos subcontratan cada vez más la fabricación a fabricantes de equipos originales (CMO) especializados para centrarse en competencias clave como la innovación y el marketing. La creciente complejidad de los dispositivos de clase II y clase III ha incrementado aún más la dependencia de fabricantes por contrato con experiencia en normativas. Las capacidades de fabricación integral, que incluyen ensamblaje, empaquetado y validación, respaldan la adopción. La creciente demanda global de dispositivos médicos acelera la subcontratación de la producción. La rentabilidad y una comercialización más rápida siguen siendo factores clave. Los acuerdos de suministro a largo plazo garantizan la estabilidad de los ingresos. La expansión de los CMO en las economías emergentes refuerza su dominio. La automatización avanzada y los sistemas de calidad refuerzan aún más el liderazgo de este segmento.

Se espera que el segmento de Servicios de Diseño y Desarrollo de Productos experimente la tasa de crecimiento anual compuesta (TCAC) más rápida, de alrededor del 23,4 %, entre 2026 y 2033, impulsada por los rápidos avances tecnológicos y los crecientes ciclos de innovación. Las empresas de dispositivos médicos externalizan cada vez más la I+D para reducir los plazos y los riesgos de desarrollo. La creciente demanda de dispositivos portátiles, digitales y mínimamente invasivos impulsa el crecimiento. La externalización permite el acceso a conocimientos multidisciplinarios y tecnologías avanzadas de prototipado. Las complejidades regulatorias fomentan la colaboración inicial con los proveedores de servicios. Las startups dependen en gran medida de los servicios de diseño externalizados debido a las limitaciones de capital. El aumento de los requisitos de personalización impulsa la demanda. El crecimiento de las soluciones centradas en el paciente acelera la adopción. La fuerte inversión en innovación en tecnología médica sustenta la expansión a largo plazo.

- Por producto

En función del producto, el mercado de subcontratación de dispositivos médicos se segmenta en productos terminados, electrónica y materias primas. El segmento de productos terminados y electrónica representó la mayor cuota de mercado en ingresos, con aproximadamente el 62,1 % en 2025, impulsado por los altos volúmenes de subcontratación de dispositivos completos y subconjuntos electrónicos. La creciente adopción de dispositivos médicos conectados ha incrementado la demanda de servicios de fabricación de productos electrónicos. Los fabricantes de equipos originales (OEM) prefieren la subcontratación para garantizar el cumplimiento de las normas regulatorias globales. La creciente complejidad del software y los sensores integrados refuerza el dominio del segmento. Los altos requisitos de inversión de capital favorecen la subcontratación de productos terminados. La demanda de dispositivos de diagnóstico por imagen y monitorización se mantiene sólida. Los requisitos de garantía de calidad y trazabilidad refuerzan aún más la subcontratación. Las capacidades de producción a gran escala impulsan la preferencia. Las sólidas alianzas entre fabricantes de equipos originales (OEM) y proveedores de servicios de gestión de la calidad (EMS) refuerzan el liderazgo.

Se prevé que el segmento de Materias Primas crezca a la tasa de crecimiento anual compuesta (TCAC) más rápida, de aproximadamente el 21,2 % entre 2026 y 2033, impulsado por la creciente demanda de materiales biocompatibles y especializados. El crecimiento de los dispositivos desechables y de un solo uso impulsa la externalización de materiales. Los fabricantes de equipos originales (OEM) confían en proveedores certificados para el cumplimiento normativo. La creciente personalización en el diseño de dispositivos impulsa la innovación en materiales. La creciente demanda de polímeros y aleaciones avanzadas impulsa el crecimiento. La externalización garantiza la consistencia y la calidad. La expansión de los volúmenes de fabricación de dispositivos médicos impulsa el consumo de materias primas. Los avances tecnológicos en la ciencia de los materiales aceleran su adopción. Los mercados emergentes contribuyen aún más a la rápida expansión.

- Por tipo de dispositivo

Según el tipo de dispositivo, el mercado de subcontratación de dispositivos médicos se segmenta en dispositivos de Clase I, Clase II y Clase III. El segmento de Clase II dominó el mercado con una participación en los ingresos de aproximadamente el 47,9 % en 2025, gracias al alto volumen de dispositivos con regulación moderada. Estos incluyen bombas de infusión, equipos de diagnóstico y dispositivos de monitorización. La creciente prevalencia de enfermedades crónicas impulsa una demanda sostenida. La subcontratación ayuda a gestionar eficientemente el cumplimiento normativo. Las frecuentes actualizaciones de diseño fomentan el apoyo externo a la fabricación. La optimización de costes sigue siendo un factor clave. Los fabricantes de equipos originales (OEM) se benefician de la producción escalable. La fuerte demanda de hospitales y clínicas refuerza el dominio. La innovación continua mantiene el liderazgo del mercado.

The Class III segment is projected to register the fastest CAGR of around 24.6% from 2026 to 2033, driven by rising demand for implantable and life-sustaining devices. Stringent regulatory requirements encourage partnerships with specialized outsourcing firms. Increasing aging population boosts demand for advanced implants. Technological innovation in cardiovascular and neuro devices fuels growth. High development costs favor outsourcing models. CMOs provide validation and compliance expertise. Growing investment in high-risk devices supports expansion. Clinical trial outsourcing further drives growth. Long approval cycles sustain long-term demand.

- By Application

On the basis of application, the Medical Device Outsourcing market is segmented into Cardiology, Diagnostic Imaging, Orthopaedic, IVD, Ophthalmic, General and Plastic Surgery, Drug Delivery, Dental, Endoscopy, Diabetes Care, and Others. The Cardiology segment held the largest market revenue share of approximately 19.8% in 2025, driven by high demand for cardiovascular devices. Rising incidence of heart diseases globally fuels device production. Continuous technological advancements increase outsourcing needs. Regulatory complexity encourages reliance on experienced partners. High procedural volumes sustain demand. Implantable devices require precision manufacturing. Outsourcing ensures quality and scalability. OEMs seek faster commercialization. Strong reimbursement frameworks support dominance.

The IVD segment is expected to witness the fastest CAGR of around 25.1% from 2026 to 2033, driven by increasing diagnostic testing volumes. Growth in personalized medicine supports expansion. Rising adoption of point-of-care diagnostics fuels demand. Outsourcing supports rapid scaling of production. Regulatory compliance requirements boost reliance on service providers. Post-pandemic diagnostic awareness remains high. Technological innovation accelerates product launches. Growing healthcare access in emerging markets supports growth. Continuous R&D investments sustain momentum.

- By End User

On the basis of end user, the Medical Device Outsourcing market is segmented into Small Medical Device Companies, Medium Medical Device Companies, Large Medical Device Companies, and Others. The Large Medical Device Companies segment dominated the market with a revenue share of approximately 44.3% in 2025, driven by large-scale production requirements. These companies outsource to optimize operational efficiency. Global supply chain management supports adoption. High R&D pipelines sustain outsourcing demand. Long-term contracts ensure cost stability. Advanced regulatory expertise strengthens partnerships. Focus on innovation drives outsourcing. Expansion into emerging markets boosts volumes. Strong financial capacity reinforces dominance.

Se prevé que el segmento de Pequeñas Empresas de Dispositivos Médicos (PEEM) crezca a la tasa de crecimiento anual compuesta (TCAC) más rápida, de aproximadamente el 26,3 %, entre 2026 y 2033, impulsada por las limitadas capacidades de fabricación interna. Las startups recurren cada vez más a la externalización para reducir la inversión de capital. Los crecientes ecosistemas de innovación en tecnología médica apoyan a los nuevos participantes. Los servicios de apoyo regulatorio fomentan la externalización. Los ciclos de desarrollo de productos más rápidos impulsan la demanda. Los socios contractuales facilitan la escalabilidad. El aumento de la financiación de riesgo impulsa el crecimiento. Las altas tasas de innovación aceleran la adopción. La externalización sigue siendo crucial para la supervivencia y la expansión.

Análisis regional del mercado de subcontratación de dispositivos médicos en Oriente Medio y África

- Se proyecta que el mercado de subcontratación de dispositivos médicos de Medio Oriente y África (MEA) se expandirá a una CAGR sustancial durante el período de pronóstico, impulsado por la creciente demanda de dispositivos médicos de alta calidad, estándares regulatorios estrictos y la creciente tendencia de los OEM a subcontratar actividades de fabricación e I+D.

- El enfoque de la región en la producción rentable, junto con la adopción de tecnologías avanzadas, está alentando a los fabricantes de dispositivos médicos a colaborar con socios de subcontratación especializados.

- MEA está experimentando un sólido crecimiento en el diseño de dispositivos médicos, fabricación de precisión, pruebas y servicios de soporte regulatorio, respaldado por una mejor infraestructura de atención médica y un ecosistema emergente de MedTech en varios países.

Análisis del mercado de subcontratación de dispositivos médicos en Arabia Saudita

El mercado de externalización de dispositivos médicos de Arabia Saudita dominó el mercado de externalización de dispositivos médicos en Oriente Medio y África, con una participación en los ingresos de aproximadamente el 31,5 % en 2025, gracias a una importante inversión gubernamental en infraestructura sanitaria, un número creciente de fabricantes de dispositivos médicos, políticas favorables para las colaboraciones internacionales y una creciente demanda de servicios de fabricación por contrato e I+D de alta calidad. Se prevé que las iniciativas estratégicas para fortalecer las capacidades nacionales de tecnología médica y apoyar las colaboraciones internacionales mantengan el liderazgo del país en el mercado de externalización de Oriente Medio y África durante el período de pronóstico.

Análisis del mercado de subcontratación de dispositivos médicos en los Emiratos Árabes Unidos (EAU)

Se prevé que el mercado de externalización de dispositivos médicos de los EAU sea el de mayor crecimiento en Oriente Medio y África durante el período de pronóstico. Este crecimiento se debe a la rápida expansión de los centros de salud, la creciente adopción de tecnologías médicas avanzadas, las iniciativas gubernamentales de apoyo a la innovación en tecnología médica y un fuerte enfoque en atraer empresas internacionales de externalización. La ubicación estratégica de los EAU, junto con políticas comerciales favorables e incentivos a la inversión, le permite consolidarse como un destino predilecto para los fabricantes de equipos originales (OEM) globales que buscan servicios de fabricación por contrato, diseño y soporte regulatorio.

Cuota de mercado de subcontratación de dispositivos médicos en Oriente Medio y África

La industria de subcontratación de dispositivos médicos está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- IQVIA Holdings Inc. (EE. UU.)

- SGS SA (Suiza)

- Eurofins Scientific (Luxemburgo)

- WuXi AppTec (China)

- Lonza Group AG (Suiza)

- ICON plc (Irlanda)

- Parexel International Corporation (EE. UU.)

- Intertek Group plc (Reino Unido)

- TÜV SÜD (Alemania)

- Bureau Veritas (Francia)

- Catalent, Inc. (EE. UU.)

- Jabil Inc. (EE. UU.)

- Flex Ltd. (Singapur)

- Plexus Corp. (EE. UU.)

- TE Connectivity (Suiza)

- Stryker (EE. UU.)

- Medtronic plc (Irlanda)

- Sanmina Corporation (EE. UU.)

- Nemera (Francia)

Últimos avances en el mercado de subcontratación de dispositivos médicos en Oriente Medio y África

- En enero de 2023, Integer Holdings Corporation anunció la adquisición de Pulse Technologies, Inc., una empresa privada de tecnología, ingeniería y fabricación por contrato centrada en el micromaquinado complejo de componentes de dispositivos médicos, mejorando las capacidades de subcontratación de Integer en los segmentos de dispositivos cardíacos estructurales, de bombas cardíacas, de electrofisiología y de neuromodulación.

- En noviembre de 2023, Jabil Inc. completó la adquisición de Retronix, un proveedor innovador en recuperación y reacondicionamiento de componentes electrónicos, ampliando sus servicios de subcontratación de dispositivos médicos y reforzando su capacidad para respaldar la fabricación de productos electrónicos médicos complejos.

- En julio de 2023, Medical Device, Inc. (un proveedor estadounidense de fabricación por contrato) adquirió NextPhase Medical Devices LLC, un fabricante con sede en México, para formar United Group, duplicando la capacidad de producción y creando siete sitios globales de subcontratación/producción de extremo a extremo para respaldar a los fabricantes de equipos originales (OEM) de dispositivos médicos en América del Norte, Europa y el norte de África.

- En marzo de 2025, Flex Ltd inauguró un nuevo centro de introducción de productos (NPI) cerca de Boston, MA, diseñado para respaldar a los fabricantes de equipos originales (OEM) del sector salud con el desarrollo integral de productos, desde la creación de prototipos hasta la transferencia de producción, incluidos servicios con certificación ISO13485 que aceleran la comercialización subcontratada de dispositivos médicos.

- En mayo de 2025, Quasar Medical anunció la adquisición de las operaciones de fabricación por contrato de Nordson en Galway y Tecate, fortaleciendo sus ofertas globales de organización de desarrollo y fabricación por contrato (CDMO), particularmente en el diseño de catéteres y balones médicos.

- En febrero de 2025, Arterex Ltd. completó la adquisición de Phoenix Srl, un desarrollador/fabricante europeo de dispositivos médicos con una red de ventas internacional, ampliando las capacidades de subcontratación y exportación de Arterex para productos de dispositivos médicos.

- En junio de 2025, DuPont firmó un acuerdo para adquirir Donatelle Plastics Incorporated, un fabricante por contrato líder de dispositivos médicos especializado en el diseño, desarrollo y producción de componentes de alta precisión, lo que impulsa la presencia de fabricación subcontratada de DuPont.

- En mayo de 2025, Arch Systems anunció una expansión plurianual de su asociación con Flex Ltd., mejorando los servicios de subcontratación colaborativa y ampliando la capacidad de producción para la fabricación de dispositivos médicos y de diagnóstico avanzados.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.