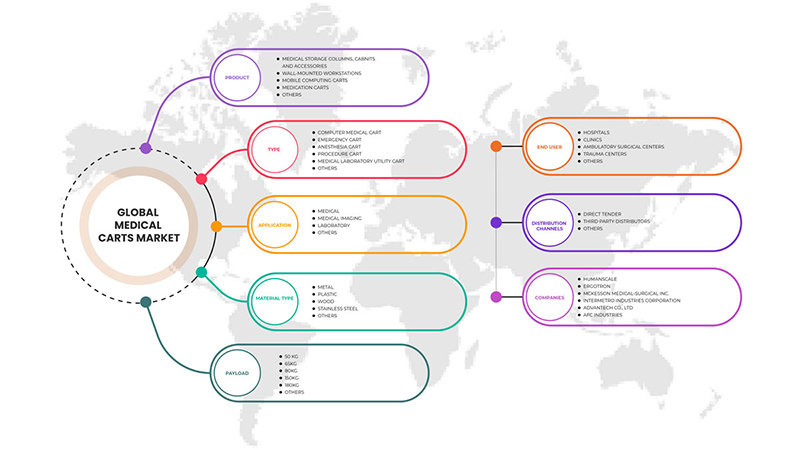

Middle East and Africa Medical Carts Market, By Product (Mobile Computing Carts, Medical Storage Columns, Cabinets and Accessories, Medication Carts, Wall-Mounted Workstations and Other), Type (Computer Medical Cart, Emergency Cart, Procedure Cart, Anesthesia Cart, Medical Laboratory Utility Cart, and Others), Application (Medical, Medical Imaging, Laboratory, and Others), Material Type (Plastic, Wood, Stainless Steel, Metal and Others), Payload (50 kg, 65 kg, 80 kg, 150 kg, 180 kg and Others), End User (Hospitals, Clinics, Ambulatory Surgical Centers, Trauma Centers, and Others), Distribution Channel (Direct Tender, Third Party Distributors and Others) – Industry Trends and Forecast to 2029.

Middle East and Africa Medical Carts Market Analysis and Insights

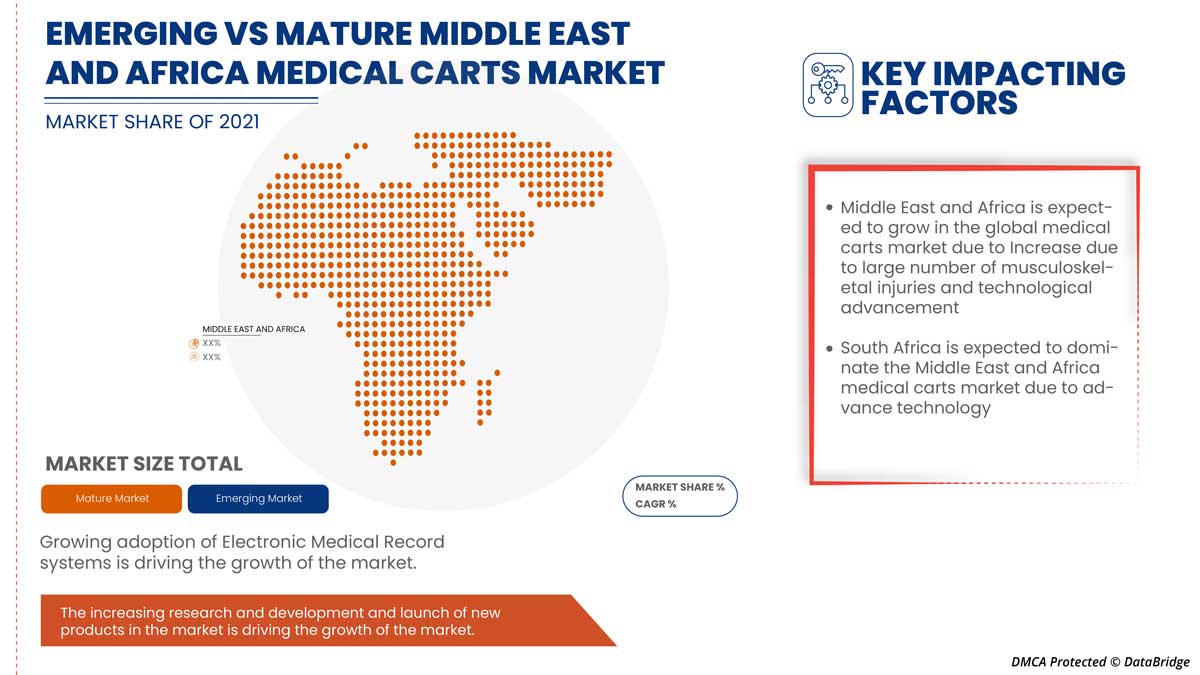

Middle East and Africa medical carts market is expected to grow due to improving healthcare facilities and infrastructures and adopting electronic medical records at the hospital, which can drive the market's growth. The other factors which are anticipated to propel the growth of the medical carts market include the rising cases of musculoskeletal injuries and surgeries.

The other factors, such as the lack of skilled professionals and the high cost of customized medical carts, hamper the growth of the Middle East and Africa medical carts market. On the other hand, the increased healthcare expenditure and emerging countries with developed hospitals act as an opportunity for the growth of the Middle East and Africa medical carts market.

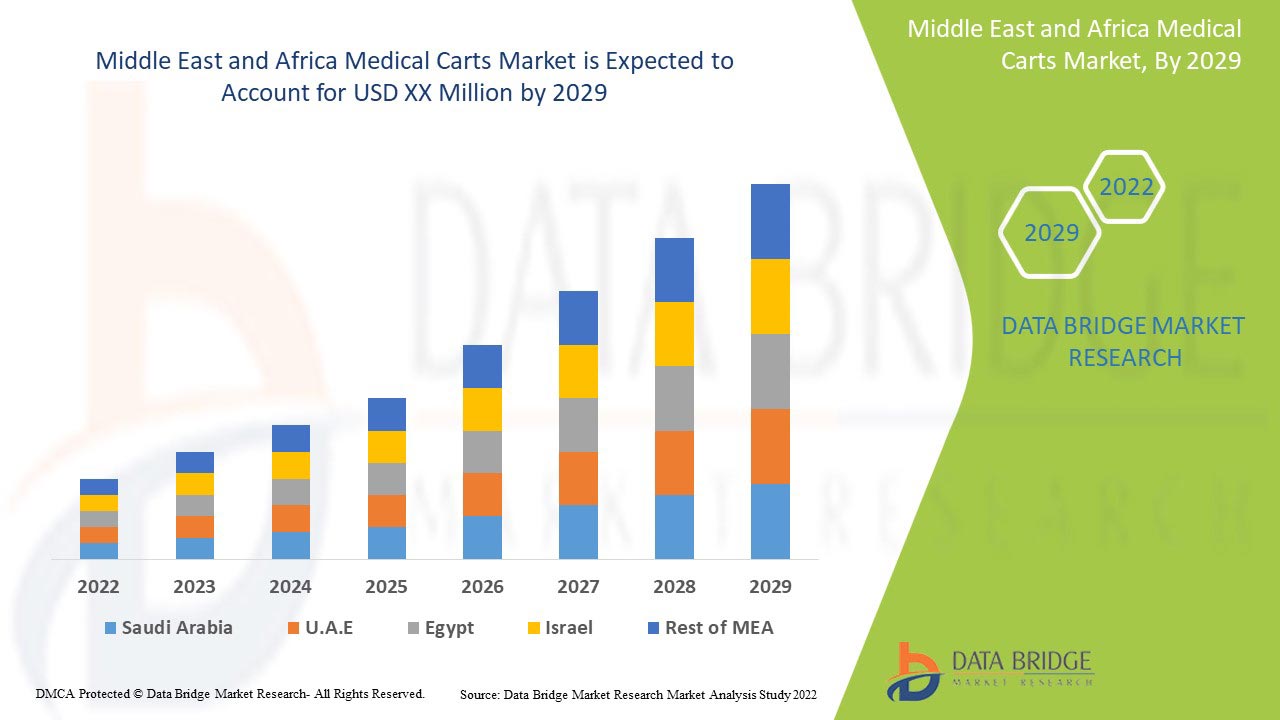

Data Bridge Market Research analyzes that the Middle East and Africa medical carts market will grow at a CAGR of 5.6% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Product (Mobile Computing Carts, Medical Storage Columns, Cabinets and Accessories, Medication Carts, Wall-Mounted Workstations and Other), Type (Computer Medical Cart, Emergency Cart, Procedure Cart, Anesthesia Cart, Medical Laboratory Utility Cart, and Others), Application (Medical, Medical Imaging, Laboratory, and Others), Material Type (Plastic, Wood, Stainless Steel, Metal and Others), Payload (50 kg, 65 kg, 80 kg, 150 kg, 180 kg and Others), End User (Hospitals, Clinics, Ambulatory Surgical Centers, Trauma Centers, and Others), Distribution Channel (Direct Tender, Third Party Distributors and Others) |

|

Countries Covered |

South Africa, Saudi Arabia, U.A.E, Egypt, Israel and Rest of Middle East and Africa |

|

Market Players Covered |

ITD Gmbh, Omnicell Inc., Midmark Corporation, Herman Miller, Inc., and AMD Telemedicine, among others. |

Definición del mercado de carros médicos en Oriente Medio y África

Los carros médicos son carros móviles livianos que se utilizan en las instalaciones médicas para diversas aplicaciones. Se utilizan ampliamente para almacenar y transportar medicamentos, equipos de emergencia y suministros médicos. Los carros de medicación suelen ser unidades rectangulares o cuadradas con ruedas giratorias y compartimentos específicos para contener numerosos suministros médicos. Están hechos para que las enfermeras, los médicos y los profesionales de la salud puedan administrar constantemente la rutina de medicación de los pacientes durante su estadía en el hospital. Su marco está hecho principalmente de acero inoxidable o aleación de acero. Los carros de emergencia se colocan en todos los hospitales, lo que permite el acceso en cualquier momento de emergencia. Cada cajón del carro está etiquetado correctamente para que el personal de atención médica encuentre el equipo fácilmente con prisa. Algunos otros carros médicos incluyen carros de anestesia, carros de servicios médicos, carros de procedimientos y carros montados en la pared. Algunos carros médicos, como los carros móviles para máquinas de ultrasonidos portátiles, cuentan con tecnologías avanzadas como una palanca neumática para un fácil ajuste de altura. Están habilitados con soportes para sondas de ultrasonido, toallitas clínicas, dispensadores de gel de ultrasonido, dispensador de guantes higiénicos y vienen con una rueda de alta resistencia.

Dinámica del mercado de carros médicos en Oriente Medio y África

Conductores

- Mejorar las instalaciones y la infraestructura sanitaria

En Oriente Medio y África, la cantidad de centros de atención sanitaria, hospitales, clínicas, centros de atención ambulatoria, centros de atención especializada, centros de maternidad y centros de atención psiquiátrica está aumentando debido al aumento de casos de enfermedades crónicas e infecciosas que requieren ingresos y estancias hospitalarias. La situación de pandemia ha aumentado significativamente la demanda de carros médicos y de unidades de cuidados intensivos (UCI) para el tratamiento de los pacientes. Muchos países en desarrollo están adoptando diversas soluciones y estrategias para mejorar las instalaciones sanitarias de sus países.

- Adopción de Historias Clínicas Electrónicas (HCE) en los hospitales

A muchos sectores de la salud se les ha informado que deben instalar de forma obligatoria registros médicos electrónicos en sus hospitales o clínicas para convertir todos los historiales médicos a formato digital, que se incorporan principalmente en carros médicos para facilitar el acceso. Cualquier hospital que no habilite registros médicos electrónicos será considerado como si tuviera datos o registros ilegibles e incompletos.

- Aplicación avanzada de carros médicos

Los carros médicos de reciente fabricación incorporan numerosas soluciones informáticas que permiten un fácil almacenamiento y acceso a los medicamentos. La mayoría de los dispositivos vienen con paneles táctiles con diseños delgados para facilitar su uso. Son ligeros y tienen ruedas suaves que permiten una fácil movilidad con una presión considerablemente menor por parte de las enfermeras para evitar dolores musculares. Estos paneles táctiles pueden mejorar la calidad de la atención y eliminar las desastrosas consecuencias humanas que pueden provocar un error en la dosificación y el suministro del tratamiento. Muchos fabricantes están tratando de innovar con nuevos avances en sus carros médicos.

Oportunidades

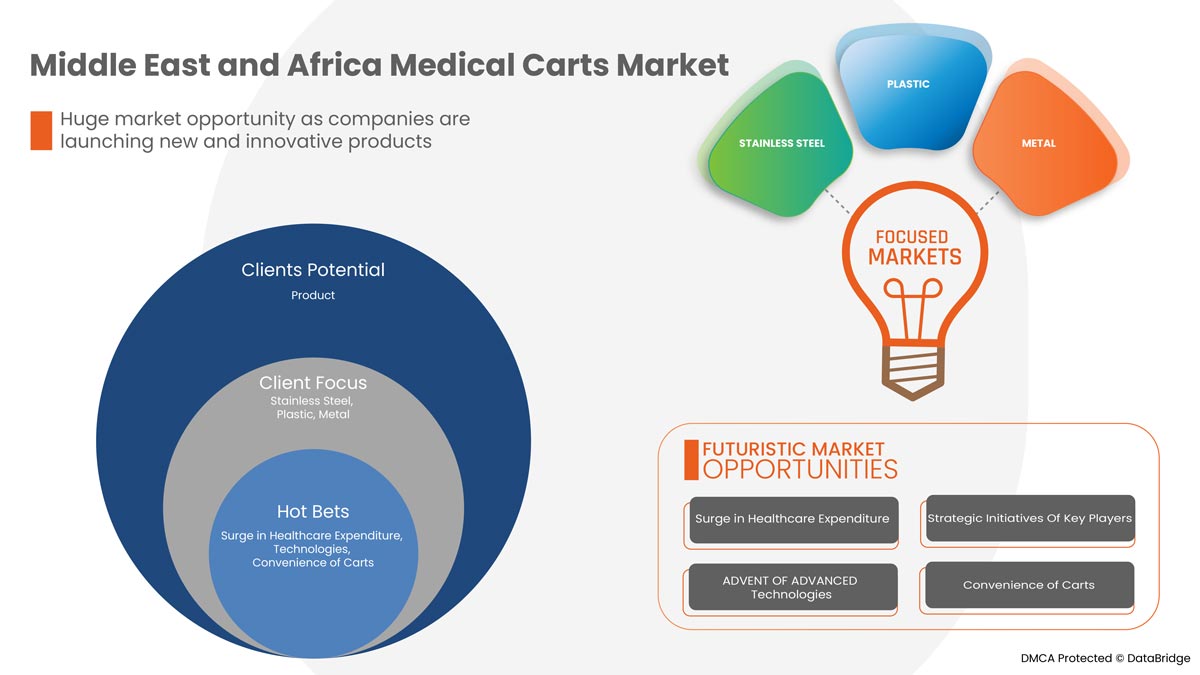

- aumento del gasto sanitario

La cantidad de dinero que un país destina a su atención sanitaria y su tasa de crecimiento a lo largo del tiempo están condicionadas por una amplia variedad de factores económicos y sociales, incluidos los mecanismos de financiación y la estructura de la organización del sistema de salud. En particular, existe una fuerte correlación entre el nivel de ingresos total y el gasto que la población de ese país realiza en atención sanitaria.

El gasto en atención sanitaria ha aumentado en los países desarrollados y en las economías emergentes a medida que aumenta el ingreso disponible de las personas. Además, para satisfacer las necesidades de la población, los organismos gubernamentales y las organizaciones de atención sanitaria de las diferentes regiones están tomando la iniciativa acelerando el gasto en atención sanitaria. El aumento del gasto en atención sanitaria ayuda a las organizaciones de atención sanitaria a mejorar sus instalaciones y equipos, incluidos los carros médicos.

- Iniciativas estratégicas de los actores clave del mercado

Las iniciativas estratégicas, como adquisiciones, asociaciones, acuerdos contractuales y participación en conferencias, brindan oportunidades para hacer crecer su base de clientes. Además, a través de estas estrategias de iniciativa, ambas empresas amplían su alcance a través de nuevos mercados geográficos o industriales, acceso a nuevos productos o servicios o nuevos tipos de clientes. Ambos actores del mercado abren la puerta a recursos adicionales o nuevos, como tecnología y talento.

- Conveniencia de los carros

Los carros médicos están ayudando al personal médico y quirúrgico a trabajar sin preocupaciones gracias a su cómoda aplicación. Muchos proveedores de atención médica han optado por carros médicos con sistemas EMR para almacenar datos médicos y mantenerlos en el lugar para tener una visión continua del progreso del tratamiento. Estos han ayudado a los proveedores de atención médica a eliminar la montaña de documentos en papel que contienen datos médicos. La carga se ha reducido con un panel táctil para almacenar y acceder a múltiples datos en carros médicos EMR. En casos de emergencia, estos carros con EMR permiten una búsqueda rápida y la visualización de registros al instante.

- Países emergentes con hospitales desarrollados

Los países en desarrollo, como India, China y Argentina, entre otros, están mejorando sus instalaciones sanitarias. El aumento de casos de enfermedades crónicas no transmisibles, paros cardíacos, diabetes y otras enfermedades exige una mayor dotación de instalaciones hospitalarias, con un aumento de los ingresos y tratamientos hospitalarios. Las altas tasas de enfermedades en los países en desarrollo también aumentan la oportunidad de que los actores del mercado distribuyan sus productos a un buen ritmo. La causa fundamental de su carga de enfermedades son las consecuencias de la pobreza, como la mala nutrición, la contaminación del aire y los hábitos alimentarios y el estilo de vida insalubres. Por lo tanto, esto aumenta la necesidad de hospitales con instalaciones de alta calidad en estos países en desarrollo.

Restricciones/Desafíos

- Estación de trabajo pesada sobre ruedas

La mayoría de los carros médicos que se utilizan en hospitales o pabellones médicos deben tener un diseño ergonómico para evitar problemas de peso para cualquier profesional sanitario que los utilice. Las estaciones de trabajo pesadas sobre ruedas siempre afectan a las enfermeras que empujan el carro.

- marco regulatorio estricto

El uso de carros médicos con numerosas especificidades y avances en los hospitales está aumentando rápidamente, con el crecimiento de la población envejecida y varias enfermedades cancerígenas que requieren largas estadías en el hospital y mantenimiento médico de rutina. Al mismo tiempo, los actores de los fabricantes de carros médicos en el mercado tienen que seguir regulaciones específicas para obtener la aprobación de las autoridades superiores para lanzar el producto al mercado. Estas estrictas pautas deben seguirse, y esta es una de las tareas más desafiantes entre todos los pasos. La aprobación previa a la comercialización de varios dispositivos médicos varía de un país a otro. La FDA de EE. UU. regula los carros médicos en EE. UU. La Unión Europea (UE) tiene en Europa. Sin embargo, el rápido desarrollo de políticas y regulaciones de privacidad se está realizando en Asia-Pacífico, Europa, Medio Oriente y África, incluidos India, Rusia, China, Corea del Sur, Singapur, Hong Kong y Australia.

Impacto posterior al COVID-19 en el mercado de carros médicos en Oriente Medio y África

El COVID-19 ha tenido un gran impacto en el mercado de carros médicos de Oriente Medio y África. El COVID-19 no ha afectado de forma perjudicial el precio y la demanda de los productos de carros médicos a un nivel superior debido a las progresivas ventas en línea y las innovadoras alternativas de entrega disponibles con las máximas preocupaciones de seguridad para los principales centros de atención médica, hospitales, clínicas y centros quirúrgicos ambulatorios. Sin embargo, el aumento de las enfermedades crónicas, los casos quirúrgicos y las admisiones hospitalarias han hecho crecer significativamente el uso de carros médicos en Oriente Medio y África. Durante y después del COVID-19, los carros médicos tuvieron una mayor demanda debido al aumento de los requisitos hospitalarios en varias regiones y los avances en investigación y desarrollo de equipos médicos han acelerado el crecimiento del mercado en Oriente Medio y África. La demanda de carros médicos ha aumentado en los últimos años a medida que los carros médicos están creciendo en hospitales, clínicas, centros de traumatología y centros quirúrgicos ambulatorios. Por lo tanto, la demanda de carros médicos siempre se ha mantenido alta, ya que muchos hospitales aumentaron con la necesidad de mejores instalaciones de equipos. El brote de la pandemia de COVID-19 afectó positivamente el crecimiento del mercado debido a la gran demanda de carros médicos, especialmente en varios hospitales, pero la interrupción de la cadena de suministro ha sido un desafío. Sin embargo, muchos otros carros médicos utilizados en cirugías y salas de cuidados intensivos de emergencia se ponen a disposición de los hospitales mediante transporte innovador y ventas en línea. La prioridad actual en la mayoría de los hospitales se da a los tratamientos de COVID-19, ya que el aumento de casos de COVID-19 sigue siendo persistente, lo que también aumenta el uso de carros médicos para numerosos suministros de medicamentos. Además, muchos gobiernos internacionales y organizaciones de atención médica han apoyado el suministro de estos productos debido a su alta prioridad en casos cruciales.

Acontecimientos recientes

- En septiembre de 2021, Omnicell, Inc. anunció que había completado la adquisición previamente anunciada de FDS Amplicare. La adquisición agrega un conjunto integral y complementario de soluciones de gestión financiera, análisis y salud de la población SaaS a la división EnlivenHealth de Omnicell, lo que impacta en el crecimiento del mercado de la empresa.

- En septiembre de 2020, Midmark Corp anunció que había adquirido Schroer Manufacturing Company (“Shor-Line”), un fabricante de equipos para la salud animal con sede en Kansas City, Kansas. La adquisición se suma a la cartera de Midmark y posiciona a la empresa como un socio de diseño preferido para los profesionales del cuidado de animales.

Alcance del mercado de carros médicos en Oriente Medio y África

El mercado de carros médicos de Oriente Medio y África se clasifica en siete segmentos notables según el producto, el tipo, la aplicación, el tipo de material, la carga útil, el usuario final y el canal de distribución. El crecimiento entre estos segmentos ayudará a analizar los segmentos de crecimiento del mercado en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Producto

- Carros de computación móviles

- Columnas de almacenamiento médico

- Armarios y accesorios

- Carritos de medicación

- Estaciones de trabajo montadas en la pared

- Otro

Según el producto, el mercado de carros médicos está segmentado en carros informáticos móviles, columnas de almacenamiento médico, gabinetes y accesorios, carros de medicamentos, estaciones de trabajo montadas en la pared y otros.

Tipo

- Carro médico para computadora

- Carro de emergencia

- Carro de procedimientos

- Carro de anestesia

- Carro utilitario para laboratorio médico

- Otros

Según el tipo, el mercado de carros médicos se segmenta en carro médico de computadora, carro de emergencia, carro de procedimientos, carro de anestesia, carros de servicios públicos de laboratorio médico y otros.

Solicitud

- Médico

- Imágenes médicas

- Laboratorio

- Otros

Según la aplicación, el mercado de carros médicos se segmenta en carros médicos, carros de imágenes médicas, carros de laboratorio y otros.

Tipo de material

- Plástico

- Madera

- Acero inoxidable

- Metal

- Otros

Según el tipo de material, el mercado de carros médicos está segmentado en plástico, madera, acero inoxidable, metal y otros .

Carga útil

- 50 kilos

- 65 kilos

- 80 kilos

- 150 kilos

- 180 kilos

- Otros

Según la carga útil, el mercado de carros médicos se segmenta en 50 kg, 65 kg, 80 kg, 150 kg, 180 kg y otros.

Usuario final

- Hospitales

- Clínicas

- Centros de cirugía ambulatoria

- Centros de trauma

- Otros.

Según el usuario final, el mercado de carros médicos está segmentado en hospitales, clínicas, centros quirúrgicos ambulatorios, centros de traumatología y otros.

Canal de distribución

- Licitación directa

- Distribuidores de terceros

- Otros

Según el canal de distribución, el mercado de carros médicos se segmenta en licitación directa, distribuidores externos y otros.

Análisis y perspectivas regionales del mercado de carros médicos en Oriente Medio y África

Se analiza el mercado de carros médicos de Oriente Medio y África. La información y las tendencias del tamaño del mercado se basan en el producto, el tipo, la aplicación, el tipo de material, la carga útil, el usuario final y el canal de distribución.

The countries covered in the Middle East and Africa medical carts market report are South Africa, Saudi Arabia, U.A.E, Egypt, Israel and Rest of Middle East and Africa.

South Africa dominates the Middle East and Africa medical carts market with a CAGR of around 7.4% in terms of market share and market revenue. It will continue to flourish its dominance during the forecast period. This is due to the rising cases of musculoskeletal injuries, surgeries, and the adoption electronic medical records at the hospital.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa Medical Carts Market Share Analysis

Middle East and Africa medical carts market competitive landscape provides details about the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, company strengths and weaknesses, product launch, regulatory guidelines, brand analysis, product approvals, product payload, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the Middle East and Africa medical carts market.

Some of the major players operating in the Middle East and Africa medical carts market are ITD Gmbh, Omnicell Inc., Midmark Corporation, Herman Miller, Inc., and AMD Telemedicine, among others.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA MEDICAL CARTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 MULTIVARIATE MODELLING

2.1 PRODUCT LIFELINE CURVE

2.2 DBMR MARKET POSITION GRID

2.3 VENDOR SHARE ANALYSIS

2.4 MARKET APPLICATION COVERAGE GRID

2.5 SECONDARY SOURCES

2.6 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: REGULATIONS

5.1 REGULATION IN THE U.S.

5.2 REGULATIONS IN EUROPE:

5.3 REGULATIONS IN CHINA:

5.4 REGULATIONS IN JAPAN:

5.5 REGULATION IN INDIA:

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 IMPROVING HEALTHCARE FACILITIES AND INFRASTRUCTURE

6.1.2 ADOPTION OF ELECTRONIC MEDICAL RECORD (EMR) AT HOSPITALS

6.1.3 ADVANCED MEDICAL CARTS APPLICATION

6.1.4 DURING COVID-19, MEDICAL CARTS SUPPLIED BY THE VENDORS, RISING THE MARKET GROWTH

6.2 RESTRAINTS

6.2.1 HIGH COST OF PRODUCT CUSTOMIZED MEDICAL CARTS

6.2.2 POTENTIAL PROBLEMS WITH BATTERY-OPERATED CARTS

6.2.3 LACK OF SKILLED PROFESSIONALS

6.3 OPPORTUNITIES

6.3.1 SURGE IN HEALTHCARE EXPENDITURE

6.3.2 STRATEGIC INITIATIVES BY KEY MARKET PLAYERS

6.3.3 CONVENIENCE OF CARTS

6.3.4 EMERGING COUNTRIES WITH DEVELOPED HOSPITALS

6.4 CHALLENGES

6.4.1 HEAVY WORKSTATION ON WHEELS

6.4.2 STRINGENT REGULATORY FRAMEWORK

7 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 MOBILE COMPUTING CARTS

7.2.1 BY APPLICATION

7.2.1.1 TELEHEALTH WORKSTATION

7.2.1.2 DOCUMENTATION

7.2.1.3 MEDICATION DELIVERY

7.2.1.4 EQUIPMENT

7.2.1.5 OTHERS

7.2.2 BY ENERGY SOURCE

7.2.2.1 NON-POWERED

7.2.2.2 POWERED

7.2.3 BY DISPLAY TYPE

7.2.3.1 1 MONITOR

7.2.3.2 LAPTOP

7.2.3.3 TABLET

7.2.3.4 2 MONITORS

7.3 MEDICAL STORAGE COLUMNS, CABINETS AND ACCESSORIES

7.3.1 STORAGE CABINETS

7.3.2 SUPPLY CABINETS

7.3.3 STERILIZATION CABINETS

7.3.4 DRYING CABINETS

7.3.5 TRANSFER CABINETS

7.3.6 DISPENSING CABINETS

7.3.7 OTHERS

7.4 MEDICATION CARTS

7.4.1 PUNCH-CARD CARTS

7.4.2 BOX-BIN-PUNCH CARD CARTS

7.4.3 BOX CARTS

7.4.4 BIN CARTS

7.5 WALL-MOUNTED WORKSTATIONS

7.5.1 SIT-STAND COMBO SYSTEM

7.5.2 WALL-MOUNT SYSTEM

7.5.3 OTHERS

7.6 OTHERS

8 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY TYPE

8.1 OVERVIEW

8.2 COMPUTER MEDICAL CART

8.2.1 TELEMEDICINE CART

8.2.2 POINT OF CARE PC CART

8.3 EMERGENCY CART

8.4 ANESTHESIA CART

8.5 PROCEDURE CART

8.6 MEDICAL LABORATORY UTILITY CART

8.7 OTHERS

9 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 MEDICAL

9.2.1 TELEMEDICINE

9.2.2 SURGERY

9.3 LABORATORY

9.4 MEDICAL IMAGING

9.5 OTHERS

10 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY MATERIAL TYPE

10.1 OVERVIEW

10.2 PLASTIC

10.3 STAINLESS STEEL

10.4 METAL

10.5 WOOD

10.6 OTHERS

11 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY PAYLOAD

11.1 OVERVIEW

11.2 80 KG

11.3 65 KG

11.4 50 KG

11.5 150 KG

11.6 180 KG

11.7 OTHERS

12 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS

12.2.1 LONG-TERM CARE HOSPITALS

12.2.2 ACUTE CARE HOSPITALS

12.2.3 NURSING FACILITIES

12.2.4 REHABILITATION CENTERS

12.3 CLINICS

12.4 AMBULATORY SURGICAL CENTERS

12.5 TRAUMA CENTERS

12.6 OTHERS

13 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 THIRD PARTY DISTRIBUTORS

13.3 DIRECT TENDER

13.4 OTHERS

14 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY REGION

14.1 MIDDLE EAST AND AFRICA

14.1.1 SOUTH AFRICA

14.1.2 SAUDI ARABIA

14.1.3 U.A.E

14.1.4 EGYPT

14.1.5 ISRAEL

14.1.6 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 HUMANSCALE

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.1.5 PARTNERSHIP

17.1.6 ACQUISITION

17.2 MCKESSON MEDICAL-SURGICAL INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 COMPANY SHARE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENT

17.3 ERGOTRON, INC.

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.3.4.1 PRODUCT PORTFOLIO

17.3.5 PARTNERSHIP

17.3.5.1 PRODUCT PORTFOLIO

17.4 HERMAN MILLER, INC.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 INTERMETRO INDUSTRIES CORPORATION

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 ADVANTECH CO., LTD.

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 AFC INDUSTRIES

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.7.3.1 ACQUISITION

17.8 AMD MIDDLE EAST & AFRICA TELEMEDICINE

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.8.3.1 PARTNERSHIP

17.9 ALTUS, INC.

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.9.3.1 EXPANSION

17.9.3.2 PARTNERSHIP

17.9.3.3 PRODUCT PORTFOLIO

17.1 BAILIDA MEDICAL.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 BERGMANN GROUP

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 BIHEALTHCARE (ZHANGJIAGANG BRAUN INDUSTRY CO., LTD.)

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.12.3.1 THE COMPANY’S WEBSITE HAS NO RECENT DEVELOPMENT RELATED TO THE MARKET

17.13 BYTEC HEALTHCARE LTD.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 CAPSA HEALTHCARE

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.14.3.1 ACQUISITION

17.15 CHANG GUNG MEDICAL TECHNOLOGY CO., LTD.

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 ENOVATE MEDICAL.

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.16.3.1 PRODUCT LAUNCH

17.17 HARLOFF MANUFACTURING COMPANY

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 HI-LIFE TECHNOLOGY

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 HUA SHUO PLASTIC CO., LTD.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 ITD GMBH

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.20.3.1 ACQUISITION

17.20.3.2 MODIFICATION

17.21 JACO INC.

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.21.3.1 PRODUCT LAUNCH

17.22 JEGNA (XIAMEN) INFO&TECH CO., LTD

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENT

17.23 JOSON-CARE ENTERPRISE CO., LTD.

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENTS

17.24 MEDICAL MASTER CO., LTD.

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 MIDMARK CORPORATION

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT DEVELOPMENT

17.25.3.1 ACQUISITION

17.26 OMNICELL INC.

17.26.1 COMPANY SNAPSHOT

17.26.2 REVENUE ANALYSIS

17.26.3 PRODUCT PORTFOLIO

17.26.4 RECENT DEVELOPMENTS

17.27 PEDIGO PRODUCTS

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENT

17.28 PERFORMANCE HEALTH

17.28.1 COMPANY SNAPSHOT

17.28.2 PRODUCT PORTFOLIO

17.28.3 RECENT DEVELOPMENT

17.29 VILLARD

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT DEVELOPMENT

17.3 ZHANGJIAGANG BESTRAN TECHNOLOGY CO.,LTD

17.30.1 COMPANY SNAPSHOT

17.30.2 PRODUCT PORTFOLIO

17.30.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tablas

TABLE 1 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 3 MIDDLE EAST & AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 6 MIDDLE EAST & AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (UNITS)

TABLE 8 MIDDLE EAST & AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (UNITS)

TABLE 10 MIDDLE EAST & AFRICA MEDICAL STORAGE COLUMNS, CABINETS AND ACCESSORIES IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 13 MIDDLE EAST & AFRICA MEDICATI0N CARTS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 16 MIDDLE EAST & AFRICA WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 19 MIDDLE EAST & AFRICA OTHERS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 22 MIDDLE EAST & AFRICA COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 25 MIDDLE EAST & AFRICA EMERGENCY CART IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA ANESTHESIA CART IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA PROCEDURE CART IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA MEDICAL LABORATORY UTILITY CART IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA OTHERS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA MEDICAL IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA MEDICAL IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA LABORATORY IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA MEDICAL IMAGING IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA OTHERS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (UNITS)

TABLE 38 MIDDLE EAST & AFRICA PLASTIC IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA STAINLESS STEEL IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA METAL IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA WOOD IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA OTHERS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY PAYLOAD, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA 80 KG IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA 65 KG IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA 50 KG IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA 150 KG IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA 180 KG IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA OTHERS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST & AFRICA HOSPITALS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA HOSPITALS IN MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 53 MIDDLE EAST & AFRICA CLINICS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA AMBULATORY SURGICAL CENTERS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 MIDDLE EAST & AFRICA TRAUMA CENTERS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA OTHERS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA THIRD PARTY DISTRIBUTORS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 MIDDLE EAST & AFRICA DIRECT TENDER IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA OTHERS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 61 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 62 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 63 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 64 MIDDLE EAST AND AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 MIDDLE EAST AND AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 66 MIDDLE EAST AND AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (USD MILLION)

TABLE 67 MIDDLE EAST AND AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (UNITS)

TABLE 68 MIDDLE EAST AND AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (USD MILLION)

TABLE 69 MIDDLE EAST AND AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (UNITS)

TABLE 70 MIDDLE EAST AND AFRICA MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 71 MIDDLE EAST AND AFRICA STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 72 MIDDLE EAST AND AFRICA MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 73 MIDDLE EAST AND AFRICA MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 74 MIDDLE EAST AND AFRICA WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 75 ASIA-PACIFIC WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 76 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 78 MIDDLE EAST AND AFRICA COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 MIDDLE EAST AND AFRICA COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 80 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 MIDDLE EAST AND AFRICA MEDICAL IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 83 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (UNITS)

TABLE 84 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY PAYLOAD, 2020-2029 (USD MILLION)

TABLE 85 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 86 MIDDLE EAST AND AFRICA HOSPITALS IN MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 87 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 88 SOUTH AFRICA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 89 SOUTH AFRICA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 90 SOUTH AFRICA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 91 SOUTH AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 SOUTH AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 93 SOUTH AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (ASP)

TABLE 94 SOUTH AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (USD MILLION)

TABLE 95 SOUTH AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (UNITS)

TABLE 96 SOUTH AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (ASP)

TABLE 97 SOUTH AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (USD MILLION)

TABLE 98 SOUTH AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (UNITS)

TABLE 99 SOUTH AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (ASP)

TABLE 100 SOUTH AFRICA MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 101 SOUTH AFRICA MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 102 SOUTH AFRICA MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 103 SOUTH AFRICA MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 104 SOUTH AFRICA MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 105 SOUTH AFRICA MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 106 SOUTH AFRICA WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 107 SOUTH AFRICA WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 108 SOUTH AFRICA WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 109 SOUTH AFRICA MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 SOUTH AFRICA MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 111 SOUTH AFRICA MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 112 SOUTH AFRICA COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 SOUTH AFRICA COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 114 SOUTH AFRICA COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 115 SOUTH AFRICA MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 116 SOUTH AFRICA MEDICAL IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 117 SOUTH AFRICA MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 118 SOUTH AFRICA MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (UNITS)

TABLE 119 SOUTH AFRICA MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (ASP)

TABLE 120 SOUTH AFRICA MEDICAL CARTS MARKET, BY PAYLOAD, 2020-2029 (USD MILLION)

TABLE 121 SOUTH AFRICA MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 122 SOUTH AFRICA HOSPITALS IN MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 123 SOUTH AFRICA MEDICAL CARTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 124 SAUDI ARABIA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 125 SAUDI ARABIA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 126 SAUDI ARABIA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 127 SAUDI ARABIA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 128 SAUDI ARABIA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 129 SAUDI ARABIA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (ASP)

TABLE 130 SAUDI ARABIA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (USD MILLION)

TABLE 131 SAUDI ARABIA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (UNITS)

TABLE 132 SAUDI ARABIA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (ASP)

TABLE 133 SAUDI ARABIA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (USD MILLION)

TABLE 134 SAUDI ARABIA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (UNITS)

TABLE 135 SAUDI ARABIA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (ASP)

TABLE 136 SAUDI ARABIA MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 137 SAUDI ARABIA MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 138 SAUDI ARABIA MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 139 SAUDI ARABIA MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 140 SAUDI ARABIA MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 141 SAUDI ARABIA MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 142 SAUDI ARABIA WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 143 SAUDI ARABIA WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 144 SAUDI ARABIA WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 145 SAUDI ARABIA MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 SAUDI ARABIA MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 147 SAUDI ARABIA MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 148 SAUDI ARABIA COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 SAUDI ARABIA COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 150 SAUDI ARABIA COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 151 SAUDI ARABIA MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 152 SAUDI ARABIA MEDICAL IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 153 SAUDI ARABIA MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 154 SAUDI ARABIA MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (UNITS)

TABLE 155 SAUDI ARABIA MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (ASP)

TABLE 156 SAUDI ARABIA MEDICAL CARTS MARKET, BY PAYLOAD, 2020-2029 (USD MILLION)

TABLE 157 SAUDI ARABIA MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 158 SAUDI ARABIA HOSPITALS IN MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 159 SAUDI ARABIA MEDICAL CARTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 160 U.A.E MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 161 U.A.E MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 162 U.A.E MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 163 U.A.E MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 164 U.A.E MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 165 U.A.E MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (ASP)

TABLE 166 U.A.E MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (USD MILLION)

TABLE 167 U.A.E MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (UNITS)

TABLE 168 U.A.E MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (ASP)

TABLE 169 U.A.E MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (USD MILLION)

TABLE 170 U.A.E MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (UNITS)

TABLE 171 U.A.E MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (ASP)

TABLE 172 U.A.E MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 173 U.A.E MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 174 U.A.E MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 175 U.A.E MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 176 U.A.E MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 177 U.A.E MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 178 U.A.E WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 179 U.A.E WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 180 U.A.E WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 181 U.A.E MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 182 U.A.E MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 183 U.A.E MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 184 U.A.E COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 185 U.A.E COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 186 U.A.E COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 187 U.A.E MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 188 U.A.E MEDICAL IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 189 U.A.E MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 190 U.A.E MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (UNITS)

TABLE 191 U.A.E MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (ASP)

TABLE 192 U.A.E MEDICAL CARTS MARKET, BY PAYLOAD, 2020-2029 (USD MILLION)

TABLE 193 U.A.E MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 194 U.A.E HOSPITALS IN MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 195 U.A.E MEDICAL CARTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 196 EGYPT MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 197 EGYPT MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 198 EGYPT MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 199 EGYPT MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 200 EGYPT MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 201 EGYPT MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (ASP)

TABLE 202 EGYPT MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (USD MILLION)

TABLE 203 EGYPT MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (UNITS)

TABLE 204 EGYPT MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (ASP)

TABLE 205 EGYPT MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (USD MILLION)

TABLE 206 EGYPT MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (UNITS)

TABLE 207 EGYPT MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (ASP)

TABLE 208 EGYPT MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 209 EGYPT MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 210 EGYPT MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 211 EGYPT MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 212 EGYPT MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 213 EGYPT MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 214 EGYPT WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 215 EGYPT WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 216 EGYPT WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 217 EGYPT MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 218 EGYPT MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 219 EGYPT MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 220 EGYPT COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 221 EGYPT COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 222 EGYPT COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 223 EGYPT MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 224 EGYPT MEDICAL IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 225 EGYPT MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 226 EGYPT MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (UNITS)

TABLE 227 EGYPT MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (ASP)

TABLE 228 EGYPT MEDICAL CARTS MARKET, BY PAYLOAD, 2020-2029 (USD MILLION)

TABLE 229 EGYPT MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 230 EGYPT HOSPITALS IN MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 231 EGYPT MEDICAL CARTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 232 ISRAEL MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 233 ISRAEL MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 234 ISRAEL MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 235 ISRAEL MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 236 ISRAEL MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 237 ISRAEL MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (ASP)

TABLE 238 ISRAEL MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (USD MILLION)

TABLE 239 ISRAEL MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (UNITS)

TABLE 240 ISRAEL MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (ASP)

TABLE 241 ISRAEL MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (USD MILLION)

TABLE 242 ISRAEL MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (UNITS)

TABLE 243 ISRAEL MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (ASP)

TABLE 244 ISRAEL MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 245 ISRAEL MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 246 ISRAEL MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 247 ISRAEL MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 248 ISRAEL MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 249 ISRAEL MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 250 ISRAEL WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 251 ISRAEL WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 252 ISRAEL WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 253 ISRAEL MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 254 ISRAEL MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 255 ISRAEL MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 256 ISRAEL COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 257 ISRAEL COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 258 ISRAEL COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 259 ISRAEL MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 260 ISRAEL MEDICAL IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 261 ISRAEL MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 262 ISRAEL MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (UNITS)

TABLE 263 ISRAEL MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (ASP)

TABLE 264 ISRAEL MEDICAL CARTS MARKET, BY PAYLOAD, 2020-2029 (USD MILLION)

TABLE 265 ISRAEL MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 266 ISRAEL HOSPITALS IN MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 267 ISRAEL MEDICAL CARTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 268 REST OF MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 269 REST OF MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 270 REST OF MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

Lista de figuras

FIGURE 1 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: MIDDLE EAST & AFRICA VS REGIONAL ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: SEGMENTATION

FIGURE 11 IMPROVING HEALTHCARE FACILITIES AND INFRASTRUCTURE AND ADOPTION OF ELECTRONIC MEDICAL RECORD (EMR) AT HOSPITAL IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA MEDICAL CARTS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 MOBILE COMPUTING CARTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA MEDICAL CARTS MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA MEDICAL CARTS MARKET AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA MEDICAL CARTS MARKET

FIGURE 15 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY PRODUCT, 2021

FIGURE 16 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY PRODUCT, 2020-2029 (USD MILLION)

FIGURE 17 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY PRODUCT, CAGR (2022-2029)

FIGURE 18 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 19 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY TYPE, 2021

FIGURE 20 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY TYPE, 2020-2029 (USD MILLION)

FIGURE 21 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 22 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 23 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY APPLICATION, 2021

FIGURE 24 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY APPLICATION, 2020-2029 (USD MILLION)

FIGURE 25 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 26 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 27 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY MATERIAL TYPE, 2021

FIGURE 28 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY MATERIAL TYPE, 2020-2029 (USD MILLION)

FIGURE 29 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY MATERIAL TYPE, CAGR (2022-2029)

FIGURE 30 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY MATERIAL TYPE, LIFELINE CURVE

FIGURE 31 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY PAYLOAD, 2021

FIGURE 32 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY PAYLOAD, 2020-2029 (USD MILLION)

FIGURE 33 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY PAYLOAD, CAGR (2022-2029)

FIGURE 34 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY PAYLOAD, LIFELINE CURVE

FIGURE 35 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY END USER, 2021

FIGURE 36 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 37 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY END USER, CAGR (2022-2029)

FIGURE 38 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY END USER, LIFELINE CURVE

FIGURE 39 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY THIRD PARTY DISTRIBUTORS, 2021

FIGURE 40 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY THIRD PARTY DISTRIBUTORS, 2020-2029 (USD MILLION)

FIGURE 41 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY THIRD PARTY DISTRIBUTORS, CAGR (2022-2029)

FIGURE 42 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY THIRD PARTY DISTRIBUTORS, LIFELINE CURVE

FIGURE 43 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET: SNAPSHOT (2021)

FIGURE 44 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET: BY COUNTRY (2021)

FIGURE 45 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 46 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 47 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET: BY PRODUCT (2022-2029)

FIGURE 48 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.