Middle East And Africa Medical Aesthetics Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

593.91 Million

USD

1,387.09 Million

2024

2032

USD

593.91 Million

USD

1,387.09 Million

2024

2032

| 2025 –2032 | |

| USD 593.91 Million | |

| USD 1,387.09 Million | |

|

|

|

|

Mercado de productos médicos estéticos en Oriente Medio y África, por tipo de producto (dispositivos láser estéticos, dispositivos de energía, dispositivos de contorno corporal, dispositivos estéticos faciales, implantes estéticos y dispositivos estéticos para la piel), aplicación (antienvejecimiento y arrugas, rejuvenecimiento facial y de la piel, aumento de senos, modelado corporal y celulitis, eliminación de tatuajes, lesiones vasculares, quemaduras, lesiones pigmentarias, reconstructivas, psoriasis y vitíligo, y otras), usuario final (centros de estética, clínicas de dermatología, hospitales y spas médicos y centros de belleza), canal de distribución (licitación directa y venta minorista): tendencias de la industria y pronóstico hasta 2032

Análisis del mercado médico estético de Oriente Medio y África

La medicina estética tiene una rica historia que se remonta a las civilizaciones antiguas, donde los tratamientos de belleza se practicaban con remedios naturales y formas tempranas de procedimientos cosméticos. A principios del siglo XX, la medicina estética comenzó a fusionarse con los avances en la tecnología médica, con innovaciones como el primer colágeno inyectable para el tratamiento de las arrugas en la década de 1970. El desarrollo del Botox en la década de 1980 marcó un hito importante, al introducir el rejuvenecimiento facial no quirúrgico. A lo largo de las décadas, el campo se expandió con la llegada de las tecnologías láser, los rellenos dérmicos y los tratamientos no invasivos de contorno corporal. Hoy en día, la medicina estética combina la tecnología avanzada con el creciente deseo de procedimientos cosméticos no invasivos, lo que la convierte en una industria en rápido crecimiento en la atención médica de Oriente Medio y África.

Tamaño del mercado de la medicina estética en Oriente Medio y África

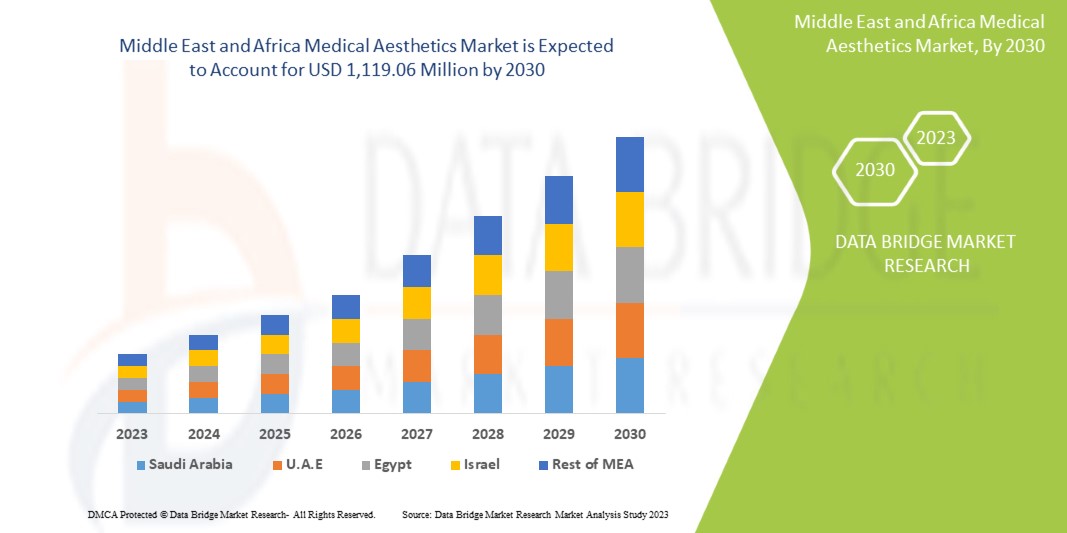

El tamaño del mercado de estética médica en Oriente Medio y África se valoró en USD 593,908 millones en 2024 y se proyecta que alcance los USD 1,387,088 millones para 2032, con una CAGR del 11,2% durante el período de pronóstico de 2025 a 2032. Además de la información sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas / consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio.

Tendencias del mercado médico estético en Oriente Medio y África

“Aumento de la demanda de procedimientos no quirúrgicos”

El mercado de la medicina estética en Oriente Medio y África está experimentando una tendencia significativa hacia los procedimientos cosméticos no quirúrgicos, impulsada por los avances tecnológicos, los tiempos de recuperación mínimos y la creciente preferencia de los consumidores por tratamientos menos invasivos. Los procedimientos como las inyecciones de bótox, los rellenos dérmicos, los tratamientos con láser y el contorno corporal no quirúrgico se están volviendo cada vez más populares a medida que las personas buscan mejorar su apariencia sin los riesgos y el tiempo de recuperación asociados con las cirugías tradicionales. La creciente conciencia sobre los tratamientos estéticos, junto con la influencia de las redes sociales en los estándares de belleza, ha contribuido a este aumento de la demanda. Además, el aumento de los ingresos disponibles, junto con el envejecimiento de la población en los mercados desarrollados, está impulsando la expansión del mercado. La creciente disponibilidad de tratamientos innovadores y personalizados y la creciente aceptación de la medicina estética en la sociedad en general aceleran aún más esta tendencia, posicionando las opciones no quirúrgicas como la opción preferida para muchos consumidores.

Alcance del informe y segmentación del mercado de medicina estética en Oriente Medio y África

|

Atributos |

Perspectivas del mercado de la medicina estética en Oriente Medio y África |

|

Segmentos cubiertos |

|

|

Región cubierta |

Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos y resto de Medio Oriente y África. |

|

Actores clave del mercado |

Mentor WorldWide LLC (una subsidiaria de Johnsons & Johnsons) (EE. UU.), Allergan (una subsidiaria de AbbVie Inc.) (Irlanda), GALDERMA (Suiza), Cutera, Inc. (EE. UU.), Lumenis Be Ltd. (Israel), Densply Sirona (EE. UU.), Institut Straumann AG (EE. UU.), Candela Corporation (EE. UU.), Medytrox (Corea del Sur), BioHorizons (EE. UU.), BTL (India), Nobel Biocare Services AG (Suiza), Merz Pharma (Alemania), Cynosure, LLC (EE. UU.), Sharplight Technologies Inc. (Israel), Alma Lasers (EE. UU.), MEGA'GEN IMPLANT CO., LTD. (India), 3M (EE. UU.), Quanta System (Italia), Sciton (California) y entre otros. |

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de la información sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis de consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Definición del mercado médico estético de Oriente Medio y África

La estética médica incluye todos los tratamientos médicos que se centran en mejorar la apariencia estética de los pacientes. La estética médica se encuentra en un hermoso nicho entre la industria de la belleza y la cirugía plástica. Los médicos, enfermeras o dentistas calificados pueden brindar una multitud de tratamientos sorprendentes para mejorar su apariencia. Estos tratamientos requieren un alto grado de habilidad, capacitación y conocimiento de su anatomía y fisiología. Esto es lo que separa los tratamientos estéticos médicos de los tratamientos de belleza como el enhebrado de cejas, la depilación con cera o las extensiones de pestañas. Por otro lado, los tratamientos estéticos médicos no son tan agresivos como las intervenciones quirúrgicas (los tratamientos estéticos médicos a veces se denominan tratamientos cosméticos no quirúrgicos), que incluyen procedimientos como estiramientos faciales, aumentos de senos o liposucción.

Dinámica de definición del mercado de medicina estética en Oriente Medio y África

Conductores

- Aumento de la población envejecida

El aumento de la población que envejece impulsa significativamente el mercado de servicios estéticos debido al creciente deseo entre los adultos mayores de mantener una apariencia juvenil y mejorar su calidad de vida. A medida que las personas envejecen, a menudo experimentan una disminución de la elasticidad de la piel, la aparición de arrugas y otros signos de envejecimiento que pueden afectar la autoestima y el bienestar general. Este cambio demográfico ha llevado a una mayor demanda de diversos tratamientos estéticos, incluidos procedimientos no invasivos como el botox, los rellenos dérmicos y las terapias de rejuvenecimiento de la piel. La creciente conciencia de estas opciones estéticas, junto con un énfasis cultural en la belleza y la apariencia, impulsa a los adultos mayores a buscar soluciones que les permitan lucir tan vibrantes como se sienten, lo que impulsa el crecimiento del mercado.

Por ejemplo,

- En septiembre de 2022, según un artículo publicado por The Nation, la industria de la salud y la estética de Tailandia se ha visto impulsada por el envejecimiento de la población del país. Además, según la misma fuente, al 31 de diciembre del año pasado, 12,24 millones o el 18,5% de la población de Tailandia tenía 60 años o más.

- En enero de 2024, según las noticias publicadas por PRB, se producirá un aumento significativo de la población envejecida en los Estados Unidos, y se prevé que el número de estadounidenses de 65 años o más aumente del 17 % al 23 % para 2060. Este cambio demográfico impulsa el mercado de la medicina estética en Oriente Medio y África, ya que los adultos mayores buscan tratamientos para abordar problemas relacionados con la edad, como arrugas, flacidez de la piel y pérdida de volumen. La creciente demanda de procedimientos antienvejecimiento, como el bótox, los rellenos dérmicos y los tratamientos de rejuvenecimiento de la piel, impulsa el crecimiento del mercado y la innovación en productos y servicios estéticos.

- En mayo de 2023, según la noticia publicada en la Oficina del Censo de EE. UU., el informe destaca un aumento del 38,6% en la población estadounidense de 65 años o más de 2010 a 2020, lo que impulsa la demanda de tratamientos antienvejecimiento como el bótox y los rellenos dérmicos, impulsando así el crecimiento en el mercado de la estética médica en Oriente Medio y África.

Además, el aumento de los ingresos disponibles entre la población de edad avanzada contribuye a la expansión del mercado de servicios estéticos. A medida que los adultos mayores buscan invertir en su apariencia y bienestar personal, están más dispuestos a gastar en tratamientos de mejora.

En conclusión, los avances tecnológicos han hecho que los procedimientos estéticos sean más seguros, mínimamente invasivos y más accesibles, atrayendo a un segmento más amplio de adultos mayores que antes podían haber dudado sobre este tipo de intervenciones. Esta convergencia de tendencias demográficas, aumento de los ingresos disponibles y una mejor oferta de servicios representa un crecimiento significativo para el sector de los servicios estéticos, impulsando la innovación y la competencia entre los proveedores.

- Los cambiantes estándares de belleza y la influencia de las redes sociales

La evolución de los estándares de belleza y la influencia de las plataformas de redes sociales impulsan significativamente la demanda de tratamientos de estética médica. Las plataformas de redes sociales como Instagram y TikTok muestran estándares de belleza idealizados, lo que alienta a las personas a buscar mejoras estéticas para lograr looks similares. Los influencers y las celebridades a menudo promueven los tratamientos estéticos, lo que los hace más comunes y deseables. Esta tendencia genera una mayor conciencia y aceptación de la estética médica, lo que impulsa el crecimiento del mercado.

Por ejemplo,

- En junio de 2023, según un artículo publicado en la Biblioteca Nacional de Medicina, la creciente demanda de estética médica impulsada por el envejecimiento de la población y los avances tecnológicos. A medida que las personas envejecen, buscan tratamientos para abordar los signos del envejecimiento, como las arrugas y la flacidez de la piel. Los avances tecnológicos han hecho que estos tratamientos sean más efectivos y accesibles, lo que impulsa aún más el crecimiento del mercado. Además, la creciente conciencia y aceptación de los procedimientos estéticos contribuyen a la expansión del mercado.

- En julio de 2024, según un artículo publicado en ResearchGate, las redes sociales tuvieron una influencia significativa en la imagen corporal y las consideraciones sobre la cirugía estética. Las plataformas de redes sociales a menudo retratan estándares de belleza idealizados, lo que lleva a las personas a buscar mejoras estéticas para lograr una apariencia similar. Esta tendencia impulsa la demanda de tratamientos de estética médica, ya que las personas se ven cada vez más influenciadas por las imágenes y los estilos de vida que ven en línea. El análisis destaca el papel de las redes sociales en la configuración de las percepciones de la belleza y la creciente aceptación de los procedimientos cosméticos, lo que impulsa el crecimiento del mercado.

El mercado de la medicina estética en Oriente Medio y África está impulsado por los cambiantes estándares de belleza y la influencia generalizada de las redes sociales. A medida que las personas se esfuerzan por cumplir con estos ideales en evolución, la demanda de tratamientos estéticos continúa aumentando, lo que fomenta la innovación y la expansión dentro de la industria.

Oportunidades

- Desarrollo de nuevos tratamientos innovadores

La introducción de tratamientos nuevos e innovadores presenta una oportunidad importante para el mercado de la medicina estética. Con los avances en la tecnología médica, los tratamientos estéticos han evolucionado para incluir opciones no invasivas y altamente efectivas que satisfacen la creciente demanda de mejores resultados con un tiempo de recuperación mínimo. Los tratamientos como las terapias con células madre, las técnicas láser avanzadas y los estiramientos faciales no quirúrgicos están reconfigurando el mercado al brindarles a los consumidores una gama más amplia de opciones que satisfacen sus diversas necesidades y preferencias. Estas innovaciones no solo mejoran la eficacia y la seguridad de los tratamientos, sino que también reducen los riesgos asociados con los procedimientos quirúrgicos más tradicionales. A medida que los consumidores buscan cada vez más soluciones de vanguardia para mantener su juventud y mejorar su apariencia, la demanda de estos servicios estéticos avanzados continúa aumentando. Este cambio hacia tratamientos más nuevos y efectivos actúa como una oportunidad clave, impulsando el crecimiento en el mercado y posicionándolo para una expansión a largo plazo a medida que la tecnología continúa transformando la industria.

Por ejemplo,

- En febrero de 2022, según el artículo publicado por Science Direct, las células madre, utilizadas originalmente para enfermedades degenerativas crónicas, ahora están surgiendo como un tratamiento prometedor y mínimamente invasivo en estética. Este cambio hacia las terapias con células madre ofrece soluciones efectivas para el rejuvenecimiento de la piel y el antienvejecimiento, lo que atrae un creciente interés de los consumidores. A medida que este tratamiento innovador gana terreno, presenta una oportunidad significativa para que el mercado de servicios estéticos del sudeste asiático se expanda y evolucione.

- En agosto de 2021, según el artículo publicado por NCBI, las células madre, en particular las derivadas del tejido adiposo, están ganando popularidad en la dermatología cosmética debido a su capacidad de autorrenovarse y diferenciarse en varios tipos de células. Su facilidad de recolección y abundancia las convierten en una opción atractiva para tratamientos estéticos, como el rejuvenecimiento de la piel. Esta innovación presenta una valiosa oportunidad para que el mercado de servicios estéticos del sudeste asiático crezca y diversifique su oferta.

- En enero de 2023, según el artículo publicado en la revista MedEsthetics, importantes innovaciones tecnológicas impulsarán el crecimiento del mercado médico estético. Estos avances incluyen procedimientos indoloros de nueva generación, dispositivos avanzados, rejuvenecimiento fraccionado, lipoescultura asistida por ultrasonido de tercera generación e imágenes avanzadas de la piel. La integración de VR, AR, AI, CAD, telemedicina e IoT mejora la precisión y la eficiencia de los procedimientos, haciéndolos más precisos y menos invasivos.

- En febrero de 2024, según el artículo publicado en MDPI, los avances en medicina regenerativa para la dermatología estética se centran en tratamientos innovadores y mínimamente invasivos para el rejuvenecimiento y la regeneración facial. La estrecha correlación entre la reparación de tejidos, la regeneración y el envejecimiento ha allanado el camino para la aplicación de los principios de la medicina regenerativa en la dermatología cosmética.

La introducción de tratamientos nuevos y avanzados ofrece una valiosa oportunidad para el mercado médico estético. Innovaciones como las terapias con células madre, los tratamientos láser mejorados y los estiramientos faciales no quirúrgicos ofrecen a los consumidores opciones más seguras y efectivas que requieren menos tiempo de recuperación. Estos avances satisfacen la creciente demanda de procedimientos no invasivos y atraen a quienes buscan resultados mejores y más duraderos. A medida que estos tratamientos ganan popularidad, crean una fuerte demanda, actuando como un impulsor clave para el crecimiento del mercado y posicionándolo para una expansión continua.

- Asociaciones e innovaciones médicas

Las colaboraciones e innovaciones médicas representan una oportunidad importante para el mercado de la medicina estética, ya que mejoran la credibilidad y la calidad de los servicios ofrecidos. Las colaboraciones entre proveedores de servicios estéticos y profesionales médicos calificados, como dermatólogos y cirujanos plásticos, garantizan que los tratamientos no solo sean efectivos, sino también seguros para los consumidores. Estas colaboraciones también permiten la integración de tecnologías y técnicas médicas avanzadas en los procedimientos estéticos, lo que hace que los servicios sean más confiables y atractivos para una base de clientes más amplia. Con la participación de profesionales médicos de confianza, los consumidores se sienten más seguros con los procedimientos, lo que genera una mayor demanda de servicios estéticos. Además, estas colaboraciones abren las puertas al desarrollo de nuevos tratamientos de vanguardia que aborden las necesidades emergentes de los consumidores. Esta alianza entre la estética y la medicina impulsa el crecimiento del mercado al posicionarlo como un sector confiable, innovador y de alta calidad.

Por ejemplo,

- En noviembre de 2024, según el artículo publicado por The Nation, la asociación de MASTER con "Lumeo Health" de Indonesia lo posiciona como el principal proveedor de cirugía estética del sudeste asiático. Esta colaboración fomenta la innovación y mejora las asociaciones médicas, ofreciendo servicios estéticos avanzados a un mercado en crecimiento. Al combinar experiencia y recursos, esta alianza abre nuevas oportunidades para un acceso ampliado, tratamientos de vanguardia y mejores resultados para los pacientes, impulsando el crecimiento del sector estético.

- En octubre de 2023, según el artículo publicado por Health365, la asociación con el Hospital de Bangkok marca un paso importante en la mejora de los servicios estéticos en el sudeste asiático. Al combinar la experiencia de Health365 con la innovación médica del Hospital de Bangkok, esta colaboración promueve el acceso a tratamientos de primera clase y tecnologías avanzadas. Esta alianza estratégica presenta una valiosa oportunidad para elevar el mercado de servicios estéticos de la región, impulsando el crecimiento y mejorando la atención al paciente.

Las alianzas médicas representan una valiosa oportunidad para el mercado de servicios estéticos médicos, ya que mejoran la credibilidad y la calidad de los servicios. Las colaboraciones entre proveedores estéticos y profesionales médicos calificados garantizan que los tratamientos sean seguros y efectivos, lo que genera confianza en los consumidores. Estas alianzas también facilitan la introducción de técnicas y tecnologías avanzadas, lo que atrae a una base de clientes más amplia. Al combinar la experiencia médica con la innovación estética, el mercado experimenta un crecimiento y una mayor demanda.

Restricciones/Desafíos

- Falta de profesionales capacitados

La falta de profesionales capacitados en el mercado de servicios estéticos obstaculiza significativamente el crecimiento y la proliferación de estos servicios. Los procedimientos estéticos, que a menudo requieren habilidades y conocimientos especializados, necesitan una fuerza laboral bien versada en las últimas tecnologías, técnicas y protocolos de seguridad. La escasez de profesionales certificados limita la disponibilidad de servicios y plantea riesgos para la seguridad del paciente, lo que genera posibles complicaciones e insatisfacción con los resultados. Esto crea un ciclo en el que los consumidores dudan en contratar ofertas estéticas, lo que estanca aún más el crecimiento del mercado.

Por ejemplo,

- En agosto de 2023, según un artículo publicado por The Malaysian Reserve, la ignorancia o la falta de concienciación sobre los procedimientos estéticos riesgosos que realizan los esteticistas o los profesionales sin licencia en Malasia suponen una grave amenaza para los consumidores. El uso de productos de calidad inferior o prácticas insalubres puede provocar graves problemas de salud, infecciones o daños irreversibles. Además, la ausencia de supervisión regulatoria deja a los consumidores vulnerables a prácticas engañosas, lo que les dificulta buscar recursos en caso de mala praxis o efectos adversos.

- En julio de 2019, según un artículo titulado "La asociación promueve a los esteticistas cualificados en Malasia", se afirmó que las estimaciones locales sugieren que hay 20.000 esteticistas no certificados en comparación con solo 200 titulares certificados de cualificaciones profesionales. Esto supone un reto para la industria a la hora de mantener sus estándares de prestación de servicios estéticos.

- En octubre de 2024, según el artículo publicado en The Evaluation Company, la escasez significativa de personal médico en los EE. UU., lo que supone una limitación para el mercado de la medicina estética en Oriente Medio y África. La escasez no solo afecta a los médicos, sino también a las enfermeras y otros profesionales de la salud, lo que provoca tiempos de espera más largos y una menor disponibilidad de tratamientos estéticos. Esta escasez de profesionales cualificados puede limitar el crecimiento y la expansión del mercado de la medicina estética, ya que la demanda de profesionales cualificados supera la oferta.

Además, esta falta de talento puede impedir que las clínicas y los proveedores de servicios amplíen sus operaciones o su oferta. A medida que la demanda de servicios estéticos sigue aumentando, en particular entre los grupos demográficos más jóvenes que buscan tratamientos no invasivos, la capacidad de satisfacer esta demanda se ve obstaculizada por un grupo limitado de profesionales calificados. Este desafío afecta la reputación y la confianza de la marca, ya que los clientes son más propensos a elegir establecimientos conocidos por su personal capacitado y experimentado. En consecuencia, sin programas de capacitación específicos e iniciativas de apoyo para nutrir a los profesionales de la salud en el campo de la estética, el potencial del mercado de la estética médica en Oriente Medio y África sigue infrautilizado.

- Riesgos de efectos secundarios asociados con estos procedimientos

El riesgo de efectos secundarios asociados con los procedimientos estéticos actúa como un freno importante para el mercado médico estético al generar aprensión entre los clientes potenciales. Muchos procedimientos cosméticos, ya sean quirúrgicos o no, conllevan el riesgo inherente de complicaciones como infecciones, cicatrices o resultados insatisfactorios. Este miedo a los efectos adversos puede disuadir a las personas de buscar estos servicios, ya que los consumidores están cada vez más informados a través de las redes sociales y plataformas en línea sobre las experiencias de otros, incluidos los resultados negativos. En consecuencia, la posibilidad de efectos secundarios puede crear una percepción de que estos procedimientos no valen la pena, lo que lleva a una menor demanda y participación en el mercado.

Por ejemplo,

- En octubre de 2024, según un artículo titulado 'Peligros de la cirugía estética en Tailandia' del Dr. Ehsan Jadoon, los peligros asociados con las cirugías estéticas incluyen hinchazón, hematomas, infecciones, reacciones alérgicas, resultados asimétricos, lesiones vasculares, traumatismos nerviosos, alteraciones visuales, trauma psicológico y daños corporales graves.

- En octubre de 2024, según un artículo publicado en el Journal of Cutaneous and Aesthetic Surgery, muchos eventos adversos no se notifican debido a la falta de regulación y la aplicación deficiente de las normas, ya que los procedimientos suelen realizarse en entornos no médicos, como spas y salones de belleza. Esta falta de supervisión puede provocar complicaciones como necrosis grasa, infecciones y otros efectos secundarios, especialmente cuando los procedimientos los realizan profesionales sin experiencia. El miedo a la publicidad adversa en los medios y las bajas tasas de notificación agravan aún más estos problemas, por lo que es crucial que la industria implemente estrictas medidas de prevención y evaluación de riesgos para garantizar la seguridad de los pacientes y mantener el crecimiento del mercado.

- En agosto de 2020, según la noticia publicada en The PMFA Journal, las complicaciones pueden surgir de varios factores, incluida la selección del paciente, las técnicas de inyección y los riesgos inherentes a los procedimientos en sí. Estas complicaciones pueden variar desde problemas menores como hematomas e hinchazón hasta problemas más graves como infecciones, oclusiones vasculares y reacciones alérgicas. El miedo a estas posibles complicaciones puede disuadir a las personas de buscar tratamientos estéticos, lo que limita el crecimiento del mercado.

Además, la influencia de los sistemas sanitarios locales y los entornos normativos aumentan aún más las preocupaciones sobre los efectos secundarios en la región. Si las personas perciben que la clínica puede no priorizar la seguridad o no cumplir con las normas sanitarias rigurosas, es menos probable que opten por los tratamientos estéticos. Este escepticismo puede verse agravado por la cobertura mediática de procedimientos chapuceros y prácticas inseguras, lo que hace que los clientes potenciales desconfíen de los riesgos asociados. Como resultado, el miedo a sufrir efectos secundarios no solo frena el interés individual, sino que también plantea desafíos para el crecimiento del mercado a medida que las empresas se esfuerzan por generar confianza en los consumidores y seguridad en sus servicios.

Alcance del mercado médico estético en Oriente Medio y África

El mercado está segmentado en función de los productos, las aplicaciones, el usuario final y el canal de distribución. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Producto

- Dispositivos láser estéticos

- Dispositivos de rejuvenecimiento cutáneo ablativo

- Láser de CO2

- Láser de erbio

- Otros

- Dispositivos de rejuvenecimiento con láser fraccionado no ablativo

- Frecuencia de radio

- Luz pulsada intensa

- Láser fraccional

- El láser ND:YAG con conmutación Q

- Otros

- Dispositivos de energía

- Dispositivos de cirugía láser

- Dispositivos de electrocauterio

- Dispositivos de electrocirugía

- Dispositivos de criocirugía

- Bisturí armónico

- Dispositivos de microondas

- Dispositivos para el contorno corporal

- Liposucción

- Estiramiento de la piel sin cirugía

- Tratamiento de la celulitis

- Dispositivos estéticos faciales

- Inyección de Botox

- Relleno dérmico

- Rellenos dérmicos naturales

- Rellenos dérmicos sintéticos

- Inyecciones de colágeno

- Peeling químico

- Tonificación facial

- Fraxel

- Acupuntura cosmética

- Electroterapia

- Microdermoabrasión

- Maquillaje permanente

- Implantes estéticos

- Aumento de senos

- Implantes de solución salina

- Implantes de silicona

- Aumento de glúteos

- Implantes dentales estéticos

- Implantes dentales de titanio

- Implantes dentales de zirconio

- Implantes faciales

- Implantes de tejidos blandos

- Implante transdérmico

- Otros

- Dispositivos estéticos para la piel

- Dispositivos de rejuvenecimiento cutáneo con láser

- Dispositivos no quirúrgicos para tensar la piel

- Dispositivos de terapia de luz

- Dispositivos para eliminar tatuajes

- Productos de microagujas

- Productos de lifting con hilos

- Dispositivos láser para el tratamiento de uñas

- Otros

Solicitud

- Antienvejecimiento y Arrugas

- Rejuvenecimiento facial y de la piel

- Aumento de senos

- Remodelación corporal y celulitis

- Eliminación de tatuajes

- Lesiones vasculares

- Sears, lesiones pigmentarias, reconstructiva

- Psoriasis y vitíligo

- Otros

Usuario final

- Centros de estética

- Clínicas de Dermatología

- Hospitales

- Spas médicos y centros de belleza

Canal de distribución

- Licitación directa

- Minorista

Análisis regional del mercado de la medicina estética en Oriente Medio y África

Se analiza el mercado y se proporcionan información sobre el tamaño del mercado y las tendencias por país, productos, aplicaciones, usuarios finales y canales de distribución como se menciona anteriormente.

Las regiones cubiertas por el mercado son Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos y el resto de Medio Oriente y África.

Los Emiratos Árabes Unidos dominan el mercado mundial de estética médica debido a su alta demanda de procedimientos cosméticos, infraestructura de atención médica avanzada y un enfoque creciente en la belleza y el bienestar.

Arabia Saudita es el mercado de más rápido crecimiento, impulsado por una población joven, un mayor ingreso disponible y un cambio cultural hacia los tratamientos cosméticos, lo que lo convierte en un sector en auge en la región.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Puntos de datos como análisis de la cadena de valor aguas arriba y aguas abajo, tendencias técnicas y análisis de las cinco fuerzas de Porter, estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de Medio Oriente y África y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales al proporcionar un análisis de pronóstico de los datos del país.

Cuota de mercado de la medicina estética en Oriente Medio y África

El panorama competitivo del mercado proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en Oriente Medio y África, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado.

Los líderes del mercado médico estético de Oriente Medio y África que operan en el mercado son:

- Mentor WorldWide LLC (una subsidiaria de Johnsons & Johnsons) (EE. UU.)

- Allergan (una subsidiaria de AbbVie Inc.) (Irlanda)

- GALDERMA (Suiza)

- Cutera, Inc. (Estados Unidos)

- Lumenis Be Ltd. (Israel)

- Densply Sirona (Estados Unidos)

- Instituto Straumann AG (Estados Unidos)

- Corporación Candela (Estados Unidos)

- Medytrox (Corea del Sur)

- BioHorizons (Estados Unidos)

- BTL (India)

- Nobel Biocare Services AG (Suiza)

- Merz Pharma (Alemania)

- Cynosure, LLC (Estados Unidos)

- Sharplight Technologies Inc. (Israel)

- Láseres Alma (EE. UU.)

- MEGA'GEN IMPLANT CO., LTD. (India)

- 3M (Estados Unidos)

- Sistema Quanta (Italia)

- Sciton (California)

Últimos avances en el mercado médico estético de Oriente Medio y África

- En enero de 2023, Galderma anunció el lanzamiento de FACE by Galderma, una innovadora aplicación de realidad aumentada. Esta revolucionaria solución permite a los profesionales de la estética y a los pacientes visualizar los resultados del tratamiento en la fase de planificación. La tecnología se presentará a la comunidad científica estética en el Congreso Mundial del Curso de Máster Internacional sobre Ciencia del Envejecimiento (IMCAS) 2023

- En febrero de 2022, Allergan (una subsidiaria de AbbVie Inc.) anunció la aprobación por parte de la FDA de JUVÉDERM VOLBELLA XC para la mejora de las cavidades infraorbitales en adultos mayores de 21 años. Esto ayudó a la empresa a ampliar la cartera de productos estéticos en el mercado estadounidense.

- En enero de 2022, Mentor Worldwide LLC (una subsidiaria de Johnson & Johnson Medical Devices Companies) anunció que la FDA aprobó el implante mamario MENTOR MemoryGel BOOST para el aumento y la reconstrucción mamaria. Este producto ha ayudado a la empresa a ampliar la cartera de productos estéticos en el mercado estadounidense.

- En enero de 2021, Cutera, Inc. anunció que la empresa había lanzado un truSculpt Flex+, optimizado para ofrecer un esculpido uniforme, repetible y específico de las áreas problemáticas. Esto ayuda a la empresa a mejorar su cartera de productos dentro del mercado.

- En noviembre de 2019, Lumenis Be Ltd. anunció su adquisición con Baring Private Equity Asia (BPEA), un proveedor líder de dispositivos médicos especializados basados en energía en el campo de la estética. Esto demuestra que la empresa cuenta con un fuerte apoyo dentro del mercado de la estética para su cartera de productos.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 DBMR MARKET POSITION GRID

2.8 VENDOR SHARE ANALYSIS

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN THE AGEING POPULATION

5.1.2 CHANGING BEAUTY STANDARDS AND SOCIAL MEDIA INFLUENCE

5.1.3 INCREASE IN POSITIVE ATTITUDE TOWARDS COSMETIC PROCEDURES

5.1.4 INCREASE IN THE NUMBER OF TECHNOLOGICAL ADVANCEMENTS IN DERMATOLOGY

5.2 RESTRAINTS

5.2.1 LACK OF TRAINED PROFESSIONALS

5.2.2 RISK OF SIDE EFFECTS ASSOCIATED WITH THESE PROCEDURES

5.3 OPPORTUNITIES

5.3.1 DEVELOPMENT OF NEW INNOVATIVE TREATMENTS

5.3.2 MEDICAL PARTNERSHIPS AND INNOVATIONS

5.3.3 INCREASING DISPOSABLE INCOME

5.4 CHALLENGES

5.4.1 SAFETY AND LIABILITY RISKS ASSOCIATED WITH AESTHETIC TREATMENTS

5.4.2 LIMITED INSURANCE COVERAGE

6 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 AESTHETIC LASER DEVICES

6.2.1 ABLATIVE SKIN RESURFACING DEVICES

6.2.2 NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES

6.3 ENERGY DEVICES

6.4 BODY CONTOURING DEVICES

6.5 FACIAL AESTHETIC DEVICES

6.5.1 DERMAL FILLERS

6.6 AESTHETIC IMPLANTS

6.6.1 BREAST AUGMENTATION

6.6.2 AESTHETIC DENTAL IMPLANTS

6.7 SKIN AESTHETIC DEVICES

7 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 ANTI-AGING AND WRINKLES

7.3 FACIAL AND SKIN REJUVENATION

7.4 BREAST ENHANCEMENT

7.5 BODY SHAPING AND CELLULITE

7.6 TATTOO REMOVAL

7.7 VASCULAR LESIONS

7.8 SEARS, PIGMENT LESIONS, RECONSTRUCTIVE

7.9 PSORIASIS AND VITILIGO

7.1 OTHERS

8 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET, BY END USER

8.1 OVERVIEW

8.2 COSMETIC CENTERS

8.3 DERMATOLOGY CLINICS

8.4 HOSPITALS

8.5 MEDICAL SPAS AND BEAUTY CENTERS

9 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 DIRECT TENDER

9.3 RETAIL

10 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET, BY REGION

10.1 MIDDLE EAST AND AFRICA

10.1.1 SOUTH AFRICA

10.1.2 UAE

10.1.3 SAUDI ARABIA

10.1.4 REST OF MIDDLE EAST & AFRICA

11 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 ALLERGAN (A SUBSIDIARY OF ABBVIE INC.)

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENT

13.2 CUTERA, INC.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 MENTOR WORLDWIDE LLC (A SUBSIDIARY OF JOHNSONS & JOHNSONS)

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENT

13.4 LUMENIS BE LTD.

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 GALDERMA

13.5.1 COMPANY SNAPSHOT

13.5.2 COMPANY SHARE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENTS

13.6 ALMA LASERS

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENTS

13.7 BIOHORIZONS

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 BTL

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 CANDELA CORPORATION

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 CYNOSURE, LLC

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 DENTSPLY SIRONA

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENT

13.12 INSTITUT STRAUMANN AG

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENT

13.13 MEDYTROX

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 MEGA'GEN IMPLANT CO., LTD.

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 MERZ PHARMA

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENTS

13.16 3M

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENT

13.17 NOBEL BIOCARE SERVICES AG

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 QUANTA SYSTEM

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENT

13.19 SCITON

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 SHARPLIGHT TECHNOLOGIES INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tablas

TABLE 1 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 MIDDLE EAST AND AFRICA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA DERMAL FILLERS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA BREAST AUGMENTATION IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA ANTI-AGING AND WRINKLES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA FACIAL AND SKIN REJUVENATION IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA BREAST ENHANCEMENT IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA BODY SHAPING AND CELLULITE IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA VASCULAR LESIONS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA SEARS, PIGMENT LESIONS, RECONSTRUCTIVE IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA PSORIASIS AND VITILIGO IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA OTHERS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA COSMETIC CENTERS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA DERMATOLOGY CLINICS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA HOSPITALS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA MEDICAL SPAS AND BEAUTY CENTERS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA DIRECT TENDER IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA RETAIL IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA MEDICAL AESTHETIC MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST & AFRICA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST & AFRICA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST & AFRICA ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST & AFRICA NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST & AFRICA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 MIDDLE EAST & AFRICA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 MIDDLE EAST & AFRICA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST & AFRICA DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 MIDDLE EAST & AFRICA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST & AFRICA BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST & AFRICA AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST & AFRICA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 MIDDLE EAST & AFRICA MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 50 MIDDLE EAST & AFRICA MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST & AFRICA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 52 SOUTH AFRICA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 SOUTH AFRICA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 SOUTH AFRICA ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 SOUTH AFRICA NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 SOUTH AFRICA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 SOUTH AFRICA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 SOUTH AFRICA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 SOUTH AFRICA DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 SOUTH AFRICA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 SOUTH AFRICA BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 SOUTH AFRICA AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 SOUTH AFRICA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 SOUTH AFRICA MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 65 SOUTH AFRICA MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 66 SOUTH AFRICA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 67 UAE MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 UAE AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 UAE ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 UAE NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 UAE ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 UAE BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 UAE FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 UAE DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 UAE AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 UAE BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 UAE AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 UAE SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 UAE MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 80 UAE MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 81 UAE MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 82 SAUDI ARABIA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 SAUDI ARABIA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 SAUDI ARABIA ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 SAUDI ARABIA NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 SAUDI ARABIA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 SAUDI ARABIA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 SAUDI ARABIA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 SAUDI ARABIA DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 SAUDI ARABIA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 SAUDI ARABIA BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 SAUDI ARABIA AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 SAUDI ARABIA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 SAUDI ARABIA MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 95 SAUDI ARABIA MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 96 SAUDI ARABIA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 97 REST OF MIDDLE EAST & AFRICA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

Lista de figuras

FIGURE 1 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: REGION VS COUNTRY MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: SEGMENTATION

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 SIX SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 INCREASE IN POSITIVE ATTITUDE TOWARDS COSMETIC PROCEDURES IS DRIVING THE GROWTH OF THE MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET FROM 2025 TO 2032

FIGURE 14 THE AESTHETIC LASER DEVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET IN 2025 AND 2032

FIGURE 15 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: BY PRODUCT TYPE, 2024

FIGURE 16 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: BY PRODUCT TYPE, 2025-2032 (USD THOUSAND)

FIGURE 17 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: PRODUCT TYPE, CAGR (2025-2032)

FIGURE 18 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 19 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: BY APPLICATION, 2024

FIGURE 20 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: BY APPLICATION, 2025-2032 (USD THOUSAND)

FIGURE 21 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: BY APPLICATION, CAGR (2025-2032)

FIGURE 22 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 23 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: BY END USER, 2024

FIGURE 24 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 25 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: BY END USER, CAGR (2025-2032)

FIGURE 26 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: BY END USER, LIFELINE CURVE

FIGURE 27 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 28 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

FIGURE 29 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 30 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 31 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: SNAPSHOT (2024)

FIGURE 32 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: COMPANY SHARE 2024 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.