Middle East And Africa Insoluble Sulfur Market For Automotive Sector

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

16,771.78 Thousand

USD

24,480.74 Thousand

2022

2030

USD

16,771.78 Thousand

USD

24,480.74 Thousand

2022

2030

| 2023 –2030 | |

| USD 16,771.78 Thousand | |

| USD 24,480.74 Thousand | |

|

|

|

Mercado de azufre insoluble en Oriente Medio y África para el sector automotriz, por grado (grados regulares, grados de alta dispersión, grados de alta estabilidad y grados especiales), producto (azufre insoluble relleno de aceite y azufre insoluble sin aceite), aplicación (neumáticos y no neumáticos) - Tendencias de la industria y pronóstico hasta 2030.

Análisis y tamaño del mercado de azufre insoluble para el sector automotriz en Oriente Medio y África

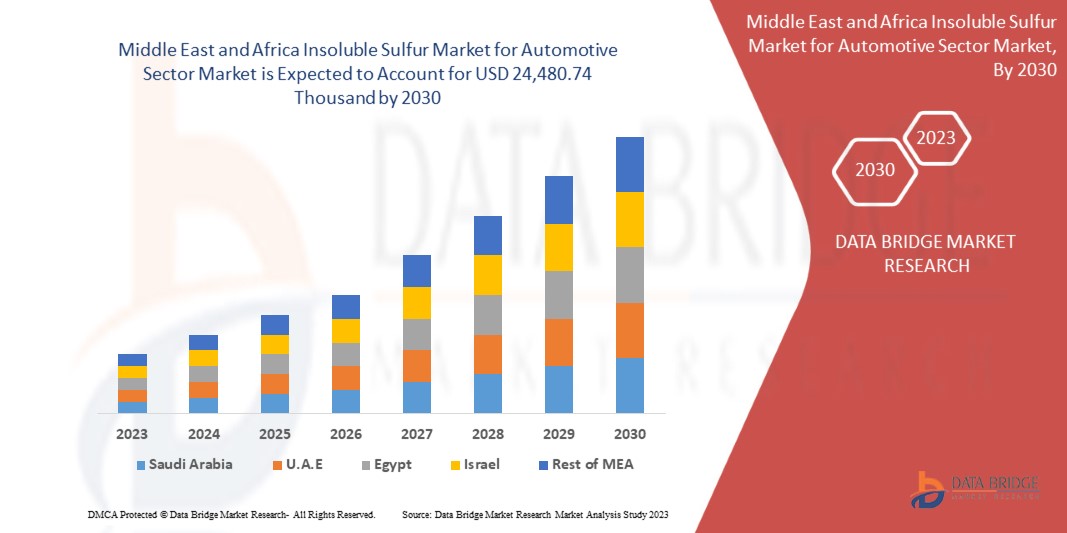

Data Bridge Market Research analiza que se espera que el mercado de azufre insoluble para el sector automotriz de Medio Oriente y África alcance los USD 24,480.74 mil para 2030 desde USD 16,771.78 mil en 2022, creciendo con una CAGR sustancial del 4.9% en el período de pronóstico de 2023 a 2030.

El informe del mercado de azufre insoluble en Oriente Medio y África para el sector automotriz proporciona detalles sobre la participación de mercado, los nuevos desarrollos y el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un informe de analista. Nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Año histórico |

2021 (Personalizable para 2015 - 2020) |

|

Unidades cuantitativas |

Ingresos en miles de USD |

|

Segmentos cubiertos |

Grado (Grados regulares, Grados de alta dispersión, Grados de alta estabilidad y Grados especiales), Producto (Azufre insoluble relleno de aceite y Azufre insoluble no relleno de aceite), Aplicación (Neumáticos y no neumáticos) |

|

Países cubiertos |

Arabia Saudita, Sudáfrica, Egipto, Israel, Emiratos Árabes Unidos y resto de Oriente Medio y África |

|

Actores del mercado cubiertos |

Grupo Azoty, SHIKOKU CHEMICALS CORPORATION (una subsidiaria de SHIKOKU KASEI HOLDINGS CORPORATION), FLEXSYS, Lions Industries sro, China Sunsine Chemical Holdings, Oriental Carbon and Chemicals Limited, LANXESS, Joss Elastomers & Chemicals, SANSHIN CHEMICAL INDUSTRY CO.,LTD., Leader Technologies Co., Ltd y WUXI HUASHENG RUBBER TECHNICAL CO., LTD, entre otros. |

Definición de mercado

El azufre insoluble (IS) es una forma de polímero de azufre que es insoluble en CS2 y funciona bien como agente vulcanizante para el caucho. Viene en dos tipos, es decir, lleno de aceite y sin aceite. Es un componente crucial de los aditivos de caucho . Aumenta el nivel de resistencia al desgaste y a la fatiga y al envejecimiento de los productos. Además de ser generalmente aceptado como el mejor agente vulcanizante, también se utiliza en la producción de látex, todo tipo de componentes de caucho para automóviles, tuberías de caucho, zapatos, materiales aislantes de cables y alambres y neumáticos para cinturones. Como resultado, el IS, que tiene la propiedad de no florecer, se emplea con frecuencia en la producción de caucho radial y otros productos de caucho sintético, así como en la producción de productos de caucho de color claro donde el azufre común está presente en proporciones considerables.

Dinámica del mercado de azufre insoluble para el sector automotriz en Oriente Medio y África

En esta sección se aborda la comprensión de los factores impulsores, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- La fabricación y venta de neumáticos en todo el mundo hace un uso extensivo del azufre insoluble

La demanda de neumáticos de repuesto convenientes y de bajo mantenimiento ha aumentado como resultado del creciente número de vehículos en carretera y la distancia que recorren. Como resultado, la producción, las ventas y la demanda de neumáticos están aumentando en su mayoría a nivel mundial. En consecuencia, existe una creciente necesidad de neumáticos eficientes. En la industria del caucho, el azufre insoluble se utiliza principalmente como acelerador y agente de vulcanización. Permite que el caucho se adhiera más firmemente, evita que el caucho se desintegre y aumenta la resistencia al calor y al desgaste de los neumáticos. Por estas razones, es una materia prima crucial en la fabricación de neumáticos. Como resultado, la producción de neumáticos hace un uso sustancial de azufre insoluble. Además, la demanda, la fabricación y las ventas de neumáticos tienen el potencial de ser una fuerza impulsora importante en la expansión del mercado.

- Aumento mundial del número de vehículos utilizados en carretera

La industria automotriz, un indicador económico clave, está al borde de importantes avances tecnológicos. Actualmente, la industria automotriz está siendo impulsada por las demandas de los clientes de características distintivas y costosas. La industria automotriz tiene el potencial de estimular la actividad y crear empleos en varias esferas de la economía, incluida la producción de automóviles, neumáticos, accesorios, logística, comercio y servicios financieros. La creciente urbanización, el crecimiento de la población, el aumento de los ingresos disponibles y la facilidad para obtener crédito y financiación son los principales impulsores de la expansión de la industria automotriz. A nivel mundial, los clientes utilizan vehículos para todo uso, como automóviles de pasajeros, camiones, automóviles eléctricos, vehículos de dos y tres ruedas, lo que está impulsando el crecimiento del mercado. La necesidad de neumáticos nuevos y reemplazos de neumáticos convenientes y de bajo mantenimiento ha aumentado como resultado del aumento de las ventas de automóviles y el creciente número de automóviles en carretera en el mundo. Como resultado, impulsará considerablemente la fabricación y el consumo de neumáticos. Como el ingrediente de curado principal utilizado en la producción de caucho y neumáticos es azufre insoluble, la industria automotriz tiene el potencial de ser una fuerza impulsora importante en la expansión del mercado.

Oportunidad

- Innovación de nuevos productos y aumento de las actividades de I+D

El azufre insoluble impide que el caucho de la capa de caucho circundante se mueva. La velocidad de migración del azufre normal es particularmente alta en compuestos de caucho hechos de caucho cis y caucho butílico; sin embargo, esto se puede evitar añadiendo azufre insoluble. El proceso de curado se acelera. Un paso conocido como activación, o despolimerización en cadena, ocurre cuando se alcanza la temperatura de vulcanización. Esta etapa acelera la vulcanización y reduce el contenido de azufre.

Si bien el azufre insoluble tiene muchas ventajas, también tiene ciertas desventajas, como el uso de productos químicos peligrosos, procesos complicados y una gran cantidad de azufre y sulfuro de carbono. Los fabricantes deben aumentar la inversión y la experiencia en I+D, desarrollar nuevos productos para las líneas existentes, construir nuevas instalaciones, colaborar con otros actores y lanzar nuevos productos para superar estos inconvenientes.

Además, la empresa puede invertir dinero y realizar I+D en tecnologías ecológicas e innovar productos más eficientes, lo que se espera que cree una excelente oportunidad para el crecimiento del mercado.

Restricción/Desafío

- Normas y reglamentos estrictos

La creciente preocupación por el uso de sustancias químicas peligrosas en el proceso de fabricación ha dado lugar a la aplicación de normas y reglamentos estrictos en el sector del azufre insoluble. Estas directrices y leyes abarcan el uso de sustancias químicas específicas como materias primas, entre ellas el azufre, el disulfuro de carbono y el aceite de hidrocarburo. Además, las normas y reglamentos establecidos para los productos de caucho, como los neumáticos, también desempeñan un papel importante como factores restrictivos.

Si bien estas normas y reglamentaciones estrictas son esenciales para reducir los problemas de salud ambiental, afectarán el uso de materias primas, productos químicos, procesos de producción y tecnologías. Como consecuencia de ello, los fabricantes se verán obligados a tomar las medidas correspondientes, lo que puede llevar a un aumento del precio de producción y de las inversiones necesarias, lo que a su vez afectará al mercado insoluble al aumentar el costo de sus productos.

La fabricación y el uso del caucho sintético tienen un impacto negativo en el medio ambiente debido al consumo de energía, el uso de combustibles fósiles como materia prima, las emisiones de CO2 al aire y al agua y los productos de desecho. Estas sustancias no son fácilmente biodegradables, por lo que cuando se vierten aguas residuales en el agua, pueden agotar el contenido de oxígeno del océano y aumentar la cantidad de venenos que pueden dañar la vida marina.

Los neumáticos no se descomponen. Los neumáticos pueden liberar sustancias químicas al aire, al suelo y al agua que pueden alterar el ecosistema cuando se acumulan en vertederos o depósitos de chatarra. En caso de que el neumático se incendie, puede liberarse humo negro venenoso a la atmósfera. Este humo transporta muchas de las sustancias químicas utilizadas en la fabricación de neumáticos. La mayoría de los materiales de los neumáticos provienen de combustibles fósiles. Son extremadamente combustibles y difíciles de extinguir una vez que se incendian. Un pequeño montón de neumáticos en llamas puede seguir ardiendo durante meses antes de quedarse sin combustible.

Acontecimientos recientes

- En octubre de 2022, China Sunsine Chemical Holdings presentó el proyecto MBT, que involucra nueva tecnología que les ayuda a aumentar su producción por fases para satisfacer sus demandas.

- En mayo de 2022, la empresa FLEXSYS acudió a la "Tire Technology Expo 2022" de Hannover, Alemania, para mostrar los nuevos avances tecnológicos en el mercado del azufre insoluble y mejorar la reputación de la empresa en el mercado.

- En diciembre de 2021, OCCL inició su primera fase de expansión de la capacidad de producción de azufre insoluble, que es de 5.500 MTPA. Estos productos IS se venden bajo el nombre “DIAMOND SULF” principalmente como agentes vulcanizantes en la industria de los neumáticos.

- En noviembre de 2021, One Rock Capital Partners, LLC, una firma de capital privado orientada a la creación de valor y centrada en las operaciones, anunció hoy que una de sus filiales completó con éxito la adquisición previamente anunciada del negocio de aditivos para neumáticos de Eastman Chemical Company, FLEXSYS. Eastman Chemical Company es líder en productos químicos especiales esenciales para la industria de los neumáticos con una presencia global de activos y servicios técnicos de primer nivel.

Mercado de azufre insoluble para el sector automotriz en Oriente Medio y África Alcance del mercado

El mercado de azufre insoluble para el sector automotriz en Oriente Medio y África se divide en tres segmentos importantes según el grado, el producto y la aplicación. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Calificación

- Calificaciones regulares

- Grados de alta dispersión

- Grados de alta estabilidad

- Calificaciones especiales

Según el grado, el mercado está segmentado en grados regulares, grados de alta dispersión, grados de alta estabilidad y grados especiales.

Producto

- Azufre insoluble relleno de aceite

- Azufre insoluble sin relleno de aceite

Sobre la base del producto, el mercado está segmentado en azufre insoluble relleno de aceite y azufre insoluble no relleno de aceite.

Solicitud

- Neumático

- Sin neumáticos

Sobre la base de la aplicación, el mercado se segmenta en neumáticos y no neumáticos.

Análisis y perspectivas regionales del mercado de azufre insoluble para el sector automotriz en Oriente Medio y África

El mercado de azufre insoluble de Medio Oriente y África para el sector automotriz está segmentado en tres segmentos notables según el grado, el producto y la aplicación.

Los países cubiertos en este informe de mercado son Arabia Saudita, Arabia Saudita, Sudáfrica, Egipto, Israel, Emiratos Árabes Unidos y el resto de Medio Oriente y África.

Se espera que los Emiratos Árabes Unidos dominen el mercado de azufre insoluble para el sector automotriz en Medio Oriente y África debido a la creciente necesidad de IS en la industria del caucho como agente vulcanizante.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. El análisis de los puntos de datos de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para cada país. Además, se consideran la presencia y disponibilidad de marcas regionales y los desafíos que enfrentan debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales al proporcionar un análisis de pronóstico de los datos del país.

Panorama competitivo y análisis de la participación del mercado de azufre insoluble en el sector automotriz en Oriente Medio y África

El panorama competitivo del mercado de azufre insoluble para el sector automotriz en Oriente Medio y África proporciona detalles de los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de supervivencia de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado.

Algunos de los principales actores del mercado que operan en este mercado son Grupa Azoty, SHIKOKU CHEMICALS CORPORATION (una subsidiaria de SHIKOKU KASEI HOLDINGS CORPORATION), FLEXSYS, Lions Industries sro, China Sunsine Chemical Holdings, Oriental Carbon and Chemicals Limited, LANXESS, Joss Elastomers & Chemicals, SANSHIN CHEMICAL INDUSTRY CO., LTD., Leader Technologies Co., Ltd y WUXI HUASHENG RUBBER TECHNICAL CO., LTD, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 GRADE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THE THREAT OF SUBSTITUTES

4.2.3 CUSTOMER BARGAINING POWER

4.2.4 SUPPLIER BARGAINING POWER

4.2.5 INTERNAL COMPETITION (RIVALRY)

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT’S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 SUPPLY CHAIN ANALYSIS

4.4.1 OVERVIEW

4.4.2 LOGISTIC COST SCENARIO

4.4.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.5 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.6 IMPORT EXPORT SCENARIO

4.7 PRICE ANALYSIS

4.8 PRODUCTION CONSUMPTION ANALYSIS

4.9 RAW MATERIAL COVERAGE

4.1 TIRE MARKET- VOLUME DEMAND

4.11 VENDOR SELECTION CRITERIA

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 WORLDWIDE INCREASE IN THE NUMBER OF ON-ROAD VEHICLES UTILIZATION

6.1.2 MANUFACTURING AND SALES OF TIRES AROUND THE WORLD MAKES USE OF INSOLUBLE SULFUR EXTENSIVELY

6.1.3 INCREASING NEED FOR INSOLUBLE SULFUR FROM THE RUBBER INDUSTRY AS A VULCANIZING AGENT

6.2 RESTRAINTS

6.2.1 VOLATILITY IN RAW MATERIAL PRICES AFFECTING THE COST OF PRODUCTS

6.2.2 STRINGENT RULES AND REGULATIONS

6.3 OPPORTUNITIES

6.3.1 NEW PRODUCT INNOVATION AND INCREASING R&D ACTIVITIES

6.3.2 DEVELOPMENT OF MORE FUEL-EFFICIENT TIRES

6.4 CHALLENGE

6.4.1 ENVIRONMENTAL AND ECONOMIC ISSUES

7 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY REGION

7.1 MIDDLE EAST AND AFRICA

7.1.1 UNITED ARAB EMIRATES

7.1.2 SAUDI ARABIA

7.1.3 EGYPT

7.1.4 SOUTH AFRICA

7.1.5 ISRAEL

7.1.6 REST OF MIDDLE EAST AND AFRICA

8 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: COMPANY LANDSCAPE

8.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

8.2 FACILITY EXPANSION

8.3 ACQUISITION

8.4 EVENT

9 COMPANY PROFILES

9.1 ORIENTAL CARBON AND CHEMICALS LIMITED

9.1.1 COMPANY SNAPSHOT

9.1.2 REVENUE ANALYSIS

9.1.3 COMPANY SHARE ANALYSIS

9.1.4 PRODUCT PORTFOLIO

9.1.5 SWOT ANALYSIS

9.1.6 RECENT DEVELOPMENT

9.2 SHIKOKU CHEMICALS CORPORATION. (SUBSIDIARY OF SHIKOKU KASEI HOLDINGS CORPORATION.)

9.2.1 COMPANY SNAPSHOT

9.2.2 REVENUE ANALYSIS

9.2.3 COMPANY SHARE ANALYSIS

9.2.4 SWOT ANALYSIS

9.2.5 PRODUCT PORTFOLIO

9.2.6 RECENT DEVELOPMENTS

9.3 LANXESS

9.3.1 COMPANY SNAPSHOT

9.3.2 COMPANY SHARE ANALYSIS

9.3.3 PRODUCT PORTFOLIO

9.3.4 REVENUE ANALYSIS

9.3.5 SWOT ANALYSIS

9.3.6 RECENT DEVELOPMENTS

9.4 JOSS ELASTOMERS AND CHEMICALS

9.4.1 COMPANY SNAPSHOT

9.4.2 COMPANY SHARE ANALYSIS

9.4.3 PRODUCT PORTFOLIO

9.4.4 SWOT

9.4.5 RECENT DEVELOPMENTS

9.5 LEADER TECHNOLOGIES CO., LTD

9.5.1 COMPANY SNAPSHOT

9.5.2 COMPANY SHARE ANALYSIS

9.5.3 PRODUCT PORTFOLIO

9.5.4 SWOT

9.5.5 RECENT DEVELOPMENTS

9.6 ALBEMARLE CORPORATION

9.6.1 COMPANY SNAPSHOT

9.6.2 REVENUE ANALYSIS

9.6.3 SWOT ANALYSIS

9.6.4 RECENT DEVELOPMENT

9.7 MIDDLE EAST & AFRICA SUNSINE CHEMICAL HOLDINGS.

9.7.1 COMPANY SNAPSHOT

9.7.2 REVENUE ANALYSIS

9.7.3 PRODUCT PORTFOLIO

9.7.4 SWOT ANALYSIS

9.7.5 RECENT DEVELOPMENT

9.8 FLEXSYS

9.8.1 COMPANY SNAPSHOT

9.8.2 SWOT ANALYSIS

9.8.3 PRODUCT PORTFOLIO

9.8.4 RECENT DEVELOPMENTS

9.9 GRUPA AZOTY.

9.9.1 COMPANY SNAPSHOT

9.9.2 REVENUE ANALYSIS

9.9.3 SWOT ANALYSIS

9.9.4 PRODUCT PORTFOLIO

9.9.5 RECENT DEVELOPMENTS

9.1 LIONS INDUSTRIES S.R.O.

9.10.1 COMPANY SNAPSHOT

9.10.2 SWOT ANALYSIS

9.10.3 PRODUCT PORTFOLIO

9.10.4 RECENT DEVELOPMENTS

9.11 NYNAS AB

9.11.1 COMPANY SNAPSHOT

9.11.2 REVENUE ANALYSIS

9.11.3 SWOT ANALYSIS

9.11.4 RECENT DEVELOPMENTS

9.12 SANSHIN CHEMICAL INDUSTRY CO., LTD.

9.12.1 COMPANY SNAPSHOT

9.12.2 PRODUCT PORTFOLIO

9.12.3 SWOT

9.12.4 RECENT DEVELOPMENTS

9.13 WUXI HUASHENG RUBBER TECHNICAL CO., LTD

9.13.1 COMPANY SNAPSHOT

9.13.2 PRODUCT PORTFOLIO

9.13.3 SWOT

9.13.4 RECENT DEVELOPMENTS

10 QUESTIONNAIRE

11 RELATED REPORTS

Lista de Tablas

TABLE 1 REGULATORY COVERAGE

TABLE 2 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY COUNTRY, 2021-2030 (TONS)

TABLE 4 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (TONS)

TABLE 6 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 8 UNITED ARAB EMIRATES INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 9 UNITED ARAB EMIRATES INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (TONS)

TABLE 10 UNITED ARAB EMIRATES INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 11 UNITED ARAB EMIRATES INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 12 SAUDI ARABIA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 13 SAUDI ARABIA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (TONS)

TABLE 14 SAUDI ARABIA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 15 SAUDI ARABIA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 16 EGYPT INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 17 EGYPT INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (TONS)

TABLE 18 EGYPT INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 19 EGYPT INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 20 SOUTH AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 21 SOUTH AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (TONS)

TABLE 22 SOUTH AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 23 SOUTH AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 24 ISRAEL INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 25 ISRAEL INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (TONS)

TABLE 26 ISRAEL INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 27 ISRAEL INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 28 REST OF MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 29 REST OF MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (TONS)

Lista de figuras

FIGURE 1 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR

FIGURE 2 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: THE GRADE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: MARKET APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: SEGMENTATION

FIGURE 14 WORLDWIDE INCREASE IN THE NUMBER OF ON-ROAD VEHICLES UTILIZATION IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR IN THE FORECAST PERIOD

FIGURE 15 THE REGULAR GRADES IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR IN 2023 AND 2030

FIGURE 16 IMPORT-EXPORT SCENARIO (USD THOUSAND)

FIGURE 17 PRICE ANALYSIS FOR THE MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR (USD/KG)

FIGURE 18 VENDOR SELECTION CRITERIA

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR

FIGURE 20 NUMBER OF CAR SALES IN THE U.S. FROM 2018 TO 2022 (IN MILLION)

FIGURE 21 NUMBER OF PASSENGER CAR SALES IN EUROPE FROM 2017 TO 2021 (IN MILLION)

FIGURE 22 REVENUE OF THE MIDDLE EAST & AFRICA TOP TIRE MANUFACTURING COMPANIES (IN USD MILLION)

FIGURE 23 MIDDLE EAST & AFRICA SUNSINE CHEMICAL HOLDINGS LTD. INSOLUBLE SULFUR SALES VOLUME (IN TONS)

FIGURE 24 MIDDLE EAST AND AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: SNAPSHOT (2022)

FIGURE 25 MIDDLE EAST AND AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: BY COUNTRY (2022)

FIGURE 26 MIDDLE EAST AND AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: BY COUNTRY (2023 & 2030)

FIGURE 27 MIDDLE EAST AND AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: BY COUNTRY (2022 & 2030)

FIGURE 28 MIDDLE EAST AND AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: BYGRADE (2023-2030)

FIGURE 29 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.