Middle East And Africa Iga Nephropathy Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

16.52 Million

USD

64.66 Million

2024

2032

USD

16.52 Million

USD

64.66 Million

2024

2032

| 2025 –2032 | |

| USD 16.52 Million | |

| USD 64.66 Million | |

|

|

|

|

Segmentación del mercado de nefropatía por IgA en Oriente Medio y África, por tipo de enfermedad (nefropatía por IgA primaria y secundaria), síntomas (hematuria, proteinuria, edema y otros), tipo (diagnóstico y tratamiento), población (pediátrica y adulta), vía de administración (oral, parenteral y otras), usuario final (hospitales, clínicas, atención domiciliaria y otros), canal de distribución (licitación directa, farmacia hospitalaria, farmacia minorista, farmacia en línea y otros) - Tendencias del sector y previsiones hasta 2032

Tamaño del mercado de la nefropatía por IgA

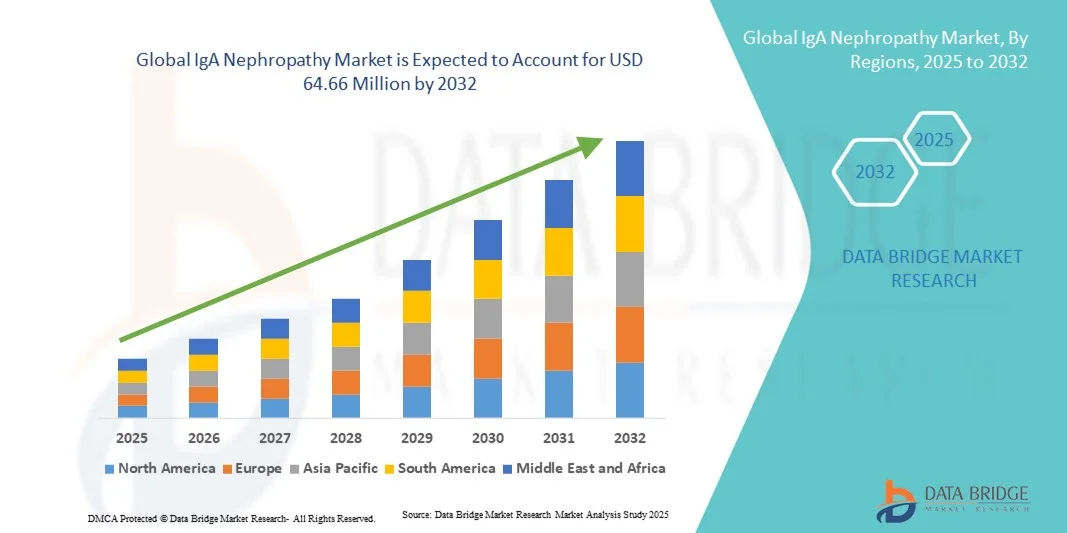

- El tamaño del mercado de la nefropatía por IgA en Oriente Medio y África se valoró en 16,52 millones de dólares en 2024 y se espera que alcance los 64,66 millones de dólares en 2032 , con una tasa de crecimiento anual compuesta (TCAC) del 18,60 % durante el período de previsión.

- El crecimiento del mercado se debe en gran medida a la creciente prevalencia de trastornos renales en todo el mundo y a la mayor concienciación sobre la importancia del diagnóstico precoz y el tratamiento de la enfermedad, factores que impulsan la demanda de tratamientos eficaces para la nefropatía por IgA (IgAN). Los avances en técnicas diagnósticas como las biopsias renales y las pruebas de biomarcadores están mejorando aún más la detección de la enfermedad y permitiendo una intervención oportuna.

- Además, el creciente interés por la medicina de precisión, junto con el desarrollo de nuevos productos biológicos y terapias dirigidas a reducir la proteinuria y preservar la función renal, está acelerando la adopción de soluciones innovadoras para el tratamiento de la nefropatía por IgA. Estos factores convergentes están impulsando significativamente el crecimiento del sector y apoyando la transición hacia una atención renal personalizada.

Análisis del mercado de la nefropatía por IgA

- La nefropatía por IgA (IgAN), también conocida como enfermedad de Berger, es un trastorno renal autoinmune caracterizado por la acumulación de la proteína inmunoglobulina A (IgA) en los glomérulos, lo que provoca inflamación y deterioro de la función renal. El mercado está experimentando un crecimiento significativo debido a la creciente prevalencia de las enfermedades renales crónicas, la mayor concienciación sobre el diagnóstico precoz y los avances en los tratamientos nefrológicos.

- La creciente demanda de opciones de tratamiento innovadoras, incluidos los fármacos biológicos dirigidos y los inhibidores de la vía del complemento, está impulsando la expansión del mercado de la nefropatía por IgA. Además, el aumento de los ensayos clínicos, las aprobaciones regulatorias favorables y las mejores capacidades de diagnóstico contribuyen al crecimiento general de este sector.

- Arabia Saudí dominó el mercado de la nefropatía por IgA con la mayor cuota de ingresos (32,8%) en 2024, impulsada por las crecientes inversiones en salud del país, la mayor prevalencia de trastornos renales y las iniciativas gubernamentales del programa Visión 2030 destinadas a mejorar la infraestructura sanitaria. La presencia de centros de nefrología avanzados, la creciente adopción de opciones de tratamiento innovadoras, como los fármacos biológicos dirigidos, y la mayor concienciación sobre el diagnóstico precoz han contribuido significativamente al liderazgo de Arabia Saudí en el mercado de la nefropatía por IgA en Oriente Medio.

- Se prevé que los Emiratos Árabes Unidos sean el país con mayor crecimiento en el mercado de la nefropatía por IgA, registrando una tasa de crecimiento anual compuesto (TCAC) del 9,1 % durante el período de pronóstico. Este crecimiento se debe principalmente a las rápidas mejoras en la infraestructura sanitaria, la creciente prevalencia de enfermedades renales crónicas y la mayor demanda de soluciones avanzadas de diagnóstico y tratamiento. Se espera que el enfoque del país en la medicina de precisión, junto con las crecientes campañas de concientización sobre la salud renal, impulse mayores tasas de diagnóstico de pacientes.

- El segmento de adultos dominó el mercado con la mayor cuota de ingresos, un 79,0%, en 2024, ya que la mayoría de los casos de nefropatía por IgA clínicamente significativos y la actividad de tratamiento comercial se producen en poblaciones adultas.

Alcance del informe y segmentación del mercado de la nefropatía por IgA

|

Atributos |

Información clave del mercado sobre la nefropatía por IgA |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Oriente Medio y África

|

|

Principales actores del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de datos de valor añadido |

Además de los datos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado elaborados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, epidemiología de pacientes, análisis de proyectos en desarrollo, análisis de precios y marco regulatorio. |

Tendencias del mercado de la nefropatía por IgA

Avances en terapias dirigidas y basadas en el complemento

- Una tendencia significativa y en auge en el mercado global de la nefropatía por IgA (IgAN) es la creciente adopción de terapias dirigidas que se centran en mecanismos específicos de la enfermedad, como la inhibición del complemento, la modulación de las células B y la regulación de la inmunidad de las mucosas. Este cambio desde los inmunosupresores convencionales hacia tratamientos más personalizados y basados en mecanismos está transformando el panorama terapéutico.

- Por ejemplo, en diciembre de 2023, Novartis recibió la aprobación de la FDA para Iptacopan (Fabhalta), el primer inhibidor oral del factor B de su clase para la nefropatía por IgA, lo que representó un hito importante en las terapias renales dirigidas. De manera similar, Tarpeyo (budesonida) de Calliditas Therapeutics tuvo una gran acogida en el mercado como el primer fármaco aprobado que aborda la fisiopatología subyacente de la nefropatía por IgA al actuar sobre el sistema inmunitario de la mucosa intestinal.

- La investigación se centra cada vez más en la vía del complemento, que desempeña un papel clave en la progresión de la nefropatía por IgA. Empresas como Omeros Corporation (narsoplimab) y Vera Therapeutics (atacicept) están avanzando en ensayos clínicos de fase avanzada, lo que pone de manifiesto la tendencia del mercado hacia las terapias inmunomoduladoras de precisión.

- La integración de diagnósticos basados en biomarcadores y enfoques de estratificación de pacientes permite un seguimiento más eficaz de la progresión de la enfermedad y la respuesta al tratamiento. Este modelo de medicina de precisión mejora los resultados clínicos y reduce la exposición innecesaria a inmunosupresores de amplio espectro.

- Además, la colaboración entre empresas farmacéuticas, compañías biotecnológicas e instituciones de investigación está acelerando el desarrollo de nuevos fármacos. Por ejemplo, numerosos ensayos clínicos de fase II y III en Estados Unidos, Europa y Asia-Pacífico están explorando nuevos productos biológicos y terapias basadas en ARN dirigidas a ralentizar la progresión del daño renal.

- Esta tendencia hacia opciones de tratamiento biológicas, dirigidas y basadas en la precisión está transformando el mercado de la nefropatía por IgA, posicionándolo como una de las áreas terapéuticas de más rápida evolución en nefrología.

Dinámica del mercado de la nefropatía por IgA

Conductor

Aumento de la prevalencia de enfermedades y creciente adopción de nuevas terapias

- El aumento global de la incidencia de la nefropatía por IgA, junto con una mayor concienciación sobre las enfermedades renales crónicas, es un factor clave para el crecimiento del mercado. La enfermedad afecta aproximadamente a 2,5 personas por cada 100.000 al año, con tasas de prevalencia más elevadas en las poblaciones asiáticas.

- Por ejemplo, en marzo de 2024, Travere Therapeutics recibió la aprobación de la FDA para Sparsentan, un antagonista dual de los receptores de endotelina y angiotensina, para el tratamiento de la nefropatía por IgA. Este hito demuestra una tendencia creciente hacia terapias que reducen la proteinuria y preservan la función renal con mayor eficacia que los corticosteroides tradicionales.

- Las técnicas de diagnóstico mejoradas, incluidos los biomarcadores genéticos y proteicos, permiten una detección más temprana y un mejor seguimiento de las enfermedades, ampliando así el abanico de tratamientos potenciales.

- La financiación pública y privada para la investigación, junto con las colaboraciones para ensayos clínicos, han estimulado aún más el desarrollo de terapias en Norteamérica, Europa y Asia-Pacífico.

- Además, la disponibilidad de múltiples clases de fármacos avanzados —incluidos los corticosteroides, las formulaciones de liberación dirigida y los inhibidores del complemento— ha diversificado las opciones de tratamiento.

- Como resultado, se prevé que el mercado mundial de la nefropatía por IgA crezca a una tasa de crecimiento anual compuesta (TCAC) del 7,2 % entre 2025 y 2032, impulsado por una mayor concienciación de los pacientes, el aumento de las aprobaciones de medicamentos y un mejor acceso a los servicios de atención nefrológica.

Restricción/Desafío

Altos costos de tratamiento y complejidad clínica

- A pesar de los prometedores avances, los elevados costes del tratamiento siguen siendo un obstáculo importante para la adopción generalizada de las terapias avanzadas para la nefropatía por IgA. Los fármacos biológicos y los inhibidores del complemento recientemente aprobados suelen costar más de 100 000 USD al año , lo que limita el acceso en los países de ingresos bajos y medios.

- Por ejemplo, si bien Tarpeyo y Fabhalta ofrecen importantes beneficios terapéuticos, su elevado precio y la limitada cobertura de reembolso presentan desafíos de asequibilidad tanto para los pacientes como para los sistemas de salud.

- Además, la fisiopatología compleja y heterogénea de la nefropatía por IgA plantea dificultades para estandarizar los enfoques de tratamiento, ya que la progresión de la enfermedad y la respuesta a la terapia varían ampliamente entre los individuos.

- Muchos ensayos clínicos requieren largos períodos de seguimiento para medir variables como la reducción de la proteinuria y la preservación de la función renal, lo que ralentiza el ritmo de aprobación de nuevos fármacos.

- La limitada disponibilidad de centros de nefrología especializados en las regiones en desarrollo también dificulta el diagnóstico precoz y el tratamiento constante, lo que restringe aún más el alcance del mercado.

- Abordar estos desafíos mediante reformas de precios, programas de asistencia al paciente y esfuerzos de investigación colaborativa será fundamental para sostener el crecimiento del mercado a largo plazo. A pesar de estas limitaciones, se espera que la innovación continua y el aumento de la inversión en I+D impulsen un progreso constante en la mejora de los resultados para los pacientes en todo el mundo.

Alcance del mercado de la nefropatía por IgA

El mercado está segmentado en función del tipo de enfermedad, los síntomas, el tipo de población, la vía de administración, el usuario final y el canal de distribución.

- Por tipo de enfermedad

Según el tipo de enfermedad, el mercado de la nefropatía por IgA se segmenta en nefropatía por IgA primaria y secundaria. El segmento de nefropatía por IgA primaria dominó el mercado con la mayor cuota de ingresos (68,4 %) en 2024, lo que refleja su mayor prevalencia y mayor relevancia clínica a nivel mundial. La nefropatía por IgA primaria representa la mayoría de los casos diagnosticados que presentan depósitos mesangiales característicos de IgA, e impulsa la demanda de atención nefrológica especializada y el desarrollo de terapias dirigidas. Las guías clínicas y los registros priorizan las cohortes de pacientes con la enfermedad primaria para su inclusión en ensayos clínicos, lo que aumenta la visibilidad y la actividad terapéutica. Las vías diagnósticas, que incluyen la biopsia renal y el control de la proteinuria, se aplican con mayor frecuencia en la nefropatía por IgA primaria, lo que conlleva una mayor utilización de los servicios diagnósticos y terapéuticos. La concentración de la financiación para la investigación y la mayoría de los fármacos en fase avanzada de desarrollo se centran en los mecanismos de la enfermedad primaria, lo que refuerza la cuota de mercado. Las políticas de las aseguradoras y los patrones de derivación a especialistas también orientan los recursos hacia el manejo de la nefropatía por IgA primaria. En general, la centralidad de la nefropatía IgA primaria en la epidemiología, la investigación y la práctica clínica sustenta su papel dominante en el mercado.

Se prevé que el segmento de nefropatía por IgA secundaria registre la tasa de crecimiento anual compuesto (TCAC) más rápida, del 11,2 %, entre 2025 y 2032, impulsada por una mejor identificación de las causas secundarias y un mayor cribado en poblaciones de riesgo. La nefropatía por IgA secundaria surge asociada a afecciones como hepatopatías, infecciones, trastornos autoinmunitarios y ciertos medicamentos; contextos en los que la expansión de la vigilancia y los modelos de atención integrada están permitiendo detectar pacientes previamente infradiagnosticados. A medida que los servicios de hepatología, enfermedades infecciosas y reumatología integran la monitorización renal en las vías de atención crónica, aumentan las derivaciones a nefrología. El desarrollo de protocolos de manejo personalizados y algoritmos diagnósticos más accesibles para las formas secundarias está acelerando la adopción del tratamiento. Además, las terapias dirigidas, probadas en cohortes más amplias de nefropatía por IgA, se están evaluando para indicaciones secundarias, lo que favorece el crecimiento del mercado. Se espera que la creciente colaboración entre especialidades y la mayor inclusión de la nefropatía por IgA secundaria en las guías clínicas mantengan esta mayor TCAC.

- Por síntomas

Según los síntomas, el mercado de la nefropatía por IgA se segmenta en hematuria, proteinuria, edema y otros. El segmento de proteinuria dominó el mercado con la mayor cuota de ingresos (55,1 %) en 2024, dado su papel fundamental como marcador diagnóstico y criterio de valoración terapéutico en la nefropatía por IgA. La proteinuria persistente se correlaciona fuertemente con la progresión de la enfermedad y es el principal indicador utilizado en ensayos clínicos y guías de tratamiento para evaluar la eficacia. En consecuencia, las terapias y las herramientas de monitorización que reducen la proteinuria captan una atención clínica y comercial considerable. Los nefrólogos priorizan las intervenciones que han demostrado reducir la proteinuria, lo que impulsa la demanda de opciones farmacológicas, monitorización de la función renal y servicios de seguimiento ambulatorio. El enfoque regulatorio en la reducción de la proteinuria como criterio de valoración sustituto aprobable también ha incentivado las inversiones en I+D dirigidas a este síntoma. Los sistemas de reembolso suelen vincular la cobertura a los indicadores de proteinuria, lo que refuerza aún más su dominio del mercado. En resumen, la importancia pronóstica y regulatoria de la proteinuria explica su posición de liderazgo.

Se prevé que el segmento de hematuria alcance la tasa de crecimiento anual compuesto (TCAC) más rápida, del 10,6 %, entre 2025 y 2032, gracias a la mejora de las pruebas de detección mediante análisis de orina, los diagnósticos en el punto de atención y los programas de concienciación pública, que incrementan las tasas de detección precoz. Las intervenciones que abordan la inflamación subyacente y previenen la hematuria macroscópica o microscópica recurrente están ganando terreno, lo que impulsa una mayor adopción de protocolos diagnósticos en atención primaria y clínicas de nefrología. Los ensayos clínicos reportan cada vez más la mejoría de la hematuria como un resultado secundario, lo que respalda afirmaciones terapéuticas más amplias. Además, la identificación de la hematuria en los controles de salud rutinarios está generando derivaciones más tempranas a nefrología, lo que amplía la población tratada e impulsa la demanda tanto de diagnósticos como de terapias de intervención precoz. El crecimiento de la telemedicina y la monitorización remota de análisis de orina también contribuye a una adopción más rápida de la atención centrada en la hematuria.

- Por tipo

Según su tipo, el mercado de la nefropatía por IgA se divide en diagnóstico y tratamiento. El segmento de tratamiento dominó el mercado con la mayor cuota de ingresos (62,7%) en 2024, lo que refleja el gasto sostenido en farmacoterapias, productos biológicos, medicamentos de apoyo y atención intervencionista para pacientes con nefropatía por IgA. El tratamiento abarca medicamentos (inmunomoduladores, corticosteroides, agentes de la vía de la angiotensina), formulaciones especializadas y regímenes de apoyo como los inhibidores de SGLT2 y los agentes reductores de proteínas; estos productos representan la mayor parte del gasto sanitario. El creciente desarrollo de agentes modificadores de la enfermedad y varias aprobaciones de alto valor han impulsado los ingresos del mercado en el área de tratamiento. Las actividades de comercialización —colaboraciones con fabricantes, marketing dirigido a especialistas e inclusión en formularios hospitalarios— se centran en la terapéutica, lo que refuerza la concentración de ingresos. Los servicios de tratamiento también incluyen el seguimiento a largo plazo y el apoyo clínico complementario, que generan flujos de ingresos recurrentes. En general, el desarrollo terapéutico activo y la dependencia clínica de la farmacoterapia consolidan el dominio del tratamiento.

Se prevé que el segmento de Diagnóstico registre la tasa de crecimiento anual compuesto (TCAC) más rápida, del 12,0 %, entre 2025 y 2032, gracias a los avances en biomarcadores no invasivos, análisis multiplex y modalidades de imagen que reducen la dependencia de la biopsia invasiva. El mercado está experimentando una rápida innovación en proteómica urinaria, biomarcadores serológicos y análisis de imágenes, lo que permite una estratificación de enfermedades más temprana y precisa. Las pruebas diagnósticas complementarias, junto con las terapias dirigidas, están acelerando la adopción de diagnósticos, ya que los médicos utilizan cada vez más los perfiles de biomarcadores para personalizar el tratamiento. El crecimiento de las plataformas de diagnóstico descentralizadas y en el punto de atención también mejora el acceso en entornos comunitarios, ampliando el número de pacientes atendidos. La expansión de los programas de cribado y las herramientas de salud digital para la monitorización remota están impulsando aún más los servicios de diagnóstico a un ritmo superior al observado históricamente.

- Por tipo de población

Según el tipo de población, el mercado de la nefropatía por IgA se divide en pediátrico y adulto. El segmento de adultos dominó el mercado con la mayor cuota de ingresos (79,0 %) en 2024, dado que la mayoría de los casos de nefropatía por IgA clínicamente significativos y la actividad de tratamiento comercial se dan en esta población. Los pacientes adultos presentan con mayor frecuencia proteinuria progresiva y deterioro de la función renal que requiere intervención farmacológica, lo que impulsa la demanda de tratamientos, atención hospitalaria y manejo a largo plazo. Las poblaciones de los ensayos clínicos son predominantemente adultas, lo que orienta las estrategias de aprobación de fármacos y los lanzamientos al mercado hacia las indicaciones para adultos. Los sistemas de salud destinan una mayor proporción de recursos nefrológicos a la atención de adultos debido al mayor número absoluto de casos y a la carga de comorbilidades, lo que refuerza la concentración de ingresos. Por lo tanto, las estrategias de acceso al mercado, el reembolso por parte de las aseguradoras y los servicios especializados se dirigen a la población adulta, manteniendo así su posición dominante.

Se prevé que el segmento de Pediatría registre la tasa de crecimiento anual compuesto (TCAC) más rápida, del 13,5 %, entre 2025 y 2032, impulsada por el aumento de las pruebas de detección en la población pediátrica, los programas de intervención temprana y la creciente evidencia de que el manejo oportuno mejora los resultados a largo plazo. Los centros de nefrología pediátrica están ampliando sus capacidades para realizar pruebas genéticas, monitorizar biomarcadores y ofrecer tratamientos personalizados para niños. La mayor concienciación entre los pediatras y las iniciativas de salud escolar contribuyen a la detección precoz de la hematuria y la proteinuria. Los estudios clínicos pediátricos y las formulaciones pediátricas también están en auge, lo que motiva a los fabricantes a obtener el etiquetado pediátrico y ampliar su alcance en el mercado. En conjunto, estas dinámicas aceleran el crecimiento del mercado pediátrico a un ritmo superior al de la atención a adultos.

- Por vía administrativa

Según la vía de administración, el mercado de la nefropatía por IgA se segmenta en oral, parenteral y otras. El segmento oral dominó el mercado con la mayor cuota de ingresos (58,2 %) en 2024, ya que los fármacos orales (moléculas pequeñas, antagonistas de receptores y muchos fármacos de apoyo) representan la forma terapéutica más prescrita, rentable y preferida por los pacientes. Los medicamentos orales permiten el manejo ambulatorio crónico, mejoran la adherencia al tratamiento y reducen la carga de los centros de infusión; por lo tanto, se utilizan ampliamente en la práctica nefrológica. Muchos de los nuevos fármacos orales dirigidos en desarrollo y varias aprobaciones recientes corresponden a formulaciones orales, lo que refuerza la actividad comercial y el volumen de prescripciones. Los sistemas de pago y los formularios favorecen las terapias orales para el manejo ambulatorio, lo que contribuye a mayores ventas y utilización. La comodidad y la escalabilidad de la dosificación oral explican la posición dominante de este segmento.

Se prevé que el segmento de terapia parenteral alcance la tasa de crecimiento anual compuesto (TCAC) más rápida, del 14,1 %, entre 2025 y 2032, impulsada por la maduración y comercialización de productos biológicos, anticuerpos monoclonales e inhibidores del complemento inyectables emergentes. Las terapias parenterales, si bien suelen tener un precio más elevado, tratan enfermedades graves o refractarias y a menudo ofrecen potentes efectos específicos sobre el mecanismo de acción que los fármacos orales no pueden replicar. El creciente número de regímenes administrados en clínicas o basados en infusiones, junto con la mejora de la infraestructura de infusión ambulatoria y los servicios de infusión domiciliaria, facilita un mayor acceso. Las aprobaciones regulatorias de agentes parenterales para la nefropatía por IgA y la creciente evidencia de un beneficio clínico duradero son factores clave que impulsan este rápido crecimiento.

- Por usuario final

Según el usuario final, el mercado de la nefropatía por IgA se segmenta en hospitales, clínicas, atención domiciliaria y otros. El segmento de hospitales dominó el mercado con la mayor cuota de ingresos (51,6 %) en 2024, debido a su papel en el diagnóstico de casos complejos, la realización de biopsias renales, la administración de terapias parenterales y el manejo de las exacerbaciones agudas. Los centros de atención terciaria y los hospitales universitarios cuentan con equipos multidisciplinarios y tecnología avanzada para el diagnóstico por imagen, concentrando los procedimientos de alto valor y las consultas con especialistas en el entorno hospitalario. Los hospitales también sirven como centros principales para ensayos clínicos y la adopción temprana de nuevas terapias, impulsando las compras institucionales y los ingresos. Las hospitalizaciones por brotes graves y procedimientos contribuyen sustancialmente al gasto total del mercado. La infraestructura, el personal especializado y los modelos de reembolso que favorecen la atención hospitalaria sustentan la posición de liderazgo de este segmento.

Se prevé que el segmento de atención médica domiciliaria registre la tasa de crecimiento anual compuesto (TCAC) más rápida, del 15,0 %, entre 2025 y 2032. Este crecimiento se debe a la expansión de la monitorización remota, los servicios de infusión domiciliaria y las iniciativas de telenefrología, que permiten el manejo de la nefropatía por IgA crónica fuera del ámbito hospitalario. Los avances en dispositivos de diagnóstico portátiles, servicios de toma de muestras de laboratorio a domicilio y plataformas de educación para el paciente facilitan un seguimiento más rutinario y la administración de tratamientos en el hogar. El interés de las aseguradoras por reducir la hospitalización y mejorar la comodidad del paciente favorece una mayor adopción de los modelos de atención domiciliaria. El auge de los servicios de farmacia especializada y la entrega a domicilio de medicamentos orales y parenterales acelera aún más esta transición, impulsando el rápido crecimiento del canal de atención médica domiciliaria.

- Por canal de distribución

Según el canal de distribución, el mercado de la nefropatía por IgA se segmenta en licitación directa, farmacia hospitalaria, farmacia minorista, farmacia en línea y otros. El segmento de farmacia hospitalaria dominó el mercado con la mayor cuota de ingresos (44,7 %) en 2024, lo que refleja el papel fundamental de los hospitales en el abastecimiento de terapias de alto costo, productos biológicos parenterales y medicamentos de apoyo especializados para pacientes hospitalizados y ambulatorios. Las farmacias hospitalarias gestionan las adquisiciones para las unidades de nefrología, los centros de infusión y los ensayos clínicos, lo que genera volúmenes de compra concentrados. Los formularios institucionales y los contratos negociados favorecen a las farmacias hospitalarias para las terapias complejas, lo que refuerza su cuota de ingresos. La integración clínica entre los médicos prescriptores y los servicios de farmacia hospitalaria impulsa aún más la utilización y el acceso inmediato a los nuevos fármacos.

Se prevé que el segmento de farmacias en línea experimente el mayor crecimiento anual compuesto (CAGR) del 17,8 % entre 2025 y 2032, impulsado por la creciente digitalización de la adquisición de medicamentos, la mayor preferencia de los pacientes por la entrega a domicilio y el auge de las farmacias electrónicas especializadas que ofrecen medicamentos para enfermedades crónicas y programas de apoyo al paciente. Los canales en línea mejoran el acceso a terapias orales y medicamentos de mantenimiento, proporcionan servicios de suscripción y recordatorios que fomentan la adherencia al tratamiento y permiten la asistencia remota al paciente. La mayor confianza en el comercio electrónico, la adaptación normativa para la entrega de recetas y la integración con plataformas de telemedicina están ampliando el alcance de las farmacias en línea. La comodidad, los precios competitivos y las herramientas de interacción con el paciente basadas en datos que ofrecen los distribuidores digitales están acelerando su adopción entre pacientes y profesionales sanitarios.

Análisis regional del mercado de la nefropatía por IgA

- Se prevé que el mercado de la nefropatía por IgA en Oriente Medio experimente un crecimiento significativo durante el período de pronóstico, impulsado por el aumento de las inversiones en atención médica en la región, la creciente prevalencia de enfermedades renales crónicas y el rápido avance de las tecnologías de diagnóstico y tratamiento.

- Las iniciativas de modernización de la atención médica lideradas por el gobierno, la ampliación del acceso a la atención nefrológica especializada y la creciente colaboración con empresas farmacéuticas internacionales están impulsando aún más la expansión del mercado.

- La región está experimentando mejoras notables en la concienciación sobre la enfermedad renal y en las tasas de diagnóstico precoz, gracias al apoyo de programas nacionales de salud y la participación del sector privado destinados a mejorar los resultados renales.

Perspectivas del mercado de la nefropatía por IgA en Arabia Saudita

En 2024, Arabia Saudita dominó el mercado de la nefropatía por IgA con la mayor cuota de ingresos (32,8%), impulsada por el aumento de las inversiones en salud del país, la creciente prevalencia de trastornos renales y las iniciativas gubernamentales del programa Visión 2030 para mejorar la infraestructura sanitaria. La presencia de centros de nefrología avanzados, la mayor adopción de tratamientos innovadores como los fármacos biológicos dirigidos y la creciente concienciación sobre la importancia del diagnóstico precoz han contribuido significativamente al liderazgo de Arabia Saudita en el mercado de la nefropatía por IgA en Oriente Medio. Además, la colaboración entre hospitales saudíes y empresas biofarmacéuticas internacionales apoya la investigación clínica y amplía el acceso a nuevas opciones terapéuticas.

Perspectivas del mercado de la nefropatía por IgA en los EAU

Se prevé que el mercado de nefropatía por IgA en los Emiratos Árabes Unidos sea el de mayor crecimiento en el sector, con una tasa de crecimiento anual compuesta (TCAC) del 9,1 % durante el período de pronóstico. Este crecimiento se debe principalmente a las rápidas mejoras en la infraestructura sanitaria, la creciente prevalencia de enfermedades renales crónicas y la mayor demanda de soluciones avanzadas de diagnóstico y tratamiento. El enfoque del país en la medicina de precisión, junto con las crecientes campañas de concientización sobre la salud renal, impulsará mayores tasas de diagnóstico. Además, la expansión de clínicas de nefrología especializadas, las alianzas estratégicas con empresas farmacéuticas líderes y las iniciativas gubernamentales para promover la atención preventiva fortalecerán la posición de los Emiratos Árabes Unidos como un mercado emergente clave para el tratamiento de la nefropatía por IgA en Oriente Medio.

Cuota de mercado de la nefropatía por IgA

La industria de la nefropatía por IgA está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Novartis AG (Suiza)

- AstraZeneca (Reino Unido)

- Roche Holding AG (Suiza)

- GSK plc (Reino Unido)

- Bayer AG (Alemania)

- Sanofi (Francia)

- AbbVie Inc. (EE. UU.)

- Boehringer Ingelheim (Alemania)

- Compañía Farmacéutica Otsuka, Ltd. (Japón)

- Novartis Medio Oriente FZE (EAU)

- Hikma Pharmaceuticals plc (Reino Unido)

- Novo Nordisk A/S (Dinamarca)

- Fresenius Medical Care AG & Co. KGaA (Alemania)

Últimos avances en el mercado de la nefropatía por IgA en Oriente Medio y África

- En diciembre de 2021, la Administración de Alimentos y Medicamentos de los Estados Unidos (FDA) otorgó la aprobación acelerada a TARPEYO (budesonida de liberación dirigida) para reducir la proteinuria en adultos con nefropatía IgA primaria con riesgo de progresión rápida de la enfermedad, lo que representa la primera aprobación regulatoria específica para la nefropatía IgA centrada en la reducción de la proteinuria.

- En marzo de 2023, la FDA de EE. UU. otorgó la aprobación acelerada a FILSPARI (sparsentán) de Travere Therapeutics como la primera terapia no inmunosupresora para reducir la proteinuria en adultos con nefropatía por IgA primaria con riesgo de progresión rápida de la enfermedad, creando una nueva e importante clase de tratamiento para esta afección.

- Entre octubre y diciembre de 2023, se lograron avances significativos en los hitos regulatorios y de las principales líneas de investigación para los agentes dirigidos a la vía del complemento: los datos provisionales y en curso de la fase 3 de narsoplimab (Omeros) mostraron fuertes señales de proteinuria y seguridad en el estudio ARTEMIS-IGAN, y se incrementó la actividad de solicitudes regulatorias y revisiones prioritarias en varios programas en fase avanzada, lo que subraya la tendencia hacia terapias dirigidas al mecanismo de acción de la nefropatía por IgA.

- En agosto de 2024, Fabhalta (iptacopan) de Novartis —un inhibidor oral del complemento, primero en su clase, para la nefropatía por IgA— recibió la aprobación acelerada (EE. UU.) para la reducción de la proteinuria en la nefropatía por IgA primaria, basándose en los resultados provisionales de la fase 3 que mostraron una reducción sustancial de la proteinuria en comparación con el placebo, ampliando así las opciones de tratamiento con inhibidores del complemento para los pacientes con nefropatía por IgA.

- En septiembre de 2024, Travere Therapeutics anunció la aprobación completa/ampliada por la FDA para FILSPARI (sparsentán) (conversión de aprobación acelerada a aprobación completa/indicación ampliada) después de que los datos confirmatorios del estudio PROTECT demostraran un beneficio duradero en la proteinuria y la preservación de la función renal, lo que fortaleció el posicionamiento comercial y clínico de sparsentán en la nefropatía por IgA.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.