Middle East And Africa Health Insurance Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

155.16 Billion

USD

207.49 Billion

2024

2032

USD

155.16 Billion

USD

207.49 Billion

2024

2032

| 2025 –2032 | |

| USD 155.16 Billion | |

| USD 207.49 Billion | |

|

|

|

|

Mercado de seguros de salud en Oriente Medio y África por tipo (productos y soluciones), servicios (tratamiento hospitalario, tratamiento ambulatorio, asistencia médica y otros), nivel de cobertura (bronce, plata, oro y platino), proveedores de servicios (seguros de salud públicos y privados), planes de seguro de salud (punto de servicio [POS], organización de proveedores exclusivos [EPOS], seguro de salud de indemnización, cuenta de ahorros para gastos médicos [HSA], acuerdos de reembolso de gastos médicos para pequeñas empresas cualificadas [QSEHRAS], organización de proveedores preferidos [PPO], organización para el mantenimiento de la salud [HMO] y otros), demografía (adultos, menores y adultos mayores), tipo de cobertura (cobertura vitalicia, cobertura a término), usuario final (empresas, particulares y otros), canal de distribución (venta directa, instituciones financieras, comercio electrónico, hospitales, clínicas y otros), tendencias y pronóstico del sector hasta 2032.

Tamaño del mercado de seguros de salud en Oriente Medio y África

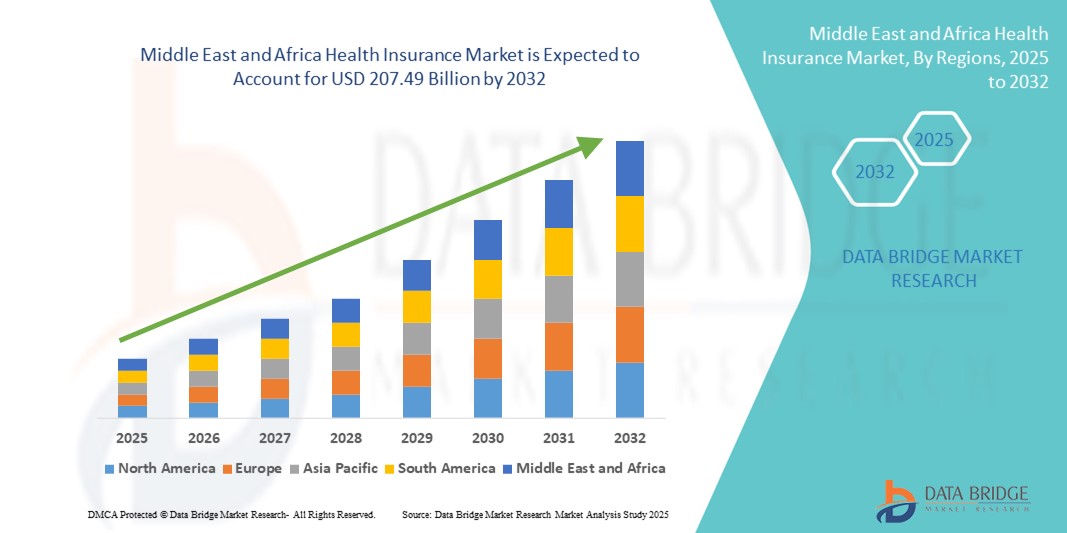

- El tamaño del mercado de seguros de salud de Medio Oriente y África se valoró en USD 155,16 mil millones en 2024 y se espera que alcance los USD 207,49 mil millones para 2032 , con una CAGR del 3,70% durante el período de pronóstico.

- El mercado de seguros de salud de Medio Oriente y África está experimentando un fuerte crecimiento, impulsado por una creciente conciencia de la importancia de la cobertura de salud, especialmente a la luz de las crecientes tasas de enfermedades crónicas, los altos gastos de atención médica de bolsillo y la expansión de las poblaciones de clase media en toda la región.

- Las reformas de salud lideradas por el gobierno, la introducción de pólizas de seguro de salud obligatorias en países como los Emiratos Árabes Unidos y Arabia Saudita, y el aumento de las inversiones en infraestructura de salud digital están impulsando aún más la adopción de seguros de salud entre individuos, familias y empresas.

Análisis del mercado de seguros de salud en Oriente Medio y África

- El mercado de seguros de salud de Oriente Medio y África está experimentando un crecimiento significativo debido a la creciente demanda de servicios de atención sanitaria accesibles y asequibles, la creciente prevalencia de enfermedades crónicas y la expansión de las iniciativas gubernamentales y del sector privado para mejorar la cobertura sanitaria en toda la región.

- El crecimiento del mercado está impulsado por la creciente conciencia sobre los beneficios del seguro de salud, el aumento de los gastos de atención médica, las reformas regulatorias favorables y la creciente necesidad de protección financiera contra emergencias médicas y altos costos de tratamiento.

- Arabia Saudita dominó el mercado de seguros de salud de Medio Oriente y África con una participación de ingresos del 34,7 % en 2024, impulsada por sólidos planes de seguros de salud dirigidos por el gobierno, un sector de seguros privados en expansión y requisitos de seguro obligatorios para expatriados y empleados del sector privado.

- Se proyecta que los Emiratos Árabes Unidos serán el país de más rápido crecimiento en el mercado de seguros de salud de Medio Oriente y África, y se espera que registren una CAGR del 11,6 % durante 2025-2032, impulsada por el aumento del turismo médico, las plataformas de seguros digitales mejoradas y el impulso del gobierno para una cobertura sanitaria universal.

- El segmento de seguros de salud individuales dominó el mercado de seguros de salud de Oriente Medio y África con una participación en los ingresos del 53,1 % en 2024, atribuido al aumento de la inscripción entre autónomos, trabajadores independientes y empleados del sector informal que buscan una cobertura de salud integral y personalizada.

Alcance del informe y segmentación del mercado de seguros de salud en Oriente Medio y África

|

Atributos |

Perspectivas del mercado de seguros de salud en Oriente Medio y África |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Oriente Medio y África

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis en profundidad de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de seguros de salud en Oriente Medio y África

Las reformas gubernamentales y la transformación digital impulsan el mercado de seguros de salud en Oriente Medio y África

- Una tendencia importante que está dando forma al mercado de seguros de salud de Medio Oriente y África es la rápida digitalización de los servicios de seguros, donde las aseguradoras integran plataformas impulsadas por IA, soluciones de telemedicina y aplicaciones de salud móviles para mejorar el acceso de los clientes y la eficiencia operativa.

- Los gobiernos de países como Arabia Saudita y los Emiratos Árabes Unidos están introduciendo regulaciones de seguro médico obligatorio para expatriados y empleados del sector privado, expandiendo significativamente la población asegurada y mejorando el acceso a la atención médica.

- Las empresas emergentes de Insurtech y las aseguradoras tradicionales están aprovechando la tecnología blockchain y los sistemas basados en la nube para mejorar la transparencia de las reclamaciones, prevenir el fraude y agilizar el proceso de gestión de pólizas, atrayendo a consumidores más jóvenes y conocedores de la tecnología.

- Hay una creciente inversión en asociaciones público-privadas para ampliar la infraestructura de atención de la salud y la cobertura de seguros en regiones rurales desatendidas de Sudáfrica, Nigeria y Kenia, apoyando iniciativas de financiación de la salud inclusiva.

- La conciencia pospandemia sobre la protección financiera ante costos médicos inesperados ha aumentado significativamente la demanda de planes de seguro de salud individuales y familiares, especialmente entre trabajadores autónomos y del sector informal.

- Países como Egipto y Marruecos están implementando marcos de cobertura sanitaria universal (CSU), integrando aseguradoras públicas y privadas para reducir los gastos de bolsillo y mejorar el acceso a servicios médicos esenciales.

- Se espera que esta ola de reformas regulatorias, junto con la innovación tecnológica y un cambio hacia la atención preventiva, transforme el panorama del mercado de seguros de salud de Medio Oriente y África, fomentando una mayor penetración de seguros y un crecimiento sostenido hasta 2032.

Dinámica del mercado de seguros de salud en Oriente Medio y África

Conductor

La creciente demanda impulsada por las reformas regulatorias, la expansión digital y la participación del sector privado

- El mercado de seguros de salud de Oriente Medio y África está experimentando un sólido crecimiento, impulsado por las reformas regulatorias en curso, la expansión del ecosistema de salud digital y la creciente participación del sector privado para cerrar las brechas de acceso a la atención médica en las poblaciones urbanas y rurales.

- En abril de 2024, el Banco Central de Arabia Saudita (SAMA) lanzó un programa de sandbox de seguros de salud digitales para permitir que las empresas InsurTech prueben plataformas de cobertura de salud impulsadas por IA bajo supervisión regulatoria, lo que refleja el cambio de la región hacia modelos de seguros impulsados por la tecnología.

- Países como Egipto, Kenia y Marruecos están ampliando los programas de cobertura sanitaria universal (CSU), integrando planes de seguros privados para reducir los gastos de bolsillo y mejorar la accesibilidad a servicios de atención sanitaria esenciales para las poblaciones de bajos ingresos.

- La creciente penetración de las plataformas de seguros móviles en África subsahariana, impulsada por la adopción de teléfonos inteligentes y la infraestructura de dinero móvil, está posibilitando planes de microseguro de salud a pedido, adaptados a los trabajadores del sector informal y a los participantes de la economía informal.

- Las aseguradoras con sede en los Emiratos Árabes Unidos se están asociando con nuevas empresas de salud digital para brindar servicios de teleconsulta, farmacia electrónica y gestión de enfermedades crónicas incluidos en sus planes de seguro de salud, mejorando la participación del paciente y los resultados de la atención preventiva.

- Los gobiernos de la región del CCG están imponiendo una cobertura de seguro de salud a cargo del empleador para expatriados y trabajadores del sector privado, lo que contribuye a un grupo de riesgo más amplio y a una mejor sostenibilidad del sistema de atención de la salud.

- La expansión de los proveedores de seguros internacionales y las empresas de reaseguros en mercados como Nigeria, Sudáfrica y Ghana está introduciendo modelos de suscripción avanzados, opciones de pólizas personalizables y mejores prácticas globales en los ecosistemas locales.

- Las campañas de alfabetización sobre seguros de salud, apoyadas por asociaciones público-privadas en países como Ruanda y Tanzania, están ayudando a los ciudadanos a comprender los beneficios de la cobertura, los procedimientos de reclamo y los derechos bajo los programas nacionales de seguros de salud.

- Hasta 2032, la convergencia de la innovación en salud digital, los entornos de políticas favorables y la creciente demanda de atención accesible y asequible seguirán acelerando la formalización y el crecimiento del mercado de seguros de salud en Oriente Medio y África.

Restricción/Desafío

Barreras de asequibilidad, fragmentación regulatoria y brechas de infraestructura

- A pesar del crecimiento del mercado, el mercado de seguros de salud de Medio Oriente y África enfrenta desafíos relacionados con la asequibilidad, la estandarización regulatoria limitada y la infraestructura de atención médica subdesarrollada en regiones rurales y de bajos ingresos.

- Por ejemplo, en varios países del África subsahariana, más del 60% de la población sigue sin seguro debido a los altos costos de las primas y la falta de modelos de seguro patrocinados por los empleadores, lo que limita la escala de adopción de seguros formales.

- Los marcos regulatorios fragmentados entre países (como las diferencias en los mandatos de cobertura, los protocolos de manejo de reclamos y los requisitos de solvencia) crean complejidades operativas para las aseguradoras regionales y multinacionales.

- En regiones como Sudán, Somalia y partes de África Central, la inestabilidad política persistente, la débil capacidad institucional y los sistemas de salud pública insuficientemente financiados restringen gravemente el alcance de los proveedores de seguros de salud públicos y privados.

- El escepticismo cultural hacia los seguros y una falta general de conocimiento sobre los beneficios de las pólizas conducen a una baja aceptación, en particular en las comunidades rurales donde las prácticas de atención tradicionales a menudo prevalecen sobre los sistemas de atención de salud formales.

- Las preocupaciones sobre la privacidad de los datos, la alfabetización digital inadecuada y el acceso deficiente a registros de salud confiables siguen obstaculizando la implementación de modelos de seguros digitales, especialmente entre las poblaciones de mayor edad.

- Para superar estos obstáculos, los esfuerzos deben centrarse en los subsidios a las primas para los grupos de bajos ingresos, la armonización regulatoria entre regiones, las asociaciones entre el sector público y el privado para la infraestructura y campañas agresivas de concientización para mejorar la penetración del seguro de salud hasta 2032.

Alcance del mercado de seguros de salud en Oriente Medio y África

El mercado está segmentado según tipo, servicios, nivel de cobertura, proveedores de servicios, planes de seguro de salud, demografía, tipo de cobertura, usuario final y canal de distribución.

- Por tipo

Según el tipo de seguro, el mercado de seguros de salud de Oriente Medio y África se segmenta en productos y soluciones. El segmento de productos tuvo la mayor cuota de mercado, con un 62,4 %, en 2024, gracias a la adopción generalizada de pólizas de seguro estandarizadas, como la cobertura básica de salud, los planes de enfermedades graves y las prestaciones de salud a cargo del empleador. Estos productos son populares gracias a sus beneficios estructurados, la facilidad de comparación y el cumplimiento normativo.

Se prevé que el segmento de soluciones registre la tasa de crecimiento anual compuesta (TCAC) más rápida, del 9,8 %, entre 2025 y 2032, impulsada por la creciente demanda de servicios de seguros personalizados y tecnológicos, como la gestión digital de pólizas, la integración de telesalud, la suscripción basada en IA y las plataformas de detección de fraude. Estas innovaciones están revolucionando la experiencia del usuario y la eficiencia operativa en todo el ecosistema de seguros de salud.

- Por Servicios

En cuanto a los servicios, el mercado de seguros médicos de Oriente Medio y África se segmenta en tratamiento hospitalario, tratamiento ambulatorio, asistencia médica y otros. El segmento de tratamiento hospitalario lideró el mercado con la mayor participación en ingresos, un 41,9 %, en 2024, debido principalmente a la creciente carga de enfermedades crónicas y los altos costos de tratamiento asociados con cirugías, hospitalizaciones prolongadas y cuidados intensivos. El seguro médico desempeña un papel fundamental para reducir la carga financiera de los pacientes hospitalizados.

Se proyecta que el segmento de asistencia médica crecerá a la CAGR más rápida del 11,2 % entre 2025 y 2032, impulsado por la creciente necesidad de servicios de respuesta a emergencias las 24 horas, los 7 días de la semana, asistencia de ambulancia, segundas opiniones médicas y consultas de salud virtuales, especialmente en áreas remotas y desatendidas.

- Por nivel de cobertura

Según el nivel de cobertura, el mercado de seguros de salud de Oriente Medio y África se segmenta en bronce, plata, oro y platino. El segmento plata dominó el mercado con una participación en los ingresos del 36,8 % en 2024, ya que ofrece una combinación equilibrada de primas asequibles y gastos de bolsillo moderados. Es especialmente popular entre familias de ingresos medios que buscan una protección adecuada sin un sobrecosto en las primas.

Se anticipa que el segmento platino crecerá a la CAGR más rápida del 11,1 % entre 2025 y 2032, impulsado por la creciente demanda de planes integrales y de primera calidad que cubran una amplia gama de servicios con un costo compartido mínimo, especialmente entre personas de alto patrimonio y pacientes con necesidades médicas complejas.

- Por proveedores de servicios

En cuanto a los proveedores de servicios, el mercado de seguros médicos de Oriente Medio y África se segmenta en proveedores de seguros médicos públicos y privados. El segmento de proveedores de seguros médicos privados tuvo la mayor cuota de mercado, con un 69,1 %, en 2024, gracias a su capacidad para ofrecer una tramitación más rápida de reclamaciones, una red hospitalaria más amplia y opciones de cobertura más personalizadas. Muchos empleadores y particulares prefieren las aseguradoras privadas por su eficiencia y sus servicios centrados en el cliente.

Se espera que el segmento de proveedores de seguros de salud públicos crezca a la CAGR más rápida del 8,9% entre 2025 y 2032, respaldado por una mayor inversión gubernamental en programas nacionales de salud, planes de seguro social y políticas destinadas a ampliar el acceso a la atención médica a las poblaciones rurales y de bajos ingresos.

- Por planes de seguro de salud

En cuanto a los planes de seguro médico, el mercado de seguros médicos de Oriente Medio y África se segmenta en POS, EPOS, indemnización, HSA, QSEHRA, PPO, HMO y otros. El segmento HMO lideró el mercado con la mayor participación en ingresos, un 31,6 % en 2024, gracias a su rentabilidad y a su modelo de atención coordinada, que requiere que los pacientes accedan a los servicios a través de un médico de atención primaria dentro de una red definida. Este modelo resulta atractivo tanto para las aseguradoras como para los asegurados gracias a sus primas más bajas y a su gestión simplificada.

Se proyecta que el segmento HSA crecerá a la CAGR más rápida del 10,9 % entre 2025 y 2032, ya que más consumidores optan por planes de salud con deducibles altos vinculados con cuentas de ahorro con ventajas fiscales, lo que proporciona flexibilidad y control sobre el gasto en atención médica.

- Por demografía

Según la demografía, el mercado de seguros de salud de Oriente Medio y África se segmenta en adultos, menores y adultos mayores. El segmento de adultos dominó el mercado con una participación en los ingresos del 54,8 % en 2024, lo que representa la mayor población asegurable que busca activamente cobertura a través de empleadores, planes individuales o planes gubernamentales. Los adultos son los principales responsables de la cobertura médica familiar y contribuyen significativamente al fondo común de primas de seguros.

Se prevé que el segmento de personas mayores crezca a la CAGR más rápida del 12,3 % entre 2025 y 2032, impulsado por una creciente población geriátrica, una mayor prevalencia de enfermedades relacionadas con la edad y la necesidad de cuidados a largo plazo y beneficios de hospitalización.

- Por tipo de cobertura

Según el tipo de cobertura, el mercado de seguros de salud de Oriente Medio y África se segmenta en cobertura vitalicia y temporal. El segmento temporal tuvo la mayor cuota de mercado, con un 60,2 %, en 2024, gracias a su asequibilidad y popularidad entre los jóvenes y los asegurados primerizos que buscan protección temporal o a corto o medio plazo.

Se espera que el segmento de cobertura de por vida crezca a la CAGR más rápida del 9,6 % entre 2025 y 2032, a medida que los consumidores se vuelven cada vez más conscientes de la importancia de la protección financiera de por vida contra los riesgos para la salud, especialmente a la luz de las crecientes condiciones relacionadas con el estilo de vida y la inflación médica.

- Por el usuario final

En función del usuario final, el mercado de seguros de salud de Oriente Medio y África se segmenta en empresas, particulares y otros. El segmento de seguros de salud individuales dominó el mercado con una cuota de ingresos del 53,1 % en 2024, debido al aumento de la afiliación entre autónomos, freelancers y empleados del sector informal que buscan una cobertura médica integral y personalizada.

También se proyecta que el segmento de individuos crecerá a la CAGR más rápida del 11,4% entre 2025 y 2032, a medida que los profesionales autónomos, los trabajadores de la economía informal y las poblaciones sin seguro recurren cada vez más a planes de seguro médico personal facilitados por la incorporación digital y ofertas de productos simplificadas.

- Por canal de distribución

Según el canal de distribución, el mercado de seguros de salud de Oriente Medio y África se segmenta en venta directa, instituciones financieras, comercio electrónico, hospitales, clínicas y otros. El segmento de venta directa dominó el mercado con una cuota de ingresos del 36,5 % en 2024, gracias a la eficacia de las redes de distribución basadas en agentes y las interacciones presenciales para generar confianza, explicar los beneficios de las pólizas y ofrecer recomendaciones personalizadas.

Se espera que el segmento de comercio electrónico crezca a la CAGR más rápida del 12,6 % entre 2025 y 2032, respaldado por la creciente penetración de Internet, la accesibilidad móvil y la creciente adopción de plataformas en línea que permiten a los usuarios comparar, comprar y gestionar pólizas en tiempo real.

Análisis regional del mercado de seguros de salud en Oriente Medio y África

- El mercado de seguros de salud de Oriente Medio y África representó el 8,4 % de la cuota de mercado mundial en 2024 y se proyecta que crezca a una CAGR del 10,7 % entre 2025 y 2032, impulsado por la creciente concienciación sobre la salud pública, el aumento del gasto sanitario y las iniciativas políticas destinadas a ampliar el acceso a una atención de calidad en diversas poblaciones.

- Los gobiernos de la región están implementando activamente reformas regulatorias, estrategias de digitalización y esquemas de seguros obligatorios para abordar la baja penetración de seguros y los altos costos de bolsillo de la atención médica.

- El mercado está siendo testigo de una mayor participación de aseguradoras privadas, empresas emergentes de InsurTech y firmas de reaseguros internacionales, que introducen plataformas digitales innovadoras, planes personalizados y modelos de suscripción basados en riesgos adaptados a segmentos desatendidos.

Perspectivas del mercado de seguros de salud de Arabia Saudita

El mercado de seguros de salud de Arabia Saudita dominó el mercado con una participación del 34,7% en los ingresos en 2024, impulsado por los sólidos planes de seguro de salud gubernamentales, la expansión del sector privado de seguros y los requisitos de cobertura obligatoria para expatriados y empleados del sector privado. Las reformas de la Visión 2030 del país están impulsando inversiones a gran escala en infraestructura de salud digital y la expansión de la cobertura de seguros. El Consejo Cooperativo de Seguros de Salud (CCHI) está acelerando la adopción de sistemas estandarizados de reclamaciones digitales y modelos de atención integrada, a la vez que aumenta la transparencia y el cumplimiento normativo entre los proveedores. La creciente demanda de paquetes de seguros privados complementarios entre las poblaciones urbanas de altos ingresos está impulsando aún más el crecimiento del mercado en ciudades como Riad, Yeda y Dammam.

Perspectivas del mercado de seguros de salud de los EAU

El mercado de seguros de salud de los EAU capturó el 22,1% de la cuota de mercado regional en 2024 y se proyecta que será el país con mayor crecimiento, registrando una tasa de crecimiento anual compuesta (TCAC) del 11,6% entre 2025 y 2032. Este crecimiento se ve impulsado por el creciente estatus del país como centro de turismo médico, la adopción generalizada de plataformas digitales de seguros de salud y la iniciativa del gobierno para lograr una cobertura sanitaria universal mediante mandatos regulatorios como la Ley de Seguros de Salud de Dubái y el Programa Thiqa de Abu Dabi. La integración de la telemedicina, la farmacia electrónica y el análisis de salud basado en IA está mejorando la eficiencia y la accesibilidad de los servicios de seguros de salud. Las aseguradoras con sede en los EAU colaboran cada vez más con startups de salud digital para ofrecer servicios de valor añadido y cobertura personalizada, atrayendo aún más a expatriados y pacientes internacionales que buscan paquetes de atención premium.

Cuota de mercado de seguros de salud en Oriente Medio y África

El mercado de seguros de salud está liderado principalmente por empresas bien establecidas, entre las que se incluyen:

- Bupa (Reino Unido)

- Now Health International (China)

- Cigna (EE. UU.)

- Aetna Inc. (EE. UU.)

- AXA (Francia)

- HBF Health Limited (Australia)

- Vitality (Reino Unido)

- Centene Corporation (EE. UU.)

- International Medical Group, Inc. (EE. UU.)

- Anthem Insurance Companies, Inc. (EE. UU.)

- Broadstone Corporate Benefits Limited (Reino Unido)

- Allianz Care (Francia)

- HealthCare International Middle East and Africa Network Ltd (Reino Unido)

- Assicurazioni Generali SPA (Italia)

- Aviva (Reino Unido)

- Grupo Vhi (Irlanda)

- UnitedHealth Group (EE. UU.)

- MAPFRE (España)

- AIA Group Limited (China)

Últimos avances en el mercado de seguros de salud de Oriente Medio y África

- En febrero de 2025, Bupa Arabia lanzó su plataforma CareConnect y el servicio Bupa Pro para revolucionar el seguro médico digital en Arabia Saudita. CareConnect permite a los usuarios acceder a tarjetas sanitarias digitales, realizar el seguimiento de reclamaciones y almacenar datos médicos, mientras que Bupa Pro elimina las preaprobaciones ambulatorias para más de 200.000 afiliados mediante la validación API en tiempo real. Estas innovaciones buscan reducir los tiempos de espera de los pacientes y mejorar la accesibilidad a los servicios de salud en toda la región.

- En mayo de 2025, la Fundación OMS firmó una alianza estratégica con Tawuniya, una de las principales aseguradoras de Arabia Saudita, para impulsar la innovación y la resiliencia de los sistemas de salud en la región del Mediterráneo Oriental. La colaboración se centra en la gestión de la salud poblacional, la aceleración de la salud digital y la cobertura sanitaria universal, marcando un hito en la transformación regional de la atención sanitaria.

- En abril de 2025, la Autoridad de Servicios Financieros de Omán lanzó Dhamani , una plataforma digital nacional de seguros de salud destinada a automatizar las reclamaciones, mejorar la transparencia y agilizar los procesos de seguros. La iniciativa respalda la visión de Omán de digitalizar el ecosistema sanitario y ampliar la cobertura de seguros a más ciudadanos y residentes.

- En enero de 2024, AXA Egipto lanzó un nuevo producto llamado AXA Health Advantage , que ofrece consultas de telemedicina, apoyo en salud mental y gestión de enfermedades crónicas como parte de sus planes de salud individuales y corporativos. Esta iniciativa responde a la creciente demanda de modelos de atención médica híbridos en todo el país.

- En marzo de 2024, Discovery Health South Africa anunció su intención de integrar el procesamiento de reclamaciones basado en IA para 2026, con el objetivo de reducir el fraude, automatizar las decisiones y mejorar la satisfacción del cliente. Esta iniciativa forma parte del esfuerzo más amplio de Discovery por la transformación digital y la mejora de la eficiencia operativa.

- En junio de 2024, Medgulf Insurance en Arabia Saudita se asoció con Altibbi, proveedor líder de salud digital, para ofrecer servicios de telesalud en conjunto con sus planes de seguro. Esta integración permite a los asegurados acceder a consultas remotas y recetas electrónicas las 24 horas, los 7 días de la semana, a través de una aplicación móvil, lo que refleja una importante tendencia hacia los servicios de seguros con tecnología en la región.

- En junio de 2021, Vitality anunció su colaboración con Samsung UK para integrar Samsung Health en el Programa Vitality, ofreciendo a sus miembros más opciones para monitorizar su actividad y mejorar su salud. Esta nueva colaboración con Samsung permitirá a los usuarios de Android disfrutar de todos los beneficios del Programa Vitality, ya que podrán vincular su perfil de Samsung Health a su cuenta de Vitality Member Zone para registrar automáticamente sus pasos diarios y su frecuencia cardíaca y así ganar puntos de actividad Vitality.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.