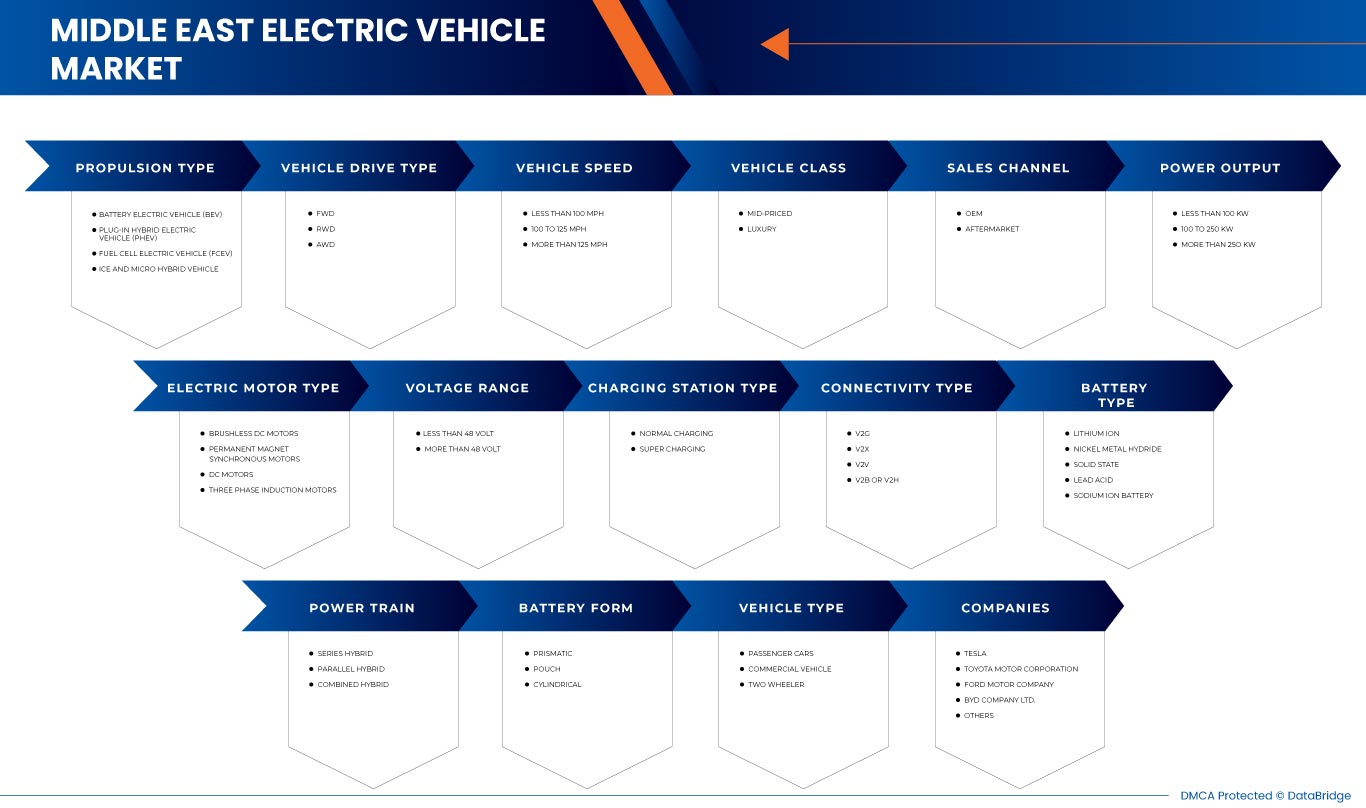

Mercado de vehículos eléctricos de Oriente Medio, por tipo de propulsión (vehículo eléctrico de batería (BEV), vehículo eléctrico híbrido enchufable (PHEV), vehículo eléctrico de pila de combustible (FCEV) y vehículo ICE y microhíbrido), tipo de tracción del vehículo (FWD, RWD y AWD), velocidad del vehículo (menos de 100 MPH, de 100 a 125 MPH y más de 125 MPH), clase de vehículo (de precio medio y de lujo), canal de ventas (OEM y posventa), potencia de salida (menos de 100 KW, de 100 a 250 KW y más de 250 KW), tipo de motor eléctrico (motores de CC sin escobillas, motores síncronos de imán permanente, motores de CC y motores de inducción trifásicos), rango de voltaje (menos de 48 voltios y más de 48 voltios), tipo de estación de carga (carga normal y súper carga), tipo de conectividad (V2G, V2X, V2V y V2B o V2H), tren motriz (híbrido en serie, Híbrido paralelo e híbrido combinado), tipo de vehículo (automóviles de pasajeros, vehículos comerciales y vehículos de dos ruedas), tipo de batería (iones de litio, níquel-hidruro metálico, estado sólido, plomo-ácido y batería de iones de sodio), forma de la batería (prismática, bolsa y cilíndrica), tendencias de la industria y pronóstico hasta 2030.

Análisis y perspectivas del mercado de vehículos eléctricos en Oriente Medio

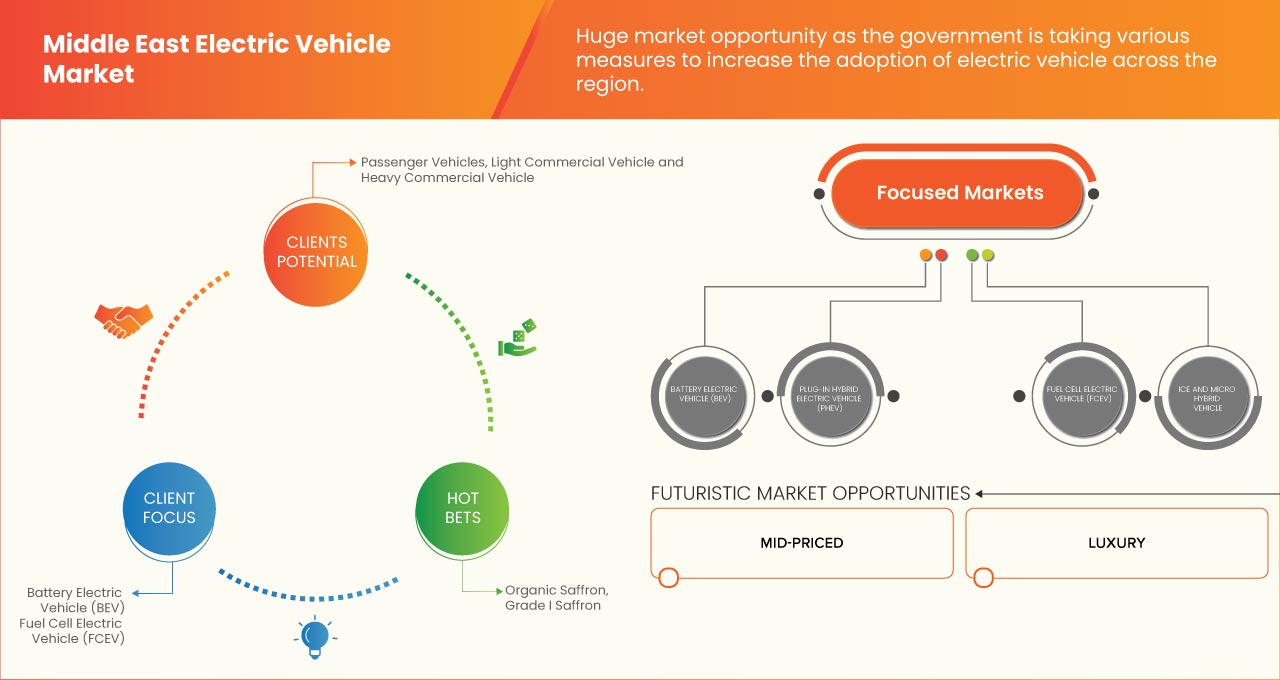

Los vehículos eléctricos son un prometedor sustituto renovable de los vehículos a gasolina para la protección del medio ambiente, y muchos gobiernos están tomando iniciativas para promover los vehículos eléctricos y están ofreciendo reembolsos de impuestos y reembolsos. El aumento del mercado de vehículos eléctricos en Oriente Medio se debe a que la tecnología se está actualizando a un ritmo rápido, lo que está haciendo que aumente la demanda de vehículos eléctricos en el mercado. Algunos de los factores que impulsan el mercado son la creciente demanda de vehículos eléctricos, los incentivos y subsidios del gobierno para vehículos eléctricos y las crecientes preocupaciones ambientales. Sin embargo, el alto costo inicial está obstaculizando el crecimiento del mercado.

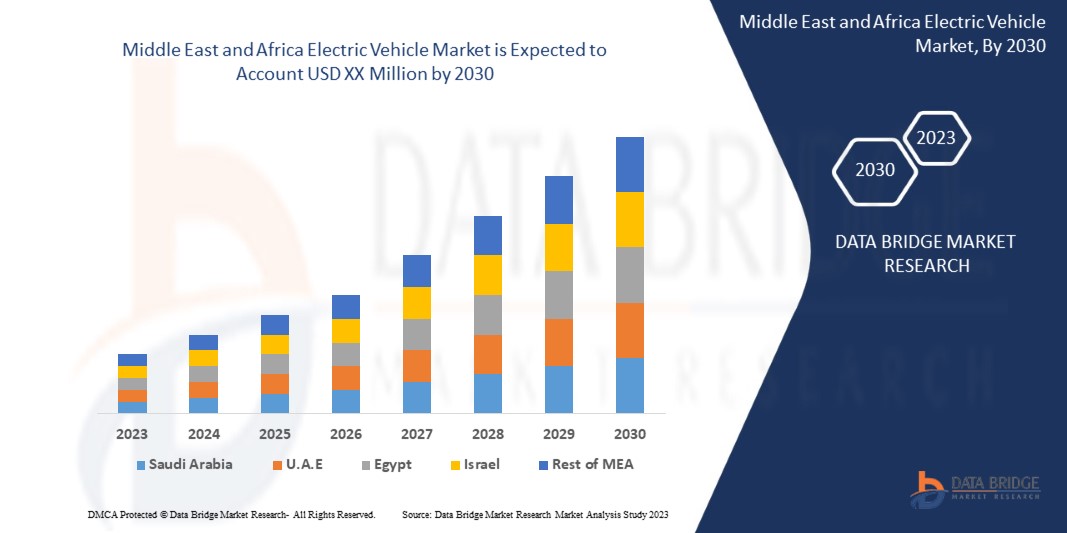

Data Bridge Market Research analiza que el mercado de vehículos eléctricos de Oriente Medio crecerá a una CAGR del 28,1% durante el período de pronóstico de 2023 a 2030.

|

Métrica del informe |

Detalles |

|

Año base |

2022 |

|

Período de pronóstico |

2023 - 2030 |

|

Años históricos |

2021 (Personalizable para 2020-2016) |

|

Unidades cuantitativas |

Ingresos en millones, volúmenes en miles de unidades, precios en USD |

|

Segmentos cubiertos |

Por tipo de propulsión (vehículo eléctrico de batería (BEV), vehículo eléctrico híbrido enchufable (PHEV), vehículo eléctrico de pila de combustible (FCEV) y vehículo ICE y microhíbrido), tipo de tracción del vehículo (FWD, RWD y AWD), velocidad del vehículo (menos de 100 MPH, de 100 a 125 MPH y más de 125 MPH), clase de vehículo (de precio medio y de lujo), canal de venta (OEM y posventa), potencia de salida (menos de 100 KW, de 100 a 250 KW y más de 250 KW), tipo de motor eléctrico ( motores de CC sin escobillas , motores síncronos de imán permanente, motores de CC y motores de inducción trifásicos), rango de voltaje (menos de 48 voltios y más de 48 voltios), tipo de estación de carga (carga normal y súper carga), tipo de conectividad (V2G, V2X, V2V y V2B o V2H), tren motriz (híbrido en serie, híbrido en paralelo y Híbrido combinado), tipo de vehículo (automóviles de pasajeros, vehículos comerciales y vehículos de dos ruedas), tipo de batería (iones de litio, batería de níquel e hidruro metálico , estado sólido, ácido de plomo y batería de iones de sodio), forma de la batería (prismática, bolsa y cilíndrica). |

|

Países cubiertos |

Arabia Saudita, Emiratos Árabes Unidos, Bahréin, Qatar, Kuwait, Omán y resto de Oriente Medio. |

|

Actores del mercado cubiertos |

BMW AG, Nissan Motor Co., Ltd., MITSUBISHI MOTORS CORPORATION, Hyundai Motor Company, Mercedes-Benz Group AG, Tesla, TOYOTA MOTOR CORPORATION, Ford Motor Company, BYD Motors Inc., General Motors Company, Mahindra & Mahindra Ltd., MG MOTOR, JAGUAR LAND ROVER AUTOMOTIVE PLC, Renault Group, Geely Automobile Holdings Limited., Lucid Group, Inc., entre otros. |

Definición de mercado

Un vehículo eléctrico es un vehículo que funciona total o parcialmente con electricidad. A diferencia de los vehículos convencionales que solo utilizan combustibles fósiles, los vehículos eléctricos utilizan un motor eléctrico alimentado por una pila de combustible o baterías. "Vehículo eléctrico" o "VE" son los términos comunes que se utilizan para un vehículo eléctrico. En la mayoría de los casos, el término incluye tanto a los BEV como a los PHEV. Las letras BEV significan vehículos eléctricos de batería, mientras que PHEV significan vehículos eléctricos híbridos enchufables. Un vehículo eléctrico (VE) funciona con un motor eléctrico en lugar de un motor de combustión interna que genera energía quemando una mezcla de combustible y gases. Por lo tanto, los vehículos eléctricos se consideran un posible reemplazo para los automóviles de la generación actual para abordar el problema de la creciente contaminación, el calentamiento global y el agotamiento de los recursos naturales. La autonomía de un vehículo eléctrico es la distancia que puede cubrir con una sola carga.

Dinámica del mercado de vehículos eléctricos en Oriente Medio

En esta sección se aborda la comprensión de los factores impulsores, las oportunidades, los desafíos y las limitaciones del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- Aumento de la demanda de vehículos eléctricos

La industria automotriz ha experimentado un enorme crecimiento a lo largo de los años debido a la creciente demanda de vehículos eléctricos de lujo. Algunos de los factores que impulsan las ventas de vehículos eléctricos incluyen las estrictas regulaciones gubernamentales sobre las emisiones de los vehículos y la creciente demanda de vehículos de bajo consumo de combustible, alto rendimiento y bajas emisiones.

- Incentivos y subsidios del gobierno para vehículos eléctricos

Se ha observado que los gobiernos de muchos estados específicos están concienciando a los ciudadanos sobre los vehículos eléctricos y brindando más beneficios como la reducción o devolución de impuestos. La gente está optando por vehículos eléctricos más automatizados y tecnológicamente actualizados, ya que se ha observado un mayor número de vehículos eléctricos en las carreteras.

Oportunidad

-

Estaciones de carga basadas en la nube (carga inteligente de vehículos eléctricos)

La carga basada en la nube permite que las estaciones de carga de vehículos eléctricos se conecten a Internet y se comuniquen constantemente con un sistema central. En caso de que falle un servidor, el sistema en la nube simplemente utiliza uno de los múltiples servidores de respaldo y su estación de carga ni siquiera notará ningún cambio. Las estaciones de carga basadas en la nube crean una gran oportunidad, ya que tienen muchos beneficios, como una conexión más sencilla con los datos del usuario y del vehículo, la realización de cálculos mucho más rápido y la posibilidad de reemplazarlas y actualizarlas fácilmente.

Restricción/Desafío

- Falta de infraestructura de recarga para vehículos eléctricos en países subdesarrollados

El principal requisito para el crecimiento de los vehículos eléctricos es la disponibilidad de estaciones de carga adecuadas a una distancia adecuada. Sin embargo, existe una enorme escasez de desarrollo de infraestructura en los países subdesarrollados, lo que limita el crecimiento del mercado de vehículos eléctricos. Hay escasez de estaciones de carga y las empresas no están tomando la iniciativa de lanzar nuevos vehículos eléctricos y bicicletas eléctricas debido a la escasez prevaleciente de estaciones de carga.

Impacto de la COVID-19 en el mercado de vehículos eléctricos

El COVID-19 afectó fuertemente al transporte público. Durante el tiempo de distanciamiento social, se pidió a los viajeros que evitaran viajar a menos que fuera completamente necesario. Además, el comportamiento de las personas ciertamente ha cambiado durante la pandemia, lo que ha llevado a una disminución en la venta de vehículos automotores. La pandemia provocó una gran caída en las ventas del mercado de vehículos eléctricos, ya que el confinamiento prevaleció en la mayoría de las regiones. El confinamiento llevó a los fabricantes y consumidores a detener completamente los procesos durante unos meses. La demanda de vehículos eléctricos enfrentó una caída drástica debido al cierre de varias industrias automovilísticas, de transporte y electrónica. Además, las ventas mundiales de automóviles eléctricos experimentaron una caída sin precedentes. Sin embargo, las cosas se están normalizando día a día y el crecimiento de los vehículos eléctricos ahora está obsoleto.

Los fabricantes están tomando diversas decisiones estratégicas para recuperarse tras la COVID-19. Las empresas están llevando a cabo múltiples actividades de investigación y desarrollo para mejorar el rendimiento y las ventas de vehículos eléctricos. Con esto, las empresas llevarán vehículos eléctricos avanzados al mercado.

Por ejemplo,

- En abril de 2021, según la Sociedad de Fabricantes de Vehículos Eléctricos (SMEV), el registro de todos los vehículos eléctricos durante el año 2021 disminuyó un 20 por ciento en comparación con las unidades vendidas en el año fiscal 20. Los vehículos eléctricos de dos ruedas experimentaron una disminución del 6 por ciento. Los vehículos eléctricos de tres ruedas (E3W) experimentaron una caída del 37 por ciento en comparación con las unidades vendidas en el año fiscal 20.

Por lo tanto, el COVID-19 ha impactado severamente la demanda de vehículos eléctricos en el mercado, la oferta limitada y la escasez de semiconductores y dispositivos han afectado significativamente la oferta de vehículos eléctricos en el mercado.

Acontecimientos recientes

- En abril de 2022, TOYOTA MOTOR CORPORATION anunció el lanzamiento de su SUV totalmente eléctrico bZ4X. Estará disponible con tracción delantera (FWD) y tracción trasera (RWD), ambas con una batería de 71,4 kWh. De esta forma, la compañía ofrecerá a sus clientes un SUV con mayor autonomía.

- En enero de 2022, Mercedes-Benz Group AG anunció que su división EQ lanzará los SUV EQA, EQB y EQC, así como los sedanes de lujo EQE y EQS en la región. Los vehículos se venderán y recibirán servicio a través de 36 concesionarios especialmente designados en el país. De esta forma, la empresa ampliará su presencia en la región.

Panorama del mercado de vehículos eléctricos en Oriente Medio

El mercado de vehículos eléctricos está segmentado en función del tipo de propulsión, el tipo de conducción del vehículo, la velocidad del vehículo, la clase de vehículo, el canal de venta, el tipo de motor eléctrico, la potencia de salida, el rango de voltaje, el tipo de estación de carga, el tipo de conectividad, el tren de potencia, la forma de la batería, el tipo de batería y el tipo de vehículo. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de propulsión

- Vehículo eléctrico de batería (VEB)

- Vehículo eléctrico híbrido enchufable (PHEV)

- Vehículo eléctrico de pila de combustible (FCEV)

- Vehículos ICE y microhíbridos

Sobre la base del tipo de propulsión, el mercado de vehículos eléctricos de Oriente Medio está segmentado en vehículos eléctricos de batería (BEV), vehículos eléctricos híbridos enchufables (PHEV), vehículos eléctricos de pila de combustible (FCEV) y vehículos ICE y microhíbridos.

Tipo de conducción del vehículo

- Delantero

- Tracción trasera

- Tracción total

Según el tipo de conducción del vehículo, el mercado de vehículos eléctricos de Oriente Medio está segmentado en FWD, RWD y AWD.

Velocidad del vehículo

- Menos de 100 MPH

- 100 A 125 MPH

- Más de 125 MPH

Sobre la base de la velocidad del vehículo, el mercado de vehículos eléctricos de Oriente Medio se segmenta en menos de 100 MPH, de 100 a 125 MPH y más de 125 MPH.

Clase de vehículo

- Precio medio

- Lujo

Según la clase de vehículo, el mercado de vehículos eléctricos de Oriente Medio está segmentado en modelos de precio medio y de lujo.

Canal de venta

- Fabricante de equipos originales (OEM)

- Mercado de accesorios

Sobre la base del canal de ventas, el mercado de vehículos eléctricos de Medio Oriente está segmentado en OEM y mercado de accesorios.

Tipo de motor eléctrico

- Motores de corriente continua

- Motores de corriente continua sin escobillas

- Motores síncronos de imanes permanentes

- Motores de inducción trifásicos

Sobre la base del tipo de motor eléctrico, el mercado de vehículos eléctricos de Oriente Medio está segmentado en motores de CC, motores de CC sin escobillas, motores síncronos de imanes permanentes y motores de inducción trifásicos.

Potencia de salida

- Menos de 100 KW

- 100 A 250KW

- Más de 250 KW

Sobre la base de la potencia de salida, el mercado de vehículos eléctricos de Oriente Medio se segmenta en menos de 100 KW, de 100 a 250 KW y más de 100 KW.

Rango de voltaje

- Menos de 48 voltios

- Más de 48 voltios

Sobre la base del rango de voltaje, el mercado de vehículos eléctricos de Medio Oriente está segmentado en menos de 48 voltios y más de 48 voltios.

Tipo de estación de carga

- Carga normal

- Súper carga

Según el tipo de estación de carga, el mercado de vehículos eléctricos de Oriente Medio está segmentado en carga normal y súper carga.

Tipo de conectividad

- V2B o V2H

- V2G

- V2V

- V2X

Según el tipo de conectividad, el mercado de vehículos eléctricos de Oriente Medio está segmentado en V2B o V2H, V2G, V2V y V2X.

Tren de potencia

- Híbrido paralelo

- Serie Híbrida

- Híbrido combinado

Sobre la base del sistema de propulsión, el mercado de vehículos eléctricos de Oriente Medio está segmentado en híbrido paralelo, híbrido en serie e híbrido combinado.

Tipo de vehículo

- Automóviles de pasajeros

- Vehículo comercial

- Vehículo de dos ruedas

Según el tipo de vehículo, el mercado de vehículos eléctricos de Oriente Medio está segmentado en vehículos de pasajeros, vehículos comerciales y vehículos de dos ruedas.

Tipo de batería

- Iones de litio

- Hidruro metálico de níquel

- Estado sólido

- Plomo ácido

- Batería de iones de sodio

Según el tipo de batería, el mercado de vehículos eléctricos de Oriente Medio está segmentado en baterías de iones de litio, de hidruro metálico de níquel, de estado sólido, de plomo-ácido y de iones de sodio.

Forma de la batería

- Prismático

- Bolsa

- Cilíndrico

Sobre la base de la forma de la batería, el mercado de vehículos eléctricos de Oriente Medio está segmentado en prismático, tipo bolsa y cilíndrico.

Análisis del mercado de vehículos eléctricos en Oriente Medio

Se analiza el mercado de vehículos eléctricos y se proporcionan información y tendencias del tamaño del mercado según el tipo de propulsión, el tipo de conducción del vehículo, la velocidad del vehículo, la clase de vehículo, el canal de ventas, el tipo de motor eléctrico, la potencia de salida, el rango de voltaje, el tipo de estación de carga, el tipo de conectividad, el tren de potencia, el tipo de vehículo, el tipo de batería, la forma de la batería y los países mencionados anteriormente.

El mercado de vehículos eléctricos de Oriente Medio abarca países como Arabia Saudita, Emiratos Árabes Unidos, Baréin, Qatar, Kuwait, Omán y el resto de Oriente Medio.

Saudi Arabia is expected to dominate the Middle East electric vehicle market as Saudi Arabia is a regional leader in adopting EVs. The Saudi Arabia government aims to boost its own EV use by 20 percent in the year 2021, which will help to extend EV growth and the growth of the country in the Middle East electric vehicle market. Moreover, Saudi Arabia has the largest number of EV charging stations in the Middle East region. The highest concentration of charging stations is in Dubai. Initiatives such as Dubai Green Mobility which promotes the use of low-carbon transportation, motivate their residents and businesses to use electric and hybrid vehicles is promoting the growth of EVs. Also, the Dubai Supreme Council of Energy mandated that 10 percent of all new cars in the Emirate must be electric or hybrid by 2020, and 10 percent of all cars should be green by 2030. Saudi Arabia has also established an incentive system such as free charging stations, discounted car registrations and renewal, toll exemptions, bonus warranties for EVs, free parking in certain areas and other perks to boost EV adoption in the country. All these factors were contributing to the growth of the country in the Middle East electric vehicle market.

The country section of the electric vehicle market report also provides individual market impacting factors and changes in regulations in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, disease epidemiology and import-export tariffs are some of the significant pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East Electric Vehicle Market Share Analysis

The electric vehicle market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, solution launch, product width and breadth, application dominance. The above data points are only related to the companies' focus on the electric vehicle market.

Some of the major players operating in the Middle East electric vehicle market are BMW AG, Nissan Motor Co., Ltd., MITSUBISHI MOTORS CORPORATION, Hyundai Motor Company, Mercedes-Benz Group AG, Tesla, TOYOTA MOTOR CORPORATION, Ford Motor Company, BYD Motors Inc., General Motors Company, Mahindra & Mahindra Ltd., MG MOTOR, JAGUAR LAND ROVER AUTOMOTIVE PLC, Renault Group, Geely Automobile Holdings Limited., Lucid Group, Inc., among others.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST ELECTRIC VEHICLE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 EHAIL TECHNOLOGIES TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 EHAIL TECHNOLOGIES MARKET POSITION GRID

2.7 THE MARKET CHALLENGE MATRIX

2.8 MULTIVARIATE MODELING

2.9 VEHICLE CLASS TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 XPENG INC. SWOT ANALYSIS

4.2 XPENG INC. BRAND AND COST ANALYSIS AND POSITIONING IN THE GLOBAL MARKET

4.3 OPPORTUNITIES FOR MARKET INTRODUCTION OF THE XPENG BRAND IN THE MIDDLE EAST

4.4 BRAND ANALYSIS OF XPENG INC.

4.5 PORTERS FIVE FORCE MODEL

4.6 TECHNOLOGICAL ADVANCEMENT

4.6.1 CHARGING TECHNOLOGY

4.6.2 AUTONOMOUS DRIVING

4.6.3 BATTERY TECHNOLOGY

4.7 REGULATORY STANDARDS

4.7.1 UAE

4.7.2 SAUDI ARABIA

4.8 SUPPLY CHAIN ANALYSIS

4.9 PESTLE ANALYSIS

4.9.1 POLITICAL FACTORS

4.9.2 ECONOMIC FACTORS

4.9.3 SOCIAL FACTORS

4.9.4 TECHNOLOGICAL FACTORS:

4.9.5 ENVIRONMENTAL FACTORS:

4.9.6 LEGAL FACTORS:

4.1 VENDOR SELECTION CRITERIA

4.11 COMPANY/BRAND COMPARATIVE ANALYSIS

4.11.1 BRAND COMPARATIVE ANALYSIS

4.11.2 TESLA

4.11.3 AUDI

4.11.4 TOYOTA

4.12 RAW MATERIAL PRODUCTION COVERAGE

4.13 SCENARIO-BASED ON PRODUCT ADOPTION

4.14 CONSUMER BEHAVIOUR PATTERN

4.15 FACTORS INFLUENCING THE BUYING DECISION

4.16 GOVERNMENT INCENTIVES TOWARD ELECTRIC VEHICLE

4.16.1 U.A.E.

4.17 TOP SELLING EV MODEL SALES IN 2022

4.18 PRICING ANALYSIS AND PROPOSED MANUFACTURER'S SUGGESTED RETAIL PRICE (MSRP) OF VARIOUS BRANDS OFFERING ELECTRIC VEHICLES

4.19 MARKETING STRATEGY OF MAJOR PLAYERS

4.2 SALES DATA OF ELECTRIC VEHICLES IN THE MIDDLE EAST REGION

4.21 AVAILABILITY OF CHARGING STATION INFRASTRUCTURE IN THE MIDDLE EAST REGION

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN DEMAND FOR ELECTRIC VEHICLES

5.1.2 INCENTIVES & SUBSIDIES BY THE GOVERNMENT FOR ELECTRIC VEHICLES

5.1.3 INCREASE IN ENVIRONMENTAL CONCERNS

5.1.4 GOVERNMENT INITIATIVES TO REDUCE EMISSION LEVELS

5.1.5 HIGH FLUCTUATION IN FUEL PRICES

5.2 RESTRAINTS

5.2.1 HIGH UPFRONT COST

5.2.2 LACK OF CHARGING INFRASTRUCTURE FOR ELECTRIC VEHICLES IN THE MEA REGION

5.3 OPPORTUNITIES

5.3.1 CLOUD BASED CHARGING STATIONS (SMART ELECTRIC VEHICLE CHARGING)

5.3.2 ADOPTION OF NEW TECHNOLOGIES IN LITHIUM-ION BATTERIES

5.4 CHALLENGE

5.4.1 BATTERY PERFORMANCE IN DIFFERENT ENVIRONMENTAL CONDITIONS

5.4.2 LACK OF CHARGING INFRASTRUCTURE FOR ELECTRIC VEHICLES IN UNDERDEVELOPED COUNTRIES

6 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE

6.1 OVERVIEW

6.2 BATTERY ELECTRIC VEHICLE (BEV)

6.2.1 LESS THAN 100 KW

6.2.2 100 TO 250 KW

6.2.3 MORE THAN 250 KW

6.3 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

6.3.1 LESS THAN 100 KW

6.3.2 100 TO 250 KW

6.3.3 MORE THAN 250 KW

6.4 FUEL CELL ELECTRIC VEHICLE (FCEV)

6.4.1 LESS THAN 100 KW

6.4.2 100 TO 250 KW

6.4.3 MORE THAN 250 KW

6.5 ICE AND MICRO HYBRID VEHICLE

6.5.1 LESS THAN 100 KW

6.5.2 100 TO 250 KW

6.5.3 MORE THAN 250 KW

7 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE

7.1 OVERVIEW

7.2 FWD

7.3 RWD

7.4 AWD

8 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED

8.1 OVERVIEW

8.2 LESS THAN 100 MPH

8.3 100 TO 125 MPH

8.4 MORE THAN 125 MPH

9 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS

9.1 OVERVIEW

9.2 MID-PRICED

9.3 LUXURY

10 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY SALES CHANNEL

10.1 OVERVIEW

10.2 OEM

10.3 AFTERMARKET

11 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY POWER OUTPUT

11.1 OVERVIEW

11.2 LESS THAN 100 KW

11.3 100 TO 250 KW

11.4 MORE THAN 250 KW

12 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE

12.1 OVERVIEW

12.2 BRUSHLESS DC MOTORS

12.3 PERMANENT MAGNET SYNCHRONOUS MOTORS

12.4 DC MOTORS

12.5 THREE PHASE INDUCTION MOTORS

13 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE

13.1 OVERVIEW

13.2 LESS THAN 48 VOLT

13.3 MORE THAN 48 VOLT

14 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE

14.1 OVERVIEW

14.2 NORMAL CHARGING

14.2.1 LEVEL 2

14.2.2 LEVEL 3

14.2.3 LEVEL 1

14.3 SUPER CHARGING

14.3.1 LEVEL 2

14.3.2 LEVEL 3

14.3.3 LEVEL 1

15 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE

15.1 OVERVIEW

15.2 V2G

15.3 V2X

15.4 V2V

15.5 V2B OR V2H

16 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY POWER TRAIN

16.1 OVERVIEW

16.2 SERIES HYBRID

16.3 PARALLEL HYBRID

16.4 COMBINED HYBRID

17 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE

17.1 OVERVIEW

17.2 PASSENGER CARS

17.2.1 HATCHBACK

17.2.2 SEDAN

17.2.3 SUV

17.2.4 COUPE

17.2.5 MUV

17.2.6 SPORTS CAR

17.2.7 CONVERTIBLE

17.2.8 OTHERS

17.3 COMMERCIAL VEHICLE

17.3.1 LIGHT COMMERCIAL VEHICLE (LCV)

17.3.1.1 VANS

17.3.1.2 MINI BUS

17.3.1.3 PICK UP TRUCKS

17.3.1.4 OTHERS

17.3.2 HEAVY COMMERCIAL VEHICLE (HCV)

17.3.2.1 BUS

17.3.2.2 TRUCKS

17.4 TWO WHEELER

18 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY BATTERY FORM

18.1 OVERVIEW

18.2 PRISMATIC

18.3 POUCH

18.4 CYLINDRICAL

19 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY BATTERY TYPE

19.1 OVERVIEW

19.2 LITHIUM ION

19.3 NICKEL METAL HYDRIDE

19.4 SOLID STATE

19.5 LEAD ACID

19.6 SODIUM ION BATTERY

20 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY COUNTRY

20.1 SAUDI ARABIA

20.2 U.A.E.

20.3 BAHRAIN

20.4 QATAR

20.5 KUWAIT

20.6 OMAN

20.7 REST OF MIDDLE EAST

21 MIDDLE EAST ELECTRIC VEHICLE MARKET: COMPANY LANDSCAPE

21.1 COMPANY SHARE ANALYSIS: MIDDLE EAST

22 SWOT ANALYSIS

23 COMPANY PROFILE

23.1 XPENG INC.

23.1.1 COMPANY SNAPSHOT

23.1.2 REVENUE ANALYSIS

23.1.3 PRODUCT PORTFOLIO

23.1.4 RECENT DEVELOPMENTS

23.2 TESLA

23.2.1 COMPANY SNAPSHOT

23.2.2 REVENUE ANALYSIS

23.2.3 PRODUCT PORTFOLIO

23.2.4 RECENT DEVELOPMENT

23.3 TOYOTA MOTOR CORPORATION

23.3.1 COMPANY SNAPSHOT

23.3.2 REVENUE ANALYSIS

23.3.3 PRODUCT PORTFOLIO

23.3.4 RECENT DEVELOPMENT

23.4 FORD MOTOR COMPANY

23.4.1 COMPANY SNAPSHOT

23.4.2 REVENUE ANALYSIS

23.4.3 PRODUCT PORTFOLIO

23.4.4 RECENT DEVELOPMENTS

23.5 BYD COMPANY LTD

23.5.1 COMPANY SNAPSHOT

23.5.2 REVENUE ANALYSIS

23.5.3 PRODUCT PORTFOLIO

23.5.4 RECENT DEVELOPMENT

23.6 BMW AG

23.6.1 COMPANY SNAPSHOT

23.6.2 REVENUE ANALYSIS

23.6.3 PRODUCT PORTFOLIO

23.6.4 RECENT DEVELOPMENT

23.7 GEELY AUTOMOBILE HOLDINGS LIMITED

23.7.1 COMPANY SNAPSHOT

23.7.2 REVENUE ANALYSIS

23.7.3 PRODUCT PORTFOLIO

23.7.4 RECENT DEVELOPMENT

23.8 GENERAL MOTORS

23.8.1 COMPANY SNAPSHOT

23.8.2 REVENUE ANALYSIS

23.8.3 PRODUCT PORTFOLIO

23.8.4 RECENT DEVELOPMENT

23.9 HYUNDAI MOTOR COMPANY

23.9.1 COMPANY SNAPSHOT

23.9.2 REVENUE ANALYSIS

23.9.3 PRODUCT PORTFOLIO

23.9.4 RECENT DEVELOPMENT

23.1 JAGUAR LAND ROVER AUTOMOTIVE PLC

23.10.1 COMPANY SNAPSHOT

23.10.2 REVENUE ANALYSIS

23.10.3 PRODUCT PORTFOLIO

23.10.4 RECENT DEVELOPMENTS

23.11 LUCID GROUP, INC.

23.11.1 COMPANY SNAPSHOT

23.11.2 REVENUE ANALYSIS

23.11.3 PRODUCT PORTFOLIO

23.11.4 RECENT DEVELOPMENTS

23.12 MERCEDES-BENZ GROUP AG

23.12.1 COMPANY SNAPSHOT

23.12.2 PRODUCT PORTFOLIO

23.12.3 RECENT DEVELOPMENT

23.13 MAHINDRA ELECTRIC MOBILITY LIMITED

23.13.1 COMPANY SNAPSHOT

23.13.2 REVENUE ANALYSIS

23.13.3 PRODUCT PORTFOLIO

23.13.4 RECENT DEVELOPMENTS

23.14 MG MOTOR

23.14.1 COMPANY SNAPSHOT

23.14.2 PRODUCT PORTFOLIO

23.14.3 RECENT DEVELOPMENTS

23.15 MITSUBISHI MOTORS CORPORATION

23.15.1 COMPANY SNAPSHOT

23.15.2 REVENUE ANALYSIS

23.15.3 PRODUCT PORTFOLIO

23.15.4 RECENT DEVELOPMENTS

23.16 NISSAN MOTOR CO., LTD.

23.16.1 COMPANY SNAPSHOT

23.16.2 REVENUE ANALYSIS

23.16.3 PRODUCT PORTFOLIO

23.16.4 RECENT DEVELOPMENT

23.17 RENAULT GROUP

23.17.1 COMPANY SNAPSHOT

23.17.2 REVENUE ANALYSIS

23.17.3 PRODUCT PORTFOLIO

23.17.4 RECENT DEVELOPMENT

24 QUESTIONNAIRE

Lista de Tablas

TABLE 1 XPENG EV MODELS IN THE MARKET

TABLE 2 MSRP RANGE FOR XPENG EV MODELS

TABLE 3 MSRP COMPARISON AS MAKE

TABLE 4 BRAND ANALYSIS

TABLE 5 FOLLOWING ARE THE UAE STANDARDS FOR ELECTRICAL MOTOR VEHICLES:

TABLE 6 ADDITIONAL STANDARDS:

TABLE 7 COMPETITIVE EV BRANDS IN THE GLOBAL MARKET

TABLE 8 BEV PRICE TABLE

TABLE 9 PHEV PRICE TABLE

TABLE 10 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (USD MILLION)

TABLE 11 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 12 MIDDLE EAST BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 13 MIDDLE EAST BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 14 MIDDLE EAST PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 15 MIDDLE EAST PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 16 MIDDLE EAST FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 17 MIDDLE EAST FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 18 MIDDLE EAST ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 19 MIDDLE EAST ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 20 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (USD MILLION)

TABLE 21 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 22 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (USD MILLION)

TABLE 23 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (THOUSAND UNITS)

TABLE 24 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (USD MILLION)

TABLE 25 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (THOUSAND UNITS)

TABLE 26 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 27 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNITS)

TABLE 28 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 29 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 30 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (USD MILLION)

TABLE 31 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 32 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (USD MILLION)

TABLE 33 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (THOUSAND UNITS)

TABLE 34 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (USD MILLION)

TABLE 35 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 36 MIDDLE EAST NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 37 MIDDLE EAST NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 38 MIDDLE EAST SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 39 MIDDLE EAST SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 40 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (USD MILLION)

TABLE 41 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 42 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (USD MILLION)

TABLE 43 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (THOUSAND UNITS)

TABLE 44 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 45 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 46 MIDDLE EAST PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 MIDDLE EAST PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 48 MIDDLE EAST COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 MIDDLE EAST COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 50 MIDDLE EAST LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 MIDDLE EAST LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 52 MIDDLE EAST HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 53 MIDDLE EAST HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 54 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (USD MILLION)

TABLE 55 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (THOUSAND UNITS)

TABLE 56 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (USD MILLION)

TABLE 57 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (THOUSAND UNITS)

TABLE 58 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 59 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY COUNTRY, 2021-2030 (THOUSAND UNITS)

TABLE 60 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (USD MILLION)

TABLE 61 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (THOUSAND UNITS)

TABLE 62 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (USD MILLION)

TABLE 63 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 64 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (USD MILLION)

TABLE 65 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 66 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (USD MILLION)

TABLE 67 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (THOUSAND UNITS)

TABLE 68 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (USD MILLION)

TABLE 69 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 70 SAUDI ARABIA NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 71 SAUDI ARABIA NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 72 SAUDI ARABIA SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 73 SAUDI ARABIA SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 74 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (USD MILLION)

TABLE 75 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (THOUSAND UNITS)

TABLE 76 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (USD MILLION)

TABLE 77 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 78 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 79 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 80 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (USD MILLION)

TABLE 81 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 82 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (USD MILLION)

TABLE 83 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (THOUSAND UNITS)

TABLE 84 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (USD MILLION)

TABLE 85 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (THOUSAND UNITS)

TABLE 86 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (USD MILLION)

TABLE 87 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 88 SAUDI ARABIA BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 89 SAUDI ARABIA BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 90 SAUDI ARABIA PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 91 SAUDI ARABIA PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 92 SAUDI ARABIA FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 93 SAUDI ARABIA FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 94 SAUDI ARABIA ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 95 SAUDI ARABIA ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 96 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 97 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 98 SAUDI ARABIA PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 SAUDI ARABIA PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 100 SAUDI ARABIA COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 101 SAUDI ARABIA COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 102 SAUDI ARABIA LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 103 SAUDI ARABIA LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 104 SAUDI ARABIA HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 105 SAUDI ARABIA HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 106 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 107 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNITS)

TABLE 108 U.A.E. ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (USD MILLION)

TABLE 109 U.A.E. ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (THOUSAND UNITS)

TABLE 110 U.A.E. ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (USD MILLION)

TABLE 111 U.A.E. ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 112 U.A.E. ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (USD MILLION)

TABLE 113 U.A.E. ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 114 U.A.E. ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (USD MILLION)

TABLE 115 U.A.E. ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (THOUSAND UNITS)

TABLE 116 U.A.E. ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (USD MILLION)

TABLE 117 U.A.E. ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 118 U.A.E. NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 119 U.A.E. NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 120 U.A.E. SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 121 U.A.E. SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 122 U.A.E. ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (USD MILLION)

TABLE 123 U.A.E. ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (THOUSAND UNITS)

TABLE 124 U.A.E. ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (USD MILLION)

TABLE 125 U.A.E. ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 126 U.A.E. ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 127 U.A.E. ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 128 U.A.E. ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (USD MILLION)

TABLE 129 U.A.E. ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 130 U.A.E. ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (USD MILLION)

TABLE 131 U.A.E. ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (THOUSAND UNITS)

TABLE 132 U.A.E. ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (USD MILLION)

TABLE 133 U.A.E. ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (THOUSAND UNITS)

TABLE 134 U.A.E. ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (USD MILLION)

TABLE 135 U.A.E. ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 136 U.A.E. BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 137 U.A.E. BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 138 U.A.E. PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 139 U.A.E. PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 140 U.A.E. FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 141 U.A.E. FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 142 U.A.E. ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 143 U.A.E. ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 144 U.A.E. ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 145 U.A.E. ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 146 U.A.E. PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 147 U.A.E. PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 148 U.A.E. COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 149 U.A.E. COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 150 U.A.E. LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 151 U.A.E. LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 152 U.A.E. HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 153 U.A.E. HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 154 U.A.E. ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 155 U.A.E. ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNITS)

TABLE 156 BAHRAIN ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (USD MILLION)

TABLE 157 BAHRAIN ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (THOUSAND UNITS)

TABLE 158 BAHRAIN ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (USD MILLION)

TABLE 159 BAHRAIN ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 160 BAHRAIN ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (USD MILLION)

TABLE 161 BAHRAIN ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 162 BAHRAIN ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (USD MILLION)

TABLE 163 BAHRAIN ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (THOUSAND UNITS)

TABLE 164 BAHRAIN ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (USD MILLION)

TABLE 165 BAHRAIN ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 166 BAHRAIN NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 167 BAHRAIN NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 168 BAHRAIN SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 169 BAHRAIN SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 170 BAHRAIN ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (USD MILLION)

TABLE 171 BAHRAIN ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (THOUSAND UNITS)

TABLE 172 BAHRAIN ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (USD MILLION)

TABLE 173 BAHRAIN ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 174 BAHRAIN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 175 BAHRAIN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 176 BAHRAIN ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (USD MILLION)

TABLE 177 BAHRAIN ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 178 BAHRAIN ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (USD MILLION)

TABLE 179 BAHRAIN ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (THOUSAND UNITS)

TABLE 180 BAHRAIN ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (USD MILLION)

TABLE 181 BAHRAIN ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (THOUSAND UNITS)

TABLE 182 BAHRAIN ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (USD MILLION)

TABLE 183 BAHRAIN ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 184 BAHRAIN BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 185 BAHRAIN BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 186 BAHRAIN PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 187 BAHRAIN PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 188 BAHRAIN FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 189 BAHRAIN FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 190 BAHRAIN ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 191 BAHRAIN ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 192 BAHRAIN ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 193 BAHRAIN ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 194 BAHRAIN PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 195 BAHRAIN PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 196 BAHRAIN COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 197 BAHRAIN COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 198 BAHRAIN LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 199 BAHRAIN LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 200 BAHRAIN HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 201 BAHRAIN HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 202 BAHRAIN ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 203 BAHRAIN ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNITS)

TABLE 204 QATAR ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (USD MILLION)

TABLE 205 QATAR ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (THOUSAND UNITS)

TABLE 206 QATAR ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (USD MILLION)

TABLE 207 QATAR ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 208 QATAR ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (USD MILLION)

TABLE 209 QATAR ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 210 QATAR ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (USD MILLION)

TABLE 211 QATAR ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (THOUSAND UNITS)

TABLE 212 QATAR ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (USD MILLION)

TABLE 213 QATAR ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 214 QATAR NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 215 QATAR NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 216 QATAR SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 217 QATAR SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 218 QATAR ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (USD MILLION)

TABLE 219 QATAR ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (THOUSAND UNITS)

TABLE 220 QATAR ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (USD MILLION)

TABLE 221 QATAR ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 222 QATAR ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 223 QATAR ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 224 QATAR ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (USD MILLION)

TABLE 225 QATAR ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 226 QATAR ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (USD MILLION)

TABLE 227 QATAR ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (THOUSAND UNITS)

TABLE 228 QATAR ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (USD MILLION)

TABLE 229 QATAR ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (THOUSAND UNITS)

TABLE 230 QATAR ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (USD MILLION)

TABLE 231 QATAR ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 232 QATAR BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 233 QATAR BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 234 QATAR PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 235 QATAR PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 236 QATAR FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 237 QATAR FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 238 QATAR ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 239 QATAR ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 240 QATAR ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 241 QATAR ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 242 QATAR PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 243 QATAR PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 244 QATAR COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 245 QATAR COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 246 QATAR LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 247 QATAR LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 248 QATAR HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 249 QATAR HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 250 QATAR ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 251 QATAR ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNITS)

TABLE 252 KUWAIT ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (USD MILLION)

TABLE 253 KUWAIT ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (THOUSAND UNITS)

TABLE 254 KUWAIT ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (USD MILLION)

TABLE 255 KUWAIT ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 256 KUWAIT ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (USD MILLION)

TABLE 257 KUWAIT ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 258 KUWAIT ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (USD MILLION)

TABLE 259 KUWAIT ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (THOUSAND UNITS)

TABLE 260 KUWAIT ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (USD MILLION)

TABLE 261 KUWAIT ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 262 KUWAIT NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 263 KUWAIT NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 264 KUWAIT SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 265 KUWAIT SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 266 KUWAIT ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (USD MILLION)

TABLE 267 KUWAIT ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (THOUSAND UNITS)

TABLE 268 KUWAIT ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (USD MILLION)

TABLE 269 KUWAIT ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 270 KUWAIT ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 271 KUWAIT ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 272 KUWAIT ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (USD MILLION)

TABLE 273 KUWAIT ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 274 KUWAIT ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (USD MILLION)

TABLE 275 KUWAIT ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (THOUSAND UNITS)

TABLE 276 KUWAIT ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (USD MILLION)

TABLE 277 KUWAIT ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (THOUSAND UNITS)

TABLE 278 KUWAIT ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (USD MILLION)

TABLE 279 KUWAIT ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 280 KUWAIT BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 281 KUWAIT BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 282 KUWAIT PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 283 KUWAIT PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 284 KUWAIT FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 285 KUWAIT FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 286 KUWAIT ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 287 KUWAIT ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 288 KUWAIT ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 289 KUWAIT ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 290 KUWAIT PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 291 KUWAIT PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 292 KUWAIT COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 293 KUWAIT COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 294 KUWAIT LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 295 KUWAIT LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 296 KUWAIT HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 297 KUWAIT HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 298 KUWAIT ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 299 KUWAIT ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNITS)

TABLE 300 OMAN ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (USD MILLION)

TABLE 301 OMAN ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (THOUSAND UNITS)

TABLE 302 OMAN ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (USD MILLION)

TABLE 303 OMAN ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 304 OMAN ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (USD MILLION)

TABLE 305 OMAN ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 306 OMAN ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (USD MILLION)

TABLE 307 OMAN ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (THOUSAND UNITS)

TABLE 308 OMAN ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (USD MILLION)

TABLE 309 OMAN ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 310 OMAN NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 311 OMAN NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 312 OMAN SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 313 OMAN SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 314 OMAN ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (USD MILLION)

TABLE 315 OMAN ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (THOUSAND UNITS)

TABLE 316 OMAN ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (USD MILLION)

TABLE 317 OMAN ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 318 OMAN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 319 OMAN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 320 OMAN ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (USD MILLION)

TABLE 321 OMAN ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 322 OMAN ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (USD MILLION)

TABLE 323 OMAN ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (THOUSAND UNITS)

TABLE 324 OMAN ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (USD MILLION)

TABLE 325 OMAN ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (THOUSAND UNITS)

TABLE 326 OMAN ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (USD MILLION)

TABLE 327 OMAN ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 328 OMAN BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 329 OMAN BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 330 OMAN PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 331 OMAN PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 332 OMAN FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 333 OMAN FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 334 OMAN ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 335 OMAN ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 336 OMAN ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 337 OMAN ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 338 OMAN PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 339 OMAN PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 340 OMAN COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 341 OMAN COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 342 OMAN LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 343 OMAN LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 344 OMAN HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 345 OMAN HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 346 OMAN ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 347 OMAN ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNITS)

TABLE 348 REST OF MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (USD MILLION)

TABLE 349 REST OF MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (THOUSAND UNITS)

Lista de figuras

FIGURE 1 MIDDLE EAST ELECTRIC VEHICLE MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST ELECTRIC VEHICLE MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST ELECTRIC VEHICLE MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST ELECTRIC VEHICLE MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST ELECTRIC VEHICLE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST ELECTRIC VEHICLE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST ELECTRIC VEHICLE MARKET: EHAIL TECHNOLOGIES MARKET POSITION GRID

FIGURE 8 MIDDLE EAST ELECTRIC VEHICLE MARKET: EHAIL TECHNOLOGIES CHALLENGE MATRIX

FIGURE 9 MIDDLE EAST ELECTRIC VEHICLE MARKET: EHAIL TECHNOLOGIES MULTIVARIATE MODELING

FIGURE 10 MIDDLE EAST ELECTRIC VEHICLE MARKET: EHAIL TECHNOLOGIES VEHICLE CLASS

FIGURE 11 MIDDLE EAST ELECTRIC VEHICLE MARKET: SEGMENTATION

FIGURE 12 GOVERNMENT INITIATIVE TOWARDS LOWER DOWN THE EMISSION CONTRIBUTE TO DEMAND FOR EVS IS EXPECTED TO DRIVE MIDDLE EAST ELECTRIC VEHICLE MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 MID-PRICED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST ELECTRIC VEHICLE MARKET IN 2023 & 2030

FIGURE 14 SWOT ANALYSIS

FIGURE 15 TIME OF DELIVERY AND PLANNED PRICE POSITIONING OF THE COMPANY'S FUTURE SMART EV MODELS

FIGURE 16 EV SALES BY UNITS FOR THE YEAR 2020 & 2021

FIGURE 17 PORTER'S FIVE FORCE ANALYSIS

FIGURE 18 FACTORS INFLUENCING BUYING DECISIONS OF CONSUMERS

FIGURE 19 ELECTRIC CAR REGISTRATIONS AND SALES SHARE IN CHINA IN 2021 (IN THOUSANDS)

FIGURE 20 ELECTRIC CAR (PEVS AND PHEVS) SALES SHARE BY MODELS IN CHINA IN 2021

FIGURE 21 ELECTRIC VEHICLE REGISTRATIONS AND SALES SHARE IN EUROPE IN 2021 (IN THOUSANDS)

FIGURE 22 ELECTRIC CAR (PEVS AND PHEVS) SALES SHARE BY MODELS IN EUROPE IN 2021

FIGURE 23 ELECTRIC CAR REGISTRATIONS AND SALES SHARE IN THE USA IN 2021 (IN THOUSANDS)

FIGURE 24 ELECTRIC VEHICLE (PEVS AND PHEVS) SALES SHARE BY MODELS IN THE US IN 2021

FIGURE 25 TOP-SELLING ELECTRIC CARS IN 2022 (JANUARY-OCTOBER) (UNITS)

FIGURE 26 MERCEDES-BENZ GROUP AG

FIGURE 27 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST ELECTRIC VEHICLE MARKET

FIGURE 28 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY PROPULSION TYPE, 2022

FIGURE 29 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY VEHICLE DRIVE TYPE, 2022

FIGURE 30 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY VEHICLE SPEED, 2022

FIGURE 31 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY VEHICLE CLASS, 2022

FIGURE 32 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY SALES CHANNEL, 2022

FIGURE 33 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY POWER OUTPUT, 2022

FIGURE 34 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY ELECTRIC MOTOR TYPE, 2022

FIGURE 35 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY VOLTAGE RANGE, 2022

FIGURE 36 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY CHARGING STATION TYPE, 2022

FIGURE 37 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY CONNECTIVITY TYPE, 2022

FIGURE 38 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY POWER TRAIN, 2022

FIGURE 39 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY VEHICLE TYPE, 2022

FIGURE 40 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY BATTERY FORM, 2022

FIGURE 41 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY BATTERY TYPE, 2022

FIGURE 42 MIDDLE EAST ELECTRIC VEHICLE MARKET: SNAPSHOT (2022)

FIGURE 43 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY COUNTRY (2022)

FIGURE 44 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 45 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 46 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY VEHICLE CLASS (2023-2030)

FIGURE 47 MIDDLE EAST ELECTRIC VEHICLE MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.