Middle East And Africa Corneal Transplant Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

22.87 Million

USD

32.76 Million

2024

2032

USD

22.87 Million

USD

32.76 Million

2024

2032

| 2025 –2032 | |

| USD 22.87 Million | |

| USD 32.76 Million | |

|

|

|

|

Segmentación del mercado de trasplantes de córnea en Oriente Medio y África, por tipo de procedimiento (queratoplastia endotelial, queratoplastia penetrante, queratoplastia lamelar anterior (ALK), trasplante de células madre limbares corneales, trasplante de córnea artificial y otros), tipo (córnea humana y sintética), tipo de donante (autoinjerto y aloinjerto), tipo de injerto (injertos de espesor parcial [lamelar] e injertos de espesor completo [penetrantes]), tipo de cirugía (cirugía convencional y cirugía asistida por láser), indicación (distrofia endotelial de Fuchs, queratitis infecciosa, queratopatía bullosa, queratocono, procedimientos de reinjerto, cicatrización corneal, úlceras corneales y otros), género (femenino y masculino), grupo de edad (geriátrico, adulto y pediátrico), usuario final (hospitales, clínicas oftalmológicas, centros de cirugía ambulatoria, académicos y de investigación). Institutos y otros) - Tendencias de la industria y pronóstico hasta 2032

Tamaño del mercado de trasplante de córnea en Oriente Medio y África

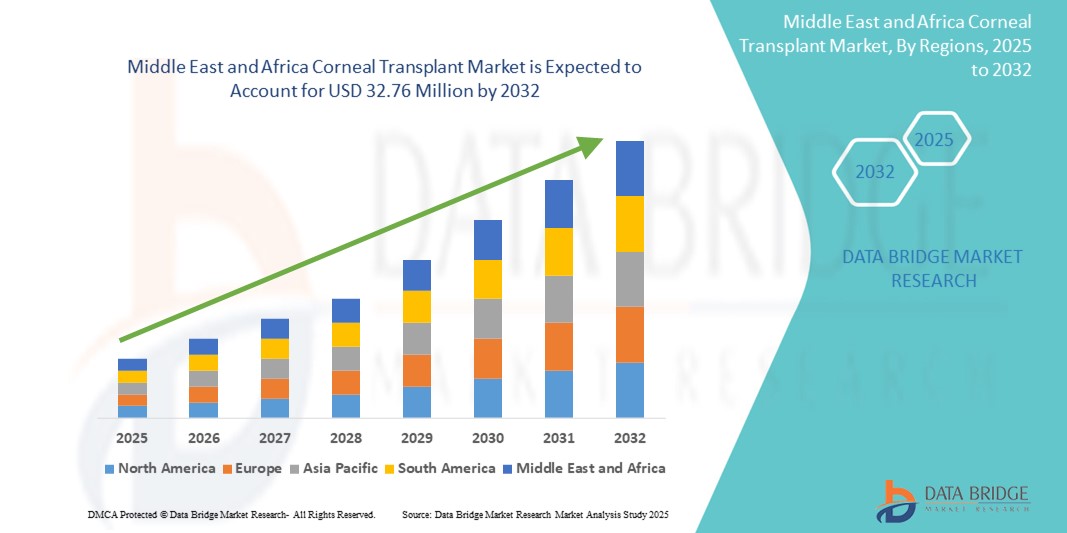

- El tamaño del mercado de trasplante de córnea de Oriente Medio y África se valoró en 22,87 millones de dólares en 2024 y se espera que alcance los 32,76 millones de dólares en 2032 , con una CAGR del 4,60 % durante el período de pronóstico.

- La expansión del mercado está impulsada por la creciente prevalencia de ceguera corneal, junto con una mayor conciencia y una mejor accesibilidad a la atención oftalmológica avanzada y a las intervenciones quirúrgicas en toda la región.

- Además, las crecientes iniciativas gubernamentales y no gubernamentales para establecer bancos de ojos y fortalecer la infraestructura de trasplantes están impulsando la demanda. Estos esfuerzos colectivos están fomentando una mayor adopción del trasplante de córnea, impulsando así el crecimiento del mercado en Oriente Medio y África.

Análisis del mercado de trasplantes de córnea en Oriente Medio y África

- Los trasplantes de córnea, que implican el reemplazo de tejido corneal dañado o enfermo con córneas de donantes, se están volviendo procedimientos cada vez más vitales en Medio Oriente y África debido a la creciente carga de ceguera corneal, traumatismos y enfermedades oculares infecciosas en la región.

- La creciente demanda se ve impulsada en gran medida por el aumento de las inversiones en atención médica, una mayor conciencia sobre las causas tratables de la discapacidad visual y el desarrollo de centros oftalmológicos especializados en países como Sudáfrica, Arabia Saudita y los Emiratos Árabes Unidos.

- Sudáfrica dominó el mercado de trasplante de córnea en Medio Oriente y África con la mayor participación en los ingresos del 32,5 % en 2024, respaldada por una infraestructura quirúrgica más sólida, la ampliación de la disponibilidad de córneas de donantes e iniciativas público-privadas para combatir la ceguera corneal.

- Se espera que los Emiratos Árabes Unidos sean el país de más rápido crecimiento en el mercado de trasplante de córnea durante el período de pronóstico, impulsado por programas avanzados de modernización de la atención médica, el aumento del turismo médico y la expansión de la adopción de tecnologías innovadoras de tratamiento de la córnea.

- El segmento de queratoplastia penetrante dominó el mercado de trasplante de córnea con una participación de mercado del 49,2 % en 2024, atribuido a su tasa de éxito establecida y su idoneidad para una amplia gama de afecciones de la córnea comúnmente tratadas en la región.

Alcance del informe y segmentación del mercado de trasplante de córnea en Oriente Medio y África

|

Atributos |

Perspectivas clave del mercado de trasplantes de córnea en Oriente Medio y África |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Oriente Medio y África

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis en profundidad de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de trasplantes de córnea en Oriente Medio y África

Impulsando la banca ocular y la infraestructura quirúrgica

- Una tendencia notable que define el mercado de trasplantes de córnea en Oriente Medio y África es el desarrollo continuo de bancos regionales de ojos y un mayor acceso a infraestructura quirúrgica oftálmica avanzada. Estos esfuerzos son cruciales para abordar la alta incidencia de ceguera corneal y mejorar la disponibilidad de trasplantes.

- Por ejemplo, en 2024, el Banco Nacional de Ojos de Sudáfrica amplió su red de donantes y su capacidad de preservación de córneas, lo que incrementó significativamente la disponibilidad de injertos de córnea. De igual manera, Arabia Saudita está invirtiendo en centros de cirugía oftalmológica de vanguardia como parte de sus objetivos de salud Visión 2030.

- La expansión de las instalaciones de bancos de ojos está mejorando la calidad y la seguridad del tejido trasplantable, lo que permite una distribución más eficiente de la córnea y reduce los tiempos de espera para trasplantes. Además, la incorporación de tecnologías diagnósticas y quirúrgicas avanzadas, como los láseres de femtosegundo y las técnicas de queratoplastia endotelial, está mejorando los resultados quirúrgicos en toda la región.

- Las nuevas alianzas público-privadas apoyan campañas de concientización, iniciativas de captación de donantes y programas de desarrollo de habilidades para cirujanos oftalmólogos. Estos esfuerzos están alineando gradualmente a la región con los estándares globales de trasplante de córnea.

- Esta tendencia hacia la creación de un ecosistema de trasplantes sostenible está transformando los sistemas regionales de atención oftalmológica y mejorando el acceso a procedimientos que restauran la visión. En consecuencia, países como los Emiratos Árabes Unidos y Egipto se están convirtiendo en centros regionales de atención oftalmológica, impulsados por el auge del turismo médico y las crecientes inversiones en hospitales oftalmológicos especializados.

- El énfasis en ampliar los grupos de donantes de córnea, perfeccionar la precisión quirúrgica y capacitar a profesionales capacitados está acelerando el ritmo del trasplante de córnea en Medio Oriente y África, mejorando la viabilidad del mercado a largo plazo.

Dinámica del mercado de trasplantes de córnea en Oriente Medio y África

Conductor

Aumento de la ceguera corneal e iniciativas gubernamentales de salud ocular

- La creciente incidencia de ceguera corneal debido a traumatismos, infecciones y trastornos degenerativos es un importante impulsor del crecimiento del mercado de trasplantes de córnea en Oriente Medio y África. Esta creciente necesidad de restaurar la visión impulsa la demanda de soluciones quirúrgicas.

- Por ejemplo, en 2024, el Ministerio de Salud de los EAU puso en marcha un registro nacional de donación de córnea y un sistema de coordinación de trasplantes para agilizar el acceso y reducir la dependencia de tejido de donantes importados. Iniciativas similares en Kenia y Egipto se centran en la ceguera prevenible mediante intervenciones quirúrgicas y una mejor accesibilidad.

- Los gobiernos y las organizaciones sanitarias priorizan cada vez más la atención oftalmológica en sus estrategias nacionales de salud, con especial atención al desarrollo de capacidades, la educación del paciente y el desarrollo de infraestructura. Se espera que estos compromisos a nivel de políticas impulsen el volumen de trasplantes en los próximos años.

- Los trasplantes de córnea están cobrando importancia como soluciones rentables para restaurar la visión y mejorar la calidad de vida, especialmente en poblaciones marginadas. Las campañas de concienciación de donantes y la adopción de servicios móviles de atención oftalmológica también están impulsando un acceso más amplio en las zonas rurales.

- La integración de sistemas de seguimiento de donantes, métodos de conservación mejorados y programas de formación especializados para cirujanos de córnea están reforzando aún más el panorama regional de trasplantes, haciéndolo más receptivo a la creciente demanda.

Restricción/Desafío

Disponibilidad limitada de córneas donantes y altos costos de tratamiento

- Un desafío crítico en el mercado de trasplantes de córnea en Oriente Medio y África es la persistente escasez de córneas de donantes, lo que limita el número de cirugías viables que se pueden realizar. Esta escasez es particularmente grave en países de bajos recursos con sistemas de donación subdesarrollados.

- Por ejemplo, muchos países subsaharianos dependen en gran medida de tejidos de donantes importados debido a la inadecuada infraestructura local de bancos de ojos, lo que genera demoras y mayores costos de procedimiento.

- Los altos costos de tratamiento, en particular para procedimientos de trasplante avanzados como DMEK o DSAEK, representan otra barrera en mercados sensibles a los costos. Los gastos de bolsillo a menudo disuaden a los pacientes de buscar atención quirúrgica, especialmente en regiones rurales y marginadas.

- Las lagunas regulatorias, las leyes de donación inconsistentes y la resistencia cultural a la donación de ojos también obstaculizan la expansión de las bases de donantes en varios países. Además, la falta de cirujanos oftalmólogos capacitados y de herramientas quirúrgicas modernas en algunas zonas reduce las tasas de éxito de los procedimientos y limita la escalabilidad.

- Abordar estos desafíos mediante financiación gubernamental específica, colaboración transfronteriza en bancos de ojos, educación pública y asociaciones internacionales será esencial para ampliar el acceso y mejorar la asequibilidad en toda la región.

Alcance del mercado de trasplante de córnea en Oriente Medio y África

El mercado está segmentado según el tipo de procedimiento, tipo, tipo de donante, tipo de injerto, tipo de cirugía, indicación, género, grupo de edad y usuario final.

- Por tipo de procedimiento

Según el tipo de procedimiento, el mercado de trasplante de córnea en Oriente Medio y África se segmenta en queratoplastia endotelial, queratoplastia penetrante, queratoplastia lamelar anterior (ALK), trasplante de células madre limbares corneales, trasplante de córnea artificial, entre otros. El segmento de la queratoplastia penetrante dominó el mercado con la mayor cuota de mercado, un 49,2 %, en 2024, gracias a su amplia aplicabilidad en el tratamiento de enfermedades corneales de espesor completo, especialmente en regiones con acceso limitado a herramientas quirúrgicas avanzadas. Hospitales y centros oftalmológicos de Sudáfrica y Nigeria siguen confiando en este procedimiento tradicional debido a su eficacia y familiaridad quirúrgica.

Se prevé que el segmento de la queratoplastia endotelial experimente el mayor crecimiento entre 2025 y 2032, impulsado por su naturaleza mínimamente invasiva, una recuperación visual más rápida y la creciente disponibilidad de cirujanos oftalmólogos cualificados, especialmente en los Emiratos Árabes Unidos y Arabia Saudita. El auge de las técnicas DMEK y DSAEK contribuye a la expansión del segmento.

- Por tipo

En cuanto al tipo de córnea, el mercado de trasplantes de córnea en Oriente Medio y África se segmenta en córnea humana y sintética. El segmento de córnea humana obtuvo la mayor cuota de mercado en 2024, impulsado por la continua preferencia por los tejidos derivados de donantes y el creciente establecimiento de bancos de ojos en países como Sudáfrica, Egipto y Kenia. La compatibilidad natural y las altas tasas de éxito de los trasplantes respaldan su dominio.

Se espera que el segmento sintético crezca de manera constante durante el período de pronóstico, debido a los avances tecnológicos en queratoprótesis y al creciente uso en casos de fallas de múltiples injertos o cuando no se encuentra disponible tejido de donante humano.

- Por tipo de donante

Según el tipo de donante, el mercado de trasplantes de córnea en Oriente Medio y África se segmenta en autoinjerto y aloinjerto. El segmento de aloinjerto dominó el mercado con la mayor participación en los ingresos en 2024, debido principalmente a la práctica común de utilizar córneas de donantes fallecidos y a los crecientes programas de concienciación sobre la donación. Las iniciativas de los ministerios de salud regionales y las ONG están mejorando el registro de donantes en países como Egipto y Kenia.

Se espera que el segmento de autoinjerto sea testigo del crecimiento más rápido durante el período de pronóstico, restringido principalmente a los procedimientos de trasplante de células madre del limbo corneal, y generalmente se utiliza en casos altamente especializados.

- Por tipo de injerto

Según el tipo de injerto, el mercado de trasplantes de córnea en Oriente Medio y África se segmenta en injertos de espesor parcial (lamelares) e injertos de espesor completo (penetrantes). El segmento de injertos de espesor completo (penetrantes) obtuvo la mayor cuota de mercado en 2024, gracias a su uso consolidado en hospitales públicos y privados y a su capacidad para tratar afecciones corneales avanzadas y complejas en Oriente Medio y África.

Se proyecta que el segmento de injertos de espesor parcial (lamelar) crezca a un ritmo mayor durante el período de pronóstico debido a menos complicaciones posoperatorias, un tiempo de curación más rápido y una creciente adopción en centros oftalmológicos tecnológicamente avanzados.

- Por tipo de cirugía

Según el tipo de cirugía, el mercado de trasplante de córnea en Oriente Medio y África se segmenta en cirugía convencional y cirugía asistida por láser. El segmento de cirugía convencional dominó el mercado en 2024, debido al uso generalizado de técnicas manuales tradicionales en las operaciones de trasplante de córnea, especialmente en países de ingresos bajos y medios con acceso limitado a sistemas quirúrgicos avanzados.

Se espera que el segmento de cirugía asistida por láser crezca rápidamente entre 2025 y 2032, impulsado por la creciente demanda de precisión, la reducción del tiempo de curación y el uso creciente de sistemas láser de femtosegundo en los Emiratos Árabes Unidos y Arabia Saudita.

- Por indicación

Según la indicación, el mercado de trasplante de córnea en Oriente Medio y África se segmenta en distrofia endotelial de Fuchs, queratitis infecciosa, queratopatía bullosa, queratocono, procedimientos de reimplante, cicatrización corneal, úlceras corneales, entre otros. El segmento del queratocono registró la mayor cuota de mercado en 2024, debido a su alta prevalencia regional, especialmente entre adultos jóvenes de países de Oriente Medio como Arabia Saudí y los Emiratos Árabes Unidos. El diagnóstico temprano y la disponibilidad de opciones quirúrgicas avanzadas son factores clave.

Se anticipa que el segmento de distrofia endotelial de Fuchs experimentará el crecimiento más rápido durante el período de pronóstico, respaldado por el aumento de la población geriátrica, la creciente concientización y el acceso a los procedimientos de queratoplastia endotelial en entornos de atención médica urbanos.

- Por género

En cuanto al género, el mercado de trasplantes de córnea en Oriente Medio y África se segmenta en mujeres y hombres. El segmento masculino representó la mayor cuota de mercado en 2024, debido principalmente a una mayor exposición a lesiones oculares ocupacionales y a una mayor prevalencia de casos de traumatismo corneal en hombres, especialmente en zonas industriales de Sudáfrica y Nigeria.

Se espera que el segmento femenino muestre un crecimiento más rápido durante el período de pronóstico, ayudado por el aumento del acceso de las mujeres a la atención médica, el aumento de las campañas de concientización y un enfoque en la igualdad de género en las iniciativas de salud regionales.

- Por grupo de edad

Según el grupo de edad, el mercado de trasplante de córnea en Oriente Medio y África se segmenta en geriátrico, adulto y pediátrico. El segmento adulto dominó el mercado con la mayor participación en ingresos en 2024, impulsado por la alta incidencia de afecciones como el queratocono y la queratitis infecciosa en la población en edad laboral.

Se proyecta que el segmento geriátrico crecerá al ritmo más rápido durante el período de pronóstico debido al envejecimiento de la población y al aumento de casos de disfunción endotelial y queratopatía ampollosa entre personas mayores en los Emiratos Árabes Unidos y Egipto.

- Por el usuario final

En cuanto al usuario final, el mercado de trasplante de córnea en Oriente Medio y África se segmenta en hospitales, clínicas oftalmológicas, centros de cirugía ambulatoria, institutos académicos y de investigación, entre otros. El segmento hospitalario lideró el mercado en 2024, gracias a una infraestructura avanzada, capacidades quirúrgicas integradas y la presencia de oftalmólogos cualificados en centros médicos de primera línea en Sudáfrica, Egipto y los Emiratos Árabes Unidos.

Se espera que el segmento de clínicas oftalmológicas experimente el crecimiento más rápido entre 2025 y 2032, impulsado por la expansión de las redes de atención oftalmológica especializada y una mayor accesibilidad en áreas urbanas y suburbanas.

Análisis regional del mercado de trasplante de córnea en Oriente Medio y África

- Sudáfrica dominó el mercado de trasplante de córnea en Medio Oriente y África con la mayor participación en los ingresos del 32,5 % en 2024, respaldada por una infraestructura quirúrgica más sólida, la ampliación de la disponibilidad de córneas de donantes e iniciativas público-privadas para combatir la ceguera corneal.

- Los pacientes del país se benefician de una mayor conciencia sobre las discapacidades visuales tratables, el acceso a profesionales oftalmológicos capacitados y programas dirigidos por el gobierno destinados a reducir la carga de la ceguera corneal.

- El liderazgo de la región en procedimientos de trasplante se ve reforzado aún más por los avances en los bancos de ojos, el acceso mejorado a las tecnologías quirúrgicas y las colaboraciones continuas con organizaciones internacionales, posicionando a Sudáfrica como un centro clave para el cuidado de la córnea en Medio Oriente y África.

Perspectiva del mercado sudafricano de trasplantes de córnea

El mercado sudafricano de trasplantes de córnea captó la mayor participación en los ingresos de la región, con un 32,5 %, en 2024, gracias a sus instalaciones de vanguardia para el cuidado ocular y a la creciente red de programas de donación de córnea. Las colaboraciones público-privadas y la mayor capacitación de los cirujanos oftalmólogos han mejorado significativamente el acceso a los procedimientos y sus resultados. El país continúa liderando la adopción regional gracias al sólido apoyo gubernamental, la expansión de los registros de trasplantes y la colaboración con organizaciones internacionales de salud ocular, lo que lo posiciona como un centro clave para el cuidado de la córnea.

Análisis del mercado de trasplantes de córnea en los Emiratos Árabes Unidos

Se prevé que el mercado de trasplantes de córnea de los EAU crezca a una sólida tasa de crecimiento anual compuesta (TCAC) durante el período de pronóstico, impulsado por una infraestructura sanitaria de vanguardia y el creciente turismo médico. El enfoque del gobierno en la salud digital, la innovación y la atención especializada ha impulsado una mayor disponibilidad de procedimientos de trasplante asistidos por láser. La creciente concienciación, sumada a los programas nacionales de donantes y la integración de los estándares quirúrgicos globales, está impulsando una sólida adopción en hospitales públicos y privados.

Análisis del mercado de trasplantes de córnea en Arabia Saudita

Se prevé una expansión constante del mercado de trasplantes de córnea en Arabia Saudita gracias a las reformas sanitarias de la Visión 2030 y al aumento de la prevalencia de enfermedades corneales. Las inversiones en centros oftalmológicos y las iniciativas para concienciar a los donantes están ayudando a cerrar la brecha entre la oferta y la demanda de córneas trasplantables. Los avances tecnológicos y la mejora del acceso a la formación impulsan el desarrollo de técnicas quirúrgicas avanzadas, como la queratoplastia endotelial, en hospitales líderes de Riad y Yida.

Perspectivas del mercado de trasplantes de córnea en Egipto

El mercado egipcio de trasplantes de córnea está experimentando un auge, impulsado por la creciente incidencia de enfermedades oculares infecciosas y daños corneales relacionados con traumatismos. La expansión de los servicios públicos de atención oftalmológica y la colaboración con bancos de ojos en el extranjero están contribuyendo a mejorar la disponibilidad de córnea. Se espera que el mercado se beneficie de una sólida base de pacientes, campañas de concienciación impulsadas por el gobierno y alianzas internacionales centradas en la reducción de la ceguera corneal en regiones desatendidas.

Perspectivas del mercado de trasplantes de córnea en Kenia

Se proyecta que el mercado de trasplantes de córnea en Kenia crecerá gradualmente, impulsado por la expansión de iniciativas de atención oftalmológica sin fines de lucro y unidades quirúrgicas móviles. A medida que mejora el acceso a la atención oftalmológica especializada en las zonas rurales, aumenta la demanda de procedimientos de trasplante de córnea asequibles y eficaces. Se espera que las iniciativas de organizaciones sanitarias mundiales y las mejoras en los hospitales públicos mejoren el acceso a la córnea de los donantes y los resultados quirúrgicos durante el período previsto.

Cuota de mercado de trasplante de córnea en Oriente Medio y África

La industria de trasplante de córnea en Oriente Medio y África está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- CorneaGen, Inc. (EE. UU.)

- KeraLink International (EE. UU.)

- Aurolab (India)

- AJL Oftalmológica SA (España)

- DIOPTEX GmbH (Austria)

- Presbia PLC (Irlanda)

- Banco de ojos de los Leones de Florida (EE. UU.)

- Banco de ojos de San Diego (EE. UU.)

- TissueTech, Inc. (EE. UU.)

- Eversight (EE. UU.)

- Alcon Inc. (Suiza)

- Bausch + Lomb Incorporated (EE. UU.)

- Ziemer Ophthalmic Systems AG (Suiza)

- Gebauer Medizintechnik GmbH (Alemania)

- MEDIPHACOS Ltda. (Brasil)

- Ophtec BV (Países Bajos)

- Corporación de Especialidades Quirúrgicas (EE. UU.)

- EyeYon Medical Ltd. (Israel)

- Miracles Optical (India)

- Keramed, Inc. (EE. UU.)

¿Cuáles son los desarrollos recientes en el mercado de trasplante de córnea en Oriente Medio y África?

- En mayo de 2024, el Banco Nacional de Ojos de Sudáfrica anunció una importante iniciativa de expansión para mejorar la recolección y preservación de córneas de donantes. Este desarrollo busca abordar la creciente demanda de trasplantes de córnea en la región, aumentando la disponibilidad de injertos de alta calidad. La iniciativa subraya el compromiso de la organización con la reducción de la ceguera corneal mediante el fortalecimiento de la infraestructura de los bancos de ojos, la mejora de los protocolos de manejo de tejidos y la ampliación de los programas de alcance a donantes en toda Sudáfrica.

- En abril de 2024, el Hospital Oftalmológico Moorfields de Dubái, centro líder en atención oftalmológica en los EAU, lanzó un programa avanzado de trasplante de córnea que integra tecnología láser de femtosegundo. Este programa está diseñado para ofrecer resultados quirúrgicos de precisión para afecciones como la distrofia de Fuchs y el queratocono. Al adoptar equipos de última generación y estándares quirúrgicos internacionales, Moorfields consolida su liderazgo regional en el cuidado de la córnea y apoya el objetivo de los EAU de convertirse en un centro de excelencia médica.

- En marzo de 2024, el Hospital de Oftalmología Rey Khaled de Arabia Saudita firmó un acuerdo de colaboración con la organización internacional sin fines de lucro Orbis International para ampliar los programas de capacitación para cirujanos de córnea. La colaboración se centra en el desarrollo de capacidades, incluyendo capacitación quirúrgica presencial, talleres y apoyo mediante telemedicina para mejorar la capacidad de trasplante en todo el Reino. Esta iniciativa destaca la importancia de las colaboraciones internacionales para mejorar la calidad y la accesibilidad de la atención oftalmológica en Arabia Saudita.

- En febrero de 2024, el Ministerio de Salud de Kenia lanzó una campaña pública de concienciación sobre la donación de ojos, en colaboración con ONG regionales y bancos internacionales de ojos. La campaña busca aumentar el registro de donantes locales y reducir la dependencia del país de la importación de tejido corneal. Este avance refleja el creciente interés del gobierno por abordar la ceguera prevenible mediante la movilización de donantes locales y la mejora de la infraestructura de trasplantes.

- En enero de 2024, los Hospitales y Centros Magrabi de Egipto introdujeron un registro centralizado de trasplantes de córnea para agilizar la gestión de los pacientes y optimizar la asignación de tejido donante. El sistema facilita el seguimiento transparente de los resultados quirúrgicos, la compatibilidad donante-receptor y la atención postoperatoria. Esta iniciativa refleja un enfoque basado en datos para mejorar la eficiencia de los trasplantes, posicionando a Egipto como un actor emergente en la innovación quirúrgica oftálmica en la región.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.