Middle East And Africa Clinical Laboratory Services Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

12.71 Billion

USD

18.35 Billion

2025

2033

USD

12.71 Billion

USD

18.35 Billion

2025

2033

| 2026 –2033 | |

| USD 12.71 Billion | |

| USD 18.35 Billion | |

|

|

|

|

Segmentación del mercado de servicios de laboratorio clínico en Oriente Medio y África por especialidad (análisis de química clínica, hematología, microbiología , inmunología, drogas, citología y genética ), proveedor (laboratorios independientes y de referencia, hospitales, enfermería y consultorios médicos), aplicación (descubrimiento de fármacos, desarrollo de fármacos, bioanálisis y química de laboratorio, toxicología, terapia celular y génica, ensayos preclínicos y clínicos, y otros servicios de laboratorio clínico), tipo de servicio (análisis rutinarios, esotéricos y anatómicos): tendencias y pronóstico del sector hasta 2033.

Tamaño del mercado de servicios de laboratorio clínico en Oriente Medio y África

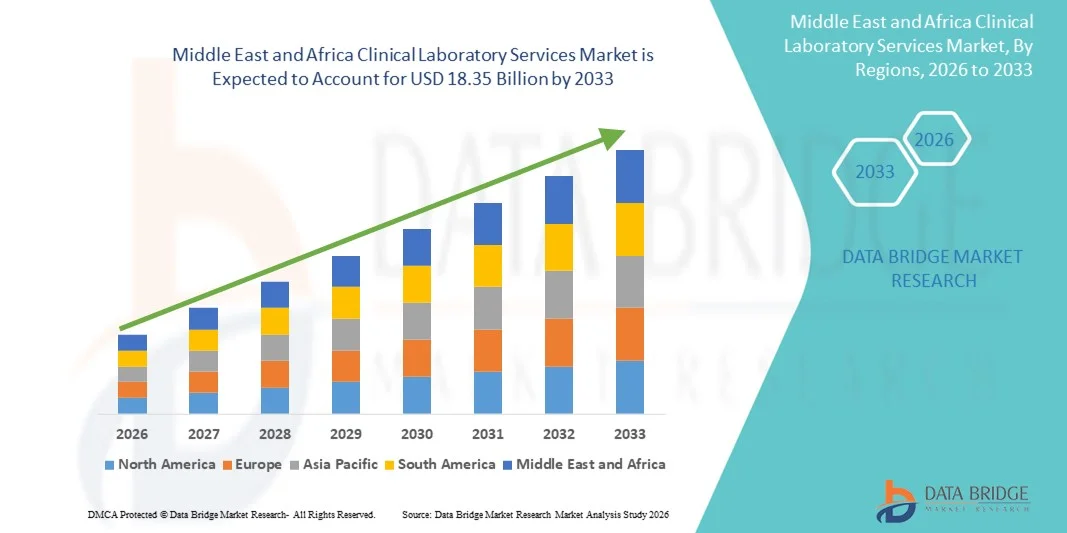

- El tamaño del mercado de servicios de laboratorio clínico de Medio Oriente y África se valoró en USD 12,71 mil millones en 2025 y se espera que alcance los USD 18,35 mil millones para 2033 , con una CAGR del 4,70% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente demanda de pruebas de diagnóstico precisas, oportunas y de alta calidad, impulsada por la creciente prevalencia de enfermedades crónicas, enfermedades infecciosas y condiciones de salud relacionadas con el estilo de vida en todo el mundo.

- Además, la creciente conciencia sobre la atención médica preventiva, los avances en las tecnologías de laboratorio, la automatización en los diagnósticos clínicos y la expansión de la infraestructura de atención médica están acelerando la adopción de soluciones de servicios de laboratorio clínico, lo que impulsa significativamente el crecimiento general del mercado de servicios de laboratorio clínico.

Análisis del mercado de servicios de laboratorio clínico en Oriente Medio y África

- Los servicios de laboratorio clínico, que abarcan pruebas de diagnóstico, patología y otros análisis de laboratorio, son cada vez más importantes en la atención médica moderna para la detección temprana de enfermedades, el monitoreo de condiciones crónicas y el apoyo a planes de tratamiento personalizados.

- El crecimiento del mercado está impulsado principalmente por la creciente prevalencia de enfermedades crónicas, la creciente demanda de atención médica preventiva, los avances tecnológicos en la automatización de laboratorios y plataformas de diagnóstico, y la expansión de la infraestructura de atención médica en todo el mundo.

- Arabia Saudita dominó el mercado de servicios de laboratorio clínico, representando aproximadamente el 39,8 % de los ingresos regionales en 2025, gracias a sólidas iniciativas gubernamentales en materia de salud, inversiones en centros de diagnóstico avanzados y la adopción generalizada de tecnologías de laboratorio modernas en hospitales, clínicas y centros de diagnóstico especializados. La presencia de proveedores líderes de servicios de laboratorio a nivel regional y la creciente concienciación de los pacientes sobre la importancia de los diagnósticos de calidad refuerzan aún más el dominio de Arabia Saudita en el mercado.

- Se espera que los Emiratos Árabes Unidos sean el país de más rápido crecimiento, con una CAGR estimada del 9,1 % entre 2026 y 2033, impulsada por la rápida expansión de la infraestructura de atención médica privada, el aumento de las iniciativas gubernamentales para la salud preventiva, el aumento del turismo médico y la creciente adopción de tecnologías avanzadas de diagnóstico y automatización en los laboratorios clínicos.

- El segmento de Laboratorios Independientes y de Referencia dominó la mayor participación en ingresos del mercado con un 45,1 % en 2025, debido a sus amplias carteras de servicios, capacidades de prueba de última generación y capacidad para atender a múltiples hospitales y clínicas.

Alcance del informe y segmentación del mercado de servicios de laboratorio clínico

|

Atributos |

Perspectivas clave del mercado de servicios de laboratorio clínico |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Oriente Medio y África

|

|

Actores clave del mercado |

• LabCorp (EE. UU.) |

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis en profundidad de expertos, epidemiología de pacientes, análisis de la cartera de productos, análisis de precios y marco regulatorio. |

Tendencias del mercado de servicios de laboratorio clínico en Oriente Medio y África

Ampliación de los servicios de diagnóstico avanzado

- Una tendencia significativa y en aceleración en el mercado de servicios de laboratorio clínico de Medio Oriente y África es la expansión de servicios de diagnóstico y pruebas avanzados, impulsada por la creciente demanda de medicina de precisión y capacidades de pruebas especializadas.

- Por ejemplo, en 2024, proveedores líderes de diagnóstico como Al Borg Diagnostics ampliaron sus servicios de pruebas moleculares y genómicas en los Emiratos Árabes Unidos y Arabia Saudita para satisfacer la creciente demanda de los pacientes. La adopción de plataformas de pruebas de alto rendimiento y la automatización en los laboratorios está mejorando la eficiencia, reduciendo los plazos de entrega y mejorando la precisión.

- La integración de los sistemas de información de laboratorio (LIS) con las redes de hospitales y clínicas permite una gestión y generación de informes de datos de pacientes fluida. Los hospitales y centros de diagnóstico invierten cada vez más en capacidades avanzadas de análisis para oncología, enfermedades infecciosas y trastornos metabólicos.

- La concienciación de los pacientes y la demanda de diagnóstico temprano y atención preventiva impulsan la adopción de pruebas clínicas especializadas. Las iniciativas gubernamentales que promueven el desarrollo de infraestructura sanitaria y la vigilancia de la salud pública aceleran aún más el crecimiento.

- La acreditación y las certificaciones de calidad, como ISO y CAP, incentivan a los laboratorios a modernizar sus tecnologías y carteras de servicios. La colaboración entre proveedores de servicios de diagnóstico e instituciones de investigación mejora las capacidades de análisis y el apoyo a los ensayos clínicos.

- La adopción de servicios de pruebas integrados en múltiples ubicaciones permite un mayor acceso a los pacientes y una mayor eficiencia operativa. Los programas de capacitación para el personal de laboratorio garantizan el manejo adecuado de pruebas complejas y el cumplimiento de las normas regulatorias.

Dinámica del mercado de servicios de laboratorio clínico en Oriente Medio y África

Conductor

Creciente demanda de pruebas especializadas y de alta precisión

- La creciente prevalencia de enfermedades crónicas, enfermedades infecciosas y trastornos genéticos en Oriente Medio y África es un importante impulsor del crecimiento del mercado.

- Por ejemplo, en 2025, Al Borg Diagnostics introdujo servicios de secuenciación de próxima generación y diagnóstico molecular en Arabia Saudita, mejorando significativamente sus capacidades de servicio.

- Los proveedores de atención médica buscan soluciones de diagnóstico precisas, rápidas e integrales para guiar la gestión del paciente y las decisiones de tratamiento.

- La expansión de hospitales y cadenas de diagnóstico en áreas urbanas y semiurbanas favorece mayores volúmenes de pruebas

- Las iniciativas gubernamentales de atención sanitaria y las asociaciones público-privadas están promoviendo la modernización de los laboratorios y la expansión de la capacidad.

- El aumento de la investigación clínica y la participación en estudios epidemiológicos regionales crean una demanda adicional de pruebas especializadas.

- La preferencia de los pacientes por la detección temprana, la atención médica preventiva y el tratamiento personalizado impulsa la adopción de servicios de laboratorio avanzados.

- Las actualizaciones tecnológicas en los equipos de laboratorio y la adopción de plataformas automatizadas garantizan un mayor rendimiento y menores tasas de error.

- La colaboración entre laboratorios y compañías farmacéuticas para ensayos clínicos está impulsando la demanda de pruebas especializadas. La formación continua y el desarrollo de habilidades para los profesionales de laboratorio mejoran la calidad y la precisión del servicio.

- La expansión de la cobertura de seguros y el reembolso de las pruebas diagnósticas favorece la asequibilidad y la adopción. En general, la creciente demanda clínica, los avances tecnológicos y las políticas sanitarias de apoyo impulsan el mercado de servicios de laboratorio clínico en la región.

Restricción/Desafío

Altos costos operativos y fuerza laboral calificada limitada

- El alto costo de establecer y mantener laboratorios clínicos avanzados es un desafío importante para los centros de diagnóstico más pequeños.

- Por ejemplo, la inversión en plataformas automatizadas de pruebas moleculares y analizadores de alto rendimiento puede ascender a millones de dólares, lo que limita la expansión de nuevos participantes.

- La escasez de técnicos de laboratorio capacitados y patólogos especializados restringe la capacidad de ampliar los servicios de manera eficiente.

- Los procesos de cumplimiento normativo y acreditación de calidad pueden ser largos y costosos. El mantenimiento de equipos avanzados y la garantía de la calibración y el control de calidad incrementan los gastos operativos.

- Las limitaciones de infraestructura en regiones remotas y rurales reducen el acceso de los pacientes a servicios de laboratorio avanzados

- Los altos costos de los reactivos, consumibles y kits de prueba pueden aumentar aún más los precios del servicio, lo que afecta la asequibilidad.

- La limitada conciencia y adopción de pruebas preventivas en algunas poblaciones puede restringir la penetración en el mercado

- A pesar de la creciente demanda, la escasez de profesionales capacitados sigue siendo una barrera clave para brindar servicios de diagnóstico de alta calidad de manera constante.

- Las alianzas estratégicas, los programas de capacitación y los modelos de reparto de costos son esenciales para superar estos desafíos.

- El desarrollo de soluciones de laboratorio escalables y rentables e iniciativas de capacitación regional pueden mitigar los problemas de mano de obra y costos.

- Abordar estas barreras es crucial para sostener el crecimiento a largo plazo en el mercado de servicios de laboratorio clínico de Medio Oriente y África.

Alcance del mercado de servicios de laboratorio clínico en Oriente Medio y África

El mercado está segmentado según la especialidad, el proveedor, la aplicación y el tipo de servicio.

- Por especialidad

Según la especialidad, el mercado de servicios de laboratorio clínico se segmenta en análisis de química clínica, hematología, microbiología, inmunología, drogas, citología y genética. El segmento de análisis de química clínica obtuvo la mayor cuota de mercado con un 38,6 % en 2025, impulsado por la alta prevalencia de enfermedades crónicas como la diabetes, los trastornos cardiovasculares y los síndromes metabólicos en Oriente Medio y África. Los perfiles químicos de rutina, las pruebas de función hepática y renal son ampliamente solicitados en hospitales y clínicas ambulatorias, lo que ha consolidado la química clínica como un servicio fundamental de laboratorio. Los avances en analizadores automatizados y plataformas de alto rendimiento han aumentado la eficiencia y la precisión, reduciendo los plazos de entrega y mejorando la fiabilidad. Los centros sanitarios priorizan los análisis de química clínica por su capacidad para proporcionar datos diagnósticos rápidos y completos. La adopción de sistemas integrados de información de laboratorio permite una gestión optimizada de los datos de los pacientes, lo que garantiza una mejor toma de decisiones clínicas. Además, las iniciativas gubernamentales que promueven la atención médica preventiva y el diagnóstico precoz fomentan los análisis químicos periódicos. La expansión de las redes hospitalarias y los laboratorios independientes en regiones urbanas y semiurbanas también sustenta la alta demanda. Además, las colaboraciones con entidades farmacéuticas y de investigación para ensayos clínicos impulsan el uso de ensayos de química clínica. Las prácticas de acreditación y estandarización en los laboratorios aumentan la confianza en los resultados de las pruebas. La creciente concienciación de los pacientes sobre el control rutinario de la salud refuerza el dominio del mercado. Las pruebas de química clínica siguen siendo fundamentales para el diagnóstico clínico debido a su rentabilidad, accesibilidad y amplia aplicabilidad en diversas enfermedades.

Se espera que el segmento de Pruebas Hematológicas experimente la tasa de crecimiento anual compuesta (TCAC) más rápida, del 15,9 %, entre 2026 y 2033, impulsada por la creciente demanda de hemogramas completos, perfiles de coagulación y análisis hematológicos especializados en hospitales y centros de diagnóstico. El aumento de casos de anemia, leucemia y otros trastornos sanguíneos está impulsando el volumen de pruebas. La expansión de la capacidad hospitalaria, especialmente en Arabia Saudita, Emiratos Árabes Unidos y Egipto, contribuye a este crecimiento. La automatización de los analizadores hematológicos reduce errores y mejora la respuesta. La creciente adopción en paquetes de atención médica preventiva, chequeos médicos y pruebas cubiertas por seguros médicos acelera su adopción. Las pruebas hematológicas son fundamentales para las evaluaciones preoperatorias, el manejo de enfermedades crónicas y la monitorización terapéutica. Las alianzas estratégicas entre laboratorios y proveedores de tecnología diagnóstica introducen soluciones innovadoras. Además, un mayor enfoque en la investigación y los ensayos clínicos para trastornos hematológicos impulsa el crecimiento del segmento. La capacitación de personal de laboratorio cualificado garantiza la ejecución fiable de pruebas complejas. La integración de las pruebas hematológicas en paneles de diagnóstico más amplios mejora la eficiencia del flujo de trabajo. La creciente concienciación sobre la salud sanguínea y el diagnóstico precoz fomenta la realización de pruebas más frecuentes. Los programas de salud de los gobiernos regionales que promueven la anemia y el control de enfermedades contribuyen aún más. En general, las pruebas hematológicas se posicionan como el segmento de especialidad de mayor crecimiento debido a su importancia clínica y su creciente accesibilidad.

- Por proveedor

Según el proveedor, el mercado se segmenta en Laboratorios Independientes y de Referencia, Laboratorios Hospitalarios y Laboratorios en Consultorios Médicos y de Enfermería. El segmento de Laboratorios Independientes y de Referencia dominó la mayor cuota de mercado en ingresos, con un 45,1% en 2025, gracias a su amplia cartera de servicios, sus capacidades de análisis de vanguardia y su capacidad para atender a múltiples hospitales y clínicas. Estos laboratorios ofrecen servicios de análisis especializados y diagnósticos de alto rendimiento, que a menudo integran ensayos moleculares, genéticos y esotéricos. Los pacientes prefieren cada vez más los laboratorios independientes por su comodidad, rapidez de respuesta y opciones integrales de análisis. El auge de centros de diagnóstico centralizados en las regiones urbanas garantiza una amplia cobertura geográfica. Las inversiones en automatización y sistemas LIS mejoran la eficiencia operativa y la precisión de los resultados. Las alianzas con compañías farmacéuticas para ensayos clínicos y servicios bioanalíticos fortalecen las fuentes de ingresos. La acreditación según las normas ISO y CAP garantiza la calidad y la fiabilidad, atrayendo a clientes institucionales. Los laboratorios independientes también ofrecen servicios de mensajería y recogida de muestras a domicilio, lo que mejora la accesibilidad de los pacientes. La expansión estratégica en zonas semiurbanas impulsa la penetración en el mercado. La colaboración con instituciones de investigación facilita la adopción de pruebas de vanguardia. La reputación del segmento en cuanto a precisión, eficiencia y diversidad de servicios refuerza su posición dominante.

Se espera que los laboratorios hospitalarios experimenten la tasa de crecimiento anual compuesta (TCAC) más rápida, del 16,7 %, entre 2026 y 2033, impulsada por el creciente número de hospitales y centros de salud en la región. Los laboratorios hospitalarios integran las pruebas directamente con la atención al paciente, garantizando resultados oportunos para el diagnóstico y el tratamiento. La expansión de hospitales multidisciplinarios en Arabia Saudita, Emiratos Árabes Unidos y Egipto impulsa la demanda. La creciente adopción de pruebas en el punto de atención, la automatización y la integración de sistemas de información de laboratorio (LIS) mejora la eficiencia del servicio. Los laboratorios hospitalarios también desempeñan un papel clave en los ensayos clínicos y los estudios farmacogenómicos, lo que contribuye al crecimiento del segmento. La creciente concienciación entre los médicos sobre las pruebas internas para una rápida toma de decisiones clínicas promueve su adopción. Las inversiones en equipos modernos para hematología, diagnóstico molecular e inmunología fortalecen las capacidades. La colaboración con las aseguradoras médicas mejora la asequibilidad de las pruebas. El desarrollo de personal cualificado en los hospitales garantiza la precisión en ensayos complejos. El segmento se beneficia de un mayor volumen de pacientes y una atención integrada. Los programas gubernamentales que fomentan la expansión de la infraestructura de laboratorio impulsan la adopción en el mercado. En general, los laboratorios hospitalarios se posicionan como el segmento de proveedores de más rápido crecimiento.

- Por aplicación

Según la aplicación, el mercado de servicios de laboratorio clínico se segmenta en servicios relacionados con el descubrimiento de fármacos, servicios relacionados con el desarrollo de fármacos, servicios de química bioanalítica y de laboratorio, servicios de pruebas toxicológicas, servicios relacionados con la terapia celular y génica, servicios relacionados con ensayos preclínicos y clínicos, y otros servicios de laboratorio clínico. El segmento de servicios relacionados con ensayos preclínicos y clínicos dominó la mayor cuota de mercado de ingresos del 39,8% en 2025, debido al creciente número de ensayos clínicos y estudios de investigación en oncología, enfermedades infecciosas y trastornos metabólicos. Las organizaciones de investigación por contrato (CRO) y las compañías farmacéuticas están colaborando con laboratorios regionales para apoyar el desarrollo de fármacos. La expansión de los centros de investigación clínica en los Emiratos Árabes Unidos, Arabia Saudita y Egipto impulsa los volúmenes de pruebas. La adopción de protocolos estandarizados e instrumentación avanzada garantiza datos precisos para el cumplimiento normativo. La integración de plataformas de bioinformática y gestión de datos mejora la eficiencia de la investigación. El crecimiento de las instituciones académicas y de investigación genera una demanda adicional. Los servicios preclínicos, que incluyen toxicología y farmacocinética, complementan las actividades de ensayos clínicos. La alta inscripción de pacientes en los estudios impulsa los requisitos de pruebas repetidas. Los laboratorios que ofrecen capacidades de análisis multicéntrico ganan preferencia. La demanda de ensayos farmacogenómicos y moleculares impulsa la expansión del segmento. El énfasis en el cumplimiento normativo garantiza una generación constante de ingresos. En general, el segmento sigue siendo crucial para la investigación clínica y el desarrollo de fármacos.

Se prevé que el segmento de Servicios Relacionados con el Desarrollo de Fármacos registre la tasa de crecimiento anual compuesta (TCAC) más rápida, del 17,3 %, entre 2026 y 2033, impulsada por la creciente externalización de servicios analíticos, bioanalíticos y de laboratorio por parte de empresas farmacéuticas y biotecnológicas. La creciente inversión en nuevas líneas de desarrollo de fármacos y el aumento de la actividad de ensayos clínicos en oncología, inmunología y enfermedades raras impulsan la demanda. Las plataformas de pruebas avanzadas, los flujos de trabajo de alto rendimiento y los sistemas de calidad estandarizados facilitan una rápida adopción. La expansión de laboratorios regionales con alianzas con CRO acelera el crecimiento. Los requisitos regulatorios para obtener datos farmacocinéticos y de seguridad precisos impulsan el potencial del mercado. La integración de servicios de pruebas preclínicas, bioanalíticas y clínicas facilita el apoyo integral al desarrollo de fármacos. El creciente enfoque en la medicina personalizada y el diagnóstico molecular impulsa la demanda. Las colaboraciones estratégicas entre empresas farmacéuticas y laboratorios locales optimizan la prestación de servicios. La formación y el desarrollo de personal de laboratorio cualificado garantizan la precisión de las pruebas. El aumento de los incentivos gubernamentales para la investigación y el desarrollo impulsa aún más la adopción. La creciente concienciación entre los actores del sector farmacéutico sobre la generación de datos de calidad garantiza un crecimiento sostenido. El segmento se posiciona como la aplicación de más rápido crecimiento en la región.

- Por tipo de servicio

Según el tipo de servicio, el mercado de Servicios de Laboratorio Clínico se segmenta en Servicios de Pruebas de Rutina, Servicios Esotéricos y Servicios de Anatomía Patológica. El segmento de Servicios de Pruebas de Rutina dominó la mayor participación en ingresos del mercado, con un 41,5% en 2025, impulsado por el alto volumen de pruebas diagnósticas estándar, como hemogramas, perfiles metabólicos y análisis de orina, realizadas en hospitales y centros ambulatorios. Los servicios de rutina se utilizan ampliamente para chequeos médicos preventivos, monitoreo de enfermedades crónicas y evaluaciones preoperatorias. La adopción de analizadores automatizados y plataformas de alto rendimiento garantiza tiempos de respuesta rápidos y resultados confiables. La expansión de los centros de salud en áreas urbanas y semiurbanas permite un alto volumen de pacientes. La integración con LIS y redes hospitalarias mejora la eficiencia de los informes y el flujo de trabajo. La cobertura de seguros para pruebas de rutina fomenta una mayor participación de los pacientes. Las iniciativas gubernamentales de atención médica preventiva promueven los diagnósticos de rutina. Los laboratorios independientes y hospitalarios amplían activamente sus capacidades de pruebas de rutina para satisfacer la creciente demanda. Las medidas de capacitación y control de calidad mantienen la precisión en un alto volumen de pruebas. Las alianzas con instituciones de investigación amplían la cobertura del servicio. La accesibilidad y la asequibilidad refuerzan el dominio en el segmento de servicios.

Se espera que el segmento de Servicios Esotéricos experimente la tasa de crecimiento anual compuesta (TCAC) más rápida, del 18,1 %, entre 2026 y 2033, impulsada por la creciente demanda de pruebas moleculares, genéticas e inmunológicas especializadas. Técnicas avanzadas como la secuenciación de nueva generación, los ensayos basados en PCR y el análisis de biomarcadores son cada vez más necesarias para la medicina de precisión y el diagnóstico de enfermedades raras. La expansión de laboratorios independientes y hospitalarios con capacidades para realizar pruebas esotéricas acelera su adopción. Las compañías farmacéuticas confían en los servicios esotéricos para ensayos clínicos y apoyo al desarrollo de fármacos. La creciente concienciación de los pacientes sobre las pruebas genéticas y la atención médica personalizada fomenta su adopción. Las iniciativas gubernamentales que promueven el diagnóstico avanzado contribuyen al crecimiento. La integración con plataformas de investigación y bioinformática mejora la precisión de los datos y la generación de informes. La capacitación de personal cualificado garantiza la ejecución precisa de pruebas complejas. Una mayor colaboración entre laboratorios e instituciones de investigación impulsa las capacidades. La alta rentabilidad y la baja competencia atraen a nuevos participantes en el mercado. En general, los Servicios Esotéricos representan el tipo de servicio de mayor crecimiento en el mercado de Servicios de Laboratorio Clínico en Oriente Medio y África.

Análisis regional del mercado de servicios de laboratorio clínico en Oriente Medio y África

- Se proyecta que el mercado de servicios de laboratorio clínico de MEA se expandirá a una CAGR sustancial durante el período de pronóstico.

- Impulsado principalmente por fuertes iniciativas de atención médica del gobierno, inversiones en instalaciones de diagnóstico avanzadas y la adopción generalizada de tecnologías de laboratorio modernas en hospitales, clínicas y centros de diagnóstico especializados.

- La presencia de proveedores líderes de servicios de laboratorio regionales y la creciente conciencia de los pacientes sobre los diagnósticos de calidad contribuyen aún más al crecimiento del mercado en toda la región.

Análisis del mercado de servicios de laboratorio clínico en Arabia Saudita

El mercado de servicios de laboratorio clínico de Arabia Saudita dominó el mercado de servicios de laboratorio clínico de Oriente Medio y África, representando aproximadamente el 39,8 % de los ingresos regionales en 2025, gracias a sólidas iniciativas gubernamentales de salud, importantes inversiones en centros de diagnóstico avanzados y la adopción generalizada de tecnologías de laboratorio modernas. Los principales proveedores de servicios de laboratorio del país y la creciente concienciación de los pacientes sobre la importancia de los diagnósticos de calidad refuerzan aún más su dominio del mercado.

Análisis del mercado de servicios de laboratorio clínico en los EAU

Se espera que el mercado de servicios de laboratorio clínico de los Emiratos Árabes Unidos sea el país de más rápido crecimiento en la región, registrando una CAGR estimada del 9,1 % entre 2026 y 2033, impulsado por la rápida expansión de la infraestructura de atención médica privada, el aumento de las iniciativas gubernamentales para la salud preventiva, el aumento del turismo médico y la creciente adopción de tecnologías avanzadas de diagnóstico y automatización en los laboratorios clínicos.

Cuota de mercado de servicios de laboratorio clínico en Oriente Medio y África

La industria de servicios de laboratorio clínico está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

• LabCorp (EE. UU.)

• Quest Diagnostics (EE. UU.)

• Eurofins Scientific (Luxemburgo) •

Synlab (Alemania

) • Cerba Healthcare (Francia)

• SRL Diagnostics (India) •

Unilabs (Suiza

) • Acibadem Labmed (Turquía)

• Dr. Lal PathLabs (India)

• NMC Healthcare Labs (EAU)

• PathCare (Sudáfrica)

• BioReference Laboratories (EE. UU.

) • Aspen Medical Laboratories (Australia)

• Maccabi Healthcare Services Labs (Israel)

• Al Mokhtabar Labs (Egipto)

• HealthHub Laboratories (EAU)

Últimos avances en el mercado de servicios de laboratorio clínico en Oriente Medio y África

- En mayo de 2025, Laboratory Corporation of America (LabCorp) inauguró un nuevo centro de diagnóstico regional en Chantilly, Virginia, su instalación más grande hasta la fecha, con más de 200 profesionales y capaz de procesar más de 26 000 muestras de pacientes diariamente, ampliando los servicios de histología y citología para mejorar las capacidades de diagnóstico.

- En febrero de 2025, Myriad Genetics, Inc. inició una colaboración con INTERLINK Care Management y CancerCARE for Life para ampliar el acceso a su prueba de cáncer hereditario MyRisk con RiskScore a más de un millón de personas, mejorando los servicios de detección genética y predicción del riesgo de cáncer.

- En abril de 2025, Scientist.com lanzó Clinical Labs Navigator™, una herramienta de plataforma de adquisiciones diseñada para agilizar el abastecimiento y la gestión de servicios de ensayos clínicos, aumentando la eficiencia y la colaboración entre patrocinadores y proveedores de laboratorio.

- En marzo de 2025, IQVIA Laboratories presentó la suite Site Lab Navigator, que incluye una solución de solicitud electrónica que permite a los sitios enviar solicitudes de pruebas y administrar muestras digitalmente, lo que reduce los errores manuales y mejora los flujos de trabajo del laboratorio de ensayos clínicos.

- En febrero de 2025, SK pharmteco inauguró un laboratorio de pruebas analíticas mejorado centrado en ingredientes farmacéuticos activos de alta potencia (HPAPI), mejorando las capacidades de servicio de laboratorio para el análisis de sustancias farmacológicas complejas.

- En agosto de 2024, LEAP Consulting Group lanzó una práctica para apoyar a los laboratorios clínicos con el cumplimiento, incluida la orientación sobre las regulaciones de la FDA para las pruebas desarrolladas en laboratorio (LDT), lo que refleja el enfoque de la industria en la preparación regulatoria.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.