Middle East And Africa Biodegradable Film Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

837.72 Million

USD

1,164.23 Million

2025

2033

USD

837.72 Million

USD

1,164.23 Million

2025

2033

| 2026 –2033 | |

| USD 837.72 Million | |

| USD 1,164.23 Million | |

|

|

|

|

Segmentación del mercado de películas biodegradables en Asia-Pacífico: por tipo (PLA, mezclas de almidón, poliéster biodegradable, PHA, a base de soja, a base de celulosa, a base de lignina, etc.), tipo de producto (oxobiodegradable e hidrobiodegradable), tipo de cultivo (frutas y verduras, cereales y oleaginosas, flores y plantas, etc.), aplicación (envasado de alimentos, agricultura y horticultura, productos cosméticos y de cuidado personal, envases industriales, etc.): tendencias y pronóstico del sector hasta 2033.

¿Cuál es el tamaño y la tasa de crecimiento del mercado de películas biodegradables en Asia-Pacífico?

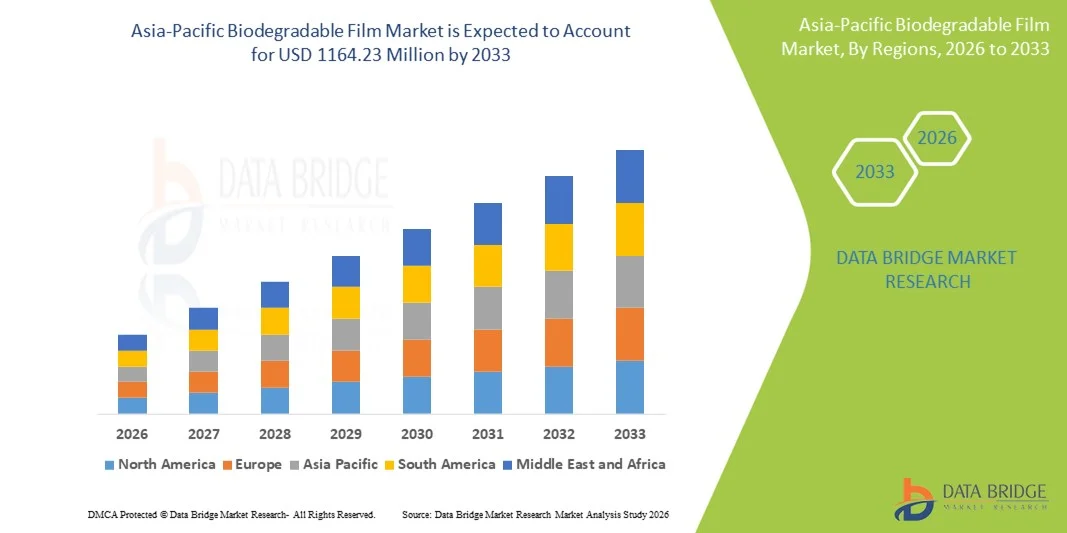

- El tamaño del mercado de películas biodegradables de Asia-Pacífico se valoró en USD 837,72 millones en 2025 y se espera que alcance los USD 1164,23 millones para 2033 , con una CAGR del 4,2 % durante el período de pronóstico.

- La fluctuación de precios y la disponibilidad a largo plazo de combustibles fósiles impulsan la demanda del mercado de películas biodegradables. El coste de producción, comparativamente más elevado, de las películas plásticas está frenando la demanda de este mercado.

¿Cuáles son las principales conclusiones del mercado de películas biodegradables?

- El crecimiento del mercado de películas sostenibles representa una oportunidad para el mercado de películas biodegradables. La incapacidad de las películas biodegradables para degradarse cuando no se cumplen ciertas condiciones ambientales dificulta la demanda de este mercado.

- Arabia Saudita dominó el mercado de películas biodegradables de Medio Oriente y África con una participación líder en los ingresos del 32,25 % en 2025, impulsada por las crecientes iniciativas gubernamentales para reducir los desechos plásticos, la creciente adopción de envases sostenibles en los sectores alimentario y minorista y el aumento de las inversiones en la fabricación de materiales de base biológica.

- Se espera que Egipto registre la CAGR más rápida del 11,58% entre 2026 y 2033 dentro del mercado de películas biodegradables de Oriente Medio y África, impulsado por la rápida urbanización, el aumento del consumo de alimentos envasados y el creciente enfoque del gobierno en la sostenibilidad ambiental.

- El segmento PLA dominó el mercado con una participación estimada del 38,9 % en 2025, impulsado por su excelente transparencia, capacidad de impresión, compostabilidad y adopción generalizada en envases de alimentos, etiquetas y aplicaciones desechables.

Alcance del informe y segmentación del mercado de películas biodegradables

|

Atributos |

Perspectivas clave del mercado de películas biodegradables |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Oriente Medio y África

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

¿Cuál es la tendencia clave en el mercado de películas biodegradables?

Transición rápida hacia películas biodegradables de alto rendimiento, sostenibles y compostables

- El mercado de películas biodegradables está siendo testigo de una creciente adopción de películas de alto rendimiento, compostables y de base biológica diseñadas para brindar una mejor resistencia mecánica, propiedades de barrera y degradación controlada en aplicaciones agrícolas y de envasado.

- Los fabricantes están introduciendo películas biodegradables multicapa con mayor resistencia al desgarro, capacidad de sellado térmico y barreras contra la humedad para reemplazar las películas plásticas convencionales en envases de alimentos, venta minorista y usos industriales.

- El creciente énfasis en las prácticas de economía circular, incluidas las materias primas renovables, las certificaciones de compostabilidad y la reducción de la huella de carbono, está acelerando la adopción de materiales sostenibles a nivel mundial.

- Por ejemplo, empresas como BASF, Futamura, Walki Group, Avery Dennison y Novamont están desarrollando películas biodegradables y compostables avanzadas para envases de alimentos, etiquetas, bolsas de transporte y aplicaciones de mantillo agrícola.

- La creciente presión regulatoria sobre los plásticos de un solo uso en Estados Unidos, Europa y Asia-Pacífico está impulsando la demanda de soluciones de películas biodegradables y compostables certificadas.

- A medida que las regulaciones de sostenibilidad se endurecen y los propietarios de marcas priorizan los envases ecológicos, las películas biodegradables seguirán siendo fundamentales para reducir los residuos plásticos y cumplir los objetivos de cumplimiento ambiental.

¿Cuáles son los impulsores clave del mercado de películas biodegradables?

- Las crecientes regulaciones globales que prohíben o restringen los plásticos de un solo uso en envases, agricultura y venta minorista están impulsando significativamente la demanda de películas biodegradables.

- Por ejemplo, entre 2024 y 2025, empresas como BASF, Futamura y Walki Group ampliaron sus carteras de películas biodegradables para respaldar los requisitos de embalajes compostables y películas agrícolas en Europa y Asia-Pacífico.

- La creciente conciencia de los consumidores sobre la contaminación plástica, la seguridad alimentaria y la sostenibilidad ambiental está fomentando la adopción de alternativas biodegradables con compostabilidad certificada.

- Las innovaciones tecnológicas, incluidas las películas basadas en PLA, PHA, almidón y celulosa, están mejorando la flexibilidad, el rendimiento de barrera y la compatibilidad con la vida útil.

- La creciente demanda de envases para alimentos y bebidas, películas para acolchado agrícola, cuidado personal y comercio electrónico continúa fortaleciendo el crecimiento del mercado.

- Con el respaldo de los mandatos de sostenibilidad, los compromisos de las marcas y los avances en polímeros de origen biológico, se proyecta que el mercado de películas biodegradables experimente una fuerte expansión a largo plazo.

¿Qué factor está obstaculizando el crecimiento del mercado de películas biodegradables?

- Los mayores costos de las materias primas de origen biológico, los polímeros especiales y los procesos de certificación limitan su adopción en comparación con las películas plásticas convencionales.

- Durante 2024-2025, la volatilidad de los precios de los materiales a base de PLA, PHA, celulosa y almidón aumentó los costos de producción para varios fabricantes mundiales.

- Las limitaciones de rendimiento, como una menor resistencia al calor, sensibilidad a la humedad y una vida útil más corta, pueden restringir el uso en ciertas aplicaciones de envasado de alta demanda.

- La infraestructura limitada para el compostaje industrial y la falta de concienciación de los consumidores respecto de la eliminación adecuada reducen la eficacia ambiental de las películas biodegradables en algunas regiones.

- La competencia de los plásticos convencionales de bajo costo y las alternativas oxodegradables crea presión sobre los precios y ralentiza la penetración en el mercado.

- Para abordar estos desafíos, los fabricantes se están centrando en la optimización de costos, la innovación de materiales, las asociaciones de infraestructura y las iniciativas educativas para acelerar la adopción global de películas biodegradables.

¿Cómo está segmentado el mercado de películas biodegradables?

El mercado está segmentado según el tipo, tipo de producto, tipo de cultivo y aplicación .

- Por tipo

Según el tipo, el mercado de películas biodegradables se segmenta en PLA, mezclas de almidón, poliéster biodegradable, PHA, a base de soja, a base de celulosa, a base de lignina y otros. El segmento de PLA dominó el mercado con una participación estimada del 38,9 % en 2025, gracias a su excelente transparencia, imprimibilidad, compostabilidad y amplia adopción en envases de alimentos, etiquetas y aplicaciones desechables. Las películas de PLA ofrecen una buena resistencia mecánica y son compatibles con las tecnologías de procesamiento existentes, lo que las convierte en la opción preferida para los fabricantes que abandonan los plásticos convencionales.

Se prevé que el segmento de PHA crezca a la tasa de crecimiento anual compuesta (TCAC) más alta entre 2026 y 2033, gracias a su superior biodegradabilidad en entornos marinos y terrestres, la creciente inversión en I+D y el creciente uso en envases de alto rendimiento y películas agrícolas. La creciente presión regulatoria y la demanda de materiales totalmente biodegradables impulsan aún más el crecimiento de los nuevos tipos de polímeros de base biológica.

- Por tipo de producto

Según el tipo de producto, el mercado se segmenta en películas oxobiodegradables e hidrobiodegradables. El segmento hidrobiodegradable dominó el mercado con una cuota de mercado de aproximadamente el 64,5 % en 2025, gracias al creciente apoyo regulatorio a los materiales compostables y de origen biológico que se degradan completamente sin dejar residuos microplásticos. Estas películas se utilizan ampliamente en el envasado de alimentos, la agricultura y los bienes de consumo, gracias a sus certificaciones de compostabilidad y a sus exigencias de sostenibilidad.

Se proyecta que el segmento oxobiodegradable crezca a un ritmo moderado, principalmente en mercados sensibles a los costos y en transición, donde aún se permiten los plásticos convencionales mezclados con aditivos. Sin embargo, se espera que el segmento hidrobiodegradable siga siendo el de mayor crecimiento entre 2026 y 2033, impulsado por prohibiciones más estrictas de plásticos, una mayor conciencia ambiental y la expansión de la infraestructura de compostaje industrial en Europa y Asia-Pacífico.

- Por tipo de cultivo

Por tipo de cultivo, el mercado de películas biodegradables se segmenta en frutas y verduras, cereales y oleaginosas, flores y plantas, y otros. El segmento de frutas y verduras dominó el mercado con una cuota estimada del 42,3 % en 2025, gracias al amplio uso de películas de acolchado biodegradables para la retención de humedad, el control de malezas, la regulación de la temperatura del suelo y la mejora del rendimiento de los cultivos. Los ciclos de cultivo cortos y la alta adopción de prácticas agrícolas sostenibles impulsan aún más la demanda en este segmento.

Se prevé que el segmento de Flores y Plantas crezca a la tasa de crecimiento anual compuesta (TCAC) más alta entre 2026 y 2033, impulsado por el auge de la floricultura comercial, el cultivo en invernadero y la demanda de soluciones de cultivo ecológicas. Se espera que el aumento de los incentivos gubernamentales para la agricultura sostenible y la creciente adopción de películas biodegradables en la horticultura aceleren el crecimiento en los mercados agrícolas, tanto en desarrollo como desarrollados.

- Por aplicación

Según su aplicación, el mercado se segmenta en envases para alimentos, agricultura y horticultura, productos cosméticos y de cuidado personal, envases industriales y otros. El segmento de envases para alimentos dominó el mercado con una participación del 46,8 % en 2025, impulsado por la creciente demanda de soluciones de envasado sostenibles, las estrictas regulaciones sobre plásticos de un solo uso y la sólida adopción por parte de las marcas de alimentos que buscan alternativas compostables. Las películas biodegradables se utilizan ampliamente en envoltorios, bolsas, bandejas y aplicaciones de etiquetado.

Se prevé que el segmento de Agricultura y Horticultura experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente adopción de películas de acolchado biodegradables, iniciativas de preservación de la salud del suelo y programas de agricultura sostenible respaldados por el gobierno. La creciente demanda de insumos agrícolas ecológicos continúa impulsando la expansión del mercado a largo plazo.

¿Qué región posee la mayor participación en el mercado de películas biodegradables?

- Arabia Saudita dominó el mercado de películas biodegradables de Medio Oriente y África con una participación líder en los ingresos del 32,25 % en 2025, impulsada por las crecientes iniciativas gubernamentales para reducir los desechos plásticos, la creciente adopción de envases sostenibles en los sectores alimentario y minorista y el aumento de las inversiones en la fabricación de materiales de base biológica.

- La creciente demanda de envases de alimentos ecológicos, películas agrícolas y bolsas de transporte para la venta minorista, respaldada por programas nacionales de sostenibilidad y políticas de reducción de residuos, está acelerando el uso de películas biodegradables en todo el Reino.

- Una sólida infraestructura industrial, la creciente participación del sector privado y las regulaciones ambientales respaldadas por el gobierno continúan reforzando el liderazgo de Arabia Saudita en el mercado de películas biodegradables de MEA.

Perspectiva del mercado de películas biodegradables de Sudáfrica

En Sudáfrica, la demanda constante de películas biodegradables se ve impulsada por la creciente concienciación sobre la contaminación plástica, la creciente aplicación de las normativas de responsabilidad extendida del productor (REP) y la creciente adopción de envases sostenibles en los sectores de alimentación, bebidas y comercio minorista. Las películas biodegradables se utilizan cada vez más en envoltorios de alimentos, bolsas de plástico, etiquetas y películas de acolchado agrícola, especialmente en la agricultura comercial y la agricultura de exportación. La creciente inversión en la producción local de envases biodegradables, sumada a las iniciativas de sostenibilidad corporativa de los principales minoristas, está impulsando la expansión del mercado. Las mejoras en los sistemas de gestión de residuos y el desarrollo gradual de la infraestructura de compostaje impulsan aún más el crecimiento estable del mercado sudafricano de películas biodegradables.

Análisis del mercado egipcio de películas biodegradables

Se espera que Egipto registre la tasa de crecimiento anual compuesta (TCAC) más rápida del 11,58 % entre 2026 y 2033 en el mercado de películas biodegradables de Oriente Medio y África, impulsado por la rápida urbanización, el aumento del consumo de alimentos envasados y la mayor atención del gobierno a la sostenibilidad ambiental. La creciente adopción de películas biodegradables en envases de alimentos, aplicaciones agrícolas y productos de cuidado personal está impulsando la demanda. Las iniciativas gubernamentales que promueven materiales sostenibles, amplían la capacidad de fabricación local y aumentan la concienciación sobre la gestión de residuos plásticos están acelerando la penetración en el mercado. El aumento de las inversiones de las empresas regionales de envasado en películas biodegradables a base de PLA y almidón consolida aún más la posición de Egipto como un mercado de alto crecimiento en la región MEA.

¿Cuáles son las principales empresas en el mercado de películas biodegradables?

La industria de películas biodegradables está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- BASF SE (Alemania)

- GRUPO DE INDUSTRIAS TAGHLEEF (EAU)

- Película Shreejistretch (India)

- Polyplex Corporation Ltd. (India)

- STOROPACK HANS REICHENECKER GMBH (Alemania)

- Grafix Plastics (EE. UU.)

- Profol GmbH (Alemania)

- Walki Group Oy (Finlandia)

- BioBag Americas, Inc. (EE. UU.)

- AVERY DENNISON CORPORATION (EE. UU.)

- Cortec Corporation (EE. UU.)

- BI-AX International Inc. (EE. UU.)

- Grupo Futamura (Japón)

- Poysha Packaging Private Limited (India)

- Plastika Kritis SA (Grecia)

¿Cuáles son los desarrollos recientes en el mercado mundial de películas biodegradables?

- En septiembre de 2024, Pester Pac Automation colaboró con Solutum Technologies para presentar una innovadora película de embalaje ecológica diseñada para sustituir los materiales plásticos convencionales. Esta película biodegradable se descompone completamente en el suelo y el agua, sin dejar residuos microplásticos. Su excelente resistencia al desgarro permite el uso de material más fino, lo que se traduce en menores costes. Además, se integra a la perfección con los equipos de enfardado y sobreenvoltura de Pester, garantizando una mayor eficiencia operativa y sostenibilidad. Este avance supone un paso significativo hacia la reducción del impacto ambiental en las operaciones de envasado.

- En enero de 2024, CAMM Solutions presentó una película estirable biodegradable que ofrece un sustituto sostenible a las películas estirables de plástico convencionales utilizadas en logística y embalaje. Fabricada con una combinación de ingredientes naturales y formulaciones avanzadas de PVOH, la película iguala el rendimiento de las películas estirables tradicionales, eliminando al mismo tiempo la contaminación por microplásticos. Se disuelve rápidamente en la naturaleza, lo que la hace inocua si se libera al medio ambiente y proporciona una estabilización fiable para palés y mercancías transportadas. Este desarrollo refleja la creciente demanda de soluciones logísticas ecológicas.

- En febrero de 2022, SRF anunció sus planes de establecer una nueva planta de fabricación de película BOPP en Indore, India, centrada en la producción de películas biodegradables. La planta contribuirá a ampliar la disponibilidad de opciones de envasado sostenible en la región, apoyando la demanda nacional e internacional de soluciones de película respetuosas con el medio ambiente. Esta inversión pone de manifiesto el compromiso de SRF con el avance de la producción de película biodegradable en India.

- En octubre de 2021, Walki Group amplió su presencia en el mercado con la adquisición de Rollpack, reforzando así su capacidad en la producción de películas y soluciones de embalaje sostenibles. Esta adquisición amplía la oferta de películas biodegradables de Walki Group y consolida su posición como actor clave en el sector global de los embalajes ecológicos.

- En diciembre de 2021, investigadores de la Universidad de Harvard y la Universidad Tecnológica de Nanyang desarrollaron con éxito una nueva película biodegradable derivada de la proteína de maíz. Este avance ofrece una alternativa renovable y vegetal a las películas de plástico convencionales y se alinea con los crecientes esfuerzos para reducir los residuos plásticos. Esta innovación subraya el papel de la colaboración científica para impulsar avances en materiales sostenibles.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.