Middle East And Africa Aluminum Foil Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

1.89 Billion

USD

2.76 Billion

2024

2032

USD

1.89 Billion

USD

2.76 Billion

2024

2032

| 2025 –2032 | |

| USD 1.89 Billion | |

| USD 2.76 Billion | |

|

|

|

Segmentación del mercado de papel de aluminio en Oriente Medio y África, por producto (envoltorios de aluminio, bolsas, blísteres, tubos plegables, bandejas/contenedores, cápsulas, tapas laminadas, bolsas con revestimiento de aluminio, láminas de chocolate, sellos redondos de aluminio, otros), tipo (impreso, sin imprimir), grosor (0,07 mm, 0,09 mm, 0,2 mm, 0,4 mm), usuario final (alimentos, productos farmacéuticos, cosméticos, aislamiento, electrónica, muestreo geoquímico, componentes de automoción, otros): tendencias del sector y pronóstico hasta 2032.

Análisis del mercado del papel de aluminio

El papel de aluminio se utiliza en una amplia gama de productos en todo el mundo, debido a una mayor concienciación sobre la contaminación que generan los plásticos en el medio ambiente. Los clientes pueden usar papel de aluminio tanto en hornos tradicionales como con ventilador, lo que les permite elegir entre ambos. Además, protege las muestras de roca de los disolventes orgánicos mediante un sellado.

Tamaño del mercado del papel de aluminio

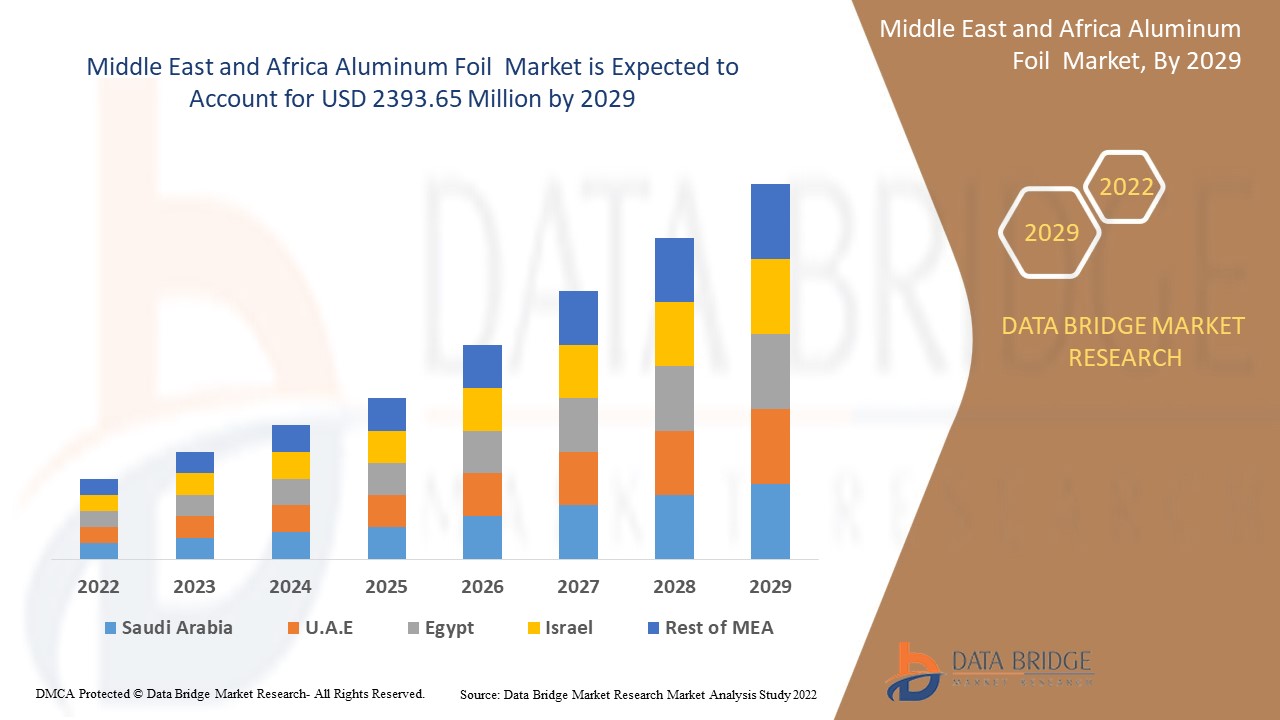

El tamaño del mercado de papel de aluminio de Medio Oriente y África se valoró en USD 1.89 mil millones en 2024 y se proyecta que alcance los USD 2.76 mil millones para 2032, con una CAGR del 4,84% durante el período de pronóstico de 2025 a 2032.

Alcance del informe y segmentación del mercado

|

Atributos |

Perspectivas clave del mercado del papel de aluminio |

|

Segmentación |

|

|

Países cubiertos |

Emiratos Árabes Unidos, Arabia Saudita, Egipto, Israel, Sudáfrica, Resto de Oriente Medio y África. |

|

Actores clave del mercado |

Amcor PLC (Suiza), Constantia Flexibles (Austria), Novelis Aluminum (EE. UU.), Raviraj Foils Ltd (India), Novelis Aluminum (EE. UU.), Ampco metal (Suiza), All hilal group (Arabia Saudita), Caterpack (Sudáfrica), Alcon (Suiza), Huyi Aluminum Co., Ltd. (EAU), Cosmoplast (EAU), Symetal (EE. UU.), Aluminum Foil Converters (Sudáfrica), UNIPACK (EE. UU.), Express Group (EAU), ERAMCO (Arabia Saudita) |

|

Oportunidades de mercado |

|

Definición del mercado del papel de aluminio

El papel de aluminio es un componente clave de los laminados y se encuentra comúnmente en envases de alimentos. Ofrece una mayor barrera contra la humedad, el oxígeno y otros gases, así como contra olores volátiles y la luz, que cualquier material laminado plástico. El papel de aluminio también se utiliza para fabricar envases esterilizados. El papel de aluminio ofrece numerosas ventajas a las industrias del envasado y la alimentación, así como al consumidor, como su facilidad de uso y su reciclabilidad.

Dinámica del mercado del papel de aluminio

Conductores

- Aumento de las iniciativas gubernamentales para difundir la concienciación del consumidor

El mercado está siendo impulsado por la creciente demanda de papel de aluminio por parte de usuarios finales como alimentos, productos farmacéuticos y cosméticos como resultado de mayores acciones gubernamentales para promover la conciencia sobre la seguridad alimentaria.

- Normas y regulaciones estrictas en materia de seguridad alimentaria

Las normas gubernamentales que rigen la seguridad alimentaria y los estándares de calidad han impulsado el auge del negocio nacional del papel de aluminio, alentando a los productores a desarrollar soluciones de envasado eficaces que eviten la contaminación de los alimentos.

- Aumentar la demanda del comercio electrónico

Es probable que la dinámica cambiante del sector minorista impulse la demanda de diferentes productos, impulsando así el crecimiento de los envases listos para usar. Además, el desarrollo del comercio electrónico ha desplazado a los consumidores de las tiendas físicas a las tiendas en línea. Es probable que la industria alimentaria en línea siga siendo un mercado clave para los productos de papel de aluminio.

- Creciente demanda de productos biológicos

Se espera que el desarrollo de la biotecnología y la creciente demanda de productos biológicos impulsen la demanda de papel de aluminio en productos como polvos, líquidos y tabletas.

Oportunidades

- Aumento de las innovaciones de productos

El creciente desarrollo de productos mejorará la tasa de crecimiento de la industria al crear nuevas oportunidades de mercado. El aluminio es un material reciclable que representa una oportunidad lucrativa para los fabricantes, ya que el aumento de las tasas de recolección y recuperación del producto se traduce en un menor costo de producción y una mayor rentabilidad.

- Demanda de producción de paquetes ligeros

El uso de papel de aluminio, junto con películas flexibles, para producir envases ligeros está aumentando a un ritmo considerable. Es probable que esto ofrezca nuevas oportunidades a los vendedores del mercado a corto plazo. Estos envases pueden utilizarse en el envasado de alimentos, café y pescado.

Restricciones/ Desafíos

El mercado global está creciendo enormemente. Sin embargo, existen algunas dificultades para su crecimiento. Estas dificultades incluyen la falta de técnicas de envasado adecuadas. Algunos países aún se aferran a los métodos tradicionales. Debido al cambio en el estilo de vida de las personas, una parte significativa del mundo aún no tiene suficiente dinero para comprar alimentos envasados. Estas son las principales limitaciones del mercado que obstaculizarán su crecimiento.

Este informe sobre el mercado del papel de aluminio proporciona detalles sobre los últimos desarrollos, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, cuota de mercado, impacto de los actores del mercado nacional y local, análisis de oportunidades en cuanto a nuevas fuentes de ingresos, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimiento de la categoría, nichos de aplicación y dominio, aprobaciones y lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado del papel de aluminio, contacte con Data Bridge Market Research para obtener un informe analítico. Nuestro equipo le ayudará a tomar decisiones informadas para impulsar el crecimiento del mercado.

Alcance del mercado del papel de aluminio

El mercado del papel de aluminio está segmentado según productos, tipos, grosores y usuarios finales. El crecimiento de estos segmentos le ayudará a analizar los segmentos con menor crecimiento en las industrias y proporcionará a los usuarios una valiosa visión general del mercado y perspectivas que les ayudarán a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Productos

- Envoltorios de papel de aluminio

- Bolsas

- Paquetes blíster

- Tubos plegables

- Bandejas/Contenedores

- Cápsulas

- Tapas laminadas

- Bolsas forradas con papel de aluminio

- Láminas de chocolate

- Sellos redondos de aluminio

- Otros

Tipo

- Impreso

- Sin imprimir

Espesor

- 0,07 mm

- 0,09 mm

- 0,2 mm

- 0,4 mm

Usuario final

- Alimento

- productos farmacéuticos

- Productos cosméticos

- Aislamiento

- Electrónica

- Muestreo geoquímico

- Componentes automotrices

- Otros

Análisis regional del mercado del papel de aluminio

Se analiza el mercado del papel de aluminio y se proporcionan información y tendencias del tamaño del mercado por país, productos, tipos, espesor y usuario final como se menciona anteriormente.

Los países cubiertos en el informe del mercado de papel de aluminio son Emiratos Árabes Unidos, Arabia Saudita, Egipto, Israel, Sudáfrica, resto de Medio Oriente y África.

La sección de países del informe también presenta los factores que impactan cada mercado y los cambios en la regulación del mercado que impactan las tendencias actuales y futuras. Datos como el análisis de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de caso son algunos de los indicadores utilizados para pronosticar el escenario del mercado en cada país. Además, se consideran la presencia y disponibilidad de marcas globales y los desafíos que enfrentan debido a la alta o escasa competencia de marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales, al proporcionar un análisis de pronóstico de los datos nacionales.

Cuota de mercado del papel de aluminio

El panorama competitivo del mercado del papel de aluminio ofrece detalles por competidor. Se incluye información general de la empresa, sus estados financieros, ingresos generados, potencial de mercado, inversión en investigación y desarrollo, nuevas iniciativas de mercado, presencia global, plantas de producción, capacidad de producción, fortalezas y debilidades de la empresa, lanzamiento de productos, alcance y variedad de productos, y dominio de aplicaciones. Los datos anteriores se refieren únicamente al enfoque de las empresas en el mercado del papel de aluminio.

Los líderes del mercado de papel de aluminio que operan en el mercado son:

- Amcor PLC (Suiza)

- Constantia Flexibles (Austria)

- Novelis Aluminio (EE. UU.)

- Raviraj Foils Ltd (India)

- Novelis Aluminio (EE. UU.)

- Ampco metal (Suiza)

- Grupo All Hilal (Arabia Saudita)

- Caterpack (Sudáfrica)

- Alcon (Suiza)

- Huyi Aluminum Co., Ltd. (EAU)

- Cosmoplast (EAU)

- Symetal (EE. UU.)

- Convertidores de papel de aluminio (Sudáfrica)

- UNIPACK (EE. UU.)

- Express Group (EAU)

- ERAMCO (Arabia Saudita)

Últimos avances en el mercado del papel de aluminio

- En noviembre de 2021, ProAmpac anunció que su empresa matriz, IFP Investments Limited, había desarrollado Irish Flexible Packaging y Fispak. Se trata de productores y proveedores irlandeses de envases flexibles y sostenibles que atienden a los mercados de pescado, lácteos, panadería, carne y queso en Irlanda y a nivel mundial.

- En septiembre de 2021, Flex Films, la división de fabricación de películas de la empresa de envases flexibles Uflex, lanzó su película BOPET de alta barrera F-UHB-M. Esta película está diseñada para reemplazar el papel de aluminio en aplicaciones de envases flexibles y resolver problemas de la industria que presentan deficiencias en la integridad, disponibilidad de materiales y altos precios, entre otros. Estas alternativas en el mercado pueden llevar a la producción de alimentos a sustituir el papel de aluminio para envasar sus productos, lo que se prevé que desafíe el crecimiento del mercado.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 SECONDARY SOURCES

2.15 MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET: RESEARCH SNAPSHOT

2.16 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO (BY COUNTRY)

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

5.8.1 PRODUCT CODES

5.8.2 CERTIFIED STANDARDS

5.8.3 SAFETY STANDARDS

5.8.3.1. MATERIAL HANDLING & STORAGE

5.8.3.2. TRANSPORT & PRECAUTIONS

5.8.3.3. HARAD IDENTIFICATION

6 PRICING ANALYSIS

7 SUPPLY CHAIN ANALYSIS

7.1 OVERVIEW

7.2 LOGISTIC COST SCENARIO

7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

8 CLIMATE CHANGE SCENARIO

8.1 ENVIRONMENTAL CONCERNS

8.2 INDUSTRY RESPONSE

8.3 GOVERNMENT’S ROLE

8.4 ANALYST RECOMMENDATIONS

9 PRODUCTION CAPACITY OUTLOOK

10 MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

10.1 OVERVIEW

10.2 FOIL WRAPPERS

10.2.1 FOOD PACKAGING

10.2.2 PHARMACEUTICAL PACKAGING

10.2.3 COSMETIC PACKAGING

10.3 POUCHES

10.3.1 STAND-UP POUCHES

10.3.2 FLAT POUCHES

10.3.3 OTHERS

10.4 BLISTER PACKS

10.4.1 PHARMACEUTICAL BLISTERS

10.4.1.1. TABLET BLISTERS

10.4.1.2. CAPSULE BLISTERS

10.4.1.3. MEDICINE STRIPS

10.4.1.4. OTHERS

10.4.2 CONSUMER GOODS BLISTERS

10.4.3 OTHERS

10.5 COLLAPSIBLE TUBES

10.5.1 COSMETIC TUBES

10.5.2 PHARMACEUTICAL TUBES

10.5.3 FOOD TUBES

10.5.4 OTHERS

10.6 TRAYS/CONTAINERS

10.6.1 FOOD TRAYS

10.6.2 MEDICAL TRAYS

10.6.3 OTHERS

10.7 CAPSULES

10.7.1 PHARMACEUTICAL CAPSULES

10.7.2 NUTRACEUTICAL CAPSULES

10.7.3 OTHERS

10.8 LAMINATED LIDS

10.8.1 FOOD LIDS

10.8.2 PHARMACEUTICAL LIDS

10.8.3 OTHERS

10.9 FOIL LINED BAGS

10.9.1 FOOD BAGS

10.9.2 ELECTRONICS BAGS

10.9.3 OTHERS

10.1 CHOCOLATE FOILS

10.10.1 WRAPPED CHOCOLATES

10.10.2 CONFECTIONERY PACKAGING

10.10.3 OTHERS

10.11 FOIL ROUND SEALS

10.11.1 FOOD SEALS

10.11.2 PHARMACEUTICAL SEALS

10.12 OTHERS

11 MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET, BY TYPE, 2018-2032 (USD MILLION)

11.1 OVERVIEW

11.2 PRINTED ALUMINUM FOIL

11.3 UNPRINTED ALUMINUM FOIL

12 MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET, BY THICKNESS, 2018-2032 (USD MILLION)

12.1 OVERVIEW

12.2 0.07 MM

12.3 0.09 MM

12.4 0.2 MM

12.5 0.4 MM

12.6 OTHERS

13 MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

13.1 OVERVIEW

13.2 PACKAGING

13.2.1 PACKAGING, BY CATEGORY

13.2.1.1. INDUSTRIAL

13.2.1.2. CONSUMER

13.2.2 PACKAGING, BY VERTICAL

13.2.2.1. FOOD PACKAGING

13.2.2.1.1. READY-TO-EAT MEALS

13.2.2.1.2. SNACK PACKAGING

13.2.2.1.2.1 CHIPS

13.2.2.1.2.2 POPCORN

13.2.2.1.2.3 OTHERS

13.2.2.1.3. CONFECTIONERY PACKAGING

13.2.2.1.3.1 CHOCOLATES

13.2.2.1.3.2 CANDIES

13.2.2.1.3.3 OTHERS

13.2.2.1.4. BAKERY PACKAGING

13.2.2.1.4.1 CAKES

13.2.2.1.4.2 PASTRIES

13.2.2.1.4.3 TARTS

13.2.2.1.4.4 OTHERS

13.2.2.1.5. FRESH PRODUCE PACKAGING

13.2.2.1.5.1 FRUITS

13.2.2.1.5.2 VEGETABLES

13.2.2.1.5.3 SEA FOOD

13.2.2.1.5.4 OTHERS

13.2.2.1.6. FROZEN FOOD PACKAGING

13.2.2.1.7. PROCESSED FOOD PACKAGING

13.2.2.1.8. OTHERS

13.2.2.2. PHARMACEUTICAL PACKAGING

13.2.2.2.1. BLISTER PACKS FOR TABLETS & CAPSULES

13.2.2.2.2. LIQUID MEDICINE PACKAGING (SYRUPS)

13.2.2.2.3. SACHETS FOR SINGLE-DOSE MEDICATIONS

13.2.2.2.4. OINTMENT AND CREAM TUBES

13.2.2.2.5. OTHERS

13.2.2.3. COSMETICS AND PERSONAL CARE

13.2.2.3.1. SKINCARE TUBES AND JARS

13.2.2.3.2. HAIRCARE PACKAGING

13.2.2.3.3. COSMETIC SAMPLE PACKAGING

13.2.2.3.4. TOOTHPASTE PACKAGING

13.2.2.3.5. DEODORANT STICK PACKAGING

13.2.2.3.6. OTHERS

13.2.2.4. BEVERAGE PACKAGING

13.2.2.4.1. BEVERAGE CANS

13.2.2.4.2. DRINK POUCHES

13.2.2.4.3. OTHERS

13.2.2.5. AGRICULTURAL PACKAGING

13.2.2.5.1. SEED PACKAGING

13.2.2.5.2. FERTILIZER BAGS

13.2.2.5.3. ORGANIC PRODUCT PACKAGING

13.2.2.5.4. OTHERS

13.2.2.6. ELECTRONICS PACKAGING

13.2.2.6.1. ANTISTATIC BAGS FOR COMPONENTS

13.2.2.6.2. PROTECTIVE ALUMINUM FOIL WRAPPING

13.2.2.6.3. OTHERS

13.2.2.7. AUTOMOTIVE PACKAGING

13.2.2.7.1. HEAT SHIELDS FOR ENGINES

13.2.2.7.2. SOUNDPROOFING PANELS FOR VEHICLES

13.2.2.7.3. OTHERS

13.2.2.8. OTHERS

13.3 INSULATION

13.3.1 THERMAL INSULATION

13.3.1.1. BUILDING INSULATION

13.3.1.1.1. WALLS

13.3.1.1.2. ROOFS

13.3.1.1.3. OTHERS

13.3.1.2. INDUSTRIAL INSULATION

13.3.1.2.1. PIPES

13.3.1.2.2. BOILERS

13.3.1.2.3. OTHERS

13.3.1.3. AUTOMOTIVE THERMAL INSULATION

13.3.1.4. OTHERS

13.3.2 ACOUSTIC INSULATION

13.3.2.1. SOUNDPROOFING FOR BUILDINGS

13.3.2.2. AUTOMOTIVE SOUND INSULATION

13.3.2.3. OTHERS

13.4 ELECTRONICS AND ELECTRICAL APPLICATIONS

13.4.1 ELECTRONICS INSULATION

13.4.1.1. CIRCUIT BOARDS PROTECTION

13.4.1.2. POWER CABLES INSULATION

13.4.1.3. OTHERS

13.4.2 ELECTRICAL SHIELDING

13.4.2.1. ELECTROMAGNETIC INTERFERENCE (EMI) SHIELDING

13.4.2.2. ELECTRICAL WIRING INSULATION

13.5 INDUSTRIAL APPLICATIONS

13.5.1 FOIL FOR INDUSTRIAL USES

13.5.1.1. RAW MATERIAL PACKAGING

13.5.1.2. BULK PRODUCT PACKAGING

13.5.1.3. PROTECTIVE FILM FOR MANUFACTURING

13.5.1.4. OTHERS

13.5.2 AUTOMOTIVE COMPONENTS

13.5.2.1. HEAT SHIELDS FOR EXHAUST SYSTEMS

13.5.2.2. SOUND INSULATION FOR VEHICLE INTERIORS

13.5.2.3. OTHERS

13.6 OTHERS

14 MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET, BY GEOGRAPHY, 2018-2032 (USD MILLION) (MILLION UNITS)

14.1 MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

14.2 MIDDLE EAST AND AFRICA

14.2.1 SOUTH AFRICA

14.2.2 EGYPT

14.2.3 SAUDI ARABIA

14.2.4 UNITED ARAB EMIRATES

14.2.5 ISRAEL

14.2.6 QATAR

14.2.7 OMAN

14.2.8 KUWAIT

14.2.9 BAHRAIN

14.2.10 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

15.2 MERGERS AND ACQUISITIONS

15.3 NEW PRODUCT DEVELOPMENT AND APPROVALS

15.4 EXPANSIONS

15.5 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

16 MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET - SWOT ANALYSIS

17 MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET - COMPANY PROFILES

17.1 AMCOR PLC

17.1.1 COMPANY SNAPSHOT

17.1.2 PRODUCT PORTFOLIO

17.1.3 REVENUE ANALYSIS

17.1.4 RECENT UPDATES

17.2 CONSTANTIA FLEXIBLES

17.2.1 COMPANY SNAPSHOT

17.2.2 PRODUCT PORTFOLIO

17.2.3 REVENUE ANALYSIS

17.2.4 RECENT UPDATES

17.3 ERAMCO

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 REVENUE ANALYSIS

17.3.4 RECENT UPDATES

17.4 RAVIRAJ FOILS LIMITED

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 REVENUE ANALYSIS

17.4.4 RECENT UPDATES

17.5 CATERPACK

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 REVENUE ANALYSIS

17.5.4 RECENT UPDATES

17.6 ALUMINIUM FOIL CONVERTERS (PTY) LTD

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 REVENUE ANALYSIS

17.6.4 RECENT UPDATES

17.7 SYMETAL

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 REVENUE ANALYSIS

17.7.4 RECENT UPDATES

17.8 COSMOPLAST UAE

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 REVENUE ANALYSIS

17.8.4 RECENT UPDATES

17.9 EXPRESS GROUP

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 REVENUE ANALYSIS

17.9.4 RECENT UPDATES

17.1 UACJ CORPORATION

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 REVENUE ANALYSIS

17.10.4 RECENT UPDATES

17.11 ZHENGZHOU EMING ALUMINIUM INDUSTRY CO., LTD.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 REVENUE ANALYSIS

17.11.4 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

18 RELATED REPORTS

19 QUESTIONNAIRE

20 CONCLUSION

21 ABOUT DATA BRIDGE MARKET RESEARCH

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.