Middle East And Africa Aluminum Casting Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

4.60 Billion

USD

7.91 Billion

2024

2032

USD

4.60 Billion

USD

7.91 Billion

2024

2032

| 2025 –2032 | |

| USD 4.60 Billion | |

| USD 7.91 Billion | |

|

|

|

|

Segmentación del mercado de fundición de aluminio en Oriente Medio y África por proceso (fundición en molde desechable y fundición en molde no desechable), fuente (primaria [aluminio nuevo] y secundaria [aluminio reciclado]), aplicación (colectores de admisión, carcasas de cárter de aceite, piezas estructurales, piezas de chasis, culatas, bloques de motor, transmisiones, ruedas y frenos, transferencia de calor y otros), usuario final (automoción, construcción, industria, electrodomésticos, aeroespacial, electrónica y electricidad, herramientas de ingeniería y otros) - Tendencias del sector y previsiones hasta 2032.

Tamaño del mercado de fundición de aluminio en Oriente Medio y África

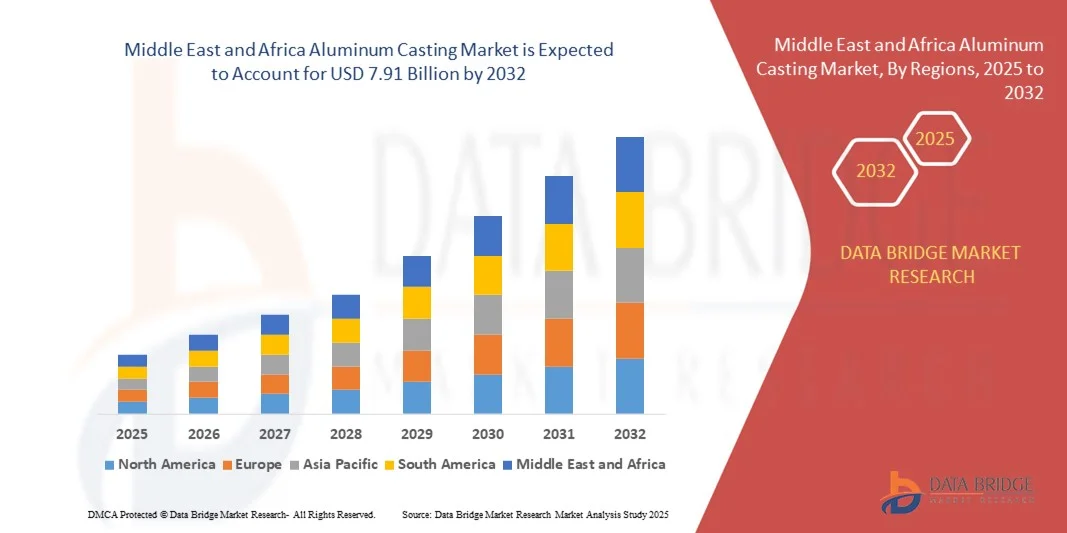

- El tamaño del mercado de fundición de aluminio de Oriente Medio y África se valoró en 4.600 millones de dólares en 2024 y se prevé que alcance los 7.910 millones de dólares en 2032 , con una tasa de crecimiento anual compuesta (TCAC) del 7,00% durante el período de previsión.

- El crecimiento del mercado se debe principalmente al aumento de la industrialización, la expansión de los sectores automotriz y de la construcción, y la creciente demanda de componentes ligeros y de alto rendimiento en diversas aplicaciones.

- Además, los avances en las tecnologías de fundición, junto con el enfoque en prácticas de fabricación sostenibles y soluciones energéticamente eficientes, están impulsando su adopción tanto en mercados consolidados como emergentes. Estos factores combinados están acelerando la adopción de soluciones de fundición de aluminio, lo que impulsa significativamente el crecimiento del sector.

Análisis del mercado de fundición de aluminio en Oriente Medio y África

- Las piezas fundidas de aluminio, que proporcionan componentes ligeros y de alta resistencia para aplicaciones automotrices, de construcción e industriales, son cada vez más importantes en la fabricación moderna debido a su durabilidad, resistencia a la corrosión y adaptabilidad a diseños complejos.

- La creciente demanda de fundición de aluminio se debe principalmente al crecimiento del sector automotriz, la expansión de las actividades de construcción y la necesidad de soluciones ligeras y energéticamente eficientes en diversas aplicaciones industriales.

- Los Emiratos Árabes Unidos dominaron el mercado de fundición de aluminio de Oriente Medio y África con la mayor cuota de ingresos, un 37,2%, en 2024, gracias a una importante infraestructura industrial, inversiones en los sectores automotriz y aeroespacial, y la presencia de fabricantes clave de fundición, especialmente en países como los Emiratos Árabes Unidos y Arabia Saudita, donde la demanda de componentes de aluminio de alto rendimiento está aumentando.

- Se prevé que Arabia Saudita sea la región de mayor crecimiento en el mercado de fundición de aluminio de Oriente Medio y África durante el período de pronóstico, debido a la rápida industrialización, el desarrollo de infraestructuras y el aumento de la producción automotriz en países como Sudáfrica y Nigeria.

- El segmento de fundición en moldes desechables dominó el mercado con la mayor cuota de ingresos, un 57,4%, en 2024, impulsado por su idoneidad para producir geometrías complejas, componentes ligeros y piezas de alto rendimiento en aplicaciones automotrices e industriales.

Alcance del informe y segmentación del mercado de fundición de aluminio en Oriente Medio y África

|

Atributos |

Información clave del mercado de fundición de aluminio |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Oriente Medio y África

|

|

Principales actores del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de datos de valor añadido |

Además de información sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y principales actores, los informes de mercado elaborados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de cuota de mercado de marcas, encuestas a consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de fundición de aluminio en Oriente Medio y África

Avances en componentes de aluminio ligeros y de alto rendimiento

- Una tendencia significativa y en auge en el mercado de fundición de aluminio de Oriente Medio y África es la creciente adopción de componentes de aluminio ligeros y de alto rendimiento en aplicaciones automotrices, aeroespaciales e industriales. Este cambio se debe a la necesidad de mejorar la eficiencia del combustible, reducir las emisiones y optimizar el rendimiento estructural.

- Por ejemplo, los fabricantes de automóviles utilizan cada vez más bloques de motor, componentes de chasis y paneles de carrocería de aluminio para reducir el peso de los vehículos sin comprometer su resistencia ni durabilidad. Del mismo modo, las empresas aeroespaciales integran piezas de aluminio fundido en componentes estructurales para optimizar el peso sin comprometer la seguridad ni el rendimiento.

- Los avances en tecnologías de fundición, como la fundición a presión y la fundición al vacío, permiten la producción de geometrías complejas con tolerancias ajustadas y acabados superficiales superiores. Estas innovaciones mejoran el rendimiento y la fiabilidad de los componentes, a la vez que reducen el tiempo de producción y el desperdicio de material.

- El creciente interés por las prácticas de fabricación sostenibles también está impulsando su adopción, ya que el aluminio es altamente reciclable y puede reutilizarse sin una pérdida significativa de sus propiedades. Esto se alinea con las regulaciones ambientales globales y los objetivos de sostenibilidad corporativa, particularmente en las regiones de rápida industrialización de Oriente Medio y África.

- Empresas como Emirates Global Aluminium y SABIC están desarrollando aleaciones de aluminio de alta resistencia y soluciones de fundición avanzadas adaptadas a los sectores automotriz, de la construcción y aeroespacial, que contribuyen tanto a la optimización del rendimiento como a la sostenibilidad ambiental.

- La demanda de piezas fundidas de aluminio ligeras, duraderas y eficientes se está expandiendo rápidamente en Oriente Medio y África, impulsada por el crecimiento industrial, los proyectos de infraestructura y el creciente énfasis en las prácticas de fabricación energéticamente eficientes y ambientalmente responsables .

Dinámica del mercado de fundición de aluminio en Oriente Medio y África

Conductor

El aumento de la demanda está impulsado por la expansión industrial y la adopción de materiales ligeros.

- La rápida industrialización en Oriente Medio y África, junto con la creciente demanda de los sectores automotriz, de la construcción y aeroespacial, es un factor importante para el aumento del uso de piezas fundidas de aluminio.

- Por ejemplo, en 2024, Emirates Global Aluminium amplió su capacidad de producción para satisfacer la creciente demanda de componentes de aluminio ligeros y de alta resistencia para la industria automotriz y de la construcción. Se prevé que estas iniciativas de empresas clave impulsen el crecimiento del mercado de fundición de aluminio durante el período de pronóstico.

- A medida que los fabricantes dan mayor prioridad a la eficiencia del combustible, la reducción del peso estructural y la mejora del rendimiento, las piezas fundidas de aluminio ofrecen una solución versátil en comparación con materiales tradicionales más pesados como el acero. Las piezas fundidas avanzadas ofrecen durabilidad, resistencia a la corrosión y flexibilidad de diseño, lo que las hace ideales para aplicaciones de alto rendimiento.

- Además, el desarrollo continuo de edificios inteligentes y energéticamente eficientes, junto con los proyectos de infraestructura en los mercados emergentes, está impulsando la adopción de piezas de aluminio fundido en aplicaciones estructurales y arquitectónicas, donde tanto la resistencia como la ligereza son esenciales.

- La demanda de componentes de ingeniería de precisión, incluidas piezas de motores de automóviles, chasis y maquinaria industrial, está impulsando aún más el crecimiento, respaldado por los avances en la fundición a presión, la fundición asistida por vacío y otras tecnologías de producción modernas.

Restricción/Desafío

Altos costes de producción y requisitos de habilidades técnicas

- La inversión inicial relativamente alta que se requiere para las instalaciones, maquinaria y tecnología avanzadas de fundición de aluminio puede suponer un reto para los fabricantes pequeños y medianos de la región.

- Por ejemplo, la instalación de líneas de fundición a presión de alta precisión o la adopción de técnicas de fundición asistida por vacío implican un gasto de capital sustancial y la capacitación de mano de obra calificada, lo que puede limitar la penetración en el mercado en áreas en desarrollo.

- Además, mantener una calidad constante en las piezas de aluminio fundido exige conocimientos técnicos especializados y controles de proceso rigurosos. Las variaciones en la composición de la aleación, la temperatura y las velocidades de enfriamiento pueden afectar al rendimiento y la fiabilidad de los productos finales, lo que supone un reto para los fabricantes con experiencia o recursos limitados.

- Si bien la automatización y las modernas tecnologías de fundición están reduciendo gradualmente las necesidades de mano de obra y mejorando la eficiencia, la necesidad de personal capacitado y procesos de control de calidad sigue siendo una barrera crítica.

- Superar estos desafíos mediante la inversión en tecnologías de fundición avanzadas, la capacitación de la fuerza laboral y la optimización de procesos será vital para el crecimiento sostenido y la competitividad en el mercado de fundición de aluminio de Oriente Medio y África.

Alcance del mercado de fundición de aluminio en Oriente Medio y África

El mercado de fundición de aluminio de Oriente Medio y África se segmenta en función del proceso, la fuente, la aplicación y el usuario final.

- Por proceso

Según el proceso, el mercado de fundición de aluminio en Oriente Medio y África se divide en fundición con molde desechable y fundición con molde no desechable. El segmento de fundición con molde desechable dominó el mercado con la mayor cuota de ingresos, un 57,4 % en 2024, gracias a su idoneidad para producir geometrías complejas, componentes ligeros y piezas de alto rendimiento para aplicaciones automotrices e industriales. Los fabricantes prefieren los procesos con molde desechable por su capacidad para minimizar los requisitos de mecanizado y ofrecer flexibilidad de diseño.

Se prevé que el segmento de fundición en moldes no consumibles experimente la tasa de crecimiento anual compuesto (TCAC) más rápida, del 19,8%, entre 2025 y 2032, impulsada por la creciente demanda de soluciones de moldes reutilizables y rentables, especialmente en escenarios de producción de volumen medio a alto, donde la durabilidad, la repetibilidad y los menores costes operativos la convierten en una opción atractiva.

- Por fuente

Según su origen, el mercado se divide en aluminio primario (aluminio virgen) y secundario (aluminio reciclado). El segmento de aluminio primario representó la mayor cuota de ingresos, con un 62,1 % en 2024, impulsado por el suministro constante de aluminio de alta calidad y sus excelentes propiedades mecánicas, necesarias para aplicaciones críticas como componentes de motores, piezas de chasis y maquinaria industrial. El creciente desarrollo industrial y la producción automotriz en la región respaldan esta demanda.

Se prevé que el segmento del aluminio secundario experimente la mayor tasa de crecimiento anual compuesto (TCAC) del 21,5 % entre 2025 y 2032, impulsada por una creciente conciencia ambiental, las iniciativas gubernamentales que promueven el reciclaje y las ventajas en costos. El uso de aluminio reciclado está aumentando en la construcción, la automoción y los bienes de consumo debido a sus beneficios en eficiencia energética y sostenibilidad.

- Mediante solicitud

Según su aplicación, el mercado de fundición de aluminio en Oriente Medio y África se segmenta en colectores de admisión, carcasas de cárter de aceite, piezas estructurales, piezas de chasis, culatas, bloques de motor, transmisiones, ruedas y frenos, sistemas de transferencia de calor y otros. El segmento de piezas estructurales dominó el mercado con una cuota de ingresos del 38,7 % en 2024, debido a su uso generalizado en aplicaciones de automoción y construcción que requieren componentes ligeros pero duraderos.

Se prevé que el segmento de ruedas y frenos experimente la tasa de crecimiento anual compuesto (TCAC) más rápida, del 20,3%, entre 2025 y 2032, impulsada por el aumento de la producción de vehículos, el impulso hacia la eficiencia del combustible y la creciente adopción de aleaciones de aluminio ligeras para mejorar el rendimiento y reducir las emisiones.

- Por el usuario final

Según el usuario final, el mercado de fundición de aluminio en Oriente Medio y África se segmenta en automoción, construcción, industria, electrodomésticos, aeroespacial, electrónica y electricidad, herramientas de ingeniería y otros. El segmento de automoción representó la mayor cuota de ingresos, con un 45,6 % en 2024, impulsado por la demanda de componentes ligeros y de alta resistencia, las exigencias normativas para la reducción de emisiones y la proliferación de vehículos eléctricos.

Se prevé que el segmento aeroespacial experimente la tasa de crecimiento anual compuesto (TCAC) más rápida, del 22,1%, entre 2025 y 2032, debido a la creciente adopción de piezas fundidas de aluminio en componentes de aeronaves para la optimización del peso, la eficiencia del combustible y la mejora del rendimiento, junto con el crecimiento de las actividades de aviación comercial y de defensa en la región.

Análisis regional del mercado de fundición de aluminio en Oriente Medio y África

- Los Emiratos Árabes Unidos dominaron el mercado de fundición de aluminio con la mayor cuota de ingresos, un 37,2%, en 2024, impulsados por la rápida industrialización, la expansión de los sectores automotriz y de la construcción, y la creciente demanda de componentes ligeros y de alto rendimiento.

- Los fabricantes y usuarios finales de la región prefieren cada vez más las piezas fundidas de aluminio por su relación resistencia-peso, su resistencia a la corrosión y su versatilidad en aplicaciones automotrices, industriales y de construcción.

- Esta adopción generalizada se ve respaldada además por iniciativas gubernamentales que promueven la fabricación sostenible, avances en las tecnologías de fundición y crecientes inversiones en soluciones energéticamente eficientes, lo que consolida la fundición de aluminio como una opción preferida tanto para las industrias establecidas como para los mercados emergentes de Oriente Medio y África.

Perspectivas del mercado de fundición de aluminio en Arabia Saudita

El mercado de fundición de aluminio de Arabia Saudita captó una importante cuota de ingresos en 2024, impulsado por los proyectos de infraestructura a gran escala del país, la expansión de la producción automotriz y las iniciativas gubernamentales para diversificar el sector industrial. La demanda de componentes de aluminio ligeros y de alto rendimiento para la construcción, el transporte y la maquinaria industrial está impulsando el crecimiento del mercado. Además, la adopción de tecnologías de fundición avanzadas y el enfoque en prácticas de fabricación sostenibles y energéticamente eficientes están acelerando aún más la expansión del mercado.

Perspectivas del mercado de fundición de aluminio en los EAU

Se prevé que el mercado de fundición de aluminio de los EAU experimente un crecimiento sustancial durante el período de pronóstico, impulsado por la rápida urbanización, el aumento de la construcción comercial y residencial, y las inversiones en los sectores aeroespacial, de defensa y automotriz. El uso de piezas de fundición de aluminio de alta calidad en edificios modernos, vehículos y equipos industriales, junto con los avances tecnológicos en los procesos de producción, está impulsando la adopción en el mercado. Las iniciativas gubernamentales que apoyan la innovación industrial y la eficiencia energética también contribuyen al crecimiento.

Perspectivas del mercado de fundición de aluminio en Sudáfrica

Se prevé que el mercado de fundición de aluminio en Sudáfrica crezca de forma sostenida, impulsado por la fabricación de automóviles, la producción de maquinaria industrial y la fabricación de equipos mineros. La creciente demanda de componentes de aluminio ligeros y resistentes a la corrosión, junto con los esfuerzos gubernamentales por modernizar la base industrial, está fomentando su adopción en los sectores automotriz, de la construcción e industrial. La inversión en tecnologías de fundición avanzadas y una mayor eficiencia energética respaldan aún más la expansión del mercado.

Perspectivas del mercado egipcio de fundición de aluminio

Se prevé que el mercado egipcio de fundición de aluminio experimente un notable crecimiento anual compuesto durante el período de pronóstico, impulsado por el desarrollo de infraestructura, el auge del ensamblaje automotriz y las inversiones en proyectos de construcción y energía. La creciente demanda de componentes de aluminio duraderos y ligeros para aplicaciones estructurales, mecánicas y automotrices está impulsando la adopción de esta tecnología en el mercado. La integración de prácticas de fabricación sostenibles y avances tecnológicos en la fundición está impulsando aún más el crecimiento del mercado.

Cuota de mercado de fundición de aluminio en Oriente Medio y África

La industria de la fundición de aluminio está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

• Plantas laminadoras de aluminio del Golfo (EAU)

• Sabic (Arabia Saudita)

• Emirates Global Aluminium (EAU)

• Alcoa (EE. UU.)

• Noranda Aluminum (Canadá)

• Constellium (Francia)

• Industrias Hindalco (India)

• China Zhongwang Holdings (China)

• Novelis (EE. UU.)

• ElvalHalcor (Grecia)

• Mubadala Aluminium (EAU)

• Productos de acero Al Jazeera (Qatar)

• Aluminio Bahréin (Bahréin)

• Compañía Nacional de Productos de Aluminio (Arabia Saudita)

• Maaden Aluminio (Arabia Saudita)

• Sundwiger Aluminium (Alemania)

• AAI (Industrias Africanas del Aluminio) (Sudáfrica)

• Metallum (Sudáfrica)

• Alumeco (EAU)

• Laminación de aluminio en Bahréin (Bahréin)

¿Cuáles son los últimos avances en el mercado de fundición de aluminio en Oriente Medio y África?

- En abril de 2023, Emirates Global Aluminium (EGA), productor líder de aluminio en los EAU, anunció la ampliación de sus avanzadas instalaciones de fundición de aluminio para satisfacer la creciente demanda en los sectores de la automoción y la construcción. Esta iniciativa se centra en el suministro de componentes de aluminio de alta calidad, ligeros y energéticamente eficientes, lo que subraya el compromiso de EGA con la innovación y las prácticas de fabricación sostenibles en la región de Oriente Medio y África.

- En marzo de 2023, South African Foundries Ltd. lanzó una nueva línea de piezas fundidas de aluminio de precisión, diseñadas para maquinaria industrial y aplicaciones automotrices. Este desarrollo estratégico subraya el compromiso de la empresa con la mejora del rendimiento y la durabilidad de sus productos, el apoyo a los fabricantes locales y el fortalecimiento de su presencia en el creciente mercado regional de fundición de aluminio.

- En marzo de 2023, Egyptian Aluminum Company (EGAL) inauguró con éxito una moderna planta de fundición de aluminio diseñada para abastecer a los crecientes sectores de la construcción y el transporte. Mediante la adopción de tecnologías de fundición de vanguardia, EGAL está mejorando la eficiencia de la producción, la calidad de los componentes e impulsando a la región hacia prácticas de fabricación más sostenibles.

- En febrero de 2023, Aluminium Bahrain BSC (Alba) anunció una colaboración con fabricantes de equipos originales (OEM) regionales del sector automotriz para el suministro de piezas fundidas de aluminio de alto rendimiento para componentes estructurales y de motores. Esta alianza subraya el compromiso de Alba con el crecimiento industrial, la promoción de soluciones ligeras y la expansión del uso de piezas fundidas de aluminio en diversas aplicaciones en Oriente Medio y África.

- En enero de 2023, United Casting Solutions (UCS), líder regional en componentes de aluminio de precisión, presentó en los Emiratos Árabes Unidos una nueva línea de fundición automatizada diseñada para aplicaciones aeroespaciales y automotrices. Esta iniciativa subraya el compromiso de UCS con la integración de tecnología avanzada, la mejora de la eficiencia de producción y el suministro de componentes de aluminio ligeros y de alta calidad para satisfacer la creciente demanda regional.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.