Middle East And Africa Alternative Proteins Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

1,034.02 Million

USD

2,710.20 Million

2021

2029

USD

1,034.02 Million

USD

2,710.20 Million

2021

2029

| 2022 –2029 | |

| USD 1,034.02 Million | |

| USD 2,710.20 Million | |

|

|

|

|

Mercado de proteínas alternativas en Oriente Medio y África por categoría (orgánica e inorgánica), tipo de producto (proteínas alternativas, proteína de insectos, micoproteína, carne cultivada y otras), forma (seca y líquida), aplicación (alimentos y bebidas, piensos para animales, productos farmacéuticos, cuidado personal y cosméticos y otros) – Tendencias de la industria y pronóstico hasta 2029

Análisis y tamaño del mercado de proteínas alternativas en Oriente Medio y África

Las preferencias alimentarias de los consumidores están cambiando en Oriente Medio y África, y entre ellos hay una baja preferencia por la carne y los productos a base de carne. El creciente número de consumidores flexitarianos o veganos ha creado numerosas oportunidades para que los fabricantes introduzcan e innoven en el segmento de las proteínas alternativas. Las preocupaciones por la salud, la acción climática y la creciente conciencia de las cuestiones éticas en la ganadería industrial están impulsando la demanda de proteínas alternativas . Las empresas de proteínas alternativas se están expandiendo rápidamente en la actualidad. Para obtener una ventaja competitiva en el mercado, los nuevos participantes están empleando tecnologías disruptivas como la biología sintética, el big data, la inteligencia artificial, el aprendizaje automático, la robótica y la Internet de las cosas.

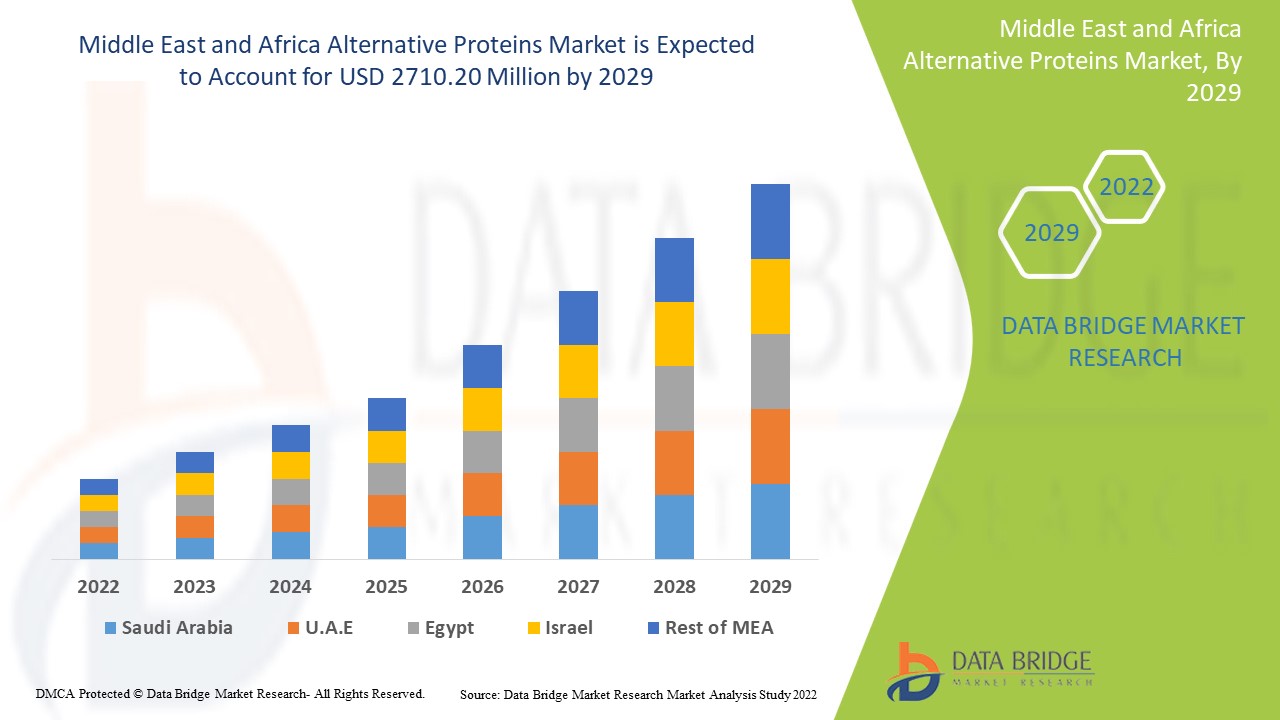

Data Bridge Market Research analiza que el mercado de proteínas alternativas se valoró en USD 1034,02 millones en 2021 y se espera que alcance el valor de USD 2710,20 millones para 2029, con una CAGR del 12,8% durante el período de pronóstico de 2022-2029.

Definición de mercado

Las proteínas derivadas de algas, plantas e insectos se denominan proteínas alternativas. Aportan una cantidad significativa de proteínas y requieren menos aportes naturales que las fuentes de proteínas tradicionales, como el pescado y la carne. Las proteínas son las principales responsables de la formación de tejido corporal magro y del suministro de elementos necesarios para las enzimas digestivas.

Segmentación y tamaño del mercado de proteínas alternativas en Oriente Medio y África

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2014 - 2019) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Categoría (orgánico e inorgánico), tipo de producto (proteínas alternativas, proteínas de insectos, micoproteínas, carne cultivada y otras), forma (seca y líquida), aplicación (alimentos y bebidas, alimentos para animales, productos farmacéuticos, cuidado personal y cosméticos y otros), |

|

Países cubiertos |

Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos, Kuwait y el resto de Oriente Medio y África |

|

Actores del mercado cubiertos |

Glanbia plc. (Irlanda), Now Health Group, Inc. (EE. UU.), Nutiva Inc (EE. UU.), The Simply Good Food Co (EE. UU.), Iovate Health Sciences International Inc. (Canadá), MusclePharm Corporation (EE. UU.), Kerry Group Plc (Irlanda), CytoSport, Inc. (EE. UU.), The Nature's Bounty Co. (EE. UU.), Reliance Vitamin Company, Inc. (EE. UU.), Herbalife Nutrition, Inc. (EE. UU.), Danone SA (Francia), GNC Holdings, LLC. (EE. UU.), Orgain Inc. (EE. UU.), True Nutrition (EE. UU.) |

|

Oportunidades |

|

Dinámica del mercado de las proteínas alternativas

Conductores

- Aumento de los casos de obesidad y mayor concienciación pública

El crecimiento del mercado de proteínas alternativas se ve favorecido por un proceso de extrusión modificado con alto contenido de humedad y un nuevo proceso de investigación de la composición. Los consumidores que no consumen productos lácteos, por ejemplo, están recurriendo a opciones de leche de origen vegetal, que han experimentado un crecimiento significativo en los últimos años. Esta innovadora línea de productos listos para consumir sin comprometer la textura ni el sabor también está impulsando el crecimiento del mercado de proteínas alternativas.

- Esfuerzos constantes de los actores del mercado para encontrar alternativas éticas y sostenibles a los productos de origen animal

Los grupos de la sociedad civil y los nuevos actores del sector alimentario presionan constantemente a las empresas de carne y lácteos establecidas para que conviertan los productos de origen vegetal en una alternativa ética y sostenible a los productos de origen animal. La creciente tendencia de los millennials a adoptar dietas flexitarianas y sin carne indica un cambio significativo en los hábitos de compra de las generaciones anteriores. Las empresas, desde los productores hasta los minoristas, ya están invirtiendo en estas oportunidades. Algunas empresas invierten en otras empresas que producen alternativas para protegerse o prepararse para una disminución de la demanda de productos animales.

Oportunidad

Se espera que el creciente número de gimnasios y la mayor participación femenina impulsen el crecimiento del mercado. Las proteínas alternativas son respetuosas con el medio ambiente. A medida que los consumidores son más conscientes de las propiedades de las proteínas alternativas, también están adoptando productos respetuosos con el medio ambiente y libres de alérgenos. El aumento de la demanda en el mercado libre de alérgenos creará oportunidades de crecimiento en el período de pronóstico.

Restricciones

La disponibilidad de sustitutos de bajo costo, la publicidad negativa y los efectos secundarios impedirán el crecimiento del mercado de suplementos de proteínas alternativas durante el período de pronóstico. Los vegetarianos consumen proteínas alternativas, pero las alergias en los consumidores, como la intolerancia a la lactosa, actuarán como una restricción, lo que dificultará aún más el crecimiento del mercado de proteínas alternativas ecológicas en el período de pronóstico.

Este informe sobre el mercado de proteínas alternativas proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado por categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de proteínas alternativas, comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Impacto de la COVID-19 en el mercado de proteínas alternativas

La pandemia de COVID-19 ha impulsado significativamente la industria de las proteínas alternativas. La pandemia ha aumentado la conciencia pública sobre las infecciones virales zoonóticas, cuyo riesgo también puede estar relacionado con el ganado. Debido a la abundancia de macronutrientes, micronutrientes y antioxidantes en las proteínas alternativas, pueden ayudar a reducir los efectos de las infecciones virales. En términos de fabricación y distribución, esta industria ha visto una demanda sin precedentes por parte de los fabricantes y consumidores, en particular de ciertos productos como los análogos de la carne y la leche de origen vegetal. La pandemia de COVID-19 también dio lugar a algunos modelos de mejores prácticas para la industria de las proteínas alternativas. Los gobiernos anunciaron flexibilizaciones de algunos requisitos de la legislación sobre competencia impuestos a las proteínas alternativas, principalmente a los productos proteínicos de origen vegetal y a las proteínas de insectos.

Desarrollo reciente

- Protix (Países Bajos) recaudó 50 millones de euros en capital para su expansión internacional en febrero de 2022.

- Calysta (EE. UU.) recaudó USD 39 millones en inversiones en septiembre de 2021 para apoyar la ampliación de la producción de proteína FeedKind de Calysta en Medio Oriente y África.

- Entomo Farms (Canadá) recaudó 3,7 millones de dólares canadienses (2,9 millones de dólares estadounidenses) en una ronda de financiación liderada por inversores asiáticos y canadienses en enero de 2021 para respaldar el crecimiento y la expansión de la empresa.

- MycoTechnology (EE. UU.) recaudó USD 120,69 millones en una ronda de financiación de Serie D de inversores hasta junio de 2020.

- En 2020, Mitsubishi Corporation, Blue Horizon Ventures, Target Middle East and Africa, ArcTern Ventures y Rubio Impact Ventures invertirán USD 75 millones en Mosa Meat, una empresa holandesa de tecnología alimentaria.

- Cricket Lab, un fabricante de proteínas de insectos con sede en Tailandia, recaudó USD 2,1 millones en financiación en 2020.

Alcance del mercado de proteínas alternativas en Oriente Medio y África

El mercado de proteínas alternativas está segmentado en función de la categoría, el tipo de producto, la forma y la aplicación. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Categoría

- Orgánico

- Inorgánico

Tipo de producto

- Proteínas alternativas

- Proteína de insectos

- Micoproteína

- Carne cultivada

- Otros

Forma

- Seco

- Líquido

Solicitud

- Alimentos y bebidas

- Alimento para animales

- Productos farmacéuticos

- Cuidado personal

- Productos cosméticos

- Otros

Análisis y perspectivas regionales del mercado de proteínas alternativas

Se analiza el mercado de proteínas alternativas y se proporcionan información y tendencias del tamaño del mercado por país, categoría, tipo de producto, forma y aplicación como se menciona anteriormente.

Los países cubiertos en el informe del mercado de proteínas alternativas son Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos, Kuwait y el resto de Medio Oriente y África.

Sudáfrica domina la conciencia y la demanda de proteínas alternativas en diferentes sectores, como alimentos y bebidas, piensos y otros. Las personas consumen en gran medida carne de origen vegetal y evitan el consumo de carne, por lo que el crecimiento del mercado es alto.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Puntos de datos como análisis de la cadena de valor aguas arriba y aguas abajo, tendencias técnicas y análisis de las cinco fuerzas de Porter, estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de Medio Oriente y África y sus desafíos afrontados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de las proteínas alternativas

El panorama competitivo del mercado de proteínas alternativas proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en Oriente Medio y África, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos, y el dominio de las aplicaciones. Los puntos de datos proporcionados anteriormente solo están relacionados con el enfoque de las empresas en relación con el mercado de proteínas alternativas.

Algunos de los principales actores que operan en el mercado de proteínas alternativas son:

- Glanbia plc. (Irlanda)

- Now Health Group, Inc. (Estados Unidos)

- Nutiva Inc (Estados Unidos)

- La empresa Simply Good Food (Estados Unidos)

- Iovate Health Sciences International Inc. (Canadá)

- Corporación MusclePharm (Estados Unidos)

- Kerry Group Plc (Irlanda)

- CytoSport, Inc. (Estados Unidos)

- La compañía Nature's Bounty (Estados Unidos)

- Reliance Vitamin Company, Inc. (Estados Unidos)

- Herbalife Nutrition, Inc. (Estados Unidos)

- Danone SA (Francia)

- GNC Holdings, LLC. (Estados Unidos)

- Orgain Inc. (Estados Unidos)

- Nutrición verdadera (EE. UU.)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 CATEGORY LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 REGULATORY FRAMEWORK AND GOVERNMENT INITIATIVES: MIDDLE EAST AND AFRICA ALTERNATIVE PROTEIN MARKET

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING NUMBER OF HEALTH CONSCIOUS CONSUMERS

6.1.2 EASY AVAILABILITY OF EDIBLE INSECTS

6.1.3 RISING AWARENESS ABOUT THE BENEFITS OF ALTERNATIVE PROTEINS

6.1.4 RISE IN POPULATION WITH LACTOSE INTOLERANT CONSUMERS

6.1.5 GROWTH IN INVESTMENTS & COLLABORATIONS IN ALTERNATIVE PROTEIN BUSINESS

6.1.6 INCREASING USAGE OF ALTERNATIVE PROTEINS IN VARIOUS APPLICATIONS

6.2 RESTRAINTS

6.2.1 LACK OF AUTOMATED FARMING METHODS

6.2.2 STRINGENT REGULATIONS ON ALTERNATIVE PROTEINS

6.2.3 HIGHER COSTS OF PROTEINS

6.3 OPPORTUNITIES

6.3.1 LESS ENVIRONMENTAL IMPACTS OF ALTERNATIVE PROTEINS

6.3.2 NEW PRODUCT INNOVATION RELATED TO ALTERNATIVE PROTEINS

6.3.3 RISE IN DEMAND FOR ORGANIC INGREDIENTS

6.3.4 NEW AND EMERGING SOURCES OF PROTEINS

6.4 CHALLENGES

6.4.1 MICROBIAL AND TOXICITY RISKS ASSOCIATED WITH INSECTS

6.4.2 USE OF GMO PRODUCTS

6.4.3 ECONOMIC CONSTRAINTS RELATED TO PROCESSING CAPACITY

7 COVID-19 IMPACT ON ALTERNATIVE PROTEIN MARKET IN FOOD & BEVERAGE INDUSTRY

7.1 INITIATIVES

7.2 CONCLUSION

8 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINSMARKET, BY CATEGORY

8.1 OVERVIEW

8.2 INORGANIC

8.3 ORGANIC

9 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 PLANT PROTEIN

9.2.1 SOY

9.2.2 WHEAT

9.2.3 PEA

9.2.4 RICE

9.2.5 OAT

9.2.6 POTATO

9.2.7 CANOLA

9.2.8 OTHERS

9.3 INSECT PROTEIN

9.3.1 CRICKETS

9.3.2 BLACK SOLDIER FLIES

9.3.3 MEALWORMS

9.3.4 BEETLES

9.3.5 CATERPILLARS

9.3.6 BEES, WASPS, ANTS

9.3.7 GRASSHOPPERS

9.3.8 OTHERS

9.4 MYCOPROTEIN

9.5 CULTURED MEAT

9.5.1 POULTRY

9.5.2 BEEF

9.5.3 PORK

9.5.4 FISH

9.5.5 OTHERS

9.6 OTHERS

10 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET, BY FORM

10.1 OVERVIEW

10.2 LIQUID

10.3 DRY

11 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 FOOD & BEVERAGES

11.2.1 BAKERY & CONFECTIONERY PRODUCTS

11.2.1.1 BREADS

11.2.1.2 CHOCOLATE

11.2.1.3 CANDIES

11.2.1.4 CAKES, MUFFINS & DOUGHNUTS

11.2.1.5 COOKIES, CRACKERS

11.2.1.6 PIE CRUSTS & PIZZA DOUGH

11.2.1.7 CHEWING GUMS

11.2.1.8 OTHERS

11.2.2 BAKERY & CONFECTIONERY PRODUCTS, BY PRODUCT TYPE

11.2.2.1 PLANT PROTEIN

11.2.2.2 INSECT PROTEIN

11.2.2.3 MYCOPROTEIN

11.2.2.4 CULTURED MEAT

11.2.2.5 OTHERS

11.2.3 CONVENIENCE FOOD

11.2.3.1 READY TO EAT MEALS

11.2.3.2 DRESSINGS & CONDIMENTS

11.2.3.3 SOUPS & SAUCES

11.2.3.4 NOODLES & PASTA

11.2.3.5 SNACKS & EXTRUDED SNACKS

11.2.3.6 OTHERS

11.2.4 CONVENIENCE FOOD, BY PRODUCT TYPE

11.2.4.1 PLANT PROTEIN

11.2.4.2 INSECT PROTEIN

11.2.4.3 MYCOPROTEIN

11.2.4.4 OTHERS

11.2.5 DAIRY PRODUCTS

11.2.5.1 DAIRY DESSERTS

11.2.5.1.1 ICE CREAM

11.2.5.1.2 PUDDING

11.2.5.1.3 SORBET

11.2.5.1.4 OTHERS

11.2.5.2 YOGURTS

11.2.5.3 CREAMER

11.2.5.4 CHEESE

11.2.5.5 TOFU

11.2.5.6 OTHERS

11.2.6 DAIRY PRODUCTS, BY PRODUCT TYPE

11.2.6.1 PLANT PROTEIN

11.2.6.2 INSECT PROTEIN

11.2.6.3 MYCOPROTEIN

11.2.6.4 OTHERS

11.2.7 DAIRY ALTERNATIVES

11.2.7.1 MILK

11.2.7.2 YOGURTS

11.2.7.3 CREAMER

11.2.7.4 OTHERS

11.2.8 DAIRY ALTERNATIVES, BY PRODUCT TYPE

11.2.8.1 PLANT PROTEIN

11.2.8.2 INSECT PROTEIN

11.2.8.3 MYCOPROTEIN

11.2.8.4 OTHERS

11.2.9 MEAT & POULTRY PRODUCTS

11.2.9.1 SAUSAGE

11.2.9.2 BURGER PATTY

11.2.9.3 NUGGETS

11.2.9.4 MINCE

11.2.9.5 SALAMI

11.2.9.6 OTHERS

11.2.10 MEAT & POULTRY PRODUCTS, BY PRODUCT TYPE

11.2.10.1 PLANT PROTEIN

11.2.10.2 INSECT PROTEIN

11.2.10.3 MYCOPROTEIN

11.2.10.4 OTHERS

11.2.11 NUTRITIONAL BARS

11.2.11.1 PLANT PROTEIN

11.2.11.2 INSECT PROTEIN

11.2.11.3 MYCOPROTEIN

11.2.11.4 OTHERS

11.2.12 INFANT FORMULA

11.2.12.1 PLANT PROTEIN

11.2.12.2 INSECT PROTEIN

11.2.12.3 MYCOPROTEIN

11.2.12.4 OTHERS

11.2.13 BEVERAGES

11.2.13.1 DAIRY DRINKS

11.2.13.2 FRUIT JUICES

11.2.13.3 NUTRITIONAL DRINKS

11.2.13.4 FRUIT SMOOTHIE

11.2.13.5 SPORTS AND ENERGY DRINKS

11.2.13.6 OTHERS

11.2.14 BEVERAGES, BY PRODUCT TYPE

11.2.14.1 PLANT PROTEIN

11.2.14.2 INSECT PROTEIN

11.2.14.3 MYCOPROTEIN

11.2.14.4 OTHERS

11.3 ANIMAL FEED

11.3.1 RUMINANT

11.3.1.1 DAIRY CATTLE

11.3.1.2 BEEF CATTLE

11.3.1.3 CALVES

11.3.1.4 OTHERS

11.3.2 SWINE

11.3.2.1 SOW

11.3.2.2 GROWER

11.3.2.3 STARTER

11.3.3 POULTRY

11.3.3.1 BROILERS

11.3.3.2 LAYERS

11.3.3.3 BREEDERS

11.3.4 AQUATIC ANIMAL

11.3.4.1 FISH FEED

11.3.4.2 MOLLUSK FEED

11.3.4.3 CRUSTACEANS

11.3.5 PETS

11.3.5.1 DOGS

11.3.5.2 CATS

11.3.5.3 RABBITS

11.3.5.4 OTHERS

11.4 ANIMAL FEED, BY PRODUCT TYPE

11.4.1 PLANT PROTEIN

11.4.2 INSECT PROTEIN

11.4.3 MYCOPROTEIN

11.4.4 OTHERS

11.5 PERSONAL CARE & COSMETICS

11.5.1 SKIN CARE

11.5.2 HAIR CARE

11.5.3 ORAL CARE

11.5.4 OTHERS

11.6 PERSONAL CARE & COSMETICS, BY PRODUCT TYPE

11.6.1 PLANT PROTEIN

11.6.2 INSECT PROTEIN

11.6.3 MYCOPROTEIN

11.6.4 OTHERS

11.7 PHARMACEUTICALS

11.7.1 PLANT PROTEIN

11.7.2 INSECT PROTEIN

11.7.3 MYCOPROTEIN

11.7.4 OTHERS

11.8 OTHERS

12 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET, BY REGION

12.1 MIDDLE EAST & AFRICA

12.1.1 SOUTH AFRICA

12.1.2 SAUDI ARABIA

12.1.3 UAE

12.1.4 KUWAIT

12.1.5 REST OF MIDDLE EAST & AFRICA

13 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 CARGILL, INCORPORATED

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 DUPONT

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 BENEO

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 ADM

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 AXIOM FOODS, INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENTS

15.6 CHS INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 COMPANY SHARE ANALYSIS

15.6.4 PRODUCT PORTFOLIO

15.6.5 RECENT DEVELOPMENT

15.7 ENTERRA FEED CORPORATION

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 ENTOMOFARMS

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 FARBEST BRANDS

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 GLANBIA PLC

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 SOLUTION PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

15.11 INGREDION INCORPORATED

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENTS

15.12 AGRIPROTEIN

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 KERRY GROUP PLC

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 NOW FOODS

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 PARABEL

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 PROTIFARM

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 PROTIX B.V.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 ROQUETTE FRÈRES

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.19 TIANJIN NORLAND BIOTECH CO.,LTD

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 ŸNSECT

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

LIST OF TABLES

TABLE 1 FAT, PROTEIN, AND LACTOSE CONTENT IN MILK OF DIFFERENT MAMMALIAN SPECIES

TABLE 2 LACTOSE INTOLERANCE IN DIFFERENT HUMAN GROUPS

TABLE 3 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINSMARKET, BY CATEGORY, 2018– 2027 (USD THOUSAND )

TABLE 4 MIDDLE EAST AND AFRICA INORGANIC IN ALTERNATIVE PROTEINS MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 5 MIDDLE EAST AND AFRICA ORGANIC IN ALTERNATIVE PROTEINS MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 6 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET, BY PRDUCT TYPE, 2018-2027 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA ALTERNATIVE PLANT PROTEINS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA ALTERNATIVE PLANT PROTEINS MARKET, BY PRDUCT TYPE, 2018-2027 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA ALTERNATIVE INSECT PROTEINS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA ALTERNATIVE INSECT PROTEINS MARKET, BY PRDUCT TYPE, 2018-2027 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA MYCOPROTEIN ALTERNATIVE PROTEINS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA CULTURED MEAT ALTERNATIVE PROTEINS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA CULTURED MEAT ALTERNATIVE PROTEINS MARKET, BY PRDUCT TYPE, 2018-2027 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA OTHERS ALTERNATIVE PROTEINS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET, BY FORM, 2018-2027 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA LIQUID IN ALTERNATIVE PROTEINS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA DRY IN ALTERNATIVE PROTEINS MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 18 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET , BY GRADE, 2018– 2027 (USD THOUSANDS )

TABLE 19 MIDDLE EAST AND AFRICA FOOD & BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 20 MIDDLE EAST AND AFRICA FOOD & BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 21 MIDDLE EAST AND AFRICA BAKERY & CONFECTIONERY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 22 MIDDLE EAST AND AFRICA BAKERY & CONFECTIONERY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 23 MIDDLE EAST AND AFRICA CONVENIENCE FOOD IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 24 MIDDLE EAST AND AFRICA CONVENIENCE FOOD IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 25 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 26 MIDDLE EAST AND AFRICA DAIRY DESSERTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 27 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 28 MIDDLE EAST AND AFRICA DAIRY ALTERNATIVES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 29 MIDDLE EAST AND AFRICA DAIRY ALTERNATIVES IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 30 MIDDLE EAST AND AFRICA MEAT & POULTRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 31 MIDDLE EAST AND AFRICA MEAT & POULTRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 32 MIDDLE EAST AND AFRICA NUTRITIONAL BARS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 33 MIDDLE EAST AND AFRICA INFANT FORMULA IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 34 MIDDLE EAST AND AFRICA BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 35 MIDDLE EAST AND AFRICA BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 36 MIDDLE EAST AND AFRICA ANIMAL FEED IN ALTERNATIVE PROTEINS MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 37 MIDDLE EAST AND AFRICA ANIMAL FEED IN ALTERNATIVE PROTEINS MARKET, BY ANIMALS, 2018-2027 (USD THOUSANDS)

TABLE 38 MIDDLE EAST AND AFRICA ANIMAL FEED IN ALTERNATIVE PROTEINS MARKET, BY ANIMALS, 2018-2027 (USD THOUSANDS)

TABLE 39 MIDDLE EAST AND AFRICA SWINE IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 40 MIDDLE EAST AND AFRICA POULTRY IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 41 MIDDLE EAST AND AFRICA AQUATIC ANIMAL IN ALTERNATIVE PROTEINS, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 42 MIDDLE EAST AND AFRICA PETS IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 43 MIDDLE EAST AND AFRICA ANIMAL FEED IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 44 MIDDLE EAST AND AFRICA PERSONAL CARE & COSMETICS IN ALTERNATIVE PROTEINS MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 45 MIDDLE EAST AND AFRICA PERSONAL CARE & COSMETICS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS))

TABLE 46 MIDDLE EAST AND AFRICA PERSONAL CARE & COSMETICS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 47 MIDDLE EAST AND AFRICA PERSONAL CARE & COSMETICS IN ALTERNATIVE PROTEINS MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 48 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN ALTERNATIVE PROTEINS MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 49 MIDDLE EAST AND AFRICA OTHERS IN ALTERNATIVE PROTEINS MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 50 MIDDLE EAST & AFRICA ALTERNATIVE PROTEINS MARKET, BY COUNTRY, 2018-2027 (USD THOUSANDS)

TABLE 51 MIDDLE EAST & AFRICA ALTERNATIVE PROTEINS MARKET, BY CATEGORY, 2018-2027 (USD THOUSANDS)

TABLE 52 MIDDLE EAST & AFRICA ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 53 MIDDLE EAST & AFRICA PLANT PROTEIN IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 54 MIDDLE EAST & AFRICA INSECT PROTEIN IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 55 MIDDLE EAST & AFRICA CULTURED MEAT IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 56 MIDDLE EAST & AFRICA ALTERNATIVE PROTEINS MARKET, BY FORM, 2018-2027 (USD THOUSANDS)

TABLE 57 MIDDLE EAST & AFRICA ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 58 MIDDLE EAST & AFRICA FOOD & BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 59 MIDDLE EAST & AFRICA BAKERY & CONFECTIONERY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 60 MIDDLE EAST & AFRICA BAKERY & CONFECTIONERY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 61 MIDDLE EAST & AFRICA CONVENIENCE FOOD IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 62 MIDDLE EAST & AFRICA CONVENIENCE FOOD IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 63 MIDDLE EAST & AFRICA DAIRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 64 MIDDLE EAST & AFRICA DAIRY DESSERTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 65 MIDDLE EAST & AFRICA DAIRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 66 MIDDLE EAST & AFRICA DAIRY ALTERNATIVES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 67 MIDDLE EAST & AFRICA DAIRY ALTERNATIVES IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 68 MIDDLE EAST & AFRICA MEAT & POULTRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 69 MIDDLE EAST & AFRICA MEAT & POULTRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 70 MIDDLE EAST & AFRICA NUTRITIONAL BARS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 71 MIDDLE EAST & AFRICA INFANT FORMULA IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 72 MIDDLE EAST & AFRICA BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 73 MIDDLE EAST & AFRICA BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 74 MIDDLE EAST & AFRICA ANIMAL FEED IN ALTERNATIVE PROTEINS MARKET, BY ANIMALS, 2018-2027 (USD THOUSANDS)

TABLE 75 MIDDLE EAST & AFRICA RUMINANTS IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 76 MIDDLE EAST & AFRICA SWINE IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 77 MIDDLE EAST & AFRICA POULTRY IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 78 MIDDLE EAST & AFRICA AQUATIC ANIMAL IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 79 MIDDLE EAST & AFRICA PETS IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 80 MIDDLE EAST & AFRICA ANIMAL FEED IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 81 MIDDLE EAST & AFRICA PERSONAL CARE & COSMETICS IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 82 MIDDLE EAST & AFRICA PERSONAL CARE & COSMETICS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 83 MIDDLE EAST & AFRICA PHARMACEUTICALS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 84 SOUTH AFRICA ALTERNATIVE PROTEINS MARKET, BY CATEGORY, 2018-2027 (USD THOUSANDS)

TABLE 85 SOUTH AFRICA ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 86 SOUTH AFRICA PLANT PROTEIN IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 87 SOUTH AFRICA INSECT PROTEIN IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 88 SOUTH AFRICA CULTURED MEAT IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 89 SOUTH AFRICA ALTERNATIVE PROTEINS MARKET, BY FORM, 2018-2027 (USD THOUSANDS)

TABLE 90 SOUTH AFRICA ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 91 SOUTH AFRICA FOOD & BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 92 SOUTH AFRICA BAKERY & CONFECTIONERY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 93 SOUTH AFRICA BAKERY & CONFECTIONERY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 94 SOUTH AFRICA CONVENIENCE FOOD IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 95 SOUTH AFRICA CONVENIENCE FOOD IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 96 SOUTH AFRICA DAIRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 97 SOUTH AFRICA DAIRY DESSERTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 98 SOUTH AFRICA DAIRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 99 SOUTH AFRICA DAIRY ALTERNATIVES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 100 SOUTH AFRICA DAIRY ALTERNATIVES IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 101 SOUTH AFRICA MEAT & POULTRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 102 SOUTH AFRICA MEAT & POULTRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 103 SOUTH AFRICA NUTRITIONAL BARS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 104 SOUTH AFRICA INFANT FORMULA IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 105 SOUTH AFRICA BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 106 SOUTH AFRICA BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 107 SOUTH AFRICA ANIMAL FEED IN ALTERNATIVE PROTEINS MARKET, BY ANIMALS, 2018-2027 (USD THOUSANDS)

TABLE 108 SOUTH AFRICA RUMINANTS IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 109 SOUTH AFRICA SWINE IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 110 SOUTH AFRICA POULTRY IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 111 SOUTH AFRICA AQUATIC ANIMAL IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 112 SOUTH AFRICA PETS IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 113 SOUTH AFRICA ANIMAL FEED IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 114 SOUTH AFRICA PERSONAL CARE & COSMETICS IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 115 SOUTH AFRICA PERSONAL CARE & COSMETICS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 116 SOUTH AFRICA PHARMACEUTICALS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 117 SAUDI ARABIA ALTERNATIVE PROTEINS MARKET, BY CATEGORY, 2018-2027 (USD THOUSANDS)

TABLE 118 SAUDI ARABIA ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 119 SAUDI ARABIA PLANT PROTEIN IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 120 SAUDI ARABIA INSECT PROTEIN IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 121 SAUDI ARABIA CULTURED MEAT IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 122 SAUDI ARABIA ALTERNATIVE PROTEINS MARKET, BY FORM, 2018-2027 (USD THOUSANDS)

TABLE 123 SAUDI ARABIA ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 124 SAUDI ARABIA FOOD & BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 125 SAUDI ARABIA BAKERY & CONFECTIONERY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 126 SAUDI ARABIA BAKERY & CONFECTIONERY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 127 SAUDI ARABIA CONVENIENCE FOOD IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 128 SAUDI ARABIA CONVENIENCE FOOD IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 129 SAUDI ARABIA DAIRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 130 SAUDI ARABIA DAIRY DESSERTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 131 SAUDI ARABIA DAIRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 132 SAUDI ARABIA DAIRY ALTERNATIVES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 133 SAUDI ARABIA DAIRY ALTERNATIVES IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 134 SAUDI ARABIA MEAT & POULTRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 135 SAUDI ARABIA MEAT & POULTRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 136 SAUDI ARABIA NUTRITIONAL BARS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 137 SAUDI ARABIA INFANT FORMULA IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 138 SAUDI ARABIA BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 139 SAUDI ARABIA BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 140 SAUDI ARABIA ANIMAL FEED IN ALTERNATIVE PROTEINS MARKET, BY ANIMALS, 2018-2027 (USD THOUSANDS)

TABLE 141 SAUDI ARABIA RUMINANTS IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 142 SAUDI ARABIA SWINE IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 143 SAUDI ARABIA POULTRY IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 144 SAUDI ARABIA AQUATIC ANIMAL IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 145 SAUDI ARABIA PETS IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 146 SAUDI ARABIA ANIMAL FEED IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 147 SAUDI ARABIA PERSONAL CARE & COSMETICS IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 148 SAUDI ARABIA PERSONAL CARE & COSMETICS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 149 SAUDI ARABIA PHARMACEUTICALS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 150 UAE ALTERNATIVE PROTEINS MARKET, BY CATEGORY, 2018-2027 (USD THOUSANDS)

TABLE 151 UAE ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 152 UAE PLANT PROTEIN IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 153 UAE INSECT PROTEIN IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 154 UAE CULTURED MEAT IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 155 UAE ALTERNATIVE PROTEINS MARKET, BY FORM, 2018-2027 (USD THOUSANDS)

TABLE 156 UAE ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 157 UAE FOOD & BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 158 UAE BAKERY & CONFECTIONERY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 159 UAE BAKERY & CONFECTIONERY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 160 UAE CONVENIENCE FOOD IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 161 UAE CONVENIENCE FOOD IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 162 UAE DAIRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 163 UAE DAIRY DESSERTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 164 UAE DAIRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 165 UAE DAIRY ALTERNATIVES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 166 UAE DAIRY ALTERNATIVES IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 167 UAE MEAT & POULTRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 168 UAE MEAT & POULTRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 169 UAE NUTRITIONAL BARS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 170 UAE INFANT FORMULA IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 171 UAE BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 172 UAE BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 173 UAE ANIMAL FEED IN ALTERNATIVE PROTEINS MARKET, BY ANIMALS, 2018-2027 (USD THOUSANDS)

TABLE 174 UAE RUMINANTS IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 175 UAE SWINE IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 176 UAE POULTRY IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 177 UAE AQUATIC ANIMAL IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 178 UAE PETS IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 179 UAE ANIMAL FEED IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 180 UAE PERSONAL CARE & COSMETICS IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 181 UAE PERSONAL CARE & COSMETICS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 182 UAE PHARMACEUTICALS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 183 KUWAIT ALTERNATIVE PROTEINS MARKET, BY CATEGORY, 2018-2027 (USD THOUSANDS)

TABLE 184 KUWAIT ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 185 KUWAIT PLANT PROTEIN IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 186 KUWAIT INSECT PROTEIN IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 187 KUWAIT CULTURED MEAT IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 188 KUWAIT ALTERNATIVE PROTEINS MARKET, BY FORM, 2018-2027 (USD THOUSANDS)

TABLE 189 KUWAIT ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 190 KUWAIT FOOD & BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 191 KUWAIT BAKERY & CONFECTIONERY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 192 KUWAIT BAKERY & CONFECTIONERY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 193 KUWAIT CONVENIENCE FOOD IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 194 KUWAIT CONVENIENCE FOOD IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 195 KUWAIT DAIRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 196 KUWAIT DAIRY DESSERTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 197 KUWAIT DAIRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 198 KUWAIT DAIRY ALTERNATIVES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 199 KUWAIT DAIRY ALTERNATIVES IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 200 KUWAIT MEAT & POULTRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 201 KUWAIT MEAT & POULTRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 202 KUWAIT NUTRITIONAL BARS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 203 KUWAIT INFANT FORMULA IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 204 KUWAIT BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 205 KUWAIT BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 206 KUWAIT ANIMAL FEED IN ALTERNATIVE PROTEINS MARKET, BY ANIMALS, 2018-2027 (USD THOUSANDS)

TABLE 207 KUWAIT RUMINANTS IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 208 KUWAIT SWINE IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 209 KUWAIT POULTRY IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 210 KUWAIT AQUATIC ANIMAL IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 211 KUWAIT PETS IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 212 KUWAIT ANIMAL FEED IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 213 KUWAIT PERSONAL CARE & COSMETICS IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 214 KUWAIT PERSONAL CARE & COSMETICS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 215 KUWAIT PHARMACEUTICALS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 216 REST OF MIDDLE EAST & AFRICA ALTERNATIVE PROTEINS MARKET, BY CATEGORY, 2018-2027 (USD THOUSANDS)

Lista de figuras

LIST OF FIGURES

FIGURE 1 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET : SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET : DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET : DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET : MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET : COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET : INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET : DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET : VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET : SEGMENTATION

FIGURE 11 INCREASING NUMBER OF HEALTH CONSCIOUS CONSUMERS AND EASY AVAILABILITY OF EDIBLE INSECTS ARE LEADING THE GROWTH OF THE MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 12 INORGANIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET IN 2020 & 2027

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET

FIGURE 14 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET, BY CATEGORY, 2019

FIGURE 15 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE

FIGURE 16 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET, BY FORM

FIGURE 17 FIGURE 1 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET , BY APPLICATIONS, 2019

FIGURE 18 MIDDLE EAST & AFRICA ALTERNATIVE PROTEINS MARKET: SNAPSHOT (2019)

FIGURE 19 MIDDLE EAST & AFRICA ALTERNATIVE PROTEINS MARKET: BY COUNTRY (2019)

FIGURE 20 MIDDLE EAST & AFRICA ALTERNATIVE PROTEINS MARKET: BY COUNTRY (2020 & 2027)

FIGURE 21 MIDDLE EAST & AFRICA ALTERNATIVE PROTEINS MARKET: BY COUNTRY (2019 & 2027)

FIGURE 22 MIDDLE EAST & AFRICA ALTERNATIVE PROTEINS MARKET: BY TYPE (2020-2027)

FIGURE 23 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET: COMPANY SHARE 2019 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.