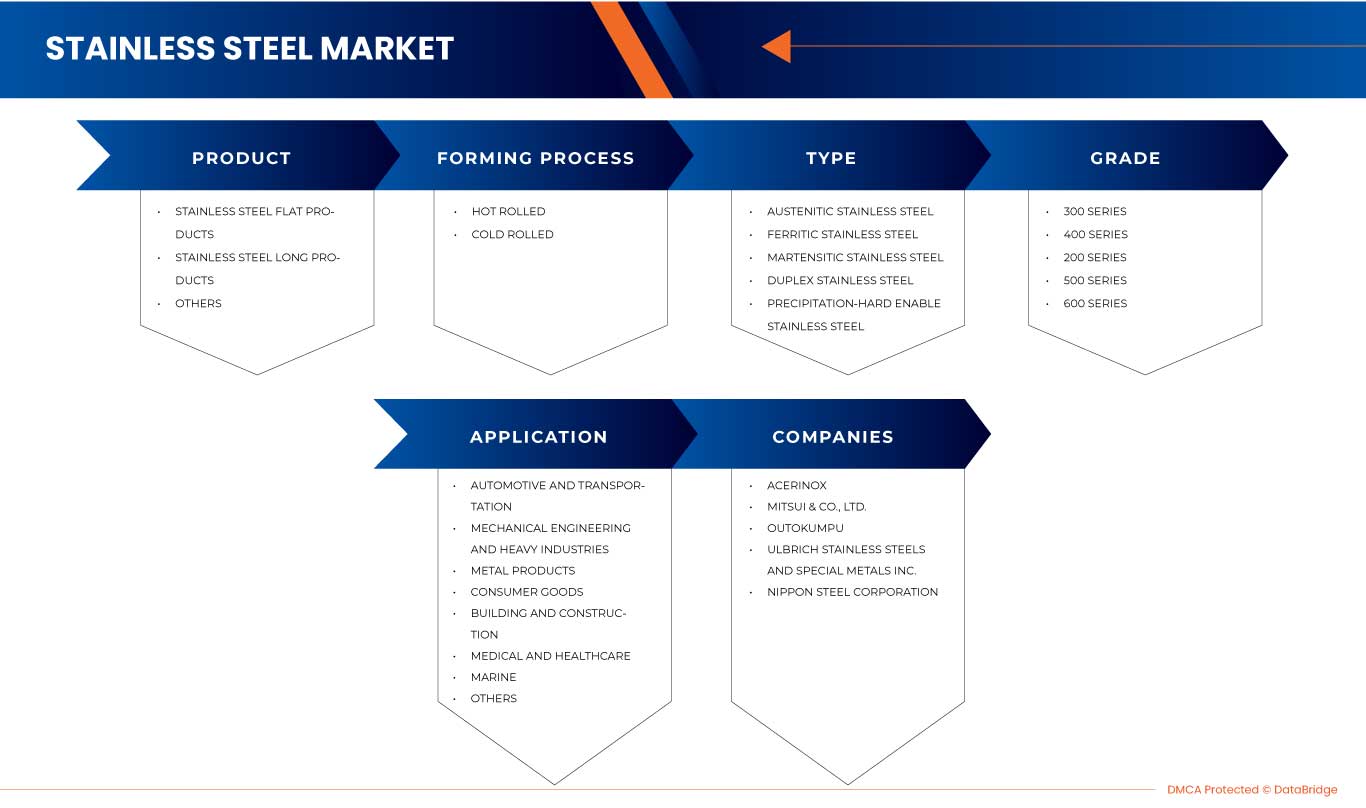

Mercado de acero inoxidable en México, por producto (productos planos de acero inoxidable, productos largos de acero inoxidable y otros), proceso de conformado (laminado en caliente y laminado en frío), tipo (acero inoxidable austenítico, acero inoxidable ferrítico, acero inoxidable martensítico, acero inoxidable dúplex y acero inoxidable endurecido por precipitación), grado (serie 300, serie 400, serie 200, serie 500 y serie 600), aplicación (automotriz y transporte, ingeniería mecánica e industrias pesadas, productos metálicos, bienes de consumo, médicos y atención médica, construcción y edificación, marina y otros) - Tendencias de la industria y pronóstico hasta 2030.

Análisis y perspectivas del mercado de acero inoxidable en México

Se espera que el mercado de acero inoxidable de México crezca significativamente en el período de pronóstico de 2023 a 2030. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 3,7% en el período de pronóstico de 2023 a 2030 y se espera que alcance los USD 991.441,52 mil para 2030. El uso creciente de acero inoxidable en diversas industrias ha sido el principal impulsor del mercado de acero inoxidable de México.

El informe de mercado proporciona detalles sobre la participación de mercado, los nuevos desarrollos y el impacto de los actores del mercado local y nacional, y analiza las oportunidades en términos de nuevas oportunidades de ingresos, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un informe de analista. Nuestro equipo lo ayudará a crear una solución que tenga impacto en los ingresos para lograr su objetivo deseado.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2015 - 2020) |

|

Unidades cuantitativas |

Ingresos en miles de USD y volumen en toneladas |

|

Segmentos cubiertos |

Producto (productos planos de acero inoxidable, productos largos de acero inoxidable y otros), proceso de conformado (laminado en caliente y laminado en frío), tipo (acero inoxidable austenítico, acero inoxidable ferrítico, acero inoxidable martensítico, acero inoxidable dúplex y acero inoxidable endurecido por precipitación), grado (serie 300, serie 400, serie 200, serie 500 y serie 600), aplicación (automotriz y transporte, ingeniería mecánica e industrias pesadas, productos de metal, bienes de consumo, medicina y atención médica, construcción y edificación, marina y otros) |

|

Regiones cubiertas |

Norte de México, Centro de México, Este de México, Oeste de México y Sur de México |

|

Actores del mercado cubiertos |

Entre otros se encuentran: Industeel, Acerinox, Aperam, NIPPON STEEL CORPORATION, Alleima, MITSUI & CO., LTD., Olympic Steel, Outokumpu, Ulbrich Stainless Steels and Special Metals Inc., Swiss Steel Holding AG, Gibbs Wire & Steel Company LLC, TIMEX METALS, Shrikant Steel Centre, Nitech Stainless Inc y RH Alloys. |

Definición de mercado

Una aleación de potencia se crea cuando se combinan diferentes componentes que se encuentran en el acero inoxidable. En algunas circunstancias, el acero inoxidable, una aleación de hierro, cromo y níquel, brinda resistencia a la corrosión del hierro. Esta cualidad resistente de la aleación se debe al cromo. La capa pasiva es una película delgada de óxido secretada por el cromo. Además del cromo, esta aleación también incluye nitrógeno y molibdeno . Es una aleación ambientalmente neutra e inerte, lo que la hace reciclable indefinidamente. El acero inoxidable es fuerte y duradero, lo que lo hace ideal para su uso en muchos sectores verticales de usuarios finales.

Dinámica del mercado del acero inoxidable en México

En esta sección se aborda la comprensión de los factores impulsores, las oportunidades, los desafíos y las limitaciones del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- Crece la actividad industrial en México

El aumento de la actividad industrial está impulsando la demanda de acero inoxidable en México. En los últimos años, ha habido un aumento notable en la industrialización en una amplia gama de industrias, incluidas la automotriz, la construcción, la manufactura y la energía. El acero inoxidable se ha convertido en el material preferido para una amplia gama de aplicaciones industriales debido a sus propiedades excepcionales, como la resistencia a la corrosión, la fuerza y el atractivo estético. La expansión de las actividades industriales en México ha estado acompañada de una creciente necesidad de materiales duraderos y confiables. Las características únicas del acero inoxidable lo convierten en una opción ideal para diversas aplicaciones dentro del panorama industrial. La versatilidad y la resiliencia del acero inoxidable lo posicionan como un actor clave en el desarrollo económico de México a medida que las industrias continúan evolucionando y se esfuerzan por lograr la eficiencia y la sostenibilidad.

- Creciente urbanización y desarrollo de infraestructura.

La creciente urbanización y el desarrollo de infraestructura en México son impulsores importantes de la creciente demanda de acero inoxidable. Existe una mayor demanda de construcción de estructuras residenciales y comerciales, y el desarrollo de proyectos de infraestructura a medida que se acelera la urbanización del país. El acero inoxidable se ha convertido en un material popular para las estructuras arquitectónicas debido a su excelente resistencia a la corrosión y durabilidad, lo que ha aumentado la demanda de acero inoxidable en la industria de la construcción.

Oportunidad

- Integración en industrias verdes

La integración del acero inoxidable en industrias verdes, como la producción de vehículos eléctricos e infraestructura sustentable, representa una oportunidad de mercado para México. El acero inoxidable puede posicionarse como un actor clave en estos sectores en desarrollo gracias a su inherente tenacidad y resistencia a la corrosión, ofreciendo a la industria perspectivas de crecimiento prometedoras.

El uso de acero inoxidable en proyectos de energía renovable es una de las perspectivas más prometedoras para este material en México. El país ha estado realizando inversiones activas en fuentes de energía renovables como la eólica, la solar y la hidroeléctrica para diversificar su matriz energética y reducir la dependencia de los combustibles fósiles. La durabilidad y la resistencia a la corrosión del acero inoxidable lo convierten en un material muy adecuado para una variedad de componentes utilizados en la infraestructura para fuentes de energía renovables. Por ejemplo, las estructuras de soporte y las turbinas eólicas utilizadas en la energía eólica suelen estar expuestas a condiciones climáticas adversas, como vientos fuertes y exposición al agua salada en las zonas costeras. La durabilidad y la fiabilidad de las torres y los componentes de las turbinas eólicas están garantizadas por la alta resistencia mecánica y la resistencia a la corrosión del acero inoxidable.

Restricción

- Fluctuación de los precios de las materias primas

El mercado mexicano del acero inoxidable se ve obstaculizado por la fluctuación de los costos de las materias primas, en particular de componentes críticos como el níquel, el cromo y el hierro. Estas materias primas son fundamentales para la producción de acero inoxidable y los cambios en sus precios pueden tener un impacto significativo en los costos generales de producción en que incurren los fabricantes. La capacidad de la industria para mantener precios estables y garantizar la rentabilidad es cada vez más difícil.

La producción de aceros inoxidables resistentes a la corrosión requiere una cantidad significativa de níquel, una materia prima que se utiliza ampliamente en el proceso de fabricación de acero inoxidable. Si bien el hierro es el componente principal de la mayoría de las aleaciones de acero inoxidable, el cromo es crucial para mejorar la resistencia a la corrosión y la resistencia del acero inoxidable. Numerosas variables, como los cambios en las condiciones del mercado, los acontecimientos geopolíticos y la dinámica de la demanda y la oferta mundiales, tienen un impacto en los precios de estas materias primas.

Desafío

- Desafíos en infraestructura y logística

El movimiento eficiente de productos de acero inoxidable en ciertas regiones de México se ve obstaculizado por la falta de infraestructura de transporte adecuada y limitaciones logísticas. Estos factores pueden causar demoras y aumentos de costos, lo que afecta el crecimiento y la competitividad de la industria del acero inoxidable. Abordar estas deficiencias de infraestructura es fundamental para garantizar el flujo fluido de productos de acero inoxidable y apoyar el crecimiento de la industria en estas regiones.

El transporte eficiente de productos de acero inoxidable desde las plantas de fabricación hasta los usuarios finales o los centros de distribución puede verse obstaculizado en algunas partes de México debido a una infraestructura de transporte insuficiente. El transporte de mercancías a larga distancia puede resultar complicado debido a carreteras, puentes y autopistas mal desarrolladas o en mal estado. Como resultado, pueden producirse retrasos en los plazos de entrega, lo que afecta a los plazos de producción y posiblemente da como resultado un potencial de mercado sin explotar.

Desarrollo reciente

- En 2022, según SteelOrbis Electronic Marketplace Inc., la industria siderúrgica en México recibió 2.140 millones de dólares en Inversión Extranjera Directa (IED), un aumento del 674 por ciento respecto a los 276 millones de dólares del año anterior. Esto ubicó al sector en el cuarto lugar en preferencia de los inversionistas, solo detrás de la fabricación de vehículos y camiones, que recibió 2.700 millones de dólares en IED en el mismo año. México, como país, recibió un total de 35.290 millones de dólares en IED en 2022, con una suma acumulada de 674.540 millones de dólares de 1999 a 2022.

Alcance del mercado de acero inoxidable en México

El mercado se clasifica en cinco segmentos notables según el producto, el proceso de conformado, el tipo, el grado y la aplicación. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Producto

- Productos planos de acero inoxidable

- Productos largos de acero inoxidable

- Otros

Sobre la base del producto, el mercado de acero inoxidable de México está segmentado en productos planos de acero inoxidable, productos largos de acero inoxidable y otros.

Proceso de formación

- Laminado en caliente

- Laminado en frío

Con base en el proceso de conformado, el mercado de acero inoxidable de México está segmentado en laminado en caliente y laminado en frío.

Tipo

- Acero inoxidable austenítico

- Acero inoxidable ferrítico

- Acero inoxidable martensítico

- Acero inoxidable dúplex

- Acero inoxidable resistente a la precipitación

Según el tipo, el mercado de acero inoxidable de México está segmentado en acero inoxidable austenítico, acero inoxidable ferrítico, acero inoxidable martensítico, acero inoxidable dúplex y acero inoxidable resistente a la precipitación.

Calificación

- Serie 300

- Serie 400

- Serie 200

- Serie 500

- Serie 600

Según el grado, el mercado de acero inoxidable de México está segmentado en serie 300, serie 400, serie 200, serie 500 y serie 600.

Solicitud

- Automoción y transporte

- Ingeniería mecánica e industrias pesadas

- Productos de metal

- Bienes de consumo

- Medicina y atención sanitaria

- Construcción y edificación

- Marina

- Otros

Sobre la base de la aplicación, el mercado de acero inoxidable de México está segmentado en automotriz y transporte, ingeniería mecánica e industrias pesadas, productos de metal, bienes de consumo, médicos y atención médica, construcción y edificación, marino y otros.

Análisis y perspectivas regionales del mercado de acero inoxidable en México

El mercado se clasifica en cinco segmentos notables según el producto, el proceso de formación, el tipo, el grado y la aplicación.

Las regiones cubiertas por el mercado de acero inoxidable de México son el norte de México, el centro de México, el este de México, el oeste de México y el sur de México.

Se espera que la región norte domine el mercado mexicano de acero inoxidable debido a la creciente demanda en la industria automotriz. Además, el norte de México es la región de más rápido crecimiento debido a la creciente demanda en industrias de uso final como la automotriz, la construcción, etc.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. El análisis de los puntos de datos de la cadena de valor aguas abajo y aguas arriba, el análisis de las cinco fuerzas de Porter de las tendencias técnicas y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se consideran la presencia y disponibilidad de marcas mexicanas y los desafíos que enfrentan debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles internos y las rutas comerciales al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado del acero inoxidable

El panorama competitivo del mercado proporciona detalles de los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la variedad de productos, el dominio de las aplicaciones y la curva de vida de la tecnología. Los puntos de datos proporcionados anteriormente solo están relacionados con el enfoque de las empresas en relación con el mercado del acero inoxidable.

Algunos de los principales actores del mercado que operan en el mercado son Industeel, Acerinox, Aperam, NIPPON STEEL CORPORATION, Alleima, MITSUI & CO., LTD., Olympic Steel, Outokumpu, Ulbrich Stainless Steels and Special Metals Inc., Swiss Steel Holding AG, Gibbs Wire & Steel Company LLC, TIMEX METALS, Shrikant Steel Centre, Nitech Stainless Inc y RH Alloys, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES

4.3 PRODUCTION CONSUMPTION ANALYSIS

4.4 CLIMATE CHANGE SCENARIO

4.4.1 ENVIRONMENTAL CONCERNS

4.4.2 INDUSTRY RESPONSE

4.4.3 GOVERNMENT’S ROLE

4.4.4 ANALYST RECOMMENDATION

4.5 COMPARATIVE OVERVIEW OF NORTH AMERICA

4.6 ADDITIONAL CUSTOMIZATION

4.7 IMPORT-EXPORT SCENARIO

4.8 PRICE INDEX SCENARIO

4.9 RAW MATERIAL COVERAGE

4.9.1 NICKEL

4.9.2 IRON ORE

4.9.3 CHROMIUM

4.9.4 SILICON

4.9.5 MOLYBDENUM

4.9.6 OTHERS

4.1 SUPPLY CHAIN ANALYSIS

4.10.1 OVERVIEW

4.10.2 LOGISTIC COST SCENARIO

4.10.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.11 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.12 VENDOR SELECTION CRITERIA

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING INDUSTRIAL ACTIVITIES IN MEXICO

6.1.2 RISING URBANIZATION AND INFRASTRUCTURE DEVELOPMENT

6.1.3 GROWING FOREIGN INVESTMENT AND TRADE AGREEMENTS

6.2 RESTRAINTS

6.2.1 FLUCTUATING RAW MATERIAL COSTS

6.2.2 COMPETITION FROM ALTERNATIVE MATERIALS

6.3 OPPORTUNITIES

6.3.1 INTEGRATION INTO GREEN INDUSTRIES

6.3.2 EXPANSION INTO MEDICAL AND HEALTHCARE SECTORS

6.4 CHALLENGES

6.4.1 INFRASTRUCTURE AND LOGISTIC CHALLENGES

6.4.2 ENVIRONMENTAL REGULATIONS COMPLIANCE

7 MEXICO STAINLESS STEEL MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 BUILDING AND CONSTRUCTION

7.2.1 BUILDING AND CONSTRUCTION

7.2.1.1 RESIDENTIAL

7.2.1.2 COMMERCIAL

7.2.1.3 INFRASTRUCTURE

7.3 AUTOMOTIVE AND TRANSPORTATION

7.3.1 AUTOMOTIVE AND TRANSPORTATION

7.3.1.1 VEHICLES

7.3.1.1.1 TWO-WHEELER

7.3.1.1.2 FOUR-WHEELER

7.3.1.1.3 OTHERS

7.3.1.2 AEROSPACE

7.3.1.2.1 COMMERCIAL AIRCRAFT

7.3.1.2.2 MILITARY AIRCRAFT

7.3.1.2.3 PRIVATE CHARTER

7.4 MARINE

7.4.1 MARINE

7.4.1.1 CARGOS

7.4.1.2 PASSENGER SHIPS

7.4.1.3 BOATS

7.4.1.4 OTHERS

7.5 CONSUMER GOODS

7.5.1 CONSUMER GOODS

7.5.1.1 KITCHEN SINKS

7.5.1.2 CUTLERY

7.5.1.3 COOKWARE

7.5.1.4 KITCHEN APPLIANCES

7.5.1.5 FURNITURE

7.5.1.6 GARDEN EQUIPMENT

7.5.1.7 OTHERS

7.6 MECHANICAL ENGINEERING AND HEAVY INDUSTRIES

7.6.1 MECHANICAL ENGINEERING AND HEAVY INDUSTRIES

7.6.1.1 AGGREGATE MINING

7.6.1.2 METAL MINING

7.6.1.3 COAL MINING

7.6.1.4 OTHERS

7.7 METAL PRODUCTS

7.8 MEDICAL AND HEALTHCARE

7.8.1 MEDICAL AND HEALTHCARE

7.8.1.1 MEDICAL DEVICES

7.8.1.2 SURGICAL TOOLS

7.9 OTHERS

8 MEXICO STAINLESS STEEL MARKET BY REGION

8.1 NORTHERN MEXICO

8.2 CENTRAL MEXICO

8.3 EASTERN MEXICO

8.4 WESTERN MEXICO

8.5 SOUTHERN MEXICO

9 MEXICO STAINLESS STEEL MARKET, COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: MEXICO

9.2 ACQUISITION

9.3 SUSTAINABILITY

9.4 PARTNERSHIP

9.5 PRODUCT LAUNCH

9.6 AWARD

10 SWOT ANALYSIS

11 COMPANY PROFILES

11.1 ACERINOX

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 PRODUCT PORTFOLIO

11.1.4 RECENT DEVELOPMENTS

11.2 MITSUI & CO., LTD

11.2.1 COMPANY SNAPSHOT

11.2.2 REVENUE ANALYSIS

11.2.3 PRODUCT PORTFOLIO

11.2.4 RECENT DEVELOPMENT

11.3 OUTOKUMPU

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 PRODUCT PORTFOLIO

11.3.4 RECENT DEVELOPMENT

11.4 ULBRICH STAINLESS STEELS AND SPECIAL METALS INC.

11.4.1 COMPANY SNAPSHOT

11.4.2 PRODUCT PORTFOLIO

11.4.3 RECENT DEVELOPMENTS

11.5 NIPPON STEEL CORPORATION

11.5.1 COMPANY SNAPSHOT

11.5.2 REVENUE ANALYSIS

11.5.3 PRODUCT PORTFOLIO

11.5.4 RECENT DEVELOPMENT

11.6 ALLEIMA

11.6.1 COMPANY SNAPSHOT

11.6.2 REVENUE ANALYSIS

11.6.3 PRODUCT PORTFOLIO

11.6.4 RECENT DEVELOPMENTS

11.7 APERAM

11.7.1 COMPANY SNAPSHOT

11.7.2 REVENUE ANALYSIS

11.7.3 PRODUCT PORTFOLIO

11.7.4 RECENT DEVELOPMENT

11.8 GIBBS WIRE & STEEL COMPANY LLC

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT DEVELOPMENT

11.9 INDUSTEEL

11.9.1 COMPANY SNAPSHOT

11.9.2 PRODUCT PORTFOLIO

11.9.3 RECENT DEVELOPMENTS

11.1 NITECH STAINLESS INC

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 RECENT DEVELOPMENT

11.11 OLYMPIC STEEL

11.11.1 COMPANY SNAPSHOT

11.11.2 REVENUE ANALYSIS

11.11.3 PRODUCT PORTFOLIO

11.11.4 RECENT DEVELOPMENTS

11.12 R H ALLOYS

11.12.1 COMPANY SNAPSHOT

11.12.2 PRODUCT PORTFOLIO

11.12.3 RECENT DEVELOPMENT

11.13 SHRIKANT STEEL CENTRE

11.13.1 COMPANY SNAPSHOT

11.13.2 PRODUCT PORTFOLIO

11.13.3 RECENT DEVELOPMENT

11.14 SWISS STEEL HOLDING AG

11.14.1 COMPANY SNAPSHOT

11.14.2 REVENUE ANALYSIS

11.14.3 PRODUCT PORTFOLIO

11.14.4 RECENT DEVELOPMENT

11.15 TIMEX METALS

11.15.1 COMPANY SNAPSHOT

11.15.2 PRODUCT PORTFOLIO

11.15.3 RECENT DEVELOPMENT

11.16 POSCO HOLDINGS

11.16.1 COMPANY SNAPSHOT

11.16.2 REVENUE ANALYSIS

11.16.3 PRODUCT PORTFOLIO

11.16.4 RECENT DEVELOPMENT

11.17 AK STEEL INTERNATIONAL B.V. (CLEVELAND-CLIFFS INC)

11.17.1 COMPANY SNAPSHOT

11.17.2 PRODUCT PORTFOLIO

11.17.3 RECENT DEVELOPMENT

12 QUESTIONNAIRE

13 RELATED REPORTS

Lista de Tablas

TABLE 1 COMPARATIVE DATA OF NORTH AMERICA STAINLESS STEEL MARKET (U.S. AND CANADA)

TABLE 2 ANNUAL APPARENT NATIONAL CONSUMPTION OF STAINLESS STEEL PRODUCTS IN MEXICO

TABLE 3 ANNUAL APPARENT REGIONAL CONSUMPTION OF STAINLESS STEEL PRODUCTS

TABLE 4 ANNUAL WEIGHTED AVERAGE MARGIN

TABLE 5 APPARENT NATIONAL CONSUMPTION ACROSS MAJOR STATES IN MEXICO

TABLE 6 CONSUMPTION DATA FOR HIGH ALLOY STAINLESS STEEL IN MEXICO

TABLE 7 ESTIMATED IMPORT AND PRODUCTION DATA OF STAINLESS STEEL IN MEXICO

TABLE 8 REGULATORY COVERAGE

TABLE 9 MEXICO STAINLESS STEEL MARKET, 2021-2030

TABLE 10 MEXICO STAINLESS STEEL MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 MEXICO STAINLESS STEEL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 12 MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 13 MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 14 MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 15 MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (TONS)

TABLE 16 MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 17 MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (TONS)

TABLE 18 MEXICO STAINLESS STEEL BARS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 19 MEXICO STAINLESS STEEL MARKET, BY FORMING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 20 MEXICO STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 21 MEXICO DUPLEX STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 22 MEXICO STAINLESS STEEL MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 23 MEXICO 300 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 24 MEXICO 400 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 25 MEXICO 200 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 26 MEXICO STAINLESS STEEL MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 27 MEXICO AUTOMOTIVE AND TRANSPORTATION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 MEXICO VEHICLES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 29 MEXICO AEROSPACE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 30 MEXICO MECHANICAL ENGINEERING AND HEAVY INDUSTRIES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 MEXICO CONSUMER GOODS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 MEXICO BUILDING AND CONSTRUCTION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 33 MEXICO MEDICAL AND HEALTHCARE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 MEXICO MARINE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 NORTHERN MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 36 NORTHERN MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 37 NORTHERN MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 38 NORTHERN MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (TONS)

TABLE 39 NORTHERN MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 40 NORTHERN MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (TONS)

TABLE 41 NORTHERN MEXICO STAINLESS STEEL BARS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 42 NORTHERN MEXICO STAINLESS STEEL MARKET, BY FORMING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 43 NORTHERN MEXICO STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 44 NORTHERN MEXICO DUPLEX STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 NORTHERN MEXICO STAINLESS STEEL MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 46 NORTHERN MEXICO 300 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 47 NORTHERN MEXICO 400 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 48 NORTHERN MEXICO 200 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 49 NORTHERN MEXICO STAINLESS STEEL MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 50 NORTHERN MEXICO AUTOMOTIVE AND TRANSPORTATION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 NORTHERN MEXICO VEHICLES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 NORTHERN MEXICO AEROSPACE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 NORTHERN MEXICO MECHANICAL ENGINEERING AND HEAVY INDUSTRIES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 NORTHERN MEXICO CONSUMER GOODS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 NORTHERN MEXICO MEDICAL AND HEALTHCARE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 NORTHERN MEXICO BUILDING AND CONSTRUCTION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 NORTHERN MEXICO MARINE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 CENTRAL MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 59 CENTRAL MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 60 CENTRAL MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 61 CENTRAL MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (TONS)

TABLE 62 CENTRAL MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 63 CENTRAL MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (TONS)

TABLE 64 CENTRAL MEXICO STAINLESS STEEL BARS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 CENTRAL MEXICO STAINLESS STEEL MARKET, BY FORMING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 66 CENTRAL MEXICO STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 CENTRAL MEXICO DUPLEX STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 68 CENTRAL MEXICO STAINLESS STEEL MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 69 CENTRAL MEXICO 300 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 70 CENTRAL MEXICO 400 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 71 CENTRAL MEXICO 200 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 72 CENTRAL MEXICO STAINLESS STEEL MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 73 CENTRAL MEXICO AUTOMOTIVE AND TRANSPORTATION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 CENTRAL MEXICO VEHICLES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 75 CENTRAL MEXICO AEROSPACE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 76 CENTRAL MEXICO MECHANICAL ENGINEERING AND HEAVY INDUSTRIES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 77 CENTRAL MEXICO BUILDING AND CONSTRUCTION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 78 CENTRAL MEXICO CONSUMER GOODS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 79 CENTRAL MEXICO MEDICAL AND HEALTHCARE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 80 CENTRAL MEXICO MARINE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 81 EASTERN MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 82 EASTERN MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 83 EASTERN MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 84 EASTERN MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (TONS)

TABLE 85 EASTERN MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 86 EASTERN MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (TONS)

TABLE 87 EASTERN MEXICO STAINLESS STEEL BARS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 88 EASTERN MEXICO STAINLESS STEEL MARKET, BY FORMING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 89 EASTERN MEXICO STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 90 EASTERN MEXICO DUPLEX STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 91 EASTERN MEXICO STAINLESS STEEL MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 92 EASTERN MEXICO 300 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 93 EASTERN MEXICO 400 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 94 EASTERN MEXICO 200 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 95 EASTERN MEXICO STAINLESS STEEL MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 96 EASTERN MEXICO MECHANICAL ENGINEERING AND HEAVY INDUSTRIES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 97 EASTERN MEXICO BUILDING AND CONSTRUCTION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 98 EASTERN MEXICO CONSUMER GOODS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 99 EASTERN MEXICO MARINE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 100 EASTERN MEXICO AUTOMOTIVE AND TRANSPORTATION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 101 EASTERN MEXICO VEHICLES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 102 EASTERN MEXICO AEROSPACE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 103 EASTERN MEXICO MEDICAL AND HEALTHCARE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 104 WESTERN MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 105 WESTERN MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 106 WESTERN MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 107 WESTERN MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (TONS)

TABLE 108 WESTERN MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 109 WESTERN MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (TONS)

TABLE 110 WESTERN MEXICO STAINLESS STEEL BARS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 111 WESTERN MEXICO STAINLESS STEEL MARKET, BY FORMING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 112 WESTERN MEXICO STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 113 WESTERN MEXICO DUPLEX STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 114 WESTERN MEXICO STAINLESS STEEL MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 115 WESTERN MEXICO 300 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 116 WESTERN MEXICO 400 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 117 WESTERN MEXICO 200 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 118 WESTERN MEXICO STAINLESS STEEL MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 119 WESTERN MEXICO MECHANICAL ENGINEERING AND HEAVY INDUSTRIES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 120 WESTERN MEXICO AUTOMOTIVE AND TRANSPORTATION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 121 WESTERN MEXICO VEHICLES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 122 WESTERN MEXICO AEROSPACE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 123 WESTERN MEXICO CONSUMER GOODS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 124 WESTERN MEXICO MEDICAL AND HEALTHCARE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 125 WESTERN MEXICO BUILDING AND CONSTRUCTION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 126 WESTERN MEXICO MARINE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 127 SOUTHERN MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 128 SOUTHERN MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 129 SOUTHERN MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 130 SOUTHERN MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (TONS)

TABLE 131 SOUTHERN MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 132 SOUTHERN MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 133 SOUTHERN MEXICO STAINLESS STEEL BARS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 134 SOUTHERN MEXICO STAINLESS STEEL MARKET, BY FORMING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 135 SOUTHERN MEXICO STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 136 SOUTHERN MEXICO DUPLEX STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 137 SOUTHERN MEXICO STAINLESS STEEL MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 138 SOUTHERN MEXICO 300 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 139 SOUTHERN MEXICO 400 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 140 SOUTHERN MEXICO 200 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 141 SOUTHERN MEXICO STAINLESS STEEL MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 142 SOUTHERN MEXICO MECHANICAL ENGINEERING AND HEAVY INDUSTRIES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 143 SOUTHERN MEXICO BUILDING AND CONSTRUCTION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 144 SOUTHERN MEXICO CONSUMER GOODS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 145 SOUTHERN MEXICO MARINE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 146 SOUTHERN MEXICO AUTOMOTIVE AND TRANSPORTATION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 147 SOUTHERN MEXICO VEHICLES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 148 SOUTHERN MEXICO AEROSPACE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 149 SOUTHERN MEXICO MEDICAL AND HEALTHCARE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

Lista de figuras

FIGURE 1 MEXICO STAINLESS STEEL MARKET

FIGURE 2 MEXICO STAINLESS STEEL MARKET: DATA TRIANGULATION

FIGURE 3 MEXICO STAINLESS STEEL MARKET: DROC ANALYSIS

FIGURE 4 MEXICO STAINLESS STEEL MARKET: MEXICO VS REGIONAL MARKET ANALYSIS

FIGURE 5 MEXICO STAINLESS STEEL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MEXICO STAINLESS STEEL MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 MEXICO STAINLESS STEEL MARKET: MULTIVARIATE MODELLING

FIGURE 8 MEXICO STAINLESS STEEL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MEXICO STAINLESS STEEL MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MEXICO STAINLESS STEEL MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 MEXICO STAINLESS STEEL MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MEXICO STAINLESS STEEL MARKET: SEGMENTATION

FIGURE 13 RISING URBANIZATION AND INRASTRUCTURE DEVELOPMENT ARE EXPECTED TO DRIVE THE MEXICO STAINLESS STEEL MARKET IN THE FORECAST PERIOD

FIGURE 14 THE STAINLESS STEEL FLAT PRODUCTS ARE EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MEXICO STAINLESS STEEL MARKET IN 2023 AND 2030

FIGURE 15 THE BELOW GRAPH SHOWS THE GREENHOUSE GAS EMISSIONS FOR STAINLESS STEEL.THE TOTAL EMISSIONS ARE 3.3 TONS OF CO2/ TON OF STAINLESS STEEL.

FIGURE 16 THE BELOW DIAGRAM SHOWS THE LIFE CYCLE OF STAINLESS STEEL IN 2010

FIGURE 17 IMPORT-EXPORT SCENARIO (USD THOUSAND)

FIGURE 18 THE HYBRID TECHNIQUE IS ONE OF NUMEROUS DEVELOPMENTS THAT USE HYDROGEN AS A REDUCING AGENT, WITH THE HYDROGEN BEING GENERATED THROUGH ELECTROLYSIS USING SUSTAINABLE POWER. THE MOST MAJOR ADVANTAGE FROM A NATURAL STANDPOINT IS THAT THE FUMES PRODUCED BY THIS TECHNIQUE ARE WATER RATHER THAN CARBON DIOXIDE.

FIGURE 19 VENDOR SELECTION CRITERIA

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MEXICO STAINLESS STEEL MARKET

FIGURE 21 THE BELOW DATA SHOWS THE INDUSTRIAL PRODUCTION IN MEXICO

FIGURE 22 THE BELOW FIGURE SHOWS 'MEXICO'S URBAN POPULATION BY CITY SIZE CLASS, 1990–2035 (HISTORICAL AND PROJECTED)

FIGURE 23 MEXICO STAINLESS STEEL MARKET: BY APPLICATION, 2022

FIGURE 24 MEXICO STAINLESS STEEL MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.