Ksa Aftermarket Spare Parts Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

4.79 Thousand

USD

6.61 Thousand

2023

2029

USD

4.79 Thousand

USD

6.61 Thousand

2023

2029

| 2024 –2029 | |

| USD 4.79 Thousand | |

| USD 6.61 Thousand | |

|

|

|

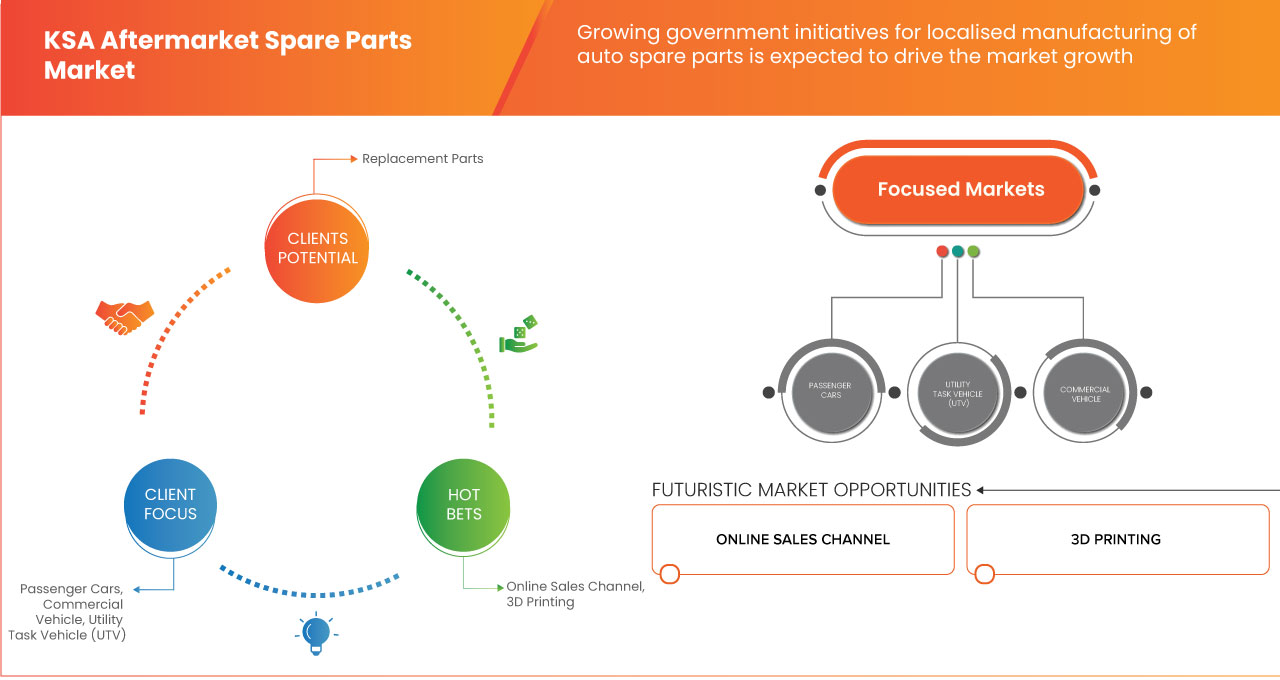

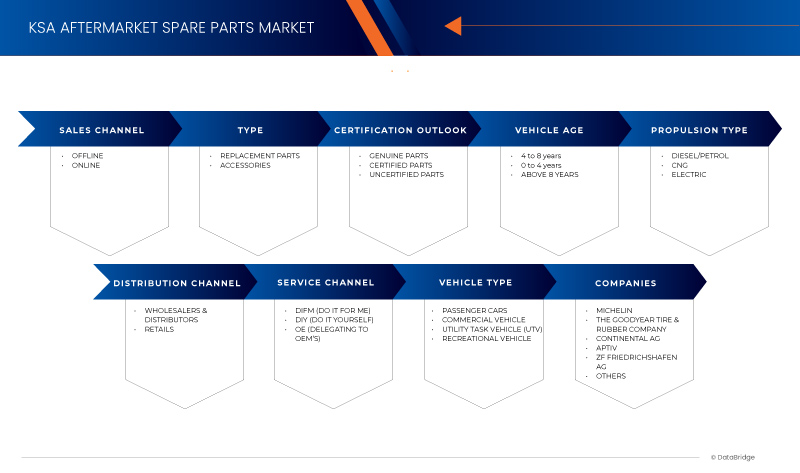

Mercado de repuestos de posventa de KSA, por tipo (repuestos y accesorios), canal de distribución (mayoristas, distribuidores y minoristas), perspectiva de certificación (repuestos originales, repuestos certificados y repuestos no certificados), canal de servicio (DIFM (Do It for Me), DIY (Do It Yourself) y OE (delegación a OEM)), antigüedad del vehículo (de 4 a 8 años, de 0 a 4 años y más de 8 años), tipo de vehículo (automóviles de pasajeros, vehículos comerciales, vehículos utilitarios (UTV), vehículos recreativos), canal de ventas (fuera de línea y en línea), tipo de propulsión (diésel/gasolina, GNC y eléctrico): tendencias de la industria y pronóstico hasta 2029.

Análisis y tamaño del mercado de repuestos de posventa de Arabia Saudita

Las piezas de repuesto del mercado de accesorios se refieren a componentes o piezas que han sido fabricadas por empresas de terceros y que se venden por separado del fabricante del equipo original (OEM). Estas piezas están diseñadas para reemplazar o reparar piezas originales en vehículos, maquinaria u otros equipos después de que las piezas originales se hayan desgastado o hayan dejado de funcionar correctamente. Las piezas de repuesto del mercado de accesorios a menudo se producen para cumplir o superar las especificaciones de las piezas del OEM y, por lo general, se ofrecen a precios competitivos. Proporcionan a los consumidores alternativas a las piezas del OEM, ofreciendo una selección más amplia y, a menudo, proporcionando ahorros de costos en comparación con la compra directa del fabricante original.

Data Bridge Market Research analiza que se espera que el mercado de repuestos de posventa de Arabia Saudita alcance un valor de USD 6,61 mil para 2029 desde 4,79 mil en 2023, creciendo a una CAGR del 5,7% durante el período de pronóstico de 2024 a 2029.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2024 a 2029 |

|

Año base |

2023 |

|

Años históricos |

2022 (Personalizable para 2016-2021) |

|

Unidades cuantitativas |

Ingresos en miles de USD |

|

Segmentos cubiertos |

Tipo (repuestos y accesorios), canal de distribución (mayoristas, distribuidores y minoristas), perspectiva de certificación (repuestos originales, repuestos certificados y repuestos no certificados), canal de servicio (DIFM (Do It for Me), DIY (Do It Yourself) y OE (Delegación a OEM)), antigüedad del vehículo (de 4 a 8 años, de 0 a 4 años y más de 8 años), tipo de vehículo (automóviles de pasajeros, vehículos comerciales, vehículos utilitarios para tareas (UTV), vehículos recreativos), canal de ventas (fuera de línea y en línea), tipo de propulsión (diésel/gasolina, GNC y eléctrico) |

|

Países cubiertos |

Arabia Saudita |

|

Actores del mercado cubiertos |

Michelin, The Goodyear Tire & Rubber Company, Continental AG, Aptiv, ZF Friedrichshafen AG, Robert Bosch GmbH, Knorr-Bremse AG, Yokohama Tire Corporation, Tenneco Inc y DENSO CORPORATION, entre otros. |

Definición de mercado

Las piezas de repuesto del mercado de accesorios se refieren a componentes o piezas que han sido fabricadas por empresas de terceros y que se venden por separado del fabricante del equipo original (OEM). Estas piezas están diseñadas para reemplazar o reparar piezas originales en vehículos, maquinaria u otros equipos después de que las piezas originales se hayan desgastado o hayan dejado de funcionar correctamente. Las piezas de repuesto del mercado de accesorios a menudo se producen para cumplir o superar las especificaciones de las piezas del OEM y, por lo general, se ofrecen a precios competitivos. Proporcionan a los consumidores alternativas a las piezas del OEM, ofreciendo una selección más amplia y, a menudo, proporcionando ahorros de costos en comparación con la compra directa del fabricante original.

Dinámica del mercado de repuestos de posventa de Arabia Saudita

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- La creciente demanda de automóviles

La creciente demanda de automóviles en Arabia Saudita actúa como un factor clave que impulsa el mercado de repuestos de posventa. La población del país crece de manera constante y las tendencias de urbanización están en aumento, lo que se traduce en un aumento correspondiente de la necesidad de transporte personal, ya sea para desplazamientos diarios o para fines de ocio. Esta mayor demanda se traduce en un aumento de las ventas de vehículos en varios segmentos, incluidos los automóviles de pasajeros, los vehículos comerciales y los vehículos todoterreno, lo que refuerza el tamaño general del parque automotor en el país.

- Crece la preferencia por las compras online de repuestos para automóviles

La creciente preferencia por las compras en línea de repuestos para automóviles representa un impulsor significativo del mercado de repuestos de posventa en Arabia Saudita. La digitalización y el comercio electrónico siguen ganando terreno, los consumidores valoran cada vez más la comodidad, la accesibilidad y la amplia selección de productos que ofrecen las plataformas en línea. La proliferación de canales de comercio electrónico y sitios web dedicados a repuestos para automóviles permite a los propietarios de vehículos navegar, comparar precios y comprar repuestos fácilmente desde la comodidad de sus hogares o lugares de trabajo.

Oportunidades

- Colaboración y asociaciones entre los actores del mercado

La colaboración y las asociaciones entre los actores del mercado representan una oportunidad importante para que el mercado de repuestos de posventa de Arabia Saudita mejore su competitividad y eficiencia. Al formar alianzas estratégicas, las empresas de la industria de repuestos pueden aprovechar las fortalezas, los recursos y la experiencia de cada una para impulsar la innovación, ampliar el alcance del mercado y mejorar la eficiencia de la cadena de suministro. Por ejemplo, las asociaciones entre fabricantes de repuestos, distribuidores y minoristas pueden agilizar los canales de distribución, reducir los plazos de entrega y optimizar la gestión de inventario, lo que en última instancia beneficia a los clientes finales con un acceso más rápido a repuestos de calidad.

- Modelos de distribución innovadores

Los modelos de distribución innovadores representan una oportunidad importante para el mercado de repuestos de posventa del Reino de Arabia Saudita (ARS). La industria automotriz en ARS, que ha experimentado un rápido crecimiento y avances tecnológicos, ha enfrentado el desafío de que los canales de distribución tradicionales se adapten a las cambiantes preferencias de los consumidores y la dinámica del mercado. Los modelos innovadores, como las plataformas de comercio electrónico, las ventas directas al consumidor y los servicios basados en suscripciones, ofrecen el potencial de revolucionar el mercado de repuestos de posventa en ARS al brindar mayor comodidad, accesibilidad y eficiencia a los consumidores.

Restricciones/Desafíos

- Cumplimiento normativo relacionado con repuestos para automóviles

El cumplimiento normativo supone una limitación importante para el mercado de repuestos de posventa en Arabia Saudita. Las estrictas normas y regulaciones establecidas por la Organización Saudí de Normas, Metrología y Calidad (SASO) exigen que los proveedores y distribuidores cumplan criterios específicos de calidad y seguridad para los repuestos de automóviles. Garantizar el cumplimiento de las normas de la SASO a menudo implica procesos de certificación rigurosos, que pueden llevar mucho tiempo y resultar costosos para las empresas que operan en el segmento de posventa. Además, las regulaciones de importación y los aranceles aduaneros aumentan aún más la complejidad y el costo de la obtención y distribución de repuestos en el mercado saudí. En consecuencia, estas cargas regulatorias pueden impedir la entrada de nuevos actores en el sector de posventa y limitar la disponibilidad de repuestos a precios competitivos, lo que obstaculiza el crecimiento del mercado y la innovación.

- Altas fluctuaciones en los precios de las materias primas

El mercado de repuestos de posventa en Arabia Saudita enfrenta una restricción formidable debido a las fluctuaciones persistentes en los precios de las materias primas. Estas fluctuaciones se propagan a lo largo de toda la cadena de suministro, afectando a los fabricantes, distribuidores y, en última instancia, a los consumidores finales. Los fabricantes, en particular las pequeñas y medianas empresas (PYME), soportan lo peor de estas oscilaciones de precios, lidiando con la desconcertante tarea de gestionar los costos operativos en un contexto de incertidumbre. Forjar alianzas con proveedores de materias primas se vuelve cada vez más complejo a medida que la negociación de contratos con precios estables se convierte en una tarea difícil de alcanzar ante la volatilidad de los mercados.

Acontecimientos recientes

- En junio de 2023, según un artículo publicado por Cotecna Inspection SA, Cotecna Worldwide anunció un avance significativo en relación con el cumplimiento normativo en Arabia Saudita. La Organización Saudí de Normas, Metrología y Calidad (SASO) aprobó modificaciones a los reglamentos técnicos y especificaciones estándar para repuestos de automóviles, lo que refleja su compromiso de mantener los estándares de calidad y seguridad de los productos en el Reino.

- En junio de 2023, según un artículo publicado por BRIDGESTONE MIDDLE EAST AND AFRICA, los veranos abrasadores en la región del CCG, con temperaturas que a menudo superan los 50 °C, plantean desafíos importantes para los neumáticos de los automóviles, por lo que es fundamental que los propietarios de vehículos tomen medidas preventivas. A medida que aumentan las temperaturas, la presión de los neumáticos aumenta debido a la expansión de las moléculas de aire en el interior de los neumáticos, lo que provoca un inflado excesivo y posibles reventones. La fricción generada durante la conducción eleva aún más las temperaturas de los neumáticos.

- En junio de 2022, según un artículo publicado por el Centro Industrial de Arabia Saudita, el Clúster Automotriz se dedica a impulsar la industria automotriz en Arabia Saudita de acuerdo con la Estrategia Industrial Nacional. Su objetivo es tener 3 o 4 OEM que produzcan más de 400.000 vehículos de pasajeros a nivel nacional para 2030, con el objetivo de lograr un valor agregado bruto local (LGVA) del 40%. Su objetivo es posicionar a Arabia Saudita como un centro de exportación de productos automotrices de alto valor agregado a nivel mundial.

- En febrero de 2024, New East General Trading e Isuzu Motors forjaron una asociación que culminó con el establecimiento de un concesionario en Arabia Saudita, lo que marcó un hito importante en la excelencia automotriz. Ubicado estratégicamente en el corazón de Arabia Saudita, el concesionario, que abarca 8060 metros cuadrados, personificó el compromiso de los socios con la innovación y la excelencia en el servicio, estableciendo nuevos estándares en la industria.

Alcance del mercado de repuestos de posventa de Arabia Saudita

El mercado de repuestos de posventa de Arabia Saudita está segmentado en ocho segmentos notables según el tipo, el canal de distribución, las perspectivas de certificación, el tipo de propulsión, el canal de servicio, la antigüedad del vehículo, el tipo de vehículo y el canal de ventas . El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y las diferencias en sus mercados objetivo.

Tipo

- Piezas de repuesto

- Accesorios

Según el tipo, el mercado se segmenta en piezas de repuesto y accesorios.

Canal de distribución

- Mayoristas y distribuidores

- Ventas al por menor

Sobre la base del canal de distribución, el mercado está segmentado en mayoristas, distribuidores y minoristas.

Perspectivas de certificación

- Piezas originales

- Piezas certificadas

- Piezas no certificadas

Sobre la base de la perspectiva de la certificación, el mercado está segmentado en piezas genuinas, piezas certificadas y piezas no certificadas.

Canal de servicio

- DIFM (Hazlo por mí)

- Hazlo tú mismo (DIY)

- OE (Delegación a OEM)

Sobre la base del canal de servicio, el mercado está segmentado en DIFM (Hazlo por mí), DIY (Hazlo tú mismo) y OE (delegación a OEM).

Antiguedad del vehículo

- 4 a 8 años

- 0 a 4 años

- Más de 8 años

En función de la antigüedad del vehículo, el mercado se segmenta en 4 a 8 años, 0 a 4 años y más de 8 años.

Tipo de vehículo

- Automóviles de pasajeros

- Vehículo comercial

- Vehículo utilitario para tareas (UTV)

- Vehículo recreativo

Según el tipo de vehículo, el mercado está segmentado en automóviles de pasajeros, vehículos comerciales, vehículos utilitarios para tareas (UTV) y vehículos recreativos.

Canal de venta

- Desconectado

- En línea

Sobre la base del canal de ventas, el mercado se segmenta en online y offline.

Tipo de propulsión

- Diésel/Gasolina

- GNC

- Eléctrico

Según el tipo de propulsión, el mercado está segmentado en diésel/gasolina, GNC y eléctrico.

Análisis del panorama competitivo y de la cuota de mercado de repuestos de posventa de Arabia Saudí

El panorama competitivo del mercado de repuestos de posventa de Arabia Saudita proporciona detalles de los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado global de automatización industrial.

Algunos de los principales actores que operan en el mercado de repuestos de posventa de Arabia Saudita son Michelin, The Goodyear Tire & Rubber Company, Continental AG, Aptiv, ZF Friedrichshafen AG, Robert Bosch GmbH, Knorr-Bremse AG, Yokohama Tire Corporation, Tenneco Inc y DENSO CORPORATION, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF KSA AFTERMARKET SPARE PARTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 TYPE TIMELINE CURVE

2.9 VEHICLE TYPE COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER FIVE FORCES ANALYSIS

4.2 REGULATORY STANDARDS

4.3 TECHNOLOGICAL TRENDS

4.4 TOP 50 SPARE PARTS PRICES

4.5 MOST SELLING SPARE PARTS FOR TOP 15 BRANDS IN KSA

4.6 MARKET SIZE TOP 5 BRANDS IN KSA

4.7 TOP EXPORTING COUNTRIES TO KSA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR AUTOMOBILE

5.1.2 SURGING PREFERENCE FOR ONLINE PURCHASES OF AUTO SPARE PARTS

5.1.3 EXTREME WEATHER CONDITIONS IN SAUDI ARABIA

5.1.4 GROWING GOVERNMENT INITIATIVES FOR LOCALISED MANUFACTURING OF AUTO SPARE PARTS

5.2 RESTRAINTS

5.2.1 REGULATORY COMPLIANCES RELATED TO AUTO SPARE PARTS

5.2.2 HIGH RAW MATERIAL PRICE FLUCTUATIONS

5.3 OPPORTUNITIES

5.3.1 COLLABORATION AND PARTNERSHIPS AMONG MARKET PLAYERS

5.3.2 INNOVATIVE DISTRIBUTION MODELS

5.3.3 TECHNOLOGICAL ADVANCEMENTS RELATED TO AUTO SPARE PARTS

5.4 CHALLENGES

5.4.1 HIGH PRODUCT VARIABILITY

5.5 PREVALENCE OF COUNTERFEIT SPARE PARTS

6 KSA AFTERMARKET SPARE PARTS MARKET, BY TYPE

6.1 OVERVIEW

6.2 REPLACEMENT PART

6.2.1 TIRE AND WHEELS

6.2.2 BATTERY

6.2.3 ENGINE AND TRANSMISSION PART

6.2.4 BRAKES AND BRAKE PARTS

6.2.5 BODY PARTS

6.2.6 ELECTRONIC COMPONENTS

6.2.6.1 LIGHTS

6.2.6.2 ALTERNATORS

6.2.6.3 STARTERS

6.2.6.4 SENSOR

6.2.7 COOLING SYSTEMS

6.2.7.1 WATER PUMPS

6.2.7.2 RADIATORS

6.2.7.3 INTERCOOLER

6.2.7.4 OTHERS

6.2.8 BELTS AND HOSES

6.2.9 FUEL INTAKE AND IGNITION PARTS

6.2.9.1 FUEL PUMP

6.2.9.2 FUEL INJECTOR

6.2.9.3 SPARK PLUG

6.2.9.4 FUEL FILTER

6.2.9.5 OTHERS

6.2.10 EXHAUST COMPONENTS

6.2.10.1 MUFFLERS

6.2.10.2 PIPES

6.2.11 IGNITION COILS AND DISTRIBUTORS

6.2.12 A/C PARTS

6.2.13 OTHERS

6.3 ACCESSORIES

6.3.1 CAR EXTERIORS

6.3.2 CAR INTERIORS

7 KSA AFTERMARKET SPARE PARTS MARKET, BY PROPULSION TYPE

7.1 OVERVIEW

7.2 DIESEL/PETROL

7.3 CNG

7.4 ELECTRIC

8 KSA AFTERMARKET SPARE PARTS MARKET, BY SERVICE CHANNEL

8.1 OVERVIEW

8.2 DIFM (DO IT FOR ME)

8.2.1 AUTO PARTS STORES

8.2.2 DISCOUNT DEPARTMENT STORES

8.3 DIY (DO IT YOURSELF)

8.4 OE (DELEGATING TO OEM’S)

9 KSA AFTERMARKET SPARE PARTS MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 WHOLESALERS & DISTRIBUTORS

9.3 RETAILS

9.3.1 OEM

9.3.2 REPAIR SHOPS

10 KSA AFTERMARKET SPARE PARTS MARKET, BY CERTIFICATION OUTLOOK

10.1 OVERVIEW

10.2 GENUINE PARTS

10.3 CERTIFIED PARTS

10.4 UNCERTIFIED PARTS

11 KSA AFTERMARKET SPARE PARTS MARKET, BY VEHICLE AGE

11.1 OVERVIEW

11.2 4 TO 8 YEARS

11.3 0 TO 4 YEARS

11.4 ABOVE 8 YEARS

12 KSA AFTERMARKET SPARE PARTS MARKET, BY SALES CHANNEL

12.1 OVERVIEW

12.2 OFFLINE

12.3 ONLINE

12.4 E-COMMERCE

12.5 COMPANY WEBSITE

13 KSA AFTERMARKET SPARE PARTS MARKET, BY VEHICLE TYPE

13.1 OVERVIEW

13.2 PASSENGER CARS

13.2.1 SUV

13.2.2 SEDAN

13.2.3 HATCHBACK

13.2.4 CROSSOVER

13.2.5 COUPE

13.2.6 CONVERTIBLE

13.2.7 OTHERS

13.3 COMMERCIAL VEHICLE

13.3.1 LIGHT COMMERCIAL VEHICLE

13.3.1.1 PICK UP TRUCKS

13.3.1.2 VANS

13.3.1.3 MINI BUS

13.3.1.4 OTHERS

13.3.2 MEDIUM COMMERCIAL VEHICLE

13.3.3 HEAVY COMMERCIAL VEHICLE

13.3.3.1 TRUCK

13.3.3.1.1 TANKER TRUCKS

13.3.3.1.2 DUMP TRUCK

13.3.3.1.3 CEMENT TRUCK

13.3.3.1.4 REFRIGERATED TRUCKS

13.3.3.1.5 TOW TRUCK

13.3.3.1.6 FIRE TRUCK

13.3.3.2 BUSES

13.3.3.3 OTHERS

13.4 UTILITY TASK VEHICLE (UTV)

13.4.1 SPORTS UTVS

13.4.2 LOAD CARRIER UTVS

13.4.3 MULTIPURPOSE UTVS

13.5 RECREATIONAL VEHICLE

14 KSA FREIGHT FORWARDING MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: KSA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 MICHELIN

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 THE GOODYEAR TIRE & RUBBER COMPANY

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 CONTINENTAL AG

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 APTIV PLC

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 ZF FRIEDRICHSHAFEN AG

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENTS

16.6 DENSO CORPORATION

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 KNORR-BREMSE AG

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 ROBERT BOSCH GMBH

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 TENNECO INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 YOKOHAMA TIRE CORPORATION

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 REGULATORY STANDARDS FOR KSA AFTERMARKET SPARE PARTS MARKET

TABLE 2 TOP 50 SPARE PARTS PRICES

TABLE 3 MOST SELLING SPARE PARTS FOR TOP 15 BRANDS IN KSA

TABLE 4 KSA AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 5 KSA AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (THOUSAND UNITS)

TABLE 6 KSA REPLACEMENT PARTS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 7 KSA REPLACEMENT PARTS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (THOUSAND UNITS)

TABLE 8 KSA ELECTRONIC COMPONENTS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 9 KSA ELECTRONIC COMPONENTS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (THOUSAND UNITS)

TABLE 10 KSA COOLING SYSTEMS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 11 KSA COOLING SYSTEMS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (THOUSAND UNITS)

TABLE 12 KSA FUEL INTAKE AND IGNITION PARTS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 13 KSA FUEL INTAKE AND IGNITION PARTS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (THOUSAND UNITS)

TABLE 14 KSA EXHAUST COMPONENTS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 15 KSA EXHAUST COMPONENTS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (THOUSAND UNITS)

TABLE 16 KSA ACCESSORIES IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 17 KSA ACCESSORIES IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (THOUSAND UNITS)

TABLE 18 KSA AFTERMARKET SPARE PARTS MARKET, BY PROPULSION TYPE, 2018-2029 (USD MILLION)

TABLE 19 KSA AFTERMARKET SPARE PARTS MARKET, BY SERVICE CHANNEL, 2018-2029 (USD MILLION)

TABLE 20 KSA DIFM (DO IT FOR ME) IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 21 KSA AFTERMARKET SPARE PARTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2029 (USD MILLION)

TABLE 22 KSA RETAILS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 23 KSA AFTERMARKET SPARE PARTS MARKET, BY CERTIFICATION OUTLOOK, 2018-2029 (USD MILLION)

TABLE 24 KSA AFTERMARKET SPARE PARTS MARKET, BY VEHICLE AGE, 2018-2029 (USD MILLION)

TABLE 25 KSA AFTERMARKET SPARE PARTS MARKET, BY SALES CHANNEL, 2018-2029 (USD MILLION)

TABLE 26 KSA ONLINE IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 27 KSA AFTERMARKET SPARE PARTS MARKET, BY VEHICLE TYPE, 2018-2029 (USD MILLION)

TABLE 28 KSA PASSENGER CARS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 29 KSA COMMERCIAL VEHICLE IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 30 KSA LIGHT COMMERCIAL VEHICLE IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 31 KSA HEAVY COMMERCIAL VEHICLE IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 32 KSA TRUCK IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 33 KSA UTILITY TASK VEHICLE (UTV) IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

Lista de figuras

FIGURE 1 KSA AFTERMARKET SPARE PARTS MARKET: SEGMENTATION

FIGURE 2 KSA AFTERMARKET SPARE PARTS MARKET: DATA TRIANGULATION

FIGURE 3 KSA AFTERMARKET SPARE PARTS MARKET : DROC ANALYSIS

FIGURE 4 KSA AFTERMARKET SPARE PARTS MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 KSA AFTERMARKET SPARE PARTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 KSA AFTERMARKET SPARE PARTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 KSA AFTERMARKET SPARE PARTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 KSA AFTERMARKET SPARE PARTS MARKET: MULTIVARIATE MODELING

FIGURE 9 KSA AFTERMARKET SPARE PARTS MARKET: TYPE TIMELINE CURVE

FIGURE 10 KSA AFTERMARKET SPARE PARTS MARKET: VEHICLE TYPE COVERAGE GRID

FIGURE 11 KSA AFTERMARKET SPARE PARTS MARKET: SEGMENTATION

FIGURE 12 INCREASING DEMAND FOR AUTOMOBILE IS EXPECTED TO DRIVE THE MARKET GROWTH IN THE FORECAST PERIOD 2024-2029

FIGURE 13 REPLACEMENT PARTS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE KSA AFTERMARKET SPARE PARTS MARKET IN 2024 & 2029

FIGURE 14 PORTER FIVE FORCES ANALYSIS

FIGURE 15 MARKET SIZE TOP 5 BRANDS IN KSA

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE KSA AFTERMARKET SPARE PART MARKET

FIGURE 17 VEHICLE SOLD IN 2022, 2023, AND 2032 (FORECASTED) IN THOUSAND UNITS

FIGURE 18 FACTORS INFLUENCING THE AUTOMOBILE DEMAND IN KSA

FIGURE 19 HIGH TEMPERATURE AFFECTS AUTO SPARE PARTS

FIGURE 20 VARIOUS GOVERNMENT INITIATIVES FOR AUTO SPARE PARTS

FIGURE 21 REGULATORY COMPLIANCES RELATED TO AUTO SPARE PARTS

FIGURE 22 STRATEGIC INITIATIVES BY KEY MARKET PLAYERS

FIGURE 23 INNOVATIONS IN WHOLESALE AUTO PARTS DISTROBUTION

FIGURE 24 TECHNOLOGICAL ADVANCEMENT IN AUTO SPARE PARTS

FIGURE 25 KSA AFTERMARKET SPARE PARTS MARKET: BY TYPE, 2023

FIGURE 26 KSA AFTERMARKET SPARE PARTS MARKET: BY PROPULSION TYPE, 2023

FIGURE 27 KSA AFTERMARKET SPARE PARTS MARKET: BY SERVICE CHANNEL, 2023

FIGURE 28 KSA AFTERMARKET SPARE PARTS MARKET: BY DISTRIBUTION CHANNEL, 2023

FIGURE 29 KSA AFTERMARKET SPARE PARTS MARKET: BY CERTIFICATION OUTLOOK, 2023

FIGURE 30 KSA AFTERMARKET SPARE PARTS MARKET: BY VEHICLE AGE, 2023

FIGURE 31 KSA AFTERMARKET SPARE PARTS MARKET: BY SALES CHANNEL, 2023

FIGURE 32 KSA AFTERMARKET SPARE PARTS MARKET: BY VEHICLE TYPE, 2023

FIGURE 33 KSA FREIGHT FORWARDING MARKET: COMPANY SHARE 2023 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.