Mercado de tratamiento de agua producida en India, por etapas (tratamiento primario, tratamiento secundario, tratamiento terciario y otros), tipo de tratamiento (tratamiento químico, tratamiento físico, tratamiento biológico, sistemas combinados y otros), recurso de hidrocarburos (gas convencional, arenas petrolíferas, gas convencional, metano de lecho de carbón, petróleo compacto, gas de esquisto), capacidad (menos de 100 mil barriles por día, de 100 a 500 mil barriles por día, más de 500 mil barriles por día), fuente de producción (gas natural, petróleo crudo), tecnología ( filtración por membrana , tecnología térmica, filtro biológico aireado (BAF), hidrociclones, flotación de gas, estanque de evaporación, adsorción, filtración de medios, tecnología de intercambio iónico, tecnología de extracción macroporosa, oxidación química, otros), usuario final (industrias petroleras, industrias del gas): tendencias de la industria y pronóstico hasta 2030.

Análisis y perspectivas del mercado de tratamiento de agua producida en India

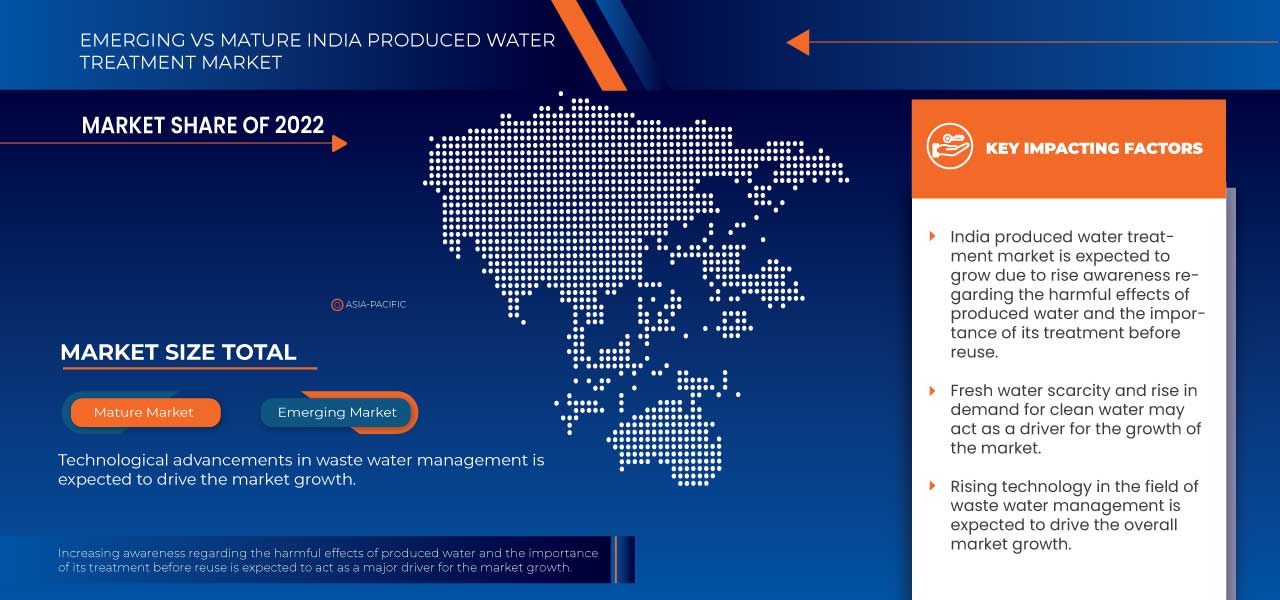

La India es uno de los mayores productores de petróleo y gas del mundo y, como consecuencia de ello, en el país se genera una cantidad significativa de agua de producción. El tratamiento de esta agua en la India es crucial para mantener la sostenibilidad ambiental y la salud pública.

El proceso de tratamiento del agua producida en la India implica varias etapas, incluido el tratamiento primario, secundario y terciario.

La creciente demanda de petróleo y gas y el creciente número de colaboraciones industriales son algunos de los impulsores que impulsan la demanda de tratamiento de agua producida en la India en el mercado.

La principal limitación que afecta al mercado es el alto costo de instalación de las plantas. Además, el estricto marco regulatorio es un factor limitante para el mercado de tratamiento de agua producida en India. Las principales empresas están ampliando sus carteras de productos en el país para fortalecer su presencia de estos productos y soluciones en el mercado.

Por ejemplo,

- En 2022, IEI anunció que había sido galardonado con el premio Water Digest 2022 a la mejor innovación en investigación. Este premio ha ayudado a la empresa en la expansión de su línea de negocio.

Data Bridge Market Research analiza que se espera que el mercado de tratamiento de agua producida en la India alcance un valor de USD 1.131,71 millones para 2030, con una CAGR del 7,2% durante el período de pronóstico.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2015 - 2020) |

|

Unidades cuantitativas |

Ingresos en millones de USD |

|

Segmentos cubiertos |

Por etapas (tratamiento primario, tratamiento secundario, tratamiento terciario y otros), tipo de tratamiento (tratamiento químico, tratamiento físico, tratamiento biológico, sistemas combinados y otros), recurso de hidrocarburos (gas convencional, arenas petrolíferas, gas convencional, metano de lecho de carbón, petróleo de esquisto, gas de esquisto), capacidad (menos de 100 mil barriles por día, de 100 a 500 mil barriles por día, más de 500 mil barriles por día), fuente de producción (gas natural, petróleo crudo), tecnología (filtración por membrana, tecnología térmica, filtro biológico aireado (BAF), hidrociclones, flotación de gas, estanque de evaporación, adsorción, filtración de medios, tecnología de intercambio iónico, tecnología de extracción macroporosa, oxidación química, otros), usuario final (industrias petroleras, industrias del gas) |

|

Países cubiertos |

India |

|

Actores del mercado cubiertos |

Thermax Limited. (India), divaenvitec (India), SOPAN (India), www.paramountlimited.com (India), BPC (India), IEI (India), ALFA LAVAL (India), Aquatech International LLC. (EE. UU.), WABAG (India), IDE (Israel), Wex Technologies (India), NETSOL WATER SOLUTIONS PVT. LTD. (India), OVIVO (India), DuPont (EE. UU.), Gradiant (EE. UU.), Hindustan Dorr-Oliver Ltd. (India), NOV Inc. (EE. UU.), Chokhavatia Associates (India), ULTRA PURE WATER TECHNOLOGIES (India), Veolia (India), entre otros. |

Definición del mercado de tratamiento de agua producida en India

El término "agua producida" se utiliza en la industria del petróleo y el gas para referirse al agua que se lleva a la superficie durante la producción de petróleo y gas. Esta agua suele contener contaminantes como aceite, grasa, sólidos disueltos y productos químicos tóxicos, lo que la hace inadecuada para su uso directo o su descarga al medio ambiente. El tratamiento del agua producida en la India se refiere al proceso de tratamiento y limpieza de esta agua para eliminar los contaminantes y hacerla segura para su reutilización o descarga. El proceso de tratamiento generalmente implica métodos físicos, químicos y biológicos para eliminar el aceite y la grasa, los sólidos suspendidos, los sólidos disueltos y otros contaminantes del agua.

El tratamiento del agua producida es esencial para proteger el medio ambiente y la salud pública y garantizar la sostenibilidad de la producción de petróleo y gas en la India. Existen varias normas y directrices que rigen el tratamiento del agua producida en la India, incluidas las normas de la Dirección de Seguridad de la Industria Petrolera (OISD) y las directrices de la Junta Central de Control de la Contaminación (CPCB).

Dinámica del mercado de tratamiento de agua producida en India

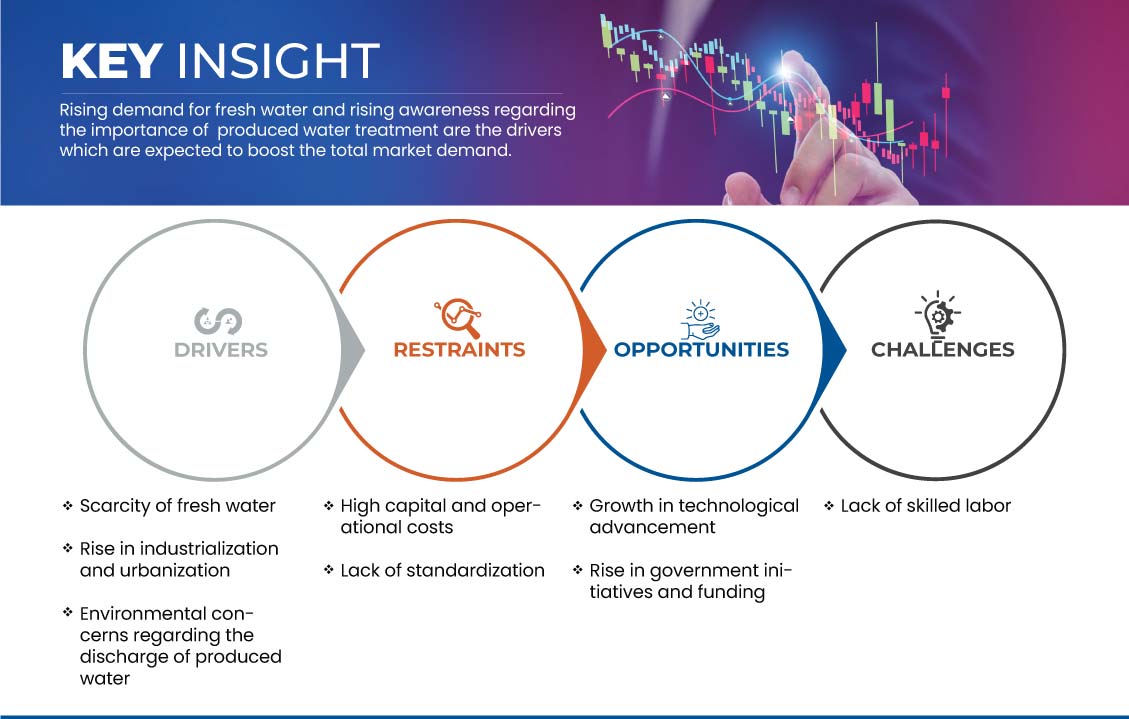

En esta sección se aborda la comprensión de los factores impulsores, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductor

- Escasez de agua dulce

En la actualidad, la India sufre una grave escasez de agua dulce como consecuencia del crecimiento demográfico, la rápida urbanización y la mayor demanda de agua para la agricultura, la industria y los hogares. Como resultado, existe una creciente demanda de fuentes de agua alternativas, como el tratamiento y la reutilización del agua producida por las operaciones de petróleo y gas.

El agua tratada producida no suele considerarse potable porque puede contener trazas de contaminantes que pueden ser perjudiciales para la salud humana. El agua producida se extrae junto con el petróleo y el gas durante las operaciones de producción y puede contener una variedad de contaminantes, como sales, hidrocarburos, metales y productos químicos. Pero el agua tratada puede reutilizarse en las industrias, la agricultura y muchos otros lugares.

Uno de los principales factores que impulsan el crecimiento del mercado de tratamiento de agua producida en la India es la creciente demanda de agua en diversas industrias. Muchas industrias, incluidas las de petróleo y gas, energía y química, requieren grandes cantidades de agua para sus operaciones. Como los recursos de agua dulce se están volviendo escasos, estas industrias están recurriendo a fuentes alternativas de agua, como el agua producida y su tratamiento para su reutilización.

Restricción

- Altos costos de capital y operativos

Si bien el crecimiento del mercado de tratamiento de agua producida en la India está siendo impulsado por diversos factores, como el aumento de la industrialización y la urbanización, también hay algunos obstáculos que actúan como factores restrictivos, incluidos los altos costos de capital y operativos.

El tratamiento del agua producida requiere equipos e infraestructura especializados, que incluyen plantas de tratamiento, tuberías e instalaciones de almacenamiento. El alto costo de instalar y mantener esta infraestructura puede ser una barrera importante para la entrada de nuevos actores en el mercado, en particular las pequeñas y medianas empresas.

Además de los costos de capital, los costos operativos también pueden ser significativos, con gastos continuos, como costos de energía y mantenimiento. El costo de tratar el agua producida puede variar según diversos factores, incluidos el tipo y la cantidad de contaminantes en el agua, la tecnología utilizada y la ubicación de la instalación de tratamiento.

Por lo tanto, se espera que los altos costos de capital y operativos del tratamiento del agua producida actúen como una restricción significativa para el crecimiento del mercado de tratamiento de agua producida en la India.

Oportunidad

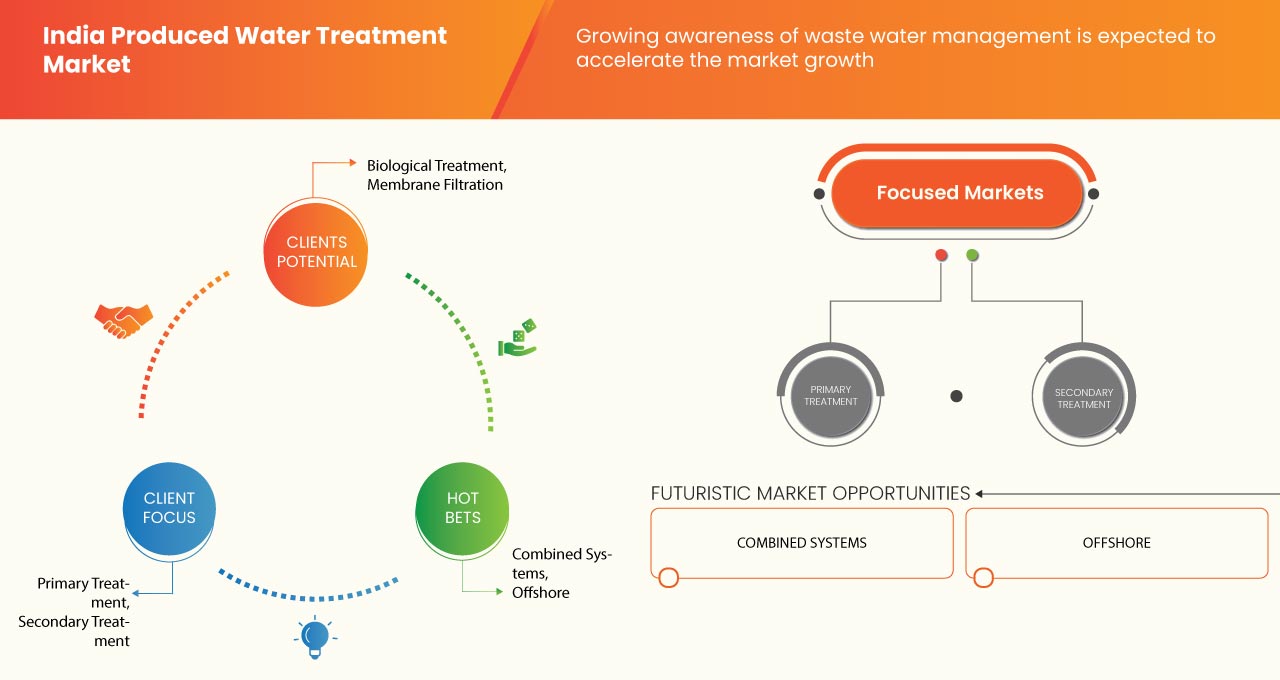

Crecimiento en el avance tecnológico

En los últimos años, la India ha experimentado un enorme crecimiento en materia de avances tecnológicos, en particular en la industria del tratamiento del agua. Con la creciente demanda de agua limpia debido al crecimiento demográfico y la urbanización, se espera que el mercado de tratamiento del agua de la India siga creciendo rápidamente. Esto presenta una oportunidad importante para el crecimiento del mercado de tratamiento del agua producida en la India.

El agua producida es un subproducto de la exploración y producción de petróleo y gas. Contiene diversos contaminantes, como aceite, grasa, sales y metales pesados, lo que dificulta su tratamiento y eliminación segura. Sin embargo, con el avance de la tecnología, el tratamiento del agua producida se ha vuelto más eficiente y rentable, lo que lo convierte en una solución viable para la industria del petróleo y el gas.

La tecnología que ha sido fundamental para el crecimiento del tratamiento de agua producida es la filtración por membrana. La filtración por membrana es un proceso que utiliza una membrana semipermeable para separar los contaminantes del agua. Es muy eficaz para eliminar aceite, grasa y otras impurezas del agua producida, lo que la hace segura para su descarga o reutilización. La tecnología de filtración por membrana también es escalable y se puede utilizar para diversas aplicaciones, lo que la convierte en una solución valiosa para la industria del petróleo y el gas.

Desafío

Falta de mano de obra calificada

Además de los altos costos operativos y de capital, la falta de mano de obra calificada limita el crecimiento del tratamiento de agua producida en la India. El tratamiento de agua producida requiere profesionales calificados con experiencia en una amplia gama de disciplinas, incluidas la ingeniería, la química y la ciencia ambiental.

Lamentablemente, en la industria de tratamiento de agua de la India hay una escasez significativa de profesionales capacitados. La escasez se puede atribuir a diversos factores, entre ellos, la falta de educación y capacitación de calidad, la falta de conocimiento sobre las oportunidades profesionales en la industria de tratamiento de agua y la fuga de cerebros de profesionales capacitados en los países desarrollados.

La exigencia de profesionales cualificados y certificados supone un gran reto para el tratamiento del agua producida.

La falta de profesionales capacitados puede provocar un tratamiento inadecuado del agua producida, lo que puede perjudicar el medio ambiente y la salud humana. También puede causar ineficiencias en el proceso de tratamiento, lo que se traduce en mayores costos operativos y una menor calidad del agua tratada.

Además, la escasez de profesionales capacitados puede dificultar la implementación de nuevas tecnologías e innovaciones en el tratamiento del agua producida. Los profesionales capacitados son esenciales para desarrollar, probar e implementar nuevas tecnologías que puedan mejorar la eficiencia del tratamiento y reducir los costos.

Análisis del impacto posterior a la COVID-19 en el mercado de tratamiento de agua producida en India

La COVID-19 se ha extendido por todo el mundo y ha afectado a diversas industrias. La disminución de la demanda y los precios del petróleo crudo ha afectado a la industria del petróleo y el gas, lo que ha provocado una reducción de las actividades de perforación, lo que ha obstaculizado el crecimiento del mercado. Las interrupciones en las actividades de transporte marítimo, las cadenas de suministro y el comercio debido a la propagación de la COVID-19 también han obstaculizado el crecimiento del mercado.

Acontecimientos recientes

- En julio de 2022, OVIVO, un proveedor global de equipos, tecnología y sistemas de tratamiento de agua y aguas residuales, anunció la adquisición de Wastech Controls & Engineering, LLC.

- En marzo de 2022, ALFA LAVAL adquirió una participación minoritaria en la empresa Marine Performance Systems (MPS), con sede en los Países Bajos. Esta adquisición ha ayudado a la empresa a expandir su negocio y sus productos.

Alcance del mercado de tratamiento de agua producida en India

El mercado de tratamiento de agua producida en India se clasifica en siete segmentos notables, como etapas, tipo de tratamiento, recurso de hidrocarburos, capacidad, fuente de producción, tecnología y usuario final. El crecimiento entre segmentos lo ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

ETAPAS

- Tratamiento primario

- Tratamiento secundario

- Tratamiento terciario

- Otros

Sobre la base de las etapas, el mercado de tratamiento de agua producida en la India se segmenta en tratamiento primario, tratamiento secundario, tratamiento terciario y otros.

TIPO DE TRATAMIENTO

- Tratamiento químico

- Tratamiento físico

- Tratamiento Biológico

- Sistemas combinados

- Otros

Sobre la base del tipo de tratamiento, el mercado de tratamiento de agua producida en India se segmenta en tratamiento químico, tratamiento físico, tratamiento biológico, sistemas combinados y otros.

RECURSO DE HIDROCARBUROS

- Petróleo convencional

- Arenas petrolíferas

- Gas convencional

- Metano de yacimientos de carbón

- Petróleo compacto

- Gas de esquisto

Sobre la base de los recursos de hidrocarburos, el mercado de tratamiento de agua producida en India está segmentado en petróleo convencional, arenas petrolíferas, gas convencional, metano de lechos de carbón, petróleo compacto y gas de esquisto.

CAPACIDAD

- Menos de 100 mil BL/DIA

- 100 a 500 mil BL/DIA

- Más de 500 mil BL/DIA

Sobre la base de la capacidad, el mercado de tratamiento de agua producida en la India se segmenta en menos de 100 mil barriles por día, entre 100 y 500 mil barriles por día y más de 500 mil barriles por día.

FUENTE DE PRODUCCIÓN

- Gas natural

- Petróleo crudo

Sobre la base de la fuente de producción, el mercado de tratamiento de agua producida en India está segmentado en gas natural y petróleo crudo.

TECNOLOGÍA

- Filtración por membrana

- Tecnología térmica

- Filtro Biológico Aireado (BAF)

- Hidrociclones

- Flotación de gas

- Estanque de evaporación

- Adsorción

- Filtración de medios

- Tecnología de intercambio iónico

- Tecnología de extracción de polímeros macroporosos

- Oxidación química

- Otros

Sobre la base de la tecnología, el mercado de tratamiento de agua producida en India está segmentado en filtración de membrana, tecnología térmica, filtro biológico aireado (BAF), hidrociclones, flotación de gas, estanque de evaporación, adsorción, filtración de medios, tecnología de intercambio iónico, tecnología de extracción de polímeros macroporosos, oxidación química, otros.

USUARIO FINAL

- Industrias petroleras

- Industrias del gas

Sobre la base del usuario final, el mercado de tratamiento de agua producida en la India está segmentado en industrias de petróleo y gas.

Análisis y perspectivas regionales del mercado de tratamiento de agua producida en India

El mercado de tratamiento de agua producida en la India se clasifica en siete segmentos notables, como etapas, tipo de tratamiento, recurso de hidrocarburos, capacidad, fuente de producción, tecnología y usuario final.

El país cubierto en este informe de mercado es India.

La sección de países del informe también proporciona factores de impacto individuales en el mercado y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales y el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de tratamiento de agua producida en la India

El panorama competitivo del mercado de tratamiento de agua producida en India ofrece detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en I+D, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las aprobaciones de productos, la amplitud y amplitud de los productos, el dominio de las aplicaciones y la curva de vida útil del tipo de producto. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa en el mercado de tratamiento de agua producida en India.

Algunas de las principales empresas que operan en el mercado de tratamiento de agua producida en la India son Thermax Limited. (India), divaenvitec (India), SOPAN (India), www.paramountlimited.com (India), BPC (India), IEI (India), ALFA LAVAL (India), Aquatech International LLC. (EE. UU.), WABAG (India), IDE (Israel), Wex Technologies (India), NETSOL WATER SOLUTIONS PVT. LTD. (India), OVIVO (India), DuPont (EE. UU.), Gradiant (EE. UU.), Hindustan Dorr-Oliver Ltd. (India), NOV Inc. (EE. UU.), Chokhavatia Associates (India), ULTRA PURE WATER TECHNOLOGIES (India), Veolia (India), entre otras.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF INDIA PRODUCED WATER TREATMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 STAGES LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES MODEL

5 INDIA PRODUCED WATER TREATMENT MARKET, REGULATION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 SCARCITY OF FRESH WATER

6.1.2 RISE IN INDUSTRIALIZATION AND URBANIZATION

6.1.3 ENVIRONMENTAL CONCERNS REGARDING THE DISCHARGE OF PRODUCED WATER

6.2 RESTRAINS

6.2.1 HIGH CAPITAL AND OPERATIONAL COSTS

6.2.2 LACK OF STANDARDIZATION

6.3 OPPORTUNITIES

6.3.1 GROWTH IN TECHNOLOGICAL ADVANCEMENT

6.3.2 RISE IN GOVERNMENT INITIATIVES AND FUNDING

6.4 CHALLENGES

6.4.1 LACK OF SKILLED LABOUR

7 INDIA PRODUCED WATER TREATMENT MARKET, BY STAGES

7.1 OVERVIEW

7.2 PRIMARY TREATMENT

7.3 SECONDARY TREATMENT

7.4 TERTIARY TREATMENT

7.5 OTHERS

8 INDIA PRODUCED WATER TREATMENT MARKET, BY TREATMENT TYPE

8.1 OVERVIEW

8.2 PHYSICAL TREATMENT

8.3 BIOLOGICAL TREATMENT

8.4 CHEMICAL TREATMENT

8.5 COMBINED SYSTEMS

8.6 OTHERS

9 INDIA PRODUCED WATER TREATMENT MARKET, BY HYDROCARBON RESOURCE

9.1 OVERVIEW

9.2 CONVENTIONAL GAS

9.3 CONVENTIONAL OIL

9.4 TIGHT OIL

9.5 COAL-BED METHANE

9.6 SHALE GAS

9.7 OIL SANDS

10 INDIA PRODUCED WATER TREATMENT MARKET, BY CAPACITY

10.1 OVERVIEW

10.2 LESS THAN 100 THSND BL/DAY

10.3 100 TO 500 THSND BL/DAY

10.4 ABOVE 500 THSND BL/DAY

11 INDIA PRODUCED WATER TREATMENT MARKET, BY PRODUCTION SOURCE

11.1 OVERVIEW

11.2 CRUDE OIL

11.3 NATURAL GAS

12 INDIA PRODUCED WATER TREATMENT MARKET, BY TECHNOLOGY

12.1 OVERVIEW

12.2 BIOLOGICAL AERATED FILTER (BAF)

12.3 MEMBRANE FILTRATION

12.3.1 MICROFILTRATION/ULTRAFILTRATION

12.3.2 REVERSE OSMOSIS AND NANOFILTRATION

12.3.3 POLYMERIC/CERAMIC MEMBRANES

12.4 ADSORPTION

12.5 MEDIA FILTRATION

12.6 HYDROCYCLONES

12.7 CHEMICAL OXIDATION

12.8 ION EXCHANGE TECHNOLOGY

12.9 GAS FLOTATION

12.1 THERMAL TECHNOLOGY

12.10.1 MULTISTAGE FLASH

12.10.2 MULTIEFFECT DISTILLATION

12.10.3 VAPOR COMPRESSION DISTILLATION

12.10.4 MULTIEFFECT DISTILLATION– VAPOR COMPRESSION HYBRID

12.11 EVAPORATION POND

12.12 MACRO-POROUS POLYMER EXTRACTION TECHNOLOGY

12.13 OTHERS

13 INDIA PRODUCED WATER TREATMENT MARKET, BY END USER

13.1 OVERVIEW

13.2 OIL INDUSTRIES

13.2.1 BY TYPE

13.2.1.1 ONSHORE

13.2.1.2 OFFSHORE

13.2.2 BY TECHNOLOGY

13.2.2.1 BIOLOGICAL AERATED FILTER (BAF)

13.2.2.2 MEMBRANE FILTRATION

13.2.2.3 ADSORPTION

13.2.2.4 MEDIA FILTRATION

13.2.2.5 HYDROCYCLONES

13.2.2.6 CHEMICAL OXIDATION

13.2.2.7 ION EXCHANGE TECHNOLOGY

13.2.2.8 GAS FLOTATION

13.2.2.9 THERMAL TECHNOLOGY

13.2.2.10 EVAPORATION POND

13.2.2.11 MACRO-POROUS POLYMER EXTRACTION TECHNOLOGY

13.2.2.12 OTHERS

13.3 GAS INDUSTRIES

13.3.1 BY TYPE

13.3.1.1 ONSHORE

13.3.1.2 OFFSHORE

13.3.2 BY TECHNOLOGY

13.3.2.1 BIOLOGICAL AERATED FILTER (BAF)

13.3.2.2 MEMBRANE FILTRATION

13.3.2.3 ADSORPTION

13.3.2.4 MEDIA FILTRATION

13.3.2.5 HYDROCYCLONES

13.3.2.6 CHEMICAL OXIDATION

13.3.2.7 ION EXCHANGE TECHNOLOGY

13.3.2.8 GAS FLOTATION

13.3.2.9 THERMAL TECHNOLOGY

13.3.2.10 EVAPORATION POND

13.3.2.11 MACRO-POROUS POLYMER EXTRACTION TECHNOLOGY

13.3.2.12 OTHERS

14 INDIA PRODUCED WATER TREATMENT MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: INDIA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 THERMAX LIMITED

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 WABAG

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 DUPONT

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 SOPAN

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT DEVELOPMENTS

16.5 GRADIANT

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENT

16.6 ALFA LAVAL

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 AQUATECH INTERNATIONAL LLC.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 BPC

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 CHOKHAVATIA ASSOCIATES

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 DIVAENVITEC

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 HINDUSTAN DORR-OLIVER LTD.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 IEI

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 IDE

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 NETSOL WATER SOLUTIONS PVT. LTD.

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 NOV INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 OVIVO

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 ULTRA PURE WATER TECHNOLOGIES

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 VEOLIA

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 WEX TECHNOLOGIES

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 WWW.WWW.PARAMOUNTLIMITED.COM.COM

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 INDIA PRODUCED WATER TREATMENT MARKET, BY STAGES, 2021-2030 (USD MILLION)

TABLE 2 INDIA PRODUCED WATER TREATMENT MARKET, BY TREATMENT TYPE, 2021-2030 (USD MILLION)

TABLE 3 INDIA PRODUCED WATER TREATMENT MARKET, BY HYDROCARBON RESOURCE, 2021-2030 (USD MILLION)

TABLE 4 INDIA PRODUCED WATER TREATMENT MARKET, BY CAPACITY, 2021-2030 (USD MILLION)

TABLE 5 INDIA PRODUCED WATER TREATMENT MARKET, BY PRODUCTION SOURCE, 2021-2030 (USD MILLION)

TABLE 6 INDIA PRODUCED WATER TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 7 INDIA MEMBRANE FILTRATION IN PRODUCED WATER TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 8 INDIA THERMAL TECHNOLOGY IN PRODUCED WATER TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 9 INDIA PRODUCED WATER TREATMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 10 INDIA OIL INDUSTRIES IN PRODUCED WATER TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 INDIA OIL INDUSTRIES IN PRODUCED WATER TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 12 INDIA GAS INDUSTRIES IN PRODUCED WATER TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 13 INDIA GAS INDUSTRIES IN PRODUCED WATER TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 INDIA PRODUCED WATER TREATMENT MARKET: SEGMENTATION

FIGURE 2 INDIA PRODUCED WATER TREATMENT MARKET: DATA TRIANGULATION

FIGURE 3 INDIA PRODUCED WATER TREATMENT MARKET: DROC ANALYSIS

FIGURE 4 INDIA PRODUCED WATER TREATMENT MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 INDIA PRODUCED WATER TREATMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 INDIA PRODUCED WATER TREATMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 INDIA PRODUCED WATER TREATMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 INDIA PRODUCED WATER TREATMENT MARKET: END USER COVERAGE GRID

FIGURE 9 INDIA PRODUCED WATER TREATMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 INDIA PRODUCED WATER TREATMENT MARKET: SEGMENTATION

FIGURE 11 TECHNOLOGICAL ADVANCEMENT IS EXPECTED TO DRIVE THE INDIA PRODUCED WATER TREATMENT MARKET IN THE FORECAST PERIOD 2023-2030

FIGURE 12 PRIMARY TREATMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE INDIA PRODUCED WATER TREATMENT MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, CHALLENGES OF INDIA PRODUCED WATER TREATMENT MARKET

FIGURE 14 INDIA PRODUCED WATER TREATMENT MARKET: BY STAGES, 2022

FIGURE 15 INDIA PRODUCED WATER TREATMENT MARKET: BY STAGES, 2023-2030 (USD MILLION)

FIGURE 16 INDIA PRODUCED WATER TREATMENT MARKET: BY STAGES, CAGR (2023-2030)

FIGURE 17 INDIA PRODUCED WATER TREATMENT MARKET: BY STAGES, LIFELINE CURVE

FIGURE 18 INDIA PRODUCED WATER TREATMENT MARKET: BY TREATMENT TYPE, 2022

FIGURE 19 INDIA PRODUCED WATER TREATMENT MARKET: BY TREATMENT TYPE, 2023-2030 (USD MILLION)

FIGURE 20 INDIA PRODUCED WATER TREATMENT MARKET: BY TREATMENT TYPE, CAGR (2023-2030)

FIGURE 21 INDIA PRODUCED WATER TREATMENT MARKET: BY TREATMENT TYPE, LIFELINE CURVE

FIGURE 22 INDIA PRODUCED WATER TREATMENT MARKET: BY HYDROCARBON RESOURCE, 2022

FIGURE 23 INDIA PRODUCED WATER TREATMENT MARKET: BY HYDROCARBON RESOURCE, 2023-2030 (USD MILLION)

FIGURE 24 INDIA PRODUCED WATER TREATMENT MARKET: BY HYDROCARBON RESOURCE, CAGR (2023-2030)

FIGURE 25 INDIA PRODUCED WATER TREATMENT MARKET: BY HYDROCARBON RESOURCE, LIFELINE CURVE

FIGURE 26 INDIA PRODUCED WATER TREATMENT MARKET: BY CAPACITY, 2022

FIGURE 27 INDIA PRODUCED WATER TREATMENT MARKET: BY CAPACITY, 2023-2030 (USD MILLION)

FIGURE 28 INDIA PRODUCED WATER TREATMENT MARKET: BY CAPACITY, CAGR (2023-2030)

FIGURE 29 INDIA PRODUCED WATER TREATMENT MARKET: BY CAPACITY, LIFELINE CURVE

FIGURE 30 INDIA PRODUCED WATER TREATMENT MARKET: BY PRODUCTION SOURCE, 2022

FIGURE 31 INDIA PRODUCED WATER TREATMENT MARKET: BY PRODUCTION SOURCE, 2023-2030 (USD MILLION)

FIGURE 32 INDIA PRODUCED WATER TREATMENT MARKET: BY PRODUCTION SOURCE, CAGR (2023-2030)

FIGURE 33 INDIA PRODUCED WATER TREATMENT MARKET: BY PRODUCTION SOURCE, LIFELINE CURVE

FIGURE 34 INDIA PRODUCED WATER TREATMENT MARKET: BY TECHNOLOGY, 2022

FIGURE 35 INDIA PRODUCED WATER TREATMENT MARKET: BY TECHNOLOGY, 2023-2030 (USD MILLION)

FIGURE 36 INDIA PRODUCED WATER TREATMENT MARKET: BY TECHNOLOGY, CAGR (2023-2030)

FIGURE 37 INDIA PRODUCED WATER TREATMENT MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 38 INDIA PRODUCED WATER TREATMENT MARKET: BY END USER, 2022

FIGURE 39 INDIA PRODUCED WATER TREATMENT MARKET: BY END USER 2023-2030 (USD MILLION)

FIGURE 40 INDIA PRODUCED WATER TREATMENT MARKET: BY END USER, CAGR (2023-2030)

FIGURE 41 INDIA PRODUCED WATER TREATMENT MARKET: BY END USER, LIFELINE CURVE

FIGURE 42 INDIA PRODUCED WATER TREATMENT MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.