Global Ventilators Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

8.30 Billion

USD

16.06 Billion

2024

2032

USD

8.30 Billion

USD

16.06 Billion

2024

2032

| 2025 –2032 | |

| USD 8.30 Billion | |

| USD 16.06 Billion | |

|

|

|

|

Segmentación del mercado global de ventiladores por tipo de producto (ventiladores de cuidados intensivos, ventiladores portátiles y ventiladores neonatales), modalidad (ventilación invasiva y no invasiva), tipo de ventilador (ventiladores para adultos, ventiladores neonatales y ventiladores pediátricos), modo (ventilación combinada, ventilación por volumen, ventilación por presión y otros), usuario final (hospitales, clínicas especializadas, centros de atención domiciliaria, centros de atención a largo plazo, centros de rehabilitación y otros): tendencias y pronóstico del sector hasta 2032.

Tamaño del mercado mundial de ventiladores

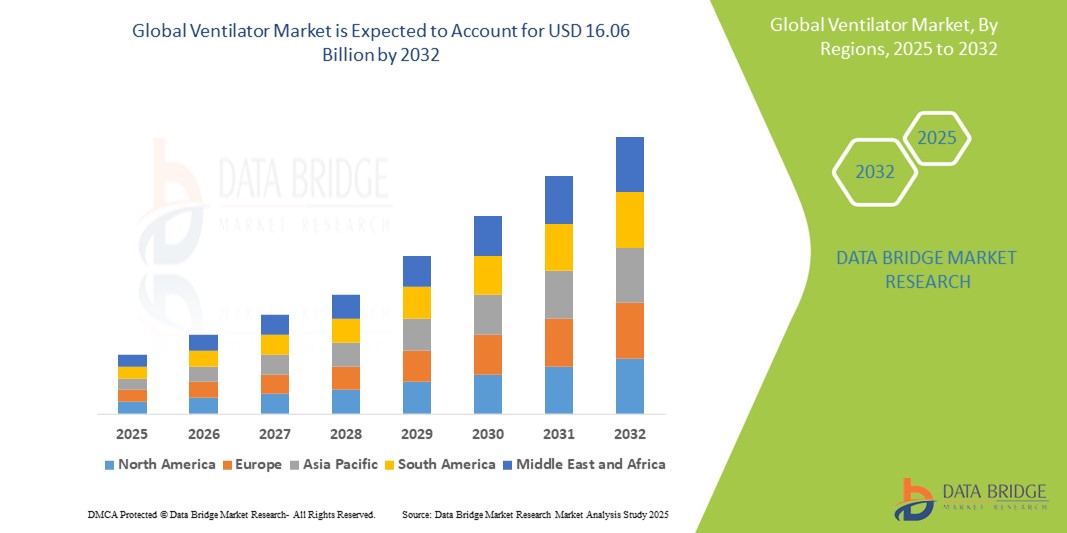

- El tamaño del mercado mundial de ventiladores se valoró en USD 8.30 mil millones en 2024 y se espera que alcance los USD 16.06 mil millones para 2032 , con una CAGR del 8,6% durante el período de pronóstico.

- Este crecimiento está impulsado por factores como la creciente prevalencia de enfermedades respiratorias, los avances tecnológicos y la integración de la telemedicina y la monitorización remota.

Análisis del mercado global de ventiladores

- Los ventiladores son dispositivos médicos esenciales que se utilizan para apoyar o reemplazar la respiración en pacientes con insuficiencia respiratoria o dificultad respiratoria grave. Son esenciales en unidades de cuidados intensivos (UCI), salas de urgencias y centros de atención domiciliaria, proporcionando asistencia respiratoria vital.

- La demanda de ventiladores está impulsada significativamente por la creciente prevalencia de enfermedades respiratorias como la enfermedad pulmonar obstructiva crónica (EPOC), el asma y el síndrome de dificultad respiratoria aguda (SDRA), junto con el aumento de la población geriátrica a nivel mundial.

- Se espera que América del Norte domine el mercado mundial de ventiladores, representando el 42,4% de la participación de mercado, impulsada por una infraestructura de atención médica avanzada, un alto gasto en atención médica, avances tecnológicos, innovación continua en tecnología de ventiladores y altas tasas de admisión a la UCI, una demanda significativa de ventiladores en unidades de cuidados intensivos (UCI).

- Se espera que Asia-Pacífico sea la región de más rápido crecimiento en el mercado mundial de ventiladores, con una CAGR del 10,5%, impulsada por la rápida urbanización, la expansión de la infraestructura de atención médica, el aumento de la prevalencia de enfermedades respiratorias, el aumento de casos de enfermedades respiratorias crónicas y el apoyo gubernamental, políticas favorables que promueven las inversiones en atención médica.

- Se espera que el segmento de ventiladores de cuidados intensivos domine el mercado mundial de ventiladores con una participación de mercado del 60,1%, impulsado por su papel fundamental en el manejo de la dificultad respiratoria grave en las unidades de cuidados intensivos (UCI).

Alcance del informe y segmentación del mercado global de ventiladores

|

Atributos |

Perspectivas clave del mercado global de ventiladores |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado mundial de ventiladores

Avances tecnológicos en sistemas de ventilación para una mejor atención al paciente

- Una tendencia destacada en la evolución de los sistemas de ventilación es la integración de tecnologías avanzadas, incluida la inteligencia artificial (IA), la automatización y el monitoreo en tiempo real, que están transformando la atención respiratoria.

- Estas innovaciones mejoran los resultados de los pacientes al optimizar los parámetros de ventilación, reducir las lesiones pulmonares y brindar asistencia respiratoria personalizada.

- Por ejemplo, los respiradores con IA pueden ajustar automáticamente la configuración de la ventilación basándose en datos del paciente en tiempo real, lo que mejora los resultados en situaciones de cuidados críticos y reduce la carga de trabajo de los profesionales sanitarios. Además, los respiradores portátiles con conectividad IoT permiten la monitorización remota de pacientes, lo que facilita la atención domiciliaria y reduce los reingresos hospitalarios.

- Estos avances están mejorando significativamente los resultados de los pacientes, mejorando la eficiencia de la atención e impulsando la demanda de ventiladores de última generación tanto en entornos hospitalarios como de atención domiciliaria.

Dinámica del mercado global de ventiladores

Conductor

Aumento de la prevalencia de enfermedades respiratorias y envejecimiento de la población

- La creciente prevalencia de enfermedades respiratorias como la enfermedad pulmonar obstructiva crónica (EPOC), el asma, la neumonía y el síndrome de dificultad respiratoria aguda (SDRA) está contribuyendo significativamente a la creciente demanda de ventiladores.

- A medida que la población mundial envejece, la incidencia de enfermedades respiratorias continúa aumentando y los adultos mayores son más susceptibles a infecciones respiratorias y enfermedades pulmonares crónicas que a menudo requieren ventilación mecánica.

- Además, el impacto de la contaminación ambiental y los efectos a largo plazo de la COVID-19 han resaltado aún más la necesidad de sistemas avanzados de soporte ventilatorio.

Por ejemplo,

- En diciembre de 2024, según un informe de la Organización Mundial de la Salud (OMS), se prevé que la EPOC se convierta en la tercera causa principal de muerte a nivel mundial para 2030, impulsada por factores como el tabaquismo, la contaminación atmosférica y el envejecimiento de la población. Esta tendencia aumenta significativamente la demanda de respiradores en centros de cuidados intensivos.

- Como resultado de la creciente prevalencia de enfermedades respiratorias y el envejecimiento de la población, existe un aumento sustancial en la demanda de ventiladores para garantizar mejores resultados para los pacientes y reducir las complicaciones respiratorias.

Oportunidad

Integración de tecnologías avanzadas en sistemas de ventilación

- Los avances tecnológicos en los sistemas de ventilación, incluida la integración de inteligencia artificial (IA), Internet de las cosas (IoT) y análisis de datos en tiempo real, están transformando la atención respiratoria.

- Los ventiladores impulsados por IA pueden ajustar automáticamente la configuración de ventilación en función de los datos del paciente en tiempo real, lo que mejora los resultados del paciente y reduce la carga de trabajo del médico.

- Además, los ventiladores habilitados para IoT pueden facilitar la monitorización remota, el mantenimiento predictivo y la toma de decisiones basada en datos, mejorando la atención general al paciente y la eficiencia operativa.

Por ejemplo,

- En enero de 2025, un estudio publicado en el Journal of Medical Systems destacó que los respiradores con IA integrada tienen el potencial de reducir la duración de las estancias hospitalarias al optimizar la configuración de la ventilación, minimizar las lesiones pulmonares y mejorar las tasas de recuperación de los pacientes. Este enfoque reduce significativamente los costes sanitarios y mejora los resultados de los pacientes.

- La adopción de tecnologías tan avanzadas en los sistemas de ventilación puede revolucionar la atención crítica, mejorar la seguridad del paciente e impulsar el crecimiento general del mercado de ventilación.

Restricción/Desafío

“Altos costos de los equipos y desafíos regulatorios”

- El alto costo de los ventiladores, particularmente aquellos con funciones avanzadas como integración de IA y monitoreo en tiempo real, plantea un desafío importante para el crecimiento del mercado, especialmente en regiones en desarrollo con presupuestos de atención médica limitados.

- Estos dispositivos pueden costar desde varios miles hasta cientos de miles de dólares, lo que limita su adopción en centros de salud más pequeños y entornos de bajos recursos.

- Además, los estrictos requisitos regulatorios y la necesidad de un mantenimiento regular aumentan aún más los costos operativos generales, creando cargas financieras para los proveedores de atención médica.

Por ejemplo,

- En noviembre de 2024, según un informe del International Journal of Health Economics, el alto costo inicial de los respiradores, combinado con los gastos de mantenimiento continuos, puede afectar significativamente la estabilidad financiera de los centros de atención médica, particularmente en las economías emergentes donde la financiación es limitada.

- Estas barreras financieras pueden limitar el acceso a cuidados respiratorios avanzados, lo que en última instancia afecta los resultados de los pacientes y obstaculiza el crecimiento general del mercado de ventiladores.

Alcance del mercado global de ventiladores

El mercado está segmentado según el tipo de producto, modalidad, tipo de ventilador, modo y usuario final.

|

Segmentación |

Subsegmentación |

|

Por tipo de producto |

|

|

Por modalidad |

|

|

Por tipo de ventilador |

|

|

Por modo |

|

|

Por el usuario final |

|

Se proyecta que en 2025, los ventiladores de cuidados intensivos dominarán el mercado con la mayor participación en el segmento de tipo de producto.

Se prevé que el segmento de ventiladores de cuidados intensivos domine el mercado mundial de ventiladores, con la mayor participación, un 60,1 %, en 2025, gracias a su papel crucial en el manejo de la dificultad respiratoria grave en las unidades de cuidados intensivos (UCI). Como equipos esenciales para pacientes críticos, estos ventiladores ofrecen un suministro preciso de oxígeno, monitorización en tiempo real y ventilación multimodo, lo que mejora la evolución del paciente. El creciente número de ingresos en UCI, la creciente prevalencia de enfermedades respiratorias crónicas y el crecimiento de la población geriátrica contribuyen aún más al predominio de este segmento.

Se espera que la ventilación no invasiva represente la mayor participación durante el período de pronóstico en el mercado de modalidades.

En 2025, se prevé que el segmento de ventilación no invasiva domine el mercado con la mayor cuota de mercado, un 45,3 %, debido a su creciente adopción en centros de atención domiciliaria, centros de cuidados a largo plazo y servicios de urgencias. Como opción preferida para pacientes con dificultad respiratoria leve a moderada, los ventiladores no invasivos reducen el riesgo de infección, mejoran la comodidad del paciente y disminuyen la necesidad de sedación, lo que impulsa el crecimiento del mercado. Los avances en la tecnología de ventiladores portátiles y la creciente concienciación sobre los beneficios de la ventilación no invasiva contribuyen aún más a su dominio del mercado.

Análisis regional del mercado global de ventiladores

Norteamérica posee la mayor participación en el mercado mundial de ventiladores.

- América del Norte domina el mercado mundial de ventiladores, representando el 42,4% de la participación de mercado, impulsada por una infraestructura de atención médica avanzada, un alto gasto en atención médica, avances tecnológicos, innovación continua en tecnología de ventiladores y altas tasas de ingreso a la UCI, una demanda significativa de ventiladores en unidades de cuidados intensivos (UCI).

- Estados Unidos lidera el mercado norteamericano, con el 75,5% de la participación regional, impulsado por una fuerte inversión en I+D, una financiación sustancial para el desarrollo de tecnología médica, sólidas redes hospitalarias, presencia de instalaciones de atención médica avanzadas y una alta capacidad de cuidados críticos, además de una gran cantidad de camas de UCI que respaldan la demanda de respiradores.

Se proyecta que Asia-Pacífico registre la CAGR más alta en el mercado mundial de ventiladores.

- Se espera que Asia-Pacífico sea testigo de la mayor tasa de crecimiento en el mercado mundial de ventiladores, con una CAGR estimada del 10,5%, impulsada por la rápida urbanización, la expansión de la infraestructura de atención médica, el aumento de la prevalencia de enfermedades respiratorias, el aumento de casos de enfermedades respiratorias crónicas y el apoyo gubernamental, políticas favorables que promueven las inversiones en atención médica.

- China domina el mercado regional, con el 61,2% de la cuota de mercado de Asia-Pacífico, impulsada por la fabricación a gran escala, la amplia capacidad de producción de respiradores, el apoyo gubernamental, importantes inversiones en tecnología sanitaria y la alta demanda, con un número creciente de admisiones en UCI.

- Se proyecta que India registre la CAGR más alta del 8,4 % en el mercado de Asia-Pacífico, impulsada por la expansión de la infraestructura de atención médica, el rápido crecimiento de las redes hospitalarias y el turismo médico, lo que aumenta la demanda de dispositivos médicos avanzados.

Cuota de mercado mundial de ventiladores

El panorama competitivo del mercado ofrece detalles por competidor. Se incluye información general de la empresa, sus estados financieros, ingresos generados, potencial de mercado, inversión en investigación y desarrollo, nuevas iniciativas de mercado, presencia global, plantas de producción, capacidad de producción, fortalezas y debilidades de la empresa, lanzamiento de productos, alcance y variedad de productos, y dominio de las aplicaciones. Los datos anteriores se refieren únicamente al enfoque de mercado de las empresas.

Los principales líderes del mercado que operan en el mercado son:

- Koninklijke Philips NV (Países Bajos)

- Air Liquide (Francia)

- Hamilton Medical (Suiza)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- Medtronic (Irlanda)

- Fisher & Paykel Healthcare Limited (Nueva Zelanda)

- Smiths Group plc (Reino Unido)

- Getinge (Suecia)

- Drägerwerk AG & Co. KGaA (Alemania)

- Leistung Equipamentos LTDA (Brasil)

- Penlon Limited (Reino Unido)

- ResMed (EE. UU.)

- Vyaire Medical (EE. UU.)

- Zoll Medical Corporation (EE. UU.)

- GE Healthcare (EE. UU.)

Últimos avances en el mercado mundial de ventiladores

- En marzo de 2025, Medtronic anunció el lanzamiento de su nuevo ventilador Puritan Bennett 980, con funciones mejoradas de monitorización basadas en IA y una mejor sincronización entre paciente y ventilador para optimizar la asistencia respiratoria en las UCI. El dispositivo busca reducir las complicaciones y mejorar los resultados de los pacientes críticos con insuficiencia respiratoria.

- En enero de 2025, Hamilton Medical presentó la última versión de su ventilador de alta gama, el Hamilton-C6, con modos avanzados para terapia de ventilación personalizada y funciones integradas de monitorización remota. Estas innovaciones están diseñadas para atender casos complejos, como pacientes con SDRA y COVID-19.

- En noviembre de 2024, GE Healthcare presentó el ventilador CARESCAPE R860 con una interfaz de pantalla táctil mejorada y una mayor duración de la batería, con el objetivo de lograr una mayor facilidad de uso y movilidad en entornos de emergencia y cuidados críticos a nivel mundial.

- En octubre de 2024, Philips Respironics amplió su cartera con el lanzamiento de Trilogy Evo, un ventilador portátil versátil optimizado para el cuidado domiciliario y el transporte, que cuenta con opciones de batería robustas y compatibilidad con múltiples modos de ventilación.

- En septiembre de 2024, Drägerwerk AG & Co. KGaA lanzó el nuevo ventilador Draeger Evita V600, que ofrece funciones mejoradas de ventilación con protección pulmonar y medidas integradas de control de infecciones. Este producto tiene como objetivo mejorar la calidad y la seguridad de la atención en unidades de cuidados críticos de todo el mundo.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.