Global Used Car Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

996,906.42 Billion

USD

1,700,106.13 Billion

2022

2030

USD

996,906.42 Billion

USD

1,700,106.13 Billion

2022

2030

| 2023 –2030 | |

| USD 996,906.42 Billion | |

| USD 1,700,106.13 Billion | |

|

|

|

|

Mercado mundial de automóviles usados, por tipo de proveedor (organizado, no organizado), propulsión (gasolina, diésel, GNC, GLP, eléctrico y otros), capacidad del motor (tamaño completo (más de 2500 cc), tamaño mediano (entre 1500 y 2499 cc), pequeño (menos de 1499 cc)), concesionario (franquiciado, independiente), canal de ventas (en línea, fuera de línea), tipo de vehículo (automóvil de pasajeros, vehículo comercial ligero, vehículo agrícola y vehículo eléctrico): tendencias de la industria y pronóstico hasta 2030.

Análisis y tamaño del mercado de vehículos usados

El aumento de los ingresos disponibles de los trabajadores está impulsando el crecimiento del mercado porque permite a las personas comprar vehículos con un presupuesto limitado. Según Statistics Canada, los ingresos disponibles de los hogares de clase baja aumentaron un 3% y un 3,3% en la fase inicial de 2021, respectivamente. Por el contrario, los ingresos de los hogares de clase alta se redujeron un 6,4% y luego aumentaron un 3,9% durante el mismo período. El crecimiento del mercado de coches usados ha experimentado un crecimiento sustancial en los últimos años debido a la competitividad de los costes entre los nuevos actores del mercado junto con la incapacidad de una gran parte de los clientes para comprar un coche nuevo.

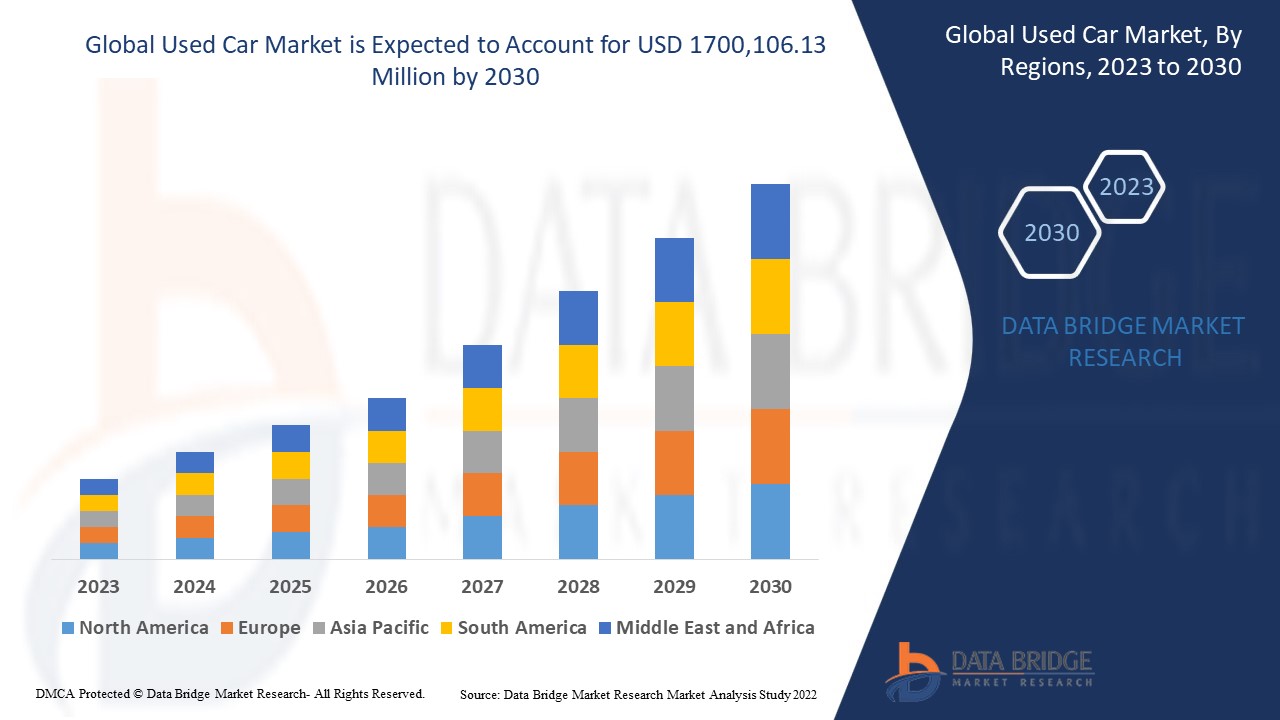

Data Bridge Market Research analiza que el mercado mundial de automóviles usados se valoró en USD 996,906.42 millones en 2022 y se espera que alcance el valor de USD 1700,106.13 millones para 2030, a una CAGR del 6.90% durante el período de pronóstico. Además de los conocimientos del mercado, como el valor de mercado, la tasa de crecimiento, los segmentos del mercado, la cobertura geográfica, los actores del mercado y el escenario del mercado, el informe de mercado curado por el equipo de Data Bridge Market Research incluye un análisis experto en profundidad, análisis de importación / exportación, análisis de precios, análisis de consumo de producción y análisis pestle.

Alcance y segmentación del mercado de vehículos usados

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2015 - 2020) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Tipo de vendedor (organizado, no organizado), propulsión (gasolina, diésel, GNC, GLP , eléctrico y otros), capacidad del motor (tamaño completo (más de 2500 cc), tamaño mediano (entre 1500 y 2499 cc), pequeño (menos de 1499 cc)), concesionario (franquiciado, independiente), canal de venta (en línea, fuera de línea), tipo de vehículo (automóvil de pasajeros, vehículo comercial ligero, vehículo comercial pesado y vehículo eléctrico) |

|

Países cubiertos |

EE. UU., Canadá y México en América del Norte, Alemania, Francia, Reino Unido, Países Bajos, Suiza, Bélgica, Rusia, Italia, España, Turquía, Resto de Europa en Europa, China, Japón, India, Corea del Sur, Singapur, Malasia, Australia, Tailandia, Indonesia, Filipinas, Resto de Asia-Pacífico (APAC) en Asia-Pacífico (APAC), Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Egipto, Israel, Resto de Medio Oriente y África (MEA) como parte de Medio Oriente y África (MEA), Brasil, Argentina y Resto de América del Sur como parte de América del Sur |

|

Actores del mercado cubiertos |

Group1 Automotive, Inc. (EE. UU.), AutoNation, Inc. (EE. UU.), HELLMAN & FRIEDMAN LLC (EE. UU.), PENDRAGON (Reino Unido), CarMax Business Services, LLC (EE. UU.), Manheim (EE. UU.), THE HERTZ CORPORATION (EE. UU.), Cox Automotive (EE. UU.), Sun Toyota (EE. UU.), eBay Inc. (EE. UU.), TrueCar, Inc. (EE. UU.), VROOM (EE. UU.), Asbury Automotive Group (EE. UU.), MARUTI SUZUKI INDIA LIMITED (India), Lithia Motors, Inc. (EE. UU.), Hendrick Automotive Group (EE. UU.) |

|

Oportunidades de mercado |

|

Definición de mercado

Un automóvil que ha tenido uno o más propietarios minoristas en el pasado se denomina automóvil usado, automóvil de segunda mano o automóvil de segunda mano. Los concesionarios de vehículos independientes y franquiciados, las agencias de alquiler de automóviles, los concesionarios de compra en el momento del pago, las oficinas de arrendamiento, las subastas y las ventas entre particulares son solo algunos de los lugares donde se pueden comprar automóviles usados. Algunos concesionarios de automóviles ofrecen "precios sin regateo", vehículos usados "certificados" y acuerdos o garantías de servicio extendidos.

Dinámica del mercado mundial de vehículos usados

Conductores

- Alto costo de un auto nuevo y preocupación por la asequibilidad

El sector automovilístico ha observado una mayor demanda de características avanzadas para los vehículos, como dirección asistida, control de climatización y sistemas de frenos antibloqueo. Ahora, el costo de los autos nuevos es mayor como resultado de esto. Además, los problemas de asequibilidad en el mercado de autos nuevos se indican por el aumento de precios en 2019, que fue impulsado por los segmentos principales de automóviles de pasajeros. Como resultado, las ventas de autos usados han aumentado en comparación con las ventas de autos nuevos en la industria automotriz. Se anticipa que esto aumentará la demanda de autos viejos.

- Creciente demanda de vehículos hatchback versátiles

Se espera que el mercado de los vehículos hatchback usados en Europa crezca a una tasa de más del 3,5 % hasta 2028, impulsado por la creciente demanda de vehículos hatchback que brinden flexibilidad al conducir en espacios pequeños. El desarrollo del mercado de vehículos usados se ve facilitado por la importante presencia de los principales fabricantes de automóviles, como Audi AG, BMW AG, Mercedes-Benz y Volkswagen, ya que estos fabricantes ofrecen una gran selección de modelos de vehículos hatchback. Los actores del mercado ofrecen vehículos hatchback con una línea de techo alta y un diseño compacto.

Oportunidades

- Creciente presencia de varios fabricantes de automóviles y concesionarios de vehículos usados

Como resultado de la simple accesibilidad a la financiación para la compra de coches usados, los ingresos del mercado europeo de coches usados superaron los 500.000 millones de dólares en 2021 y seguirán aumentando de forma constante. La industria manufacturera es el mayor inversor privado en I+D en Europa, y Europa es el principal fabricante de automóviles del mundo. Para aumentar la competitividad del sector automovilístico regional y mantener su hegemonía tecnológica a nivel mundial, la Comisión Europea promueve la estandarización tecnológica mundial y la financiación de la I+D. Los concesionarios de vehículos usados de la zona ofrecen una gama de opciones tecnológicas para realizar un seguimiento del rendimiento del automóvil, incluidas aplicaciones para teléfonos inteligentes y puntos de venta virtuales en Internet.

- Crecimiento de las tecnologías en línea y el comercio electrónico

Los avances tecnológicos en el sector de las telecomunicaciones, la mejora de la conectividad a Internet y la creciente urbanización son algunos de los factores principales por los que las personas ahora pueden acceder a la información de manera mucho más eficaz. Estas características ayudan a los propietarios de automóviles usados a anunciar rápidamente sus vehículos y compartir información sobre ellos. Con la ayuda de esta plataforma en línea, ahora más personas pueden vender y comprar automóviles.

Restricciones

- Problemas asociados a la expansión del mercado de autos usados

La expansión del mercado de autos usados se verá obstaculizada por la ausencia de leyes y regulaciones estrictas que regulen la compra de autos usados. Las altas tasas de depreciación de los autos usados dificultarán el crecimiento del mercado. El brote de coronavirus ha afectado negativamente la demanda mundial de vehículos usados al reducir la demanda de transporte público.

Este informe sobre el mercado de vehículos usados proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado por categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de vehículos usados, comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Impacto del Covid-19 en el mercado de autos usados

La pandemia de COVID-19, que obligó a los gobiernos a promulgar estrictas medidas de contención, confinamientos regionales, aislamiento social y períodos de cuarentena, afectó negativamente a la demanda del mercado en 2020. Como resultado de la relajación de las medidas de confinamiento y un cambio en la preferencia de los clientes por la movilidad personal, esto inspiró a los dueños de negocios a utilizar plataformas de Internet para el mercado de autos usados con alternativas de financiamiento flexibles. Como resultado del creciente deseo de los consumidores por autos usados en áreas sensibles al precio, se anticipa que la industria tendrá un crecimiento considerable en el futuro cercano.

Desarrollo reciente

- En diciembre de 2019, HELLMAN & FRIEDMAN LLC firmó un contrato para adquirir la empresa de AutoScout24. Con esta adquisición, la empresa pretende ofrecer soluciones de marketing de valor añadido mientras continúa digitalizando sus modelos de negocio en la industria del automóvil.

- En diciembre de 2019, Group1 Automotive, Inc. anunció la adquisición de dos concesionarias Lexus para aumentar su presencia comercial en el mercado de Nuevo México. Esto ayudó a la empresa a hacerse un hueco en el mercado de rápido crecimiento de Nuevo México.

Alcance del mercado mundial de vehículos usados

El mercado de autos usados está segmentado en función del tipo de proveedor, la propulsión, la capacidad del motor, el concesionario, el canal de venta y el tipo de vehículo. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de proveedor

- Organizado

- Desorganizado

Propulsión

- Gasolina

- Diesel

- GNC

- GLP

- Eléctrico

- Otros

Capacidad del motor

- Tamaño completo ( más de 2500 cc)

- Tamaño mediano (entre 1500 y 2499 CC)

- Pequeño (menos de 1499 CC)

Concesión

- Franquiciado

- Independiente

Canal de venta

- En línea

- Desconectado

Tipo de vehículo

- Coche de pasajeros

- Vehículo comercial ligero

- VHC

- Vehículo eléctrico

Análisis y perspectivas regionales del mercado de vehículos usados

Se analiza el mercado de automóviles usados y se proporcionan información y tendencias del tamaño del mercado por país, tipo de proveedor, propulsión, capacidad del motor, concesionario, canal de ventas y tipo de vehículo como se menciona anteriormente.

Los países cubiertos en el informe del mercado de automóviles usados son EE. UU., Canadá y México en América del Norte, Alemania, Francia, Reino Unido, Países Bajos, Suiza, Bélgica, Rusia, Italia, España, Turquía, Resto de Europa en Europa, China, Japón, India, Corea del Sur, Singapur, Malasia, Australia, Tailandia, Indonesia, Filipinas, Resto de Asia-Pacífico (APAC) en Asia-Pacífico (APAC), Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Egipto, Israel, Resto de Medio Oriente y África (MEA) como parte de Medio Oriente y África (MEA), Brasil, Argentina y Resto de América del Sur como parte de América del Sur.

La región de Asia-Pacífico domina el mercado de automóviles usados en términos de crecimiento de ingresos. Esto se debe principalmente al crecimiento de la industria de ventas organizadas y semiorganizadas. China domina el mercado de automóviles usados de Asia-Pacífico debido al mayor número de concesionarios de automóviles usados en esta región.

Se prevé que Europa sea la región con un desarrollo más rápido durante el período de pronóstico de 2023 a 2030 debido a la disponibilidad de abundantes materias primas y mano de obra barata. Además, el aumento del uso de Internet, las garantías ofrecidas en vehículos usados, las herramientas en línea para comprar o investigar automóviles usados y las diversas alternativas de compra son algunos de los otros factores importantes que probablemente impulsarán el crecimiento del mercado.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los coches usados

El panorama competitivo del mercado de autos usados proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, el dominio de las aplicaciones. Los puntos de datos proporcionados anteriormente solo están relacionados con el enfoque de las empresas en relación con el mercado de autos usados.

Algunos de los principales actores que operan en el mercado de autos usados son:

- Group1 Automotive, Inc. (Estados Unidos)

- AutoNation, Inc. (Estados Unidos)

- HELLMAN & FRIEDMAN LLC (Estados Unidos)

- PENDRAGON (Reino Unido)

- Servicios empresariales CarMax, LLC (Estados Unidos)

- Manheim (Estados Unidos)

- LA CORPORACIÓN HERTZ (EE.UU.)

- Cox Automotive (Estados Unidos)

- Sun Toyota (Estados Unidos)

- eBay Inc. (Estados Unidos)

- TrueCar, Inc. (Estados Unidos)

- VROOM (EE.UU.)

- Grupo Automotriz Asbury (Estados Unidos)

- Lithia Motors, Inc. (Estados Unidos)

- Grupo Automotriz Hendrick (Estados Unidos)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW OF GLOBAL USED CAR MARKET

- Currency and Pricing

- LIMITATIONS

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographicAL scope

- years considered for the study

- DBMR TRIPOD DATA VALIDATION MODEL

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- vendor share analysis

- Multivariate Modeling

- vendor type timeline curve

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- market overview

- DRIVERS

- EMERGENCE OF DIFFERENT E-COMMERCE PLATFORM

- INCREASE IN TRANSPARENCY & SYMMETRY OF INFORMATION BETWEEN DEALERS AND CUSTOMERS

- RISE IN DEMAND FOR OFF-LEASE CARS & SUBSCRIPTION SERVICE BY THE FRANCHISE

- RISE IN DEMAND FOR THE PERSONAl TRANSPORT MOBILITY

- UPSURGE DEMAND FOR THE VEHICLE WITH GREATER VALUE AT LOWER COST

- RESTRAINTS

- EVER INCREASE IN COST OF OWNERSHIP

- STRINGENT GOVERNMENT REGULATIONS FOR CAR DEALERS

- HIGHER MAINTENANCE AND SERVICE COST

- OPPORTUNITIES

- RISE IN STRATEGIC PARTNERSHIP AND ACquisitions BETWEEN TWO COMPANIES

- Original equipment manufacturers (oems) INVOLVEMENT IN CERTIFICATION AND MARKETING PROGRAMS

- RISE IN THE INVESTMENT BY GOVERNMENT IN AUTOMOBILE SECTOR

- AVAILABILITY OF THE REIMBURSED POLICY FOR THE USED CAR

- CHALLENGES

- LACK OF POST-Sale SERVICES OF USED CAR

- INCLINATION OF OEMS (ORIGINAL EQUIPMENT MANUFACTURERS) IN SALE OF ONLY NEW CAR

- IMPACT OF COVID ON THE GLOBAL USED CAR MARKET

- IMPACT ON SUPPLY CHAIN & DEMAND ON USED CAR MARKET

- STRATEGIC DECISIONS OF MANUFACTURERS AFTER COVID 19 TO GAIN COMPETITIVE MARKET SHARE

- CONCLUSION

- GLOBAL used car MARKET, BY vendor TYPE

- overview

- ORGANIZED

- UNORGANIZED

- GLOBAL used car MARKET, BY PROPULSION TYPE

- overview

- PETROL

- Diesel

- ELECTRIC

- LPG

- CNG

- others

- GLOBAL used car MARKET, BY engine capacity

- overview

- SMALL (BELOW 1499 CC)

- MID-SIZE (BETWEEN 1500-2499 CC)

- FULL SIZE (ABOVE 2500 CC)

- GLOBAL used car MARKET, BY dealership

- overview

- franchised

- independent

- GLOBAL used car MARKET, BY sales channel

- overview

- offline

- online

- GLOBAL used car MARKET, BY vehicle type

- overview

- passenger cars

- SUV

- SEDAN

- CROSSOVER

- Coupe

- HATCHBACK

- MPV

- CONVERTIBLE

- OTHERS

- lcv

- PICKUP TRUCKS

- VANS

- CARGO VANS

- PASSENGER VANS

- MINI BUS

- COACHES

- OTHERS

- ELECTRIC VEHICLE

- BATTERY OPERATED VEHICLES

- PLUGIN VEHICLES

- HYBRID VEHICLES

- HCV

- TRUCKS

- DUMP TRUCKS

- TOW TRUCKS

- CEMENT TRUCKS

- BUSES

- Global Used Car Market, by REGION

- overview

- EUROPE

- GERMANY

- FRANCE

- U.K.

- ITALY

- SPAIN

- RUSSIA

- TURKEY

- BELGIUM

- NETHERLANDS

- SWITZERLAND

- REST OF EUROPE

- ASIA-PACIFIC

- CHINA

- JAPAN

- SOUTH KOREA

- INDIA

- AUSTRALIA

- SINGAPORE

- THAILAND

- MALAYSIA

- INDONESIA

- PHILIPPINES

- REST OF ASIA -PACIFIC

- MIDDLE EAST & AFRICA

- SOUTH AFRICA

- EGYPT

- SAUDI ARABIA

- U.A.E

- ISRAEL

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- U.S.

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- PERU

- CHILE

- VENEZUeLA

- ECUADOR

- REST OF SOUTH AMERICA

- GLOBAL Used car market: COMPANY landscape

- company share analysis: GLOBAL

- company share analysis: NORTH AMERICA

- company share analysis: EUROPE

- company share analysis: Asia-pacific

- swot

- company profile

- CARMAX BUSINESS SERVICES, LLC

- COMPANY SNAPSHOT

- REVENNUE ANALYSIS

- COMPANY SHARE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- AUTONATION, INC.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- LITHIA MOTORS, INC.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- SONIC AUTOMOTIVE

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- GROUP1 AUTOMOTIVE, INC.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTTFOLIO

- RECENT DEVELOPMENTS

- ALIBABA GROUP HOLDING LIMITED

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- ASBURY AUTOMOTIVE GROUP

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- BIG BOY TOYZ

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- CARS24

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- CHEHAODUOJIAO MOTOR VEHICLE BROKER (BEIJING) CO., LTD.

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENT

- HELLMAN & FRIEDMAN LLC

- COMPANY SNAPSHOT

- BRAND PORTFOLIO

- RECENT DEVELOPMENTS

- HENDRICK AUTOMOTIVE GROUP

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- KAIXIN AUTO HOLDINGS

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- LEITHCARS

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- MAHINDRA FIRST CHOICE

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- MARUTI SUZUKI INDIA LIMITED

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- OLX GROUP

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- PENDRAGON

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- TRUECAR, INC.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- UXIN GROUP

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- questionnaire

- related reports

Lista de Tablas

TABLE 1 Scale of Used Vehicle Exports in the Year 2017 (USD Million)

TABLE 2 Comparison of the Brand and Estimated Maintenance Cost over 10 Years (approx.)

TABLE 3 GLOBAL USED CAR MARKET, BY VENDOR TYPE, 2019-2028 (USD MILLION)

TABLE 4 Global organized in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 5 Global UNORgANIZED in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 6 GLOBAL USED CAR MARKET, BY propulsion TYPE, 2019-2028 (USD MILLION)

TABLE 7 Global petrol in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 8 Global diesel in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 9 Global electric in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 10 Global lpg in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 11 Global cng in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 12 Global others in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 13 GLOBAL USED CAR MARKET, BY ENGINE CAPACITY, 2019-2028 (UsD MILLION)

TABLE 14 Global small (below 1499 CC) engine capacity in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 15 Global mid-size (between 1500-2499 cc) in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 16 Global full size (above 2500 cc) in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 17 GLOBAL USED CAR MARKET, BY dealership, 2019-2028 (USD MILLION)

TABLE 18 Global franchised in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 19 Global independent in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 20 GLOBAL USED CAR MARKET, BY sales channel, 2019-2028 (USD MILLION)

TABLE 21 Global offline sales channel in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 22 Global online sales channel in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 23 GLOBAL used car market, BY vehicle type, 2019-2028 (USD million)

TABLE 24 Global passenger cars in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 25 Global passenger cars in used car Market, By TYPE, 2019-2028 (USD MILLION)

TABLE 26 GLOBAL lcv in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 27 Global LCV in used car Market, By TYPE, 2019-2028 (USD MILLION)

TABLE 28 Global Vans in used car Market, By TYPE, 2019-2028 (USD MILLION)

TABLE 29 Global ELECTRIC VEHICLE IN used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 30 Global electric vehicle in used car Market, By TYPE, 2019-2028 (USD MILLION)

TABLE 31 Global HCV IN used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 32 Global HCV in used car Market, By TYPE, 2019-2028 (USD MILLION)

TABLE 33 Global Trucks in used car Market, By TYPE, 2019-2028 (USD MILLION)

TABLE 34 GLOBAL used car Market, By REGION, 2019-2028 (USD million)

TABLE 35 EUROPE Used Car Market, By Country, 2019-2028 (USD Million)

TABLE 36 EUROPE Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 37 EUROPE Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 38 EUROPE Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 39 EUROPE Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 40 EUROPE Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 41 EUROPE Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 42 EUROPE Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 43 EUROPE LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 44 EUROPE Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 45 EUROPE HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 46 EUROPE Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 47 EUROPE Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 48 GERMANY Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 49 GERMANY Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 50 GERMANY Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 51 GERMANY Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 52 GERMANY Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 53 GERMANY Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 54 GERMANY Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 55 GERMANY LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 56 GERMANY Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 57 GERMANY HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 58 GERMANY Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 59 GERMANY Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 60 FRANCE Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 61 FRANCE Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 62 FRANCE Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 63 FRANCE Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 64 FRANCE Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 65 FRANCE Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 66 FRANCE Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 67 FRANCE LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 68 FRANCE Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 69 FRANCE HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 70 FRANCE Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 71 FRANCE Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 72 U.K. Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 73 U.K. Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 74 U.K. Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 75 U.K. Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 76 U.K. Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 77 U.K. Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 78 U.K. Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 79 U.K. LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 80 U.K. Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 81 U.K. HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 82 U.K. Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 83 U.K. Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 84 ITALY Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 85 ITALY Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 86 ITALY Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 87 ITALY Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 88 ITALY Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 89 ITALY Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 90 ITALY Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 91 ITALY LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 92 ITALY Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 93 ITALY HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 94 ITALY Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 95 ITALY Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 96 SPAIN Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 97 SPAIN Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 98 SPAIN Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 99 SPAIN Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 100 SPAIN Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 101 SPAIN Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 102 SPAIN Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 103 SPAIN LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 104 SPAIN Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 105 SPAIN HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 106 SPAIN Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 107 SPAIN Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 108 RUSSIA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 109 RUSSIA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 110 RUSSIA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 111 RUSSIA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 112 RUSSIA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 113 RUSSIA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 114 RUSSIA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 115 RUSSIA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 116 RUSSIA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 117 RUSSIA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 118 RUSSIA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 119 RUSSIA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 120 TURKEY Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 121 TURKEY Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 122 TURKEY Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 123 TURKEY Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 124 TURKEY Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 125 TURKEY Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 126 TURKEY Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 127 TURKEY LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 128 TURKEY Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 129 TURKEY HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 130 TURKEY Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 131 TURKEY Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 132 BELGIUM Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 133 BELGIUM Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 134 BELGIUM Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 135 BELGIUM Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 136 BELGIUM Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 137 BELGIUM Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 138 BELGIUM Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 139 BELGIUM LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 140 BELGIUM Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 141 BELGIUM HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 142 BELGIUM Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 143 BELGIUM Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 144 NETHERLANDS Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 145 NETHERLANDS Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 146 NETHERLANDS Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 147 NETHERLANDS Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 148 NETHERLANDS Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 149 NETHERLANDS Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 150 NETHERLANDS Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 151 NETHERLANDS LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 152 NETHERLANDS Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 153 NETHERLANDS HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 154 NETHERLANDS Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 155 NETHERLANDS Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 156 SWITZERLAND Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 157 SWITZERLAND Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 158 SWITZERLAND Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 159 SWITZERLAND Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 160 SWITZERLAND Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 161 SWITZERLAND Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 162 SWITZERLAND Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 163 SWITZERLAND LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 164 SWITZERLAND Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 165 SWITZERLAND HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 166 SWITZERLAND Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 167 SWITZERLAND Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 168 Rest of EUROPE Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 169 ASIA-PACIFIC Used Car Market, By Country, 2019-2028 (USD Million)

TABLE 170 ASIA-PACIFIC Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 171 ASIA-PACIFIC Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 172 ASIA-PACIFIC Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 173 ASIA-PACIFIC Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 174 ASIA-PACIFIC Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 175 ASIA-PACIFIC Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 176 ASIA-PACIFIC Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 177 ASIA-PACIFIC LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 178 ASIA-PACIFIC Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 179 ASIA-PACIFIC HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 180 ASIA-PACIFIC Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 181 ASIA-PACIFIC Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 182 CHINA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 183 CHINA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 184 CHINA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 185 CHINA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 186 CHINA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 187 CHINA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 188 CHINA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 189 CHINA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 190 CHINA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 191 CHINA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 192 CHINA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 193 CHINA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 194 JAPAN Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 195 JAPAN Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 196 JAPAN Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 197 JAPAN Used Car Market, By DEALERSHIP, 2019-2028 (USD Million)

TABLE 198 JAPAN Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 199 JAPAN Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 200 JAPAN Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 201 JAPAN LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 202 JAPAN Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 203 JAPAN HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 204 JAPAN Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 205 JAPAN Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 206 SOUTH KOREA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 207 SOUTH KOREA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 208 SOUTH KOREA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 209 SOUTH KOREA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 210 SOUTH KOREA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 211 SOUTH KOREA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 212 SOUTH KOREA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 213 SOUTH KOREA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 214 SOUTH KOREA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 215 SOUTH KOREA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 216 SOUTH KOREA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 217 SOUTH KOREA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 218 INDIA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 219 INDIA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 220 INDIA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 221 INDIA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 222 INDIA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 223 INDIA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 224 INDIA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 225 INDIA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 226 INDIA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 227 INDIA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 228 INDIA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 229 INDIA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 230 AUSTRALIA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 231 AUSTRALIA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 232 AUSTRALIA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 233 AUSTRALIA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 234 AUSTRALIA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 235 AUSTRALIA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 236 AUSTRALIA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 237 AUSTRALIA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 238 AUSTRALIA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 239 AUSTRALIA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 240 AUSTRALIA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 241 AUSTRALIA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 242 SINGAPORE Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 243 SINGAPORE Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 244 SINGAPORE Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 245 SINGAPORE Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 246 SINGAPORE Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 247 SINGAPORE Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 248 SINGAPORE Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 249 SINGAPORE LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 250 SINGAPORE Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 251 SINGAPORE HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 252 SINGAPORE Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 253 SINGAPORE Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 254 THAILAND Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 255 THAILAND Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 256 THAILAND Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 257 THAILAND Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 258 THAILAND Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 259 THAILAND Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 260 THAILAND Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 261 THAILAND LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 262 THAILAND Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 263 THAILAND HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 264 THAILAND Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 265 THAILAND Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 266 MALAYSIA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 267 MALAYSIA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 268 MALAYSIA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 269 MALAYSIA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 270 MALAYSIA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 271 MALAYSIA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 272 MALAYSIA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 273 MALAYSIA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 274 MALAYSIA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 275 MALAYSIA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 276 MALAYSIA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 277 MALAYSIA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 278 TABLE 86: INDONESIA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 279 INDONESIA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 280 INDONESIA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 281 INDONESIA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 282 INDONESIA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 283 INDONESIA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 284 INDONESIA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 285 INDONESIA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 286 INDONESIA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 287 INDONESIA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 288 INDONESIA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 289 INDONESIA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 290 PHILIPPINES Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 291 PHILIPPINES Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 292 PHILIPPINES Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 293 PHILIPPINES Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 294 PHILIPPINES Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 295 PHILIPPINES Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 296 PHILIPPINES Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 297 PHILIPPINES LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 298 PHILIPPINES Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 299 PHILIPPINES HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 300 PHILIPPINES Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 301 PHILIPPINES Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 302 Rest of ASIA-PACIFIC Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 303 Middle East & Africa Used Car Market, By Country, 2019-2028 (USD Million)

TABLE 304 MIDDLE EAST AND AFRICA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 305 mIDDLE EAST AND AFRICA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 306 MIDDLE EAST AND AFRICA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 307 MIDDLE EAST AND AFRICA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 308 MIDDLE EAST AND AFRICA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 309 MIDDLE EAST AND AFRICA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 310 MIDDLE EAST AND AFRICA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 311 MIDDLE EAST AND AFRICA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 312 MIDDLE EAST AND AFRICA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 313 MIDDLE EAST AND AFRICA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 314 MIDDLE EAST AND AFRICA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 315 MIDDLE EAST AND AFRICA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 316 SOUTH AFRICA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 317 SOUTH AFRICA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 318 SOUTH AFRICA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 319 SOUTH AFRICA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 320 SOUTH AFRICA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 321 SOUTH AFRICA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 322 SOUTH AFRICA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 323 SOUTH AFRICA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 324 SOUTH AFRICA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 325 SOUTH AFRICA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 326 SOUTH AFRICA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 327 SOUTH AFRICA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 328 EGYPT Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 329 EGYPT Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 330 EGYPT Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 331 EGYPT Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 332 EGYPT Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 333 EGYPT Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 334 EGYPT Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 335 EGYPT LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 336 EGYPT Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 337 EGYPT HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 338 EGYPT Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 339 EGYPT Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 340 SAUDI ARABIA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 341 SAUDI ARABIA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 342 SAUDI ARABIA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 343 SAUDI ARABIA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 344 SAUDI ARABIA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 345 SAUDI ARABIA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 346 SAUDI ARABIA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 347 SAUDI ARABIA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 348 SAUDI ARABIA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 349 SAUDI ARABIA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 350 SAUDI ARABIA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 351 SAUDI ARABIA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 352 U.A.E. Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 353 U.A.E. Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 354 U.A.E. Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 355 U.A.E. Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 356 U.A.E. Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 357 U.A.E. Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 358 U.A.E. Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 359 U.A.E. LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 360 : U.A.E. Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 361 U.A.E. HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 362 U.A.E. Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 363 U.A.E. Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 364 ISRAEL Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 365 ISRAEL Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 366 ISRAEL Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 367 ISRAEL Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 368 ISRAEL Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 369 ISRAEL Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 370 ISRAEL Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 371 ISRAEL LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 372 ISRAEL Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 373 ISRAEL HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 374 ISRAEL Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 375 ISRAEL Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 376 Rest of MIDDLE EAST AND AFRICA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 377 North America Used Car Market, By Country, 2019-2028 (USD Million)

TABLE 378 North America Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 379 North America Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 380 North America Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 381 North America Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 382 North America Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 383 North America Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 384 North America Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 385 North America LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 386 North America Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 387 North America HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 388 North America Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 389 North America Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 390 U.S. Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 391 U.S. Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 392 U.S. Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 393 U.S. Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 394 U.S. Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 395 U.S. Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 396 U.S. Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 397 U.S. LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 398 U.S. Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 399 U.S. HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 400 U.S. Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 401 U.S. Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 402 CANADA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 403 CANADA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 404 CANADA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 405 CANADA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 406 CANADA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 407 CANADA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 408 CANADA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 409 CANADA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 410 CANADA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 411 CANADA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 412 CANADA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 413 CANADA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 414 MEXICO Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 415 MEXICO Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 416 MEXICO Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 417 MEXICO Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 418 MEXICO Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 419 MEXICO Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 420 MEXICO Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 421 MEXICO LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 422 MEXICO Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 423 MEXICO HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 424 MEXICO Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 425 MEXICO Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 426 South America Used Car Market, By Country, 2019-2028 (USD Million)

TABLE 427 South America Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 428 South America Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 429 South America Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 430 South America Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 431 South America Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 432 South America Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 433 South America Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 434 South America LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 435 South America Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 436 South America HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 437 South America Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 438 South America Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 439 BRAZIL Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 440 BRAZIL Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 441 BRAZIL Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 442 BRAZIL Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 443 BRAZIL Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 444 BRAZIL Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 445 BRAZIL Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 446 BRAZIL LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 447 BRAZIL Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 448 BRAZIL HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 449 BRAZIL Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 450 BRAZIL Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 451 ARGENTINA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 452 ARGENTINA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 453 ARGENTINA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 454 ARGENTINA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 455 ARGENTINA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 456 ARGENTINA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 457 ARGENTINA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 458 ARGENTINA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 459 ARGENTINA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 460 ARGENTINA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 461 ARGENTINA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 462 ARGENTINA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 463 COLOMBIA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 464 COLOMBIA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 465 COLOMBIA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 466 COLOMBIA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 467 COLOMBIA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 468 COLOMBIA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 469 COLOMBIA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 470 COLOMBIA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 471 COLOMBIA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 472 COLOMBIA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 473 COLOMBIA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 474 COLOMBIA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 475 PERU Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 476 PERU Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 477 PERU Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 478 PERU Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 479 PERU Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 480 PERU Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 481 PERU Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 482 PERU LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 483 PERU Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 484 PERU HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 485 PERU Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 486 PERU Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 487 CHILE Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 488 CHILE Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 489 CHILE Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 490 CHILE Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 491 CHILE Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 492 CHILE Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 493 CHILE Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 494 CHILE LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 495 CHILE Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 496 CHILE HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 497 CHILE Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 498 CHILE Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 499 VENEZUELA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 500 VENEZUELA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 501 VENEZUELA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 502 VENEZUELA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 503 VENEZUELA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 504 VENEZUELA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 505 VENEZUELA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 506 VENEZUELA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 507 VENEZUELA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 508 VENEZUELA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 509 VENEZUELA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 510 VENEZUELA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 511 ECUADOR Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 512 ECUADOR Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 513 ECUADOR Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 514 ECUADOR Used Car Market, By DEALERSHIP, 2019-2028 (USD Million)

TABLE 515 ECUADOR Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 516 ECUADOR Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 517 ECUADOR Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 518 ECUADOR LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 519 ECUADOR Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 520 ECUADOR HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 521 ECUADOR Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 522 ECUADOR Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 523 Rest of South America Used Car Market, By Vendor Type, 2019-2028 (USD Million)

Lista de figuras

FIGURE 1 GLOBAL USED CAR MARKET segmentation

FIGURE 2 GLOBAL used car MARKET: data triangulation

FIGURE 3 GLOBAL used car MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL used car MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL used car MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL used car MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL used car MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL used car MARKET: vendor share analysis

FIGURE 9 GLOBAL used car market SEGMENTATION

FIGURE 10 THE Emergence of different ecommerce platformS is EXPECTED TO DRIVE THE GLOBAL used car market THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 11 ORGANIZED segment is expected to account for the largest share of THE Global used car market IN 2021 & 2028

FIGURE 12 asia-pacific is expected to DOMINATE and is the fastest-growing region in THE Global used car market IN the forecast period of 2021 to 2028

FIGURE 13 asia-pacific is the fastest growing market for used car market in the forecast period of 2021 to 2028

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR GLOBAL USED CAR MARKET

FIGURE 15 Monthly Passenger Car Sales in Europe between August 2020 and June 2021 (1,000 Units)

FIGURE 16 Vehicle share per month in the year 2019 (%)

FIGURE 17 Global USEd CAR MARKET: BY VENDOR TYPE, 2020

FIGURE 18 Global USED CAR MARKET: BY PROPULSION TYPE, 2020

FIGURE 19 Global USEd CAR MARKET: BY ENGINE capacity, 2020

FIGURE 20 Global USEd CAR MARKET: BY DEALERSHIP, 2020

FIGURE 21 Global USEd CAR MARKET: BY sales channel, 2020

FIGURE 22 Global used car MARKET: BY VEHICLE type, 2020

FIGURE 23 GLOBAL USED CAR Market: SNAPSHOT (2020)

FIGURE 24 GLOBAL USED CAR Market: by Region (2020)

FIGURE 25 GLOBAL USED CAR Market: by Region (2021 & 2028)

FIGURE 26 GLOBAL Used car Market: by Region (2020 & 2028)

FIGURE 27 GLOBAL used car Market: by Vendor TYPE (2021-2028)

FIGURE 28 EUROPE USED CAR MARKET: SNAPSHOT (2020)

FIGURE 29 EUROPE USED CAR MARKET: by Country (2020)

FIGURE 30 EUROPE USED CAR MARKET: by Country (2021 & 2028)

FIGURE 31 EUROPE USED CAR MARKET: by Country (2020 & 2028)

FIGURE 32 EUROPE USED CAR MARKET: by Vendor Type (2021-2028)

FIGURE 33 ASIA-PACIFIC USED CAR MARKET: SNAPSHOT (2020

FIGURE 34 ASIA-PACIFIC USED CAR MARKET: by Country (2020)

FIGURE 35 ASIA-PACIFIC USED CAR MARKET: by Country (2021 & 2028)

FIGURE 36 ASIA-PACIFIC USED CAR MARKET: by Country (2020 & 2028)

FIGURE 37 ASIA-PACIFIC USED CAR MARKET: by Vendor Type (2021-2028)

FIGURE 38 Middle East & Africa USED CAR MARKET: SNAPSHOT (2020)

FIGURE 39 Middle East & Africa USED CAR MARKET: by Country (2020)

FIGURE 40 Middle East & Africa USED CAR MARKET: by Country (2021 & 2028)

FIGURE 41 Middle East & Africa USED CAR MARKET: by Country (2020 & 2028)

FIGURE 42 Middle East & Africa USED CAR MARKET: by Vendor Type (2021-2028)

FIGURE 43 NORTH AMERICA USED CAR MARKET: SNAPSHOT (2020)

FIGURE 44 NORTH AMERICA USED CAR MARKET: by Country (2020)

FIGURE 45 NORTH AMERICA USED CAR MARKET: by Country (2021 & 2028)

FIGURE 46 NORTH AMERICA USED CAR MARKET: by Country (2020 & 2028)

FIGURE 47 NORTH AMERICA USED CAR MARKET: by Vendor Type (2021-2028)

FIGURE 48 SOUTH AMERICA USED CAR MARKET: SNAPSHOT (2020)

FIGURE 49 SOUTH AMERICA USED CAR MARKET: by Country (2020)

FIGURE 50 SOUTH AMERICA USED CAR MARKET: by Country (2021 & 2028)

FIGURE 51 SOUTH AMERICA USED CAR MARKET: by Country (2020 & 2028)

FIGURE 52 SOUTH AMERICA USED CAR MARKET: by Vendor Type (2021-2028)

FIGURE 53 global used car Market: company share 2020 (%)

FIGURE 54 NORTH AMERICA used car Market: company share 2020 (%)

FIGURE 55 Europe used car Market: company share 2020 (%)

FIGURE 56 Asia-Pacific used car Market: company share 2020 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.