Mercado global de drones objetivo, por tipo (rotatorio y fijo), uso (objetivo aéreo, objetivo terrestre y objetivo marino), tipo de objetivo (objetivo de vuelo libre, objetivo a escala completa, objetivo a subescala, objetivo deportivo y objetivo de remolque), tipo de motor (motor a reacción y motor de combustión interna), velocidad (menos de 100 m/s y más de 100 m/s), modo de operación (pilotado a distancia, autónomo y pilotado opcionalmente), capacidad de carga útil (menos de 20 kg, 20-50 kg y más de 50 kg), aplicación (entrenamiento de combate, objetivo y señuelo, identificación de objetivos, reconocimiento y adquisición de objetivos), usuario final (defensa, seguridad nacional y comercial) - Tendencias de la industria y pronóstico hasta 2030.

Análisis y tamaño del mercado de drones objetivo

El aumento de los presupuestos de defensa es un importante motor del crecimiento del mercado. Además, se espera que los avances en la tecnología de los drones y el aumento del gasto en innovación de productos impulsen el crecimiento del mercado. Las principales limitaciones que pueden afectar negativamente al mercado son las limitaciones presupuestarias y el cumplimiento de las normativas. Se espera que las fuertes inversiones en investigación y desarrollo brinden oportunidades para el crecimiento del mercado. Sin embargo, se espera que la vulnerabilidad de los sistemas de drones objetivo a los ciberataques suponga un desafío para el crecimiento del mercado.

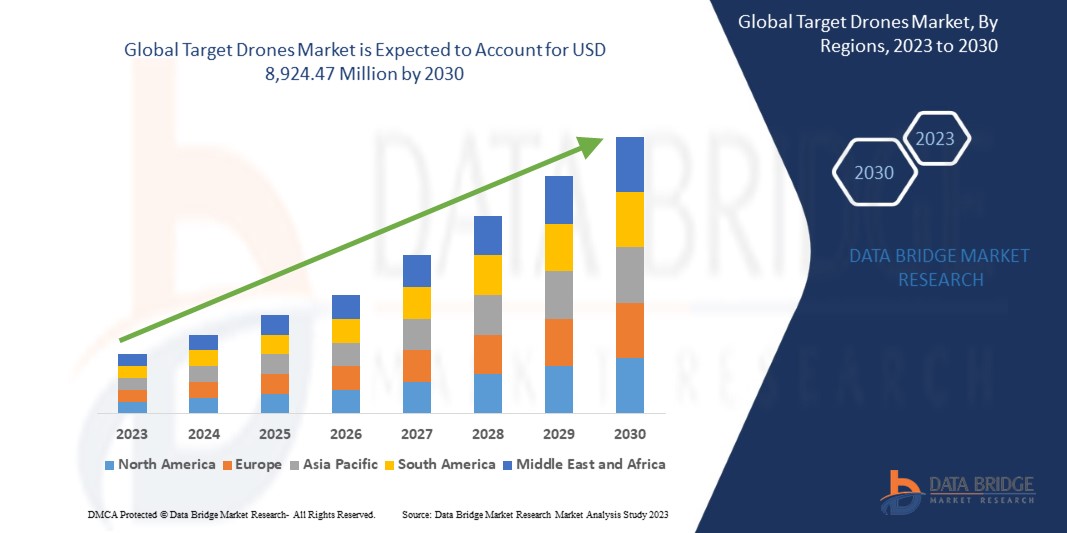

Data Bridge Market Research analiza que se espera que el mercado global de drones alcance un valor de USD 8.924,47 millones para 2030, con una CAGR del 5,3% durante el período de pronóstico.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Año histórico |

2021 (Personalizable para 2015-2020) |

|

Unidades cuantitativas |

Ingresos en millones de USD |

|

Segmentos cubiertos |

Tipo (rotatorio y fijo), uso (objetivo aéreo, objetivo terrestre y objetivo marino), tipo de objetivo (objetivo de vuelo libre, objetivo de escala completa, objetivo de subescala, objetivo deportivo y objetivo de remolque), tipo de motor (motor a reacción y motor de combustión interna), velocidad (menos de 100 m/s y más de 100 m/s), modo de operación (pilotado a distancia, autónomo y pilotado opcionalmente), capacidad de carga útil (menos de 20 kg, 20-50 kg y más de 50 kg), aplicación (entrenamiento de combate, objetivo y señuelo, identificación de objetivos, reconocimiento y adquisición de objetivos), usuario final (defensa, seguridad nacional y comercial) |

|

Países cubiertos |

Alemania, Reino Unido, Italia, Francia, Rusia, España, Suiza, Turquía, Bélgica, Países Bajos, Suecia, Dinamarca, Polonia y resto de Europa, China, Japón, Corea del Sur, India, Singapur, Tailandia, Indonesia, Malasia, Filipinas, Australia y Nueva Zelanda, Taiwán, Vietnam y resto de Asia-Pacífico, EE. UU., Canadá y México, Arabia Saudita, Sudáfrica, Emiratos Árabes Unidos, Egipto, Israel, Omán, Qatar, Baréin y resto de Oriente Medio y África, Brasil, Argentina y resto de Sudamérica |

|

Actores del mercado cubiertos |

SCR, Sistemas de Control Remoto, MSP, ANADRONE, AeroTargets International LLC., Denel Dynamics, Thales, SAAB, SAFRAN, Lockheed Martin Corporation, AIRBUS, Griffon Aerospace, Northrop Grumman, Boeing, Leonardo SpA, Kratos Defense & Security Solutions, Inc. entre otros. |

Definición de mercado

Un dron objetivo es un vehículo aéreo no tripulado (UAV) diseñado y utilizado para diversos fines militares, principalmente como objetivo en ejercicios de entrenamiento para sistemas antiaéreos, misiles guiados u otros sistemas de armas. Estos drones están destinados a simular el comportamiento y las características de aeronaves, misiles u otras amenazas enemigas reales para proporcionar escenarios de entrenamiento realistas para el personal militar.

Los drones de combate están equipados con diversos sensores, sistemas y tecnologías para imitar la sección transversal del radar, las señales infrarrojas y los patrones de vuelo de amenazas del mundo real. Pueden controlarse de forma remota o funcionar de forma autónoma, según los requisitos específicos del ejercicio de entrenamiento. Las fuerzas militares pueden probar y mejorar sus sistemas de armas, entrenar a sus operadores y mejorar su preparación para posibles situaciones de combate sin necesidad de arriesgar a pilotos humanos o aeronaves reales mediante el uso de drones de combate.

Dinámica del mercado global de drones de destino

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

Conductores

- Aumento del gasto en defensa en distintos países

Varios países, como la India, los Estados Unidos y China, junto con algunos países europeos, están aumentando estratégicamente sus inversiones en presupuestos de defensa. Estas naciones están destinando recursos financieros sustanciales para fortalecer sus capacidades de defensa y salvaguardar sus intereses de seguridad nacional. La India está aumentando progresivamente su gasto en defensa para modernizar sus fuerzas armadas y fortalecer su infraestructura de defensa. Los Estados Unidos, como potencia militar mundial, siguen destinando fondos importantes para mantener su ventaja tecnológica, apoyar la investigación y el desarrollo avanzados y garantizar la preparación de todas sus fuerzas armadas. Además, China está ampliando de manera asertiva su presupuesto de defensa para mejorar sus capacidades militares, invertir en tecnologías de vanguardia y proteger sus intereses regionales. Hay un aumento en el gasto en presupuestos de defensa en todo el mundo.

- Avances en la tecnología de drones

Los avances en la tecnología de los drones están cambiando rápidamente, avanzando en una era innovadora de capacidades y posibilidades. Los avances científicos y tecnológicos en varios dominios están convergiendo para redefinir el potencial de los drones objetivo y sus aplicaciones. Una de las áreas significativas es la tecnología de detección, donde la integración de los sistemas RADAR (Radio Detection and Ranging) y LiDaR (Light Detection and Ranging) otorga a los drones capacidades mejoradas en términos de rendimiento. Esto les permite navegar y mantener el reconocimiento en áreas complejas, evitar obstáculos con precisión y generar mapas de alta precisión. Al mismo tiempo, las comunicaciones inalámbricas y celulares están ampliando el alcance de los drones, lo que permite la transmisión de datos en tiempo real y el pilotaje remoto a grandes distancias. Estos avances han ampliado el horizonte para industrias como la agricultura, la inspección de infraestructuras y la respuesta a emergencias, lo que les permite operar con una eficiencia y capacidad de respuesta sin precedentes.

Restricciones/Desafíos

- Dependencia de personal calificado para operar

La operación y utilización eficaz de los drones de detección de blancos dependen de la experiencia de personal capacitado. Los operadores competentes son esenciales para pilotar drones de detección de blancos con precisión durante ejercicios de entrenamiento, asegurando simulaciones realistas de diversos escenarios de amenaza. Además, los técnicos capacitados desempeñan un papel crucial en el mantenimiento, la reparación y la resolución de problemas de estos sistemas avanzados, contribuyendo a su rendimiento constante y extendiendo su vida útil operativa. La dependencia de personal capacitado resalta la importancia de los programas de capacitación y el desarrollo de la experiencia para maximizar las capacidades y los beneficios de la tecnología de drones de detección de blancos en contextos de defensa y entrenamiento.

- Las preocupaciones relacionadas con los problemas de energía dificultan el rendimiento de los drones

Los drones que se utilizan como blanco dependen de una variedad de fuentes de energía para alimentar sus operaciones, cada una con sus propias limitaciones. Los drones que funcionan con baterías ofrecen la comodidad de la simplicidad y la facilidad de uso, pero su capacidad energética limitada a menudo restringe la duración de los vuelos, lo que los hace adecuados para misiones más cortas. Los motores de combustión interna, que se utilizan comúnmente en los drones que funcionan con gas, brindan mayor resistencia y opciones de reabastecimiento rápido. Sin embargo, tienden a generar niveles más altos de ruido y emisiones. Las celdas de combustible de hidrógeno dependen de la infraestructura y el almacenamiento de hidrógeno, lo que genera desafíos logísticos.

Oportunidades

- Tendencia creciente de la IA (inteligencia artificial) y la tecnología basada en datos

La tendencia emergente de la IA y la tecnología basada en datos está creando una oportunidad para el mercado. La integración de la IA permite que los drones de destino simulen comportamientos de amenazas más sofisticados y adaptables, lo que mejora el realismo de los escenarios de entrenamiento. Además, la tecnología basada en datos permite la recopilación y el análisis de grandes cantidades de datos de entrenamiento, lo que ofrece información valiosa sobre el rendimiento de los alumnos y el comportamiento del sistema. Esto crea vías para la mejora continua y la personalización de los programas de entrenamiento.

- Colaboración interna y asociaciones

Los principales actores del mercado asociados con el mercado están realizando diversos desarrollos y tomando decisiones estratégicas para crecer en su mercado y hacer frente a las crecientes estrategias de mercado de los fabricantes de drones objetivo. Desde nuevas inversiones hasta colaboraciones, los principales actores del mercado están evolucionando sus prácticas comerciales y expandiendo aún más su negocio a través de asociaciones y estrategias de promoción en todo el mundo.

Acontecimientos recientes

- En agosto de 2023, el Departamento de Defensa de Australia eligió a Lockheed Martin Corporation como su socio estratégico para supervisar la Fase 1 del AIR6500 (AIR6500-1). La Fuerza de Defensa Australiana (ADF) recibirá el Sistema de Gestión de Batalla Aérea Conjunta (JABMS) del AIR6500-1, que servirá como la arquitectura innovadora en el corazón de la próxima capacidad de Defensa Aérea y de Misiles Integrada (IAMD) de la ADF. Esto ayudará a la empresa a obtener más propuestas de pedidos de los clientes.

- En julio de 2023, Airbus Foundation unió fuerzas con Connected Conservation Foundation (CCF) para proteger la vida silvestre y preservar los ecosistemas con la ayuda de imágenes satelitales de Airbus Defence and Space.

- En julio de 2023, el Gobierno de Canadá adjudicó a Airbus Defence and Space un contrato para cuatro aviones de transporte cisterna multifunción (MRTT) Airbus A330 de nueva construcción y para la conversión de cinco A330-200 usados, en un intento de fortalecer las capacidades de defensa continental de Canadá.

- En mayo de 2023, se inauguró una nueva planta de servicios de distribución de Boeing [NYSE:BA] en el aeropuerto Panattoni Park Rzeszów III. La instalación duplica con creces el espacio para almacenar piezas de aeronaves en comparación con la ubicación anterior y amplía la presencia de Boeing en el Valle de la Aviación de Polonia, un centro industrial único.

- En febrero de 2023, el Cuerpo de Marines de los EE. UU. adjudicó a Northrop Grumman Corporation (NYSE: NOC) el contrato inicial de producción y operaciones para el sistema de orientación portátil de próxima generación (NGHTS). El NGHTS es un sistema de orientación compacto que proporciona una orientación de precisión avanzada y es capaz de funcionar en entornos sin GPS.

Alcance del mercado global de drones de destino

El mercado global de drones objetivo se divide en nueve segmentos importantes según el tipo, el uso, el tipo de objetivo, el tipo de motor, la velocidad, el modo de funcionamiento, la capacidad de carga útil, la aplicación y el usuario final. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Giratorio

- Fijado

Según el tipo, el mercado global de drones objetivo se segmenta en rotatorios y fijos.

Usar

- Objetivo aéreo

- Objetivo terrestre

- Objetivo marino

Sobre la base del uso, el mercado global de drones objetivo se segmenta en objetivos aéreos, objetivos terrestres y objetivos marinos.

Tipo de objetivo

- Objetivo de vuelo libre

- Objetivo a escala completa

- Objetivo de subescala

- Objetivo deportivo

- Objetivo de remolque

Sobre la base del tipo de objetivo, el mercado global de drones objetivo se segmenta en objetivo de vuelo libre, objetivo de escala completa, objetivo de subescala, objetivo deportivo y objetivo de remolque.

Tipo de motor

- Motor a reacción

- Motor de combustión interna

Sobre la base del tipo de motor, el mercado global de drones objetivo se segmenta en motor a reacción y motor de combustión interna.

Velocidad

- Menos de 100 M/S

- Más de 100 M/S

En función de la velocidad, el mercado mundial de drones objetivo se segmenta en menos de 100 m/s y más de 100 m/s.

Modo de funcionamiento

- Pilotado a distancia

- Autónomo

- Pilotado opcionalmente

Sobre la base del modo de operación, el mercado global de drones objetivo se segmenta en pilotados a distancia, autónomos y pilotados opcionalmente.

Capacidad de carga útil

- Menos de 20 kg

- 20 - 50 kilogramos

- Más de 50 Kgs

Sobre la base de la capacidad de carga útil, el mercado global de drones objetivo se segmenta en menos de 20 kg, 20-50 kg y más de 50 kg.

Solicitud

- Entrenamiento de combate

- Objetivo y señuelo

- Identificación de objetivos

- Reconocimiento

- Adquisición de objetivos

Sobre la base de la aplicación, el mercado global de drones objetivo se segmenta en entrenamiento de combate, objetivos y señuelos, identificación de objetivos, reconocimiento y adquisición de objetivos.

Usuario final

- Defensa

- Seguridad nacional

- Comercial

En función del usuario final, el mercado global de drones objetivo se segmenta en defensa, seguridad nacional y comercial.

Análisis y perspectivas regionales del mercado global de drones objetivo

Se analiza el mercado global de drones objetivo y se proporcionan información y tendencias del tamaño del mercado por país según tipo, uso, tipo de objetivo, tipo de motor, velocidad, modo de operación, capacidad de carga útil, aplicación y usuario final como se menciona anteriormente.

Los países cubiertos en el informe del mercado global de drones objetivo son Alemania, Reino Unido, Italia, Francia, Rusia, España, Suiza, Turquía, Bélgica, Países Bajos, Suecia, Dinamarca, Polonia y el resto de Europa, China, Japón, Corea del Sur, India, Singapur, Tailandia, Indonesia, Malasia, Filipinas, Australia y Nueva Zelanda, Taiwán, Vietnam y el resto de Asia-Pacífico, EE. UU., Canadá y México, Arabia Saudita, Sudáfrica, Emiratos Árabes Unidos, Egipto, Israel, Omán, Qatar, Bahréin y el resto de Medio Oriente y África, Brasil, Argentina y el resto de Sudamérica.

Se espera que América del Norte domine el mercado mundial de drones de ataque, ya que en los países de América del Norte, en particular en los EE. UU., hay una fuerte inversión en entrenamiento militar, preparación e investigación de defensa. Los drones de ataque son esenciales para mantener la preparación de estas fuerzas armadas. Se espera que el Reino Unido domine en la región de Europa debido al mayor énfasis en la mejora del entrenamiento militar. Se espera que China domine la región de Asia y el Pacífico debido al aumento de la I+D y las actividades de capital de riesgo en el campo de los drones.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor aguas arriba y aguas abajo, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado global de los drones objetivo

El panorama competitivo del mercado global de drones objetivo proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en el mercado global de drones objetivo.

Algunos de los principales actores que operan en el mercado global de drones objetivo son SCR, Sistemas de Control Remoto, MSP, ANADRONE, AeroTargets International LLC., Denel Dynamics, Thales, SAAB, SAFRAN, Lockheed Martin Corporation, AIRBUS, Griffon Aerospace, Northrop Grumman, Boeing, Leonardo SpA, Kratos Defense & Security Solutions, Inc., entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 MANUFACTURING FACILITIES & CAPACITIES

4.2 PRICING ANALYSIS

4.3 PRODUCTION VOLUME OVERVIEW

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING EXPENDITURES ON DEFENSE BY DIFFERENT COUNTRIES

5.1.2 ADVANCEMENTS IN DRONE TECHNOLOGY

5.1.3 RISING THREATS AND SECURITY CONCERNS

5.2 RESTRAINT

5.2.1 DEPENDENCY ON SKILLED PERSONNEL TO OPERATE

5.3 OPPORTUNITIES

5.3.1 RISING TREND OF AI (ARTIFICIAL INTELLIGENCE) AND DATA-DRIVEN TECHNOLOGY

5.3.2 INTERNAL COLLABORATION AND PARTNERSHIPS

5.4 CHALLENGE

5.4.1 CONCERNS RELATED TO POWER ISSUES HINDER THE PERFORMANCE OF DRONES

6 GLOBAL TARGET DRONES MARKET BY GEOGRAPHY

6.1 OVERVIEW

6.2 NORTH AMERICA

6.3 EUROPE

6.4 ASIA-PACIFIC

6.5 SOUTH AMERICA

6.6 MIDDLE EAST & AFRICA

7 GLOBAL TARGET DRONES MARKET: COMPANY LANDSCAPE

7.1 COMPANY SHARE ANALYSIS: GLOBAL

7.2 COMPANY SHARE ANALYSIS: EUROPE

7.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

7.4 COMPANY SHARE ANALYSIS: NORTH AMERICA

7.5 PARTNERSHIPS & CONTRACTS

7.6 EVENTS

7.7 AWARD

8 SWOT ANALYSIS

9 COMPANY PROFILE

9.1 LOCKHEED MARTIN CORPORATION

9.1.1 COMPANY SNAPSHOT

9.1.2 REVENUE ANALYSIS

9.1.3 COMPANY SHARE ANALYSIS

9.1.4 PRODUCT PORTFOLIO

9.1.5 RECENT DEVELOPMENT

9.2 AIRBUS

9.2.1 COMPANY SNAPSHOT

9.2.2 REVENUE ANALYSIS

9.2.3 COMPANY SHARE ANALYSIS

9.2.4 PRODUCT PORTFOLIO

9.2.5 RECENT DEVELOPMENTS

9.3 BOEING

9.3.1 COMPANY SNAPSHOT

9.3.2 REVENUE ANALYSIS

9.3.3 COMPANY SHARE ANALYSIS

9.3.4 PRODUCT PORTFOLIO

9.3.5 RECENT DEVELOPMENTS

9.4 GRIFFON AEROSPACE

9.4.1 COMPANY SNAPSHOT

9.4.2 COMPANY SHARE ANALYSIS

9.4.3 PRODUCT PORTFOLIO

9.4.4 RECENT DEVELOPMENT

9.5 NORTHROP GRUMMAN

9.5.1 COMPANY SNAPSHOT

9.5.2 REVENUE ANALYSIS

9.5.3 COMPANY SHARE ANALYSIS

9.5.4 PRODUCT PORTFOLIO

9.5.5 RECENT DEVELOPMENT

9.6 AEROTARGETS INTERNATIONAL LLC

9.6.1 COMPANY SNAPSHOT

9.6.2 PRODUCT PORTFOLIO

9.6.3 RECENT DEVELOPMENTS

9.7 ANADRONE

9.7.1 COMPANY SNAPSHOT

9.7.2 PRODUCT PORTFOLIO

9.7.3 RECENT DEVELOPMENT

9.8 DENEL DYNAMICS

9.8.1 COMPANY SNAPSHOT

9.8.2 PRODUCT PORTFOLIO

9.8.3 RECENT DEVELOPMENT

9.9 KRATOS DEFENSE & SECURITY SOLUTIONS, INC

9.9.1 COMPANY SNAPSHOT

9.9.2 REVENUE ANALYSIS

9.9.3 PRODUCT PORTFOLIO

9.9.4 RECENT DEVELOPMENTS

9.1 LEONARDO S.P.A.

9.10.1 COMPANY SNAPSHOT

9.10.2 REVENUE ANALYSIS

9.10.3 PRODUCT PORTFOLIO

9.10.4 RECENT DEVELOPMENTS

9.11 MSP

9.11.1 COMPANY SNAPSHOT

9.11.2 PRODUCT PORTFOLIO

9.11.3 RECENT DEVELOPMENT

9.12 SAAB AB

9.12.1 COMPANY SNAPSHOT

9.12.2 REVENUE ANALYSIS

9.12.3 PRODUCT PORTFOLIO

9.12.4 RECENT DEVELOPMENT

9.13 SAFRAN

9.13.1 COMPANY SNAPSHOT

9.13.2 REVENUE ANALYSIS

9.13.3 PRODUCT PORTFOLIO

9.13.4 RECENT DEVELOPMENT

9.14 SCR, SISTEMAS DE CONTROL REMOTO

9.14.1 COMPANY SNAPSHOT

9.14.2 PRODUCT PORTFOLIO

9.14.3 RECENT DEVELOPMENTS

9.15 THALES

9.15.1 COMPANY SNAPSHOT

9.15.2 REVENUE ANALYSIS

9.15.3 PRODUCT PORTFOLIO

9.15.4 RECENT DEVELOPMENTS

10 QUESTIONNAIRE

11 RELATED REPORTS

Lista de figuras

FIGURE 1 GLOBAL TARGET DRONES MARKET: SEGMENTATION

FIGURE 2 GLOBAL TARGET DRONES MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL TARGET DRONES MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL TARGET DRONES MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL TARGET DRONES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL TARGET DRONES MARKET: MULTIVARIATE MODELLING

FIGURE 7 GLOBAL TARGET DRONES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 GLOBAL TARGET DRONES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 GLOBAL TARGET DRONES MARKET: DBMR MARKET POSITION GRID

FIGURE 10 GLOBAL TARGET DRONES MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 GLOBAL TARGET DRONES MARKET: SEGMENTATION

FIGURE 12 NORTH AMERICA IS EXPECTED TO DOMINATE THE GLOBAL TARGET DRONES MARKET, WHILE ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 13 A RISE IN EXPENDITUTE ON DEFENSE IS EXPECTED TO DRIVE THE GROWTH OF THE GLOBAL TARGET DRONES MARKET IN THE FORECAST PERIOD

FIGURE 14 THE ROTARY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF THE GLOBAL TARGET DRONES MARKET IN 2023 AND 2030

FIGURE 15 NORTH AMERICA IS THE FASTEST-GROWING MARKET FOR THE TARGET DRONES MARKET IN THE FORECAST PERIOD

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF GLOBAL TARGET DRONES MARKET

FIGURE 17 GLOBAL TARGET DRONES MARKET: SNAPSHOT (2022)

FIGURE 18 NORTH AMERICA TARGET DRONES MARKET: SNAPSHOT (2022)

FIGURE 19 EUROPE TARGET DRONES MARKET: SNAPSHOT (2022)

FIGURE 20 ASIA-PACIFIC TARGET DRONES MARKET: SNAPSHOT (2022)

FIGURE 21 SOUTH AMERICA TARGET DRONES MARKET: SNAPSHOT (2022)

FIGURE 22 MIDDLE EAST AND AFRICA TARGET DRONES MARKET: SNAPSHOT (2022)

FIGURE 23 GLOBAL TARGET DRONES MARKET: COMPANY SHARE 2022 (%)

FIGURE 24 EUROPE TARGET DRONES MARKET: COMPANY SHARE 2022 (%)

FIGURE 25 ASIA-PACIFC TARGET DRONES MARKET: COMPANY SHARE 2022 (%)

FIGURE 26 NORTH AMERICA TARGET DRONES MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.